Market Overview

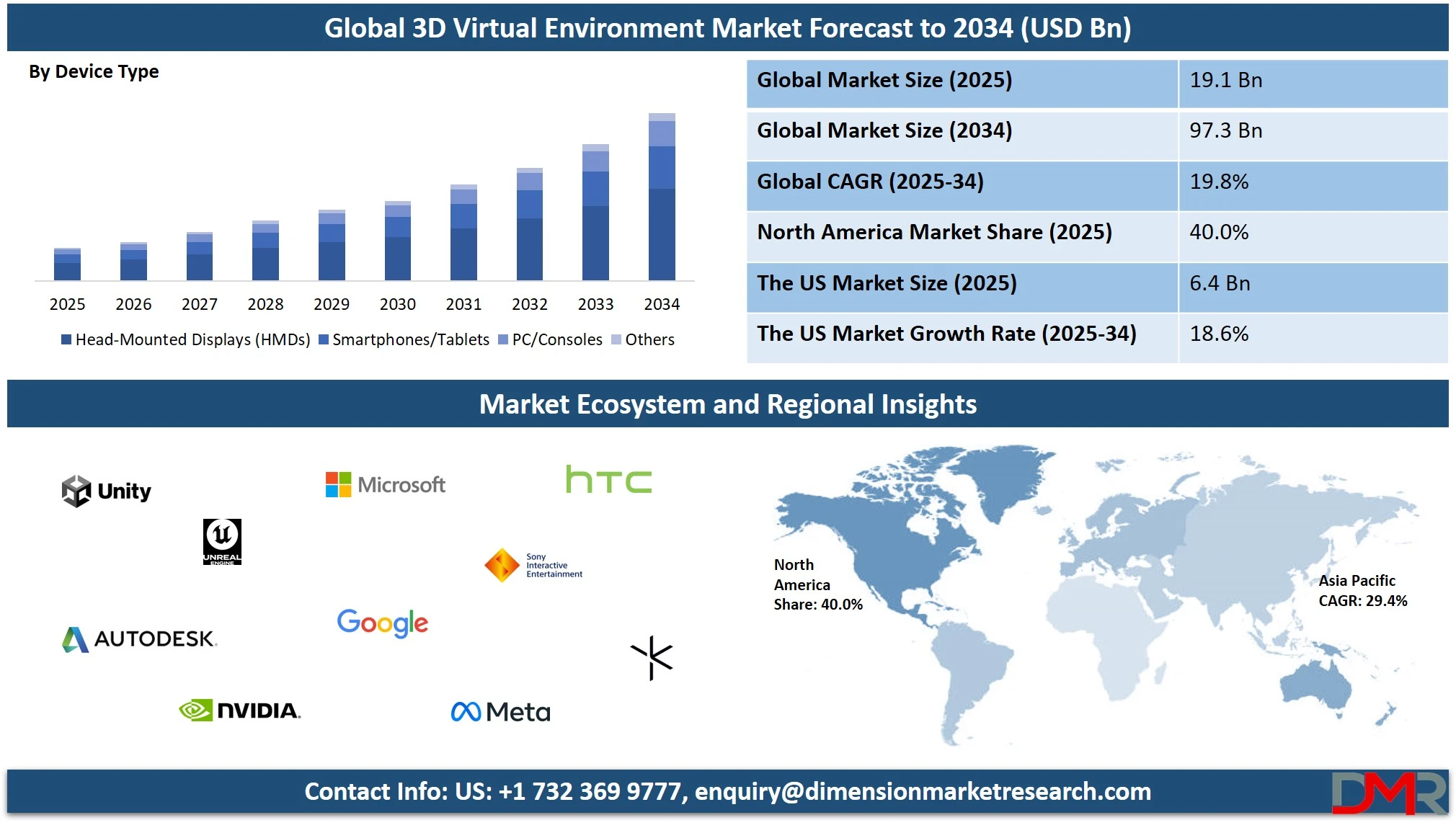

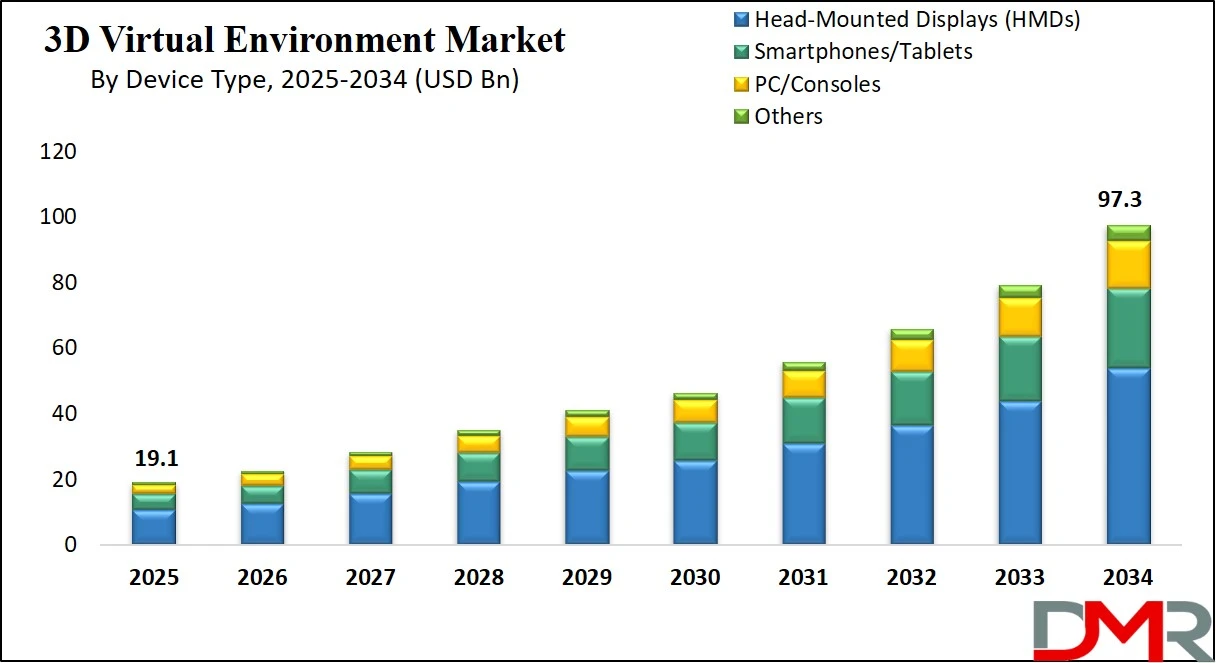

The global 3D virtual environment market is projected to grow from USD 19.1 billion in 2025 to USD 97.3 billion by 2034, expanding at a CAGR of 19.8%. This growth is driven by the growing adoption of immersive technologies, including virtual reality (VR), augmented reality (AR), and 3D simulation across sectors such as gaming, healthcare, education, retail, and industrial design. Rising demand for interactive 3D content, real-time rendering, and virtual collaboration tools is fueling market expansion globally.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

A 3D virtual environment refers to a computer-generated, immersive digital space that simulates real or imagined worlds with three-dimensional visuals. These environments allow users to interact with virtual objects and navigate spaces in real time, often through devices such as VR headsets, AR glasses, or even standard screens.

Leveraging technologies like real-time rendering, spatial audio, haptics, and artificial intelligence, 3D virtual environments provide an experiential layer to digital content, making them integral to applications like virtual simulations, training modules, collaborative workspaces, virtual gaming, digital twins, and immersive storytelling.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

These environments are not limited to entertainment but are being applied across enterprise settings, from virtual prototyping and architectural walkthroughs to medical training and education, where interactive and realistic user experiences enhance engagement, understanding, and efficiency.

The global 3D virtual environment market is witnessing robust expansion, driven by advancements in immersive technologies such as virtual reality, augmented reality, and mixed reality. Increasing adoption of these Access Platforms across sectors, including healthcare, education, retail, automotive, and real estate, is fueling demand for realistic simulation environments and interactive design tools.

Enterprises are leveraging these digital environments to simulate real-world scenarios, enabling enhanced training, remote collaboration, and risk-free prototyping. The proliferation of AI-powered 3D modeling tools, combined with real-time cloud rendering capabilities, is further accelerating the integration of 3D environments into core business operations and customer engagement strategies.

As organizations globally embrace digital transformation, the integration of 3D spatial environments is becoming a strategic imperative. In sectors like e-commerce and real estate, companies are using interactive 3D showrooms and virtual tours to elevate customer experiences. In manufacturing and aerospace, virtual twins of equipment and machinery enable predictive maintenance and design optimization.

Additionally, governments and educational institutions are deploying virtual environments for simulation-based learning, urban planning, and public safety drills. This growing cross-industry adoption highlights the versatility and economic impact of 3D virtual environments, establishing them as foundational to next-generation digital infrastructure.

Furthermore, the growing accessibility of hardware like VR headsets and the democratization of 3D content creation and Access Platforms are empowering small businesses and individual creators to enter the immersive technology space. Cloud-based Access Platforms and no-code/low-code development tools have lowered barriers to entry, while global investment in metaverse Access Platforms and spatial computing has created a fertile ground for innovation.

As connectivity improves with 5G and edge computing, the delivery of high-fidelity 3D environments in real time is becoming more scalable and efficient, paving the way for broader adoption across both developed and emerging markets. The global 3D virtual environment market is thus poised for sustained growth, underpinned by a convergence of immersive technology trends, economic digitization, and evolving user expectations.

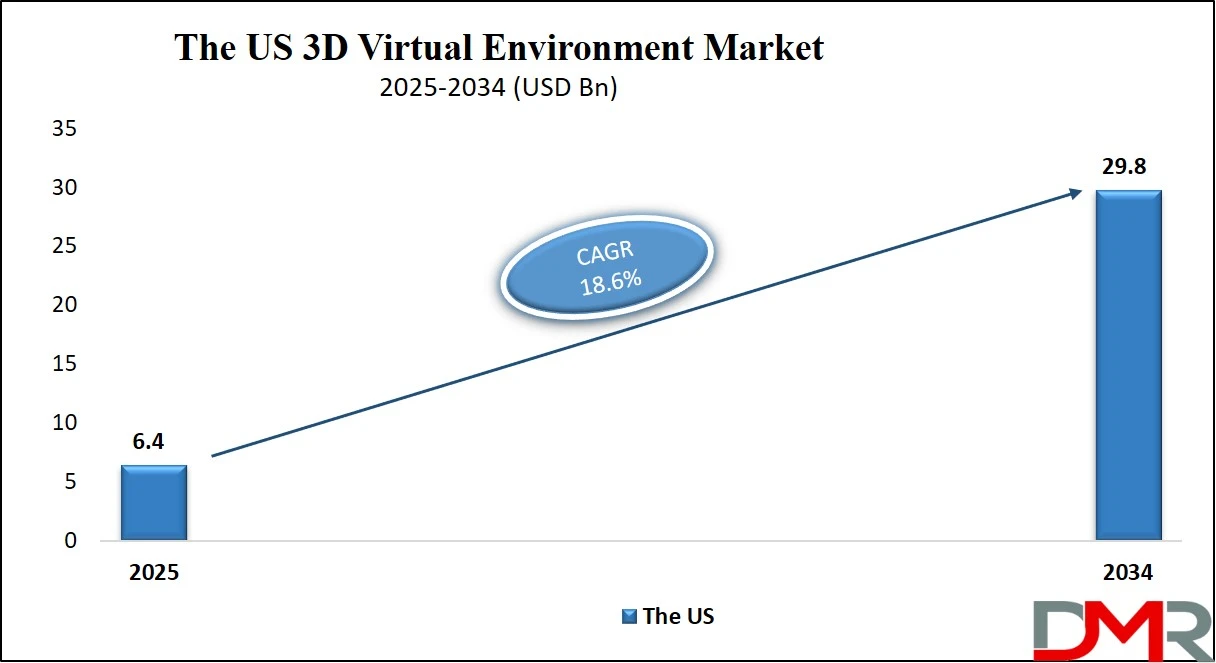

The US 3D Virtual Environment Market

The U.S. 3D Virtual Environment Market size is projected to be valued at USD 6.4 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 29.8 billion in 2034 at a CAGR of 18.6%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The U.S. 3D virtual environment market is rapidly evolving as a result of widespread integration of immersive technology across key industries such as entertainment, healthcare, defense, and enterprise training. American tech companies are at the forefront of innovation in virtual reality (VR), augmented reality (AR), and mixed reality (MR), driving the development of advanced simulation Access Platforms and interactive 3D applications.

From cinematic virtual production studios to military-grade training environments, the U.S. is leveraging virtual worlds not only for enhanced user experiences but also for strategic operational efficiency. With strong support from both private investors and federal initiatives focused on digital infrastructure and emerging technologies, the U.S. market is establishing a solid foundation for scalable 3D ecosystems. Companies are utilizing 3D modeling, spatial computing, and real-time collaboration tools to redefine how digital content is created, shared, and consumed.

Moreover, the growing demand for immersive education, remote work solutions, and digital twin technology is further strengthening the domestic adoption of 3D virtual environments. Universities and training institutions are integrating virtual campuses and lab simulations, while healthcare providers are employing VR for surgical training and patient therapy.

In retail and real estate, 3D product visualization and virtual property tours are enhancing customer engagement. The rise of AI-driven content creation tools and cloud-based rendering Access Platforms is also lowering the barrier for entry, enabling startups and smaller enterprises to create high-fidelity virtual experiences. The U.S. continues to lead in software innovation, hardware development, and immersive user interface design, positioning its 3D virtual environment market as a global benchmark for both technological advancement and practical implementation.

The European 3D Virtual Environment Market

The European 3D virtual environment market is expected to reach a valuation of approximately USD 3.8 billion in 2025, reflecting its significant presence within the global landscape. This market growth is driven by Europe’s strong industrial base, which includes automotive, aerospace, manufacturing, and healthcare sectors that rely on immersive 3D technologies for design, prototyping, training, and simulation. The region benefits from robust technological infrastructure, a highly skilled workforce, and progressive adoption of virtual and augmented reality solutions.

Additionally, government initiatives promoting digital transformation and Industry 4.0 frameworks are accelerating the integration of 3D virtual environments across enterprises, further fueling market expansion.

Europe’s market is projected to grow at a healthy compound annual growth rate (CAGR) of around 16.3%, underscoring rising investments in research and development and innovation in immersive technology applications. Increasing consumer interest in gaming, entertainment, and virtual social experiences also contributes to this growth.

Key players in software development, hardware manufacturing, and content creation are actively expanding their footprint in the region, creating a competitive yet collaborative ecosystem. Furthermore, growing emphasis on sustainability and remote work solutions is driving demand for virtual collaboration Access Platforms and digital twins, positioning Europe as a vibrant and fast-growing market within the global 3D virtual environment industry.

The Japanese 3D Virtual Environment Market

The Japanese 3D virtual environment market is projected to reach a valuation of approximately USD 1.0 billion in 2025, highlighting its growing importance within the Asia-Pacific region. Japan’s advanced technological ecosystem, combined with a strong consumer base that embraces cutting-edge innovations in gaming, entertainment, and industrial applications, is a key driver of this market size.

Industries such as automotive, electronics, healthcare, and manufacturing are adopting virtual reality (VR) and augmented reality (AR) solutions for product design, simulation, and training purposes. The country’s focus on smart manufacturing and digital transformation initiatives further fuels demand for immersive 3D technologies that enhance operational efficiency and innovation.

With a robust CAGR of 14.8%, Japan’s 3D virtual environment market is expected to experience steady and sustainable growth over the forecast period. Government support for Industry 4.0, integrated with significant R&D investments by both private and public sectors, is propelling advancements in hardware capabilities and software Access Platforms.

Additionally, consumer interest in virtual entertainment, social experiences, and mobile AR applications contributes to the expanding market footprint. Japan’s unique blend of technological prowess, industrial strength, and cultural openness to new digital experiences positions it as a vital and fast-evolving player in the global 3D virtual environment landscape.

Global 3D Virtual Environment Market: Key Takeaways

- Market Value: The global 3D virtual environment market size is expected to reach a value of USD 97.3 billion by 2034 from a base value of USD 19.1 billion in 2025 at a CAGR of 19.8%.

- By Component Segment Analysis: Software components are poised to consolidate their dominance in the component segment, capturing 65.0% of the total market share in 2025.

- By Device Type Segment Analysis: Head-Mounted Displays (HMDs) are anticipated to maintain their dominance in the device type segment, capturing 55.0% of the total market share in 2025.

- By Access Platform Segment Analysis: PC-based Access Platform services will dominate the Access Platform segment, capturing 40.0% of the market share in 2025.

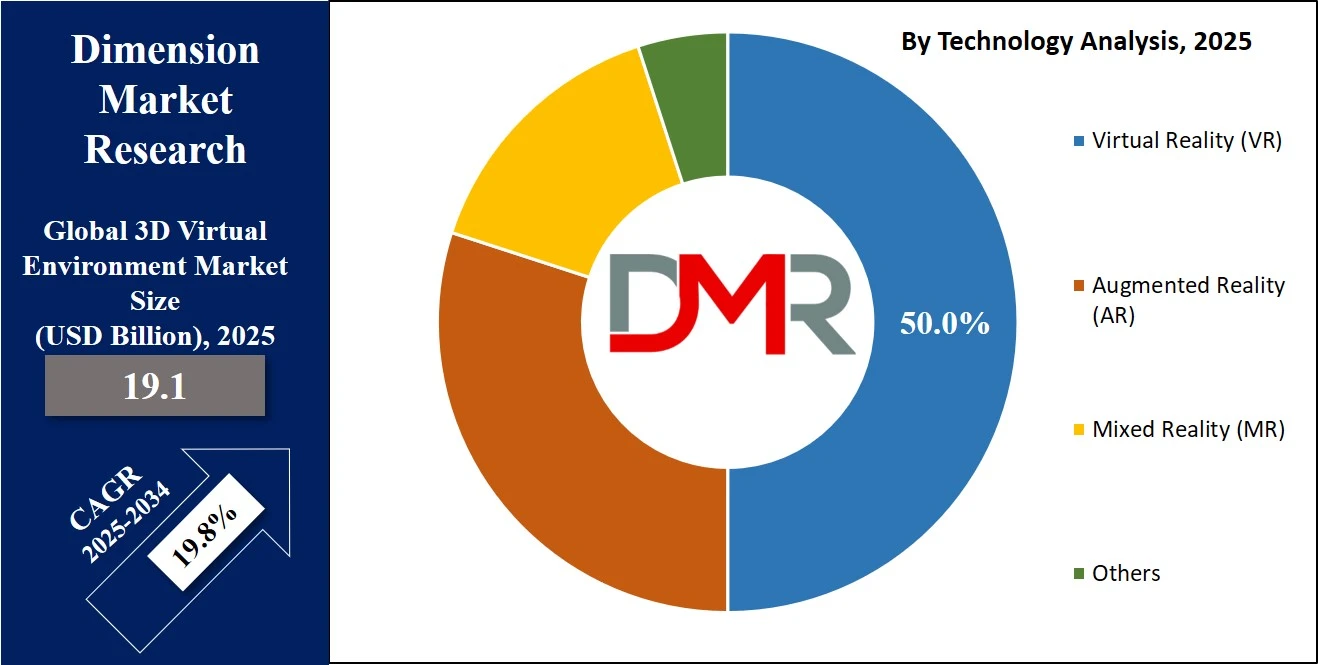

- By Technology Segment Analysis: Virtual Reality (VR) technology is expected to dominate the technology segment, capturing 50.0% of the total market share in 2025.

- By Application Segment Analysis: Gaming & Entertainment applications are projected to lead the application segment, capturing 40.9% of the total market share in 2025.

- By End-User Segment Analysis: Consumers will dominate the end-user segment, capturing 45.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global 3D virtual environment market landscape with 40.0% of total global market revenue in 2025.

- Key Players: Some key players in the global 3D virtual environment market are Unity Technologies, Epic Games (Unreal Engine), Autodesk Inc., NVIDIA Corporation, Microsoft Corporation, Google LLC, Meta Access Platforms Inc., HTC Corporation, Sony Interactive Entertainment, and other key players.

Global 3D Virtual Environment Market: Use Cases

- Virtual Training and Simulation in Healthcare: 3D virtual environments are revolutionizing medical education and training by enabling immersive, risk-free simulation experiences. Healthcare professionals use VR-based Access Platforms to practice complex surgical procedures, emergency response techniques, and patient interaction scenarios in a controlled virtual setting. These simulations enhance muscle memory, improve decision-making under pressure, and allow repetitive practice without the need for physical resources. Hospitals and medical universities are leveraging these environments for continuous skill development and certification programs. Incorporating technologies like spatial audio, motion tracking, and haptic feedback, virtual medical training offers real-time feedback and high-fidelity visuals, making it a cost-effective and scalable solution for healthcare systems aiming to reduce errors and improve patient care outcomes.

- Product Design and Digital Twin in Manufacturing: In manufacturing and industrial design, 3D virtual environments are essential for rapid prototyping and product lifecycle management. Companies create digital twins, virtual replicas of physical assets, to monitor, simulate, and optimize performance in real time. Engineers and designers collaborate in shared 3D workspaces, making iterative changes to product blueprints without the delays of physical prototyping. This immersive design process accelerates time-to-market and reduces development costs. Using augmented reality overlays and real-time simulation tools, manufacturers can identify mechanical flaws, test materials, and simulate user interaction before physical production. These capabilities support lean manufacturing principles and drive innovation in fields like automotive, aerospace, and consumer electronics.

- Immersive Retail and E-Commerce Experiences: Retailers are using 3D virtual environments to transform the customer journey by offering interactive shopping experiences. Virtual stores and showrooms allow consumers to browse products, customize configurations, and visualize items in their real-world environments using AR tools. These environments bridge the gap between online and in-store experiences by enabling product trials, virtual fitting rooms, and real-time assistance through AI-powered avatars. For e-commerce Access Platforms, immersive 3D content significantly boosts customer engagement, increases time spent on-site, and reduces product return rates. Brands are also integrating spatial analytics to track user behavior within virtual stores, providing insights into product placement, user preferences, and conversion optimization.

- Remote Collaboration and Virtual Workspaces in Enterprises: With the rise of remote and hybrid work models, enterprises are adopting 3D virtual environments to foster collaboration and team productivity. Virtual offices, meeting rooms, and project dashboards provide an immersive alternative to traditional video conferencing, allowing participants to interact with 3D objects, documents, and real-time data in a shared spatial context. These environments support cross-functional collaboration among global teams, especially in architecture, engineering, design, and R&D. Advanced features such as gesture recognition, 3D annotations, and multi-user synchronization enhance the quality of virtual meetings and streamline complex decision-making processes. This shift toward immersive workspaces reduces travel costs, enhances employee engagement, and supports digital transformation goals across industries.

Global 3D Virtual Environment Market: Stats & Facts

United States Department of Commerce (DOC)

- The U.S. virtual reality industry contributed over USD 3.5 billion to the national economy in 2023.

- 45% of U.S. manufacturing firms will have adopted some form of VR or AR technology by 2024.

- Federal investments in immersive technology R&D increased by 25% from 2021 to 2024.

- Over 30% of U.S. educational institutions use VR/AR for training and skill development as of 2023.

- The U.S. Department of Defense spent USD 1.2 billion on VR-based training simulations in 2023.

European Commission (EC) - Digital Economy and Society Index

- In 2024, 37% of European enterprises have integrated 3D virtual environments in product development or customer experience.

- The EU’s Horizon Europe program allocated €150 million for immersive technology projects in 2023.

- 25% of EU workers engaged in digital-intensive sectors will use VR/AR technologies by 2024.

- EU governments reported a 20% increase in virtual training adoption among public sector agencies between 2022-2024.

- Over 50% of European universities offer courses involving virtual environment technologies as of 2024.

Japan Ministry of Economy, Trade and Industry (METI)

- Japan’s AR/VR industry size was approximately USD 1 billion in 2024, growing at a CAGR of 14.8%.

- Over 60% of Japanese automotive manufacturers use VR environments for design and prototyping as of 2023.

- METI forecasts immersive tech adoption in industrial sectors to reach 75% by 2027.

- Japan invested over ¥15 billion in immersive technology research from 2020 to 2024.

- The government reported a 40% increase in AR/VR use in medical training programs in 2023.

China Ministry of Industry and Information Technology (MIIT)

- China’s VR hardware production capacity reached 8 million units in 2024.

- Over 100 million users engaged with VR/AR applications on mobile Access Platforms in China as of 2023.

- The Chinese government allocated RMB 5 billion towards immersive technology R&D in 2023.

- 70% of China’s leading manufacturing firms adopted 3D virtual simulation tools by 2024.

- MIIT data shows a 30% annual growth rate in enterprise AR adoption since 2021.

South Korea Ministry of Science and ICT

- South Korea invested USD 500 million in AR/VR infrastructure development in 2023.

- Over 50% of South Korean consumers used VR/AR entertainment applications in 2024.

- The government-funded Smart Factory initiative supports VR-based training for over 1,000 industrial firms.

- South Korean universities enrolled more than 10,000 students in VR/AR-related programs in 2024.

- VR/AR hardware exports from South Korea grew by 22% in 2023.

United Nations Conference on Trade and Development (UNCTAD)

- Global e-commerce sales incorporating 3D virtual environments reached USD 1.8 trillion in 2023.

- Over 60 countries have national strategies, including AR/VR, to boost digital economies as of 2024.

- Developing countries increased government funding for immersive tech by 35% between 2021-2024.

- Cross-border collaboration on virtual environment standards grew by 40% from 2022 to 2024.

- UNCTAD reports that over 20% of the global digital workforce uses virtual collaboration tools involving 3D environments.

Global 3D Virtual Environment Market: Market Dynamics

Global 3D Virtual Environment Market: Driving Factors

Surge in Immersive Technology Adoption across Industries

The rising implementation of immersive technologies such as virtual reality (VR), augmented reality (AR), and mixed reality (MR) across sectors like healthcare, manufacturing, education, and retail is a primary growth driver. Organizations are leveraging 3D simulations for medical training, architectural walkthroughs, digital product visualization, and remote collaboration. These applications enhance operational efficiency and reduce overhead costs. The proliferation of spatial computing, gesture-based interfaces, and real-time 3D rendering tools is accelerating the integration of these environments into core business functions, reinforcing the need for robust virtual environments.

Expansion of Remote Work and Virtual Collaboration Tools

With remote and hybrid work becoming the new standard, enterprises are turning to virtual environments for meetings, team collaboration, onboarding, and training. Virtual workspaces equipped with interactive 3D elements, digital whiteboards, and real-time avatars are replacing traditional communication Access Platforms. These environments enhance team productivity, foster creative collaboration, and support geographically dispersed teams. The need for immersive digital infrastructure is driving demand for enterprise-grade 3D Access Platforms powered by cloud computing, AI integration, and seamless multi-user support.

Global 3D Virtual Environment Market: Restraints

High Cost of Advanced Hardware and Development Tools

Despite growing interest, the adoption of 3D virtual environments is often limited by the high costs associated with premium VR headsets, AR glasses, haptic feedback devices, and specialized software. Small and medium enterprises (SMEs), educational institutions, and startups may find it challenging to invest in the required infrastructure. In addition, the development and maintenance of high-fidelity virtual environments require skilled labor and complex toolsets, which can drive up operational costs and deter adoption in price-sensitive markets.

Limited Standardization and Interoperability

A lack of standardization in 3D content formats, hardware compatibility, and cross-Access Platform functionality acts as a barrier to seamless deployment. Different vendors use proprietary ecosystems, which complicates integration and scalability across industries. This fragmentation hinders the development of unified virtual Access Platforms and increases dependence on specific technologies, thereby limiting user flexibility. Without common industry protocols, businesses face difficulties in achieving consistent user experiences and data synchronization within 3D virtual environments.

Global 3D Virtual Environment Market: Opportunities

Rising Demand for Digital Twins and Industrial Metaverse

The growing adoption of digital twin technology, particularly in manufacturing, smart cities, and infrastructure, presents significant opportunities for 3D virtual environments. Digital twins enable real-time monitoring, predictive maintenance, and simulation of physical assets in a virtual space. When combined with IoT, AI, and machine learning, these environments offer actionable insights that improve efficiency and decision-making. As the concept of the industrial metaverse gains traction, enterprises are expected to invest heavily in scalable, intelligent 3D ecosystems that support automation and process optimization.

Educational Transformation through Immersive Learning Access Platforms

Education systems globally are exploring immersive learning solutions to improve engagement, retention, and accessibility. 3D virtual campuses, interactive science labs, historical recreations, and skill-based training simulations are being integrated into curricula. These environments cater to diverse learning styles and allow students to explore content beyond the limitations of traditional classrooms. Governments and institutions are funding digital education initiatives, creating long-term growth potential for educational applications of 3D virtual environments.

Global 3D Virtual Environment Market: Trends

Integration of AI and Generative Design in Virtual Spaces

Artificial intelligence is playing a growing role in personalizing and automating content creation within 3D environments. AI-driven avatars, voice recognition systems, and intelligent scene rendering are enhancing interactivity and realism. Generative design tools powered by machine learning are enabling the automatic creation of virtual assets and environments based on user behavior and real-time input. This trend is significantly reducing development time and cost while growing scalability across industries.

Emergence of Web-Based 3D Access Platforms and No-Code Tools

The rise of browser-based 3D Access Platforms and no-code/low-code development environments is democratizing access to virtual environment creation. Creators without extensive programming knowledge can now design interactive 3D scenes for gaming, virtual tours, training, and marketing campaigns. These Access Platforms often support WebGL, HTML5, and cloud-based rendering, allowing real-time deployment across devices. This shift is opening new avenues for marketers, educators, and independent developers to engage users with immersive experiences at a lower entry barrier.

Global 3D Virtual Environment Market: Research Scope and Analysis

By Component Analysis

In the global 3D virtual environment market, software components are expected to dominate the component segment, accounting for approximately 65.0% of the total market share in 2025. This dominance is largely driven by the growing demand for immersive, scalable, and flexible virtual Access Platforms across a variety of industries such as healthcare, education, gaming, real estate, and manufacturing. Software solutions form the backbone of 3D environments, powering functions like real-time rendering, scene creation, avatar development, spatial audio integration, and physics-based simulation.

As enterprises seek greater control over interactive content, workflow automation, and cross-Access Platform deployment, the demand for robust 3D software development kits (SDKs), content management systems, and cloud-based rendering engines is surging. Additionally, the rise of AI-powered design tools and low-code/no-code development Access Platforms is democratizing the creation of 3D environments, further expanding the software segment’s reach and relevance.

On the other hand, hardware components play a critical role in enabling the full functionality and user immersion of 3D virtual environments. This segment includes VR headsets, AR glasses, haptic feedback devices, motion sensors, tracking systems, 3D scanners, GPUs, and high-performance computing units.

Hardware acts as the gateway through which users engage with virtual spaces, making comfort, fidelity, responsiveness, and ease of use essential design factors. Innovations such as wireless VR systems, compact form factors, eye-tracking technology, and spatial computing hardware are continuously enhancing user experiences.

Despite higher upfront costs, industries such as defense, automotive, and healthcare are heavily investing in advanced hardware setups for simulation-based training, product testing, and collaborative design reviews.

While hardware has a smaller share compared to software due to cost and upgrade cycles, its importance remains pivotal for the ecosystem’s usability, realism, and interactivity. Together, hardware and software create a synergistic framework that fuels the expansion of immersive 3D virtual environments globally.

By Device Type Analysis

In the global 3D virtual environment market, Head-Mounted Displays (HMDs) are projected to retain their leading position in the device type segment, accounting for approximately 55.0% of the total market share in 2025. HMDs are central to delivering fully immersive experiences by offering stereoscopic 3D visuals, wide fields of view, motion tracking, and real-time responsiveness. These devices are widely used in applications such as gaming, virtual training, architectural visualization, remote collaboration, and medical simulation.

As enterprise and consumer demand for deeper immersion continues to grow, HMDs such as the Meta Quest, HTC Vive, Sony PlayStation VR, and Varjo XR headsets are evolving with better resolution, improved comfort, wireless capabilities, and integration with AI-powered spatial awareness. Industries like aerospace, automotive, and defense are particularly leveraging HMDs for high-fidelity simulations and design validation, which require precision and depth perception that only dedicated headsets can deliver.

On the other hand, smartphones and tablets are emerging as more accessible and versatile devices for engaging with 3D virtual environments, especially in consumer-facing applications. Although they do not offer the same level of immersion as HMDs, smartphones and tablets provide a highly scalable and cost-effective entry point for augmented reality (AR) experiences, virtual walkthroughs, 3D product configurators, and mobile gaming.

The integration of LiDAR sensors, depth cameras, and AR toolkits (like Apple’s ARKit or Google’s ARCore) has significantly improved the spatial awareness and rendering capabilities of mobile devices.

This makes them ideal for applications in retail, education, real estate, and tourism, where users can access immersive content without specialized hardware. While their market share is lower than that of HMDs, smartphones and tablets play a vital role in democratizing access to 3D content and enabling widespread adoption of virtual environments, particularly in emerging markets and casual user segments.

By Access Platform Analysis

In the global 3D virtual environment market, PC-based Access Platform services are projected to dominate the Access Platform segment, holding an estimated 40.0% of the total market share in 2025. PC-based Access Platforms offer the processing power, graphical fidelity, and software flexibility required for rendering complex, high-resolution 3D environments in real time. These Access Platforms are essential in industries that demand intensive computing resources, such as gaming, architecture, manufacturing, military simulation, and healthcare training.

Workstations equipped with high-end GPUs and CPU configurations allow for seamless interaction with photorealistic environments, supporting advanced applications like real-time physics simulation, collaborative CAD modeling, and digital twin deployment.

PC-based environments also support a wide range of peripherals, including head-mounted displays (HMDs), haptic devices, and motion sensors, enabling fully immersive and customizable setups. The ability to run powerful software engines like Unity, Unreal Engine, Blender, and Autodesk products ensures that PC Access Platforms remain the core infrastructure for professional and enterprise-grade virtual experiences.

In contrast, mobile-based Access Platforms are becoming important for their portability, accessibility, and growing hardware capabilities. With the rapid advancement of smartphone and tablet technology, mobile devices are now able to run AR applications, 3D visualization tools, and lightweight virtual environments effectively. This segment caters primarily to sectors like retail, education, real estate, and marketing, where end-users require on-the-go access to immersive experiences without relying on complex setups.

Mobile Access Platforms, powered by AR toolkits such as ARCore and ARKit, are ideal for interactive product previews, virtual home tours, educational simulations, and location-based AR experiences. While mobile-based Access Platforms lack the raw power of PCs, they benefit from broader user adoption, cloud integration, and app ecosystem support.

As 5G, cloud rendering, and edge computing continue to evolve, mobile Access Platforms are expected to expand their role in delivering flexible, real-time 3D content to a wider audience. Their strength lies in reach and convenience, making them a key enabler of mainstream virtual environment usage across consumer markets.

By Technology Analysis

In the global 3D virtual environment market, Virtual Reality (VR) technology is anticipated to lead the technology segment, securing approximately 50.0% of the total market share in 2025. VR offers a fully immersive, computer-generated experience that isolates users from the physical world and transports them into simulated 3D environments. This technology is highly favored for applications requiring deep engagement and realism, such as virtual training simulations in defense and healthcare, immersive gaming, collaborative design in engineering, and virtual prototyping.

VR enables users to interact with complex digital models and scenarios in real time, enhancing learning outcomes, operational efficiency, and user experience. As VR hardware, such as head-mounted displays (HMDs), motion trackers, and haptic feedback devices, continues to improve, and as content ecosystems become richer and more sophisticated, VR adoption is growing in both enterprise and consumer domains. The growing affordability of standalone VR headsets and the rise of social VR Access Platforms are further fueling its dominance in the market.

On the other hand, Augmented Reality (AR) is playing a rapidly expanding role in the 3D virtual environment market, especially in applications where blending digital content with the physical world is essential. AR overlays contextual 3D information onto the real environment via smartphones, tablets, or smart glasses, enabling interactive and situational experiences without disconnecting the user from their surroundings.

This makes AR ideal for fields like retail (virtual try-ons, 3D product visualization), education (interactive textbooks, anatomy overlays), manufacturing (AR-guided assembly, real-time diagnostics), and field service (remote assistance, maintenance visualization).

The widespread availability of AR-capable mobile devices and toolkits like ARKit and ARCore has made AR more accessible, particularly in consumer-facing applications. While AR’s total market share may be lower than VR's in 2025, its adoption is expected to accelerate due to its low entry barriers, real-world integration, and utility in enhancing productivity, learning, and engagement in everyday environments.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Application Analysis

In the global 3D virtual environment market, Gaming and Entertainment applications are projected to lead the application segment, capturing approximately 40.9% of the total market share in 2025. This dominance is driven by the growing demand for immersive and interactive experiences among consumers globally. The gaming industry leverages advanced 3D virtual environments to deliver realistic gameplay, rich storytelling, and multiplayer social interactions through VR headsets, consoles, and PCs.

Entertainment sectors such as virtual concerts, theme parks, and virtual tourism also utilize 3D environments to engage audiences with highly immersive content. Technologies like real-time rendering, motion capture, and spatial audio enhance user engagement and create lifelike virtual worlds. The continuous innovation in game engines like Unreal Engine and Unity, combined with the rise of cloud gaming and metaverse Access Platforms, further fuels the growth of gaming and entertainment applications in the 3D virtual environment market.

On the other hand, the Healthcare and Medical Training segment is rapidly gaining traction as a critical application area within the 3D virtual environment market. Virtual environments are transforming medical education and professional training by providing realistic, risk-free simulations for surgical procedures, anatomy exploration, and emergency response drills. Medical institutions and hospitals use VR-based training Access Platforms to enhance precision, reduce errors, and improve patient outcomes.

These virtual simulations allow healthcare practitioners to repeatedly practice complex techniques and gain hands-on experience without the constraints of physical resources or patient availability.

Additionally, 3D environments facilitate remote collaboration among medical teams and enable patient rehabilitation through immersive therapy sessions. With the integration of haptic feedback, AI-driven diagnostics, and real-time data visualization, healthcare applications of 3D virtual environments are set to revolutionize medical training and clinical practices, driving significant growth in this segment.

By End-User Analysis

In the global 3D virtual environment market, consumers are expected to dominate the end-user segment, capturing approximately 45.0% of the market share in 2025. This dominance is primarily fueled by the widespread adoption of immersive technologies in entertainment, gaming, social interaction, and lifestyle applications. Consumers are engaging with 3D virtual environments through VR headsets, smartphones, and gaming consoles to experience interactive games, virtual social spaces, and augmented reality apps.

The rise of metaverse Access Platforms, virtual concerts, and online multiplayer experiences has further expanded consumer participation. Advances in user-friendly interfaces, affordable hardware, and rich content libraries are lowering barriers to entry, making immersive 3D environments more accessible to a broader audience. The demand for personalized and interactive digital experiences continues to drive innovation and growth in consumer-focused virtual environment offerings.

In contrast, the enterprise segment is steadily growing as businesses across various industries integrate 3D virtual environments to enhance operational efficiency, training, and collaboration. Enterprises in sectors such as manufacturing, healthcare, education, real estate, and defense leverage these technologies for virtual prototyping, remote training, digital twin simulations, and immersive product demonstrations.

Virtual environments enable enterprises to reduce costs, accelerate time-to-market, and improve decision-making by facilitating realistic simulations and interactive workflows. The adoption of enterprise-grade Access Platforms with advanced security, scalability, and integration capabilities supports complex organizational needs.

As companies invest more in digital transformation and immersive technologies, the enterprise segment is expected to capture significant market share, driven by the demand for innovative solutions that enhance productivity and competitive advantage.

The 3D Virtual Environment Market Report is segmented based on the following:

By Component

- Software

- 3D Modeling Software

- Virtual World Access Platforms

- Game Engines

- Simulation Software

- Hardware

- VR Headsets

- AR Glasses

- 3D Cameras & Sensors

- Haptic Devices

By Device Type

- Head-Mounted Displays (HMDs)

- Smartphones/Tablets

- PC/Consoles

- Others

By Access Platform

- PC-Based

- Mobile-Based

- Console-Based

- Cloud-Based

By Technology

- Virtual Reality (VR)

- Augmented Reality (AR)

- Mixed Reality (MR)

- Others

By Application

- Gaming & Entertainment

- Healthcare & Medical Training

- Education & Training

- Retail & E-commerce

- Architecture, Engineering & Construction

- Military & Defense Simulation

- Manufacturing & Industrial Design

- Others

By End-User Industry

- Consumer

- Enterprise

- Healthcare & Medical Institutions

- Education Institutions

- Government & Defense

Global 3D Virtual Environment Market: Regional Analysis

Region with the Largest Revenue Share

North America is poised to lead the global 3D virtual environment market, accounting for approximately 40.0% of total market revenue in 2025. This leadership is driven by the region’s advanced technological infrastructure, high adoption rates of immersive technologies like virtual reality and augmented reality, and the strong presence of key industry players.

The robust innovation ecosystem, substantial R&D investments, and widespread integration of 3D virtual environments across sectors such as gaming, healthcare, education, and manufacturing further reinforce North America’s dominance. Additionally, favorable government initiatives supporting digital transformation and a growing consumer base eager for immersive experiences contribute significantly to the region’s market growth.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia-Pacific region is expected to exhibit the highest compound annual growth rate (CAGR) in the 3D virtual environment market over the coming years. This rapid growth is fueled by growing investments in digital infrastructure, rising smartphone and internet penetration, and expanding adoption of immersive technologies across key sectors such as education, retail, manufacturing, and entertainment.

Emerging economies like China, India, Japan, and South Korea are driving demand through government initiatives promoting Industry 4.0 and smart city projects, alongside growing consumer interest in AR/VR gaming and virtual experiences. Additionally, the region’s large youth population and expanding technology startups ecosystem are accelerating innovation and adoption, positioning Asia-Pacific as the fastest-growing market globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global 3D Virtual Environment Market: Competitive Landscape

The global competitive landscape of the 3D virtual environment market is characterized by the presence of several well-established technology giants alongside innovative startups, creating a dynamic and rapidly evolving ecosystem.

Leading companies such as Unity Technologies, Epic Games, NVIDIA, Microsoft, and Meta Access Platforms dominate through continuous advancements in software development, real-time rendering, and immersive hardware solutions. These players focus heavily on strategic partnerships, mergers and acquisitions, and extensive R&D investments to enhance Access Platform capabilities and expand market reach.

Meanwhile, specialized firms in AR/VR hardware, cloud computing, and AI-driven content creation contribute to diversification and technological innovation. The competitive environment is further intensified by the entry of mobile-focused developers and regional players targeting emerging markets, fostering innovation across gaming, healthcare, industrial applications, and education.

As customer demands for more seamless, high-fidelity, and accessible 3D virtual experiences grow, companies are continuously refining their offerings to secure leadership and drive the market’s future trajectory.

Some of the prominent players in the global 3D virtual environment market are:

- Unity Technologies

- Epic Games (Unreal Engine)

- Autodesk, Inc.

- NVIDIA Corporation

- Microsoft Corporation

- Google LLC

- Facebook (Meta Access Platforms, Inc.)

- HTC Corporation

- Sony Interactive Entertainment

- Magic Leap, Inc.

- PTC Inc.

- Dassault Systèmes

- Siemens AG

- Varjo Technologies

- Vuzix Corporation

- Qualcomm Technologies, Inc.

- EON Reality, Inc.

- Maxon Computer GmbH

- Adobe Inc.

- Trimble Inc.

- Other Key Players

Global 3D Virtual Environment Market: Recent Developments

Product Launches

- May 2025: Unity Technologies unveiled Unity Forge, a new cloud-based collaborative Access Platform designed to streamline real-time 3D environment creation and deployment across industries, including gaming, architecture, and manufacturing.

- March 2025: Meta Access Platforms released the latest version of the Meta Quest Pro VR headset, featuring enhanced eye-tracking, mixed reality capabilities, and improved ergonomics aimed at enterprise and creative professionals.

Mergers and Acquisitions

- April 2025: Epic Games acquired Sketchfab, a leading 3D content Access Platform, to strengthen its ecosystem by providing creators with better tools for 3D asset management and distribution.

- January 2025: NVIDIA completed its acquisition of Maxon Computer GmbH, the developer of the Cinema 4D software, to expand its 3D content creation and rendering portfolio.

Funding Announcements

- February 2025: Magic Leap raised USD 200 million in a Series D funding round to accelerate development of its AR smart glasses and expand its enterprise virtual environment solutions.

- November 2024: EON Reality secured USD 50 million in growth capital to enhance its AI-driven virtual training Access Platforms and expand operations in the Asia-Pacific region.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 19.1 Bn |

| Forecast Value (2034) |

USD 97.3 Bn |

| CAGR (2025–2034) |

19.8% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 6.4 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Software, Hardware), By Device Type (Head-Mounted Displays, Smartphones/Tablets, PC/Consoles, Others), By Access Platform (PC-Based, Mobile-Based, Console-Based, Cloud-Based), By Technology (Virtual Reality, Augmented Reality, Mixed Reality, Others), By Application (Gaming & Entertainment, Healthcare & Medical Training, Education & Training, Retail & E-commerce, Architecture, Engineering & Construction, Military & Defense Simulation, Manufacturing & Industrial Design, Others), and By End-User Industry (Consumer, Enterprise, Healthcare & Medical Institutions, Education Institutions, Government & Defense). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Unity Technologies, Epic Games (Unreal Engine), Autodesk Inc., NVIDIA Corporation, Microsoft Corporation, Google LLC, Meta Platforms Inc., HTC Corporation, Sony Interactive Entertainment, and other key players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global 3D virtual environment market?

▾ The global 3D virtual environment market size is estimated to have a value of USD 19.1 billion in 2025

and is expected to reach USD 97.3 billion by the end of 2034.

What is the size of the US 3D virtual environment market?

▾ The US 3D virtual environment market is projected to be valued at USD 6.4 billion in 2025. It is expected

to witness subsequent growth in the upcoming period as it holds USD 29.8 billion in 2034 at a CAGR of

18.6%.

Which region accounted for the largest global 3D virtual environment market?

▾ North America is expected to have the largest market share in the global 3D virtual environment market,

with a share of about 40.0% in 2025.

Who are the key players in the global 3D virtual environment market?

▾ Some of the major key players in the global 3D virtual environment market are Unity Technologies, Epic

Games (Unreal Engine), Autodesk Inc., NVIDIA Corporation, Microsoft Corporation, Google LLC, Meta

Access Platforms Inc., HTC Corporation, Sony Interactive Entertainment, and other key players.

What is the growth rate of the global 3D virtual environment market?

▾ The market is growing at a CAGR of 19.8 percent over the forecasted period.