Market Overview

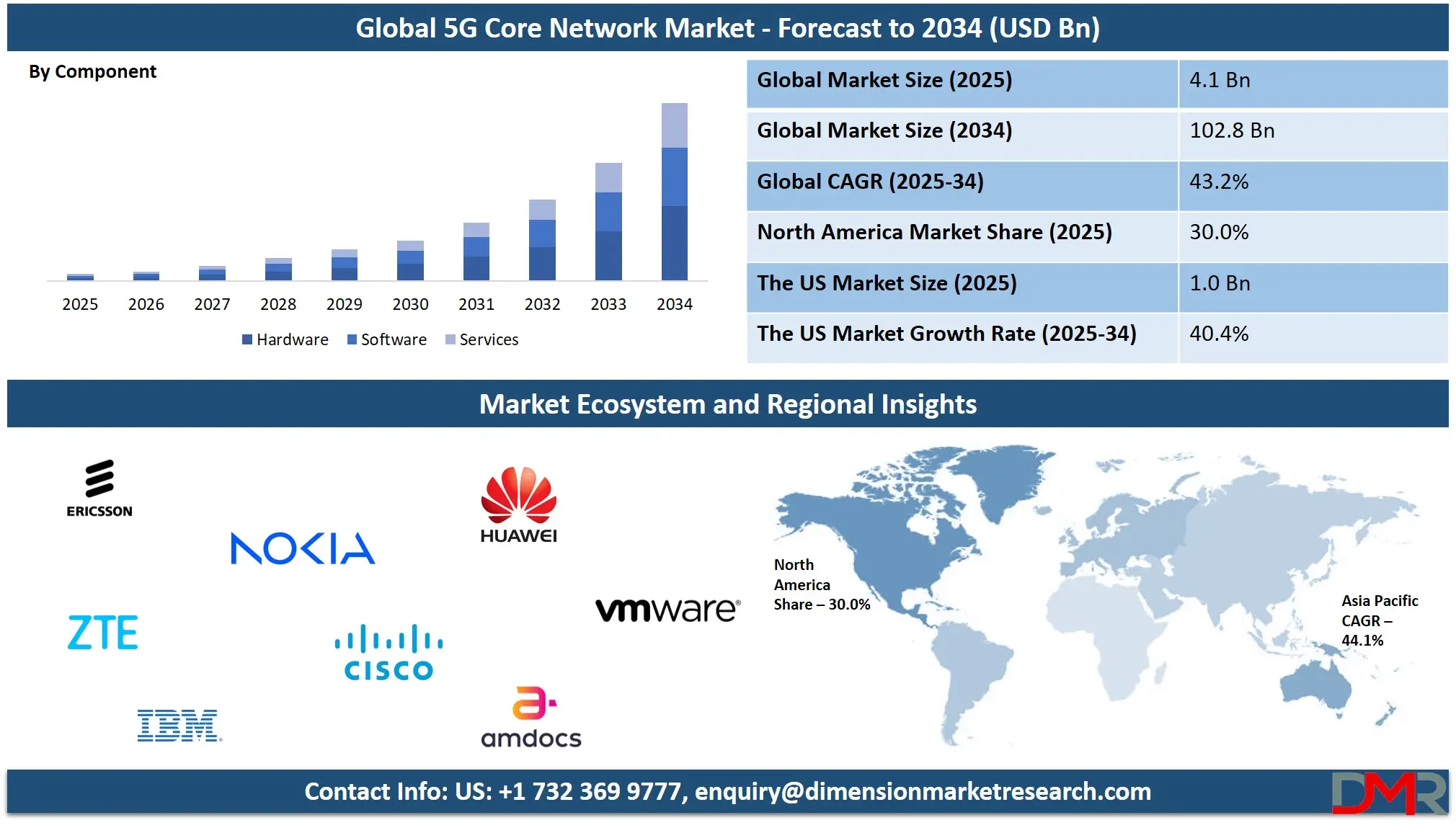

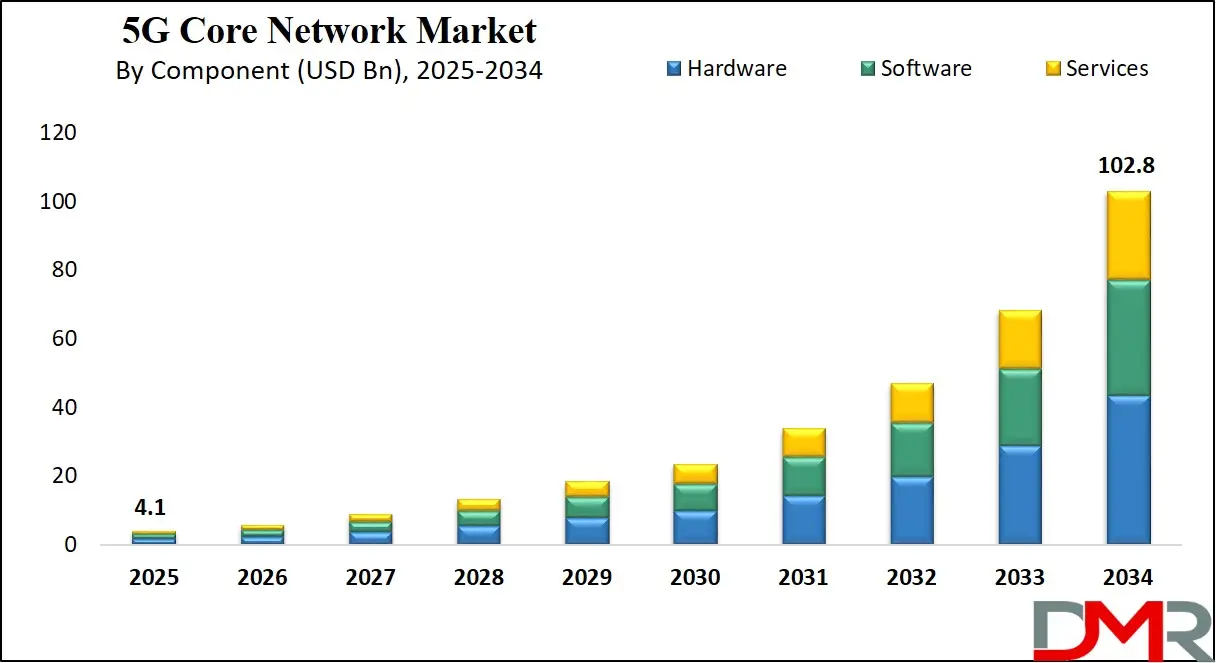

The Global 5G Core Network Market size is projected to reach USD 4.1 billion in 2025 and grow at a compound annual growth rate of 43.2% to reach a value of USD 102.8 billion in 2034.

The 5G core network market refers to the ecosystem of technologies, software, and infrastructure components that form the central foundation of 5G connectivity. It includes cloud-native architectures, standalone (SA) and non-standalone (NSA) deployments, virtualization layers, network slicing capabilities, orchestration tools, and service-based architecture (SBA) functions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

This market is vital to the broader telecom and digital economy because it enables ultra-low latency applications, massive IoT deployments, and enhanced mobile broadband, serving as the engine powering next-generation digital transformation. Emerging trends such as edge integration, AI-driven automation, and private 5G networks are shaping its growth trajectory.

The market’s expansion is accelerated by the shift from hardware-centric networks to cloud-native, software-defined architectures. Telecom operators are modernizing legacy EPC systems to achieve scalable and flexible network operations, while enterprises adopt private 5G systems for mission-critical operations. Innovations in slicing, multi-cloud deployment, and virtualized network functions represent key milestones in market development. Regulatory encouragement for local manufacturing, spectrum allocation, and digital infrastructure expansion further enhances market maturity.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Key developments in the 5G core network market include large investments in standalone deployments, partnerships between telecom vendors and hyperscalers, and acquisitions aimed at strengthening cloud-native network capabilities. Countries are updating regulatory frameworks to support secure network rollouts, cybersecurity compliance, and spectrum availability. Major innovations—such as open RAN integration, AI-enabled core functions, and programmable network frameworks—are reshaping the direction of the industry, ensuring the 5G core evolves to support 6G-aligned infrastructures in the future.

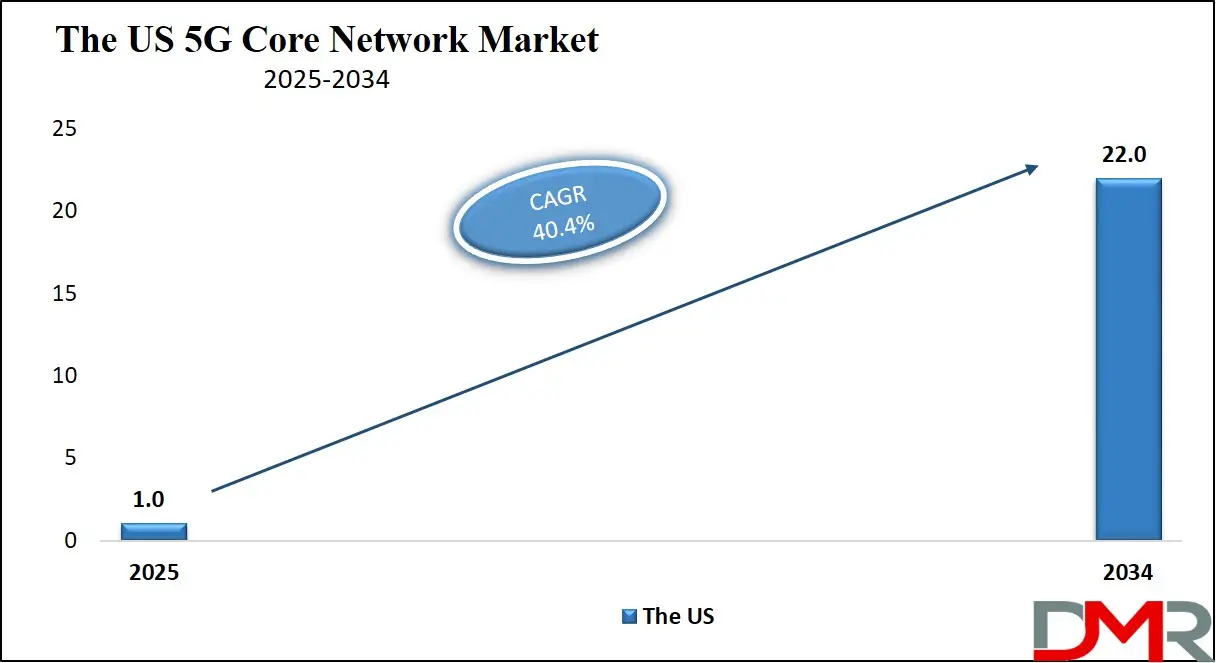

The US 5G Core Network Market

The US 5G Core Network Market size is projected to reach USD 1.0 billion in 2025 at a compound annual growth rate of 40.4% over its forecast period.

The US 5G core network market is shaped by strong investment momentum, aggressive standalone (SA) rollouts, and the presence of multiple technology innovators. The region benefits from early adoption of cloud-native technologies, allowing operators to accelerate migration from legacy EPC systems. Government initiatives, such as funding for rural broadband expansion, spectrum auctions, and incentives for domestic telecom manufacturing, also support market advancement.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Additionally, collaborations between telecom providers and cloud hyper-scalers have boosted the adoption of multi-cloud 5G core deployments, enabling flexible and scalable network operations. The US market also exhibits growing enterprise demand for private 5G networks, especially in manufacturing, healthcare, and logistics, contributing to steady network modernization and capacity expansion.

Europe 5G Core Network Market

Europe 5G Core Network Market size is projected to reach USD 820 million in 2025 at a compound annual growth rate of 42.6% over its forecast period.

The European 5G core network market is influenced by stringent regulatory frameworks, strong data protection norms, and the region’s push for digital sovereignty. The European Green Deal and policies promoting energy-efficient infrastructure strongly support sustainable deployment models. Countries such as Germany, France, and the UK are focusing on expanding private and industrial 5G networks, driven by demand from automotive, energy, and advanced manufacturing sectors.

Europe’s adoption pace is steady, with increased emphasis on secure, interoperable, and open architectures that reduce vendor lock-in. The rise of telco-cloud convergence, virtualization, and AI-assisted automation are transforming the regional market landscape, positioning Europe as a hub for 5G innovation, particularly in enterprise and smart city applications.

Japan 5G Core Network Market

Japan 5G Core Network Market size is projected to reach USD 205 million in 2025 at a compound annual growth rate of 44.6% over its forecast period.

Japan’s 5G core network market is characterized by rapid urbanization, high-tech industrialization, and strong government support for digital infrastructure. Operators in Japan are prioritizing standalone networks to enable ultra-reliable low-latency communication (URLLC) for robotics, automotive, and smart manufacturing applications. The country's smart city initiatives and public-private partnerships further stimulate demand for advanced 5G core functionalities.

Japan’s electronics and semiconductor industries also play a key role in localizing technology capabilities. Despite high deployment costs, Japan’s innovation-driven approach and early adoption of cloud-native architectures facilitate widespread market growth. Challenges such as spectrum constraints and strict technical regulations persist, but the overall trajectory remains positive due to strong enterprise adoption and the nation’s commitment to next-generation connectivity.

5G Core Network Market: Key Takeaways

- Market Growth: The 5G Core Network Market size is expected to grow by USD 97.2 billion, at a CAGR of 43.2%, during the forecasted period of 2026 to 2034.

- By Component: The hardware segment is anticipated to get the majority share of the 5G Core Network Market in 2025.

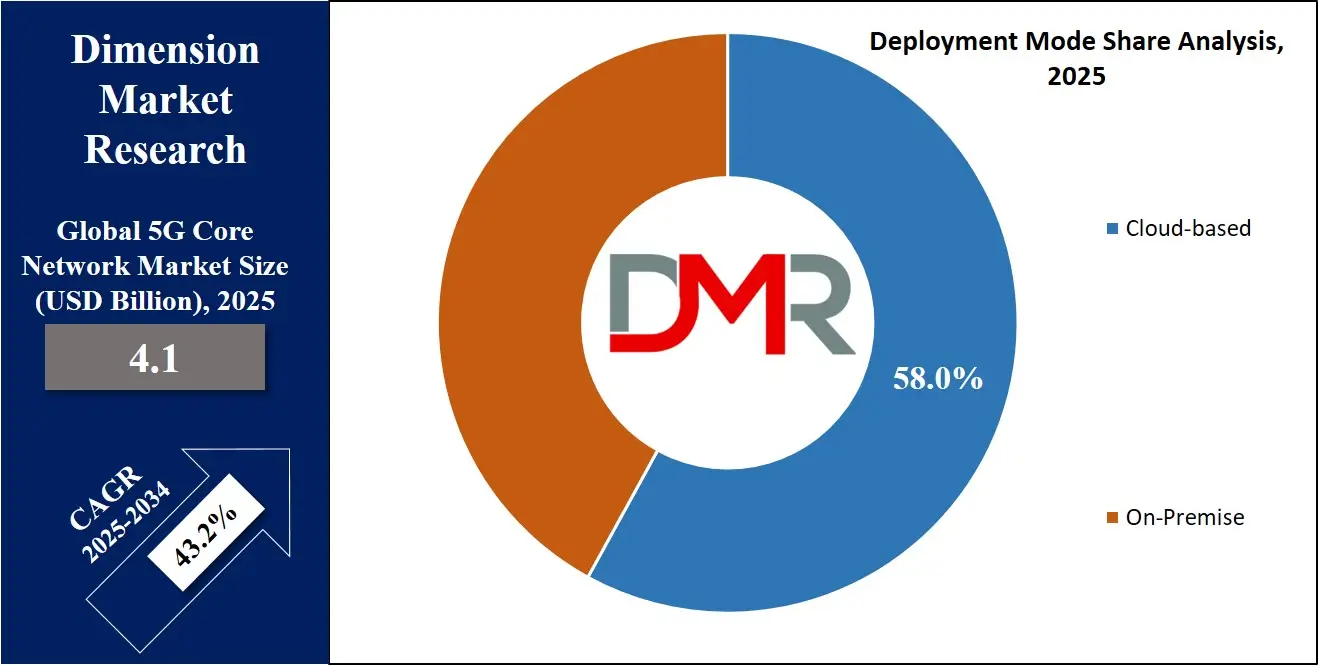

- By Deployment Mode: The cloud-based segment is expected to get the largest revenue share in 2025 in the 5G Core Network Market.

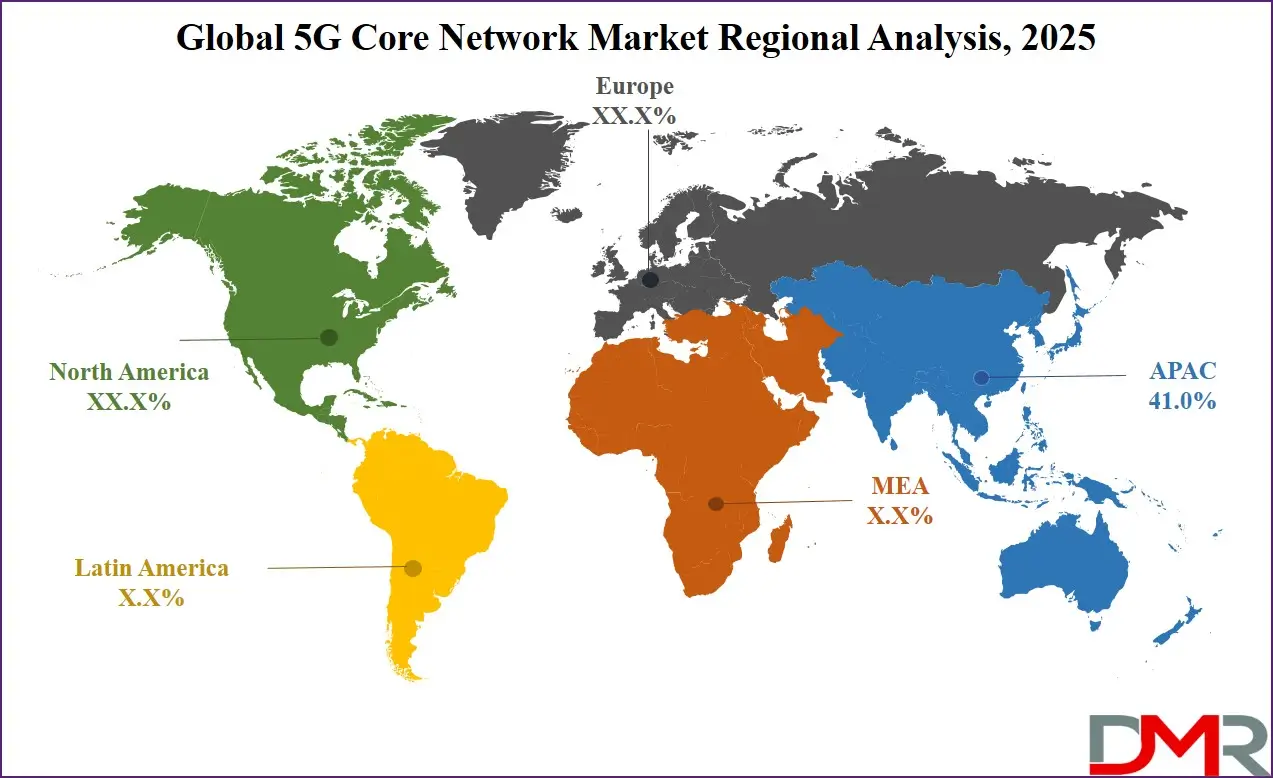

- Regional Insight: Asia Pacific is expected to hold a 41.0% share of revenue in the Global 5G Core Network Market in 2025.

- Use Cases: Some of the use cases of 5G Core Network include ultra-reliable communication for private 5G for Enterprise Connectivity, URLLC-Enabled Healthcare applications, and more.

5G Core Network Market: Use Cases

- Network Slicing for Industrial Automation: Enables highly customized, isolated network segments that support robotics, real-time monitoring, automated machinery, and mission-critical manufacturing operations with guaranteed QoS.

- Private 5G for Enterprise Connectivity: Provides secure, dedicated 5G networks for businesses needing high reliability, low latency, and full control over network resources, ideal for warehouses, factories, and campus environments.

- URLLC-Enabled Healthcare Applications: Supports ultra-reliable low-latency communication required for remote surgery, emergency response systems, connected medical devices, and real-time patient monitoring.

- Massive IoT Deployment for Smart Cities: Facilitates large-scale IoT integration across traffic systems, utilities, environmental sensors, public safety networks, and smart infrastructure with high device density support.

Stats & Facts

- U.S. Federal Communications Commission (FCC), Reported continued spectrum expansion in 2024–2025 to support nationwide 5G standalone deployments.

- European Commission highlighted that over 60% of EU industrial sites began integrating 5G-ready infrastructure by 2025.

- Japan Ministry of Internal Affairs and Communications (MIC) noted a significant rise in enterprise private 5G permits issued in 2024–2025.

- International Telecommunication Union (ITU) confirmed increased adoption of cloud-native 5G core frameworks as a global standard by 2025.

- GSMA Intelligence observed rising operator migration to SA networks globally in 2024–2025, driven by demand for advanced 5G capabilities.

- OECD Technology Outlook 2025 emphasized growing reliance on AI-driven network management in next-generation telecom ecosystems.

Market Dynamic

Driving Factors in the 5G Core Network Market

Cloud-Native Transformation

The shift toward cloud-native architectures is one of the most significant drivers of the 5G core network market. Cloud-native components allow operators to leverage microservices, containers, orchestration, and automation, enabling flexible scaling, reduced operational costs, and rapid deployment of new services. This transformation supports advanced 5G capabilities such as network slicing, edge computing integration, and low-latency connectivity. As telecom operators face rising data consumption and enterprise demand for industrial-grade connectivity, cloud-native cores ensure agility and resilience. Additionally, the emergence of hybrid and multi-cloud models enables interoperability between public cloud and on-premise environments, accelerating the adoption of modern 5G core networks.

Enterprise Adoption and Private 5G Growth

The increasing adoption of private 5G networks across enterprises is significantly fueling market growth. Sectors such as manufacturing, energy, healthcare, and automotive require reliable, high-speed, and low-latency connectivity for mission-critical operations. The 5G core enables these capabilities through standalone networks that offer greater control, security, and customization. Enterprises are investing in dedicated infrastructure to support automation, robotics, real-time monitoring, and optimized production systems. This trend is further supported by government incentives and spectrum availability for enterprise use. As private 5G ecosystems mature, demand for scalable, virtualized, and AI-enabled 5G core solutions continues to rise, creating substantial market opportunities.

Restraints in the 5G Core Network Market

High Deployment and Modernization Costs

One of the most significant restraints in the 5G core network market is the high capital expenditure required for modernization and migration from legacy systems. Transitioning from EPC to a cloud-native 5G core demands substantial investment in software, hardware, skilled personnel, and integration services. Operators often face challenges related to upgrading infrastructure, ensuring backward compatibility, and maintaining seamless service continuity. The cost of deploying a standalone architecture, along with cybersecurity compliance requirements, further increases financial burdens. Smaller operators, in particular, struggle to manage these costs, leading to slower adoption rates. These financial barriers can delay large-scale transformation initiatives across the industry.

Complexity of Integration and Skill Gaps

The 5G core network involves highly complex system integration, requiring deep expertise in cloud computing, virtualization, container orchestration, and service-based architecture. Many operators and enterprises face challenges due to limited skilled workforce and difficulties in integrating multi-vendor solutions. Interoperability issues arise when combining legacy systems with cloud-native technologies, potentially leading to performance inconsistencies or security vulnerabilities. Additionally, the rapid evolution of 5G standards and frameworks increases technical complexity. These factors contribute to slower deployment timelines and increased operational risks. The lack of standardized deployment models across regions also adds to the integration complexity, hindering widespread rollout.

Opportunities in the 5G Core Network Market

Expansion of Private 5G Ecosystems

The rapid rise of private 5G networks offers a major opportunity for the 5G core market. Enterprises are increasingly adopting customized networks to support automation, IoT applications, robotic systems, and secure data exchange. The 5G core plays a central role by enabling network slicing, secure communication, and low-latency connectivity tailored to mission-critical operations. As industries transition toward digital-first models, demand for on-premise and cloud-based 5G core solutions will grow. Governments are also opening localized spectrum for enterprise use, allowing further scalability. This creates a fertile ecosystem for vendors, integrators, and cloud providers to offer advanced, enterprise-grade 5G solutions.

AI and Automation in Network Management

AI-driven automation represents a transformative opportunity in the 5G core network market. As networks become more complex, AI tools can analyze traffic patterns, predict failures, optimize resource allocation, and enhance security. This improves operational efficiency while reducing human intervention. Automation is particularly valuable in standalone networks, where dynamic orchestration, quality-of-service management, and real-time monitoring are essential. The integration of AI also enables self-healing capabilities, intelligent slicing, and automated service deployment. As telecom operators increasingly rely on predictive analytics and machine learning, adoption of AI-powered 5G core platforms will accelerate, providing considerable competitive advantage.

Trends in the 5G Core Network Market

Rise of Standalone (SA) Networks

A major trend shaping the market is the accelerated rollout of standalone 5G networks. SA deployments unlock the full potential of 5G, providing operators with advanced capabilities such as ultra-low latency, better spectral efficiency, and more robust network slicing. Enterprises also prefer SA architecture for private 5G systems due to improved security and performance. As operators worldwide transition from NSA to SA, the demand for 5G core solutions rises significantly. This trend is supported by increased availability of cloud infrastructure, regulatory push for modernization, and evolving consumer demand for immersive applications such as AR/VR and real-time gaming.

Integration of Multi-Cloud and Edge Computing

Another key trend is the convergence of multi-cloud environments with edge computing architectures. Telecom operators increasingly deploy distributed 5G core functions closer to users to reduce latency and enhance service quality. Multi-cloud integration enables flexible deployment models, scalable infrastructure, and improved disaster recovery mechanisms. Edge computing supports advanced applications such as smart factories, connected vehicles, and remote healthcare. As operators collaborate with hyperscalers and workloads shift toward distributed architectures, the demand for cloud-native 5G core solutions continues to grow. This trend is expected to strengthen as industries prioritize real-time data processing and localized computing.

Impact of Artificial Intelligence in 5G Core Network Market

- AI optimizes network traffic routing and enhances real-time resource allocation.

- Machine learning algorithms enable predictive maintenance and self-healing networks.

- AI-driven security systems detect anomalies and prevent cyber threats proactively.

- Automation tools streamline orchestration and reduce operational expenditure.

- AI enhances network slicing precision and ensures efficient service-level management.

Research Scope and Analysis

By Component Analysis

Hardware holds an estimated 42% share in 2025 of the 5G core network market, driven by demand for robust computing systems, core networking equipment, and edge hardware that supports high-data-throughput applications. As operators transition to standalone architecture, there is a growing need for powerful servers, advanced processing units, and high-performance switching systems. Edge computing hardware also plays a major role in supporting low-latency applications, especially in industrial automation and smart city deployments. Despite the industry’s shift toward virtualization, physical infrastructure remains essential for establishing the foundational compute and data processing layers. High reliability, security-supported architecture, and scalable data centers contribute to the continued dominance of hardware within the 5G core ecosystem.

Software is the fastest-growing segment due to the increasing adoption of virtualized network functions, orchestration tools, and service-based architecture platforms. Cloud-native software enables automated operations, flexible scaling, and cost-efficient service delivery, making it highly attractive for operators and enterprises. Software-driven network slicing and virtualization are particularly crucial as operators deploy standalone networks. The rapid evolution of AI-enabled analytics and security systems further accelerates the demand for advanced 5G core software solutions.

By Deployment Mode Analysis

Cloud-based deployment accounts for 58% share of the 5G core network market in 2025, reflecting the industry's shift toward flexible, scalable, and cost-efficient architectures. Operators choose public, private, and hybrid cloud models to support rapid deployment, automation, and multi-region scalability. Cloud platforms simplify network management and reduce dependency on costly physical infrastructure. Multi-cloud integration allows operators to distribute workloads across data centers, enhancing network reliability. As enterprises adopt private 5G networks, cloud-based deployments offer rapid provisioning and customization capabilities. The cloud model aligns with digital transformation initiatives, enabling seamless integration of AI, edge computing, and automation tools.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

On-premises deployment is growing steadily due to strong demand from security-sensitive sectors such as defense, healthcare, and energy. These sectors prefer on-site infrastructure to maintain data sovereignty and ensure full control over network operations. Despite higher costs, the need for strict compliance, low-latency operations, and mission-critical connectivity drives on-premises adoption.

By Architecture Analysis

Standalone architecture holds 55% market share, making it the dominant architecture in the 5G core network market. SA architecture enables full 5G capabilities, including ultra-low latency, improved spectrum efficiency, and more advanced network slicing functionalities. Operators worldwide are transitioning to SA to support enterprise-grade applications, smart manufacturing, automotive communications, and advanced IoT ecosystems. Its cloud-native foundation allows seamless integration of virtualization, container orchestration, and AI-based automation. The rising demand for private 5G networks further boosts SA deployment. As more industries require deterministic performance and real-time control, SA architecture continues to expand rapidly.

NSA remains relevant as a transitional architecture that allows operators to leverage existing 4G infrastructure while offering enhanced mobile broadband. It is adopted primarily for faster and cost-effective early-stage 5G rollout. The segment continues to serve regions where full SA migration is not yet feasible due to financial or regulatory constraints.

By Network Function Analysis

In 2025, Control plane functions represent 62% of the market share, driven by their critical role in managing mobility, session control, policy enforcement, and network registration. Key functions such as AMF, SMF, PCF, and NRF form the backbone of 5G core operations, enabling efficient connectivity and secure communication across diverse applications. These functions support network slicing, subscriber management, and intelligent routing, all essential for delivering differentiated services. Cloud-native control functions further enhance agility, scalability, and resilience. As standalone networks expand globally, demand for advanced control plane capabilities continues to rise.

User plane functions play a vital role in handling real-time data traffic with high throughput and low latency. As data demand increases across enterprise and consumer applications, operators invest in distributed user plane deployments closer to the network edge. This supports immersive applications and mission-critical communication.

By End User Analysis

Telecom operators hold 67% market share, making them the leading end-user segment of the 5G core network market. Operators drive large-scale deployments to meet rising demand for enhanced mobile broadband, IoT connectivity, and enterprise digital transformation. Both mobile network operators and virtual network operators rely on core network modernization to maintain competitiveness. Operators are increasingly adopting cloud-native and multi-cloud cores to reduce operating costs, improve scalability, and accelerate service delivery. As standalone deployments expand, telecom operators continue to play a central role in shaping the market landscape by investing in R&D, spectrum acquisition, and infrastructure upgrades.

Enterprises represent the fastest-growing segment due to the rising adoption of private 5G networks. Manufacturing, automotive, healthcare, and utilities sectors are deploying 5G core solutions to improve automation, enhance operational visibility, and support mission-critical processes.

The 5G Core Network Market Report is segmented on the basis of the following:

By Component

- Hardware

- Core networking equipment

- Edge computing hardware

- Software

- Network orchestration

- Virtualized network functions

- Network slicing software

- Services

- Integration & deployment

- Managed services

By Deployment Mode

- Cloud-Based

- Public cloud

- Private cloud

- On-Premises

By Architecture

- Standalone (SA)

- Native 5G core

- Full virtualization

- Non-Standalone (NSA)

By Network Function

- Control Plane Functions

- User Plane Functions

By End User

- Telecom Operators

- Mobile network operators

- Virtual network operators

- Enterprises

- Manufacturing

- Healthcare

- Automotive

- Energy & utilities

Regional Analysis

Leading Region in the 5G Core Network Market

Asia-Pacific leads the 5G core network market with a 41% market share, driven by rapid deployment of 5G infrastructure, strong government support, and extensive investment in digitalization. China, Japan, and South Korea are at the forefront of 5G standalone rollouts, with large-scale manufacturing ecosystems and smart city programs fueling market demand. Governments in these countries implement policies supporting spectrum allocation, indigenous equipment manufacturing, and enterprise 5G adoption.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The region benefits from strong semiconductor and electronics industries, enabling cost-efficient hardware and software production. Enterprises across manufacturing, automotive, and logistics are integrating advanced 5G core functionalities to optimize operations. The region’s growth is also fueled by high population density and large consumer markets demanding high-speed connectivity.

Fastest Growing Region in the 5G Core Network Market

North America is the fastest-growing region due to rapid standalone deployments and high enterprise adoption rates. Strong presence of cloud hyperscalers and innovative telecom vendors accelerates the integration of cloud-native network functions. Government initiatives promoting digital infrastructure and rural broadband expansion further boost adoption. Private 5G networks are rapidly expanding across industrial sectors, driving demand for advanced 5G core capabilities.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the 5G core network market is defined by strategic initiatives such as R&D investment, cloud partnerships, and expansion into enterprise connectivity solutions. Companies focus on differentiating through advanced virtualization, automation tools, and AI-driven orchestration platforms. Market entry barriers include high capital requirements, complex integration capabilities, and the need for compliance with global telecom standards. Vendors increasingly collaborate with hyperscalers to deliver scalable cloud-native core solutions. Joint ventures and testing alliances are also becoming common as firms work to accelerate commercial deployments and adoption across industry verticals.

Some of the prominent players in the global 5G Core Network are:

- Ericsson

- Nokia

- Huawei

- ZTE

- Samsung Electronics

- Cisco Systems

- NEC Corporation

- Mavenir

- Dell Technologies

- HPE (Hewlett Packard Enterprise)

- Juniper Networks

- Oracle

- IBM

- Affirmed Networks

- Altiostar

- Red Hat

- VMware

- Netcracker Technology

- Amdocs

- Radisys

- Other Key Players

Recent Developments

- In July 2025, TeleComTech acquires CoreWave Systems. The acquisition strengthens TeleComTech’s cloud-native 5G core capabilities by adding CoreWave’s virtualization and automation technologies. This strategic move aims to enhance product offerings across private 5G deployments and enterprise connectivity solutions. The integration of CoreWave’s expertise is expected to help TeleComTech reduce deployment time, improve network performance, and expand its presence in global telecom markets.

- In March 2025, NetworkCorp launched CloudEdge 5G Core. The company introduced its cloud-native 5G core platform designed for multi-cloud and edge deployments. The product supports advanced network slicing, automated orchestration, and AI-based traffic management. With this launch, NetworkCorp aims to accelerate standalone 5G adoption among telecom operators and enterprises. The solution integrates real-time analytics and secure, scalable architecture to meet the demands of mission-critical applications.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 4.1 Bn |

| Forecast Value (2034) |

USD 102.8 Bn |

| CAGR (2025–2034) |

43.2% |

| The US Market Size (2025) |

USD 1.0 Bn |

| Historical Data |

2019 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Hardware, Software, and Services), By Deployment Mode (Cloud-Based and On-Premises), By Architecture (Standalone (SA), and Non-Standalone (NSA)), By Network Function (Control Plane Functions, and User Plane Functions), By End User (Telecom Operators and Enterprises) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Ericsson, Nokia, Huawei, ZTE, Samsung Electronics, Cisco Systems, NEC Corporation, Mavenir, Dell Technologies, HPE (Hewlett Packard Enterprise), Juniper Networks, Oracle, IBM, Affirmed Networks, Altiostar, Red Hat, VMware, Netcracker Technology, Amdocs, Radisys, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global 5G Core Network Market?

▾ The Global 5G Core Network Market size is expected to reach a value of USD 4.1 billion in 2025 and is expected to reach USD 102.8 billion by the end of 2034.

Which region accounted for the largest Global 5G Core Network Market?

▾ Asia Pacific is expected to have the largest market share in the Global 5G Core Network Market, with a share of about 41.0% in 2025.

How big is the 5G Core Network Market in the US?

▾ The 5G Core Network Market in the US is expected to reach USD 1.0 billion in 2025.

Who are the key players in 5G Core Network Market?

▾ Some of the major key players in the Global 5G Core Network Market include Ericsson, Nokia, IBM and others.

What is the growth rate in the Global 5G Core Network Market?

▾ The market is growing at a CAGR of 43.2 percent over the forecasted period.