Market Overview

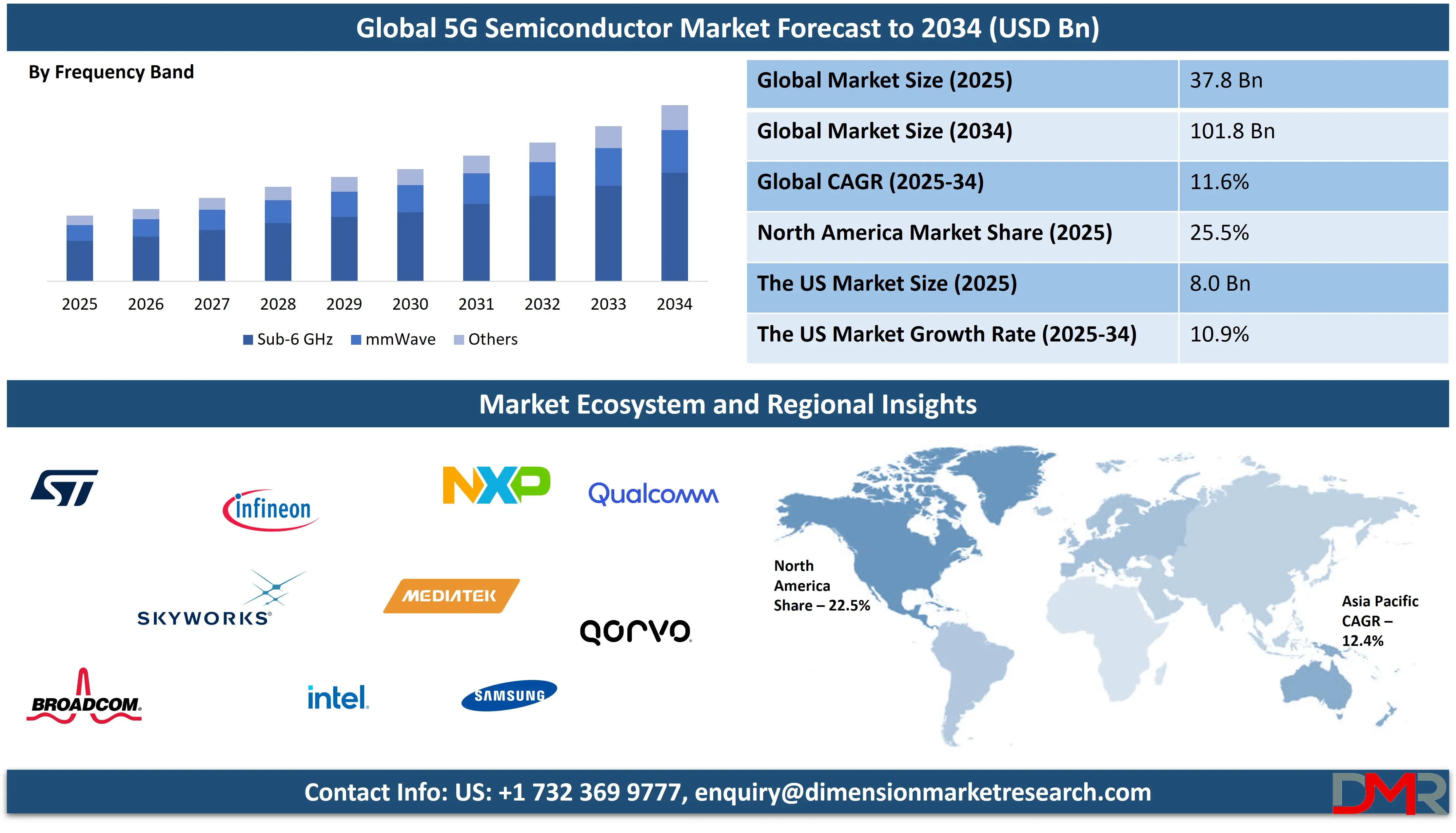

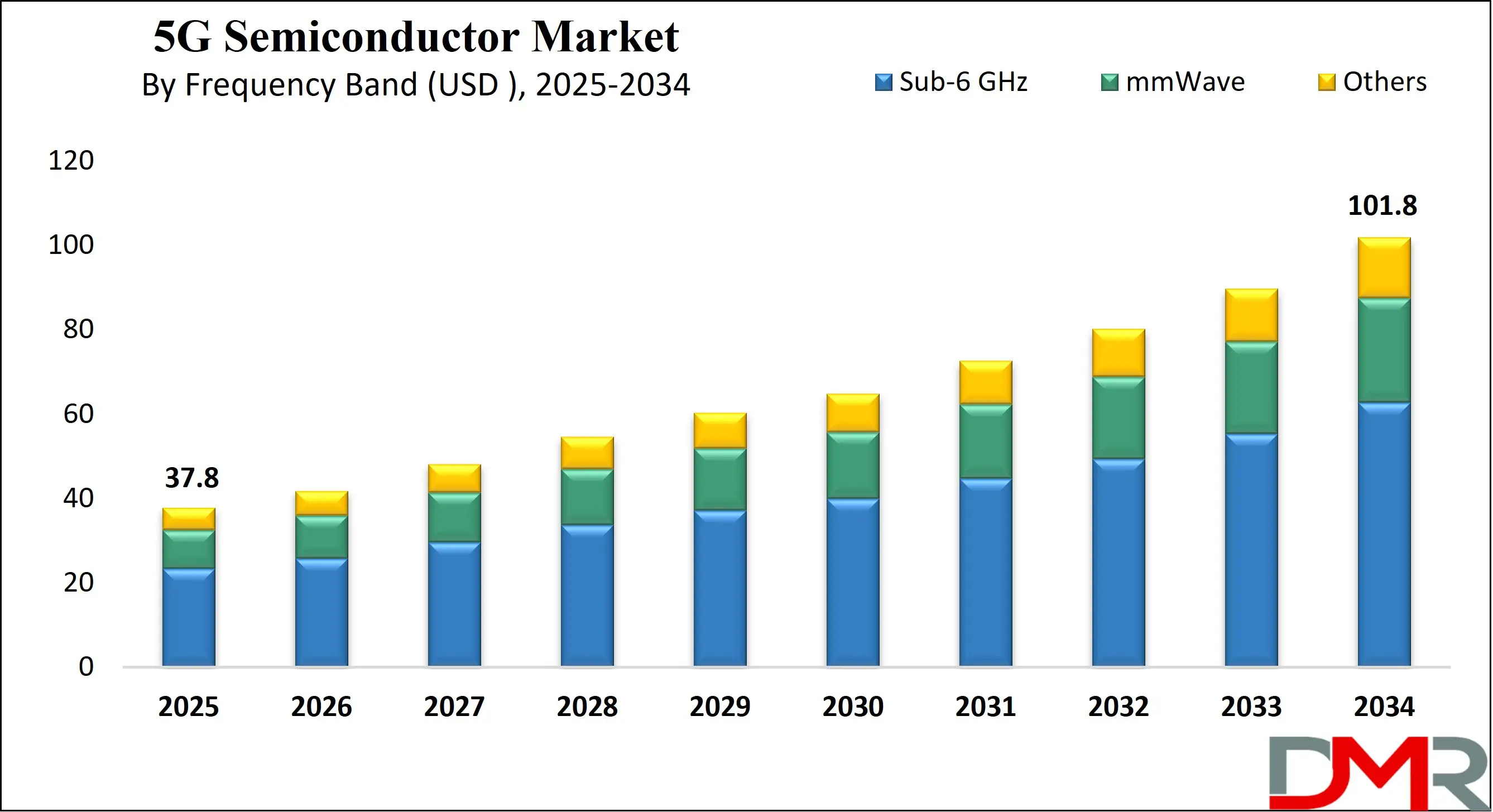

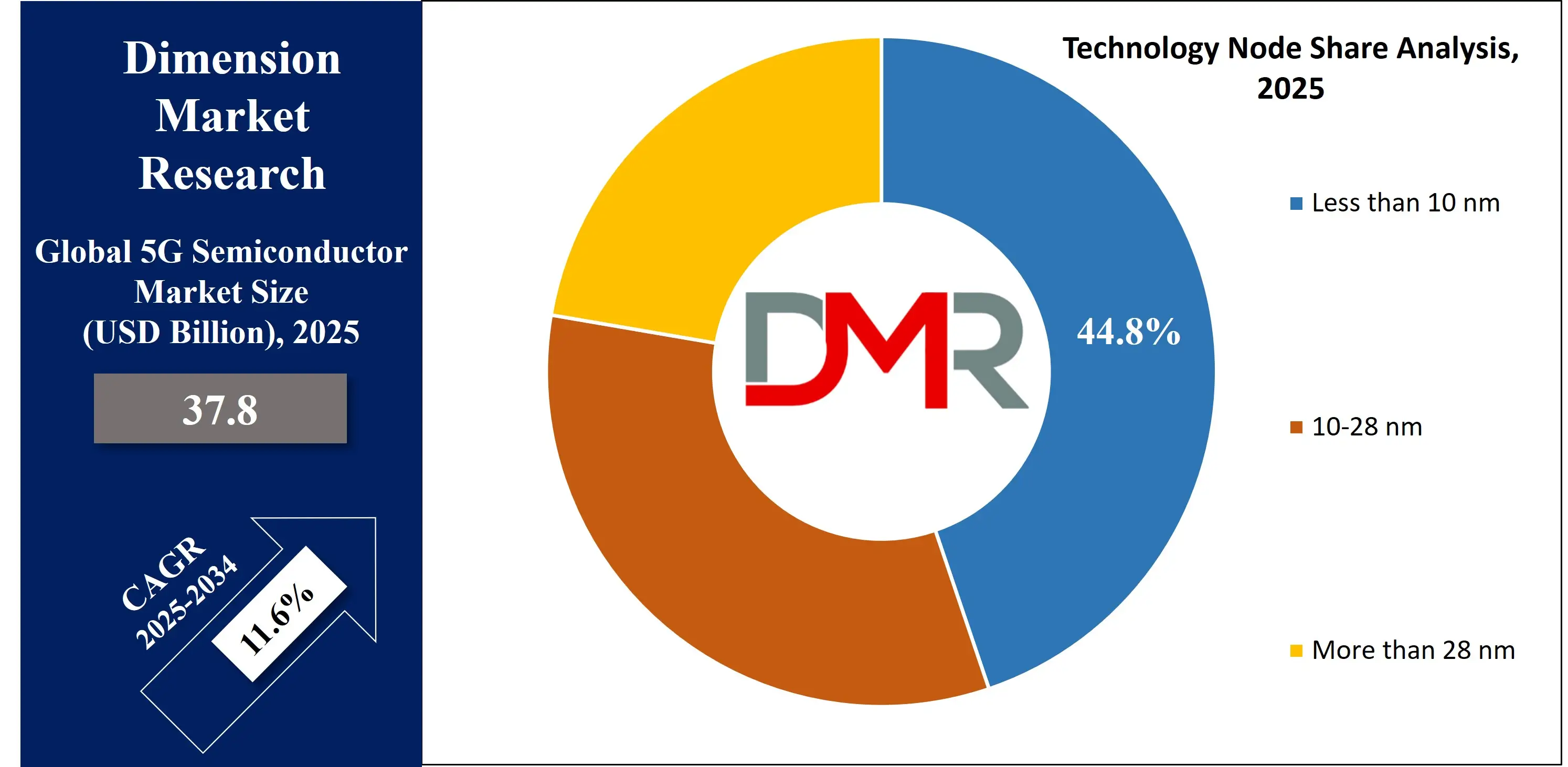

The Global 5G Semiconductor Market size is projected to reach USD 37.8 billion in 2025 and grow at compound annual growth rate of 11.6% to reach a value of USD 101.8 billion in 2034.

5G semiconductors are specialized chips and components that help power devices and infrastructure for fifth-generation (5G) wireless networks. These semiconductors are designed to handle high-speed data transfer, low latency, and massive connectivity, enabling advanced applications like autonomous vehicles, smart cities, and industrial automation. They are used in base stations, smartphones, routers, IoT devices, and other network equipment. The technology behind 5G semiconductors includes advanced processors, RF (radio frequency) chips, and mmWave components, all optimized for high-frequency signals and fast data processing. Their role is critical in ensuring the performance and reliability of 5G communication systems.

The demand for 5G semiconductors has grown rapidly in recent years due to the global rollout of 5G networks. As telecom operators expand coverage, manufacturers of devices and equipment require more advanced chips to support the higher speeds and network capacity. Industries like automotive, healthcare, manufacturing, and entertainment are adopting 5G-enabled solutions, pushing demand for specialized chipsets. Increased smartphone upgrades, rising IoT device adoption, and government-backed digitalization programs have also boosted this demand.

Trends in the 5G semiconductor market include miniaturization of chips for smaller, more efficient devices, integration of AI capabilities into 5G processors, and the development of energy-efficient components to manage power consumption in high-speed applications. There is also a push for multi-band and multi-mode chipsets to support both sub-6 GHz and mmWave frequencies. Companies are also exploring advanced semiconductor materials like gallium nitride (GaN) for improved performance.

Recent events in the industry include accelerated 5G deployment in both developed and developing regions, chip shortages that temporarily affected production, and heavy investments by leading semiconductor companies to expand manufacturing capacity. Several governments have launched initiatives to build domestic semiconductor industries to reduce reliance on imports, further shaping the market landscape.

The market environment has been influenced by collaborations between telecom operators, chipmakers, and equipment providers to create standardized, interoperable solutions. Mergers, acquisitions, and partnerships have become common strategies to secure intellectual property and improve technological capabilities. At the same time, geopolitical factors have influenced supply chains and investment flows in the sector.

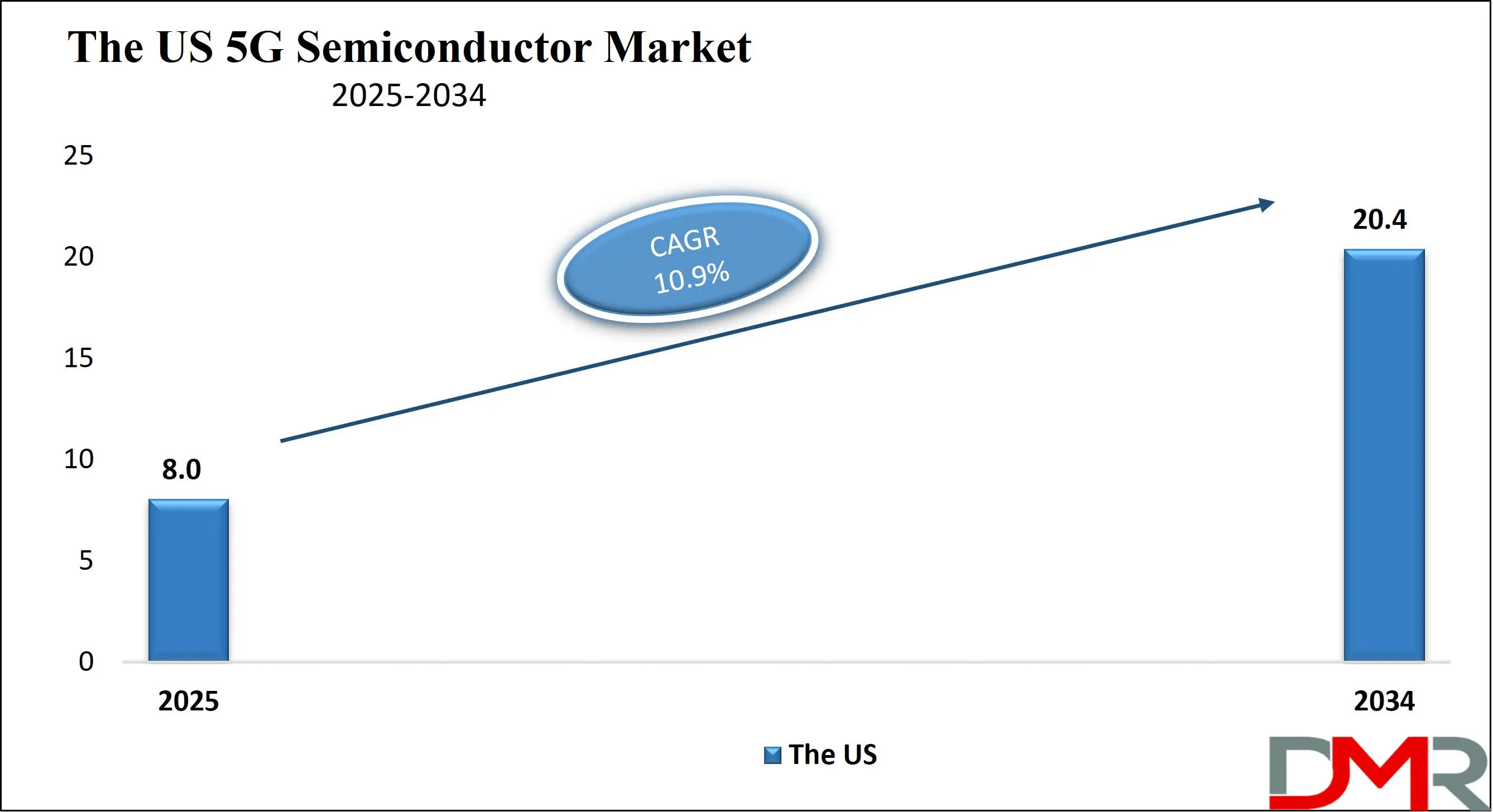

The US 5G semiconductor Market

The US 5G Semiconductor Market size is projected to reach USD 8.0 billion in 2025 at a compound annual growth rate of 10.9% over its forecast period.

The US plays a major role in the 5G semiconductor market through its leadership in research, design, and innovation. Many of the world’s most advanced chip architectures and manufacturing technologies originate from US-based companies and institutions. The country invests heavily in R&D for high-performance processors, RF components, and mmWave technologies essential for 5G. The US also drives global standards and collaborates with telecom operators to accelerate 5G adoption. Government initiatives aim to strengthen domestic semiconductor manufacturing to reduce reliance on foreign supply chains. Additionally, US advancements in AI, cloud computing, and IoT create strong demand for 5G chips, positioning the nation as both a key producer and a major consumer in the global market.

Europe 5G semiconductor Market

Europe 5G Semiconductor Market size is projected to reach USD 5.4 billion in 2025 at a compound annual growth rate of 10.1% over its forecast period.

Europe plays an important role in the 5G semiconductor market through its focus on innovation, regulatory leadership, and industrial integration. The region is home to leading research centers and technology companies developing advanced chip designs, RF solutions, and network infrastructure for 5G. European countries are actively investing in semiconductor manufacturing capabilities to strengthen supply chain resilience and reduce dependency on imports.

The region’s strong automotive, aerospace, and industrial sectors drive demand for 5G-enabled chips in connected vehicles, smart factories, and IoT applications. Europe also plays a key part in setting global 5G standards and promoting sustainable, energy-efficient semiconductor technologies, positioning itself as both a technological innovator and a strategic market for next-generation connectivity solutions.

Japan 5G semiconductor Market

Japan 5G Semiconductor Market size is projected to reach USD 2.1 billion in 2025 at a compound annual growth rate of 11.3% over its forecast period.

Japan holds a significant position in the 5G semiconductor market through its expertise in precision manufacturing, advanced materials, and microelectronics. The country is known for producing high-quality semiconductor equipment, wafers, and components essential for 5G chip production. Japanese companies excel in developing RF modules, power amplifiers, and advanced packaging technologies that support both sub-6 GHz and mmWave frequencies. With strong government support, Japan is investing in domestic semiconductor capacity to ensure supply chain stability and reduce reliance on imports.

The nation’s leadership in automotive, robotics, and consumer electronics also drives demand for 5G-enabled chips. By combining innovation, quality, and integration, Japan remains a vital contributor to global 5G semiconductor advancements and applications.

5G semiconductor Market: Key Takeaways

- Market Growth: The 5G Semiconductor Market size is expected to grow by USD 60.0 billion, at a CAGR of 11.6%, during the forecasted period of 2026 to 2034.

- By Frequency Band: The Sub 6-Ghz is anticipated to get the majority share of the 5G Semiconductor Market in 2025.

- By Technology Node: The less than 10 nm segment is expected to get the largest revenue share in 2025 in the 5G Semiconductor Market.

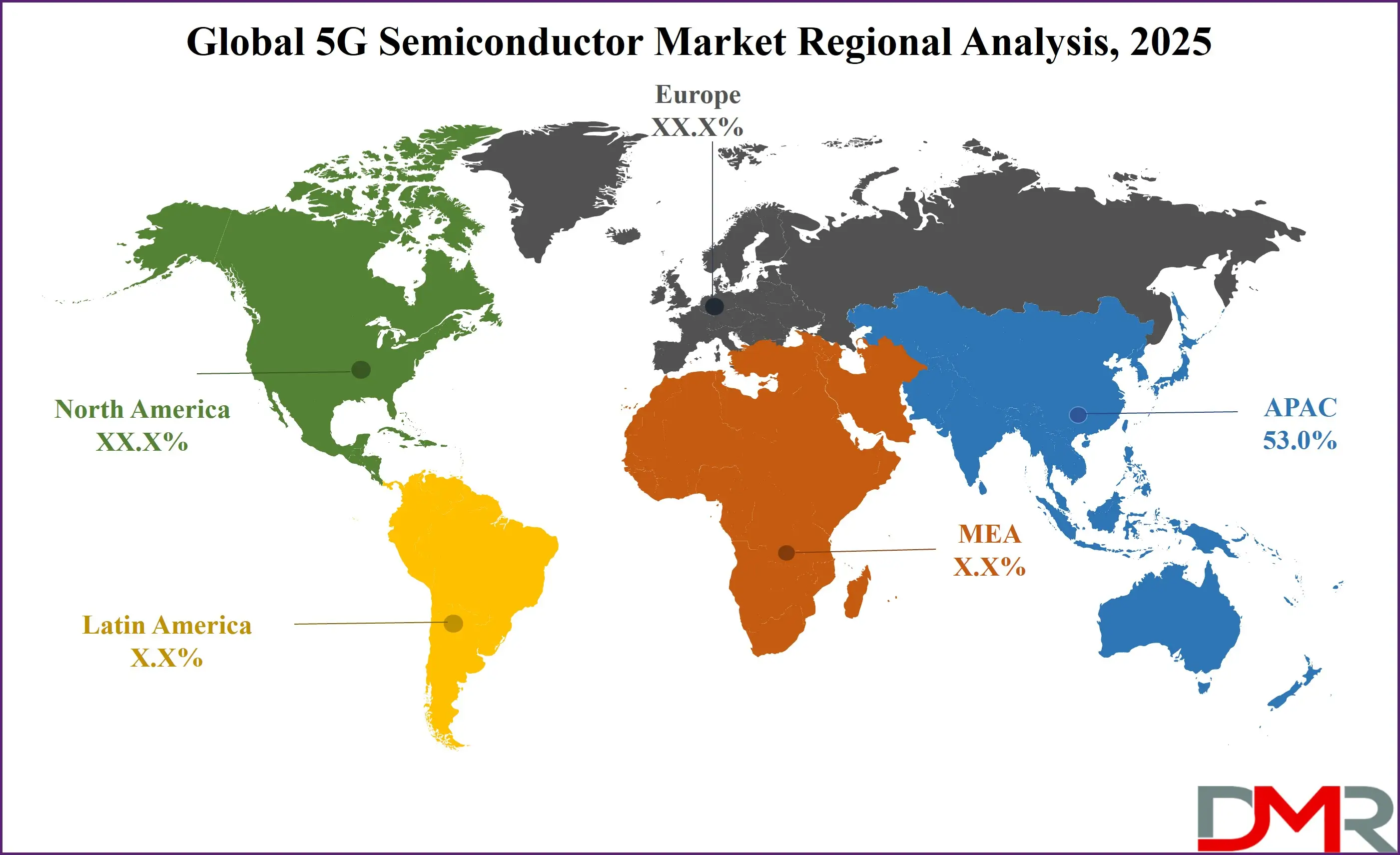

- Regional Insight: Asia Pacific is expected to hold a 53.0% share of revenue in the Global 5G Semiconductor Market in 2025.

- Use Cases: Some of the use cases of 5G Semiconductor include industrial automation & IoT, healthcare & remote services, and more.

5G semiconductor Market: Use Cases

- Smartphones and Consumer Devices: 5G semiconductors enable ultra-fast data speeds, low latency, and seamless connectivity in mobile devices. They support advanced features like high-quality video streaming, cloud gaming, and real-time video calls. These chips also help devices switch smoothly between different network bands for consistent performance.

- Autonomous Vehicles and Transportation: In vehicles, 5G semiconductors power real-time communication between cars, infrastructure, and cloud systems. This allows for faster decision-making in driver-assistance systems and autonomous driving. They also enable over-the-air software updates and enhanced navigation with minimal delay.

- Industrial Automation and IoT: Factories and smart facilities use 5G semiconductors to connect machines, sensors, and robots with near-instant responsiveness. This improves operational efficiency, predictive maintenance, and remote monitoring. The chips also support massive device connectivity without slowing down the network.

- Healthcare and Remote Services: In healthcare, 5G semiconductors allow instant transmission of large medical files, high-resolution imaging, and real-time remote consultations. They support applications like robotic surgery and connected medical devices that require reliable, low-latency communication. This improves patient care and access to advanced medical services.

Stats & Facts

-

According to Ericsson:

- Service providers that focus on strong network coverage and quality performance are seen as 5G leaders by 70% of their existing customer base, positioning themselves ahead of competitors in brand trust and satisfaction.

- These quality-led operators are three times more likely to retain their customers and also have 50% more users intending to upgrade to better 5G services, making user loyalty a major growth driver.

- They are nearly twice as likely to see their average revenue per user (ARPU) and mobile service revenues grow by at least 1% year-on-year, showing a direct link between service quality and profitability.

- A successful trial achieved 340 Mbps uplink speed over a live commercial 5G Standalone network using sub-6 GHz frequency, showcasing next-level performance using widely deployable spectrum.

- A world-first long-range achievement of 11.18 km was recorded using millimeter wave spectrum, hitting peak speeds of 1 Gbps, proving that high-band 5G can support extended fixed wireless coverage.

- A 3.6 Gbps data call was delivered using six-component carrier aggregation on sub-6 GHz in a commercial 5G network, setting new standards in speed and spectrum efficiency.

- Mid-band 5G carrier aggregation demonstrated more than 60% better reach than traditional dual connectivity setups, helping service providers improve their field-tested coverage significantly.

- Superior network performance allows operators to better handle the growing demand for mobile data while also increasing monetization potential and strengthening long-term return on infrastructure investments.

-

As per OECD (Organisation for Economic Co-operation and Development):

- Fixed Wireless Access (FWA) subscriptions across member countries rose by 17% from June 2023 to June 2024, with Hungary, the United States, and the United Kingdom recording the highest growth.

- FWA plays a much larger role in broadband access in countries like Czechia (39%), Slovak Republic (23%), New Zealand (20%), and Estonia (18.7%), particularly where terrain or infrastructure limits fiber rollout.

- Satellite broadband usage is also rising fast, with a 22.6% increase in subscriptions in the past year, and the United States accounting for nearly three-quarters of all OECD satellite broadband users.

- Total fixed broadband subscriptions reached 504 million by mid-2024, with France, Korea, Switzerland, and Norway leading in penetration per 100 inhabitants, reflecting strong infrastructure development.

- Mobile broadband subscriptions grew to 1.9 billion by June 2024, with Japan and the US leading in penetration rates, showing continued adoption even in highly connected markets.

- Mobile data usage more than doubled over two years, increasing from 8 GB per month in June 2022 to 17 GB in June 2024, driven by expanding 5G networks and heavier app usage.

- Machine-to-machine (M2M) SIM cards rose by 14% in one year, with Sweden and Austria topping the list, largely due to operators registering M2M devices for global service usage.

Market Dynamic

Driving Factors in the 5G semiconductor Market

Rising Global 5G Network Deployment:

The rapid rollout of 5G infrastructure worldwide is a major growth driver for the 5G semiconductor market. Telecom operators are expanding coverage in both urban and rural areas, creating a surge in demand for advanced chipsets used in base stations, smartphones, and network equipment. As more countries adopt 5G, there is a need for semiconductors that can handle high-speed data transfer, low latency, and multiple frequency bands. This expansion is further fueled by government initiatives promoting digital transformation and investments in smart cities. The increasing number of connected devices and applications is pushing manufacturers to innovate and scale production.

Growing Demand from Emerging Applications:

The rise of new technologies and services powered by 5G is creating fresh opportunities for semiconductor makers. Applications such as autonomous vehicles, industrial automation, augmented reality (AR), virtual reality (VR), and smart healthcare require highly specialized chips with fast processing capabilities. These applications demand semiconductors that can support massive connectivity and stable performance under heavy data loads. The integration of AI features into 5G chips is also becoming important to improve efficiency and enable advanced functions. As industries embrace these innovations, the need for reliable and energy-efficient 5G semiconductors is set to accelerate, driving sustained market growth.

Restraints in the 5G semiconductor Market

High Manufacturing Costs and Complexity

Producing 5G semiconductors involves advanced design processes, cutting-edge fabrication technology, and expensive raw materials, making manufacturing highly costly. These chips often require smaller nanometer nodes and specialized materials like gallium nitride (GaN), increasing production expenses. The complexity of integrating multi-band and mmWave capabilities adds further challenges, demanding heavy investment in R&D and precision manufacturing equipment. Smaller companies may struggle to compete due to the high entry barriers, while even large players face margin pressures. These high costs can slow down production capacity expansion and limit affordability for certain markets, especially in price-sensitive regions.

Global Supply Chain Disruptions

The 5G semiconductor market is highly dependent on a global supply chain that spans raw material suppliers, foundries, and assembly plants. Disruptions caused by geopolitical tensions, trade restrictions, and natural disasters can lead to shortages, delayed shipments, and increased costs. Semiconductor manufacturing also relies on highly specialized equipment and rare materials, making it vulnerable to supply bottlenecks. The recent global chip shortage highlighted how dependent the industry is on a few key manufacturing hubs. Such supply chain vulnerabilities can slow product launches, affect network rollout schedules, and reduce the speed at which 5G adoption grows.

Opportunities in the 5G semiconductor Market

Expansion of IoT and Smart Infrastructure

The rapid growth of IoT ecosystems, from smart homes to industrial automation, presents a major opportunity for the 5G semiconductor market. As billions of connected devices require reliable, low-latency, and high-capacity networks, demand for specialized 5G chips will rise significantly. These semiconductors can enable seamless connectivity for smart appliances, wearables, autonomous drones, and urban infrastructure like traffic management systems. The integration of edge computing with 5G chips further enhances performance, enabling real-time data processing close to the source. Governments and private sectors investing in smart city projects will accelerate adoption, creating long-term opportunities for semiconductor manufacturers.

Adoption in Advanced Technologies and New Verticals

Emerging applications such as augmented reality (AR), virtual reality (VR), telemedicine, and autonomous transport are creating fresh markets for 5G-enabled semiconductors. These technologies require powerful chips that can process high data volumes instantly while maintaining stable connections. 5G semiconductors integrated with AI capabilities can unlock new possibilities in predictive analytics, immersive entertainment, and precision manufacturing. Additionally, sectors like defense, agriculture, and energy are exploring 5G-powered solutions for surveillance, automation, and remote control. This diversification into new verticals beyond telecom and consumer electronics will expand the market scope, offering manufacturers opportunities for innovation and higher-value products.

Trends in the 5G semiconductor Market

Integration of AI and Edge Processing in 5G Chips:

A key trend in the 5G semiconductor market is the growing integration of artificial intelligence (AI) and edge computing capabilities directly into chip designs. This allows devices to process data locally rather than sending everything to the cloud, reducing latency and improving efficiency. AI-enabled 5G chips can enhance network optimization, predictive maintenance, and real-time decision-making in applications like autonomous vehicles and industrial robots. This trend is also driving demand for chips that are more power-efficient while still handling complex workloads. As AI-powered devices become more common, 5G semiconductors with built-in intelligence are gaining strong market traction.

Shift Toward Advanced Materials and Packaging Technologies:

Manufacturers are increasingly adopting advanced materials such as gallium nitride (GaN) and silicon carbide (SiC) to improve the performance of 5G semiconductors. These materials allow for higher power efficiency, faster signal transmission, and better heat management compared to traditional silicon. Alongside material innovation, advanced packaging techniques like system-in-package (SiP) and 3D stacking are being used to reduce chip size while increasing functionality. This enables compact devices to handle multi-band frequencies and complex processing requirements. Such innovations are helping overcome performance limitations, making chips more capable of supporting the diverse needs of next-generation 5G applications.

Impact of Artificial Intelligence in 5G semiconductor Market

- Enhanced Chip Performance: AI integration in 5G semiconductors allows real-time optimization of network performance, reducing latency and improving data throughput for advanced applications.

- Smarter Network Management: AI-powered chips can analyze traffic patterns and predict demand, enabling more efficient resource allocation in 5G infrastructure.

- Edge Processing Capabilities: By combining AI with 5G chips, devices can process data locally at the edge, minimizing cloud dependency and improving response times.

- Support for Advanced Applications: AI-enabled 5G semiconductors make technologies like autonomous driving, predictive maintenance, and immersive AR/VR experiences more reliable and efficient.

- Energy Efficiency Improvements: AI algorithms help manage power usage in 5G chips, extending device battery life and reducing network energy consumption.

Research Scope and Analysis

By Component Analysis

RF transceivers, leading in 2025 with a share of 24.8%, play a crucial role in the growth of the 5G semiconductor market by enabling efficient transmission and reception of high-frequency signals required for 5G networks. These components support both sub-6 GHz and mmWave bands, allowing devices to maintain fast and reliable connectivity.

As 5G technology demands higher data speeds and lower latency, RF transceivers are becoming more advanced, with improved power efficiency and miniaturization. Their ability to handle complex signal processing makes them essential in smartphones, base stations, and IoT devices. With growing network deployments and increasing device adoption, RF transceivers are set to experience strong demand, driving innovation and expanding their market presence in the global 5G semiconductor landscape.

Baseband processors, having significant growth over the forecast period, are vital components in the 5G semiconductor market that manage the core data processing and signal modulation tasks for 5G communication. These chips decode and encode digital data, handling complex algorithms that ensure smooth data flow between devices and networks. As 5G networks require higher processing power to support faster speeds and multiple connections, baseband processors are evolving to become more efficient and powerful. They enable features like carrier aggregation and massive MIMO, which improve network capacity and coverage. The increasing adoption of 5G-enabled smartphones and network infrastructure fuels demand for advanced baseband processors, making them key drivers in the expansion of the 5G semiconductor market.

By Material Analysis

GaAs, will be leading in 2025 with a share of 26.7%, plays an important role in the growth of the 5G semiconductor market due to its excellent ability to handle high-frequency signals with low noise and high efficiency. This material is widely used in RF components like power amplifiers and transceivers, which are essential for 5G networks operating on both sub-6 GHz and mmWave bands. GaAs helps improve signal quality and power performance, making devices faster and more reliable.

Its high electron mobility supports advanced wireless communication technologies, driving demand in smartphones, base stations, and IoT devices. With ongoing 5G deployments and rising network complexity, GaAs materials are set to remain critical in enhancing semiconductor performance and expanding the 5G market globally.

GaN, having significant growth over the forecast period, is a key material in the 5G semiconductor market known for its high power efficiency and ability to operate at higher voltages and frequencies than traditional silicon. This makes GaN ideal for power amplifiers and RF components that require better heat management and greater signal strength in 5G networks.

Its robustness supports the demanding requirements of mmWave frequencies, which are vital for ultra-fast data transmission. As 5G infrastructure expands and devices demand more reliable connectivity, GaN is expected to play a growing role in semiconductor manufacturing. Its use helps improve energy efficiency and device performance, driving market growth across telecom and industrial sectors.

By Frequency Band Analysis

Sub-6 GHz is anticipated to dominate in 2025 with a share of 61.6%, plays a vital role in the growth of the 5G semiconductor market by providing wide coverage and reliable connectivity. This frequency band offers a good balance between speed and range, making it suitable for urban, suburban, and rural areas. Sub-6 GHz supports many 5G applications by enabling better signal penetration through buildings and obstacles, which improves user experience in everyday environments.

Semiconductor components designed for this band focus on energy efficiency and multi-band compatibility to support smooth switching between networks. As more countries expand their 5G infrastructure, sub-6 GHz remains the dominant frequency for large-scale deployment, driving strong demand for related semiconductors in smartphones, base stations, and IoT devices.

MmWave, having significant growth over the forecast period, is a critical frequency band in the 5G semiconductor market known for its ultra-high data speeds and low latency. This band supports very fast communication over short distances, making it ideal for dense urban areas, stadiums, and indoor hotspots. Semiconductor chips built for mmWave frequencies require advanced materials and precise engineering to handle the challenges of high-frequency signal transmission and heat management.

As 5G applications demand faster and more reliable connections, mmWave is becoming increasingly important for specialized use cases like augmented reality and autonomous vehicles. With ongoing investments in mmWave infrastructure, semiconductors designed for this band are set to grow rapidly, enhancing overall 5G network performance.

By Technology Node Analysis

Less than 10 nm technology node, leading in 2025 with a share of 44.8%, plays a key role in driving the growth of the 5G semiconductor market by enabling the production of smaller, faster, and more energy-efficient chips. This advanced manufacturing process allows semiconductor makers to pack more transistors into a tiny space, improving processing power and reducing heat generation. These benefits are critical for supporting the high-speed data transfer and low-latency requirements of 5G devices and infrastructure. Chips built on less than 10 nm technology help enhance battery life in smartphones and improve overall network performance. As demand for powerful yet compact 5G-enabled devices rises, this technology node will continue to attract significant investments and innovation, shaping the future of the semiconductor market.

10 - 28 nm technology node, having significant growth over the forecast period, remains important in the 5G semiconductor market due to its cost-effectiveness and proven reliability. This node size offers a good balance between performance and manufacturing complexity, making it suitable for many 5G applications such as mid-range smartphones, IoT devices, and network equipment. Chips produced with 10 - 28 nm technology can efficiently handle 5G data speeds while keeping production costs manageable. This helps manufacturers deliver affordable 5G solutions to a wider audience, especially in emerging markets. With steady improvements in this node’s efficiency and yield, it will continue to support substantial market growth alongside more advanced technology nodes.

By Device Type Analysis

Smartphones & tablets, leading in 2025 with a share of 41.4%, play a major role in driving the growth of the 5G semiconductor market by being the primary devices that connect users to high-speed 5G networks. These devices require advanced semiconductors to support faster data speeds, better battery efficiency, and enhanced processing power for applications like video streaming, gaming, and video calls.

As consumers upgrade to 5G-enabled smartphones and tablets, the demand for powerful, energy-efficient chips increases significantly. The growing availability of affordable 5G devices also expands the user base globally, especially in emerging markets. This widespread adoption encourages continuous innovation in semiconductor technology to meet user expectations for performance, connectivity, and portability, making smartphones and tablets key contributors to the overall expansion of the 5G semiconductor industry.

Automotive & transport devices, having significant growth over the forecast period, are becoming increasingly important in the 5G semiconductor market due to the rise of connected and autonomous vehicles. These devices rely on 5G chips to enable real-time communication between vehicles, infrastructure, and cloud systems, improving safety, navigation, and traffic management. The demand for high-performance, reliable semiconductors in automotive applications supports the development of advanced driver-assistance systems (ADAS) and infotainment features. As the automotive industry shifts toward smarter, more connected transport solutions, the need for robust 5G-enabled chips in vehicles and transport infrastructure is expected to grow steadily, driving substantial growth in this segment of the semiconductor market.

By Application Analysis

Consumer electronics are expected to lead the market in 2025, with a share of 51.2%, playing a crucial role in driving the growth of the 5G semiconductor market by increasing demand for faster, smarter, and more connected devices. This application includes gadgets like smart TVs, wearables, gaming consoles, and smart home devices that rely on 5G chips to deliver seamless streaming, real-time interactions, and enhanced user experiences.

As more consumers adopt these devices, semiconductor makers focus on improving power efficiency, speed, and connectivity features. The rising popularity of smart appliances and entertainment platforms also pushes innovation in semiconductor technology. With the continuous expansion of the consumer electronics market and growing 5G coverage worldwide, this segment is set to fuel strong demand for advanced 5G semiconductors, contributing significantly to the overall market growth.

Automotive, having significant growth over the forecast period, is becoming a vital application area for 5G semiconductors due to the increasing integration of connected technologies in vehicles. This includes features such as advanced driver-assistance systems, in-car entertainment, and vehicle-to-everything (V2X) communication, all of which require powerful and reliable 5G chips.

The automotive industry’s push toward autonomous driving and smart transportation systems further boosts demand. As vehicles become more connected and reliant on real-time data exchange, 5G semiconductors play a key role in ensuring safety, efficiency, and user convenience. This growing reliance on 5G technology in automotive applications is expected to drive strong market expansion in the coming years.

The 5G semiconductor Market Report is segmented on the basis of the following

By Component

- RF Transceivers

- RF Front-End Modules

- Power Amplifiers

- Filters & Duplexers

- Baseband Processors

- Antenna Modules

- Switches

- Others

By Material

- Gallium Arsenide (GaAs)

- Gallium Nitride (GaN)

- Silicon Germanium (SiGe)

- Silicon (Si)

- Others

By Frequency Band

By Technology Node

- Less than 10 nm

- 10–28 nm

- More than 28 nm

By Device Type

- Smartphones & Tablets

- Laptops & Wearables

- Network Infrastructure Equipment

- Industrial IoT Devices

- Automotive & Transportation Devices

- Others

By Application

- Consumer Electronics

- Automotive

- Industrial Automation

- Healthcare

- Energy & Utilities

- Aerospace & Defense

- Others

Regional Analysis

Leading Region in the 5G semiconductor Market

Asia Pacific, leading in 2025 with a share of 53.0%, plays a central role in the growth of the 5G semiconductor market due to its strong manufacturing base, rapid 5G network expansion, and high consumer adoption of advanced technologies. The region is home to major semiconductor fabrication hubs and key suppliers of raw materials, making it a crucial link in the global supply chain. Countries like China, South Korea, Taiwan, and India are heavily investing in 5G infrastructure, boosting demand for advanced chipsets in smartphones, base stations, and IoT devices.

Growing use of 5G in sectors such as automotive, industrial automation, and smart cities further drives market momentum. Supportive government policies, large-scale R&D investments, and a rising number of technology startups enhance the region’s innovation capabilities. With a combination of large-scale production, growing end-user industries, and strategic investments, Asia Pacific remains the most influential region shaping the direction of the 5G semiconductor market in the coming years.

Fastest Growing Region in the 5G semiconductor Market

Latin America is showing significant growth over the forecast period in the 5G semiconductor market, driven by increasing investments in digital infrastructure and expanding mobile connectivity. Countries across the region are gradually rolling out 5G networks, creating demand for advanced semiconductor chips used in smartphones, telecom equipment, and IoT devices. Rising adoption of smart technologies in sectors like agriculture, manufacturing, and healthcare also supports market expansion.

Government initiatives aimed at improving internet access and supporting technology innovation further boost the demand for 5G-enabled semiconductors. With growing urbanization and a rising number of connected devices, Latin America is becoming an important emerging market contributing to the overall growth of the global 5G semiconductor industry.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The 5G semiconductor market is highly competitive, with many players working to develop faster, smaller, and more energy-efficient chips. Competition is driven by constant innovation, as companies race to meet the growing demand from smartphones, base stations, and connected devices. Manufacturers focus on advanced designs that support both sub-6 GHz and mmWave frequencies while integrating AI and low-power features. The market also sees strong investment in research, new fabrication technologies, and partnerships with telecom providers. Global supply chain challenges and regional manufacturing policies further shape competition, pushing companies to secure resources and strengthen their production capabilities.

Some of the prominent players in the global 5G semiconductor are

- Qualcomm Incorporated

- MediaTek Inc.

- Samsung Electronics Co., Ltd.

- Intel Corporation

- Broadcom Inc.

- Qorvo, Inc.

- Skyworks Solutions, Inc.

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors N.V.

- Texas Instruments Incorporated

- Analog Devices, Inc.

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- Infineon Technologies AG

- Marvell Technology, Inc.

- Sony Semiconductor Solutions Corporation

- Taiwan Semiconductor Manufacturing Company (TSMC)

- United Microelectronics Corporation (UMC)

- Global Foundries Inc.

- ASE Technology Holding Co., Ltd.

- Other Key Players

Recent Developments

- In July 2025, Union Electronics and IT Minister of India announced that India’s first domestically manufactured semiconductor chip will be unveiled by end of 2025. Further, milestone marks a major step toward India becoming a key global player in the semiconductor sector. Also, it highlighted that some of the world’s most complex chips are already being designed in cities such as Hyderabad, Bengaluru, Pune, Gurugram, and Chennai.

- In October 2024, Xiaomi, in collaboration with US-based chipmaker Qualcomm, launched budget 5G smartphone at the India Mobile Congress. Both companies have issued invites highlighting the event, stating the unveil of Xiaomi’s new smartphone, set to bring 5G to millions of India. The announcement also mentions that Xiaomi, powered by Qualcomm’s Snapdragon technology, will introduce its latest device designed with advanced 5G features, aiming to make next-generation connectivity more accessible to Indian consumers.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 37.8 Bn |

| Forecast Value (2034) |

USD 101.8 Bn |

| CAGR (2025–2034) |

11.6% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 8.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

Segments Covered By Component (RF Transceivers, RF Front-End Modules, Power Amplifiers, Filters & Duplexers, Baseband Processors, Antenna Modules, Switches, and Others), By Material (Gallium Arsenide (GaAs), Gallium Nitride (GaN), Silicon Germanium (SiGe), Silicon (Si), and Others), By Frequency Band (Sub-6 GHz, mmWave, and Others), By Technology Node (Less than 10 nm, 10–28 nm, and More than 28 nm), By Device Type (Smartphones & Tablets, Laptops & Wearables, Network Infrastructure Equipment, Industrial IoT Devices, Automotive & Transportation Devices, and Others), By Application (Consumer Electronics, Automotive, Industrial Automation, Healthcare, Energy & Utilities, Aerospace & Defense, and Others) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Qualcomm Incorporated, MediaTek Inc., Samsung Electronics Co., Ltd., Intel Corporation, Broadcom Inc., Qorvo, Inc., Skyworks Solutions, Inc., Murata Manufacturing Co., Ltd, NXP Semiconductors N.V., Texas Instruments Incorporated, Analog Devices, Inc., Renesas Electronics Corporation, STMicroelectronics N.V., Infineon Technologies AG, Marvell Technology, Inc., Sony Semiconductor Solutions Corporation, Taiwan Semiconductor Manufacturing Company (TSMC), United Microelectronics Corporation (UMC), Global Foundries Inc, ASE Technology Holding Co., Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The Global 5G Semiconductor Market size is expected to reach a value of USD 37.8 billion in 2025 and is expected to reach USD 101.8 billion by the end of 2034.

Asia Pacific is expected to have the largest market share in the Global 5G Semiconductor Market, with a share of about 53.0% in 2025.

The 5G Semiconductor Market in the US is expected to reach USD 8.0 billion in 2025.

Some of the major key players in the Global 5G Semiconductor Market are Broadcom Inc., Intel Corporation, Qualcomm, and others

The market is growing at a CAGR of 11.6 percent over the forecasted period.