Market Overview

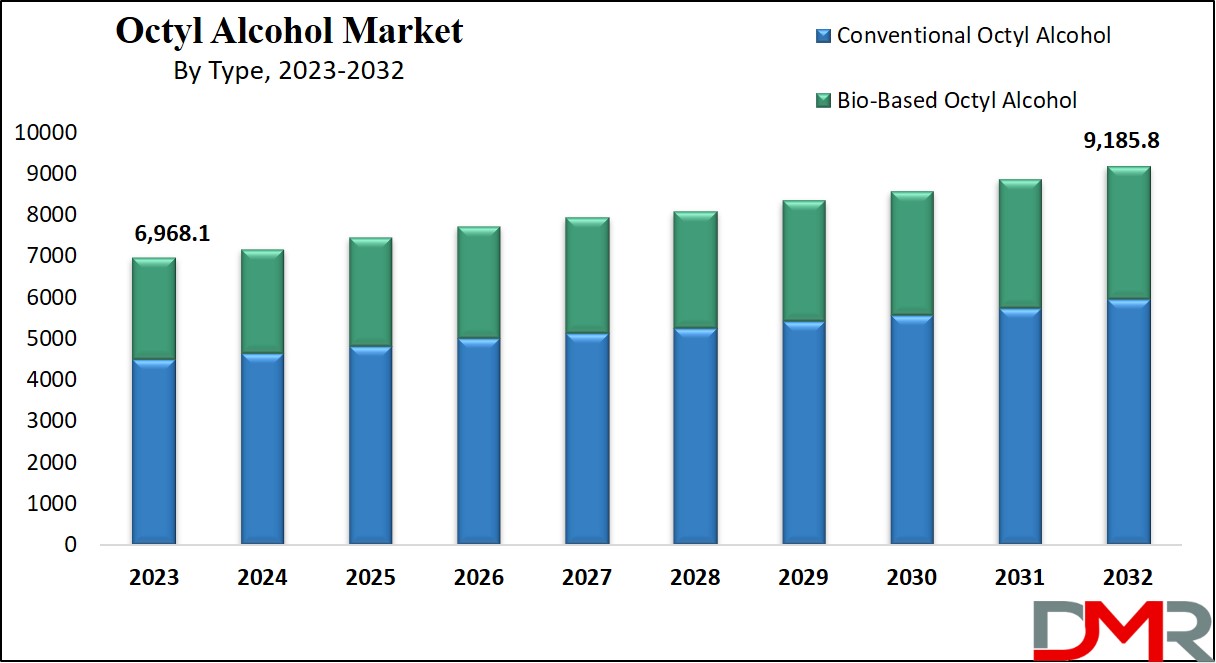

The Global Octyl Alcohol Market size is expected to be worth around USD 9185.8 Million by 2033 from USD 6,968.1 Million in 2023, growing at a CAGR of 3.1% during the forecast period from 2024 to 2033.

This growth is credited to the extensive use of octyl alcohol in several sectors, such as cosmetics, pharmaceuticals, paint & coatings, and cleaning chemicals, etc. Octyl alcohol acts as a versatile intermediate in the production of fragrances, contributing to the creation of esters known for their pleasant sweet, fruity, and floral aromas.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Additionally, its role in the pharmaceutical sector is noteworthy, as it is employed as a valuable tool for evaluating the lipophilicity of drugs and other compounds, as well as a solvent in certain manufacturing processes.

Furthermore, octyl alcohol plays an important role in the production of surfactants, which serve as an essential component utilized in the production of shampoos, detergents, & several products used for cleaning. With its colorless liquid form & mild characteristic odor, octyl alcohol continues to be a key component driving growth in numerous industrial applications.

In general, the outlook for the octyl alcohol sector seems optimistic, owing to its increasing requirement in various fields contributing to continuous expansion. As it finds utility in vital sectors and acts as a fundamental component for medications, perfumes, & surface-active agents, the global octyl alcohol market is set for extended growth in the coming future.

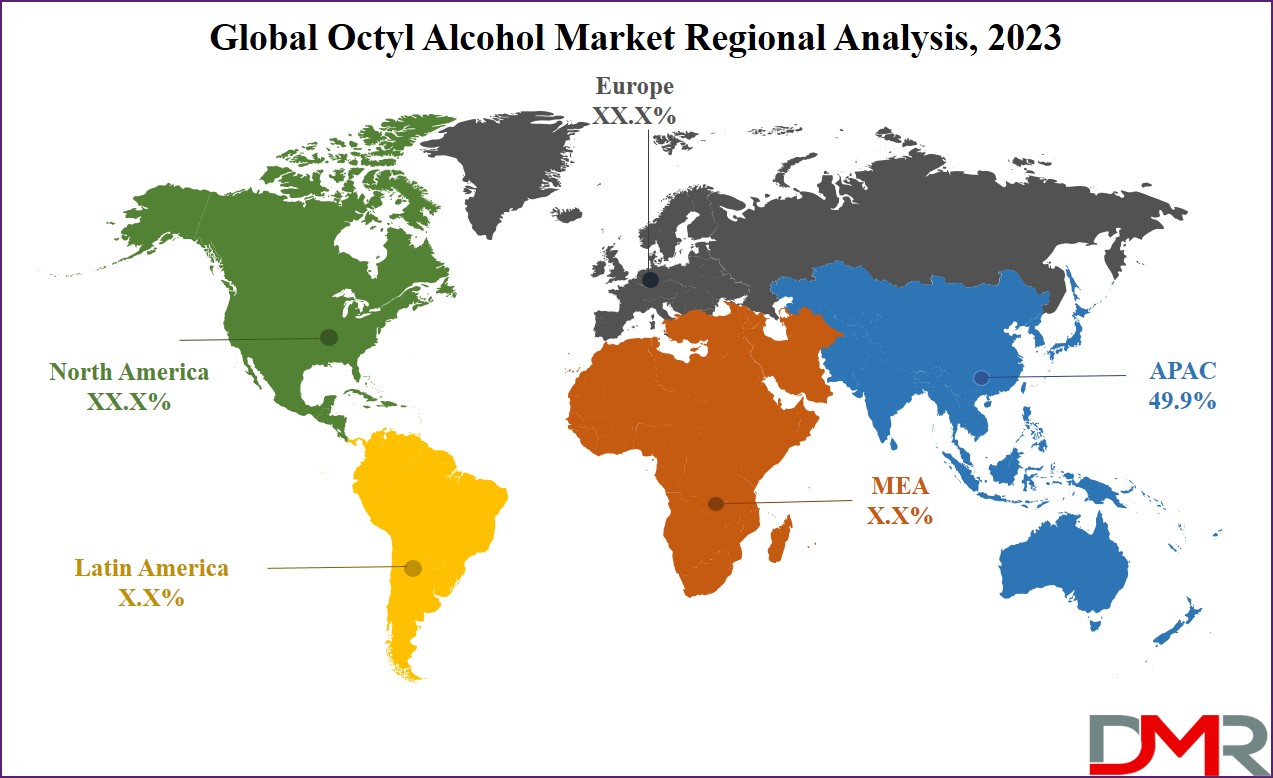

In 2023, the United States rose to become the top consumer of product across North America with a revenue share of over 49.9%. This was driven by expanding application industries such as fragrances and flavors, cosmetics and pharmaceuticals.

According to European Federation of Pharmaceutical Industries and Associations (EFPIA), North America represented approximately 49.1% of global pharmaceutical sales with 64.4% of total new medicine sales coming from the U.S. This trend should only increase during forecast period as growth in key sectors such as pharmaceuticals will likely propel product demand along the way.

Key Takeaways

- Market Growth: The octyl alcohol market is projected to rise from USD 6,968.1 million in 2023 to USD 9,185.8 million by 2033, reflecting a CAGR of 3.1%.

- Major Applications: Octyl alcohol is widely used in cosmetics, pharmaceuticals, paints, coatings, and cleaning chemicals, with key roles in fragrances and industrial surfactants.

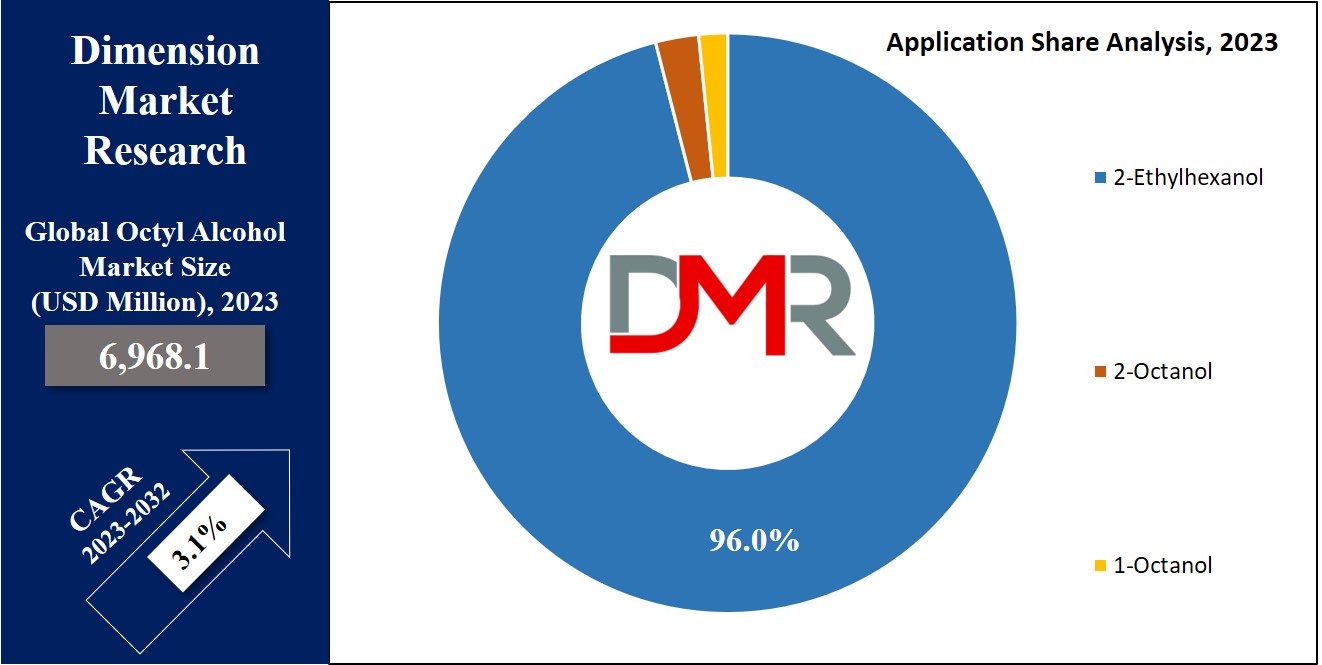

- Dominant Segment: 2-Ethylhexanol leads as the primary segment in 2023, essential for plasticized PVC production in automotive and as a solvent for inks and coatings.

- Sustainability Trend: Manufacturers are investing in bio-based octyl alcohol from renewable resources due to increasing demand for eco-friendly and biodegradable products and tightening regulations.

- Regional Leadership: Asia Pacific held the largest market share of 49.9% in 2023, driven by growing demand for cleaning chemicals, cosmetics, and healthcare.

- Key Market Drivers: Market growth is propelled by rising disposable income, expanding plastic and pharmaceutical industries, and the shift towards natural and sustainable ingredients.

Use Cases

- E-Commerce Personalization: Implementing machine learning algorithms to analyze customer behavior and purchase history to offer personalized product recommendations, improving the shopping experience and increasing sales conversion rates.

- Fraud Detection Systems: Developing advanced fraud detection systems for financial institutions that use real-time data analysis to identify and prevent fraudulent transactions, reducing financial losses and increasing trust among clients.

- Healthcare Diagnostic Tools: Creating AI-driven diagnostic tools that help healthcare professionals diagnose diseases more quickly and accurately by analyzing medical imaging and patient data, thereby improving patient outcomes and operational efficiency.

- Supply Chain Optimization: Utilizing predictive analytics to optimize supply chain operations, forecasting demand and inventory needs accurately, thus reducing costs and improving service delivery in logistics and manufacturing sectors.

- Customer Support Automation: Implementing chatbots and virtual assistants that use natural language processing to handle customer inquiries, providing 24/7 support and freeing up human agents for more complex issues.

Market Dynamic

The Global Octyl Alcohol Market is experiencing significant growth due to several key factors. One of the primary drivers is the rise in disposable income levels, coupled with the increasing popularity of natural and organic cosmetic products. Octyl alcohol, derived from natural sources, aligns with the growing consumer preference for sustainable and eco-friendly ingredients, boosting its demand in the cosmetics sector. The expanding plastic industry also plays a crucial role in the market's growth.

Octyl alcohol is utilized in the production of plasticizers, which are additives that improve the flexibility, & processability of plastics. The increasing use of plasticizers in manufacturing PVC products, coatings, adhesives, & films, especially in sectors such as automotive, construction, electrical, and packaging is propelling the market for octyl alcohol.

Furthermore, increasing industrialization, rapid urbanization, & enhanced infrastructural development are other factors further fueling the demand for several plastic-based products like insulation, cables, pipes, & roofing materials.

The rising demand in North America can be attributed to the growing need from numerous sectors such as flavors & fragrances, pharmaceuticals, & cosmetics, within the nation. The pharma sector, specifically, has been flourishing in the area. Octyl alcohol acts as an intermediary in the production of healthcare compounds & several APIs (active pharmaceutical ingredients.

The increasing number of patients with chronic diseases like cardiovascular disorders, diabetes, obesity & respiratory issues, combined with an increasing old age population, has led to an enhanced demand for such healthcare products. On the whole, these reasons actively encourage ample growth opportunities for the growing global octyl alcohol market.

Driving Factors

Octyl alcohol's widespread usage as an ingredient in plasticizers widely used across polymer and construction industries serves as a key driver of market expansion. Furthermore, its manufacturing of phthalate esters for flexible PVC production further boosts demand.

Furthermore, rising adoption of personal care and cosmetic products that utilize it as an emollient further expands market potential; expansion in industrial applications such as coatings, adhesives and lubricants further drives this expansion; urbanization and infrastructure development especially among emerging economies has created exponential demand for products containing this ingredient.

Trending Factors

The octyl alcohol market is witnessing an upward trend toward sustainability, driven by growing consumer interest in eco-friendly and biodegradable products. Manufacturers are investing in developing bio-based octyl alcohol from renewable sources in order to address environmental concerns. This trend coincides with regulations designed to reduce carbon emissions and promote green chemistry, as well as technological advances that facilitate increased efficiency and cost-effectiveness in production processes.

Furthermore, increased adoption of octyl alcohol across niche applications such as pharmaceuticals and food additives demonstrates its increasing popularity in today's marketplace while emphasizing product diversity and innovation.

Restraining Factors

Fluctuating raw material prices hinder octyl alcohol markets due to their fluctuating nature, directly impacting production costs and profit margins for manufacturers. Petrochemical feedstock poses challenges which create uncertainty for them as manufacturers.

Environmental regulations on synthetic chemical usage present another major barrier, necessitating companies to invest in compliance measures and alternative production methods in order to remain compliant. Competition from functional alternatives, like bio-alcohols and other functional beverages, heightens market pressure further. Limited awareness and accessibility in certain emerging markets also act as barriers, slowing adoption rates and impeding overall market expansion potential.

Opportunity

The increasing focus on renewable resources and sustainable production practices offers significant opportunity for the octyl alcohol market. Bio-based octyl alcohol made from plant-derived feedstock is becoming a mainstream sustainable solution, meeting global sustainability goals while remaining environmentally-friendly.

Expanding applications in emerging markets, spurred on by rapid industrialization and urbanization, present enormous growth potential in Asia-Pacific regions like Southeast Asia. Recent advancements in production technologies such as catalytic processes are allowing more cost-efficient manufacturing, creating opportunities for innovation. Meanwhile, increasing demand for personal care products containing octyl alcohol as a key ingredient provides further market expansion potential.

Research Scope and Analysis

By Type

The octyl alcohol market can be bifurcated into two major categories based on its types. The first category is Conventional Octyl Alcohol, which is produced through conventional methods & widely utilized across several sectors, such as fragrances & flavors, cleaning chemicals used in industries & plasticizers. This type has a well-established presence in the market.

In recent years, the second category, Bio-based Octyl Alcohol, has been gaining popularity because of the rising focus on ecological balance & sustainability. Bio-based octyl alcohol is obtained from natural feedstocks, for example, plant-based sources, serving as an environmentally friendly substitute to conventional sources.

As the awareness regarding sustainability increases, several sectors are taking more interest in complying with eco-friendly policies & manufacturing products, such as bio-based octyl alcohol. This eco-friendly substitute finds its usage in the same sectors as conventional octyl alcohol, & its demand is fueled by the increasing inclination toward environmentally sustainable options.

The segmentation based on types offers customers several options to choose between sustainable & traditional varieties of octyl alcohol based on their particular preferences & requirements. This not only provides more expansion into various areas in the market but also encourages an eco-friendlier approach regarding production & consumption.

By Application

The segment of 2-Ethylhexanol dominates the market with a maximum share in 2023. The major growth driver is its wide usage in several sectors. It acts as a vital ingredient in the manufacturing of plasticized PVC which finds usage in the automotive sector & serves as a solvent for various inks & surface coatings.

Moreover, it acts as a precursor in the production of plasticizers such as DOP (dioctyl phthalate) & as a raw material for the production of acrylate esters, extensively accepted in the production of surface coatings & emulsion paints.

The growth of this segment can be credited to the growing desire for durable & flexible plastics across several sectors like construction, automotive, & packaging. In these sectors, plasticizers help in enhancing several characteristics such as durability, & processability. Furthermore, the rising concerns regarding ecology & health have further propelled the demand for non-phthalate & bio-based plasticizers, further leading to an increased acceptance of 2-Ethylhexanol.

The segment of 1-Octanol is also expected to observe growth by 2032. 1-Octanol, being a fatty alcohol is majorly utilized in the manufacturing process of esters. It is widely used in flavorings & perfumes making it desirable in the food & beverages and the cosmetics sector.

Moreover, in the pharma sector, it is utilized to observe the lipophilicity of healthcare products. These wide applications are anticipated to fuel the demand for 1-Octanol in the market, encouraging its growth in the upcoming years.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Global Octyl Alcohol Market Report is segmented on the basis of the following:

By Type

- Conventional Octyl Alcohol

- Bio-Based Octyl Alcohol

By Application

- 1-octanol

- Flavors & Fragrances

- Pharmaceuticals

- Others

- 2-octanol

- 2-ethyl hexanol

- Plasticizers

- 2-EH Acrylate

- 2-EH Nitrate

Regional Analysis

The Asia Pacific region dominates the octyl alcohol market with a substantial share of 49.9% in 2023. This dominance can be ascribed to the rising demand in cleaning chemicals, cosmetics, & healthcare sectors in the Asia-Pacific region.

Significantly, China's beauty and personal care sector saw a significant rise in transactions, marking an increase of 10% from the previous year, as indicated by the ITA (International Trade Administration). Moreover, the developments in these sectors in India, Japan, & China are anticipated to propel the octyl alcohol market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Significant growth is anticipated in North America also. The pharma sector in Canada ranks among the innovative sectors in the country, positioning itself at the ninth rank globally. Additionally, the second largest pharma market in North America is Mexico, and the fifteenth largest worldwide, as registered by the WEDC (Wisconsin Economic Development Corporation).

The growing adoption of octanol in the healthcare sector is a key factor driving the demand for the product in this region. On the whole, the progression of these sectors in North America & Asia Pacific is driving the demand for octyl alcohol, leading to the growth of the market in upcoming years.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Global Octyl Alcohol Market is characterized by a high level of fragmentation, with numerous regional and international players competing for market share. Throughout the forecasted period, the competition is expected to remain fierce due to the presence of multiple industry participants and rising demand for octyl alcohol in various sectors, including flavors and fragrances, pharmaceuticals, plasticizers, and food and beverage industries.

To gain a competitive edge and ensure sustained profitability, companies in the octyl alcohol market are employing various strategies such as forming partnerships, engaging in mergers, introducing product innovations, and implementing price adjustments.

An illustrative example of this trend occurred in March 2023 when Andhra Petrochemicals Ltd and Bharat Petroleum Corporation Limited raised the prices of 2-ethylhexanol in the Indian market. The decision to increase prices was driven by a combination of higher raw material costs and robust demand for the product in the market.

This strategic move reflects the proactive measures taken by industry players to strengthen their market position and capitalize on favorable market conditions.

However, the market growth is being hindered, particularly in developed regions like North America and Europe, due to the implementation of strict government regulations. Despite these challenges, the market will continue to exhibit competitiveness as octyl alcohol finds applications in a wide range of sectors.

Some of the prominent players in the Global Octyl Alcohol Market are:

- BASF SE

- Arkema S.A.

- Aurochemicals

- Kao Corporation

- SABIC

- Sasol

- Bharat Petroleum

- KLK OLEO

- The Andhra Petrochemicals Limited

- SRL

- Sisco Research Laboratories Pvt. Ltd.

- Ecogreen Oleochemicals

- Other Key Players

Recent Developments

- In January 2025, the direct-to-consumer fragrance startup House of EM5 announced its goal to achieve Rs 24 crore in revenue by the end of the fiscal year. The company also plans to expand its operations globally, leveraging its success in the domestic market.

- In November 2024, Unilever disclosed a €100 million investment aimed at expanding its in-house fragrance design and creation capabilities. This strategic move is designed to enhance product innovation and meet growing consumer demand for bespoke fragrance experiences.

- In February 2025, the founder of Lake & Skye detailed the company's recent acquisition by Tru Fragrance. This acquisition is intended to boost Lake & Skye's market presence and expand its product offerings in the competitive fragrance industry.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 6,968.1 Mn |

| Forecast Value (2032) |

USD 9,185.8 Mn |

| CAGR (2023–2032) |

3.1% |

| Historical Data |

2017 – 2022 |

| Forecast Data |

2023 – 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Conventional Octyl Alcohol, and Bio-Based Octyl Alcohol), By Application (1-octanol, 2-octanol, and 2-ethylhexanol). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

BASF SE, Arkema S.A., Aurochemicals, Kar Corporation, SABIC, Sasol, Bharat Petroleum, KLK OLEO, The Andhra Petrochemicals Limited, SRL, Sisco Research Laboratories Pvt. Ltd., Ecogreen Oleochemicals and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

What is the value of the Global Octyl Alcohol Market?

▾ The Global Octyl Alcohol Market is expected to reach a value of USD 6,968.1 million in 2023.

What is the expected CAGR for the Global Octyl Alcohol Market?

▾ The Global Octyl Alcohol Market is expected to expand at a compounded annual growth rate (CAGR) of

3.1% from 2023 to 2032.

Which region has dominated the Global Octyl Alcohol Market?

▾ The Asia Pacific region dominates the market, accounting for 49.9% of the revenue share in the Octyl

Alcohol Market.

Who are the prominent key players in the Global Octyl Alcohol Market?

▾ Some of the prominent key players in the Global Octyl Alcohol Market include BASF SE, Arkema S.A.,

Aurochemicals, Kar Corporation, SABIC, Sasol, etc.