Market Overview

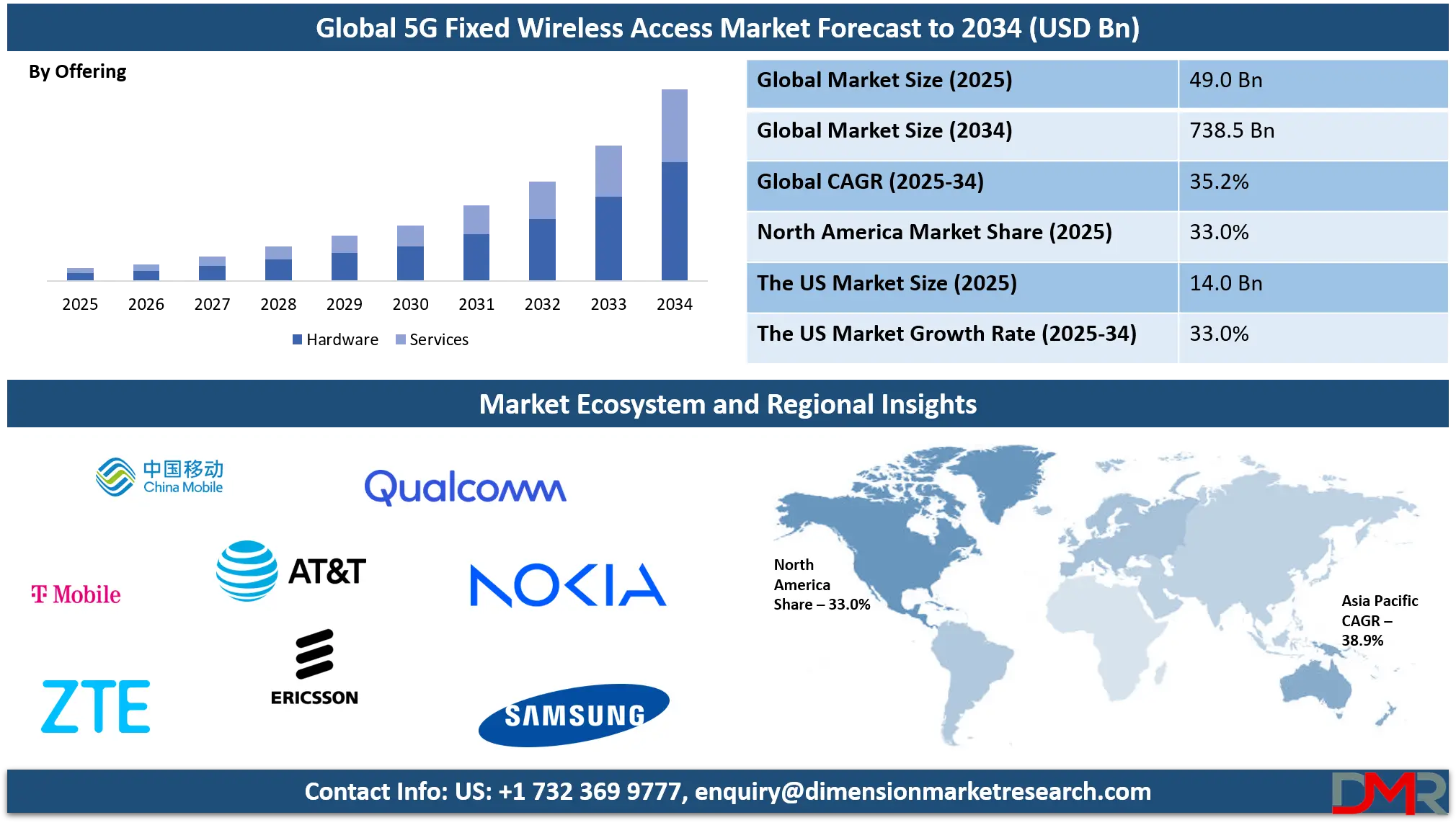

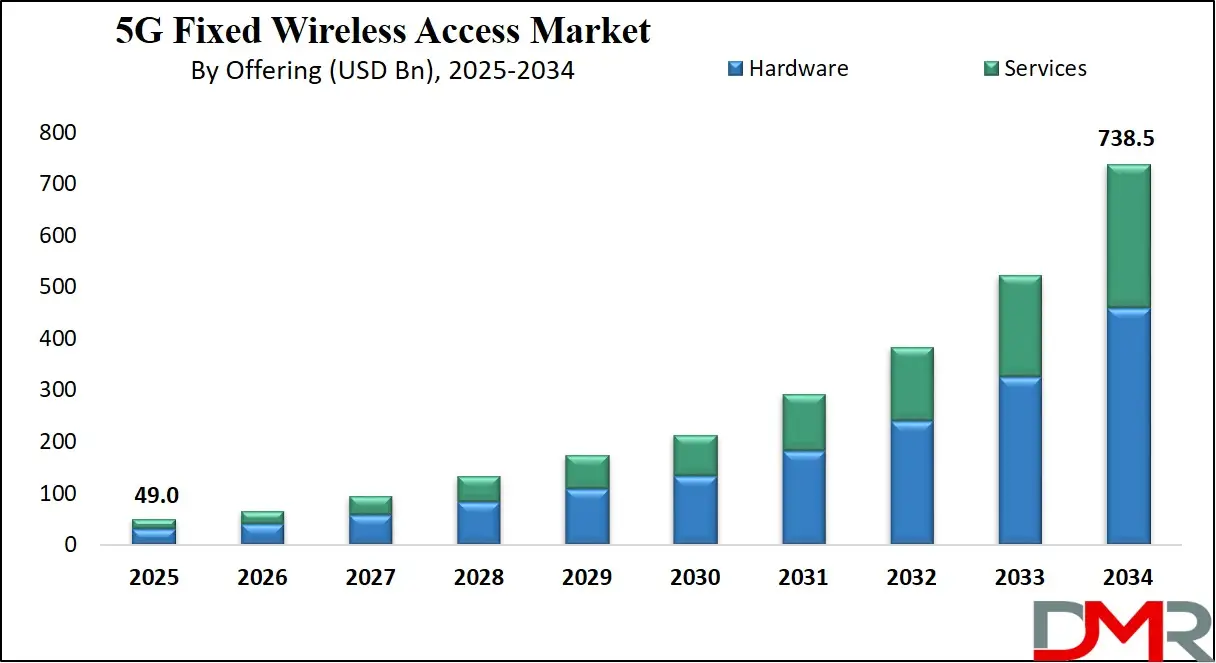

The Global 5G Fixed Wireless Access Market size is projected to reach USD 49.0 billion in 2025 and grow at compound annual growth rate of 35.2% from there until 2034 to reach a value of USD 738.5 billion.

5G Fixed Wireless Access (FWA) is a type of broadband internet service that uses 5G networks to provide high-speed internet to homes and businesses. Instead of relying on traditional fiber-optic or cable infrastructure, FWA delivers internet over the air using 5G radio signals. A receiver or router at the user’s location connects wirelessly to a nearby 5G cell tower, enabling fast and stable internet without the need for physical wiring to each building.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The need for faster and more reliable internet has increased with the rise of smart homes, streaming platforms, remote work, and digital services. In many rural or underserved areas, laying fiber or cable is expensive and time-consuming. FWA offers a quicker and often more practical solution to bridge this connectivity gap. Telecom operators are also interested in FWA because it allows them to extend their services without large infrastructure investments, especially in areas where fiber deployment is difficult.

Over the past few years, several countries have adopted 5G FWA as a key part of their national broadband plans. Governments and regulators have supported the rollout through spectrum allocations and policies favoring wireless solutions. In urban centers, 5G FWA is seen as a competitor to traditional broadband, offering similar speeds with shorter setup times. In rural areas, it is often the only viable high-speed internet option.

Some recent trends include the bundling of FWA with smart home and entertainment services, integration with Wi-Fi 6 for better indoor coverage, and use of AI to optimize signal quality. Hardware is becoming smaller, easier to install, and more energy-efficient. Operators are also testing hybrid solutions that combine 5G FWA with fiber or satellite for broader coverage and network resilience.

In the past few years, telecom giants have launched nationwide FWA services in the US, South Korea, India, and parts of Europe. Private players have entered the market with low-cost options targeting unconnected households. Trials of mmWave spectrum in urban areas have shown promising speed results, while mid-band spectrum is favored for wider coverage. These developments have created momentum in the market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

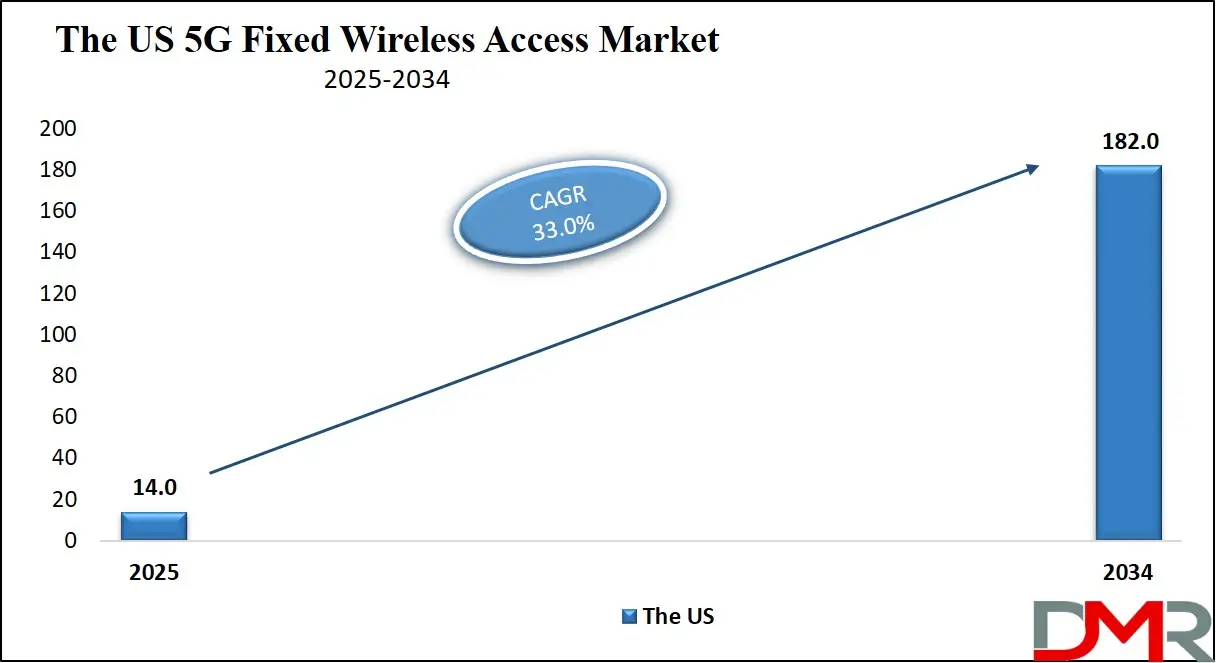

The US 5G Fixed Wireless Access Market

The US 5G Fixed Wireless Access Market size is projected to reach USD 14.0 billion in 2025 at a compound annual growth rate of 33.0% over its forecast period.

The US plays a major role in the 5G Fixed Wireless Access (FWA) market, driving both innovation and large-scale deployment. With strong support from telecom operators and favorable spectrum policies, the US has become a leader in rolling out 5G FWA services across urban and rural areas. High demand for faster internet, remote work support, and smart home integration has fueled adoption.

The US government has encouraged broadband expansion, especially in underserved regions, boosting FWA’s presence as a fiber alternative. Major tech and infrastructure investments have also contributed to the rapid growth. The country’s leadership in 5G technology and network development continues to set benchmarks for global markets and shapes the future of wireless broadband solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe 5G Fixed Wireless Access Market

Europe 5G Fixed Wireless Access Market size is projected to reach USD 12.7 billion in 2025 at a compound annual growth rate of 32.3% over its forecast period.

Europe plays a strategic role in the 5G Fixed Wireless Access (FWA) market by promoting balanced growth between urban innovation and rural connectivity. The region emphasizes digital inclusion and has supported FWA as a key solution to bridge broadband gaps in remote and less-developed areas. European regulators and governments have been proactive in allocating spectrum and encouraging private investments in 5G infrastructure.

Countries across Western and Eastern Europe are using FWA to complement fiber networks, especially where fiber deployment is slow or costly. Europe’s strong focus on sustainability and energy-efficient technologies also influences the design of FWA networks. With a mix of public-private collaboration and technology integration, Europe continues to drive steady progress in expanding 5G FWA access across diverse environments.

Japan 5G Fixed Wireless Access Market

Japan 5G Fixed Wireless Access Market size is projected to reach USD 2.9 billion in 2025 at a compound annual growth rate of 33.9% over its forecast period.

Japan plays an influential role in the 5G Fixed Wireless Access (FWA) market through its advanced telecommunications infrastructure and strong focus on technology innovation. The country leverages FWA to support high-density urban areas with growing demand for high-speed internet and seamless connectivity. With limited space for expanding wired networks in cities, FWA offers a flexible and efficient solution. Japan’s tech-driven environment encourages rapid adoption of smart homes, IoT devices, and cloud services, all of which benefit from 5G FWA.

Leading telecom providers in Japan are actively exploring new use cases, including enterprise and industrial connectivity. The government's support for 5G rollouts and smart infrastructure helps ensure that FWA remains a key part of Japan’s broader digital transformation efforts.

5G Fixed Wireless Access Market: Key Takeaways

- Market Growth: The 5G Fixed Wireless Access Market size is expected to grow by USD 674.1 billion, at a CAGR of 35.2%, during the forecasted period of 2026 to 2034.

- By Offering: The hardware is anticipated to get the majority share of the 5G Fixed Wireless Access Market in 2025.

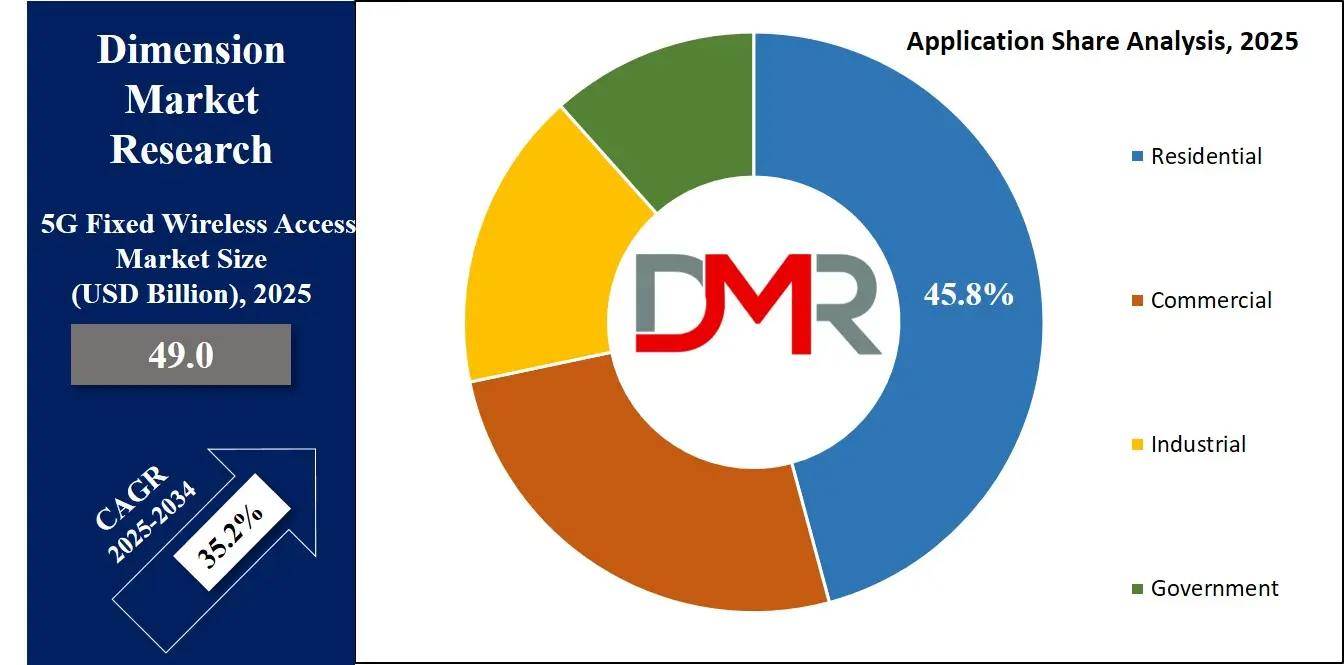

- By Application: The residential segment is expected to get the largest revenue share in 2025 in the 5G Fixed Wireless Access Market.

- Regional Insight: Asia Pacific is expected to hold a 34.5% share of revenue in the Global 5G Fixed Wireless Access Market in 2025.

- Use Cases: Some of the use cases of 5G Fixed Wireless Access include rural connectivity, home internet replacement, and more.

5G Fixed Wireless Access Market: Use Cases:

- Rural Connectivity: 5G FWA is ideal for bringing high-speed internet to rural or remote areas where laying fiber cables is difficult or costly. It enables communities to access digital services, online education, and telemedicine with minimal infrastructure. This helps close the digital divide and improve quality of life.

- Home Internet Replacement: In urban and suburban areas, 5G FWA serves as a fast and reliable alternative to traditional broadband. It offers quick installation, high data speeds, and competitive performance for streaming, gaming, and smart home devices. This flexibility makes it attractive for users seeking hassle-free home internet.

- Enterprise Backup Connectivity: Businesses use 5G FWA as a backup internet solution to maintain operations during fiber outages or network issues. Its low latency and high reliability make it suitable for point-of-sale systems, cloud access, and video conferencing. This ensures business continuity with minimal disruption.

- Temporary or Pop-Up Networks: 5G FWA is useful for events, construction sites, or temporary offices where setting up wired internet is impractical. It offers rapid deployment and strong performance without the need for digging or permits. This makes it a flexible option for short-term connectivity needs.

Stats & Facts

-

According to Ericsson:

- Service providers that focus on strong network coverage and quality performance are seen as 5G leaders by 70% of their existing customer base, positioning themselves ahead of competitors in brand trust and satisfaction.

- These quality-led operators are three times more likely to retain their customers and also have 50% more users intending to upgrade to better 5G services, making user loyalty a major growth driver.

- They are nearly twice as likely to see their average revenue per user (ARPU) and mobile service revenues grow by at least 1% year-on-year, showing a direct link between service quality and profitability.

- A successful trial achieved 340 Mbps uplink speed over a live commercial 5G Standalone network using sub-6 GHz frequency, showcasing next-level performance using widely deployable spectrum.

- A world-first long-range achievement of 11.18 km was recorded using millimeter wave spectrum, hitting peak speeds of 1 Gbps, proving that high-band 5G can support extended fixed wireless coverage.

- A 3.6 Gbps data call was delivered using six-component carrier aggregation on sub-6 GHz in a commercial 5G network, setting new standards in speed and spectrum efficiency.

- Mid-band 5G carrier aggregation demonstrated more than 60% better reach than traditional dual connectivity setups, helping service providers improve their field-tested coverage significantly.

- Superior network performance allows operators to better handle the growing demand for mobile data while also increasing monetization potential and strengthening long-term return on infrastructure investments.

-

As per OECD (Organisation for Economic Co-operation and Development):

- Fixed Wireless Access (FWA) subscriptions across member countries rose by 17% from June 2023 to June 2024, with Hungary, the United States, and the United Kingdom recording the highest growth.

- FWA plays a much larger role in broadband access in countries like Czechia (39%), Slovak Republic (23%), New Zealand (20%), and Estonia (18.7%), particularly where terrain or infrastructure limits fiber rollout.

- Satellite broadband usage is also rising fast, with a 22.6% increase in subscriptions in the past year, and the United States accounting for nearly three-quarters of all OECD satellite broadband users.

- Total fixed broadband subscriptions reached 504 million by mid-2024, with France, Korea, Switzerland, and Norway leading in penetration per 100 inhabitants, reflecting strong infrastructure development.

- Mobile broadband subscriptions grew to 1.9 billion by June 2024, with Japan and the US leading in penetration rates, showing continued adoption even in highly connected markets.

- Mobile data usage more than doubled over two years, increasing from 8 GB per month in June 2022 to 17 GB in June 2024, driven by expanding 5G networks and heavier app usage.

- Machine-to-machine (M2M) SIM cards rose by 14% in one year, with Sweden and Austria topping the list, largely due to operators registering M2M devices for global service usage.

Market Dynamic

Driving Factors in the 5G Fixed Wireless Access Market

Rising Demand for High-Speed Internet in Underserved Areas

One of the main growth drivers for the 5G Fixed Wireless Access (FWA) market is the increasing need for high-speed internet in rural and underserved regions. Many areas still lack proper broadband infrastructure due to the high cost and complexity of laying fiber or cable networks. 5G FWA provides a faster and more cost-effective way to deliver reliable internet without the need for extensive groundwork.

Governments and regulatory bodies are also supporting such solutions through funding and spectrum allocation. With more people working, learning, and accessing services online, the demand for stable internet continues to rise. 5G FWA bridges the connectivity gap, enabling digital inclusion. This makes it an essential part of national broadband and digital transformation plans.

Rapid Expansion of 5G Networks and Supporting Technologies

The global rollout of 5G networks is accelerating, creating a strong foundation for the growth of 5G FWA. Telecom providers are investing heavily in 5G infrastructure, including base stations, antennas, and spectrum, which also benefits FWA deployment. At the same time, advancements in network hardware, such as customer-premises equipment (CPE) and signal boosters, are making FWA easier to install and more efficient.

Integration with technologies like Wi-Fi 6 and edge computing further enhances performance and user experience. As 5G networks mature, they can support higher bandwidth and lower latency, which improves FWA service quality. This growing ecosystem makes 5G FWA a more attractive option for both consumers and enterprises seeking dependable and fast internet access.

Restraints in the 5G Fixed Wireless Access Market

Limited Spectrum Availability and Regulatory Challenges

One of the key restraints in the 5G Fixed Wireless Access (FWA) market is the limited availability of suitable spectrum. High-speed FWA services require access to licensed mid-band and high-band (mmWave) spectrum, which is often costly and tightly regulated. In some regions, delays in spectrum auctions or unclear regulatory policies can slow down the rollout of services. Additionally, competition for spectrum between mobile and fixed services can create conflicts.

Without adequate and affordable spectrum, providers may struggle to offer consistent performance or expand coverage. These challenges can particularly impact smaller players who lack the resources to secure prime spectrum bands. Regulatory uncertainty may also discourage investment, slowing the overall growth of the FWA ecosystem.

Network Infrastructure and Signal Limitations

Despite its promise, 5G FWA still faces limitations related to infrastructure and signal strength. High-frequency signals used in FWA, especially in the mmWave band, have shorter range and are easily blocked by buildings, trees, or weather conditions. This requires the deployment of a dense network of base stations and repeaters, which can be costly and time-consuming.

In areas with limited tower infrastructure or rough terrain, achieving strong and consistent signal coverage becomes a challenge. Moreover, the performance of FWA can vary significantly based on location and distance from the nearest tower. These limitations can affect user experience and reduce confidence in the service, especially when compared to traditional wired broadband in well-connected regions.

Opportunities in the 5G Fixed Wireless Access Market

Integration with Smart Cities and IoT Expansion

The growing adoption of smart city projects and Internet of Things (IoT) applications presents a significant opportunity for the 5G Fixed Wireless Access (FWA) market. Smart infrastructure requires reliable, low-latency, and high-bandwidth connectivity to manage systems such as traffic control, surveillance, energy grids, and public services. 5G FWA can deliver this connectivity quickly without the delays associated with laying fiber or cable networks.

As urban centers continue to digitize, demand for efficient, flexible wireless networks will rise. FWA can support both public and private sector needs, including utility management, emergency services, and connected devices. Its rapid deployment makes it a preferred option in fast-growing or redeveloping city zones, aligning well with the smart city evolution.

Emerging Markets and Digital Inclusion Goals

Developing regions offer massive growth potential for the 5G FWA market, as many areas still lack access to high-speed internet. Governments and international organizations are prioritizing digital inclusion and broadband for all as part of economic development. 5G FWA offers a practical solution in these regions, where deploying traditional wired networks may not be economically viable or geographically possible.

As mobile network operators extend their 5G coverage, they can offer FWA services to homes and businesses in these underserved communities. Local demand for online education, telemedicine, digital banking, and e-commerce is growing, driving the need for reliable connectivity. This creates a wide open market for FWA providers to scale quickly with relatively lower investment compared to fixed-line infrastructure.

Trends in the 5G Fixed Wireless Access Market

Indoor-Outdoor Hybrid Deployments

A recent trend in the 5G Fixed Wireless Access (FWA) market is the move toward hybrid indoor-outdoor setups. Providers are increasingly combining outdoor cell towers with indoor signal boosters or ceiling-mounted receivers. This helps overcome signal barriers like walls or terrain, ensuring users get strong and stable connections inside homes and offices.

These solutions make installations easier sometimes even DIY-friendly reducing the need for expensive technicians. As a result, customers experience more consistent speeds and broader coverage. This trend also helps providers manage deployment costs while improving service quality, especially in thick concrete buildings or densely populated urban zones.

Bundled Services and Flexible Plans

Another trend gaining traction in the 5G FWA space is the bundling of services with flexible subscription models. Providers now offer packages that combine internet with Smart Homes Systems features, streaming entertainment, or mobile voice services. They are also introducing flexible month-to-month plans with no long-term contracts, appealing to users who want convenience without commitment.

Some offers include temporary boosts in speeds, promotional perks, or seasonal promotions. This trend makes FWA more appealing to a wide range of users from families and remote workers to tech enthusiasts by matching their changing digital needs. It demonstrates how market players are using creativity to stand out in a competitive environment.

Impact of Artificial Intelligence in 5G Fixed Wireless Access Market

- Network Optimization: AI helps analyze real-time data to manage network traffic, predict congestion, and automatically adjust bandwidth for better performance. This ensures smooth and stable connectivity, especially in high-demand areas.

- Predictive Maintenance: AI enables operators to detect early signs of hardware failure or signal disruption by monitoring equipment health. This reduces downtime and improves service reliability without waiting for customer complaints.

- Smart Resource Allocation: AI algorithms allocate spectrum and power efficiently based on user behavior, location, and time of day. This leads to improved coverage, speed, and energy savings for both urban and rural deployments.

- Enhanced Customer Experience: AI-powered tools, such as virtual assistants and smart troubleshooting systems, help users solve issues quickly and get personalized service recommendations, improving satisfaction and support quality.

- Fraud Detection and Security: AI systems monitor traffic patterns to identify unusual activities or potential cyber threats in real-time, ensuring safer data transmission and protecting user privacy across FWA networks.

Research Scope and Analysis

By Offering Analysis

Hardware segment is expected to be leading in 2025 with a share of 62.3%, playing a crucial role in the growth of the 5G Fixed Wireless Access (FWA) market. This includes customer premises equipment (CPE), routers, modems, antennas, and access points that enable strong and stable wireless connections. As demand for fast and reliable broadband increases, especially in areas with limited fiber infrastructure, the need for efficient and easy-to-install 5G hardware continues to rise.

Manufacturers are focusing on compact, energy-efficient, and high-performance devices to improve connectivity and reduce installation time. The hardware is essential for enhancing signal strength, managing data traffic, and supporting advanced applications like smart homes and remote offices. With rising global 5G adoption, the hardware segment remains a foundation for FWA deployment and performance.

Services segment is projected to experience significant growth over the forecast period as telecom operators and solution providers expand their offerings beyond hardware. These services include network setup, installation support, maintenance, performance monitoring, and managed connectivity solutions tailored to residential and enterprise users. With growing interest in smart connectivity and digital services, users are seeking more than just internet they want seamless support and reliable service quality.

Operators are also bundling FWA with value-added services like entertainment platforms, cloud storage, and cybersecurity features. As 5G networks evolve, services play a key role in ensuring smooth delivery, customer satisfaction, and network optimization. The growing reliance on wireless broadband in various sectors boosts the importance of service-based models in the FWA ecosystem.

By Operating Frequency Analysis

Sub-6 GHz frequency band is projected to lead in 2025 with a share of 54.9%, supporting the growth of the 5G Fixed Wireless Access (FWA) market with its balanced mix of range and speed. This frequency range allows for broader coverage compared to mmWave and is better suited for suburban and rural areas where long-distance signal transmission is needed. It also performs well through obstacles like walls and trees, making it more practical for real-world environments.

Telecom providers are increasingly using Sub-6 GHz to quickly expand 5G services without the limitations of higher frequency bands. Its ability to support strong and stable connections makes it ideal for residential broadband, smart devices, and business applications. As more countries allocate spectrum in this range, Sub-6 GHz continues to play a key role in large-scale 5G FWA deployment, enabling widespread connectivity.

Hybrid frequency band is gaining strong momentum and will see significant growth over the forecast period in the 5G Fixed Wireless Access (FWA) market. This approach combines the benefits of both Sub-6 GHz and mmWave bands, allowing operators to deliver fast speeds along with broader coverage. Hybrid setups enable service providers to adapt to different geographic and user needs using mmWave in dense city areas for ultra-fast connections and Sub-6 GHz in suburban or rural zones for extended reach.

This flexibility enhances network performance, especially in regions with mixed infrastructure or diverse user demand. As network strategies evolve, hybrid frequencies support better traffic management, seamless switching, and efficient spectrum use. With rising consumer expectations for consistent and high-speed internet, hybrid frequency usage helps deliver reliable FWA service across various locations.

By Demography Analysis

Urban demography is estimated to lead in 2025 with a share of 51.7%, supporting the rapid growth of the 5G Fixed Wireless Access (FWA) market due to high population density and increasing demand for fast and flexible internet solutions. In crowded cities, where laying new fiber lines can be expensive and time-consuming, FWA provides a quicker and more adaptable alternative. Urban households and businesses are increasingly using FWA for high-speed internet to support activities like streaming, remote work, cloud access, and smart home connectivity.

The presence of advanced infrastructure and dense 5G base stations further enables strong performance in city environments. Telecom operators focus on urban rollouts to tap into large customer bases and drive faster returns. With growing tech adoption and bandwidth needs, urban areas remain central to the expansion and innovation of the FWA market.

Rural demography continues to gain importance and is set to witness significant growth over the forecast period in the 5G Fixed Wireless Access (FWA) market. In many remote or underserved regions, fiber-optic deployment is slow or economically unfeasible, making FWA a practical solution for bridging the digital divide. Rural households and small businesses benefit from reliable and high-speed connectivity, supporting online education, telehealth, and digital services.

The ability to provide wireless broadband without major infrastructure changes allows telecom providers to expand coverage efficiently. Governments and development programs are also pushing for better internet access in rural zones, further driving adoption. With rising digital needs and increasing support for remote connectivity, rural areas are becoming a key focus for future FWA deployments and long-term network expansion.

By Application Analysis

Residential application segment is projected to lead in 2025 with a share of 45.8%, strongly contributing to the expansion of the 5G Fixed Wireless Access (FWA) market. Households are increasingly demanding fast, reliable, and flexible internet for daily needs like streaming, online classes, gaming, video calls, and smart home devices. In many areas, especially where fiber connections are not feasible or take too long to deploy, 5G FWA offers an easy-to-install and high-speed alternative.

It allows families to get connected quickly without complex wiring. With the rise of remote work and digital lifestyles, dependable home broadband has become essential. Telecom providers are responding by offering tailored residential FWA plans with attractive bundles and services. This rising dependence on home internet continues to drive the residential segment as a key area of growth and innovation within the global 5G FWA market.

Government application segment is emerging as a strong growth driver and is set to experience significant expansion over the forecast period in the 5G Fixed Wireless Access (FWA) market. Public sector organizations and local authorities are increasingly using FWA to support digital transformation, smart city development, and emergency communication systems. Its ability to offer quick deployment and reliable connectivity makes it ideal for government buildings, surveillance systems, and rural outreach programs.

Governments are also using FWA to deliver e-governance services and digital infrastructure in areas where traditional broadband is lacking. The flexibility of wireless access allows faster rollout of public services, especially in remote zones. As digital governance and secure communication become national priorities, the adoption of 5G FWA by government bodies continues to grow across multiple regions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The 5G Fixed Wireless Access Market Report is segmented on the basis of the following:

By Offering

- Hardware

- Customer Premises Equipment (CPE)

- Access Units

- Services

- Installation Services

- Support & Maintenance Services

- Managed Services

By Operating Frequency

By Demography

By Application

- Residential

- Single-Family Homes

- Multi-Dwelling Units (MDUs)

- Remote/Rural Housing

- Commercial

- SMEs (Small & Medium Enterprises)

- Large Enterprises

- Office Parks/Campuses

- Retail Spaces

- Industrial

- Manufacturing Facilities

- Warehouses/Logistics Hubs

- Oil & Gas Installations

- Energy & Utilities

- Government

- Public Buildings & Infrastructure

- Emergency Services

- Defense Installations

- Municipal Connectivity

Regional Analysis

Leading Region in the 5G Fixed Wireless Access Market

Asia Pacific, leading in 2025 with a share of 34.5%, plays a major role in driving the growth of the 5G Fixed Wireless Access (FWA) market due to rapid urbanization, strong mobile infrastructure, and increasing demand for high-speed internet across both urban and rural areas. Countries like China, India, South Korea, and Australia are actively expanding 5G networks, with telecom operators using FWA to deliver broadband in areas where fiber rollout is difficult or expensive. The region’s large population, growing digital economy, and surge in smart devices are pushing the need for reliable wireless connectivity.

Government initiatives aimed at improving digital inclusion, especially in remote regions, are supporting the deployment of 5G FWA solutions. In dense cities, FWA offers a flexible and fast alternative to traditional broadband. With strong investments in technology and infrastructure, Asia Pacific is becoming a key innovation hub for 5G FWA, shaping how next-generation internet services are delivered at scale.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the 5G Fixed Wireless Access Market

Middle East and Africa (MEA) is witnessing significant growth over the forecast period in the 5G Fixed Wireless Access (FWA) market due to rising demand for fast and reliable wireless broadband. The region faces challenges with traditional fiber infrastructure, especially in remote and underserved areas, making 5G FWA a practical and scalable solution.

Countries across MEA are investing in 5G rollout and digital connectivity to support smart city initiatives, e-learning, e-health, and remote working. Telecom companies are using advanced 5G technology to provide low-latency internet and high-speed data services. It is estimated that continued support from governments and partnerships with tech firms will further drive 5G FWA adoption across MEA.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The 5G Fixed Wireless Access market is becoming more competitive as more telecom providers and technology firms join in to offer faster internet without cables. Big network operators are using their existing towers and spectrum to quickly roll out services, while smaller players are targeting rural or low-connectivity areas with affordable plans. Equipment makers are improving routers and antennas to make connections smoother and faster.

Startups and internet service providers are also entering the space, creating more options for customers. The race to deliver better coverage, speed, and pricing is driving constant upgrades and new features. Partnerships between network providers and hardware companies are common, helping to expand reach and reduce costs. The competition is making 5G FWA more accessible and innovative for everyone.

Some of the prominent players in the global 5G Fixed Wireless Access are:

- Huawei Technologies Co., Ltd.

- Nokia Corporation

- Ericsson

- Samsung Electronics Co., Ltd.

- Qualcomm Technologies, Inc.

- ZTE Corporation

- Verizon Communications Inc.

- AT&T Inc.

- T-Mobile US, Inc.

- China Mobile Ltd.

- China Telecom Corporation Limited

- China Unicom

- SK Telecom Co., Ltd.

- KT Corporation

- Rakuten Mobile, Inc.

- Reliance Jio Infocomm Ltd.

- Bharti Airtel Limited

- Deutsche Telekom AG

- Vodafone Group Plc

- Orange S.A.

- Other Key Players

Recent Developments

- In July 2025, Bharti Airtel expanded its partnership with Ericsson to support the rollout of Fixed Wireless Access (FWA) services in India using Ericsson’s core network portfolio. This deployment focuses to boost Airtel’s core capacity and deliver an enhanced FWA experience for customers. As part of the deal, Ericsson will introduce a high-capacity platform designed for FWA with a smaller footprint and improved cost efficiency. The solution builds on their earlier dual-mode 5G Core agreement, supporting Airtel’s move toward a unified and future-ready 5G Standalone network.

- In June 2025, Bharat Sanchar Nigam Limited (BSNL), the state-owned telecom operator, has launched advanced connectivity solutions in the Telangana circle, including Quantum 5G Fixed Wireless Access (FWA), a Micro Data Centre, and an International Gateway in Hyderabad. The SIM-less BSNL Q-5G FWA service is designed to offer secure and reliable high-speed internet to enterprises, businesses, gated communities, and individual homes. Developed using indigenous 5G technology in collaboration with local partners, the service highlights BSNL’s push for self-reliant, next-generation digital infrastructure in India.

- In June 2025, Inseego launched its FX4100 indoor 5G gateway in late May, developed exclusively for T-Mobile for Business. This device marks a shift in wireless connectivity, positioning it as a primary enterprise solution rather than just a backup. Co-developed over a year with T-Mobile, the FX4100 is Inseego’s first product to support 5G SA and 5G Advanced, featuring uplink carrier aggregation and full support for network slicing across industry-specific applications.

- In February 2025, Samsung Electronics unveiled that UScellular has expanded its 5G network in the Mid-Atlantic region using Samsung’s 5G mmWave and virtualized RAN (vRAN) solutions. This deployment supports growing fixed wireless access and mobile demand. The rollout includes Samsung’s Compact Macro, a lightweight, all-in-one unit combining baseband, radio, and antenna for easier installation. Operating in the 28GHz and 39GHz mmWave bands, it enables ultra-fast, low-latency connectivity. Launched in November, the enhanced network delivers high-speed performance and improved coverage for customers across multiple Mid-Atlantic markets.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 49.0 Bn |

| Forecast Value (2034) |

USD 738.5 Bn |

| CAGR (2025–2034) |

35.2% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 14.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Offering (Hardware and Services), By Operating Frequency (Sub–6 GHz, mmWave, and Hybrid), By Demography (Urban, Semi-Urban, and Rural), By Application (Residential, Commercial, Industrial, and Government) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Huawei Technologies Co., Ltd., Nokia Corporation, Ericsson, Samsung Electronics Co., Ltd., Qualcomm Technologies, Inc., ZTE Corporation, Verizon Communications Inc., AT&T Inc., T-Mobile US, Inc., China Mobile Ltd., China Telecom Corporation Limited, China Unicom, SK Telecom Co., Ltd., KT Corporation, Rakuten Mobile, Inc., Reliance Jio Infocomm Ltd., Bharti Airtel Limited, Deutsche Telekom AG, Vodafone Group Plc, Orange S.A., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global 5G Fixed Wireless Access Market?

▾ The Global 5G Fixed Wireless Access Market size is expected to reach a value of USD 49.0 billion in 2025 and is expected to reach USD 738.5 billion by the end of 2034.

Which region accounted for the largest Global 5G Fixed Wireless Access Market?

▾ Asia pacific is expected to have the largest market share in the Global 5G Fixed Wireless Access Market, with a share of about 34.5% in 2025.

How big is the 5G Fixed Wireless Access Market in the US?

▾ The 5G Fixed Wireless Access Market in the US is expected to reach USD 14.0 billion in 2025.

Who are the key 5G Fixed Wireless Access Market?

▾ Some of the major key players in the Global 5G Fixed Wireless Access Market are Huawei Technologies Co., Ltd., Nokia Corporation, Ericsson and others

What is the growth rate in the Global 5G Fixed Wireless Access Market?

▾ The market is growing at a CAGR of 35.2 percent over the forecasted period.