Overview

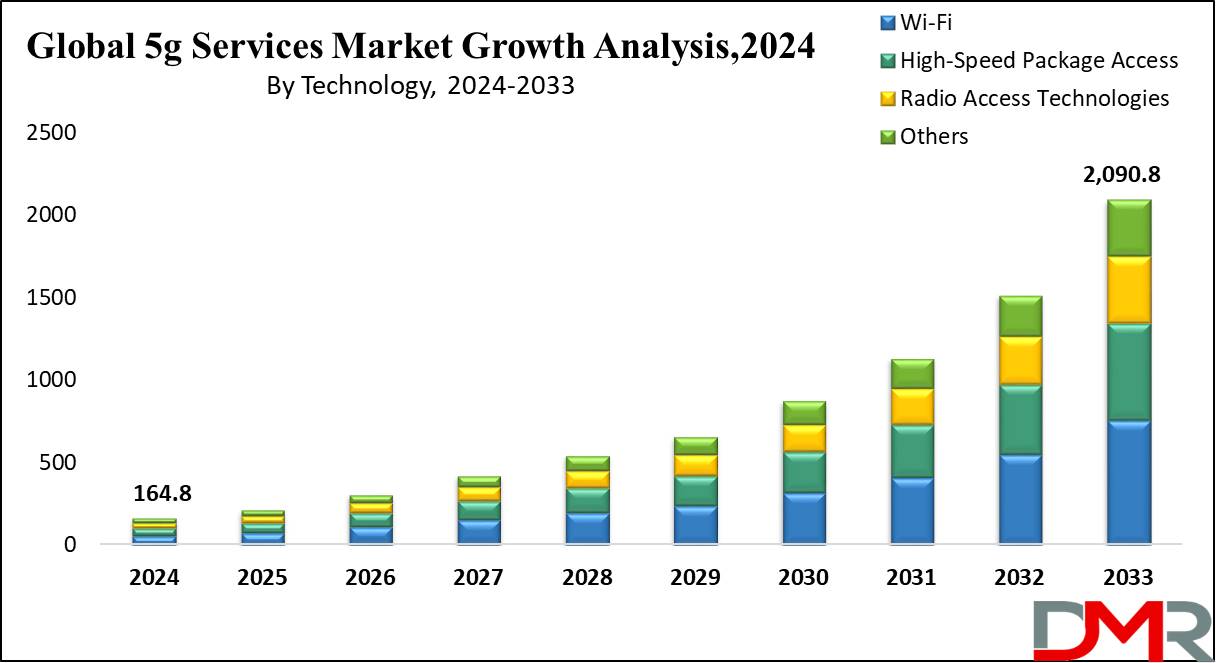

The Global 5g Services Market size is estimated to reach USD 164.8 Billion in 2024 and is further anticipated to value USD 2090.8 Billion by 2033, at a CAGR of 32.6%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

5G wireless mobile services have provided consumers with a fully connected environment, offering consumers various use cases and innovative business models. Boasting faster data speeds and low latency, 5G technology enhances user experiences across various applications such as seamless video calls, UHD streaming video, virtual reality (VR) gaming and augmented reality (AR). Demand for such high-speed data connectivity in applications like smart home energy management should drive its growth throughout this forecast period.

Fifth-Generation (5G) cellular technology delivers ultra-low latency, high speed connectivity and reliability at unprecedented levels. It encompasses all tools, applications and services necessary for its deployment; including enhanced mobile broadband services, ultra-reliable low-latency communications as well as massive machine type communications. 5G promises to revolutionize how people communicate, access entertainment content online and connect to the web.

Forbes estimated that by 2025 over 80 billion devices will be connected to the Internet, providing immense potential in industries as diverse as manufacturing, smart cities, logistics, healthcare and automotive. Internet of Things applications require reliable communication infrastructure with minimal latency; 5G networks offer these qualities. With their advanced features meeting modern technological requirements more efficiently than other modes of connectivity can, 5G should meet that demand effectively.

Key Takeaways

- Market Size & Share: Global 5g Services Market size is estimated to reach USD 164.8 Billion in 2024 and is further anticipated to value USD 2090.8 Billion by 2033, at a CAGR of 32.6%.

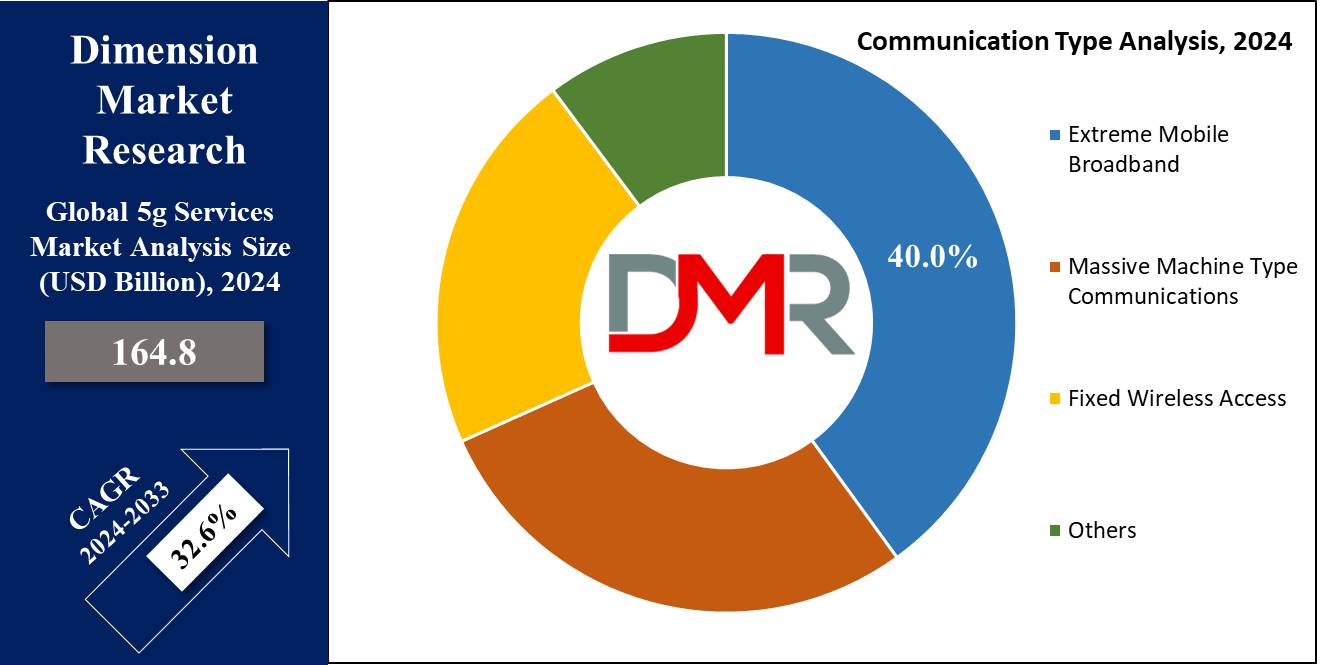

- Communication Type Analysis: Extreme Mobile Broadband (eMBB) was by far the leader, accounting for more than 40% market share by 2023

- Technology Analysis: In 2023, Radio Access Technologies (RAT) held over 50% market share.

- End User Analysis: IT & Telecom held over 35% market share in 2023

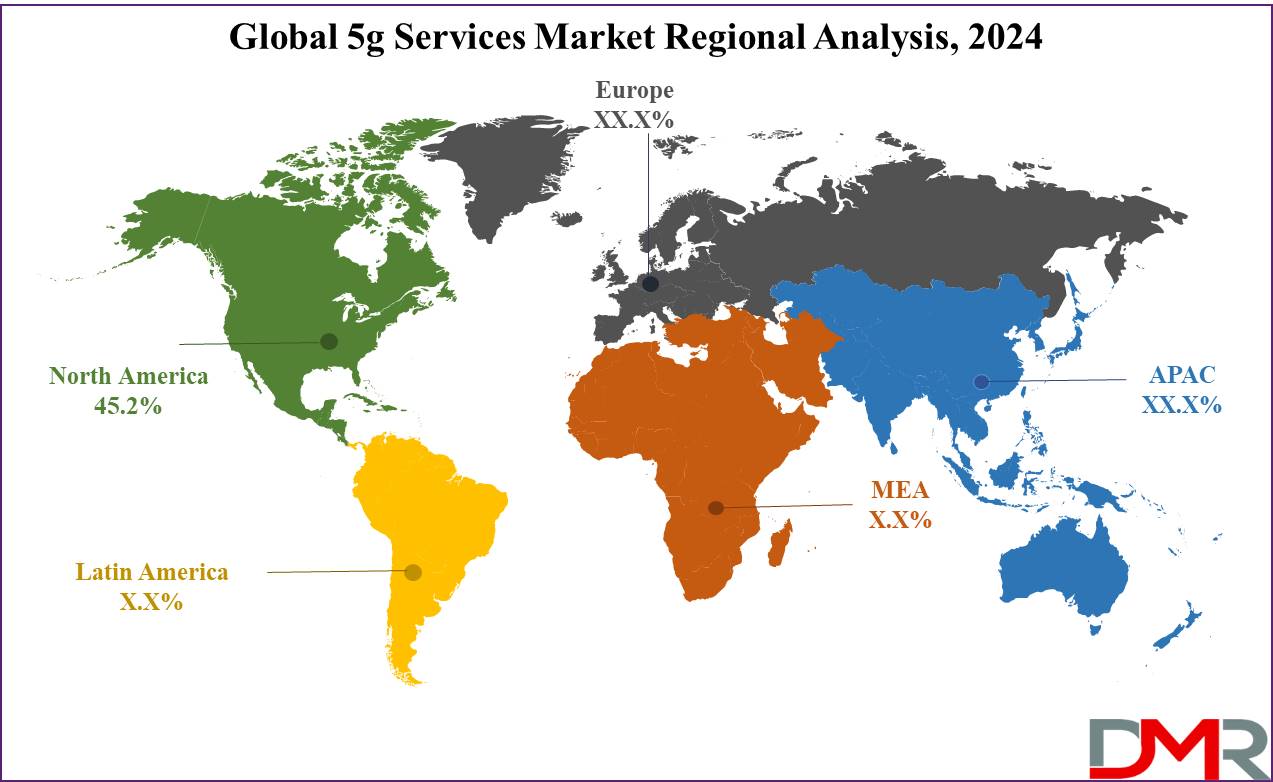

- Regional Analysis: North America led the global 5G services market with an overwhelming 45.2% market share in 2023.

- Private 5G Networks: Enterprises are increasingly adopting private 5G networks, particularly in industries like manufacturing, healthcare, and logistics, due to their enhanced security and real-time capabilities.

- Future Growth Drivers: Emerging applications in IoT, smart cities, autonomous vehicles, and industrial automation are expected to fuel further growth, alongside expanding 5G coverage in developing markets.

Use Cases

- Enhanced Mobile Broadband (eMBB): eMBB supports higher data rates and network capacity, allowing users to enjoy ultra-fast internet, HD video streaming, and seamless virtual reality (VR) experiences. This is especially useful in densely populated areas like cities or stadiums.

- Massive Internet of Things (mIoT): 5G can connect billions of IoT devices, from smart home appliances to industrial sensors, allowing for efficient and large-scale machine-to-machine communication.

- Ultra-Reliable Low-Latency Communications (URLLC): URLLC ensures real-time communication with minimal delay, crucial for mission-critical applications like autonomous vehicles, telemedicine, and industrial robotics.

- Augmented Reality (AR) and Virtual Reality (VR): 5G’s high speed and low latency enable immersive AR and VR experiences, used in entertainment, education, training simulations, and gaming.

- Fixed Wireless Access (FWA): 5G enables high-speed broadband connectivity in remote and rural areas through FWA, providing an alternative to fiber-optic or cable internet services.

Report Dynamics

Driver

Demand for faster and more reliable internet services is one of the primary drivers of 5G's market. As data-intensive applications like 4K video streaming, virtual reality (VR), and cloud gaming become more widespread, consumers and businesses require improved connectivity for consumer usage as well as business use these needs being met by 5G networks with ultra-low latency capabilities that support high speeds that have changed healthcare, manufacturing, smart cities.

Internet of Things devices connected through 5G infrastructure networks; with increased device connected IoT devices connected through IoT networks these requirements become essential further driving global deployment of 5G infrastructure globally.

Trend

One notable trend in the 5G services market is the growth of private 5G networks for enterprises. Industries including manufacturing, logistics and healthcare are increasingly turning to private networks for mission-critical applications to increase security, control and customization. These networks enable real-time automation, efficient asset tracking and improved productivity - which in turn, contribute to real time productivity gains.

Enterprises leverage these capabilities for industrial automation, smart factories and digital twins. Businesses, governments and telecom operators alike are investing in 5G spectrum allocations that allow industry-specific solutions to be created - this trend has expanded the application spectrum across sectors and developed the ecosystem of 5G technologies.

Restraint

Implementing 5G networks involves extensive infrastructure investments, which can impede market expansion. Telecommunication companies must upgrade existing infrastructure before installing a dense network of small cells, fiber optics and advanced antennas to guarantee fast and reliable coverage for users.

Furthermore, some regions' spectrum license fees can be prohibitively expensive, placing financial strain on smaller telecom providers and companies in developing regions which hinders global 5G adoption rates; as a result, deployment costs remain an obstacle to its widespread deployment.

Opportunities

Emerging Markets Offer a Major 5G Services Market opportunite Emerging markets offer 5G providers an exceptional opportunity. Asia, Latin America and Africa are experiencing rapid digitalization, creating the need for improved connectivity services such as 5G. 5G can fill this void by providing fast internet access in underserved rural and remote regions - supporting economic development and innovation while increasing economic growth and innovation overall.

Governments and telecom providers in these regions are investing in 5G infrastructure to enhance industrial automation, smart agriculture initiatives and e-learning initiatives; emerging markets will lead global adoption creating opportunities for operators companies and operators's alike!

Research Scope and Segmentation Analysis

By Communication Type Analysis

Communication type analysis in the 5G services market highlights key segments, such as Extreme Mobile Broadband (eMBB), Massive Machine-Type Communications (mMTC), Fixed Wireless Access (FWA) and Others. Extreme Mobile Broadband (eMBB) was by far the leader, accounting for more than 40% market share by 2023 and its growth being driven by demand for fast mobile internet, ultra-HD video streaming and immersive technologies such as virtual reality (VR) and augmented reality (AR).

ℹ

To learn more about this report –

Download Your Free Sample Report Here

eMBB plays an essential role in improving user experiences by providing faster data speeds and greater bandwidth, which are necessary for entertainment, gaming, and enterprise applications. Massive Machine-Type Communications (mMTC), supporting IoT devices and smart cities, is expected to see exponential growth as more devices connect.

Fixed Wireless Access (FWA) has become increasingly popular as a provider of high-speed internet to underserved areas compared to its eMBB market share; finally the Others segment includes niche or emerging communication types which contribute towards 5G ecosystem development.

By Technology Analysis

Technology analysis in the 5G services market centers around Wi-Fi, High-Speed Package Access (HSPA), Radio Access Technologies (RAT), and Others. In 2023, Radio Access Technologies (RAT) held over 50% market share and played an essential role in connecting user devices to core networks wirelessly - supporting massive connectivity, low latency communications, and fast data transfer rates, RAT played a fundamental role for both consumer and enterprise 5G applications such as enhanced mobile broadband, IoT solutions and smart city applications.

Wi-Fi technology remains an important player, particularly indoor environments and for offloading mobile data traffic, while High-Speed Package Access (HSPA) remains relevant in regions with slower 5G rollout. However, RAT remains dominant due to its extensive deployment within 5G infrastructure; others constitute emerging technologies and standards which contribute to 5G landscape but have lower market impact compared with RAT and Wi-Fi technologies.

By End User Analysis

End user analysis in the 5G services market includes end-user sectors like IT & Telecom, Banking, Healthcare, Retail & E-Commerce and Others. As of 2023, IT & Telecom held over 35% market share due to 5G's revolutionary impact in revolutionizing communication networks like ultrafast mobile broadband speeds, real time data sharing capabilities and seamless IoT integration.

Telecom operators and IT companies alike are investing heavily in 5G infrastructure for improved network reliability, edge computing capability and supporting cloud services - key requirements of next-gen digital services that rely on this emerging technology for success.

Healthcare has quickly adopted 5G, particularly for remote surgery and connected medical devices that rely on its ultra-low latency. Retail & E-Commerce companies use 5G for enhanced customer experiences like AR/VR shopping, real-time analytics, automation, mobile banking services, fintech applications, secure real-time transactions as well as automated real estate services utilizing 5G technologies.

Banking benefits from this as do mobile banking applications with real time transactions while Others industries such as manufacturing and logistics contribute further to market expansion.

The Global 5g services Market Report is segmented based on the following:

By Communication Type

- Extreme Mobile Broadband

- Massive Machine Type Communications

- Fixed Wireless Access

- Others

By Technology

- Wi-Fi

- High-Speed Package Access

- Radio Access Technologies

- Others

By End User

- IT & Telecom

- Banking

- Healthcare

- Retail & E-Commerce

- Others

Regional Analysis

North America led the global 5G services market with an overwhelming 45.2% market share in 2023. This dominance can be attributed to significant investments made by major telecom operators like Verizon, AT&T and T-Mobile in their infrastructure as well as government initiatives for spectrum allocation and technology innovation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

North America was propelled to its dominance thanks to a high demand for advanced connectivity from sectors like healthcare, manufacturing and autonomous vehicles as well as advanced networking deployment for enterprise use - this further solidifying North America's leadership on a global stage! North America boasts robust digital economy as well as early rollout that make this continent global leader among nations worldwide!

By Region and Countries

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The market for 5G services is highly competitive, with major players seeking to expand their network infrastructure and enhance service offerings. Key market players are investing heavily in research and development to enhance 5G technology capabilities, such as ultra-low latency and massive device connectivity. These companies are also forging partnerships with technology providers, governments, and enterprises to speed the global deployment of 5G services.

Furthermore, they are exploring new revenue streams via private 5G networks, edge computing, and IoT integration - providing seamless connectivity for industries such as healthcare, manufacturing, and smart cities continues to drive market expansion and innovation.

Some of the prominent players in the global 5g services market are:

- Samsung Electronics Co. Ltd.

- Qualcomm Technologies Inc.

- Verizon Communications Inc.

- Huawei Technologies Co. Ltd.

- ZTE Corporation

- Cisco Systems Inc.

- Intel Corporation

- Ericsson

- Nokia Corporation

- AT&T Inc.

- China Mobile Communications Corporation

- Deutsche Telekom AG

- China Telecom Corporation Limited

- Orange S.A.

- Vodafone Group Plc

- LG Electronics

- T-Mobile US Inc.

- SK Telecom Co. Ltd.

- Broadcom Inc.

- Fujitsu Limited

- Others

Recent Development

- Global Expansion of 5G: Telecom operators across North America, Europe and Asia are rapidly rolling out 5G networks; some reaching 70-80% population coverage in some cases. Countries such as South Korea, China and the U.S. are leading this charge while emerging markets like Africa are increasing investments into 5G technologies as well.

- Private 5G Networks: Enterprise adoption of private 5G networks has surged over 2023-2024 in industries like manufacturing, logistics and healthcare, which require greater control, security and customization for mission-critical applications. These networks can offer increased control, security and customization features than public networks do.

- 5G-Powered IoT: Integrating 5G technology with IoT has seen impressive advances, with smart cities, autonomous vehicles, and industrial automation all benefitting from rapid deployments of 5G technologies for real-time communication and data analytics.

- Edge Computing Partnerships: Telecom operators and cloud service providers are forging partnerships to enable real-time, 5G-powered edge computing capabilities closer to devices for real-time data processing, reducing latency and increasing efficiency for applications like AR/VR and AI services.

- Sustainability and Green Networks: Focused efforts are underway to make 5G networks more energy-efficient, with efforts made to reduce power consumption through network optimization, smaller cells and improved infrastructure management.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 164.8 Bn |

| Forecast Value (2033) |

USD 2090.8 Bn |

| CAGR (2024-2033) |

32.6% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Communication Type (Extreme Mobile Broadband, Massive Machine Type Communications, Fixed Wireless Access, Others) By Technology (Wi-Fi, High-Speed Package Access, Radio Access Technologies, Others) By End User (IT & Telecom, Banking, Healthcare, Retail & E-Commerce, Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Samsung Electronics Co. Ltd., Qualcomm Technologies Inc., Verizon Communications Inc., Huawei Technologies Co. Ltd., ZTE Corporation, Cisco Systems Inc., Intel Corporation, Ericsson, Nokia Corporation, AT&T Inc., China Mobile Communications Corporation, Deutsche Telekom AG, China Telecom Corporation Limited, Orange S.A., Vodafone Group Plc, LG Electronics, T-Mobile US Inc., SK Telecom Co. Ltd., Broadcom Inc., Fujitsu Limited, Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |