Market Overview

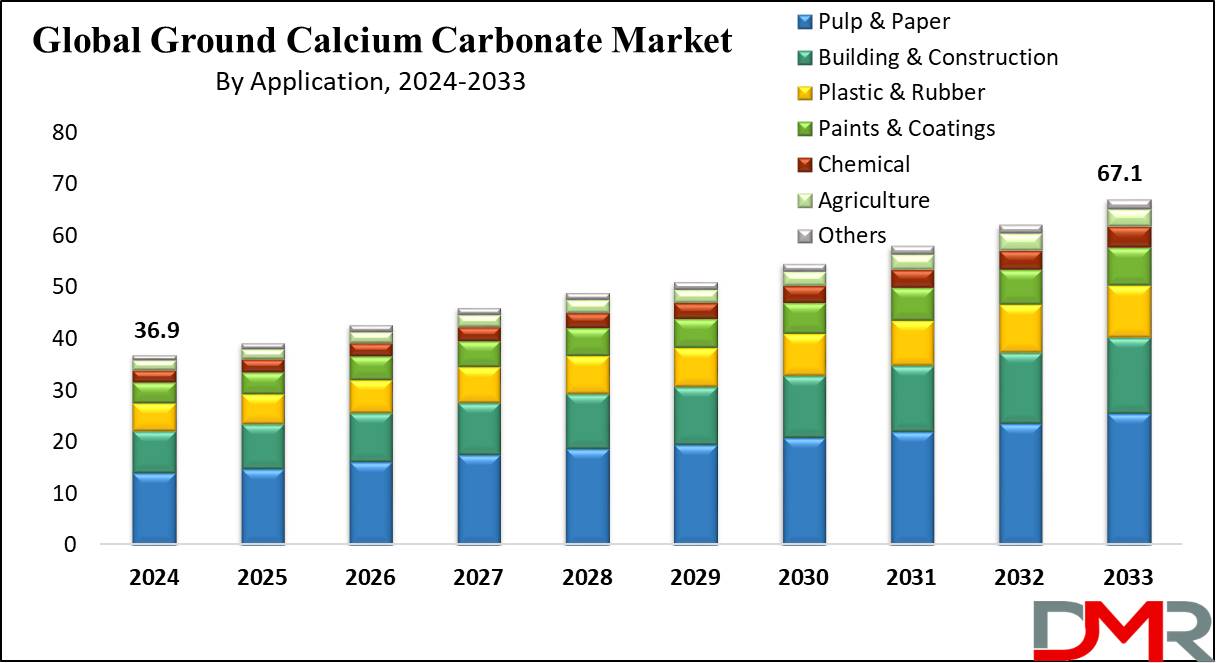

The Global Ground Calcium Carbonate Market is expected to reach USD 36.9 billion in 2024 and is further anticipated to value USD 67.1 billion by 2033, at a CAGR of 6.9%.

GCC (Ground Calcium Carbonate) used as a filler in several sectors, including rubber, plastic, ink, paper & paint. Notably, the plastic & rubber sectors commonly use Ground Calcium Carbonate in polymer composites to enhance the workability & physical properties of their products. By substituting costly resins with cost-efficient ground calcium carbonate fillers, the polymer composites’ cost can be noticeably reduced, making it an attractive option for manufacturers.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Furthermore, the paper industry is a significant consumer of ground calcium carbonate products. While kaolin serves as a replacement for calcium carbonate filler in the paper industry, Ground Calcium Carbonate is gaining prominence due to the increasing desire for shiny & heavier papers.

Its use in the paper industry helps achieve improved paper quality & performance. Overall, the widespread utilization of ground calcium carbonate in various sectors as a cost-effective filler, along with its ability to enhance product characteristics, drives its continuous growth in the global market.

Calcium carbonate plays a vital role in producing calcium citrate, derived from citric acid, which is widely used as a food additive, preservative, acidifier, and flavoring agent. Its applications extend to industries such as cleaning agents, cosmetics, pharmaceuticals, and

dietary supplements.

Additionally, calcium carbonate is instrumental in adjusting the pH levels of water during the neutralization process. Untreated water passes through calcium carbonate filters, where the material dissolves and increases the water's pH level to above 6. The growing demand for treated drinking water, driven by population growth, is expected to boost the use of calcium carbonate in water treatment.

The U.S. paper and wood products industry experienced significant tissue production growth during early 2020, according to the American Forest & Paper Association. In March alone, U.S. mills produced approximately 700 kilotons of tissue. This surge was influenced by lockdown measures and heightened hygiene concerns, which led to panic buying and stockpiling of tissues and cleaning products. These factors significantly contributed to market growth during that period.

Key Takeaways

- Market size: The global ground calcium carbonate market size is expected to grow by 24.4 billion, at a CAGR of 6.9 % during the forecasted period of 2025 to 2033.

- Market Definition: GCC is a white or off-white fine powder, derived from natural limestone or marble deposits composed primarily of calcium carbonate, with some amounts of other minerals.

- Application Analysis: Pulp & Paper as an application is expected to witness significant growth with the highest revenue share of 38.0 % throughout the forecast period.

- Regional Analysis: Asia-Pacific is anticipated to dominate the ground calcium carbonate market, capturing a revenue share of 41.2 % in 2024.

Use Cases

- Manufacturing in the paper, plastic, and rubber industry: GCC is widely used in the paper industry as a filler and coating pigment which improves paper smoothness, opacity, and brightness while reducing costs compared to other alternatives.

- Pharmaceuticals and Health Products: It is used in dietary supplements, antacids, and pharmaceutical formulations as it is a good source of calcium which helps in bone health and acid neutralization in the stomach.

- Agriculture: It is employed in agriculture as a fertilizer to neutralize soil acidity, enhance nutrient availability, and improve soil structure, promoting healthy plant growth and increased crop yields.

- Food and Beverage Industry: Many products such as baking goods, cereals, and beverages include GCC as a food additive that serves as a calcium fortifier and anti-caking agent.

Market Dynamic

Drivers

Used as a Filler Material

Ground calcium carbonate market is fueled by the rising demand for calcium carbonate in the paper industry as the size of the ground calcium carbonate (GCC) particle, enhances water drainage. GCC is particularly favored as a filler material in papermaking processes (not dependent on wood), due to its cost-effectiveness & more brightness, which contribute to its growth in this sector.

Apart from its applications in the paper industry, GCC finds widespread usage in adhesive & sealant sectors. Manufacturers utilize GCC to control shrinkage & reduce production costs. Additionally, in various formulations, it helps to maintain the viscosity, physical strength, & several other properties of the final products.

Application in Women's Healthcare

Notably, the hygiene sector utilizes Ground calcium carbonate in the production of women's personal care items, infant diapers, & products for adult incontinence. It is included in nutritional supplements for women to support muscle, bone, nervous system, and cardiovascular health.

Restrains

Balancing Raw Material Availability, Environmental Concerns, and Quality Standards

Fluctuations in raw material availability affect production costs and supply stability, which poses a risk for manufacturers & users of ground calcium carbonate.

This market is facing challenges due to rising awareness of environmental concerns, as the extraction and processing of calcium carbonate can harm the environment. Many industrial uses of these products require several quality standards and specifications, which complicates both manufacturing and distribution.

Opportunities

Developing Infrastructure and Construction Sectors

Growing infrastructure and construction sectors of developing nations provide a great opportunity for using ground calcium carbonate in various products like paints, coatings, and concrete. Many companies are prioritizing lightweight and high-performance materials due to their ability to enhance properties such as strength and durability.Increasing demand for environmentally friendly & sustainable materials creates a growth opportunity for calcium carbonate products as an eco-friendly option.

Trend

Diversification through Specialized Applications and Grades

Advancements in technology and manufacturing techniques now enable the creation of specialized calcium carbonate grades tailored to specific industries such as food, cosmetics, and pharmaceuticals. Collaborations with research institutions and efforts to enhance processes can also drive the development of new applications.

Rise of Bio-based and Renewable Materials

Ground calcium carbonate market is experiencing an increase in the adoption of bio-based and renewable materials. Calcium carbonates made from renewable feedstock are gaining popularity as companies are searching for alternative derives from fossil fuels. These trends underscore the industry's commitment to sustainability, innovation, and adaptability in meeting evolving market demands.

Research Scope and Analysis

By Application

The Pulp & Paper segment is expected to dominate the ground calcium carbonate market with a maximum share of 38.0% by the end of 2024. This growth is majorly driven by the vast expansion of online platforms and gig workers, which resulted in huge demand for food, hygiene, & lightweight packaging products. Among various alternatives in the pulp & paper sector, ground calcium carbonate emerges as the most accepted choice because of its better function.

It is widely used in paper production as a filler, providing various benefits like less price & more brightness. Additionally, the rhombohedral particle shape of GCC contributes to achieving a porous surface in the paper sheet.

Following closely, the building & construction segment comes second after the Pulp & paper segment in terms of share and is anticipated to observe the highest CAGR during 2024-2033.

This growth can be accredited to the rising desire for better infrastructures, such as airports, seaways & roadways, thereby driving the need for calcium carbonate in the market. Calcium carbonate finds extensive usage in the construction sector, both as a standalone building material & as an additive to cement. Its applications encompass, brick joining, the production of mortar, concrete blocks, stones, tiles & roofing shingles.

Moreover, calcium carbonate's decomposition produces lime & carbon dioxide, which are used in the production of steel, glass, & paper. Additionally, it finds its applications in cables, pipes, roofing, siding, fencing, flooring, window profiling, & several other applications.

The versatility of the product is evident from its use as a filler or additive in various other sectors. These include carpet backing, polymer, stucco, fiber cement, joint compounds, asphalt sealers, rubber,

water treatment & citric acid production. Furthermore, it proves beneficial in plasters having textures or patterns that demand larger particles with more brightness to meet specific optical requirements in their final utilization process.

The Global Ground Calcium Carbonate Market Report is segmented based on the following

By Application

- Pulp & Paper

- Building & Construction

- Plastic & Rubber

- Paints & Coatings

- Chemical

- Agriculture

- Others

Impact of Artificial Intelligence on Ground Calcium Carbonate Market

- Optimized Mineral Processing & Purity Enhancement: AI-driven sensors and machine learning algorithms improve the grinding, refining, and classification processes, ensuring higher purity and consistency in GCC production.

- Automated Quality Control & Defect Detection: AI-powered computer vision systems analyze particle size distribution and detect impurities in real time, reducing material waste and enhancing product quality.

- Predictive Maintenance in Manufacturing Plants: AI monitors machinery performance, predicting failures and scheduling maintenance, minimizing downtime and operational costs.

- Supply Chain & Demand Forecasting: Machine learning models analyze market trends, customer demand, and logistics, optimizing inventory management and reducing production bottlenecks.

- Sustainability & Waste Reduction: AI-driven process optimization reduces energy consumption, minimizes carbon emissions, and enhances the recycling of byproducts, supporting eco-friendly GCC production.

Regional Analysis

Asia Pacific region is expected to emerge as the dominant player in ground calcium carbonate market, with a

maximum share of 41.2% by the end of 2024. This growth can be accredited to various factors, like economic expansion, rapid urbanization, & significant development of infrastructure. This region's growth in several sectors like automotive, construction, & electronics is expected to fuel the demand for products based on ground calcium carbonate in the foreseeable future.

These factors have resulted in the growth of several sectors such as paper & pulp, and building & construction, among others, leading to a higher demand for GCC. Asia-Pacific, particularly China, emerged as a hub for global production due to supportive government policies and the availability of advanced manufacturing facilities and a skilled workforce.

After Asia-Pacific, North America is anticipated to account for a considerable share of the global market in 2024. The flourishing coatings & paints sector in North America utilizes ground calcium carbonate as a pigment enhancer & effective filler, improving the opacity durability, & flow properties of these products. Increased desire for industrial coating, & architectural coatings in Canada, & the U.S. is a driving force behind the rising usage of ground calcium carbonate.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Key players operating are making significant investments in establishing onsite production facilities to cater to the growing demand for ground calcium carbonate. The purpose of these investments is to produce various grades of GCC, including filler grade GCC & PCC, high-end GCC, and coating grade GCC. To meet industry demands effectively, players operating in the global ground calcium carbonate are placing a strong emphasis on developing new products with diverse properties.

This approach enables them to offer a wide range of options that align with the specific needs of different industries. Moreover, some market participants have taken a proactive approach by owning limestone quarries & adopting a value chain integration strategy.

This involves supplying natural and unprocessed limestone, processing the raw materials based on customer requirements, and efficiently distributing the final product to various markets. Through these strategic investments and value chain integration efforts, industry experts aim to strengthen its market position and meet the ever-increasing demand for ground calcium carbonate across multiple sectors.

Some of the prominent players in the Global Ground Calcium Carbonate Market are

- Mineral Technologies Inc.

- Omya AG

- Imerys

- Sibelco

- Carmeuse

- GLC Minerals

- U.S. Aggregates

- Shiraishi Calcium Kaisha

- GCCP Resources Limited

- Mississippi Line Company

- J.M Huber Corporation

- Others

Recent Development

- In January 2023, ASCP member, Holcim, acquired Nicem as a strategic move to advance the development of green construction material solutions. Nicem is a grounded calcium carbonate leader in Northern Italy with a broad customer base spanning multiple industries from construction to plastic, rubber, and paints.

- In September 2022, Imerys entered into exclusive negotiations for the sale of its assets like kaolin, ground calcium carbonate (GCC), precipitated calcium carbonate (PCC), and talc, serving the paper markets.

- In August 2022, Imerys announced a strategic investment in its Southeast Ground-Calcium-Carbonate business to expand capacity in its Marble Hill (GA) plan which is part of a plan to support the growing building and construction markets such as coatings, roofing, joint compound, and flooring.

- In April 2022, Omya and Asia Symbol International Pte Ltd. announced a collaborative investment to produce Ground Calcium Carbonate (GCC) and Precipitated Calcium Carbonate (PCC) needed for Asia Symbol's uncoated fine paper production machines in Jiangmen, Guangdong, China.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 36.9 Bn |

| Forecast Value (2033) |

USD 67.1 Bn |

| CAGR (2024–2033) |

6.9% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Application (Pulp & Paper, Building & Construction, Plastic & Rubber, Paints & Coatings, Chemical, Agriculture, and Others). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Lonza Group, Shanghai Nanxiang Reagent Co. Ltd., Wuhan Kemi-Works Chemical Co. Ltd., Columbus Chemical Industries, Inc, TATEYAMA KASEI Co., Ltd., Trace Zero LLC, J&K Scientific Limited, Lagos, Hefei TNJ Chemical Industry Co., Ltd, Medical Chem (Yancheng) Manuf. Co., Ltd., and Other Key Players |

| Purchase Options |

Physio-Control Inc., Schiller, Medtronic, Abbott, Boston Scientific Corporation, Koninklijke Philips N.V., Zoll Medical Corporation, BIOTRONIK, Progetti Srl, LivaNova Plc, and Other Key Players |

Frequently Asked Questions

How big is the Global Ground Calcium Carbonate Market?

▾ The Global Ground Calcium Carbonate Market size is estimated to have a value of USD 36.9 billion in 2024 and is expected to reach USD 67.1 billion by the end of 2033.

Which region accounted for the largest Global Ground Calcium Carbonate Market?

▾ Asia-Pacific is expected to be the largest market share for the Global Ground Calcium Carbonate Market with a share of about 41.2 % in 2024.

Who are the key players in the Global Ground Calcium Carbonate Market?

▾ Some of the prominent players in the Global Ground Calcium Carbonate Market include Mineral Technologies Inc., Omya AG, Imerys, Sibelco, Carmeuse, etc.

What is the growth rate of the Global Ground Calcium Carbonate Market?

▾ The market is growing at a CAGR of 6.9 percent over the forecasted period.