Market Overview

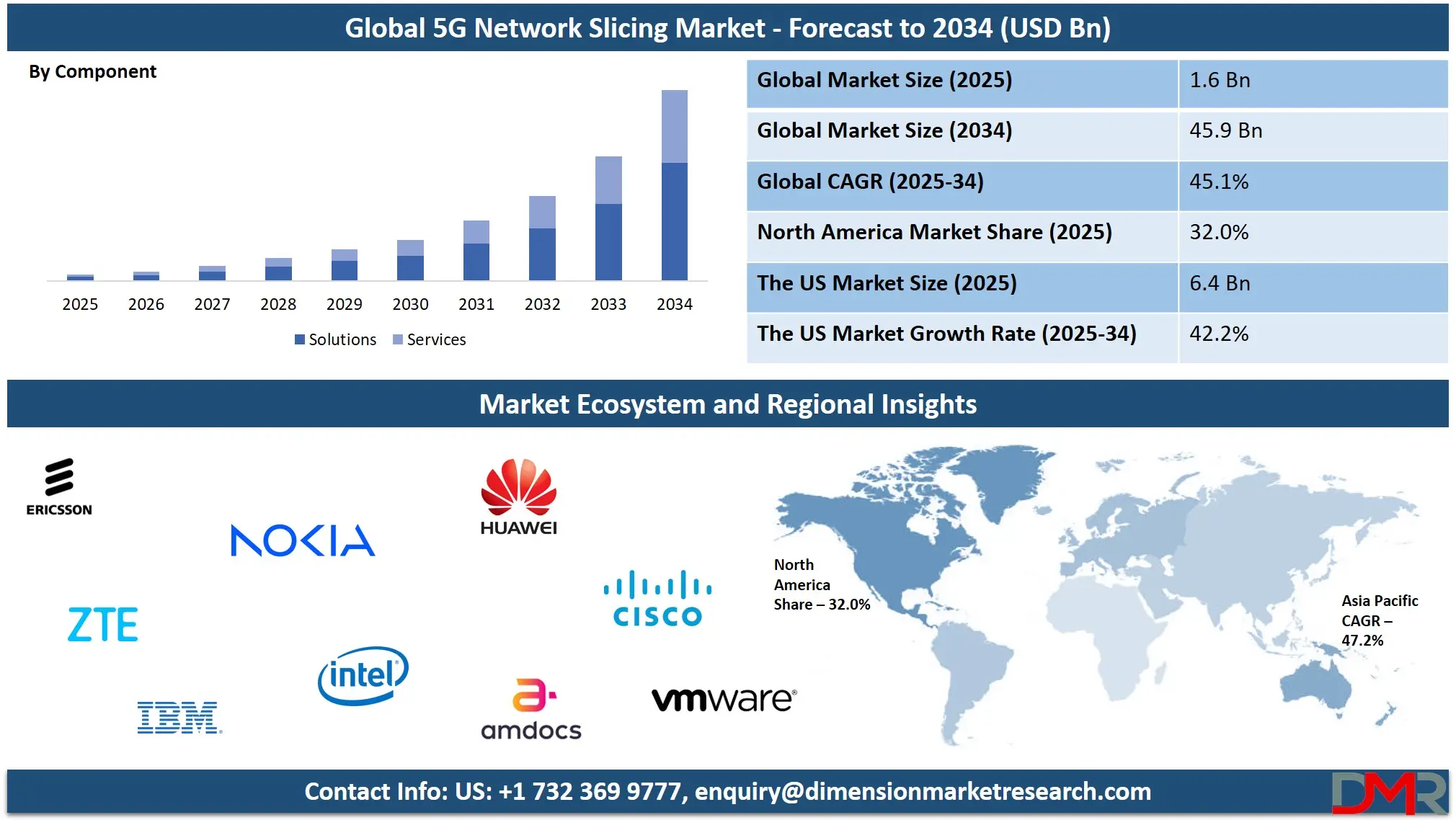

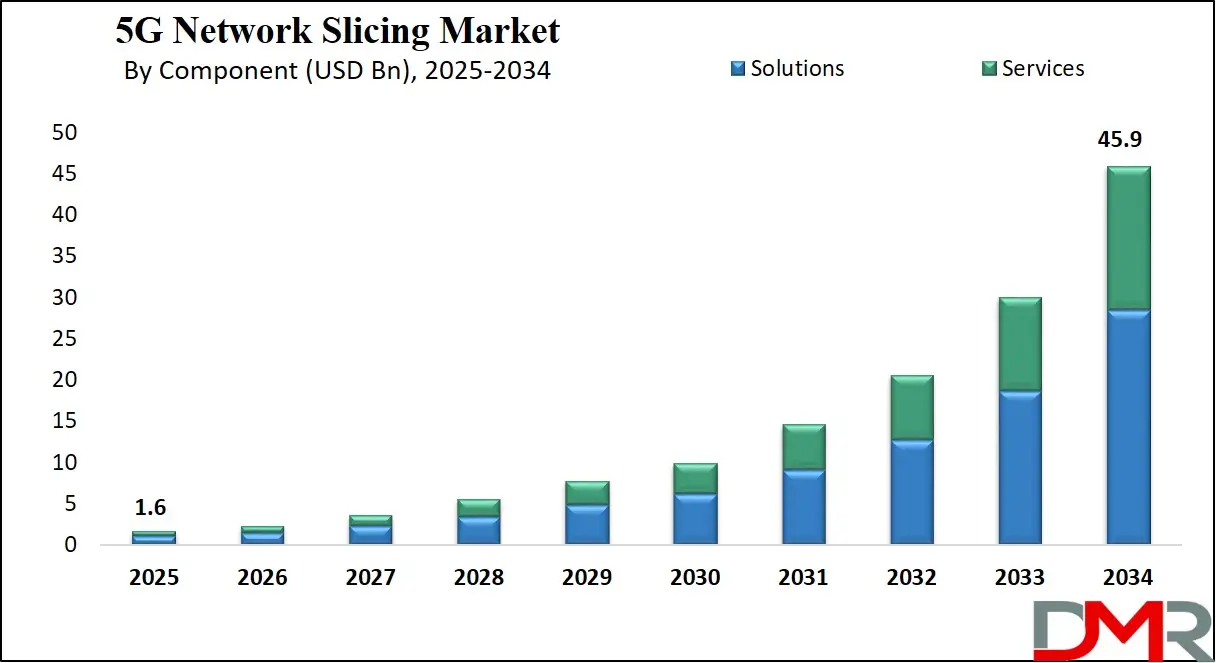

The Global 5G Network Slicing Market size is projected to reach USD 1.6 billion in 2025 and grow at a compound annual growth rate of 45.1% to reach a value of USD 45.9 billion in 2034.

The 5G Network Slicing Market refers to the ecosystem of technologies, components, and services that enable the division of a physical 5G network into multiple virtualized, independent logical networks. These slices support tailored performance requirements for applications such as autonomous vehicles, industrial IoT, remote healthcare, and smart city infrastructures.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Built on foundations like SDN, NFV, edge computing, and orchestration platforms, the market plays a critical role in enabling ultra-reliable, low-latency communication (URLLC), enhanced mobile broadband (eMBB), and massive machine-type communication (mMTC). Its emergence is transforming telecommunications by shifting from “one-size-fits-all” networks to highly customized connectivity layers that meet the diverse requirements of various industries.

Key insights into the market reveal that rapid digitization, enterprise adoption of cloud-native 5G core architecture, and increasing demand for industry-specific connectivity models are fueling growth. Regulatory encouragement for private 5G networks, combined with significant R&D spending by telecom operators and advancements in virtualization technologies, further accelerates innovation.

The market is progressing toward maturity as more industries adopt slice-as-a-service models, enabling operators to monetize networks in new ways. Additionally, interoperability improvements and standardization efforts from global bodies are paving the way for seamless cross-network slicing. Major developments include significant investments in 5G standalone (SA) infrastructure, expanding partnerships between telecom operators and hyperscalers, and technological innovations in AI-based slice orchestration.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Companies are integrating automation, predictive analytics, and cloud-native functions to enhance network agility. Governments are updating spectrum policies and supporting testbeds for industry-focused 5G slicing. Recent acquisitions in the telecom software domain, the integration of slicing into enterprise IoT strategies, and the rise of multi-domain slice orchestration are shaping the future trajectory of the market.

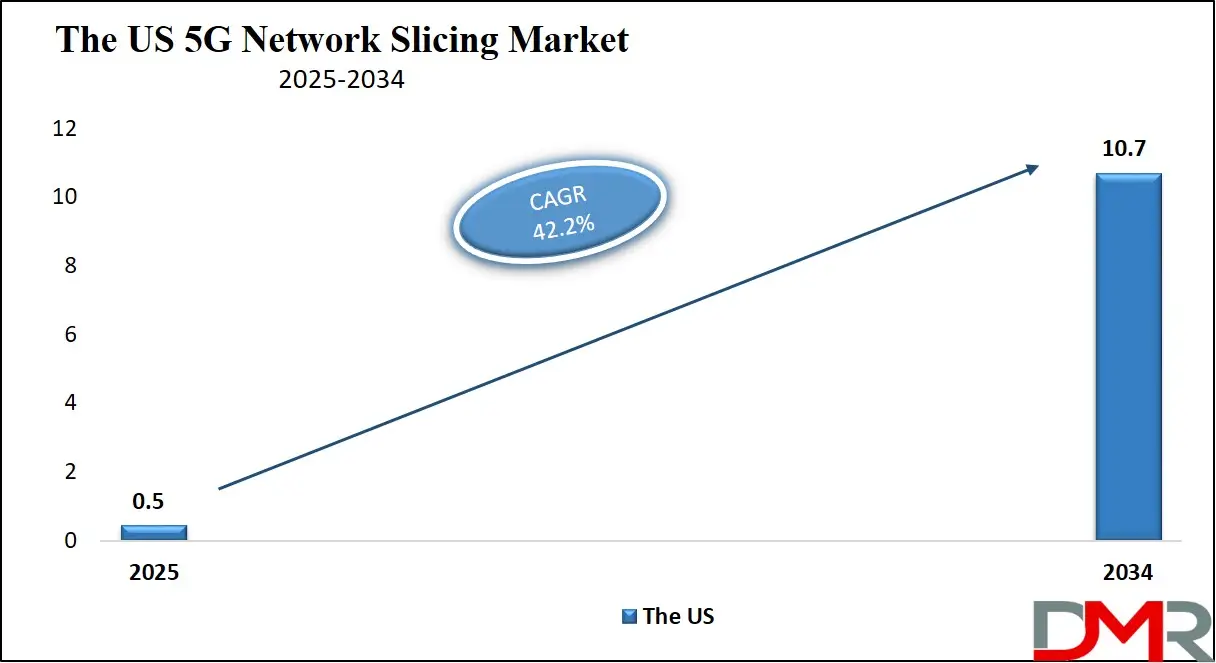

The US 5G Network Slicing Market

The US 5G Network Slicing Market size is projected to reach USD 500 million in 2025 at a compound annual growth rate of 42.2% over its forecast period.

The US 5G Network Slicing Market is expanding due to strong investments in standalone 5G infrastructure and the presence of technology-focused enterprises adopting advanced digital transformation initiatives. With major telecom operators deploying network slicing capabilities for sectors such as autonomous transportation, defense, and smart manufacturing, the market is driven by an ecosystem that promotes early technological adoption.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Federal policies encouraging next-generation wireless innovation, enhanced spectrum allocation, and incentives for 5G R&D contribute to market acceleration. Cloud providers in the US also play a critical role by enabling scalable edge resources that support slice orchestration. The combination of private 5G rollouts, enterprise partnerships, and robust regulatory support positions the US as a leading region for operational and commercial implementation of network slicing.

Europe 5G Network Slicing Market

Europe 5G Network Slicing Market size is projected to reach USD 320 million in 2025 at a compound annual growth rate of 43.4% over its forecast period.

The European 5G Network Slicing Market is shaped by strong regulatory frameworks, the European Green Deal, and regional policies promoting digital transformation across industrial sectors. With comprehensive standards for data protection and spectrum management, Europe is moving toward harmonized cross-border 5G services, including network slicing for logistics, public safety, and healthcare. The region benefits from extensive public funding for 5G testbeds and collaborative research across EU member states. Sectors like automotive manufacturing, Industry 4.0 environments, and smart energy networks are spearheading adoption. Europe’s structured approach to sustainability, energy-efficient network designs, and emphasis on secure digital infrastructure contribute to a steady pace of innovation and consistent expansion of slicing-enabled services.

Japan 5G Network Slicing Market

Japan 5G Network Slicing Market size is projected to reach USD 144 million in 2025 at a compound annual growth rate of 44.1% over its forecast period.

Japan’s 5G Network Slicing Market is propelled by rapid urbanization, advanced industrial automation, and government-backed strategies supporting nationwide 5G deployment. The country’s focus on smart cities, robotics, and high-tech manufacturing makes network slicing a critical enabler for precision connectivity. With rising demand for URLLC applications in automated production lines and remote medical systems, Japan is witnessing fast adoption in both public and private sectors. Government initiatives aimed at digital society development and spectrum liberalization further foster growth. Japan’s compact urban centers create ideal conditions for dense 5G infrastructure, although challenges such as interoperability and legacy system integration remain. Nonetheless, Japan continues to be a leading hub for innovation in slicing-enabled industrial and consumer applications.

5G Network Slicing Market: Key Takeaways

- Market Growth: The 5G Network Slicing Market size is expected to grow by USD 43.6 billion, at a CAGR of 45.1%, during the forecasted period of 2026 to 2034.

- By Component: The solutions segment is anticipated to get the majority share of the 5G Network Slicing Market in 2025.

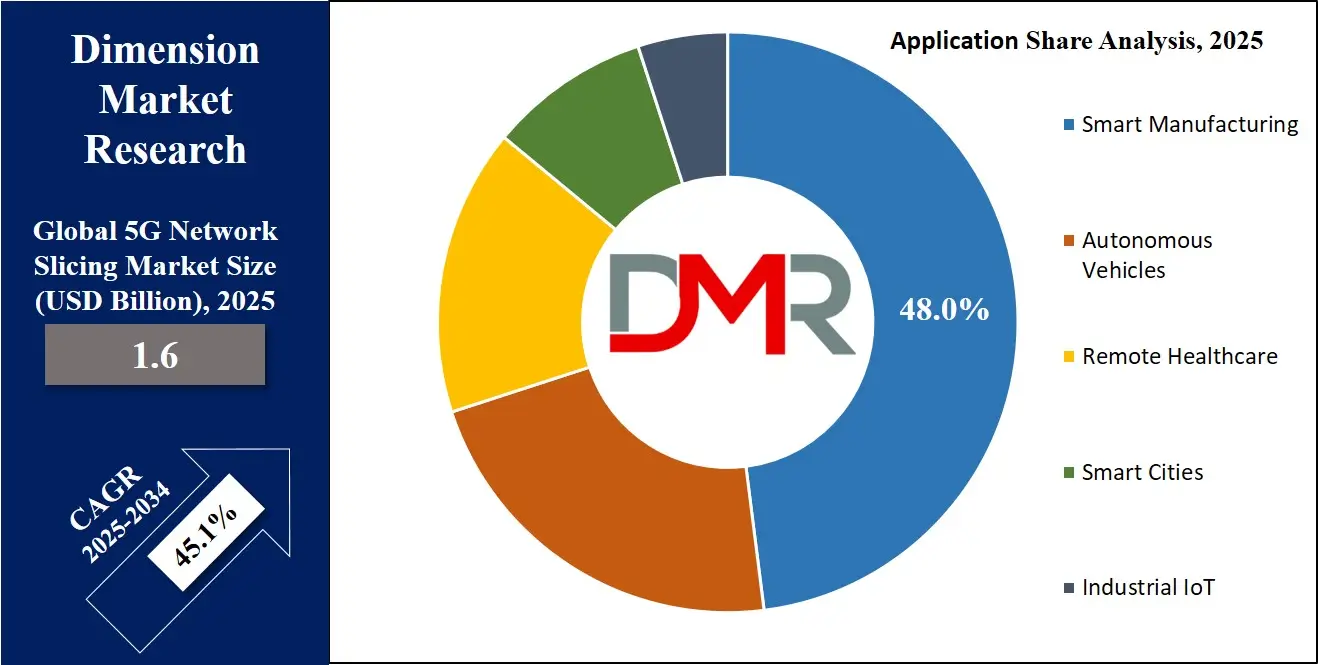

- By Application: The smart manufacturing segment is expected to get the largest revenue share in 2025 in the 5G Network Slicing Market.

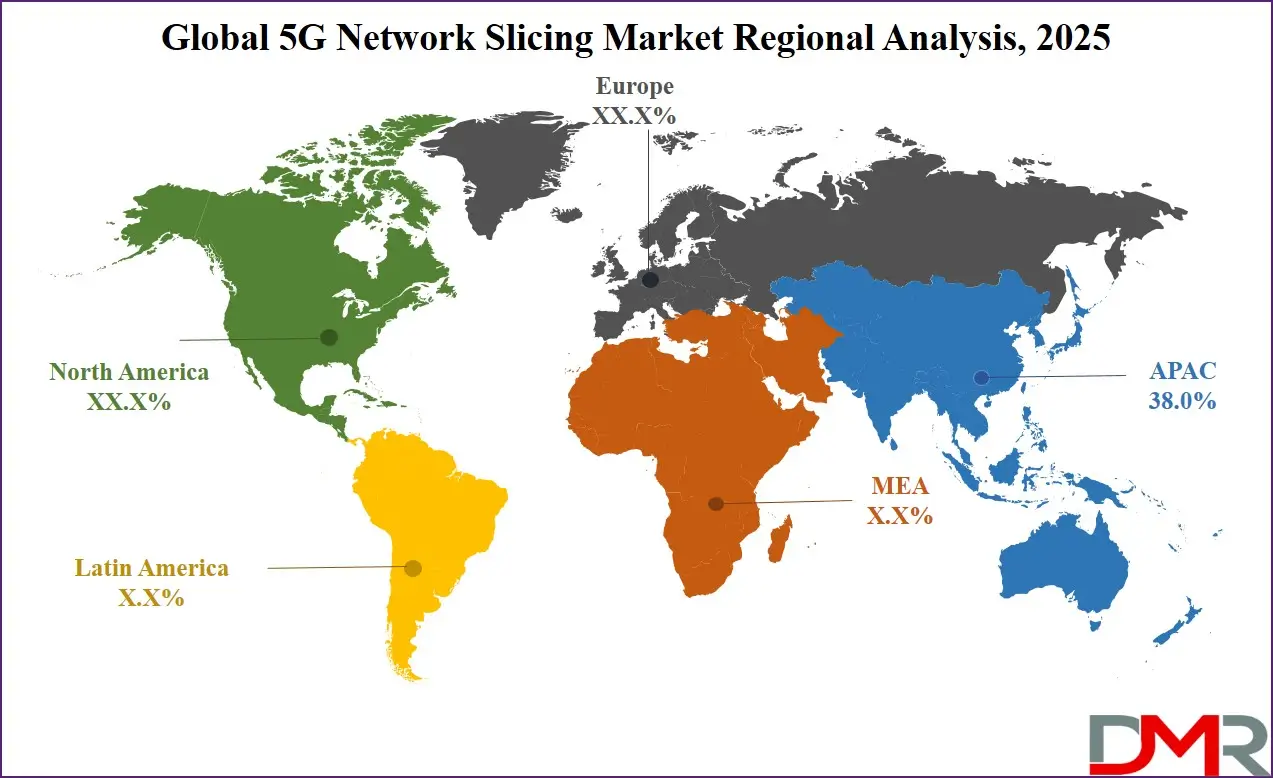

- Regional Insight: Asia Pacific is expected to hold a 38.0% share of revenue in the Global 5G Network Slicing Market in 2025.

- Use Cases: Some of the use cases of 5G Network Slicing include ultra-reliable communication for autonomous vehicles, smart city infrastructure optimization, and more.

5G Network Slicing Market: Use Cases

- Ultra-reliable communication for autonomous vehicles: Enables real-time, low-latency data exchange to support safe navigation, precise V2X communication, and uninterrupted autonomous driving operations.

- Remote robotic surgery and advanced telemedicine: Provides ultra-stable, low-latency network performance required for remote surgical control, high-quality imaging, and reliable telemedicine services.

- Industrial IoT automation in smart factories: Supports synchronized machine operations, predictive maintenance, and seamless automation through dedicated, high-performance network slices.

- Smart city infrastructure optimization: Enables efficient operation of traffic systems, utilities, surveillance, and public safety services using isolated, purpose-built network slices.

Stats & Facts

- U.S. Federal Communications Commission (FCC), reports a rise in mid-band 5G deployments supporting network slicing capabilities across industrial zones in 2024.

- European Commission (EC) confirms increased 5G SA adoption in 2025, accelerating multi-domain slicing for cross-border logistics.

- Japan Ministry of Internal Affairs and Communications (MIC) notes expansion of private 5G licenses enabling slicing for manufacturing and smart hospitals in 2024.

- International Telecommunication Union (ITU) recognizes network slicing as a core requirement for achieving global 5G performance benchmarks in 2025.

- OECD highlights enterprises allocating greater digital budgets toward 5G slicing-enabled automation in 2025.

- World Economic Forum (WEF) indicates rising dependence on network slicing for mission-critical industrial applications in 2024.

Market Dynamic

Driving Factors in the 5G Network Slicing Market

Accelerating Digital Transformation across Industries

A key driving factor in the 5G Network Slicing Market is the accelerating digital transformation across industries seeking highly customizable connectivity solutions. As enterprises increasingly adopt automation, IoT ecosystems, and data-intensive applications, the need for isolated, reliable, and secure network environments grows. Network slicing enables tailored performance metrics such as latency, bandwidth, and security—features vital for autonomous vehicles, telemedicine, and industrial robotics. Governments promoting 5G innovation through policy incentives further accelerate adoption. Combined with advancements in virtualization, cloud-native 5G core architecture, and AI-powered orchestration, these elements contribute to robust demand. The ability to monetize differentiated network slices also motivates operators to deploy slicing at scale.

Evolution of Supply Chains & Enterprise Infrastructure

Another major driver is the evolution of supply chains and enterprise infrastructure toward decentralized, edge-based models. As organizations move data processing closer to endpoints, network slicing ensures predictable performance for real-time operations, especially in sectors like logistics, energy, and smart cities. The cost efficiencies achieved by avoiding dedicated physical networks and instead leveraging virtualized slices are substantial. Additionally, telecom operators are increasingly monetizing enterprise-specific slices, enabling new business models. The surge in private 5G networks further complements slicing adoption, as enterprises seek guaranteed service levels. This integration of slicing with edge computin

Restraints in the 5G Network Slicing Market

Higher Deployment Cost

A significant restraint in the market is the high cost associated with deploying and transitioning to 5G standalone infrastructure, which is essential for enabling network slicing capabilities. Many operators still rely on non-standalone 5G architectures that cannot fully support slicing’s advanced features. Additionally, complex integration with legacy systems and the need for skilled technical expertise pose challenges. Regulatory inconsistencies across regions create further obstacles to seamless deployment. For enterprises, the lack of clear ROI models and concerns regarding security in virtualized environments contribute to slower adoption. These factors collectively restrict the pace at which slicing can be commercialized on a global scale.

Limited Awareness among SMEs

Another barrier hindering market growth is the limited awareness among small and medium enterprises regarding the operational advantages of network slicing. Many businesses perceive 5G as a general upgrade rather than a platform offering differentiated connectivity tailored to specific industry scenarios. Market fragmentation, variations in operator readiness, and insufficient interoperability between vendors reduce compatibility and integration efficiency. In certain regions, limited 5G coverage slows the practical implementation of slicing within industrial environments. Technical constraints such as challenges in multi-domain orchestration, real-time slice management, and maintaining consistent quality of service also impede adoption. These issues create gaps between capability and actual utilization.

Opportunities in the 5G Network Slicing Market

Demand for Private 5G Networks

A major opportunity for market expansion lies in the rising demand for private 5G networks across manufacturing, energy, healthcare, and transportation. These industries require mission-critical connectivity with guaranteed uptime, making slicing an ideal solution. Emerging economies are investing heavily in digital infrastructure, creating new markets for slice-enabled services. Additionally, the proliferation of smart city initiatives provides opportunities for deploying multiple slices within public utilities, transportation, and emergency services. As enterprises adopt cloud-based applications and IoT ecosystems, the need for customizable connectivity grows. Vendors offering integrated slicing solutions—combining orchestration, analytics, and automation—are poised to capture significant market share.

Integration of AI & Machine Learning

Another promising opportunity is the integration of AI and machine learning within network orchestration, enabling predictive maintenance, automated slice adjustments, and real-time traffic optimization. Governments are offering incentives for 5G modernization, further accelerating adoption. Innovations in RAN slicing, multi-access edge computing, and cross-network interoperability will open new commercial use cases. Additionally, sectors like remote healthcare, precision agriculture, and public safety are exploring slicing for reliable and secure communication channels. Partnerships between telecom operators and cloud providers are creating hybrid service models that bring slicing capabilities to enterprises with lower initial investment, making the market more accessible and scalable.

Trends in the 5G Network Slicing Market

Adoption of AI-Driven Automation

One major trend reshaping the market is the adoption of AI-driven automation for dynamic slice orchestration. Telecom operators are increasingly leveraging machine learning to predict network congestion, allocate resources efficiently, and ensure service-level compliance. The shift toward cloud-native architectures enhances scalability and operational agility, allowing slices to be deployed on demand. The rise of digital twins and virtualized testing environments is enabling faster development cycles. Industries deploying mission-critical applications are pushing the market toward more mature, real-time management capabilities. This automation trend is also reducing operational costs and accelerating the rollout of large-scale slicing deployments.

Integration with Hybrid Cloud & Multi-cloud Environments

Another significant trend is the growing integration of 5G network slicing with hybrid cloud and multi-cloud environments. Enterprises are seeking flexible connectivity services that operate seamlessly across private data centers, public clouds, and edge nodes. This trend aligns with the adoption of distributed computing models where workloads shift dynamically based on latency and performance needs. In addition, demand for multi-domain slicing, extending slices across different operators and networks, as it is increasing, particularly for global logistics and cross-border applications. Sustainability initiatives are influencing operators to optimize resource allocation, creating energy-efficient slicing configurations. These emerging trends are accelerating the evolution of the slicing ecosystem.

Impact of Artificial Intelligence in 5G Network Slicing Market

- AI enables automated, real-time slice orchestration for optimal resource allocation.

- Predictive analytics improve network reliability and reduce downtime for mission-critical applications.

- AI enhances security by detecting anomalies and preventing slice-level cyberattacks.

- Intelligent QoS monitoring supports guaranteed performance for industry-specific use cases.

- AI-driven traffic forecasting optimizes end-to-end network efficiency.

Research Scope and Analysis

By Component Analysis

Solutions dominate the component segment with an estimated 62% market share in 2025, primarily because orchestration platforms, SDN controllers, and NFV infrastructures form the backbone of 5G network slicing deployments. These solutions enable dynamic provisioning, real-time monitoring, and automated lifecycle management of slices. Enterprises and telecom operators prefer integrated solutions to ensure interoperability across virtualized environments and cloud platforms. Advancements in cloud-native 5G core implementations, RAN slicing capabilities, and intent-based networking further enhance the relevance of the solutions segment. Additionally, increasing demand for private 5G networks and industrial IoT ecosystems encourages adoption of robust slicing solutions that support end-to-end customization. As slicing complexity grows, comprehensive software and automation frameworks become indispensable for managing diverse applications.

The services segment is projected to grow at the fastest rate due to rising demand for managed services, consulting, and deployment support. Enterprises transitioning from traditional IT networks to advanced 5G architectures require specialized expertise to configure and optimize slices. Professional services support integration with cloud, security frameworks, and legacy systems, while managed services offer continuous monitoring, orchestration, and performance optimization. As operators commercialize slice-as-a-service models, demand for long-term service partnerships increases. The growth of edge computing ecosystems further necessitates specialized services to ensure efficient coordination between distributed network elements.

By Type of Slice Analysis

Enhanced Mobile Broadband (eMBB) holds the largest share at approximately 55% in 2025 due to its widespread adoption across consumer and enterprise applications. High-speed connectivity requirements for AR/VR, cloud gaming, smart campuses, and real-time video analytics make eMBB the most commercially deployed slice type. Telecom operators often prioritize eMBB because it serves as the foundation for monetizing 5G services and improving customer experience. The increasing use of high-definition content, remote work platforms, and virtual collaboration tools expands the demand for large bandwidth. As industries adopt digital twins and immersive technologies, eMBB’s relevance continues to grow. Its flexibility and scalability enhance operator readiness for advanced slicing deployments.

URLLC is expanding rapidly due to rising implementation in mission-critical applications such as autonomous vehicles, robotics, and remote surgeries. Its ultra-low-latency capabilities make it indispensable for operations requiring real-time responsiveness. As industries automate processes, demand for reliable, latency-sensitive connectivity accelerates. Governments supporting smart manufacturing and intelligent transportation further contribute to URLLC adoption. Despite requiring advanced network infrastructure and precise orchestration, it remains one of the fastest-growing slice types.

By Application Analysis

In 2025, smart manufacturing accounts for approximately 48% market share, driven by the need for highly reliable and customizable connectivity for robotics, automated systems, digital twins, and industrial IoT devices. Network slicing ensures isolated communication channels for critical operations, reducing risks associated with downtime and interference. As factories adopt Industry 4.0 technologies, including real-time analytics and machine-to-machine communication, reliable 5G slices become essential. The segment benefits from widespread adoption of private 5G networks that provide dedicated, optimized resources. Manufacturers seeking to enhance production efficiency, predictive maintenance, and energy management are increasingly adopting slicing-enabled networks that ensure consistent QoS for varied operational environments.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Remote healthcare is the fastest-growing application segment due to the increasing demand for high-quality telemedicine, remote diagnostics, and robotic-assisted procedures. URLLC-enabled slices support real-time data transmission essential for patient monitoring and emergency services. Healthcare providers are modernizing digital infrastructure to expand virtual care capabilities, leading to rapid adoption of 5G slicing. Data security and reliability remain critical drivers in this segment.

By End User Analysis

Telecom operators represent the dominant end-user segment with approximately 60% market share in 2025, as they possess the infrastructure and spectrum required to deploy and commercialize network slicing. Operators leverage slicing to create new revenue streams by offering enterprise-grade connectivity services, private networks, and tailored applications. The shift toward standalone 5G cores accelerates slicing implementation, enabling operators to deliver differentiated performance levels. Their partnerships with hyperscalers and technology vendors further strengthen this segment. As demand for digital transformation grows across industries, operators remain central to orchestrating multi-domain slices, managing security, and ensuring SLA compliance. Their strategic investments in automation and virtualization technologies reinforce their leadership.

Enterprises across industries, including manufacturing, healthcare, logistics, and energy, are increasingly adopting network slicing to meet specific operational requirements. The segment is growing quickly due to the rise of private 5G networks and industrial digitalization efforts. Enterprises seek reliable, secure, and custom connectivity solutions that traditional networks cannot offer. This segment benefits from automation, edge compute integration, and improved ROI models.

The 5G Network Slicing Market Report is segmented on the basis of the following:

By Component

- Solutions

- Orchestration & Automation

- NFV

- SDN

- Services

- Professional Services

- Managed Services

By Type of Slice

By Application

- Smart Manufacturing

- Autonomous Vehicles

- Remote Healthcare

- Smart Cities

- Industrial IoT

By End User

- Telecom Operators

- Enterprises

- Manufacturing

- Healthcare

- Transportation & Logistics

- Energy & Utilities

Regional Analysis

Leading Region in the 5G Network Slicing Market

The Asia-Pacific (APAC) region leads the 5G Network Slicing Market with an estimated 38% market share due to aggressive 5G rollout strategies, high adoption of digital technologies, and significant investments in smart infrastructure. Countries like China, South Korea, and Japan are global leaders in deploying standalone 5G networks, which form the foundation for slicing. Government-led initiatives promoting smart manufacturing, robotics, autonomous vehicles, and smart cities further accelerate adoption.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

APAC’s dense urban environments and advanced industrial sectors create ideal conditions for slicing-enabled applications. Robust ecosystem support from telecom operators, technology vendors, and government bodies enhances innovation and contributes to rapid expansion. The region’s strong focus on industrial digital transformation and public-private partnerships positions it as the dominant leader in slicing adoption.

Fastest Growing Region in the 5G Network Slicing Market

North America is the fastest-growing region due to expanding 5G standalone deployments, strong enterprise demand, and significant investments in automation and edge computing. The region hosts technology-advanced industries such as aerospace, automotive, and healthcare, which require high-performance connectivity. Government incentives and flexible spectrum regulations support innovation. Collaboration between telecom operators and hyper-scalers accelerates enterprise adoption through scalable cloud-integrated network slicing models. As more industries implement real-time applications, the demand for low-latency and secure connectivity continues to surge.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the 5G Network Slicing Market is shaped by strategic initiatives centered on innovation, partnerships, and service diversification. Market players deploy cloud-native architectures, invest in R&D, and enhance orchestration platforms to remain competitive. Many firms focus on developing interoperable slicing frameworks that integrate with edge computing and multi-cloud ecosystems. Barriers to entry include high infrastructure costs, regulatory complexity, and the need for advanced technical expertise, which favor established vendors. Companies increasingly adopt collaboration-based strategies, partnering with cloud providers, equipment manufacturers, and industry verticals to expand service portfolios. Focus on automation, energy efficiency, and service assurance drives differentiation in a rapidly evolving market.

Some of the prominent players in the global 5G Network Slicing are:

- Ericsson

- Nokia

- Huawei

- Samsung Electronics

- ZTE Corporation

- Cisco Systems

- NEC Corporation

- Fujitsu

- Intel

- Qualcomm

- HPE

- IBM

- Dell Technologies

- Microsoft

- Google Cloud

- Amazon Web Services

- VMware

- Juniper Networks

- Mavenir

- Amdocs

- Other Key Players

Recent Developments

- In March 2025, Ericsson introduced an advanced AI-powered orchestration platform designed to simplify multi-domain network slicing across 5G standalone networks. The system enables automated slice lifecycle management, real-time performance optimization, and integration with multi-cloud environments. The launch aims to support telecom operators deploying complex slicing architectures for enterprise applications, enhancing scalability and reducing operational overhead.

- In January 2025, Nokia announced a major investment into its new R&D hub focused on developing next-generation slicing technologies, including RAN slicing and AI-driven predictive analytics. The investment aims to accelerate trials with telecom operators and enterprise partners across manufacturing, logistics, and healthcare. The hub will support the creation of interoperable slicing frameworks that enhance performance, security, and automation across distributed networks.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1.6 Bn |

| Forecast Value (2034) |

USD 45.9 Bn |

| CAGR (2025–2034) |

45.1% |

| The US Market Size (2025) |

USD 0.5 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Solutions and Services), By Type of Slice (eMBB, mMTC, and URLLC), By Application (Smart Manufacturing, Autonomous Vehicles, Remote Healthcare, Smart Cities, and Industrial IoT), By End User (Telecom Operators and Enterprises) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Ericsson, Nokia, Huawei, Samsung Electronics, ZTE Corporation, Cisco Systems, NEC Corporation, Fujitsu, Intel, Qualcomm, HPE, IBM, Dell Technologies, Microsoft, Google Cloud, Amazon Web Services, VMware, Juniper Networks, Mavenir, Amdocs, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global 5G Network Slicing Market?

▾ The Global 5G Network Slicing Market size is expected to reach a value of USD 1.6 billion in 2025 and is expected to reach USD 45.9 billion by the end of 2034.

Which region accounted for the largest Global 5G Network Slicing Market?

▾ Asia Pacific is expected to have the largest market share in the Global 5G Network Slicing Market, with a share of about 38.0% in 2025.

How big is the 5G Network Slicing Market in the US?

▾ The 5G Network Slicing Market in the US is expected to reach USD 0.5 billion in 2025.

Who are the key players in 5G Network Slicing Market?

▾ Some of the major key players in the Global 5G Network Slicing Market include Ericsson, Nokia, IBM and others.

What is the growth rate in the Global 5G Network Slicing Market?

▾ The market is growing at a CAGR of 45.1 percent over the forecasted period.