Market Overview

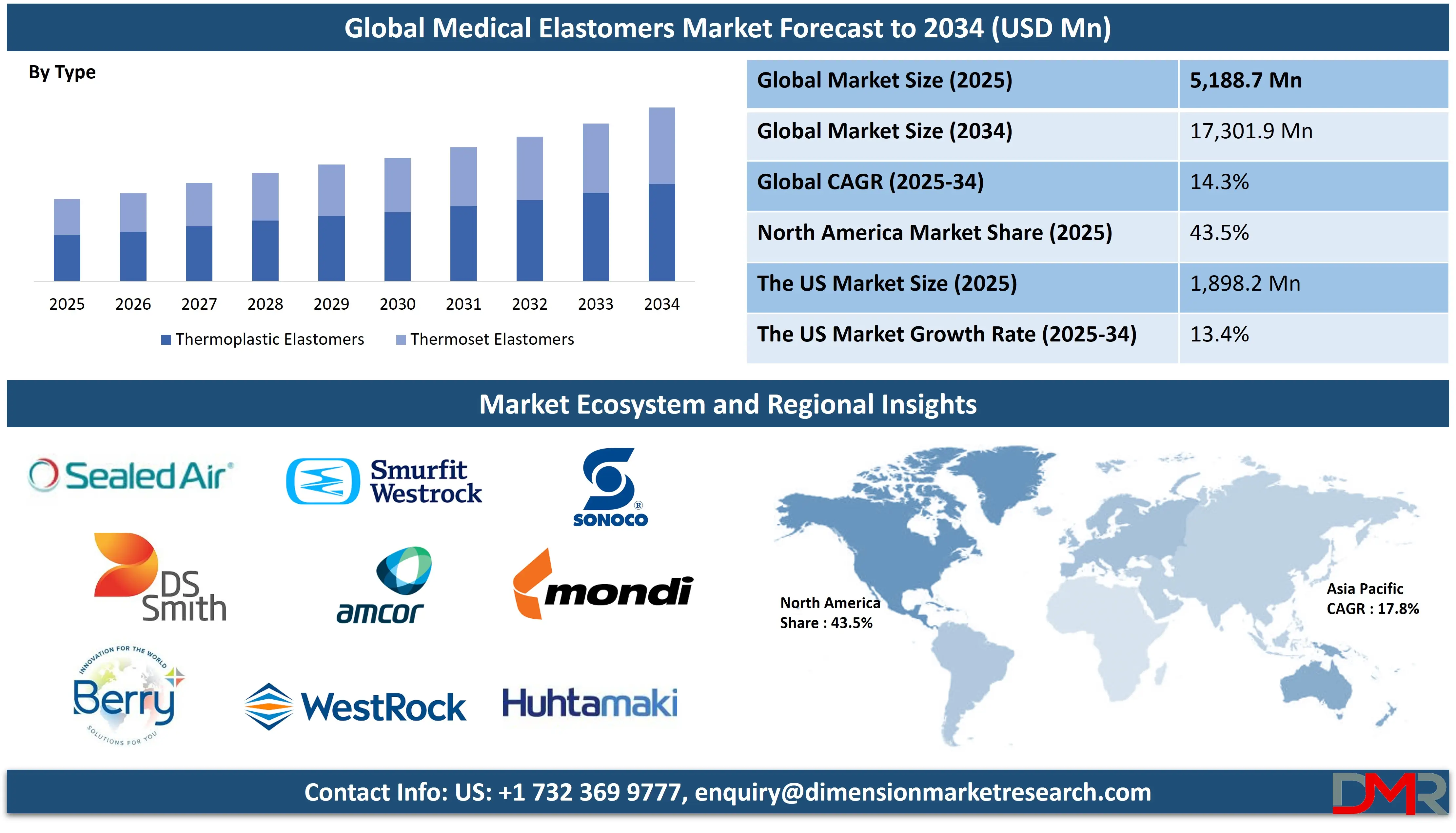

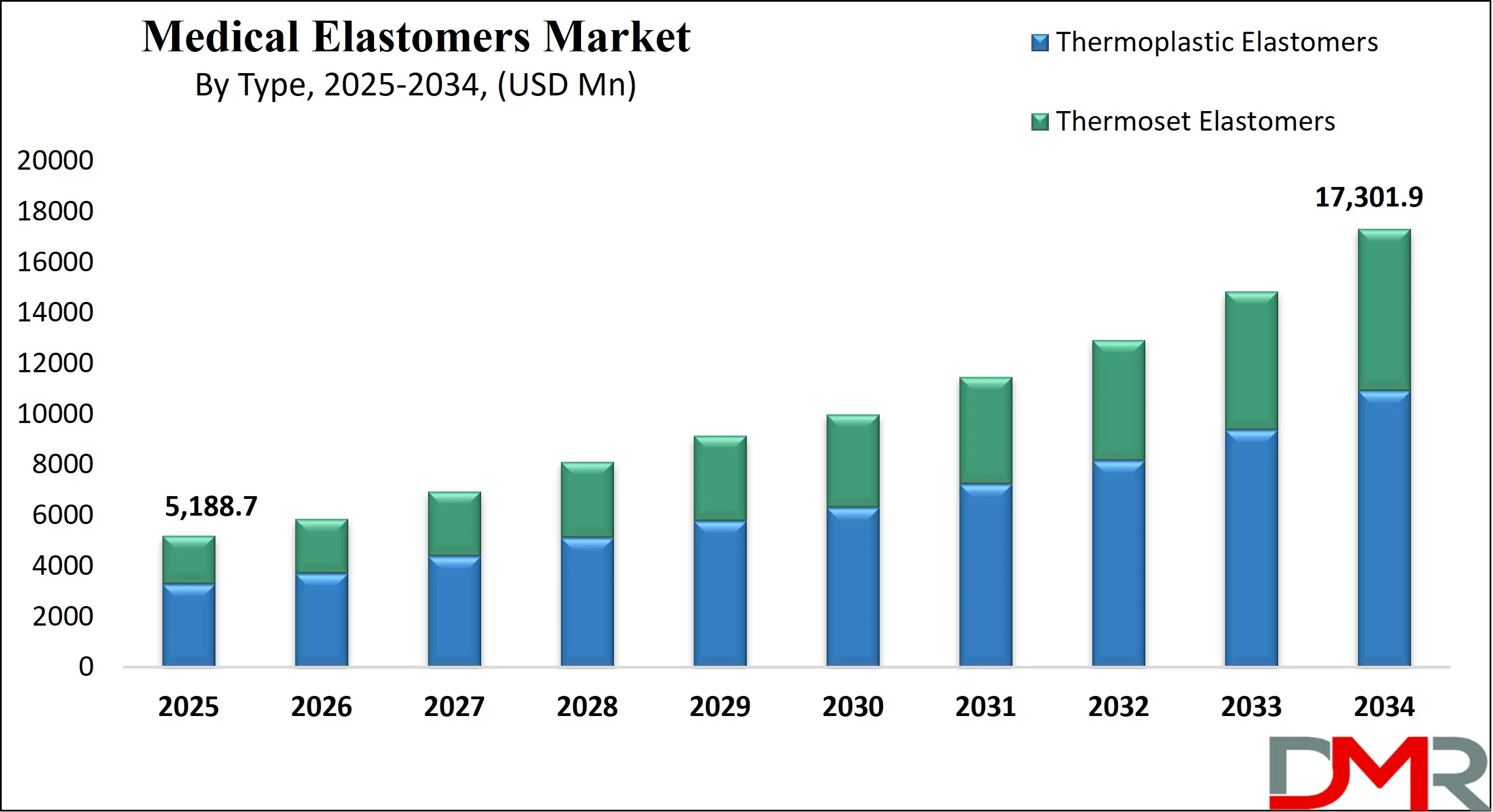

The Global Medical Elastomers Market is predicted to be valued at USD 5,188.7 million in 2025 and is expected to grow to USD 17,301.9 million by 2034, registering a compound annual growth rate (CAGR) of 14.3% from 2025 to 2034.

Medical elastomers are specialized polymeric materials designed for use in medical and healthcare applications due to their flexibility, biocompatibility, and chemical resistance. These elastomers can stretch and return to their original shape, making them ideal for products like tubing, catheters, seals, syringes, and wearable medical devices.

Common types include silicone elastomers, thermoplastic elastomers (TPE), and ethylene propylene diene monomer (EPDM). They are used in both disposable and implantable devices and must meet stringent regulatory and safety standards. Their ability to withstand sterilization and provide comfort makes them essential in modern medical technology and patient care solutions.

The global medical elastomers market is experiencing steady growth driven by increasing demand for advanced medical devices and biocompatible materials. These elastomers are essential components in manufacturing medical tubing, catheters, seals, gloves, and syringes due to their flexibility, chemical resistance, and ability to withstand sterilization processes. As healthcare systems expand and evolve, particularly in emerging economies, the need for reliable and safe materials for critical medical applications continues to rise.

Silicone elastomers and thermoplastic elastomers are among the most widely used types in the healthcare industry, valued for their high performance, durability, and compliance with stringent medical regulations. Innovations in minimally invasive surgical procedures, diagnostic devices, and wearable medical technologies are further fueling demand for medical-grade elastomeric materials. These materials are also integral to pharmaceutical packaging and drug delivery systems, where maintaining sterility and chemical compatibility is crucial.

The market is supported by a growing aging population, increased prevalence of chronic diseases, and a shift toward home-based healthcare solutions. Medical elastomers also play a critical role in patient comfort and safety, which is vital in long-term care and implantable device applications.

Additionally, sustainability trends and regulatory pressure are pushing manufacturers to develop eco-friendly and recyclable medical elastomers. Strategic collaborations, R&D investments, and technological advancements are helping players strengthen their market position. North America, Europe, and Asia-Pacific are key regions contributing to the market dynamics, with high demand across hospitals, clinics, and diagnostics labs. As healthcare infrastructure continues to modernize, the adoption of medical elastomer solutions is expected to expand across various end-use sectors.

The US Medical Elastomers Market

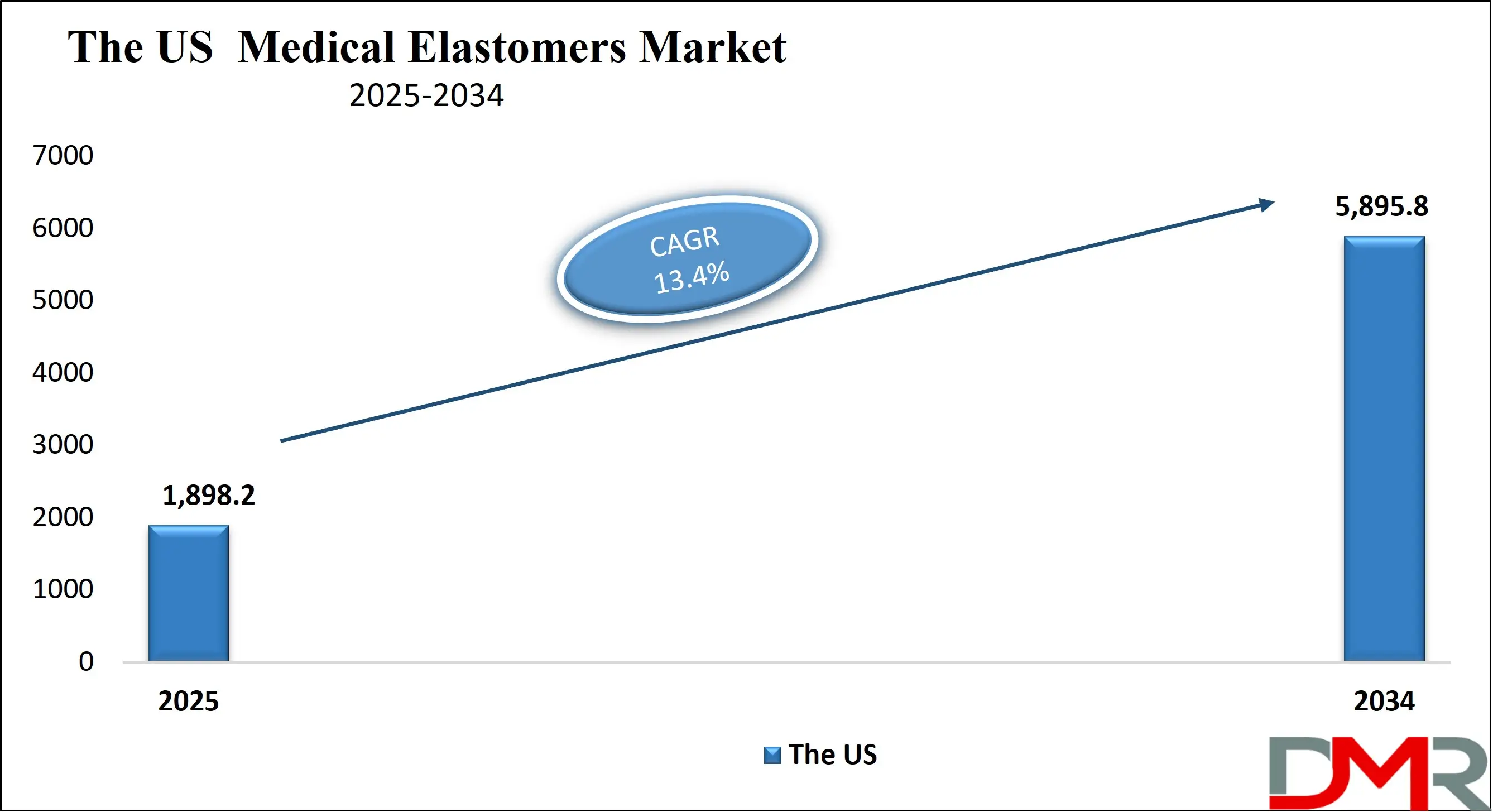

The US Medical Elastomers Market is projected to be valued at USD 1,898.2 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 5,895.8 million in 2034 at a CAGR of 13.4%.

The US medical elastomers market is driven by the growing demand for advanced and safe medical devices. Rising healthcare spending, an aging population, and the need for minimally invasive procedures have led to increased utilization of elastomeric materials in catheters, syringes, and seals. Regulatory support for biocompatible materials also supports market growth.

Moreover, the presence of major medical device manufacturers and continuous R&D initiatives promote the adoption of high-performance elastomers, especially silicone and thermoplastic variants, for use in surgical instruments, implants, and diagnostic equipment. The push for sustainable and recyclable elastomers further strengthens the industry's momentum in the United States.

In the US, the medical elastomers market is witnessing a trend toward the use of customized elastomeric compounds that cater to specific medical applications. There is growing emphasis on producing elastomers with enhanced durability, chemical resistance, and sterilizability to meet stringent healthcare standards. Silicone elastomers are increasingly preferred due to their biocompatibility and versatility.

Additionally, partnerships between material science companies and healthcare firms are accelerating product innovation. The rise of wearable healthcare devices and point-of-care diagnostics is also influencing design considerations, leading to the adoption of soft, flexible elastomers for enhanced patient comfort and device functionality.

The Japan Medical Elastomers Market

The Japan Medical Elastomers Market is projected to be valued at USD 363.2 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,015.3 million in 2034 at a CAGR of 12.1%.

Japan's mobile biometric authentication market is being driven by the country’s emphasis on security and technological innovation. The integration of biometric systems in smartphones, banking apps, and government services is accelerating adoption. Increasing concerns over data security, digital fraud, and identity theft have led to widespread deployment of fingerprint, facial, and voice recognition technologies in mobile platforms.

Government initiatives supporting smart cities and digital transformation are also contributing to the proliferation of biometric-enabled devices. Furthermore, Japan’s tech-savvy population and high smartphone penetration provide a favorable landscape for the rapid acceptance of mobile biometric solutions.

In Japan, mobile biometric authentication is evolving with advancements in multimodal biometrics that combine multiple identification methods for enhanced accuracy. The market is seeing a transition from traditional fingerprint sensors to more secure facial and iris recognition, particularly in high-end devices. Biometric authentication is increasingly being integrated into mobile payment systems and digital ID programs, supporting cashless and contactless transactions.

Artificial intelligence and machine learning are being used to refine biometric algorithms, improving reliability even under varying environmental conditions. Collaborations between telecom providers, fintech firms, and device manufacturers are shaping a dynamic and secure mobile authentication ecosystem.

The Europe Medical Elastomers Market

The Europe Medical Elastomers Market is projected to be valued at USD 908.0 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2,727.7 million in 2034 at a CAGR of 13.0%.

Europe’s medical elastomers market is driven by the region’s robust regulatory framework that emphasizes patient safety and material compliance. Increasing investments in healthcare infrastructure and technological advancements in medical devices are fueling demand for high-performance elastomeric materials.

The growing prevalence of chronic diseases and aging demographics contribute to the expansion of healthcare services, boosting the use of elastomers in devices like tubing, connectors, and valves. Furthermore, rising demand for home healthcare solutions and rehabilitation devices is encouraging manufacturers to develop elastomers with better tactile properties, enhanced comfort, and superior flexibility for patient-centric applications.

The Europe market is witnessing a shift toward sustainable and recyclable elastomer materials in medical applications. Demand for lightweight and flexible medical device components is rising, particularly in outpatient and homecare settings. Increased R&D in thermoplastic elastomers is resulting in innovations that enhance processability and sterilization compatibility.

Cross-border collaborations between medical device manufacturers and material suppliers are fostering innovation. Additionally, the incorporation of antimicrobial additives into elastomers to improve infection control and hygiene is gaining traction. Countries with strong medical technology ecosystems, such as Germany and the Netherlands, are leading this transformation with advanced material engineering practices.

Medical Elastomers Market: Key Takeaways

- Market Overview: The global medical elastomers market is expected to reach a valuation of USD 5,188.7 million in 2025 and is projected to expand to USD 17,301.9 million by 2034, reflecting a compound annual growth rate (CAGR) of 14.3% between 2025 and 2034.

- By Type Analysis: Thermoplastic elastomers are anticipated to lead the market by the end of 2025, capturing approximately 56.1% of the overall market share.

- By Technology Analysis: Injection molding is expected to be the most widely used technology in the medical elastomers industry by 2025, accounting for around 47.3% of the total share.

- By Application Analysis: Medical tubing is projected to emerge as the top application segment by 2025, representing 29.7% of the global market.

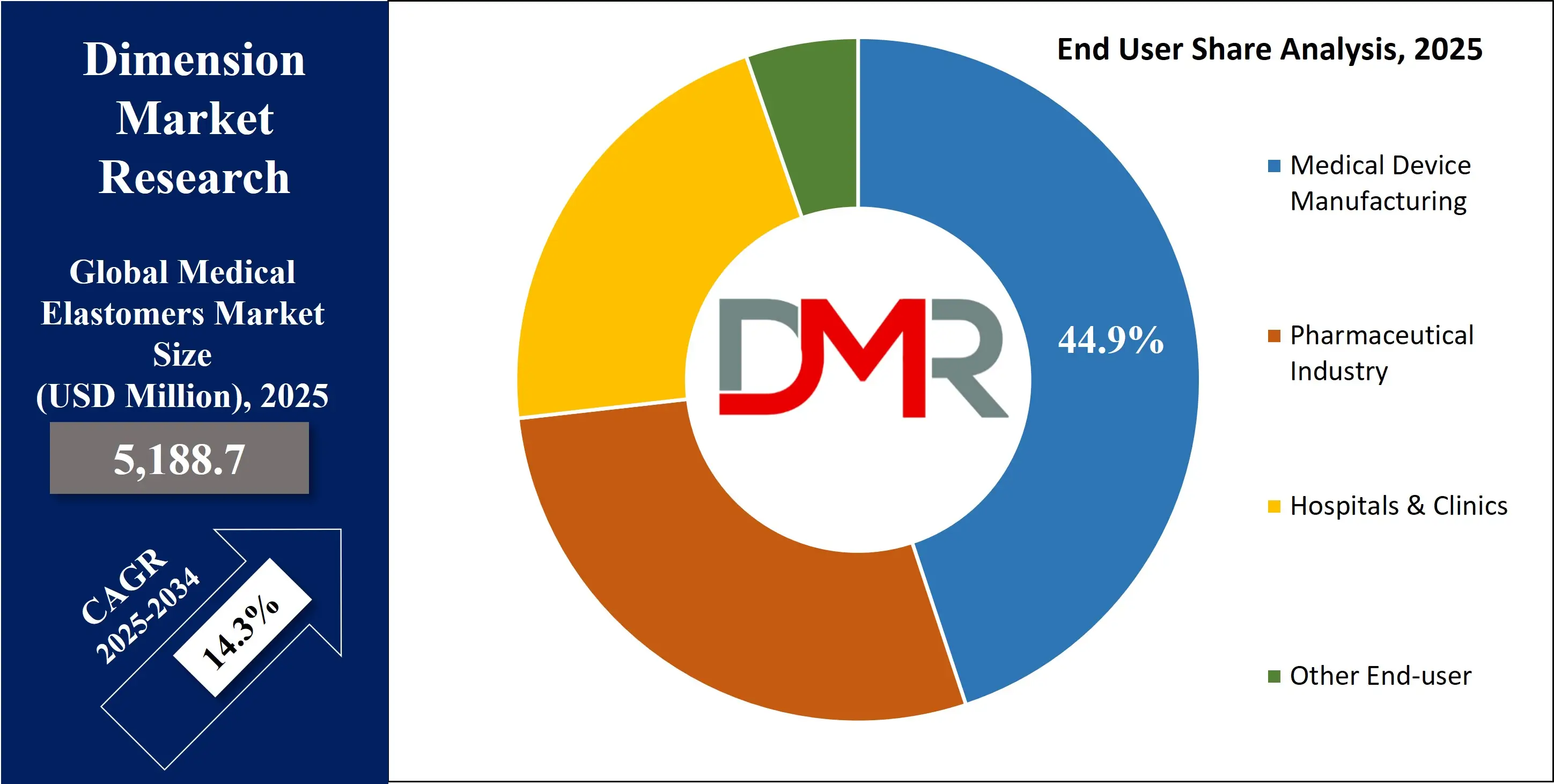

- By End-user Analysis: The medical device manufacturing sector is forecasted to remain the dominant end user of medical elastomers by 2025, holding a 44.9% share of the market.

- Region with the Largest Share: North America is anticipated to lead the global medical elastomers market with a revenue share of 43.5% by the end of 2025.

Medical Elastomers Market: Use Cases

- Catheters and Tubing: Medical elastomers are extensively used in manufacturing flexible and kink-resistant catheters and IV tubing. Their biocompatibility, elasticity, and chemical resistance ensure safe and long-term contact with bodily fluids, making them ideal for various diagnostic and therapeutic applications across hospitals, clinics, and homecare settings.

- Seals and Gaskets in Medical Devices: Elastomers are critical for seals and gaskets in medical equipment such as infusion pumps, ventilators, and dialysis machines. They ensure leak-proof and durable connections, providing consistent performance under sterilization and varied pressure conditions, thus enhancing patient safety and device reliability.

- Wearable Medical Devices: Medical-grade elastomers are utilized in wearable health monitoring devices, such as fitness trackers and glucose monitors. Their flexibility, skin-friendliness, and ability to conform to body contours make them ideal for long-duration wear, improving patient comfort and adherence to medical regimens.

- Implantable Devices: Elastomers like silicone are used in implantable devices such as pacemakers, neurostimulators, and breast implants. Their biostability, inertness, and resistance to degradation inside the human body make them a reliable choice for long-term implantation.

- Surgical Instruments and Grips: Medical elastomers are applied to the handles and grips of surgical tools and diagnostic instruments. Their anti-slip, sterilizable, and ergonomic properties improve surgeon control, reduce fatigue, and enhance hygiene standards in operating rooms.

Medical Elastomers Market: Stats & Facts

- U.S. Food and Drug Administration (FDA): The FDA classifies silicone elastomers used in medical devices as Class VI materials, ensuring they meet stringent biocompatibility standards for use in implants and surgical tools.

- Statista: In 2022, global production of medical-grade silicone, a key material in medical elastomers, exceeded 500,000 metric tons, reflecting growing demand in applications like catheters and prosthetics.

- American Chemistry Council: Thermoplastic elastomers (TPEs) used in healthcare are experiencing annual demand growth of 5% to 7% due to their recyclability, chemical resistance, and versatility in medical applications.

- European Rubber Journal: Thermoplastic polyurethanes (TPUs), a class of medical elastomers, account for more than 35% of elastomer use in flexible medical tubing and IV systems across Europe.

- Mayo Clinic Proceedings: Over 3 million patients receive implantable devices made with elastomers (e.g., pacemaker leads, cochlear implants) annually in the U.S., due to their durability and low tissue reactivity.

- National Center for Biotechnology Information (NCBI): Liquid silicone rubber (LSR) has shown over 90% tensile strength retention after sterilization cycles, making it ideal for reusable surgical components.

- PlasticsEurope: Ethylene propylene diene monomer (EPDM), a synthetic rubber elastomer, is widely used in seals for syringes and respiratory equipment, contributing to over 20% of global healthcare rubber consumption.

- World Health Organization (WHO): WHO estimates that over 16 million injections are administered globally each year, many using elastomer-sealed syringes, showing the vast scale of their use in routine healthcare.

- Dow Inc.: Silicone elastomers account for approximately 60% of the total demand for medical-grade elastomers due to their exceptional biocompatibility, thermal stability, and performance in implantable devices.

- BASF: Thermoplastic polyurethanes (TPUs) used in medical applications exhibit elongation at break values above 500%, making them ideal for flexible medical devices like catheter shafts and infusion tubing.

- Polymer Properties Database (University of Cambridge): Ethylene Propylene Diene Monomer (EPDM) rubber shows a service temperature range from -50°C to 150°C, enabling its use in autoclave-sterilized surgical equipment and seals.

- DuPont: The company reports that its specialty copolyester elastomers (COPEs) have shown tensile strengths of 25–35 MPa and are increasingly adopted in wearable medical device enclosures and flexible electronics.

- World Health Organization (WHO): With over 2 million vaccine doses administered globally per year, medical elastomeric closures and plungers are crucial components in each unit, especially made from butyl rubber and thermoplastic elastomers.

- U.S. Centers for Disease Control and Prevention (CDC): The U.S. alone uses over 1 million medical gloves annually, many of which rely on nitrile and latex elastomers for strength and allergen safety.

- Johns Hopkins Medicine: Advanced silicone elastomers are used in more than 80% of cochlear implants, which restore hearing by integrating soft, flexible materials with electronic interfaces.

- American Society of Plastic Surgeons (ASPS): In 2022, there were over 350,000 breast implant procedures in the U.S., nearly all involving silicone elastomer shells due to their long-term durability and inert properties.

Medical Elastomers Market: Market Dynamics

Artificial Intelligence (AI) is playing a transformative role in the medical elastomers market by streamlining material innovation, production, and quality assurance processes. AI-powered simulation tools enable manufacturers to model the behavior of elastomeric materials under various physiological and mechanical stresses, helping design more durable and biocompatible products faster than traditional R&D methods. Machine learning algorithms can analyze vast datasets from clinical performance, failure analysis, and material interactions to predict the best formulations for specific applications like catheters, implants, or wearable sensors.

In manufacturing, AI is enhancing process control through real-time monitoring of temperature, pressure, and viscosity during elastomer molding and extrusion. This ensures uniform quality, reduces material wastage, and improves scalability. AI-integrated vision systems are also used for automated defect detection in medical components, enhancing safety and compliance with stringent regulatory standards.

Furthermore, AI is aiding in supply chain optimization by forecasting demand for specific medical elastomer types and adjusting inventory accordingly. It also facilitates personalized healthcare by supporting the development of patient-specific elastomeric products, such as customized prosthetics and orthotics. Overall, AI integration is accelerating innovation, reducing time-to-market, and improving product performance in the evolving medical elastomers ecosystem.

Driving Factors in the Medical Elastomers Market

Rising Demand for Medical Devices

The increasing global demand for medical devices is significantly propelling the medical elastomers market. These elastomers offer superior flexibility, biocompatibility, and durability, making them ideal for use in catheters, seals, tubing, and surgical instruments. As healthcare infrastructure expands and minimally invasive surgeries become more prevalent, the adoption of silicone elastomers and thermoplastic elastomers has surged.

Innovations in medical-grade elastomer formulations ensure compliance with stringent regulatory standards, enhancing their appeal among manufacturers. The growing aging population and rising chronic disease incidence also support the consumption of elastomer-based medical components. Additionally, the trend toward home-based healthcare and wearable medical devices continues to boost demand for elastomers with excellent elasticity and skin-contact safety.

Advancements in Elastomer Technology

Technological innovation is a key driver in the medical elastomers market. Development of high-performance materials like liquid silicone rubber (LSR), thermoplastic vulcanizates (TPV), and ethylene propylene diene monomer (EPDM) has improved the mechanical strength and chemical resistance of medical elastomers. These advancements enable manufacturers to produce more complex, miniaturized, and functional medical devices.

Additionally, innovations in injection molding and extrusion processes have improved manufacturing efficiency and precision. The integration of antimicrobial properties and enhanced sterilization compatibility in modern medical elastomer materials further boosts their application across surgical devices and diagnostic equipment. These factors collectively support market expansion, particularly in advanced healthcare markets such as North America, Europe, and parts of Asia-Pacific.

Restraints in the Medical Elastomers Market

Stringent Regulatory Requirements

The medical elastomers market faces hurdles due to rigorous regulatory frameworks imposed by health authorities such as the FDA and EMA. Medical-grade elastomers must comply with biocompatibility, toxicity, and sterilization standards, which often extend product development cycles and increase testing costs.

Manufacturers must conduct extensive clinical trials and documentation to secure approvals, particularly for elastomers used in implantable devices and drug delivery systems. These complex and time-consuming approval processes can deter market entry for smaller companies. Moreover, evolving regulations regarding materials used in healthcare packaging and patient-contact products continue to raise compliance challenges. This regulatory pressure limits innovation speed and poses a significant restraint on market growth, especially for emerging players.

Volatility in Raw Material Prices

Fluctuating prices of petrochemical-based raw materials such as ethylene, propylene, and silicone compounds pose a major restraint to the medical elastomers market. As these base materials are derived from crude oil, global economic and geopolitical uncertainties significantly affect supply chains and production costs. Price volatility increases manufacturing expenses, reducing profit margins for medical device manufacturers.

Additionally, supply disruptions caused by natural disasters or political conflicts can delay production timelines. Smaller manufacturers face greater challenges in absorbing or passing on these costs, resulting in a fragmented competitive landscape. This economic uncertainty undermines investment confidence and can limit the expansion of production capacities for medical-grade elastomers.

Opportunities in the Medical Elastomers Market

Expansion of Healthcare in Emerging Economies

Rapid healthcare infrastructure development in emerging economies such as India, China, Brazil, and Southeast Asia presents vast growth opportunities for the medical elastomers market. Increased government spending on public health systems, rising medical tourism, and growing awareness of advanced medical devices are driving demand for high-performance elastomer components.

Additionally, the surge in local manufacturing and favorable policies encouraging foreign direct investment in medical device production are opening new market avenues. As hospitals and clinics modernize equipment and adopt minimally invasive techniques, the need for biocompatible, sterilizable, and cost-effective elastomer solutions is expected to grow. This trend is especially favorable for thermoplastic elastomers and silicone-based products.

Growth of Wearable and Portable Medical Devices

The increasing adoption of wearable health monitors, diagnostic patches, and portable medical equipment offers a significant opportunity for the medical elastomers market. These devices require elastomers that are skin-friendly, flexible, and durable, such as liquid silicone rubber and thermoplastic elastomers. Rising health awareness, aging populations, and a preference for remote patient monitoring are driving the wearable technology trend in healthcare.

Elastomers are critical for ensuring patient comfort, product reliability, and long-term wearability. Manufacturers are developing customized elastomer grades with breathable, hypoallergenic, and stretchable properties to support this rapidly growing segment. This shift offers new application areas and boosts demand for high-quality medical elastomers.

Trends in the Medical Elastomers Market

Rising Adoption of Sustainable and Bio-Based Elastomers

A notable trend in the medical elastomers market is the growing interest in sustainable and bio-based elastomer materials. With increasing regulatory pressure and environmental concerns, manufacturers are shifting toward greener alternatives that reduce carbon footprints and promote circular economy principles. Innovations in bio-based thermoplastic elastomers derived from renewable feedstocks such as corn starch or castor oil are gaining traction. These materials offer excellent elasticity and biocompatibility while meeting stringent regulatory standards. The healthcare industry is also exploring recyclable elastomer options to reduce medical waste. This trend reflects the convergence of sustainability goals with healthcare innovation, driving demand for eco-friendly elastomeric solutions in medical applications

Integration of Smart Elastomer Materials

Smart elastomers that respond to external stimuli such as heat, light, or pressure are becoming increasingly important in next-generation medical devices. These materials, including shape-memory elastomers and conductive elastomers, are enabling innovations in drug delivery systems, prosthetics, and diagnostic sensors. The trend toward personalized medicine and smart healthcare technologies is accelerating the adoption of responsive materials that improve patient outcomes and treatment precision. Medical elastomers that can change shape or conductivity dynamically are being used in advanced applications like biosensors and minimally invasive surgical tools. This fusion of material science and digital health technologies is reshaping the future of medical elastomer usage.

Medical Elastomers Market: Research Scope and Analysis

By Type Analysis

Thermoplastic elastomers are projected to dominate the global medical elastomers market by the end of 2025, accounting for 56.1% of the total share. Their superior elasticity, easy sterilization, and reprocessability make them a preferred choice in the production of surgical instruments, tubing, and seals. With their widespread use in minimally invasive devices and fluid management systems, they offer significant advantages over conventional materials.

The demand for lightweight and flexible healthcare components continues to surge, further driving the adoption of thermoplastic elastomer compounds in healthcare-grade applications, including wearable medical devices and single-use medical consumables.

Thermoset Elastomers are expected to witness the highest CAGR in the medical elastomers market by 2025. Their exceptional biocompatibility, resistance to high temperatures, and long-term stability make them ideal for demanding medical applications such as implants, infusion therapy components, and precision seals. The rising focus on advanced healthcare devices and long-term implantable materials is driving increased usage of thermoset elastomers.

Furthermore, their compatibility with injection molding processes and resistance to microbial contamination are positioning them as crucial materials in next-generation diagnostic and critical care solutions, contributing to their rapid market growth.

By Technology Analysis

Injection molding is predicted to lead the medical elastomers market by 2025, holding a 47.3% share. This technique is extensively used for manufacturing high-precision components required in diagnostic kits, medical housings, and surgical tools. Its high-speed processing, minimal material wastage, and ability to create complex geometries make it well-suited for high-volume production in sterile environments. As the demand for disposable healthcare products rises, injection molding continues to be favored for its repeatability and cost-efficiency across both thermoplastic and thermoset elastomer categories.

Extrusion technology is projected to exhibit the highest growth rate in the medical elastomers market through 2025. Its application in producing continuous-length items like catheters, peristaltic pump tubing, and vascular access devices is expanding, driven by increasing hospital admissions and chronic disease prevalence. The technique enables customization of tube dimensions and wall thickness while maintaining high purity and consistency, essential for patient safety. Growth in ambulatory and home-care solutions further boosts demand for extruded elastomeric components designed for flexible, portable medical systems.

By Application Analysis

Medical tubing is forecast to dominate the global medical elastomers market by 2025 with a 29.7% share. Used extensively in fluid management, intravenous therapy, and respiratory support, these tubes rely on elastomers for kink resistance, transparency, and chemical inertness. With the increased use of ventilators, dialysis units, and surgical drainage systems, medical-grade elastomers have become indispensable. Their adaptability to various sterilization techniques and patient-contact safety standards solidifies their role in life-supporting medical tubing configurations.

The implants segment is expected to grow at the highest CAGR in the medical elastomers market by 2025. Demand is increasing for biocompatible elastomeric materials used in orthopedic, cardiovascular, and cosmetic implants. The flexibility, mechanical strength, and durability of advanced elastomers like HTV silicone contribute to the success of long-term implantable medical devices. As the global population ages and elective surgeries rise, innovations in bio-elastomer technologies are expanding their application in customized, patient-specific implants with enhanced performance.

By End-user Analysis

Medical device manufacturing is projected to dominate the medical elastomers market by the end of 2025, holding a 44.9% market share. Elastomers are essential in manufacturing a wide range of devices, including drug delivery systems, diagnostic cartridges, and surgical instruments. The surge in demand for portable and wearable health monitoring systems has led to increasing integration of elastomeric parts in devices requiring flexibility, durability, and patient comfort. Regulatory emphasis on safety and hygiene also encourages OEMs to rely on elastomers that meet stringent compliance standards.

The pharmaceutical industry is expected to grow at the fastest CAGR in the medical elastomers market by 2025. The need for high-purity, contamination-free materials in packaging injectable drugs, biologics, and vaccines is accelerating elastomer adoption. Elastomeric closures, stoppers, and seals are critical for maintaining sterility and shelf life of parenteral medications. The expanding demand for biologic therapies and injectable treatments has made elastomers a strategic material in drug containment solutions, fueling rapid growth in this segment.

Impact of AI in Medical Elastomers Market

Artificial Intelligence (AI) is playing a transformative role in the medical elastomers market by streamlining material innovation, production, and quality assurance processes. AI-powered simulation tools enable manufacturers to model the behavior of elastomeric materials under various physiological and mechanical stresses, helping design more durable and biocompatible products faster than traditional R&D methods. Machine learning algorithms can analyze vast datasets from clinical performance, failure analysis, and material interactions to predict the best formulations for specific applications like catheters, implants, or wearable sensors.

In manufacturing, AI is enhancing process control through real-time monitoring of temperature, pressure, and viscosity during elastomer molding and extrusion. This ensures uniform quality, reduces material wastage, and improves scalability. AI-integrated vision systems are also used for automated defect detection in medical components, enhancing safety and compliance with stringent regulatory standards.

Furthermore, AI is aiding in supply chain optimization by forecasting demand for specific medical elastomer types and adjusting inventory accordingly. It also facilitates personalized healthcare by supporting the development of patient-specific elastomeric products, such as customized prosthetics or orthotics. Overall, AI integration is accelerating innovation, reducing time-to-market, and improving product performance in the evolving medical elastomers ecosystem.

The Medical Elastomers Market Report is segmented based on the following:

By Type

- Thermoplastic Polyurethane (TPU)

- Styrene Block Copolymers (SBC)

- Other Thermoplastic Elastomers

- High Temperature Vulcanized (HTV)

- Liquid Silicone Rubber (LSR)

- Room Temperature Vulcanized (RTV)

- Ethylene Propylene Diene Monomer (EPDM)

- Other Thermoset Elastomers

By Technology

- Injection Molding

- Extrusion

- Compression Molding

- Other Technologies

By Application

- Medical Tubing

- Catheters

- Gloves

- Syringes

- Pre-filled Syringes

- Non-Pre-filled Syringes

- Vials

- Medical & Infusion Bags

- Implants

- Other Applications

By End-user

- Hospitals & Clinics

- Pharmaceutical Industry

- Medical Device Manufacturing

- Other End-user

Regional Analysis

Region with the largest Share

North America is projected to hold the largest share in the global medical elastomers market, with a revenue share of 43.5% by the end of 2025. This dominance is primarily driven by advanced healthcare infrastructure, strong presence of medical device manufacturers, and high healthcare spending per capita. The United States accounts for a significant portion of regional demand due to rapid adoption of minimally invasive procedures and the widespread use of elastomer-based components in medical consumables and implants. Moreover, the presence of leading players and active R&D in biocompatible elastomer materials further supports market expansion. Regulatory support from agencies like the FDA for elastomer applications in drug delivery and diagnostics adds to the region’s leadership in the global medical elastomers landscape.

Region with Highest CAGR

Asia Pacific is expected to register the highest CAGR in the medical elastomers market through 2025. This growth is fueled by rising healthcare expenditure, expanding medical tourism, and increasing demand for cost-effective and quality healthcare solutions in countries like China, India, and South Korea. The rapid development of domestic medical device manufacturing, supported by favorable government policies, is encouraging local production of elastomer-based products such as tubing, seals, and wearable sensors. Additionally, a growing elderly population and rising chronic disease burden are increasing the need for advanced medical materials. The expansion of pharmaceutical and diagnostic sectors in the region is further accelerating the use of medical-grade elastomers across a wide array of applications.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Impact of Artificial Intelligence in the Medical Elastomers Market

- Innovative Material Development: Artificial Intelligence accelerates the discovery and optimization of medical elastomer formulations by predicting the ideal balance of elasticity, durability, and biocompatibility. Machine learning models analyze molecular structures and simulate performance under physiological conditions, enabling the rapid development of advanced elastomers for catheters, seals, tubing, and implantable devices.

- Smart Manufacturing and Process Efficiency: AI enhances manufacturing efficiency by monitoring and controlling production parameters such as temperature, pressure, and curing time in real time. Predictive analytics ensure consistent product quality, reduce energy consumption, and minimize material waste, making medical elastomer manufacturing more sustainable and cost-effective while meeting stringent healthcare industry standards.

- Real-Time Quality Control and Safety: AI-powered inspection systems detect defects, contamination, or inconsistencies during production using high-resolution imaging and sensor data. These systems enable real-time adjustments and predictive maintenance, ensuring superior quality and safety of medical elastomer products, which is crucial for their performance in sensitive medical and surgical applications.

- Supply Chain Optimization and Market Responsiveness

AI analyzes market trends, demand forecasts, and supplier performance to streamline the medical elastomers supply chain. By optimizing inventory, reducing lead times, and managing risk, AI ensures timely delivery and adaptability to healthcare demands, especially during crises such as pandemics or supply chain disruptions.

Competitive Landscape

The global medical elastomers market is characterized by intense competition, with key players focusing on innovation, strategic collaborations, and capacity expansion to strengthen their market position. Leading manufacturers such as Dow, DuPont, Trelleborg AB, and Mitsubishi Chemical Group are heavily investing in advanced medical-grade elastomer formulations that offer superior biocompatibility, sterilizability, and mechanical performance.

The competitive landscape is also marked by a growing emphasis on sustainability and the development of recyclable and low-leach elastomeric materials for use in disposable healthcare products and drug delivery systems.

Companies are increasingly aligning their product portfolios with evolving healthcare needs, including minimally invasive surgical devices, flexible diagnostic components, and wearable medical technologies. Strategic partnerships between material suppliers and medical device OEMs are accelerating the commercialization of innovative elastomer solutions tailored to patient-specific applications. Moreover, regional players in emerging markets are gaining traction by offering cost-effective and high-performance elastomers compliant with international regulatory standards.

Research and development activities are focused on enhancing the performance of thermoplastic elastomers, liquid silicone rubber, and EPDM for use in high-purity applications such as catheters, infusion sets, and pharmaceutical closures. As regulatory requirements tighten and demand for advanced medical materials rises, competition in the medical elastomers market is expected to intensify further over the forecast period.

Some of the prominent players in the Global Medical Elastomers Market are:

- Sealed Air Corporation

- Sonoco Products Company

- Smurfit Kappa Group

- DS Smith Plc

- Amcor Plc

- Mondi Group

- Berry Global Inc.

- WestRock Company

- Huhtamaki Oyj

- Pregis LLC

- Storopack Hans Reichenecker GmbH

- UFP Technologies, Inc.

- Pro-Pac Packaging Limited

- Cascades Inc.

- Intertape Polymer Group Inc.

- International Paper Company

- Nefab AB

- Ranpak Holdings Corp.

- Clondalkin Group

- ACH Foam Technologies, LLC

- Other Key Players

Recent Developments

- In June 2025, Dow Inc. introduced a new high-purity silicone elastomer series tailored for implantable medical devices with enhanced biocompatibility and long-term performance.

- In April 2025, DuPont announced the expansion of its medical-grade elastomer portfolio by launching a peroxide-curable EPDM for surgical and diagnostic equipment.

- In November 2024, Wacker Chemie AG opened a new silicone rubber production unit in South Korea to serve the growing demand for medical and healthcare-grade elastomers in Asia.

- In August 2024, Trelleborg Healthcare & Medical introduced a next-generation liquid silicone rubber compound optimized for catheter and drug delivery system components.

- In March 2024, Momentive Performance Materials expanded its R&D facility in Ohio to accelerate innovation in high-performance elastomers for wearable medical devices and diagnostics.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 5,188.7 Mn |

| Forecast Value (2034) |

USD 17,301.9 Mn |

| CAGR (2025–2034) |

14.3% |

| The US Market Size (2025) |

USD 1,898.2 Mn |

| Historical Data |

2019 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Thermoplastic Elastomers, Thermoset Elastomers), By Technology (Injection Molding, Extrusion, Compression Molding, Other Technologies), By Application (Medical Tubing, Catheters, Gloves, Syringes, Vials, Medical & Infusion Bags, Implants, Other Applications), By End-user (Hospitals & Clinics, Pharmaceutical Industry, Medical Device Manufacturing, Other End-user) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Sealed Air Corporation, Sonoco Products Company, Smurfit Kappa Group, DS Smith Plc, Amcor Plc, Mondi Group, Berry Global Inc., WestRock Company, Huhtamaki Oyj, Pregis LLC, Storopack Hans Reichenecker GmbH, UFP Technologies, Inc., Pro-Pac Packaging Limited, Cascades Inc., Intertape Polymer Group Inc., International Paper Company, Nefab AB, Ranpak Holdings Corp., Clondalkin Group, ACH Foam Technologies, LLC, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Medical Elastomers Market size is estimated to have a value of USD 5188.7 million in 2025 and is expected to reach USD 17,301.9 million by the end of 2034.

North America is expected to be the largest market share for the Global Medical Elastomers Market with a share of about 43.5% in 2025.

Some of the major key players in the Global Medical Elastomers Market are Sealed Air Corporation, Amcor Plc, Mondi Group and many others.

The market is growing at a CAGR of 14.3% over the forecasted period.

The US Medical Elastomers Market size is estimated to have a value of USD 1,898.2 million in 2025 and is expected to reach USD 5,895.8 million by the end of 2034.