3D Printing in Healthcare Market Overview

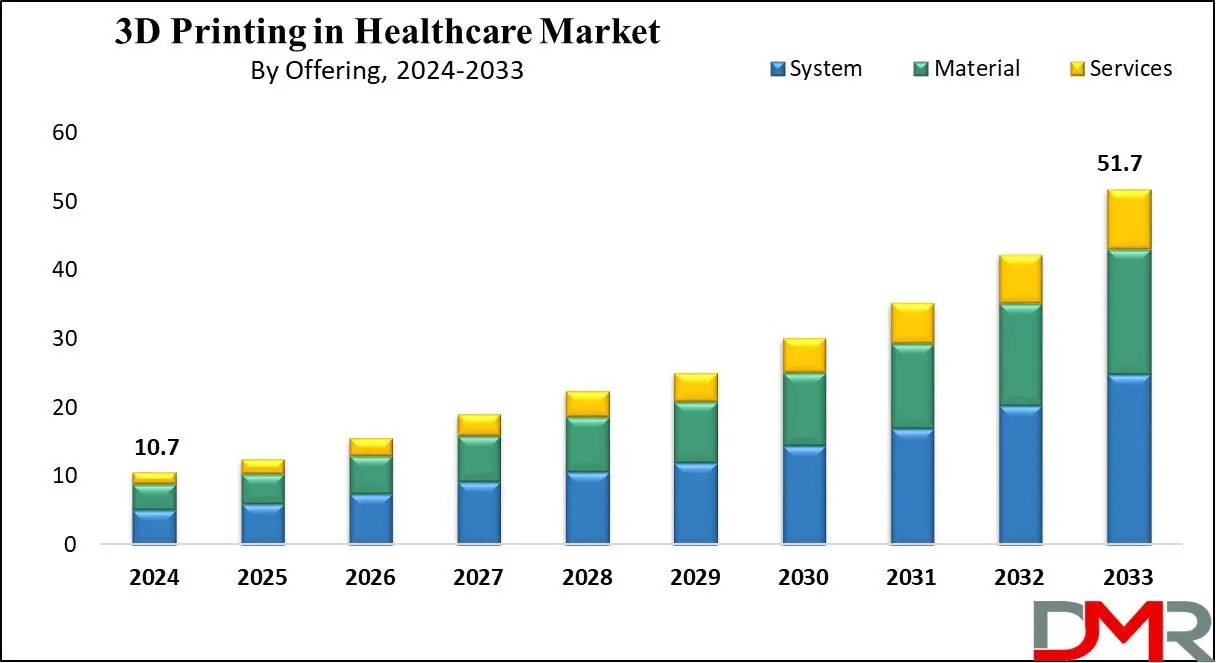

The Global 3D Printing in Healthcare Market is projected to reach USD 10.7 billion in 2024 and grow at a compound annual growth rate of 19.2% from there until 2033 to reach a value of USD 51.7 billion.

Three-dimensional (3D) printing is transforming healthcare with applications in surgical tools, prosthetics, and patient-specific models of bones and organs for better planning and training. As medical 3D printing rapidly advances, it is becoming vital in regenerative medicine, developing living tissues, and providing customized solutions like tailored prosthetics and drug formulations. By minimizing surgical risks, anesthesia exposure, and infection chances, 3D printing improves patient safety and recovery.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In addition, it saves time and costs, streamlining healthcare delivery and driving innovation in personalized care worldwide through modern healthcare 3D printing technology.

The US 3D Printing in Healthcare Market

The US 3D Printing in Healthcare Market is projected to reach USD 4.2 billion in 2024 at a compound annual growth rate of 18.0% over its forecast period.

The 3D printing healthcare market in the US offers growth opportunities driven by development in bioprinting, growing demand for customized medical devices, and expanding applications in surgical planning and implants. Patent expirations and innovation in materials and technologies further drive the growth. The country’s advanced healthcare infrastructure and aim of precision medicine improve adoption, driving future market expansion supported by advancements in additive manufacturing in healthcare.

Further, the growth in the 3D printing healthcare market is driven by developments in bioprinting, customized medicine, and a growing demand for custom implants and surgical tools. However, high initial costs & regulatory challenges act as restraints, limiting wide adoption and slowing the approval process for 3D-printed medical devices and products. Parallel innovations in the

3D Printing Market, including the emerging

3D Printing Construction, are also driving material and production efficiencies that may positively influence healthcare applications.

Key Takeaways

- Market Growth: The 3D Printing in Healthcare Market size is expected to grow by 39.2 billion, at a CAGR of 19.2% during the forecasted period of 2025 to 2033.

- By Offering: The system segment is anticipated to get the majority share of 3D Printing in Healthcare Market in 2024.

- By Application: Dental segment is expected to be leading the market in 2024

- By End User: The medical and surgical centers segment is expected to get the largest revenue share in 2024 in 3D Printing in Healthcare Market.

- Regional Insight: North America is expected to hold a 44.3% share of revenue in the Global 3D Printing in Healthcare Market in 2024.

- Use Cases: Some of the use cases of 3D Printing in Healthcare include surgical planning & training, custom prosthetics & implants, and more.

Use Cases

- Custom Prosthetics and Implants: 3D printing allows for the production of highly personalized prosthetics and implants customized to the specific anatomy of individual patients, enhancing comfort, functionality, and patient outcomes.

- Surgical Planning and Training: Surgeons can use 3D-printed models of patient-specific organs or tissues for pre-surgical planning, rehearsing complex procedures, & medical training, improving precision and reducing surgery time. This application has been boosted by interactive visualization innovations from the 3D Display.

- Tissue Engineering and Regenerative Medicine: Researchers use bioprinting, a form of 3D printing that uses bio-ink made from living cells, to develop tissues or organ structures for research, drug testing, and potentially future organ transplants.

- Drug Delivery Systems and Medical Devices: 3D printing enables the design of specialized drug delivery systems and medical devices, like stents or implants, providing customized treatment options and enhancing patient care.

3D Printing in Healthcare Market Dynamic

Driving Factors

Increasing Demand for Personalized Medical Solutions

The major focus on customized healthcare, like patient-specific prosthetics, implants, and surgical tools, is driving the adoption of 3D printing, which allows for custom-made medical solutions personalized to individual patient anatomy, enhancing treatment outcomes.

Advancements in Bioprinting and Material Innovation

Constant development in 3D bioprinting technology and the development of biocompatible materials have accelerated the potential for creating complex tissues, organs, and medical devices, driving the growth in the market. These innovations improve applications in regenerative medicine, surgical planning, and pharmaceutical research.

Restraints

High Initial Costs and Limited Accessibility

The major upfront cost required for 3D printing equipment, materials, and skilled labor can limit its broad adoption, mainly in smaller healthcare facilities or in developing regions.

Regulatory and Standardization Challenges

The healthcare sector is highly regulated, and 3D-printed medical products must undergo strict approval processes, as the lack of standardized guidelines for 3D-printed medical devices and products can halt innovation and market entry.

Opportunities

Expansion in Bioprinting and Tissue Engineering

The growing potential of bioprinting to develop complex tissues, organ models, and even functional organs provides significant opportunities for research, drug testing, and future applications in organ transplantation, creating new avenues for growth in healthcare.

Growing Adoption in Developing Markets

As the cost of 3D printing technology lowers and awareness of its medical benefits grows, there is a major opportunity for its adoption in developing markets, which can lead to better access to personalized healthcare solutions, like affordable prosthetics and surgical tools.

Trends

Advancement in 3D Bioprinting for Organ Development

A major trend is the progress in 3D bioprinting, where researchers are successfully printing tissues and organ models for drug testing, research, and the long-term goal of producing transplantable organs, which holds immense potential for personalized medicine and regenerative healthcare.

Increased Use of 3D Printing for Point-of-Care Manufacturing

Hospitals and healthcare facilities are highly adopting 3D printers on-site to produce custom implants, prosthetics, and surgical models at the point of care, reducing lead times, and costs, and enhancing patient-specific treatment delivery. In parallel,

Generative AI in Healthcare tools are supporting real-time design optimization for these on-site printed solutions.

3D Printing in Healthcare Market Research Scope and Analysis

By Offering

The system segment as an offering is expected to be the largest in the 3D printing healthcare market in 2024, mainly due to its growing demand in the healthcare industry, which is due to the rapid technological developments, like full-color 3D printing and the ability to use multiple materials, which have majorly improved the capabilities of 3D printing systems.

These innovations have increased the adoption of advanced 3D printing technologies across many healthcare applications, as they provide greater precision, flexibility, and efficacy, making them highly valuable for medical professionals.

In addition, modern 3D printing equipment in the healthcare sector is now more portable, allowing it to be easily transported to remote locations, which improves the reach of healthcare services and expands the scope of 3D printing technology in areas with limited access to advanced medical facilities. In healthcare, the demand for flawless service is critical, as it makes sure that procedures are carried out easily, yielding optimal results.

The precision and reliability provided by advanced 3D printing systems play a major role in achieving these outcomes, further driving their demand in the market.

By Technology

Laser beam sintering as technology is anticipated to lead the 3D printing healthcare market in 2024, accounting for the largest revenue share, which is highly valued for its ability to create largely personalized and precisely developed medical devices and implants. By utilizing a layer-by-layer fabrication process, laser sintering can develop complex geometries that closely matches the patient’s anatomy, making it ideal for medical applications.

Furthermore, the technology helps the use of a broad range of biocompatible materials, like titanium alloys, cobalt-chromium alloys, and polymers like polyetheretherketone (PEEK). These materials are important for developing durable and effective implants and prosthetics, further accelerating the adoption of laser sintering in healthcare.

Moreover, the droplet deposition modeling is projected to see the highest growth over the forecast period, which allows for the melting of drug-loaded filaments to create a variety of dosage forms, delivering the flexibility required to create personalized medicines. With droplet deposition, distinctive shapes, a variety of active pharmaceutical ingredients, and controlled drug release rates can be achieved.

In addition, developments in automating the 3D printing process using deposition modeling have highly improved the precision of drug manufacturing, improving both efficiency and safety in the production of pharmaceuticals, which makes it a promising area of growth in the 3D printing healthcare market.

By Application

The dental segment as an application is expected to lead the 3D printing healthcare market in 2024, driven by its increase in the use in dentistry. 3D printing mostly enhances the design & production of customized dental prosthetics, transforming traditional methods. One major advantage is the ability to prepare, scan, and print a patient’s teeth in a single session, making it a faster and more efficient process, which saves both time &resources while providing highly customized solutions for patients in real-time clinical settings, offering a clear benefit to both dental professionals and patients.

Further, tissue engineering is anticipated to see the highest growth in the coming years. The capability of 3D printing to create customized scaffolds that closely simulate the shape and structure of damaged tissues is a major factor in its rising popularity. These 3D-printed scaffolds can be developed with the right porosity, structure, and biomaterial composition, making them ideal for helping cell growth and tissue regeneration.

Moreover, the integration of growth factors into these scaffolds further improves tissue repair. The growing demand for customized medical solutions, along with advancements in regenerative medicine, is driving the better use of 3D printing in tissue engineering.

By End User

In terms of end users, the medical and surgical centers, which include hospitals, clinics, and specialized healthcare facilities, will dominate the 3D printing healthcare market in 2024, representing the largest segment. These institutions mostly use 3D printing for various applications like patient-specific anatomical models, surgical guides, custom prosthetics, and orthopedic implants.

The technology equips healthcare providers with better tools for diagnosis, treatment planning, and patient-specific interventions, ultimately enhancing patient care and surgical outcomes. By allowing more accurate procedures and personalized treatments, 3D printing is transforming how medical and surgical centers deliver healthcare, driving the adoption of this technology and fueling market growth. In addition, the pharmaceutical and biotechnology sector is using 3D printing to transform drug development, personalized medicine, and drug delivery systems.

The ability to produce 3D-printed pills, tablets, and drug-loaded implants allows precise dosing, better drug release profiles, and customized therapies for individual patients, which not only advances drug development but also enhances the safety and effectiveness of pharmaceutical products. By allowing customized treatment options, 3D printing plays a major role in the growth of the pharmaceutical and biotechnology sectors, pushing forward the development of personalized medicine and innovative drug delivery systems.

The 3D Printing in Healthcare Market Report is segmented on the basis of the following

By Offering

- System

- Materials

- Polymers

- Metals & Alloys

- Photopolymers

- Thermoplastics

- Ceramics

- Others

- Services

By Technology

- Laser Beam Sintering

- Selective Laser Sintering (SLS)

- Selective Laser Melting (SLM)

- Direct Metal Laser Sintering (DMLS)

- Droplet Deposition

- Fused Filament Fabrication (FFF) Technology

- Low-temperature Deposition Manufacturing (LDM)

- Multiphase Jet Solidification (MJS)

- Photopolymerization

- Stereolithography (SLA)

- Continous Liquid Interface Production (CLIP)

- Two-photon Polymerization (2PP)

- Electronic Beam Melting (EBM)

- Laminated Object Manufacturing

- Others

- Color Jet Printing

- MultiJet Printing

By Application

- Medical Implants

- Prosthetics

- Wearables Devices

- Tissues Engineering

- Dental

- Others

By End User

- Medical & Surgical Centers

- Pharmaceutical & Biotechnology Companies

- Academic Institutions

3D Printing in Healthcare Market Regional Analysis

North America is predicted to lead the global 3D printing in healthcare market, accounting for the largest

revenue share of 44.3%, which is driven by the growing demand for personalized additive manufacturing, expanding medical applications, and the expiration of key patents, which has driven innovation and competition.

3D printing's ability to produce highly precise anatomical models is in high demand from healthcare providers, mainly for supporting surgeons in complex procedures. Additionally, growing collaboration across the 3D Printing Market,

3D Imaging, and Generative AI in Healthcare Market ecosystems is reinforcing North America’s leadership position in medical innovation.

As a hub of technological innovation, North America promotes the development and integration of 3D printing within the healthcare sector. The region’s advanced healthcare facilities and research organizations are actively using 3D printing for patient-specific models, surgical planning, and medical device manufacturing, contributing to the quick expansion of the market.

Further, the Asia Pacific healthcare 3D printing market is anticipated to experience major growth over the forecast period, which is largely due to the growth in the demand for personalized 3D-printed medical devices & instruments, alongside the growth in the adoption of precision medicine. Patent expirations are also opening up the market to more competition, further driving the growth in the region.

However, despite these developments, the high cost of additive manufacturing and a shortage of skilled professionals provide ongoing challenges that limit the broad adoption of 3D printing technology in some parts of the Asia Pacific region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

3D Printing in Healthcare Market Competitive Landscape

The competitive landscape of the 3D printing healthcare market is growing rapidly, with key players like Stratasys, 3D Systems, and GE Healthcare leading innovation. Companies are focusing on developing advanced bioprinting technologies, and personalized medical devices while expanding their product portfolios. Strategic partnerships, mergers, and acquisitions are common as businesses look to improve their capabilities and market presence.

Further, startups are also emerging, driving competition with innovative solutions, while big companies invest in R&D to stay ahead. Regulatory approval processes and cost barriers create challenges, but the market remains dynamic and promising.

Some of the prominent players in the Global 3D Printing in Healthcare are

- Aram AB

- Materialise NV

- EoS GmBH

- 3D Systems Inc

- Renishaw PLC

- Envision TEC GmbH

- Stratasys Ltd

- Allevi Inc

- Nanoscribe GmbH & Co

- Fathom Manufacturing

- Other Key Players

Recent Developments

- In September 2024, Amnovis unveiled that it produced 50,000 implants using its proprietary heat-treatment-free 3D printing process, which has been used in the spine, orthopedics, and CMF markets since 2021. Further, the company helps other organizations design, develop, and bring titanium 3D-printed implants to market. Also, it has extensive expertise in additive manufacturing and collaborates with many firms to implement new implants, particularly in spine and orthopedics.

- In September 2024, APL and a leading contract development & manufacturing organization (CDMO), announced their partnership with CurifyLabs, a Finnish health tech company specializing in customized medicine manufacturing solutions, that improve the administration of medicines to children and critically ill patients using innovative 3D printing technology.

- In June 2024, Ricoh USA introduced the RCOH 3D for Healthcare Innovation Studio, its new point-of-care additive manufacturing facility, as it provides clinicians direct access to development, design, and manufacturing capabilities for 3D printing FDA-approved anatomic models. Further, the company claims that its on-site additive manufacturing capabilities will minimize operating times, lower medical costs, enhance diagnostic support, and alleviate FDA-compliance concerns.

- In June 2024, Stratasys launched its new J5 Digital Anatomy 3D printer for the medical market, which is designed to meet the increase in demand for affordable and accurate anatomical models. Further, the latest 3D printer is targeted at hospitals, medical device manufacturers, and research institutions.

- In October 2023, CurifyLabs launched GMP (good manufacturing practice) produced Pharma Inks for 3D printable medicines, which provides a new solution for producing patient-customized and personalized medicines in pharmacies and hospitals, which includes automated 3D printing technology and printable pharmaceutical inks, allowing wider adoption of personalized medicine, resulting in better future care for patients with various distinctive needs.

3D Printing in Healthcare Market Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 10.7 Bn |

| Forecast Value (2033) |

USD 51.7 Bn |

| CAGR (2024-2033) |

19.2% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 4.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Offering (System, Materials, Services), By Technology (Laser Beam Sintering, Droplet Deposition, Photopolymerization, Electronic Beam Melting (EBM), Laminated Object Manufacturing, and Others), By Application (Medical Implants, Prosthetics, Wearables Devices, Tissues Engineering, Dental, and Others), By End User (Medical & Surgical Centers, Pharmaceutical & Biotechnology Companies, and Academic Institutions) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Aram AB, Materialise NV, EoS GmBH, 3D Systems Inc, Renishaw PLC, Envision TEC GmbH, Stratasys Ltd, Allevi Inc, Nanoscribe GmbH & Co, Fathom Manufacturing, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global 3D Printing in Healthcare Market?

▾ The Global 3D Printing in Healthcare Market size is expected to reach a value of USD 10.7 billion in 2024 and is expected to reach USD 51.7 billion by the end of 2033.

Which region accounted for the largest Global 3D Printing in Healthcare Market?

▾ North America is expected to have the largest market share in the Global 3D Printing in Healthcare Market with a share of about 44.3% in 2024.

How big is the 3D Printing in Healthcare Market in the US?

▾ The 3D Printing in Healthcare Market in the US is expected to reach USD 4.2 billion in 2024.

Who are the key players in the Global 3D Printing in Healthcare Market?

▾ Some of the major key players in the Global 3D Printing in Healthcare Market are Aram AB, Materialise NV, EoS GmBH, and others.

What is the growth rate in the Global 3D Printing in Healthcare Market?

▾ The market is growing at a CAGR of 19.2 percent over the forecasted period.