Market Overview

The Global 5G Technology ROI market is projected to reach

USD 60.6 billion in 2024 and grow at a compound annual growth rate of

128.9% from there until 2033 to reach a value of

USD 104,834.4 billion.

The 5G technology ROI market provides next-generation wireless communications services for multiple industries. The telecommunication industry is evolving rapidly, which includes new capabilities and significant opportunities for businesses, individuals, and society.

The advent of 5G technology is changing the digital era to become more advanced and provide internet speed at least 40 times faster than 4G LTE. Telecom operators are highly investing in 5G technology to gain higher benefits. With the deployment of cutting-

edge technologies, it focuses on advancing society and providing potential opportunities. 5G is the future communication technology that is likely to help autonomous vehicles, virtual reality, and smart cities around the world.

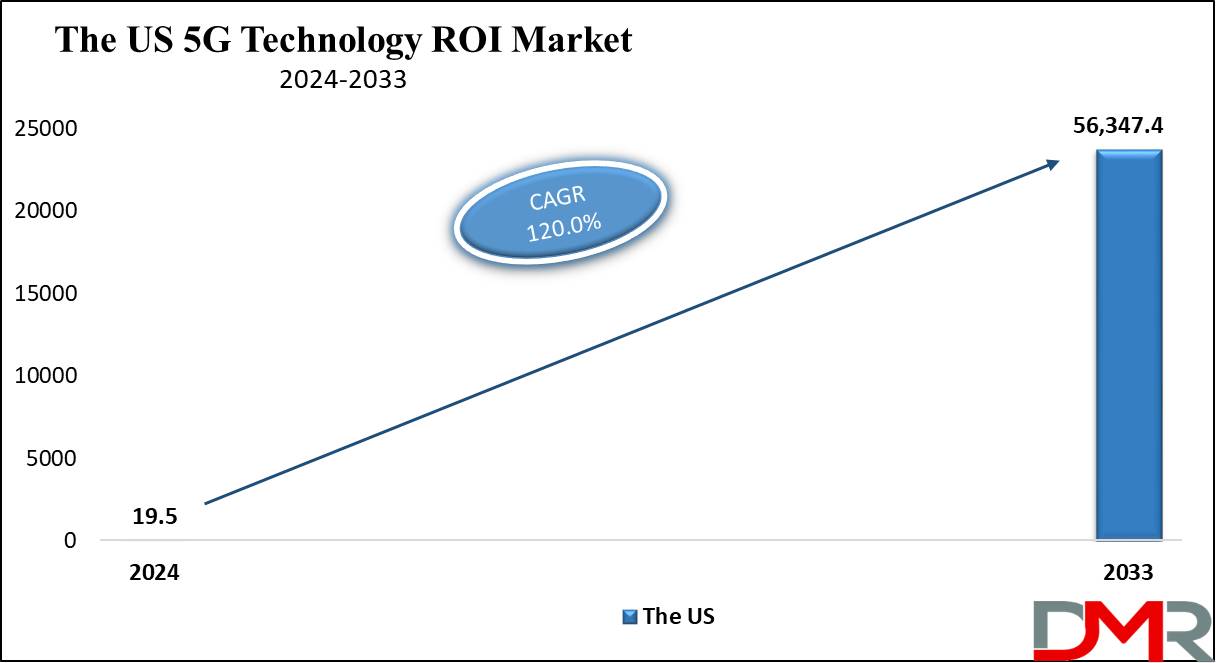

The US 5G Technology ROI Market

The US 5G Technology ROI Market is projected to reach

USD 19.5 billion in 2024 at a compound annual growth rate of

120.0% over its forecast period.

The 5G market in the US provides significant opportunities with the expansion of the IoT ecosystem and the emergence of new business models using 5G's advanced features like network slicing. Further, trends like the rise of private 5G networks in industries for enhanced control and efficacy, and the integration of edge computing to allow faster data processing and reduced latency, driving substantial ROI through innovation and better operational performance.

Further, the market here is driven by strong consumer requirements for high-speed connectivity and the push for industrial digital transformation, supporting rapid adoption and significant ROI. However, high infrastructure costs & complex regulatory environments pose restraints, potentially setting back ROI and challenging telecom operators with major financial and compliance hurdles.

Key Takeaways

- Market Growth: The 5G Technology ROI Market size is expected to grow by 104,703.1 billion, at a CAGR of 128.9% during the forecasted period of 2025 to 2033.

- By Industry Vertical: The Automotive sector is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

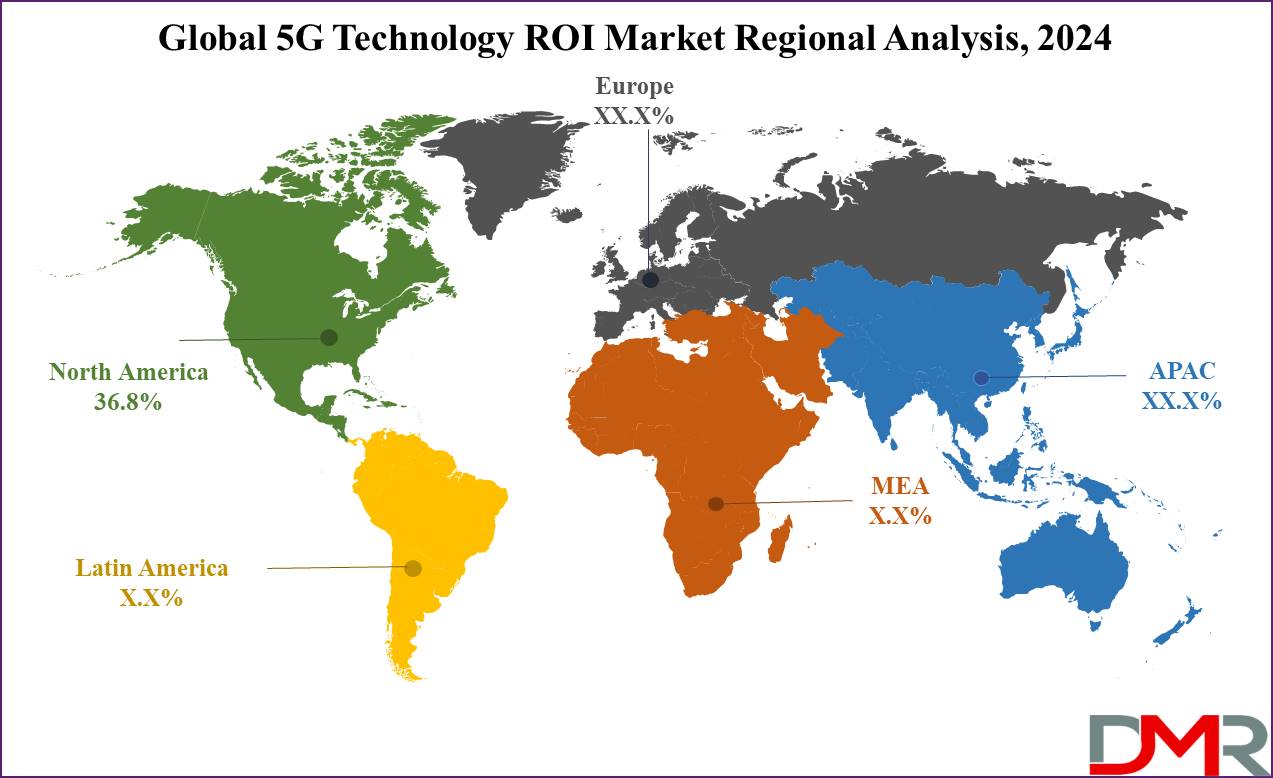

- Regional Insight: North America is expected to hold a 36.8% share of revenue in the Global 5G Technology ROI Market in 2024.

- Use Cases: Some of the use cases of 5G Technology ROI include industrial automation, autonomous vehicles, and more.

Use Cases

- Enhanced Mobile Broadband (eMBB): Provides high mobile internet speeds, leading to large data consumption and higher revenue per user for telecom operators, providing quick ROI through improved consumer services.

- Industrial Automation: Strengthening real-time control and automation in manufacturing, minimizing downtime, and increasing production efficiency, result in significant long-term ROI through operational cost savings.

- Autonomous Vehicles: Allows reliable and low-latency communication for self-driving cars, improving safety and performance, and leading to high ROI in the automotive sector through innovation & new market opportunities.

- Smart Cities: Supports higher IoT networks for smart infrastructure, improving urban management & reducing resource consumption, providing substantial ROI for municipalities through cost savings, and improving the quality of life for residents.

Market Dynamic

Driving Factors

Consumer Demand for High-Speed Connectivity

The rising need for faster internet and smooth mobile experiences drives the rapid adoption of 5G, creating higher revenue for service providers and quick ROI through better consumer services and data plans.

Industrial Digital Transformation

The push for automation, IoT integration, and live data analytics in many industries is fueling the demand for 5G, resulting in higher ROI through better operational efficiencies, reduced costs, and the creation of new business models.

Restraints

High Infrastructure Costs

The high investment needed for deploying 5G networks, like upgrading existing infrastructure and building new cell sites, can delay ROI and create financial challenges for telecom operators and stakeholders.

Regulatory and Spectrum Issues

Complex regulatory environments and limited availability of spectrum licenses can impact the timely deployment of 5G networks, slowing market growth and impacting the potential for quick ROI.

Opportunities

Expansion of IoT Ecosystem

5G's capabilities in helping massive IoT deployments provide opportunities for new services & applications across sectors like healthcare, agriculture, and smart cities, driving significant ROI through innovative solutions and better efficiencies.

Emergence of New Business Models

The advanced features of 5G, like network slicing and ultra-reliable low-latency communication, allow telecom operators and enterprises to develop customized services and applications, opening new revenue streams and enhancing ROI.

Trends

Proliferation of Private 5G Networks

Various industries, like manufacturing and logistics, are investing in private 5G networks to gain greater control over their connectivity & security, improving operational efficiency and yielding major ROI through customized & reliable network solutions.

Increased Focus on Edge Computing

The integration of 5G with edge computing is becoming prevalent, allowing faster data processing and reduced latency for applications like autonomous vehicles and live analytics, thereby driving ROI through better performance and new technological capabilities.

Research Scope and Analysis

By Industry Vertical

The 5G technologies ROI market in terms of industrial verticals is categorized into automotive, industrial machinery, infrastructure, and healthcare & life sciences. Among these, the automotive sector is expected to lead the market in 2024. 5G allows development in autonomous vehicles, providing ultra-reliable low-latency communication important for on-spot data exchange and vehicle safety. It helps in innovations in connected car services, improving navigation, entertainment, and remote diagnostics. As automotive manufacturers & tech companies invest in 5G to develop smarter, safer vehicles, the need for 5G infrastructure grows, enhancing market revenues and accelerating ROI through new business opportunities and better operational efficiencies.

Further, the industrial machinery sector is expected to have significant growth over coming years, as it boosts the growth of the 5G technologies ROI market. 5G improves real-time monitoring and control of machinery, creating better efficiency and reduced downtime. It allows advanced automation and predictive maintenance, enhancing productivity and cutting operational costs. As factories and industrial facilities adopt 5G to streamline processes and integrate IoT solutions, the need for 5G infrastructure rises, driving market growth and delivering higher ROI through advanced performance, cost savings, and new industrial capabilities.

The 5G Technology ROI Market Report is segmented on the basis of the following:

By Industry Vertical

- Automotive

- Industrial Machinery

- Infrastructure

- Healthcare & Life Science

Regional Analysis

North America is expected to dominate the 5G technologies ROI market with a

share of 36.8% in 2024. With higher investment in 5G infrastructure, the region creates early adoption, supporting innovations across many sectors. Telecom companies aggressively expand 5G networks, meeting high consumer demand for faster connectivity. In addition, North America's strong industrial base uses 5G for automation and IoT integration, improving productivity & efficiency. These factors altogether drive market growth, delivering higher ROI through better services, technological developments, and new business opportunities.

Further, Asia Pacific is anticipated to be the fastest-growing region for the market, as it is significantly driven by higher investments and rapid adoption. Countries like China, South Korea, and Japan lead in 5G deployment, improving connectivity and supporting advanced applications. The region's strong manufacturing base benefits from 5G-enabled automation & IoT integration, boosting productivity and efficiency. These developments drive substantial ROI, promoting innovation and expanding market opportunities across various sectors.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The 5G technologies ROI market is driven by rapid technological developments and diverse applications across industries by key players. Also, companies are investing heavily in infrastructure, network capabilities, and innovative solutions to capture market share. Key players aim to enhance connectivity, speed, and low latency to meet rising consumer and industrial demands. Further, strategic partnerships, R&D investments, and aggressive market expansion are vital to gaining a competitive edge and achieving substantial ROI.

Some of the prominent players in the Global 5G Technology ROI are:

- Verizon Communication

- Nokia Corporation

- AT&T Inc

- Infineon Technologies

- China Mobile

- SK Telecom

- Telefonaktiebolaget LM Ericsson

- NTT Docomo Inc

- KT Corporation

- KDDI Corporation

- Other Key Players

Recent Developments

- In July 2024, Bharti Airtel unveiled a major development in its 5G network expansion, positioning itself to rival Jio in the race to provide advanced 5G services across India. The company has begun re-farming its current mid-band spectrum, specifically the 1800, 2100, and 2300 MHz bands, to have the expanding traffic demand as more customers transition to its 5G network, which focuses on enhancing browsing speeds and indoor coverage, providing a better 5G experience for its users.

- In June 2024, Nokia released the results of the 2024 Industrial Digitalization Report, which highlighted 100 interviewed early adopters who are using private wireless networks in additional locations or have expanded their use by unveiling more use cases in existing locations. Further, private wireless early adopters in the manufacturing, transportation, and energy sectors were countries like Australia, France, Japan, UK, and US.

- In May 2024, MosoLabs launched the Moso Canopy 5GID2, the first 5G indoor access point for private networks using the Qualcomm FSM200 platform. It assists 3GPP Release 16 5G SA for Industry 4.0, provides better low latency, up to 4Gbps speeds, enterprise-grade design with PoE support, and 5G RedCap Release 17 for new enterprise and IoT application.

- In March 2024, Aircom, announced its Mentor Suite for RAN Analytics and Optimization available, providing major developments in automation, along with a host of new subscriber analytics features, APIs, and usability enhancements. 5G network complexity constantly grows at a rapid pace, which means the teams responsible for designing and optimizing radio networks always need to stay one step ahead.

- In October 2023, PETRONAS unveiled that it has successfully adopted a 5G private network at its Regasification Terminal Sungai Udang (RGTSU) in Melaka, the first in Malaysia to adopt 5G technology for enterprise use. Further, it has been promoted by the Ministry of Communications and Digital and the Malaysian Communications and Multimedia Commission (MCMC). The deployment of a 5G private network by Petronas is expected to optimize its internal operations and attain industry-wide change.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 60.6 Bn |

| Forecast Value (2033) |

USD 104,834.4 Bn |

| CAGR (2024-2033) |

128.9% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 19.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Industry Vertical (Automotive, Industrial Machinery, Infrastructure, and Healthcare & Life Science) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Verizon Communication, Nokia Corporation, AT&T Inc, Infineon Technologies, China Mobile, SK Telecom, Telefonaktiebolaget LM Ericsson, NTT Docomo Inc, KT Corporation, KDDI Corporation, and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |

Frequently Asked Questions

The Global 5G Technology ROI Market size is expected to reach a value of USD 60.6 billion in 2024 and is expected to reach USD 104,834.4 billion by the end of 2033.

North America is expected to have the largest market share in the Global 5G Technology ROI Market with a share of about 36.8% in 2024.

The 5G Technology ROI Market in the US is expected to reach USD 19.5 billion in 2024.

Some of the major key players in the Global 5G Technology ROI Market are Verizon Communication, Nokia Corporation, AT&T Inc, and others.

The market is growing at a CAGR of 128.9 percent over the forecasted period.