Market Overview

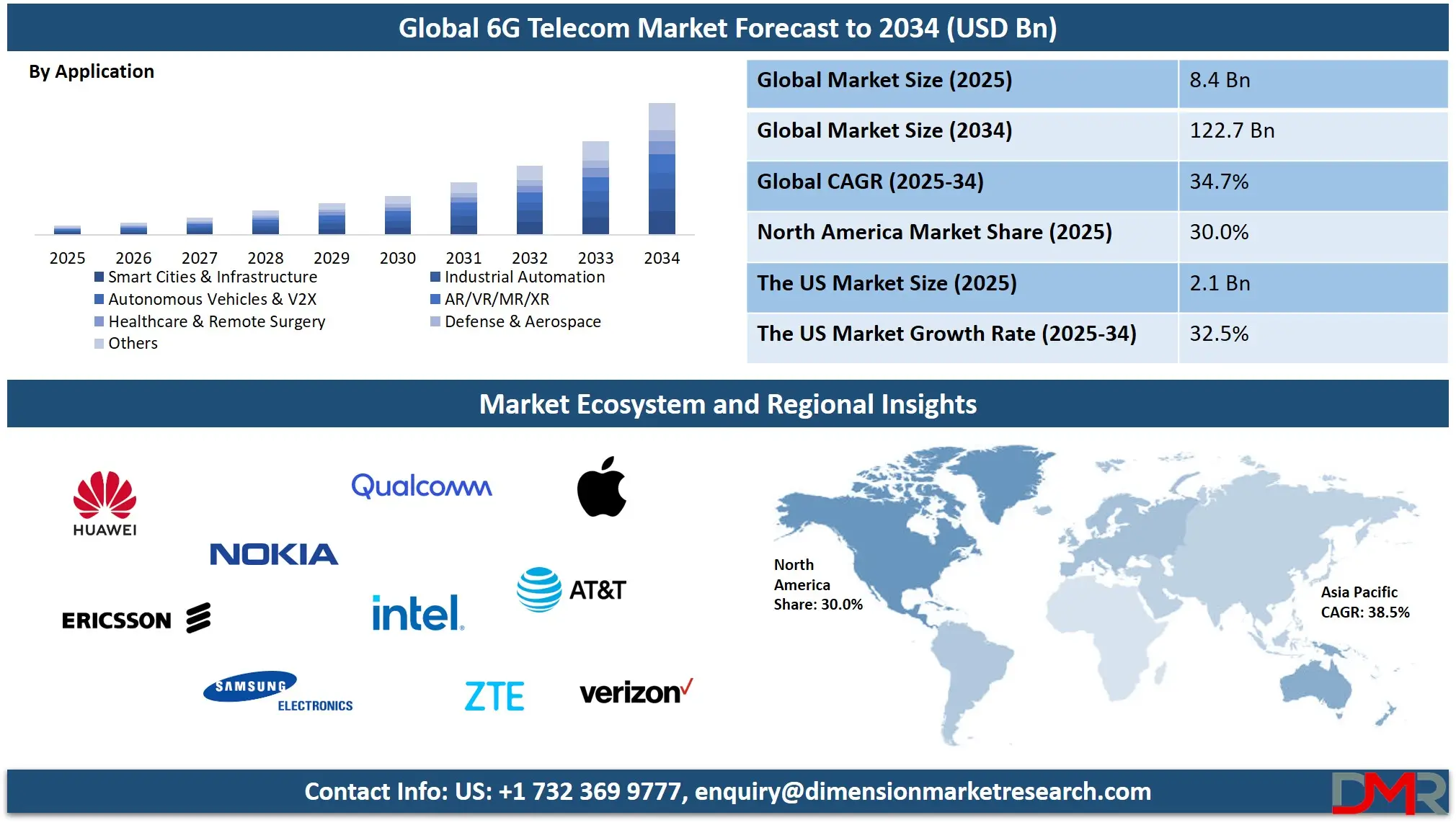

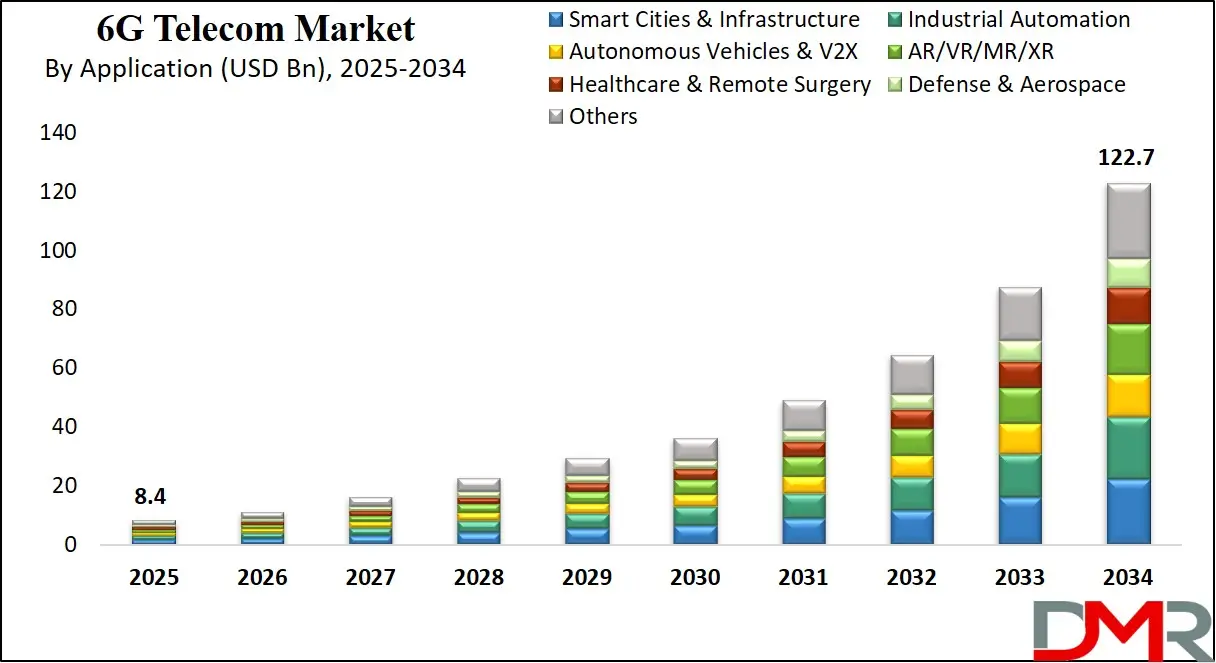

The global 6G telecom market is projected to grow from USD 8.4 billion in 2025 to USD 122.7 billion by 2034, expanding at a robust CAGR of 34.7%. This growth is driven by advancements in terahertz communication, AI-powered networks, and the growing demand for ultra-low latency and high-speed wireless connectivity across smart infrastructure, autonomous systems, and immersive technologies.

6G telecom refers to the upcoming sixth generation of wireless communication technology, envisioned to dramatically surpass the capabilities of 5G by delivering ultra-high data rates, extremely low latency, and seamless integration of artificial intelligence, sensing, and connectivity.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Unlike previous generations that focused primarily on faster speeds and broader coverage, 6G aims to create a brilliant, autonomous, and hyper-connected world where technologies such as holographic communication, tactile internet, real-time

digital twins, and augmented reality operate without interruption. The use of terahertz frequencies, advanced MIMO antenna systems, quantum encryption, and space-air-ground integrated networks will shape the architecture of 6G, transforming the way devices, machines, and humans interact in both physical and virtual environments.

The global 6G telecom market is emerging as a strategic frontier for innovation, with nations and technology companies investing heavily in research and development to gain early leadership. Although 6G commercialization is anticipated around 2030, the market is already witnessing an upsurge in pilot projects, public-private partnerships, and cross-border collaborations.

Key players are actively exploring use cases that span smart cities, autonomous mobility, industrial automation, immersive entertainment, and real-time remote healthcare. As the demand for ultra-reliable and intelligent wireless infrastructure intensifies, 6G is poised to reshape the competitive dynamics across sectors like aerospace, defense, healthcare, and manufacturing.

This market is characterized by its interdisciplinary nature, combining advancements in communications, computing, sensing, and network intelligence. The evolution of 6G will not only depend on hardware innovation but also on the development of AI-driven network management tools, decentralized data security models, and sustainable energy-efficient architectures.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The integration of non-terrestrial networks, such as low-earth orbit satellites and high-altitude platforms, will extend high-speed connectivity to remote and underserved regions. With regulatory frameworks and global standards still in the formulation stage, the 6G telecom market offers vast potential for technological breakthroughs, ecosystem transformation, and long-term socio-economic impact.

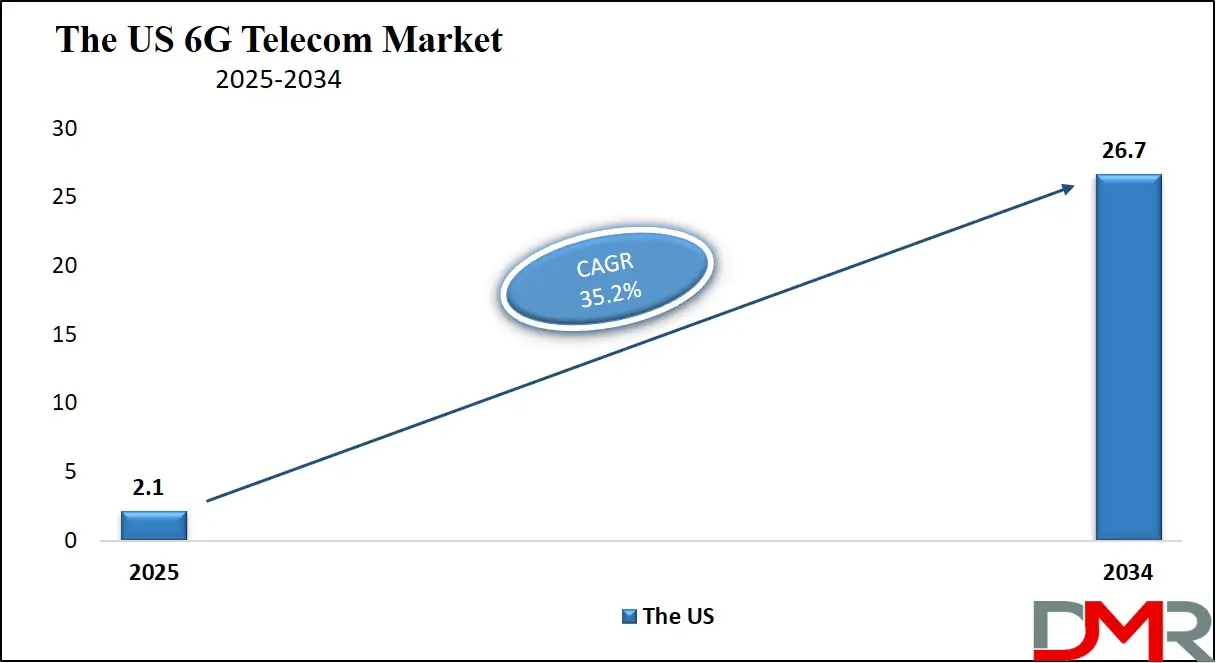

The US 6G Telecom Market

The U.S. 6G Telecom Market size is projected to be valued at USD 2.1 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 26.7 billion in 2034 at a CAGR of 32.5%.

The United States 6G telecom market is poised to become a global leader in next-generation wireless innovation, driven by significant federal funding, private-sector investment, and strategic research collaborations. Major U.S.-based technology firms, telecom operators, and academic institutions are actively engaged in developing foundational technologies such as terahertz spectrum utilization, AI-native network orchestration, and advanced edge computing.

With the Federal Communications Commission (FCC) exploring spectrum policies for 6G and agencies like the National Science Foundation supporting 6G testbeds, the U.S. is laying a robust groundwork for future deployment. Key players, including Qualcomm, Intel, Apple, and AT&T, are conducting early trials and forming global alliances to shape international standards and use cases tailored for smart cities, autonomous vehicles, and immersive extended reality applications.

The U.S. 6G market is characterized by its focus on secure, scalable, and resilient infrastructure capable of supporting critical applications such as defense communications, precision healthcare, and industrial automation. The integration of satellite-terrestrial hybrid networks and AI-driven cognitive radios will enable seamless connectivity in urban, rural, and remote regions.

Additionally, the emphasis on open RAN architecture, quantum communication technologies, and sustainable network design aligns with the broader national goal of technological leadership and digital equity. As the race toward 6G accelerates, the United States is expected to play a pivotal role in shaping the global ecosystem, fostering innovation in wireless intelligence, and driving economic growth through future-ready telecommunications infrastructure.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe 6G Telecom Market

Europe’s 6G telecom market is estimated to be valued at approximately USD 1.7 billion in 2025. This strong positioning is the result of early strategic investments by the European Union and key member states in foundational 6G research and infrastructure development. Projects such as Hexa-X and Hexa-X-II, under the EU’s Horizon Europe program, are fostering collaboration between leading telecom companies, research institutions, and academic bodies.

Countries like Germany, France, Finland, and Sweden are at the forefront of this movement, focusing on sustainable, secure, and AI-integrated network designs tailored for industrial automation, smart cities, and next-generation mobility.

The region’s 6G market is projected to grow at a robust CAGR of 31.7% from 2025 to 2034, supported by a strong emphasis on innovation, digital sovereignty, and cross-border standardization. European regulators are also working proactively on spectrum allocation and ethical frameworks to ensure privacy, sustainability, and openness in future telecom infrastructures.

As Europe strengthens its leadership in green telecom technologies and intelligent networking, the market is expected to witness growing demand from industrial sectors, public services, and smart urban infrastructure. The ongoing collaboration between private players like Nokia and Ericsson with EU institutions will further accelerate Europe’s contribution to the global 6G ecosystem.

Japan 6G Telecom Market

Japan’s 6G telecom market is projected to be valued at approximately USD 240 million in 2025, reflecting the country's early-stage investment and strategic focus on next-generation wireless technologies. Although it holds a relatively smaller share compared to regions like Asia-Pacific as a whole or Europe, Japan’s commitment to innovation positions it as a vital contributor to the global 6G landscape.

The Japanese government, in collaboration with major industry players such as NTT Docomo, NEC, SoftBank, and Fujitsu, is actively funding research into key 6G enablers like terahertz communications, AI-native networks, and non-terrestrial connectivity. These initiatives are aligned with the country’s broader goal of realizing smart cities, next-gen robotics, and digital infrastructure for a hyperconnected society.

With a projected CAGR of 35.8% from 2025 to 2034, Japan’s 6G market is set to expand rapidly as prototypes evolve into commercial trials and scalable deployments. The country’s strengths in semiconductor development, edge computing, and high-frequency circuit design will play a critical role in shaping future applications of 6G.

Additionally, Japan’s participation in global standardization efforts and cross-border technology partnerships will enhance its influence in the international telecom ecosystem. As the demand for high-speed, ultra-reliable, and secure communication solutions grows across industries like healthcare, manufacturing, and public safety, Japan is expected to transition from a research-heavy phase to a high-growth commercial phase in the latter half of the decade.

Global 6G Telecom Market: Key Takeaways

- Market Value: The global 6G telecom market size is expected to reach a value of USD 122.7 billion by 2034 from a base value of USD 8.4 billion in 2025 at a CAGR of 34.7%.

- By Component Segment Analysis: Hardware components are anticipated to dominate the component segment, capturing 42.0% of the total market share in 2025.

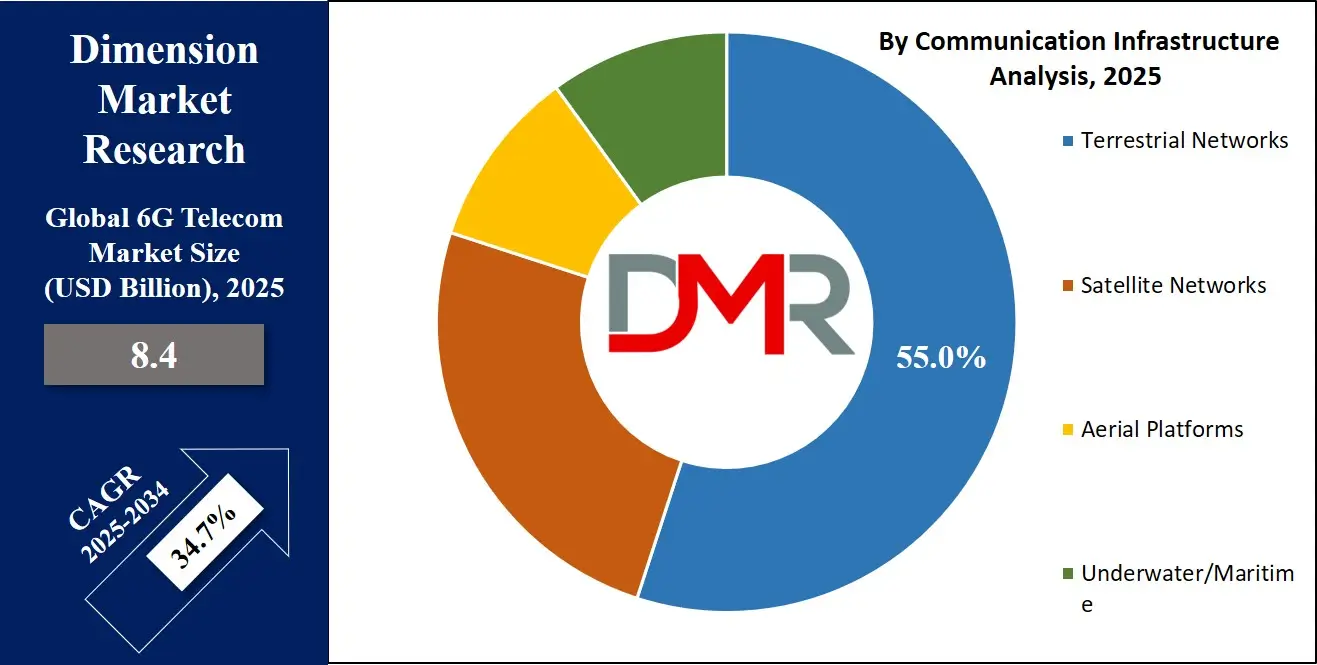

- By Communication Infrastructure Segment Analysis: Terrestrial Networks are poised to consolidate their dominance in the communication infrastructure segment, capturing 55.0% of the total market share in 2025.

- By Spectrum Band Segment Analysis: THz (0.1–10 THz) will lead in the spectrum band segment, capturing 60.0% of the market share in 2025.

- By Technology Segment Analysis: AI/ML Integrated Networks are expected to maintain their dominance in the technology segment, capturing 28.0% of the total market share in 2025.

- By Application Segment Analysis: Smart Cities & Infrastructure will dominate the application segment, capturing 18.0% of the market share in 2025.

- By End-user Industry Segment Analysis: Telecom Providers will dominate the end-user industry segment, capturing 30.0% of the market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global 6G telecom market landscape with 38.0% of total global market revenue in 2025.

- Key Players: Some key players in the global 6G telecom market are Huawei, Nokia, Ericsson, Samsung Electronics, Qualcomm, Intel Corporation, ZTE Corporation, Apple Inc., AT&T, Verizon Communications, China Mobile, NTT Docomo, SK Telecom, LG Electronics, and Others.

Global 6G Telecom Market: Use Cases

- Autonomous Mobility and Vehicle-to-Everything (V2X) Communication: 6G will be a transformative enabler of fully autonomous transportation ecosystems through real-time Vehicle-to-Everything (V2X) communication. With ultra-low latency and terahertz-speed data transmission, 6G networks will allow autonomous vehicles to instantly exchange data with nearby infrastructure, other vehicles, and pedestrians. This will enhance road safety, reduce congestion, and improve fuel efficiency. AI-integrated edge computing will process information locally, enabling split-second decision-making. From self-driving cars to aerial delivery drones, the intelligent transport systems powered by 6G will drive the future of smart mobility, especially in urban smart city environments where precision and reliability are paramount.

- Immersive Extended Reality (XR) and Holographic Communication: 6G will unlock the full potential of immersive technologies, supporting ultra-realistic augmented reality (AR), virtual reality (VR), and mixed reality (MR) experiences through extremely high bandwidth and near-zero latency. These advancements will drive adoption in remote collaboration, education, digital twin environments, and entertainment. Holographic communication, which requires immense data throughput and synchronization, will become viable for virtual meetings, training simulations, and real-time broadcasting. With 6G’s AI-native networks and intelligent signal processing, users will experience multi-sensory environments that feel lifelike, creating new opportunities for innovation in retail, healthcare, and media industries.

- Precision Healthcare and Remote Surgery: 6G will revolutionize the healthcare industry by enabling remote surgeries and real-time diagnostics through high-speed, ultra-reliable networks. Surgeons will be able to perform complex procedures using robotic systems controlled from thousands of miles away, thanks to 6G’s tactile internet capabilities and haptic feedback support. This will drastically improve healthcare access in rural and underserved regions. Additionally, AI-powered wearables and smart medical devices will continuously monitor patient health, sending real-time data to healthcare providers for early intervention. The integration of intelligent networks with biometric sensors will pave the way for predictive, personalized medicine and 24/7 connected care systems.

- Smart Manufacturing and Industrial Automation: 6G will power the next wave of Industry 5.0 by enabling intelligent, autonomous factories with real-time coordination between machines, sensors, and human workers. Ultra-reliable low-latency communication (URLLC) will facilitate seamless interaction across robotic systems, AI-driven quality control, and augmented worker assistance platforms. Industrial IoT devices will continuously share massive datasets with cloud-edge platforms for real-time analytics, improving efficiency and reducing downtime. Predictive maintenance, supply chain automation, and digital twin technologies will flourish, transforming traditional manufacturing into highly adaptive, self-optimizing systems. This level of connectivity will help industries achieve higher productivity while maintaining agility and sustainability.

Impact of Artificial Intelligence in 6G Telecom Market

Artificial Intelligence (AI) is expected to be a foundational pillar of the 6G telecom ecosystem, transforming the way networks are designed, managed, and optimized. Unlike previous generations, 6G will be AI-native, meaning AI will not just support the network; it will drive its core functions. This includes autonomous network orchestration, intelligent spectrum allocation, dynamic traffic management, and real-time fault detection. AI will play a critical role in enabling self-learning networks that can adapt to user behavior, environmental conditions, and service demands without human intervention, significantly enhancing operational efficiency and reducing latency.

In 6G, AI-powered systems will enable predictive maintenance of infrastructure, ensuring network reliability and uptime. Machine learning algorithms will help in real-time data processing at the edge, supporting ultra-fast decision-making for use cases like autonomous vehicles, remote surgery, and holographic communication.

Moreover, AI will be integral in enhancing cybersecurity by identifying and mitigating threats in real time, especially as the network expands to include billions of connected devices through the Internet of Everything (IoE). As 6G aims to deliver hyper-personalized, immersive, and context-aware experiences, the synergy between AI and next-gen wireless infrastructure will be the key to unlocking its full potential across industries.

Global 6G Telecom Market: Stats & Facts

- By the end of the 2024–2025 UK financial year, the UK government will have invested an initial £100 million in developing domestic 6G technologies.

- The UK aims to secure a leadership position in global 6G standard-setting by 2030 through initiatives like the Future Telecoms Infrastructure Review and investment in Open RAN trials.

- United States National Telecommunications and Information Administration (NTIA)

- In December 2023, the NTIA-recognized Commerce Spectrum Management Advisory Committee (CSMAC) described 6G as a general-purpose technology that will power future digital infrastructure across sectors.

- As of September 2024, the NTIA had received 43 stakeholder responses to its official Request for Comments on 6G telecommunications strategy, reflecting strong cross-sector engagement.

- United States National Institute of Standards and Technology (NIST)

- In early 2025, NIST researchers demonstrated a prototype 5G/6G hybrid core network developed in collaboration with South Korean institutions to evaluate interoperability and network efficiency.

- NIST's 6G roadmap outlines critical focus areas including integration of AI/ML in network architecture, Open RAN expansion, spectrum optimization, and development of sensing-enhanced networks.

- Japan Ministry of Internal Affairs & Communications / JETRO

- Japan launched its “Beyond 5G (6G) Promotion Fund” under the National Institute of Information and Communications Technology (NICT), allocating significant grants for R&D, international collaboration, and early testbeds.

- Government-backed estimates suggest that advanced digitalization through 6G could help Japan avoid economic losses of over USD 79 billion annually starting from 2025 by improving connectivity and industrial efficiency.

- European Union Smart Networks and Services Joint Undertaking (SNS JU)

- The SNS JU technical validation group has standardized preliminary 6G KPIs, including energy efficiency, sub-millisecond latency, terabit-level throughput, and 99.9999% reliability as targets for EU pilot programs.

- The EU’s 6G-IA Vision Group has reinforced its strategic goal to commercialize 6G by 2030, emphasizing a unified standardization process with a strong focus on sustainability and digital autonomy.

Global 6G Telecom Market: Market Dynamics

Global 6G Telecom Market: Driving Factors

Rising Demand for Ultra-High-Speed Connectivity

The global shift toward digitalization and hyperconnectivity is fueling the need for ultra-fast, reliable wireless communication. 6G technology promises data speeds exceeding 1 Tbps with ultra-low latency, essential for emerging use cases such as holographic streaming, real-time digital twins, and industrial robotics. Enterprises, governments, and consumers alike are demanding next-generation solutions that support mission-critical applications. This demand is a primary growth catalyst as industries prepare for intelligent automation and edge-based decision-making in smart ecosystems.

Government Investments and Strategic Collaborations

Many leading economies, including the United States, China, South Korea, and members of the European Union, are heavily investing in 6G research and testbeds. Public-private partnerships, national funding programs, and international consortiums are accelerating foundational research in terahertz communication, satellite integration, and AI-powered network management. These initiatives are fostering innovation and ensuring early adoption readiness, thereby creating a competitive environment that drives rapid technological progress in 6G deployment frameworks.

Global 6G Telecom Market: Restraints

Lack of Standardization and Regulatory Frameworks

Despite growing momentum, the 6G ecosystem is still in its early conceptual and development stages, with no globally agreed-upon standards. The absence of unified regulatory guidelines for spectrum allocation, cross-border coordination, and security protocols poses a significant barrier to progress. This uncertainty affects investments and slows down infrastructure planning, particularly for telecom operators and network equipment providers aiming for early commercialization.

High Infrastructure and R&D Costs

Building a fully functional 6G network requires significant capital expenditure, involving the development of terahertz-capable hardware, intelligent edge nodes, and integration with non-terrestrial platforms. The cost of advanced chipsets, AI engines, and quantum-safe encryption systems adds to the financial burden. Smaller operators and developing economies may face challenges in participating in the 6G transition due to limited financial and technical resources, creating a digital divide risk.

Global 6G Telecom Market: Opportunities

Integration of Non-Terrestrial Networks (NTN)

The convergence of satellite, aerial, and ground-based communication will be a defining feature of 6G. This opens vast opportunities to deliver seamless global coverage, especially in remote, maritime, and underserved regions. Companies investing in low-Earth orbit (LEO) satellite constellations, high-altitude platform stations (HAPS), and drone-based connectivity will play a key role in expanding broadband access and supporting global digital inclusion strategies.

Surge in AI-Driven Telecom Solutions

6G will be deeply intertwined with artificial intelligence, offering telecom providers the opportunity to develop autonomous, self-healing networks. AI algorithms will manage real-time traffic routing, predictive maintenance, and network slicing for diverse verticals. This opens doors for AI-based SaaS models and advanced analytics platforms, enabling service providers to deliver personalized, intelligent, and secure communication services across smart cities, healthcare, defense, and enterprise environments.

Global 6G Telecom Market: Trends

Evolution toward AI-Native Network Architectures

One of the most prominent trends in the 6G space is the evolution of AI-native network infrastructures. These networks will incorporate machine learning models from the ground up to facilitate self-configuring, context-aware, and predictive service delivery. Edge AI, federated learning, and real-time analytics will replace traditional manual network management, enhancing reliability and responsiveness in dynamic environments.

Focus on Sustainable and Green Network Design

As environmental concerns grow, the telecom industry is embracing green technologies and sustainable infrastructure for 6G. Low-power silicon photonics, energy-efficient terahertz transceivers, and intelligent energy management systems are being integrated into network planning. This trend supports the broader goal of building climate-resilient, carbon-neutral communication networks that align with global sustainability commitments while maintaining high performance.

Global 6G Telecom Market: Research Scope and Analysis

By Component Analysis

In the 6G telecom market, hardware components are expected to hold the largest share within the component segment, accounting for approximately 42.0% of the total market share in 2025. This dominance is primarily driven by the early-stage infrastructure requirements of 6G networks, which demand significant investment in physical assets such as terahertz-capable antennas, advanced semiconductor chipsets, base stations, and radio frequency (RF) modules.

As countries and telecom operators begin testing and deploying pilot 6G networks, the need for robust, high-performance hardware is crucial to support ultra-fast data speeds, ultra-low latency, and high-frequency transmission. The deployment of non-terrestrial networks like satellites and high-altitude platforms further amplifies the need for specialized hardware tailored to operate across diverse and dynamic environments.

On the other hand, the software segment is also gaining strong momentum and is expected to experience rapid growth throughout the forecast period. Software plays a critical role in enabling intelligent and adaptive network management through functions like AI-driven orchestration, real-time analytics, predictive maintenance, and dynamic network slicing. As 6G will be AI-native, software solutions will be essential for managing massive volumes of data, optimizing spectral efficiency, and ensuring seamless connectivity across heterogeneous networks.

Software-defined networking (SDN) and network function virtualization (NFV) will be pivotal in transforming traditional hardware-reliant networks into flexible, programmable infrastructures. While hardware drives the initial phase of deployment, software will be the key enabler of scalability, automation, and long-term service innovation in the 6G ecosystem.

By Communication Infrastructure Analysis

In the communication infrastructure segment of the 6G telecom market, terrestrial networks are projected to maintain a leading position, capturing approximately 55.0% of the total market share in 2025. This dominance is attributed to the extensive presence and continued expansion of ground-based infrastructure such as macro towers, small cells, and fiber backhaul systems that form the backbone of telecom networks. Terrestrial networks offer high data capacity, reliability, and lower latency, making them ideal for supporting early 6G use cases in urban areas, industrial zones, and densely populated regions.

Telecom operators are likely to leverage and upgrade their existing terrestrial infrastructure to integrate new 6G capabilities, including ultra-dense network deployments, edge computing nodes, and intelligent routing systems. These networks will be crucial in delivering ultra-fast, high-bandwidth services in both fixed and mobile environments.

Meanwhile, satellite networks are expected to play a strategic role in complementing terrestrial systems, particularly in extending 6G coverage to remote, rural, and underserved areas. With the rise of low-earth orbit (LEO) satellite constellations and advancements in space-based communication technologies, satellite networks will support seamless global connectivity and low-latency backhaul services.

These networks will be essential for enabling cross-border communication, maritime and aviation connectivity, and disaster recovery scenarios where terrestrial infrastructure may be unavailable or impractical. While they currently hold a smaller share of the market, satellite networks are anticipated to see rapid adoption in the coming years as part of an integrated, space-air-ground communication framework central to the vision of 6G.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Spectrum Band Analysis

In the spectrum band segment of the 6G telecom market, the terahertz (THz) band ranging from 0.1 to 10 THz is expected to take the lead, capturing around 60.0% of the total market share in 2025. This dominance is driven by the exceptional potential of THz frequencies to deliver ultra-high data rates, extremely low latency, and vast channel capacity, which are essential for supporting advanced 6G use cases such as real-time holographic communication, high-fidelity extended reality, and intelligent automation in Industry 5.0 environments.

The THz spectrum enables data transmission at terabit-per-second speeds, making it ideal for high-density scenarios and future applications requiring massive data throughput and minimal delay. Although the technology to fully exploit THz bands is still in development, heavy investments in research, semiconductor innovation, and antenna design are paving the way for its commercial integration into 6G networks.

In parallel, the millimeter wave (mmWave) band, spanning from 24 to 100 GHz, will continue to play a vital role in the evolution of 6G infrastructure. Building upon its use in 5G deployments, mmWave offers a balance between performance and deployment readiness. It supports high bandwidth and faster data rates than sub-6 GHz frequencies, while being more mature and easier to implement than THz technologies in the near term.

mmWave will be particularly important in urban and semi-urban deployments, enabling applications like smart buildings, connected vehicles, and fixed wireless access. While mmWave may not reach the data speeds of THz bands, its reliability, existing ecosystem, and technical feasibility ensure that it remains a crucial component of the spectrum strategy during the early and transitional phases of 6G rollout.

By Technology Analysis

In the technology segment of the 6G telecom market, AI/ML integrated networks are projected to maintain their dominance by capturing around 28.0% of the total market share in 2025. The core architecture of 6G will be fundamentally AI-native, meaning artificial intelligence and machine learning will not only enhance but also drive critical network functions. These include intelligent traffic routing, automated resource allocation, real-time anomaly detection, and dynamic quality of service (QoS) management.

AI will enable networks to self-learn, self-optimize, and self-heal, dramatically reducing human intervention and operational costs. As 6G expands into complex use cases such as autonomous vehicles, immersive experiences, and ultra-reliable low-latency communication, the demand for real-time, context-aware decision-making will increase.

AI/ML integration ensures the network adapts instantly to changing environments and user behaviors, improving performance, security, and energy efficiency across heterogeneous infrastructures.

Edge computing is another transformative technology within the 6G telecom market, playing a critical role in supporting real-time processing and low-latency services. By relocating computation and storage closer to the end-user or device, edge computing reduces the need to send vast amounts of data to centralized data centers, thereby minimizing delay and conserving bandwidth.

In a 6G context, edge nodes will be essential for enabling time-sensitive applications such as smart manufacturing, remote healthcare, immersive gaming, and critical infrastructure monitoring. With the massive increase in data volumes generated by IoT devices and AI-driven services, edge computing provides the scalability and responsiveness required for 6G-enabled environments.

It also enhances data privacy and network resiliency by decentralizing decision-making and reducing reliance on core network components. Together with AI, edge computing will form a foundational layer for delivering intelligent, efficient, and localized connectivity in next-generation wireless networks.

By Application Analysis

In the application segment of the 6G telecom market, smart cities and infrastructure are expected to dominate, capturing approximately 18.0% of the total market share in 2025. This growth is fueled by the growing global focus on urban modernization, sustainability, and intelligent public services.

6G’s ability to support ultra-reliable, high-speed, and low-latency communication will enable real-time data exchange between millions of interconnected devices across transportation systems, energy grids, public safety networks, and environmental monitoring units.

Technologies such as digital twins, AI-powered surveillance, smart traffic control, and adaptive lighting systems will become integral to future urban planning. The integration of non-terrestrial networks will further enhance connectivity in hard-to-reach areas, allowing city infrastructure to be fully monitored and managed from centralized control hubs. With 6G, cities will evolve into self-regulating ecosystems that can respond proactively to both human activity and environmental conditions.

Industrial automation also represents a significant and fast-growing application area in the 6G telecom market. As industries transition toward Industry 5.0, the need for seamless machine-to-machine communication, predictive maintenance, and robotic process automation becomes more pressing. 6G will support high-density industrial IoT deployments, where sensors, machines, and control systems require instant communication for synchronized operations.

Its ultra-low latency and high reliability will be crucial in environments such as autonomous manufacturing lines, smart logistics hubs, and remote-controlled mining or construction sites. Edge computing and AI will further enhance operational intelligence, enabling factories to self-adjust workflows in real time based on demand or production variables. With 6G connectivity, industrial environments will become more agile, data-driven, and capable of achieving higher productivity with reduced human intervention.

By End-User Industry Analysis

In the end-user industry vertical segment of the 6G telecom market, telecom providers are anticipated to hold the largest share, accounting for around 30.0% of the market in 2025. As the primary enablers of next-generation wireless infrastructure, telecom operators are leading the charge in deploying and testing 6G networks.

They are heavily investing in spectrum acquisition, R&D, and network transformation to support the anticipated leap in connectivity requirements. With 6G promising to deliver terabit-level speeds, ultra-low latency, and intelligent automation, telecom providers are focusing on upgrading their existing infrastructure to support AI-native and software-defined networking architectures.

Additionally, they are exploring new revenue models such as network-as-a-service (NaaS), private 6G networks, and real-time analytics platforms for enterprise and consumer markets. Their role is central not only in delivering connectivity but also in shaping how emerging technologies such as augmented reality, autonomous systems, and remote healthcare are supported through robust wireless ecosystems.

The government and public sector are also emerging as crucial stakeholders in the 6G telecom market, driving adoption through policy support, public funding, and early deployment in critical services.

Governments across the globe are relying on advanced communication technologies to enhance public safety, emergency response, smart governance, and defense capabilities. With the ultra-secure and resilient nature of 6G, public agencies can utilize this network for real-time surveillance, disaster management, border security, and connected infrastructure monitoring.

Moreover, the integration of satellite and aerial communication with 6G will help governments bridge the digital divide by extending broadband coverage to remote and rural populations. National investments in 6G research, spectrum planning, and international standardization further position the public sector as both a user and facilitator of next-generation telecom solutions, ensuring secure, inclusive, and future-ready digital governance.

The 6G Telecom Market Report is segmented based on the following:

By Component

- Hardware

- Software

- Services

By Communication Infrastructure

- Terrestrial Networks

- Satellite Networks

- Aerial Platforms

- Underwater/Maritime

By Spectrum Band

- Sub-6GHz

- mmWave (24-100 GHz)

- THz (0.1-10 THz)

By Technology

- AI/ML Integrated Networks

- Edge Computing

- Network Virtualization (NFV/SDN)

- Blockchain

- Quantum Communication

- Others

By Application

- Smart Cities & Infrastructure

- Industrial Automation

- Autonomous Vehicles & V2X

- AR/VR/MR/XR

- Healthcare & Remote Surgery

- Defense & Aerospace

- Others

By End-User Industry

- Telecom Providers

- Government & Public Sector

- Manufacturing & Automotive

- Healthcare

- Defense & Aerospace

- Retail, BFSI & Education

- Others

Global 6G Telecom Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is expected to dominate the global 6G telecom market in 2025, accounting for approximately 38.0% of the total global market revenue. This leadership is driven by aggressive investments in research and development by regional powerhouses such as China, South Korea, and Japan, which are at the forefront of 6G innovation.

Governments in the region are actively supporting testbeds, pilot projects, and early-stage deployment strategies, while major telecom companies and technology firms are forming strategic partnerships to accelerate 6G infrastructure readiness. The region's dense population, rapidly expanding urban centers, and strong demand for advanced connectivity across smart cities, industrial automation, and digital services further contribute to Asia Pacific’s leading position in shaping the future of global wireless communication.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

North America is projected to witness significant growth in the 6G telecom market over the coming years, driven by strong government support, early-stage R&D investments, and a robust ecosystem of leading technology companies and telecom operators.

The United States, in particular, is prioritizing 6G development through national initiatives, spectrum planning, and strategic collaborations between academia, industry, and federal agencies. Key players like Qualcomm, Intel, AT&T, and Verizon are actively involved in shaping 6G standards and piloting use cases ranging from autonomous systems to secure defense communication. This proactive approach positions North America as a high-growth region with substantial influence over the future 6G landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global 6G Telecom Market: Competitive Landscape

The global competitive landscape of the 6G telecom market is rapidly evolving, marked by intense rivalry among leading technology firms, telecom operators, and government-backed institutions striving for early leadership in next-generation wireless innovation.

Companies such as Huawei, Nokia, Samsung, Ericsson, Qualcomm, and ZTE are at the forefront, investing heavily in 6G research, patents, and cross-industry collaborations to secure their positions. At the same time, major U.S. and Asian players are aligning with national agendas to influence global standardization and spectrum allocation.

The race also includes cloud giants like Microsoft, Google, and IBM, integrating AI, edge computing, and quantum technologies into 6G frameworks. As the ecosystem matures, strategic partnerships, open-source initiatives, and geopolitical considerations are playing pivotal roles in shaping competitive advantages, making the 6G space not just a technological battleground but a cornerstone of future economic and digital sovereignty.

Some of the prominent players in the global 6G telecom market are:

- Huawei

- Nokia

- Ericsson

- Samsung Electronics

- Qualcomm

- Intel Corporation

- ZTE Corporation

- Apple Inc.

- AT&T

- Verizon Communications

- China Mobile

- NTT Docomo

- SK Telecom

- LG Electronics

- Google (Alphabet Inc.)

- Microsoft

- IBM

- Cisco Systems

- T-Mobile US

- NEC Corporation

- Other Key Players

Global 6G Telecom Market: Recent Developments

-

May 2024: Nokia announced the development of its 6G-ready radio prototype, showcasing terahertz spectrum capability and AI-driven network orchestration at the IEEE ICC 2024, aiming to support future ultra-low latency applications in industrial and urban environments.

- March 2024: Samsung Electronics unveiled its advanced 6G testbed system capable of supporting sub-THz band communication, achieving data speeds of over 1 Tbps in laboratory settings, emphasizing its commitment to early-stage infrastructure innovation.

-

August 2023: The U.S. National Science Foundation awarded USD 50 million in funding to multiple universities and research consortia focused on 6G innovation, including projects involving terahertz wireless, quantum networking, and AI-based spectrum management.

- June 2023: China’s Ministry of Industry and Information Technology allocated over USD 300 million in grants to state-backed telecom companies and academic institutions for 6G prototype development, standards research, and international collaboration initiatives.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 8.4 Bn |

| Forecast Value (2034) |

USD 122.7 Bn |

| CAGR (2025–2034) |

34.7% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 2.1 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software, and Services), By Communication Infrastructure (Terrestrial Networks, Satellite Networks, Aerial Platforms, and Underwater/Maritime), By Spectrum Band (Sub-6GHz, mmWave [24–100 GHz], and THz [0.1–10 THz]), By Technology (AI/ML Integrated Networks, Edge Computing, Network Virtualization [NFV/SDN], Blockchain, Quantum Communication, and Others), By Application (Smart Cities & Infrastructure, Industrial Automation, Autonomous Vehicles & V2X, AR/VR/MR/XR, Healthcare & Remote Surgery, Defense & Aerospace, and Others), and By End-User Industry (Telecom Providers, Government & Public Sector, Manufacturing & Automotive, Healthcare, Defense & Aerospace, Retail, BFSI & Education, and Others). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Huawei, Nokia, Ericsson, Samsung Electronics, Qualcomm, Intel Corporation, ZTE Corporation, Apple Inc., AT&T, Verizon Communications, China Mobile, NTT Docomo, SK Telecom, LG Electronics, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global 6G telecom market?

▾ The global 6G telecom market size is estimated to have a value of USD 8.4 billion in 2025 and is expected to reach USD 122.7 billion by the end of 2034.

What is the size of the US 6G telecom market?

▾ The US 6G telecom market is projected to be valued at USD 2.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 26.7 billion in 2034 at a CAGR of 32.5%.

Which region accounted for the largest global 6G telecom market?

▾ Asia Pacific is expected to have the largest market share in the global 6G telecom market, with a share of about 38.0% in 2025.

Who are the key players in the global 6G telecom market?

▾ Some of the major key players in the global 6G telecom market are Huawei, Nokia, Ericsson, Samsung Electronics, Qualcomm, Intel Corporation, ZTE Corporation, Apple Inc., AT&T, Verizon Communications, China Mobile, NTT Docomo, SK Telecom, LG Electronics, and Others.

What is the growth rate of the global 6G telecom market?

▾ The market is growing at a CAGR of 34.7 percent over the forecasted period