1-Decene, classified within the alpha-olefin category, is an organic molecule featuring the chemical formula C10H20.

It constitutes a linear, branched-chain hydrocarbon and falls under the domain of alkene hydrocarbons, characterized by a chain of 10 carbon atoms harboring a single double bond. This unsaturated hydrocarbon holds substantial relevance in the production of polymers, resins, and synthetic lubricants. With its expanding applications, the 1-Decene industry is gaining notable traction in global chemical and materials markets.

Notably, 1-Decene is a colorless, transparent, and fragrant poisonous liquid. Its synthesis commonly occurs through ethylene oligomerization or by cracking petroleum waxes rich in higher carbon content. This compound serves as a significant monomer in copolymers and serves as an intermediary in producing oxo alcohols, epoxides, alkylated aromatics, amines, and synthetic fatty acids.

Consequently, 1-Decene finds application across diverse sectors including fragrances, oils, medications, resins, industrial machinery, automotive transmission systems, and marine applications. Furthermore, with increasing demand for eco-friendly materials, 1-Decene has growing relevance in

Biodegradable Plastics, supporting industries that prioritize sustainability.

Key Takeaways

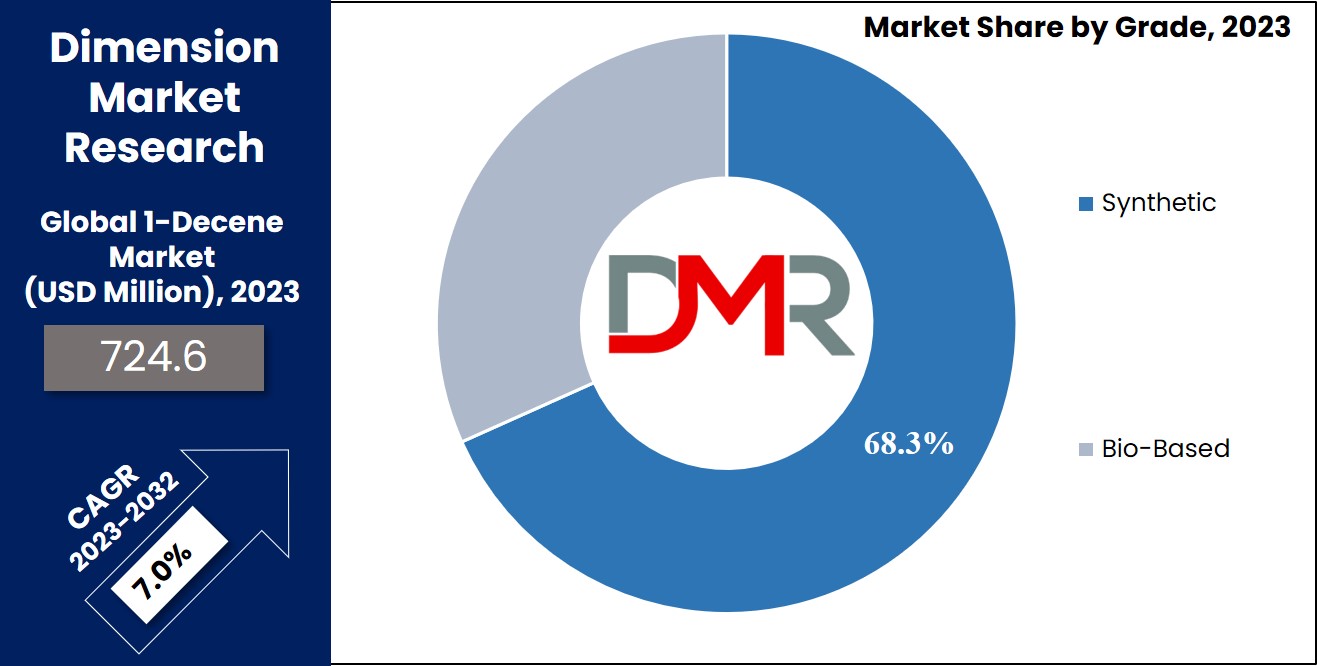

- The Global 1-Decene Market was valued at USD 724.6 million in 2023 and is projected to reach USD 1,309.7 million by 2032, growing at a CAGR of 7.0% during the forecast period.

- Polyalphaolefins (PAO) dominate the derivatives segment due to their wide usage in synthetic lubricants, gear oils, and automotive applications, ensuring continued demand.

- By grade, synthetic 1-Decene holds the largest share, but bio-based 1-Decene is gaining momentum due to rising sustainability and eco-friendly product adoption.

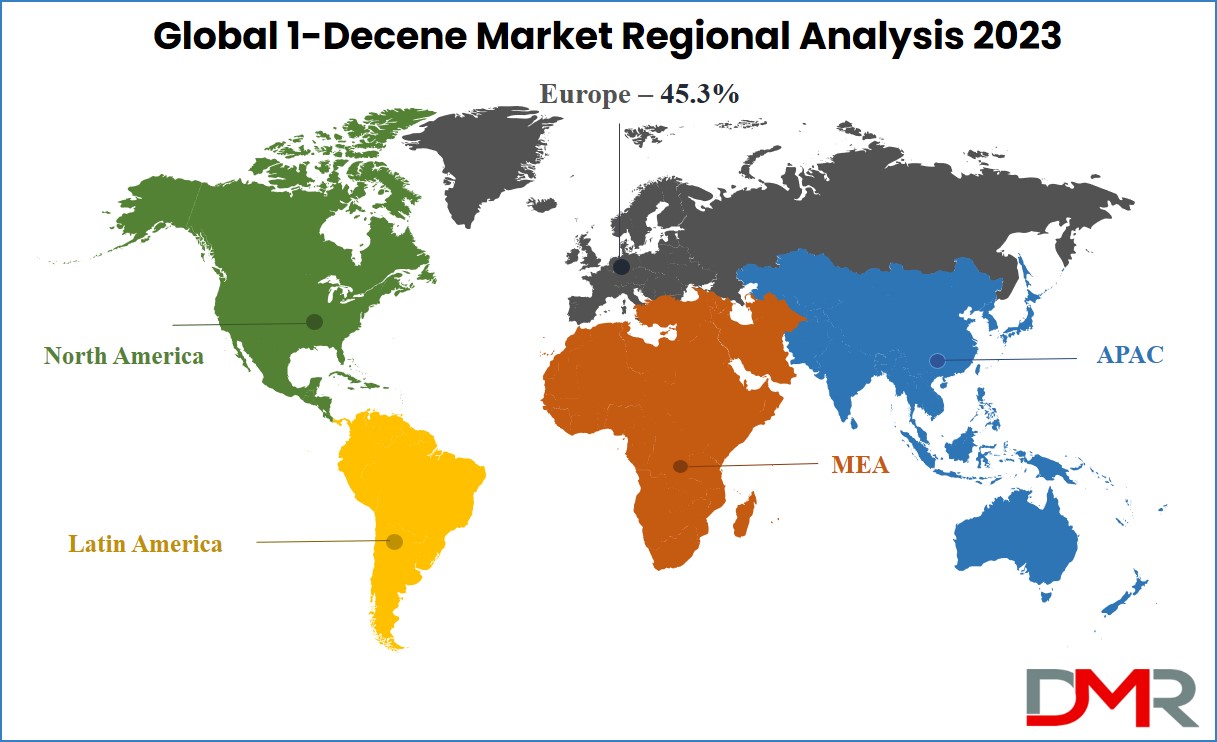

- Europe led the market in 2023 with over 45% revenue share, driven by strong PAO and lubricant production, while Asia-Pacific is expected to record the fastest growth through 2032.

- The market is supported by applications in packaging, surfactants, detergents, and biodegradable plastics, further boosted by the shale gas boom in the U.S. and China.

Use Cases

- Automotive Lubricants: The rising demand for high-performance synthetic lubricants and gear oils is driving the use of 1-Decene-based polyalphaolefins (PAOs), ensuring superior engine efficiency, reduced emissions, and extended vehicle lifespan.

- Industrial Machinery: Growing adoption of synthetic lubricants and polymers derived from 1-Decene supports operational efficiency, corrosion resistance, and durability in heavy-duty machinery, compressors, and manufacturing systems.

- Packaging & Consumer Goods: Increasing application of 1-Decene in polyethylene production enhances packaging flexibility, strength, and recyclability, catering to rising demand for sustainable food and consumer product packaging solutions.

- Healthcare & Pharmaceuticals: 1-Decene derivatives such as surfactants and specialty chemicals are utilized in drug formulations, medical-grade lubricants, and fragrance compounds, aligning with stringent safety and performance standards.

- Marine & Aviation: The use of 1-Decene-based lubricants in marine engines and aviation systems ensures reliability under extreme conditions, supporting fuel efficiency and compliance with environmental regulations.

Market Dynamics

The increasing application of 1-decene in producing polyalphaolefin (PAO) is fostering a promising market trajectory, especially in automotive and manufacturing sectors. PAO serves as a synthetic lubricant for transmission, compressors, lube-oil additives, and gear oil, contributing to positive market prospects due to its anti-corrosive attributes. Moreover, 1-decene's role in crafting polymers like

polyethylene essential for packaging adds momentum, extending its utility as food additives, glazing agents, and polishing agents in the food and beverage sector.

Additionally, 1-decene acts as a vital intermediate for detergent and surfactant manufacturing, underpinning its wide-ranging applicability across end-use industries. Factors such as increased consumer spending capacity, cost-effective raw materials, and automotive industry growth are set to drive market expansion. The shale gas boom, notably in the U.S. and China, has enhanced ethylene production, benefiting 1-decene manufacturing. This also highlights the broader alpha-olefin market, of which 1-Decene is a critical component.

This potential, alongside the unique full-range alpha olefin distribution process for 1-decene, distinguishes it from other olefins. However, the limited C-10 supply for PAO production has led lubricant manufacturers to explore alternatives like ester-based synthetic oils, possibly influencing market growth during the forecast period. In addition, the use of 1-Decene in solutions related to

Oil Spill Management highlights its growing role in environmental protection applications.

Research Scope and Analysis

By Derivatives

The derivative sector within the global 1-decene market comprises six primary types: polyalphaolefin, oxo alcohols, linear alkyne benzene, linear mercaptans, chlorinated olefins, and other derivatives. The preeminence is held by the polyalphaolefins category, asserting dominance due to its wide-ranging applications. Notably, the industrial and automotive sectors stand as primary users of polyalphaolefins, extending their utility into gear oil, lube oil additives, compressor oil, and transmission oil.

This array of practical applications contributes to heightened demand, driven by their exceptional technical performance and environmental preservation attributes.

Moreover, in the realm of laundry and dishwashing applications, detergent alcohols and their derivatives emerge as vital raw materials underpinning surfactant production, a sector poised to exhibit an above-average growth rate throughout the forecast period.

By Grade

Categorized by grade, The Global 1-Decene Market delineates into two sub-segments: synthetic and bio-based grades, delineated by raw material sources. Synthetic-grade 1-decene emerges from hydrocarbon feedstocks via chemical processes, serving versatile applications including synthetic lubricants, plasticizers, and detergents. In contrast, bio-based 1-decene is derived from renewable plant-derived oils, aligning with sustainability goals by offering eco-friendly alternatives for biodegradable lubricants, environmentally conscious plastics, and sustainable surfactants.

The dichotomy between these segments underscores the industry's responsiveness to evolving market needs and accentuates sustainability's growing significance in the contemporary chemical landscape. However, the synthetic-grade 1-decene segment has dominated the global market due to established production processes and versatile applications. However, the bio-based grade is gaining traction with rising sustainability concerns.

The Global 1-Decene Market Report is segmented on the

basis of the following

By Derivatives

- Poly Alpha Olefins

- Oxo Alcohol

- Linera Alkyl Benzene

- Linera Mercaptans

- Chlorinated Alpha Olefins

- Others

By Grade

Regional Analysis

In 2023, the Europe region asserted its dominance over the global industry by capturing

more than 45% of the total revenue, marking it as the leading contributor. The region is anticipated to maintain this prominence, steadily expanding throughout the forecast period. This continued growth is driven by significant PAO (poly alpha olefin) and synthetic lubricant production orchestrated by key product manufacturers. The availability of raw materials in this region further aids its ascendancy.

In North America, the United States, a substantial oil producer, has facilitated extensive market penetration. Notably, the presence of major industry players like ExxonMobil Corp., Shell Chemicals, and Chevron Phillips, who possess patented alpha olefin production technology, has bolstered the demand for 1-decene in North America. Simultaneously, the Asia Pacific region is poised for the most rapid growth throughout the forecast period, propelled by escalating PAO demand for lubricant production.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Global 1-Decene Market is shaped by prominent chemical industry leaders with substantial production capacities and a diverse portfolio of downstream products. These major players wield significant influence through integrated operations and established supply chains.

Alongside them, specialized producers and regional entities cater to niche markets, capitalizing on localized advantages and fostering tailored solutions. Downstream manufacturers play a pivotal role, utilizing 1-decene as a foundational raw material for products such as linear low-density polyethylene (LLDPE), synthetic lubricants, and surfactants.

Competitiveness in this landscape is built upon innovation, environmental awareness, regulatory compliance, and effective market penetration. This drives companies to invest in research, sustainability initiatives, and strategic distribution networks. To stay aligned with the ever-evolving dynamics of the 1-decene market, a vigilant eye on industry reports is essential. This enables stakeholders to navigate challenges and seize opportunities within this intricate sector.

Some of the prominent players in the Global 1-Decene Market is

- BASF SE

- Arkema

- Huntsman

- Mitsui Chemicals

- Nippon Shokubai

- Croda International

- Oxea

- SABIC

- Stepan

- The Chemours Company

- Solvay

- Shell Chemicals

- ExxonMobil Corp

- Chevron Phillips

- Other Key Players

Recent Developments

- June 2025: Verbio's renewable chemicals plant under construction in Germany is expected to start up in 2026. It will produce renewable chemicals based on rapeseed oil methyl ester, including 1-decene, with a capacity of 17,000 tonnes/year.

- June 2025: Verbio's renewable chemicals plant under construction in Germany is expected to start up in 2026. It will produce renewable chemicals based on rapeseed oil methyl ester, including 1-decene, with a capacity of 17,000 tonnes/year.

- August 2023: The global 1-decene market size is projected to expand at a CAGR of approximately 10% between 2023 and 2035, reaching a revenue of USD 6 billion by the end of 2035.

- August 2023: The global 1-decene market size is projected to expand at a CAGR of approximately 10% between 2023 and 2035, reaching a revenue of USD 6 billion by the end of 2035.

| Report Characteristics |

| Market Size (2023) |

USD 724.6 Mn |

| Forecast Value (2032) |

USD 1,309.7 Mn |

| CAGR (2023-2032) |

7.0% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Derivatives (Polyalphaolefins, Oxo Alcohol, Linear

Alkyl Benzene, Linear Mercaptans, Chlorinated Alpha Olefins, Others), By Grade

(Synthetic & Bio-Based). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

BASF SE, Arkema, Huntsman, Mitsui Chemicals, Nippon

Shokubai, Croda International, Oxea, SABIC, Stepan, The Chemours Company,

Solvay, Shell Company, ExxonMobil Corp, Chevron, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |