Market Overview

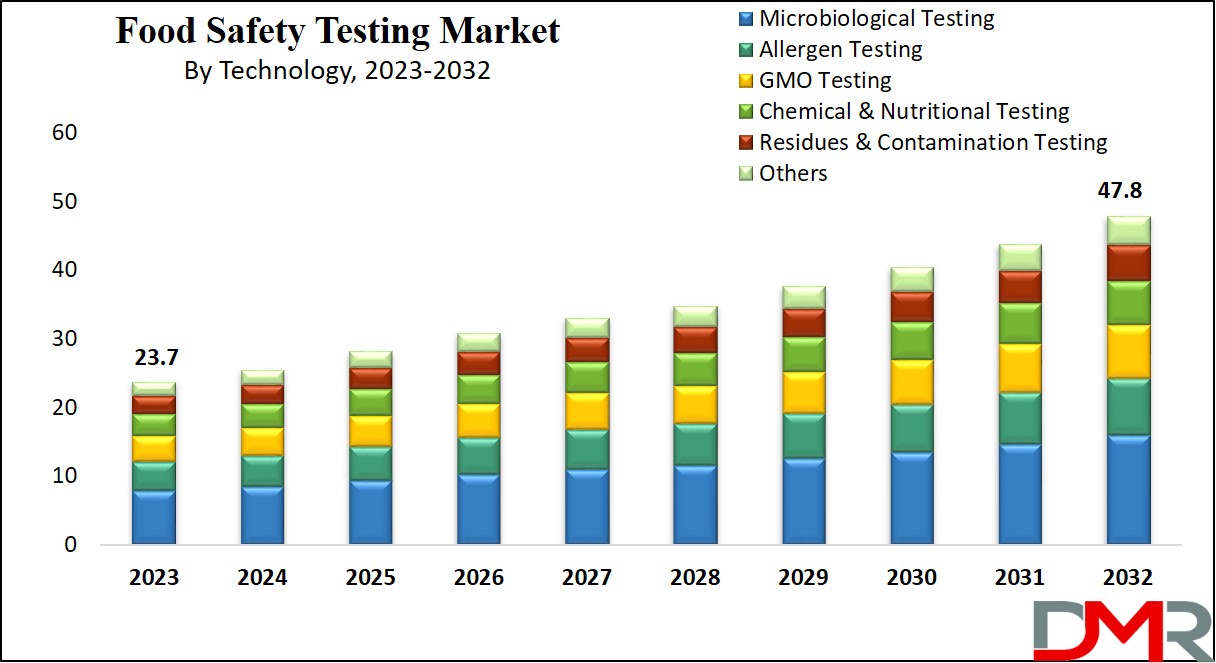

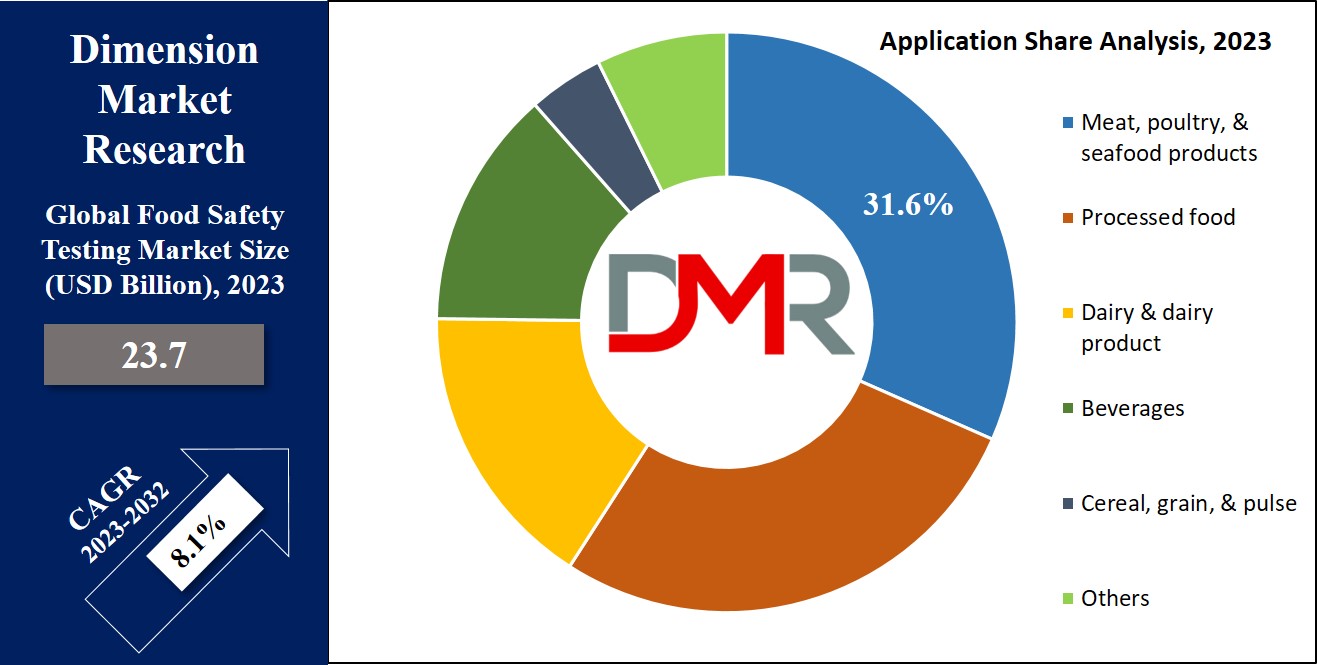

The Global Food Safety Testing Market is expected to reach a value of

USD 23.7 billion in 2023, and it is further anticipated to reach a market value of

USD 47.8 billion by 2032 at a

CAGR of 8.1%.

Food testing includes a scientific examination of food to gather information about its structure, composition, & physicochemical properties, which is, essential for quality control & ensuring food safety, contains advanced methods like analytical chemistry, sensory testing, microbiology testing, & nutrition analysis. Labs are commonly used for nutrient content determination, using turnkey solutions, nutrition analysis software, & online tools, with laboratory analysis being the most widely used method.

Key Takeaways

- By Technology, Microbiological testing segment takes the lead in 2023

- In addition, the residues & contamination testing segment is expected to have robust growth over the forecasted period.

- By Application, Meat, poultry, & seafood products take the lead & drive the market in 2023

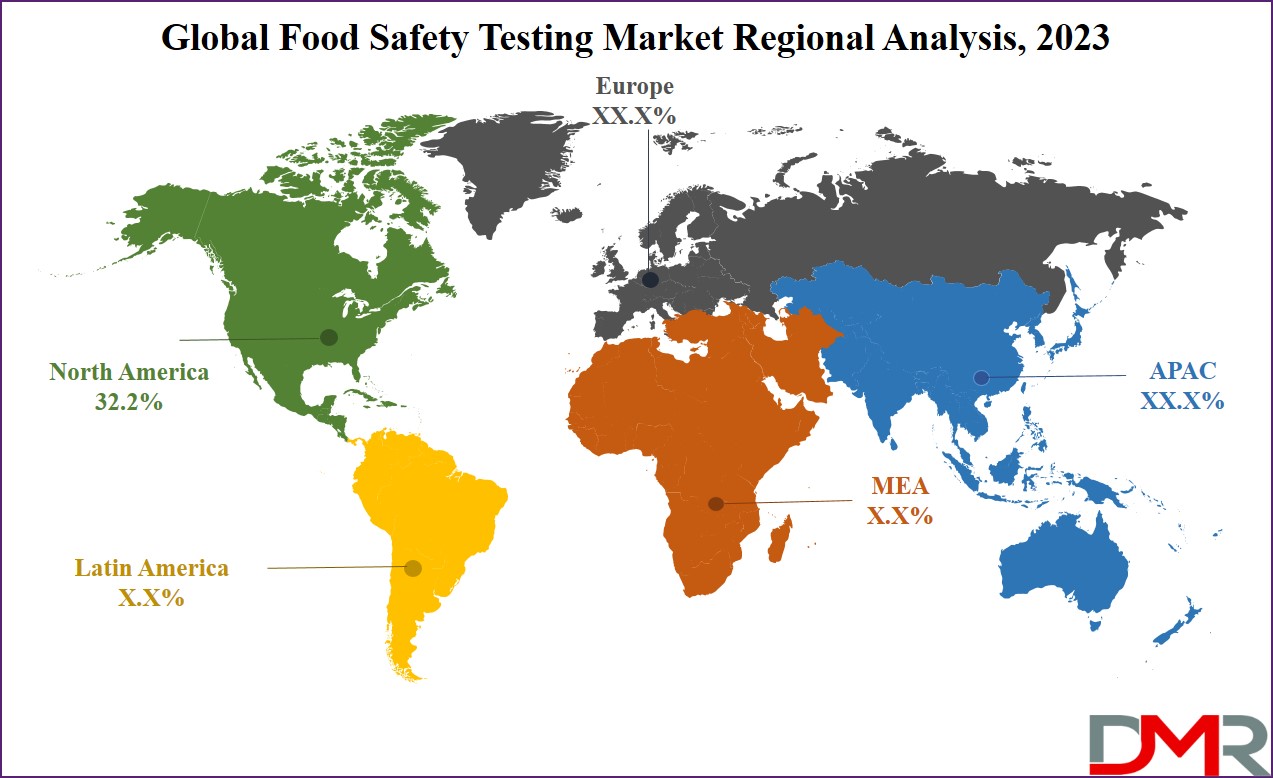

- North America has a 32.2% share of revenue in the global food safety testing market in 2023

Market Dynamic

The global food safety testing market is driven by the growing food-borne illnesses worldwide, triggered by the consumption of contaminated or spoiled food containing several microorganisms like bacteria, fungi, parasites, & viruses. Further mycotoxins, heavy metals, & chemicals further contribute to these illnesses. The lack of awareness among food handlers & manufacturers, regarding modern technologies, good manufacturing practices (GMP), hazard analysis, critical control points (HACCP) systems, & quality control, enhances problems related to food-borne diseases. Increasing product recalls, often due to contamination, highlight the need for better food safety testing equipment & systems.

However, despite rising demand, the market faces challenges, as insufficient infrastructure in testing laboratories hampers accurate results. Small enterprises lack information on advanced food safety methods, hindering their ability to meet safety requirements and posing risks of contamination. Further, as the industry embraces automation, the shortage of skilled professionals, especially in smaller enterprises, poses a challenge to effective food safety testing. Government-led educational programs are crucial to addressing the lack of expertise and technical knowledge, ensuring comprehensive food safety evaluations, and reducing the potential risks in the food & beverage industry.

Research Scope and Analysis

By Technology

The microbiological testing segment takes the lead in global revenue in 2023, playing an essential role in detecting microorganisms in food through accurate chemical, biological, molecular, & biochemical methods., which contributes to the segment’s significant market share. Also, the allergen testing segment holds a substantial portion of the global revenue, driven by the growing number of food allergies. Increased health consciousness among consumers drives advancements in food allergen testing methods, responding to the rising incidence of allergies. Notably, as reported by the CDC/National Center for Health Statistics in 2023, about 1 in 3 adults and over 1 in 4 children in the US report having a food allergy, highlighting the importance of allergen testing.

Further, the residues & contamination testing segment is expected to significantly growth due to rigorous safety checks identifying the overuse of chemicals like pesticides & herbicides, along with the increased use of antimicrobial drugs & additives. The segment’s expansion is further driven by rising demand for contamination checks in meat, poultry, & meat products, showcasing the importance of maintaining safety & quality standards.

By Application

Meat, poultry, &

seafood products take the lead among various application segments, dominating the global food safety testing market in 2023 by capturing a significant market share. The significant global consumption of meat, along with the increased risk of infections associated with red meats, is expected to drive the demand for testing in these segments in the coming years. Challenges like adulteration during packaging, processing, & storage of poultry and meat products highlight the need for regulatory guidelines, as represented by the guidelines set by the Food Safety & Inspection Service. In addition, the seafood testing sector experiences significant growth owing to the high sales of products like shrimp, crustaceans, crabs, tuna, lobsters, swordfish, & others, driven by their nutritional value, including essential nutrients & omega fatty acids.

The Food Safety Testing Market Report is segmented on the basis of the following:

By Technology

- Allergen Testing

- Chemical & Nutritional Testing

- Genetically Modified Organism (GMO) Testing

- Microbiological Testing

- Residues & Contamination Testing

- Others

By Application

- Beverages

- Meat, poultry, & seafood products

- Dairy & dairy product

- Cereal, grain, & pulse

- Processed food

- Others

Regional Analysis

North America commands a major 32.2% share of the global food safety testing market revenue in 2023. Industry players have solidified their presence in the region by providing specialized product lines & top-notch food safety testing services, including advanced manufacturing & marketing techniques. The growth in disposable income in Canada is anticipated to further boost the market’s growth.

Also, the prevalence of foodborne diseases like shigellosis, salmonellosis, & campylobacteriosis in places like Mississippi has further increased demand for high-quality food safety testing services.

Moreover, in Europe, the market is expected to grow as consumers prioritize microbiological testing to prevent foodborne diseases & detect chemical residues. The region’s strong food & beverage sector, characterized by resilience & stability, highlights the industry’s commitment to ensuring the safety of food products, driving market expansion. In addition, the Asia Pacific food safety testing market is on a significant expansion due to strict regulations, mainly in emerging nations like China, India, Indonesia, & Thailand. The region’s growing need for processed food & rise in incidents of food contamination contributes to the market’s fast expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global food safety testing market is fiercely competitive, with many regional & multinational companies aiming for dominance. Global players currently control the market, with key players holding major market shares. Further, these players are highly investing in research & development while also expanding their business operations to solidify & sustain their leading positions in the market.

In May 2022, Bureau Veritas, a company specializing in laboratory testing, inspection, & certification services, announced the inauguration of its third microbiology laboratory in Reno, Nevada, USA, which was designed to focus on rapid pathogen testing & microbiology indicator analyses specifically personalized for the agri-food sector. The expansion focuses on enhancing their capabilities in ensuring the safety & quality of agricultural and food products.

Some of the prominent players in the global Food Safety Testing Market are:

- SGS Group

- Intertek Group PLC

- NSF International

- Bureau Veritas

- TUV SUD

- UL LLC

- ALS Ltd

- Merieux Nutrisciences

- NEOGEN Corp

- NSF International

- Other Key Players

COVID-19 Pandemic & Recession: Impact on the Global Food Safety Testing Market:

The COVID-19 pandemic & economic recession have majorly influenced the global food safety testing market. The rise in awareness of health & safety has driven a growth in demand for strict food testing protocols to ensure the safety of consumables. However, the economic downturn has led to budget constraints for consumers &businesses, impacting the market’s growth. Further, supply chain disruptions & logistical challenges during the pandemic have also affected the accessibility of testing services. Despite these challenges, the growing focus on food safety & changing regulatory standards is expected to sustain the demand for testing solutions in the long run, as consumers & regulatory bodies ensure the importance of safe & secure food products.

Recent Developments

- In February 2022, Since Eurofins acquired TestAmerica in 2018, ongoing site rationalizations & reorganizations have been underway, as Eurofins purchased an 18,000 m² plot in California, United States, with a 7,950 m² building in 2019, which was then redeveloped to merge the Eurofins Calscience LLC & TestAmerica Irvine laboratories into a single facility, marking a step in the continuous integration process.

- In July 2022, SGS inaugurated a state-of-the-art food analysis laboratory in Naucalpan, Mexico, which is geared to assist the Mexican food industry by providing essential support for quality control & ensuring compliance with regulatory standards. The new laboratory reinforces SGS’s commitment to assisting organizations in the region in maintaining high standards of food safety & meeting regulatory requirements.

- In April 2022, Mérieux NutriSciences, a key player in food safety, quality, &sustainability, successfully acquired Hortec Pty Ltd in South Africa & Laboratorios Bromatológicos Araba SA in Spain, which not only highlights Mérieux NutriSciences’ entry into the South African pesticide market but also enhance its geographical footprint in Spain, aligning with the company’s long-term objectives to strengthen capabilities & expand global reach.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 23.7 Bn |

| Forecast Value (2032) |

USD 47.8 Bn |

| CAGR (2023-2032) |

8.1% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Technology (Allergen Testing, Chemical &

Nutritional Testing, Genetically Modified Organism

(GMO) Testing, Microbiological Testing, Residues &

Contamination Testing, and Others), By Application

(Beverages, Meat, poultry, & seafood products, Dairy

& dairy product, Cereal, grain, & pulse, Processed

food, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

SGS Group, Intertek Group PLC, NSF International,

Bureau Veritas, TUV SUD, UL LLC, ALS Ltd, Merieux

Nutrisciences, NEOGEN Corp, NSF International, and

Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Food Safety Testing Market size is estimated to have a value of USD 23.7 billion in 2023 and

is expected to reach USD 47.8 billion by the end of 2032.

North America has the largest market share for the Global Food Safety Testing Market with a share of

about 32.2% in 2023.

Some of the major key players in the Global Food Safety Testing Market are SGS Group, Intertek Group

PLC, NSF International, and many others.

The market is growing at a CAGR of 8.1 percent over the forecasted period.