Market Overview

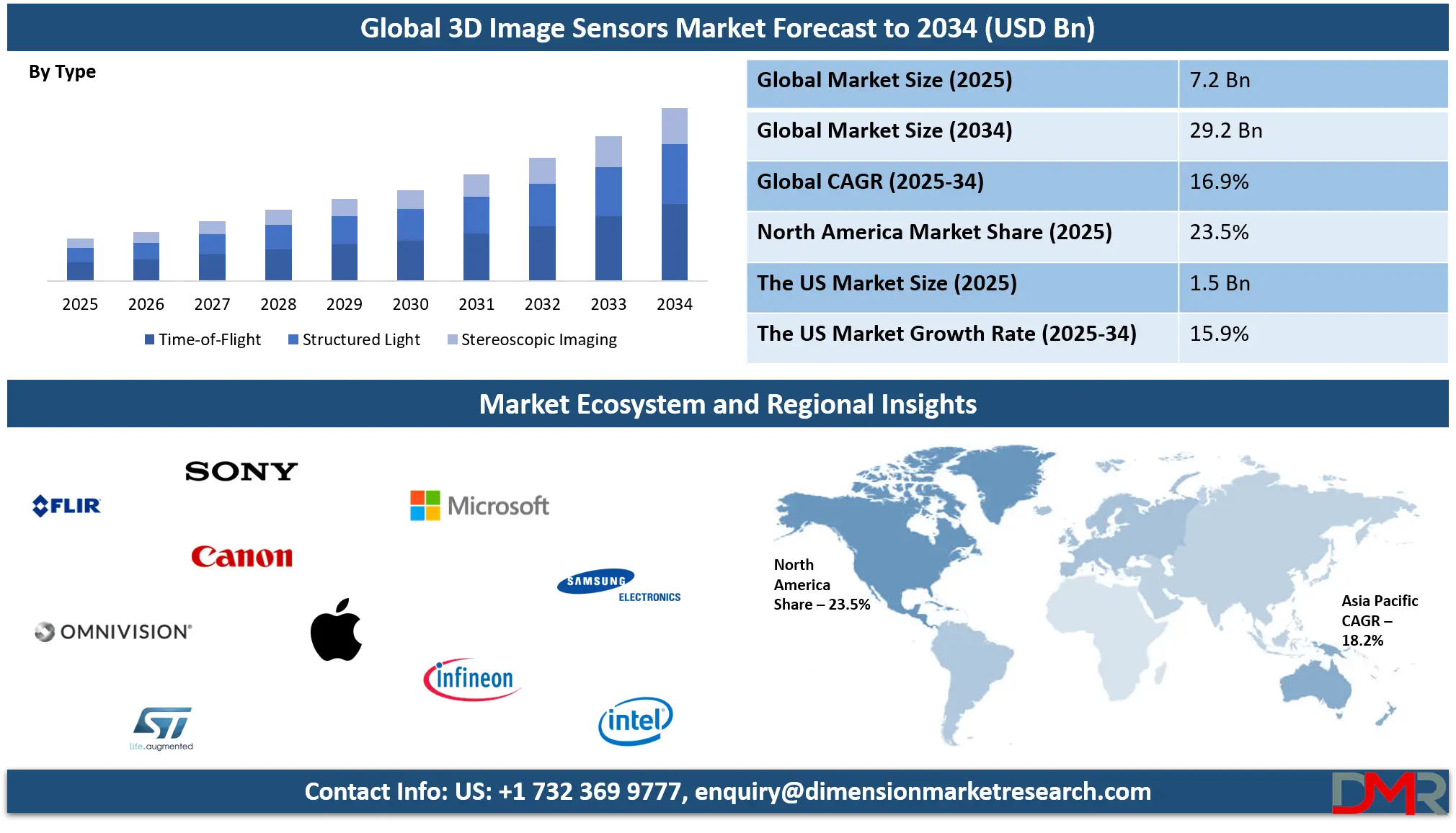

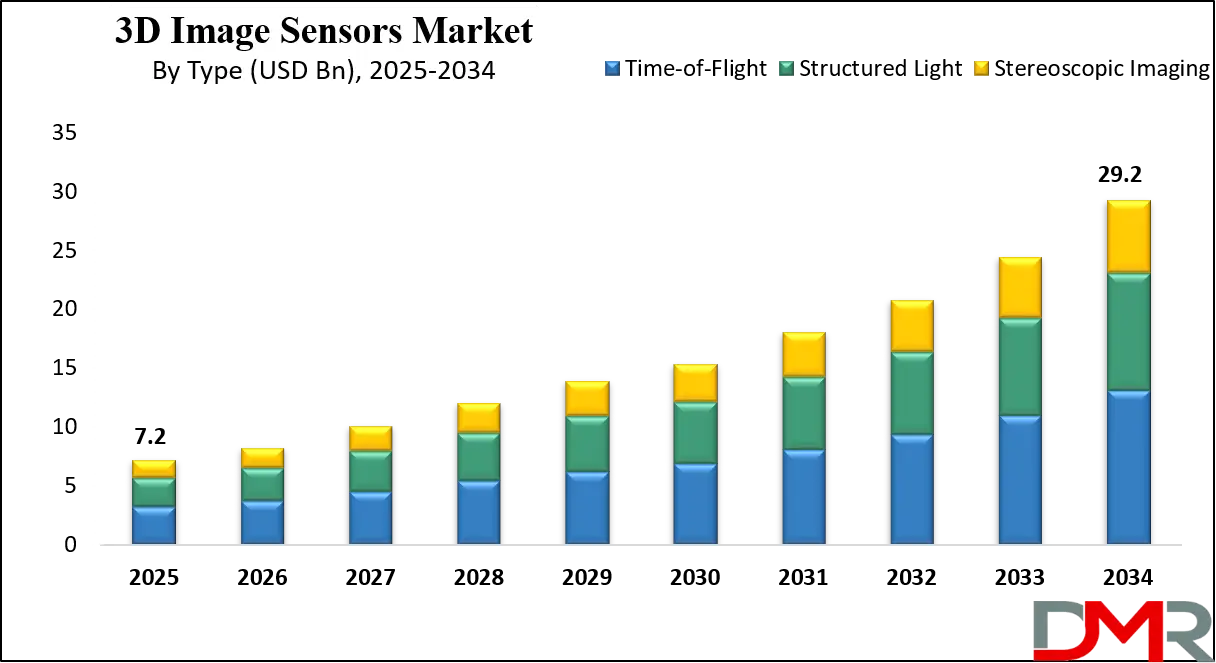

The Global 3D Image Sensors Market size is projected to reach USD 7.2 billion in 2025 and grow at compound annual growth rate of 16.9% from there until 2034 to reach a value of USD 29.2 billion.

3D image sensors are advanced devices that help capture the shape, depth, and details of objects in three dimensions, rather than just a flat, two-dimensional image. These sensors use techniques like time-of-flight, structured light, or stereo vision to create accurate 3D models of the environment. They are commonly used in devices such as smartphones, industrial robots, medical tools, security systems, and gaming equipment. The ability to see and understand depth helps machines and systems interact more naturally and intelligently with their surroundings.

The growing use of automation, robotics, and smart devices is pushing the demand for 3D image

sensors across different industries. Smartphones now use them for face recognition and augmented reality, while industries rely on them for precise object detection, inspection, and navigation. In healthcare, 3D sensors improve imaging and surgical precision. Automotive companies are also using these sensors to build safer driving systems, including features like parking assistance and collision avoidance.

Recent trends show a strong focus on miniaturizing 3D sensors to fit into smaller consumer devices. Companies are also working on improving sensor accuracy and performance under low-light or fast motion conditions. As artificial intelligence and machine learning evolve, 3D sensors are becoming more important in enabling smart environments, from homes to factories. The integration of these sensors with AI software allows systems to recognize gestures, movements, and objects more effectively.

Over the past few years, major tech companies have launched or upgraded products using 3D image sensors. For example, flagship smartphones have adopted 3D sensing for security and AR functions. Industrial equipment makers have introduced smarter robots and automated systems using 3D vision. Events like tech expos and industry conferences have often highlighted innovations in 3D sensing, drawing attention from investors, engineers, and product developers.

One key insight is that 3D image sensing is no longer limited to high-end or specialized use. As technology improves and costs go down, it is becoming a standard part of mainstream products. This shift is encouraging new applications in areas like education, retail, healthcare, and consumer electronics. As more devices get connected and smarter, the demand for machines that understand space and motion in 3D is only expected to rise.

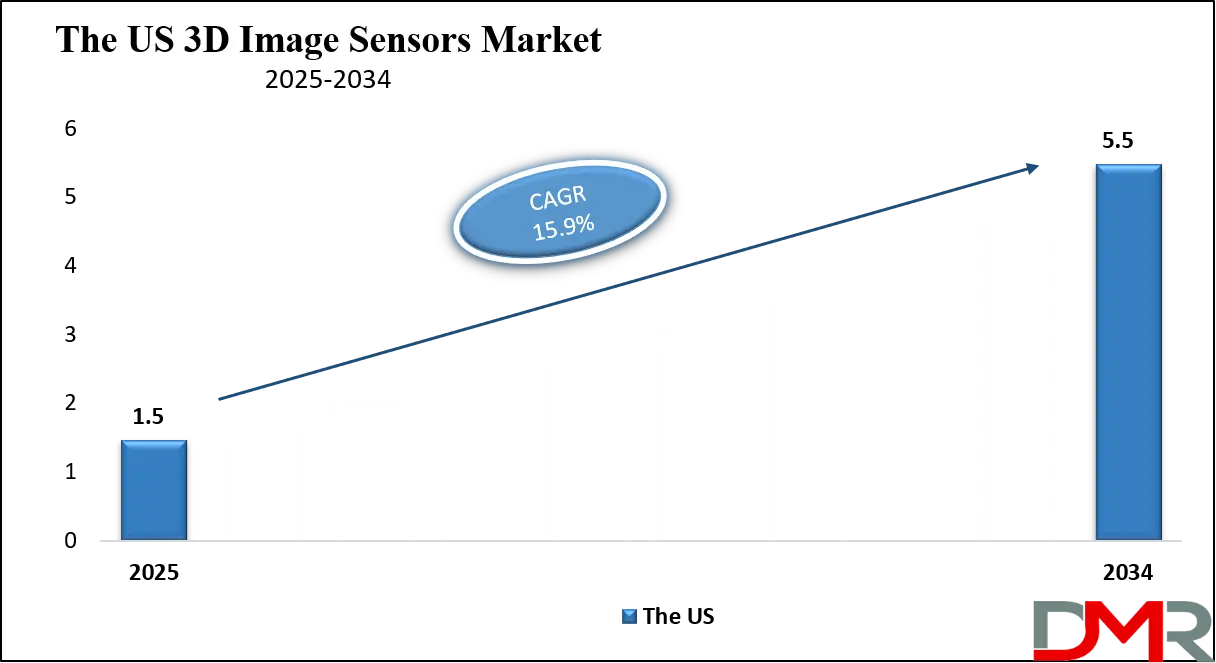

The US 3D Image Sensors Market

The US 3D Image Sensors Market size is projected to reach USD 1.5 billion in 2025 at a compound annual growth rate of 15.9% over its forecast period.

The US has a leading role in the 3D image sensors market due to its strong base of technology companies, advanced R&D capabilities, and growing demand across industries. US-based firms are driving innovation in smartphones, autonomous vehicles, and industrial automation by integrating 3D sensing into next-gen products. The country is also a hub for advancements in AI, robotics, and AR/VR, all of which rely heavily on 3D image sensors. Supportive government initiatives and significant investment in defense and healthcare technologies further strengthen the US position.

Additionally, collaboration between tech giants, startups, and research institutions continues to fuel breakthroughs, making the US a central force in the global expansion and development of 3D image sensing solutions.

Europe 3D Image Sensors Market

Europe 3D Image Sensors Market size is projected to reach USD 1.8 billion in 2025 at a compound annual growth rate of 15.1% over its forecast period.

Europe plays an important role in the 3D image sensors market through its strong focus on industrial automation, automotive innovation, and advanced manufacturing. The region is home to several automotive and robotics leaders that rely on 3D sensors for safety systems, smart navigation, and precision control. Europe's commitment to Industry 4.0 and smart factory initiatives drives demand for high-performance 3D sensing in production lines and quality control.

In addition, sectors like healthcare, aerospace, and consumer electronics are adopting these sensors to enhance performance and accuracy. European research institutions and technology firms are also involved in developing next-generation sensor technologies, often supported by public funding and collaborative projects. This balanced approach of innovation and application keeps Europe competitive in the global market.

Japan 3D Image Sensors Market

Japan 3D Image Sensors Market size is projected to reach USD 432 million in 2025 at a compound annual growth rate of 16.7% over its forecast period.

Japan plays a significant role in the 3D image sensors market, driven by its expertise in precision manufacturing and advanced electronics. Japanese companies are leaders in developing high-quality sensors featuring technologies like structured light and time-of-flight, favored for industrial automation, robotics, and automotive applications. These sensors support applications such as factory inspection, collaborative robots, and driver-assist systems.

The country’s strong electronics supply chain and focus on miniaturization help bring compact, high-performance sensors to market. Japan also emphasizes research and development through collaborations between industry and academic institutions, fostering innovation in sensor materials, packaging, and integration. With its reputation for reliability and engineering excellence, Japan continues to influence the global direction and standards of 3D image sensing technology.

3D Image Sensors Market: Key Takeaways

- Market Growth: The 3D Image Sensors Market size is expected to grow by USD 20.9 billion, at a CAGR of 16.9%, during the forecasted period of 2026 to 2034.

- By Type: The ToF is anticipated to get the majority share of the 3D Image Sensors Market in 2025.

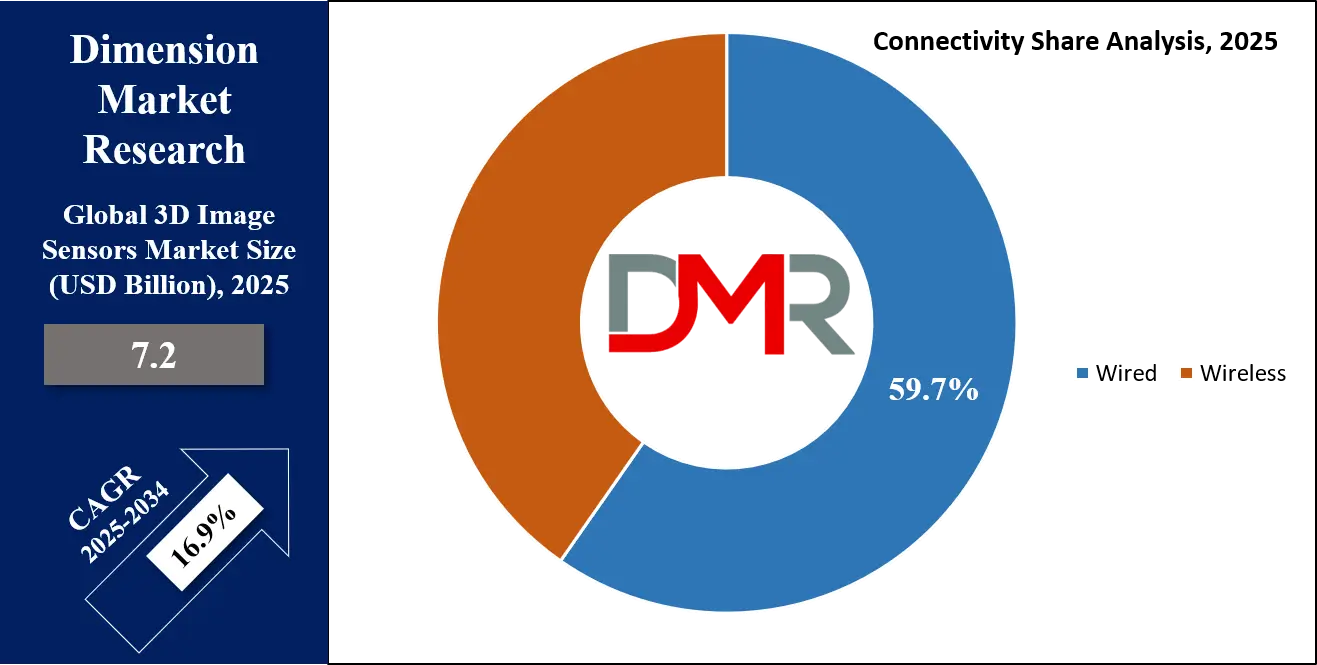

- By Connectivity: The wired segment is expected to get the largest revenue share in 2025 in the 3D Image Sensors Market.

- Regional Insight: Asia Pacific is expected to hold a 34.6% share of revenue in the Global 3D Image Sensors Market in 2025.

- Use Cases: Some of the use cases of 3D Image Sensors include smartphones & consumer electronics, healthcare & medical imaging, and more.

3D Image Sensors Market: Use Cases

- Smartphones and Consumer Electronics: 3D image sensors are widely used in smartphones for facial recognition, gesture control, and augmented reality features. They help create more secure unlocking methods and enhance the user experience in gaming and photography. Tablets, laptops, and smart TVs also use them to enable touchless control and better interaction.

- Automotive and Transportation: In vehicles, 3D sensors support driver assistance systems by detecting objects, pedestrians, and road conditions in real-time. They are used in parking assistance, collision avoidance, and navigation. These sensors improve safety by allowing vehicles to understand their environment more accurately.

- Industrial Automation and Robotics: Factories use 3D sensors in robots and machines to inspect products, measure parts, and navigate complex environments. These sensors help improve accuracy in picking, placing, and assembling components. They reduce human error and boost productivity in automated systems.

- Healthcare and Medical Imaging: 3D image sensors are used in medical devices to capture detailed scans of the body for diagnosis and surgery. They assist in creating 3D models for planning procedures and guiding tools with precision. This technology helps improve patient outcomes through better visualization and control.

Market Dynamic

Driving Factors in the 3D Image Sensors Market

Rising Adoption in Consumer Electronics

One of the major drivers of the 3D image sensors market is the increasing use of advanced sensors in consumer electronics, especially smartphones. As users demand better security and immersive experiences, manufacturers are integrating 3D sensors for facial recognition, biometric security, and augmented reality features. These sensors also enhance photography by enabling depth sensing for portrait modes and 3D imaging.

Tablets, gaming consoles, and smart home devices are also adopting this technology to offer more intuitive and responsive interactions. The trend of miniaturizing sensors while improving their performance is allowing wider use in compact devices. With every new generation of consumer tech pushing for smarter, faster, and more accurate features, the role of 3D image sensors continues to grow rapidly.

Advancements in Industrial Automation and AI

Another strong growth driver is the growing need for precision and automation in industries such as manufacturing, logistics, and healthcare. 3D image sensors are being used in robots for quality control, object detection, and automated navigation, improving efficiency and reducing errors. As factories become smarter and more connected, real-time data from these sensors help optimize operations and reduce downtime.

In healthcare, 3D sensing enables better imaging and assists in robotic surgeries and diagnostics. With artificial intelligence evolving, 3D sensors are being paired with AI algorithms to interpret depth data more effectively, making machines and systems smarter. These advances are creating new use cases and pushing demand across industrial sectors.

Restraints in the 3D Image Sensors Market

High Cost of Technology and Integration

One of the key restraints in the 3D image sensors market is the high cost of development and integration. Producing accurate and reliable 3D sensors requires advanced manufacturing techniques, which can be expensive. Additionally, integrating these sensors into devices—especially smaller ones like smartphones or wearables—requires careful design and customization, adding to the cost.

These factors make it challenging for smaller companies and price-sensitive markets to adopt the technology widely. For consumer electronics, even small cost increases can affect pricing strategies and sales volumes. This limitation slows down the adoption rate in certain applications, especially in developing regions. As a result, high costs remain a major barrier for broader market penetration.

Complexity and Compatibility Challenges

Another significant restraint is the technical complexity involved in using 3D image sensors effectively. These sensors must work in different environments, under varying lighting conditions, and with fast-moving objects, which requires highly accurate calibration and software support. Integrating them with other system components like processors, displays, and storage devices can be complicated.

Also, ensuring compatibility with various operating systems and platforms adds another layer of difficulty. If not managed well, these challenges can lead to poor performance or inconsistent results. This complexity often requires specialized skills and longer development times, which can discourage manufacturers from including 3D sensors in their products.

Opportunities in the 3D Image Sensors Market

Expansion in Augmented and Virtual Reality Applications

A major opportunity for the 3D image sensors market lies in the rapid growth of augmented reality (AR) and virtual reality (VR) technologies. As AR/VR becomes more popular in gaming, education, remote collaboration, and training, there is a growing need for sensors that can map surroundings in real time and provide accurate depth perception. 3D sensors make these immersive experiences more realistic by capturing detailed spatial data.

They enable smoother interaction between users and virtual objects, enhancing the overall quality of the experience. With tech companies investing heavily in AR glasses, headsets, and mixed-reality platforms, demand for advanced 3D sensing technology is expected to rise sharply. This creates a strong growth path for sensor manufacturers worldwide.

Growing Demand in Healthcare and Medical Devices

The healthcare sector presents a significant opportunity for 3D image sensor adoption, especially in medical imaging, diagnostics, and surgical applications. These sensors help create precise 3D models of organs, tissues, or surgical areas, aiding in better planning and execution of medical procedures. They also support robotic surgeries by offering real-time spatial awareness and accurate depth perception.

As healthcare becomes more technology-driven and patient-focused, the need for tools that improve accuracy, safety, and efficiency is growing. Additionally, 3D sensors are being explored for applications like remote patient monitoring and physical rehabilitation. This increasing reliance on smart medical devices creates a promising space for innovation and growth in the 3D image sensors market.

Trends in the 3D Image Sensors Market

Growing Use of LiDAR and Time-of-Flight in Automotive and Robotics

A major trend in the 3D image sensors market is the increasing use of LiDAR and Time-of-Flight (ToF) technologies in vehicles and robots. In the automotive industry, these sensors are helping to power safety systems like automatic braking, lane assistance, and self-driving features. Robots in factories and warehouses also use them to navigate spaces, detect objects, and perform tasks with greater precision. The growing focus on automation and smart mobility is pushing companies to improve the speed, accuracy, and affordability of these sensors. As a result, LiDAR and ToF are becoming more common in next-generation transportation and robotics systems.

Miniaturization and On-Device Intelligence with AI

Another noticeable trend is the shrinking size of 3D image sensors and the addition of artificial intelligence directly into the sensors themselves. Smaller sensors are easier to fit into slim smartphones, wearables, and compact home devices, making them more versatile. At the same time, AI integration allows these sensors to process depth and movement data faster, without needing to send information to external systems. This means quicker response times and smarter features, like facial recognition, gesture control, and environmental mapping. This trend is making devices more responsive, more efficient, and capable of handling complex tasks right at the edge.

Impact of Artificial Intelligence in 3D Image Sensors Market

- Enhanced Data Processing: AI helps 3D image sensors process large amounts of depth and spatial data more quickly and accurately. This leads to faster decision-making in real-time applications like facial recognition, object tracking, and navigation.

- Improved Object Detection and Recognition: AI-powered algorithms allow 3D sensors to identify and classify objects more precisely, even in cluttered or dynamic environments. This is especially useful in autonomous vehicles, robotics, and smart surveillance systems.

- Adaptive Performance in Complex Conditions: With AI, 3D sensors can adapt to different lighting conditions, angles, and motion, improving their performance in real-world scenarios. This makes them more reliable in both indoor and outdoor environments.

- Smarter User Interfaces: AI enables gesture control, facial mapping, and emotion detection using 3D sensors, making user interfaces more natural and interactive in consumer electronics, AR/VR, and gaming devices.

- Predictive Maintenance and Automation: In industrial settings, AI uses data from 3D sensors to predict equipment wear or failures, enhancing safety and reducing downtime through smarter automation and maintenance planning.

Research Scope and Analysis

By Type Analysis

Time-of-Flight is expected to lead the 3D image sensors market in 2025 with a share of 44.7%, driven by its growing use in smartphones, automotive safety, and industrial automation. This technology works by measuring the time it takes for light to bounce off an object and return to the sensor, creating accurate depth maps quickly and efficiently. Its ability to perform well in low light and dynamic environments makes it ideal for gesture recognition, facial mapping, and real-time 3D scanning.

Time-of-Flight sensors are being widely adopted in camera systems, AR/VR devices, and robotics for navigation and obstacle detection. Their compact size and low power consumption make them suitable for mobile and embedded systems. With rising demand for smart features and immersive user experiences, Time-of-Flight technology is expected to remain a key enabler in the expansion of depth sensing and 3D imaging applications across multiple industries.

Structured light will have significant growth over the forecast period as a key 3D image sensing technology, especially in high-precision applications. It works by projecting a known light pattern onto a surface and analyzing its deformation to capture detailed depth information. This technique is favored for its high accuracy and is commonly used in face authentication, object scanning, and medical imaging.

Structured light is gaining traction in consumer electronics, particularly for front-facing smartphone cameras and AR devices, due to its ability to deliver detailed 3D data. It is also finding applications in quality inspection, robotics, and healthcare, where exact measurements are crucial. As industries continue to shift toward smarter, vision-enabled systems, structured light is expected to play a growing role in enabling accurate, reliable, and high-resolution 3D image sensing.

By Technology Analysis

CMOS technology is expected to lead the 3D image sensors market in 2025 with a share of 68.8%, owing to its ability to deliver high-speed performance, low power consumption, and cost-effectiveness. CMOS sensors are widely used in smartphones, tablets, AR/VR devices, and automotive applications where real-time 3D imaging and depth sensing are essential. Their compact size and ability to integrate with other components make them ideal for consumer electronics and portable devices.

Manufacturers prefer CMOS for its scalability, ease of production, and ability to support advanced features like facial recognition, gesture control, and spatial mapping. As demand for intelligent imaging systems grows in industries like healthcare, robotics, and surveillance, CMOS-based 3D sensors are expected to remain at the forefront of innovation, helping devices to see, understand, and interact with the environment more efficiently and accurately.

CCD technology is expected to witness significant growth over the forecast period in the 3D image sensors market, particularly in applications where image quality and light sensitivity are top priorities. Unlike CMOS, CCD sensors capture images with minimal noise, making them suitable for scientific imaging, high-end medical devices, and certain types of industrial inspection.

Their ability to produce highly detailed 3D images even in low-light conditions gives them an edge in specific professional use cases. CCD technology, though older, continues to find relevance due to its superior dynamic range and image clarity. As industries seek better image resolution for complex tasks such as surface inspection and medical diagnostics, CCD-based 3D sensors are being increasingly considered for niche but critical applications. This continued demand ensures that CCD remains an important part of the 3D sensing technology landscape.

By Connectivity Analysis

Wired connectivity is set to dominate the 3D image sensors market in 2025 with a share of 59.7%, mainly due to its reliability, fast data transfer speeds, and stable performance in critical applications. This type of connection is widely used in industrial automation, robotics, and medical imaging, where accurate and uninterrupted data transmission is essential. Wired 3D sensors are preferred in environments that require high-resolution imaging and precise real-time depth sensing, especially in assembly lines, healthcare diagnostics, and security systems.

These sensors offer a dependable connection that ensures smooth functioning without interference or delays. As 3D sensing becomes a core part of quality inspection, facial recognition, and navigation systems, wired connectivity remains the preferred choice for high-performance and mission-critical operations, supporting consistent and secure communication across diverse industry settings.

Wireless connectivity is expected to see significant growth over the forecast period as more devices adopt untethered, flexible setups in smart homes, retail, and mobile applications. This type of connection supports easier installation, mobility, and integration into lightweight consumer electronics such as smartphones, AR/VR headsets, and smart cameras.

As the demand grows for touchless control and remote monitoring, wireless 3D sensors are being used for gesture recognition, spatial awareness, and interactive interfaces. Their ability to connect with cloud platforms and mobile systems makes them ideal for modern, connected environments. With the rising need for portable, real-time sensing solutions, wireless 3D image sensors are gaining momentum, especially in user-friendly and smart lifestyle applications.

By Application Analysis

Face recognition is projected to lead the 3D image sensors market in 2025 with a share of 25.3%, driven by its growing use in smartphones, security systems, and smart devices. This application relies on 3D sensing to capture detailed facial features, allowing for accurate identification and enhanced biometric authentication. With rising demand for secure and touchless access, face recognition has become a key feature in consumer electronics, banking apps, and surveillance systems.

It also plays a vital role in access control for offices, airports, and public venues. The accuracy and speed offered by 3D image sensors make face recognition more reliable than traditional 2D methods. As privacy and security needs continue to grow across sectors, 3D face recognition is becoming a trusted solution for both personal and commercial use, supporting the wider adoption of advanced sensing technologies.

Gesture recognition will witness significant growth over the forecast period as it becomes more common in smart consumer devices, gaming, and interactive systems. This application uses 3D image sensors to track hand and body movements, enabling users to control devices without touching them. It enhances user experience in AR/VR headsets, smart TVs, and automotive infotainment systems, allowing seamless and intuitive interaction.

The ability to operate systems through gestures is also valuable in hygiene-sensitive environments such as hospitals and public kiosks. As user interfaces move toward natural and touchless controls, 3D gesture recognition is gaining popularity. Its role in enabling immersive, real-time interactions is encouraging more industries to explore and implement this technology in their products and services.

By Resolution Analysis

Full HD is set to lead the 3D image sensors market in 2025 with a share of 41.7%, supported by its balance between image quality, performance, and cost. This resolution level is widely used in smartphones, surveillance systems, AR/VR devices, and automotive applications, where clear and accurate depth sensing is essential without requiring high bandwidth or storage. Full HD 3D sensors offer the clarity needed for facial recognition, object detection, and gesture tracking while maintaining efficient power consumption and processing speed.

Their affordability and wide compatibility make them a preferred choice across both consumer and industrial sectors. As the demand rises for smart devices with interactive capabilities, Full HD sensors continue to meet performance needs without the added complexity of ultra-high resolutions, making them a practical solution for a broad range of real-time 3D sensing applications.

UHD resolution will experience significant growth over the forecast period in the 3D image sensors market due to its ability to deliver ultra-clear imaging and higher depth accuracy. It is especially valuable in advanced applications like high-end medical imaging, industrial inspection, and premium consumer electronics, where fine details and precision are critical.

UHD sensors are becoming more common in smart TVs, surveillance systems, and professional AR/VR tools, offering enhanced visual experiences and sharper 3D mapping. As processing power improves and demand grows for highly detailed visuals, more devices are adopting UHD 3D sensors. Their advanced capabilities help support richer, more immersive interactions, positioning them as a key technology in next-generation imaging systems.

By End User Industry Analysis

Consumer electronics is projected to lead the 3D image sensors market in 2025 with a share of 28.9%, driven by the widespread use of advanced imaging and depth-sensing features in everyday devices. Smartphones, tablets, gaming consoles, and smart home devices are increasingly using 3D sensors for applications such as Facial Recognition Technology, gesture control, AR experiences, and secure access.

These sensors improve user experience by enabling more natural and interactive interfaces. With growing consumer demand for high-tech features, electronics manufacturers are continuously integrating 3D image sensing into new product models. Compact size, energy efficiency, and improved performance make these sensors ideal for personal gadgets. As connected devices and immersive digital experiences become more common, the consumer electronics industry will continue to play a major role in shaping the adoption and innovation of 3D image sensor technology.

Automotive is expected to witness significant growth over the forecast period in the 3D image sensors market, fueled by the push toward autonomous driving and enhanced safety systems. Vehicles are now equipped with 3D sensors that support features like driver monitoring, object detection, collision avoidance, and parking assistance. These sensors help create a detailed view of the car’s surroundings, enabling smarter navigation and real-time decision-making.

In-cabin applications, such as gesture control for infotainment systems and facial recognition for driver authentication, are also expanding. As automakers continue to invest in smart mobility and electrification, the need for reliable and high-performance 3D image sensors will grow. This trend positions the automotive sector as a strong contributor to future demand and innovation in the market.

The 3D Image Sensors Market Report is segmented on the basis of the following

By Type

- Structured Light

- Time-of-Flight (ToF)

- Stereoscopic Imaging

By Technology

By Connectivity

By Application

- Gesture Recognition

- Consumer Gesture Interfaces

- Automotive Gesture Controls

- Face Recognition

- Mobile Device Authentication

- Security & Surveillance

- Object Detection & Tracking

- Industrial Robotics

- AR/VR Systems

- 3D Mapping & Modeling

- Construction & Architecture

- Gaming & Simulation

- Navigation

- Autonomous Vehicles

- Drones

- Industrial Automation

- Quality Inspection

- Robotic Vision

By Resolution

- VGA (640×480)

- HD (720p)

- Full HD (1080p)

- UHD/4K and above

By End Use Industry

- Consumer Electronics

- Smartphones

- Tablets

- Gaming Consoles

- Wearables

- Automotive

- Healthcare

- Medical Imaging

- Patient Monitoring

- Industrial

- Aerospace & Defense

- UAVs

- Surveillance Systems

- Media & Entertainment

- Animation

- Virtual Reality

- Security & Surveillance

- Facial Recognition Systems

- Biometric Access Control

- Robotics

- Humanoid Robots

- Industrial Robots

Regional Analysis

Leading Region in the 3D Image Sensors Market

Asia Pacific will be leading the 3D image sensors market in 2025 with a share of 34.6%, driven by rapid adoption across electronics, automotive, and industrial sectors. Countries like China, Japan, South Korea, and India are witnessing strong growth in demand for smartphones, consumer electronics, and automation technologies that heavily rely on 3D image sensing.

The region is home to major electronics manufacturers and semiconductor companies that are investing in advanced sensor technologies to meet growing needs for face recognition, augmented reality, and machine vision. With government support for smart manufacturing and growing interest in electric and autonomous vehicles, 3D image sensors are being integrated into various applications for depth sensing and precision detection.

The availability of skilled labor, cost-efficient production, and increasing research initiatives also make Asia Pacific a hub for innovation and production of these sensors. As industrial automation and smart consumer devices expand in the region, the 3D image sensors market is expected to see strong and steady growth.

Fastest Growing Region in the 3D Image Sensors Market

North America is showing significant growth in the 3D image sensors market over the forecast period, supported by strong demand across consumer electronics, automotive safety systems, and industrial automation. The region is known for early adoption of advanced technologies like facial recognition, gesture control, and depth sensing in devices such as smartphones, AR/VR headsets, and smart home products.

Growth is further driven by rising investment in autonomous vehicles, robotics, and medical imaging tools that rely on 3D depth sensing and high-precision imaging. With a solid base of tech innovation, research, and digital transformation across industries, North America continues to strengthen its role in shaping the future of 3D image sensor technology.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The 3D image sensors market is highly competitive, with many global and regional players offering a wide range of solutions for different applications. Companies compete based on factors like sensor quality, size, speed, power use, and how well the sensors work in different lighting conditions. Innovation is key, as firms focus on making sensors smaller, more accurate, and easier to integrate into consumer devices and industrial systems.

Partnerships with tech developers, hardware makers, and software platforms are common, helping companies expand their reach. The growing use of 3D sensors in smartphones, cars, factories, and medical tools is also encouraging new players to enter the market, leading to even more innovation and options for customers in this fast-changing space.

Some of the prominent players in the global 3D Image Sensors are:

- Sony Corporation

- Intel Corporation

- Samsung Electronics Co., Ltd.

- Apple Inc.

- STMicroelectronics

- Infineon Technologies AG

- OmniVision Technologies, Inc.

- Microsoft Corporation

- Qualcomm Technologies, Inc.

- Canon Inc.

- Panasonic Holdings Corporation

- Lumentum Holdings Inc.

- Teledyne Technologies Incorporated

- Basler AG

- Cognex Corporation

- AMS OSRAM AG

- FLIR Systems (Teledyne FLIR)

- Melexis NV

- Texas Instruments Incorporated

- Leica Geosystems

- Other Key Players

Recent Developments

- In June 2025, Gpixel introduced the first two models in its new SWIR-sensitive line scan sensor family: the GIR1201 and GIR2505. Designed for imaging in the 900–1700 nm range with 75% QE at 1550 nm, both sensors feature high line rates, wide dynamic range, and on-chip 12-bit ADC. The GIR1201 offers 1024 x 1 resolution with 12.5 μm pixels, while the GIR2505 provides 512 x 2 resolution with 25 μm pixels. Both support high/low gain modes, Sub-LVDS interfaces, and consume under 450 mW at peak operation.

- In May 2025, Airy3D announced that its DepthIQ™ SDK now supports Qualcomm’s Dragonwing™ RB3 Gen 2 and RB5 platforms. This advancement allows developers and OEMs to easily embed passive depth sensing into intelligent devices powered by Qualcomm’s advanced processors. Widely used in robotics, industrial IoT, smart cameras, and edge AI, these platforms benefit from DepthIQ’s ability to deliver high-quality, high-resolution depth maps. The integration enables compact, energy-efficient 3D vision without relying on active components or additional specialized hardware.

- In April 2025, Seeing Machines introduced a new 3D camera technology tailored for in-cabin monitoring. Developed in partnership with Montreal-based Airy3D Inc. over four years, the camera integrates Airy3D’s DepthIQ™ technology to meet automotive cabin requirements. It captures 3D range data along with 5MP RGB and infrared 2D images, matching the specifications of current in-cabin systems. For the first time, a single camera module with one sensor and lens can deliver both high-quality 2D and 3D sensing for full-cabin eye tracking.

- In April 2025, OMNIVISION launched its new OV50X CMOS image sensor, offering the highest dynamic range in the mobile phone industry for cinematic-quality video capture. The OV50X is a 50-megapixel sensor featuring a 1.6-micron pixel in a 1-inch optical format, tailored for high-end smartphones. It supports single-exposure HDR video and preview, delivering outstanding low-light performance, fast autofocus, and high frame rates. This new sensor is designed to meet the growing demand for advanced imaging in flagship mobile devices.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 7.2 Bn |

| Forecast Value (2034) |

USD 7.2 Bn |

| CAGR (2025–2034) |

16.9% |

| The US Market Size (2025) |

USD 1.5 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Structured Light, Time-of-Flight (ToF), and Stereoscopic Imaging), By Technology (CMOS and CCD), By Connectivity (Wired and Wireless), By Application (Gesture Recognition, Face Recognition, Object Detection & Tracking, 3D Mapping & Modeling, Navigation, and Industrial Automation), By Resolution (VGA (640×480), HD (720p), Full HD (1080p), and UHD/4K and above), By End Use Industry (Consumer Electronics, Automotive, Healthcare, Industrial, Aerospace & Defense, Media & Entertainment, Security & Surveillance, and Robotics) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Sony Corporation, Intel Corporation, Samsung Electronics Co., Ltd., Apple Inc., STMicroelectronics, Infineon Technologies AG, OmniVision Technologies, Inc., Microsoft Corporation, Qualcomm Technologies, Inc., Canon Inc., Panasonic Holdings Corporation, Lumentum Holdings Inc., Teledyne Technologies Incorporated, Basler AG, Cognex Corporation, AMS OSRAM AG, FLIR Systems (Teledyne FLIR), Melexis NV, Texas Instruments Incorporated, Leica Geosystems, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |