Market Overview

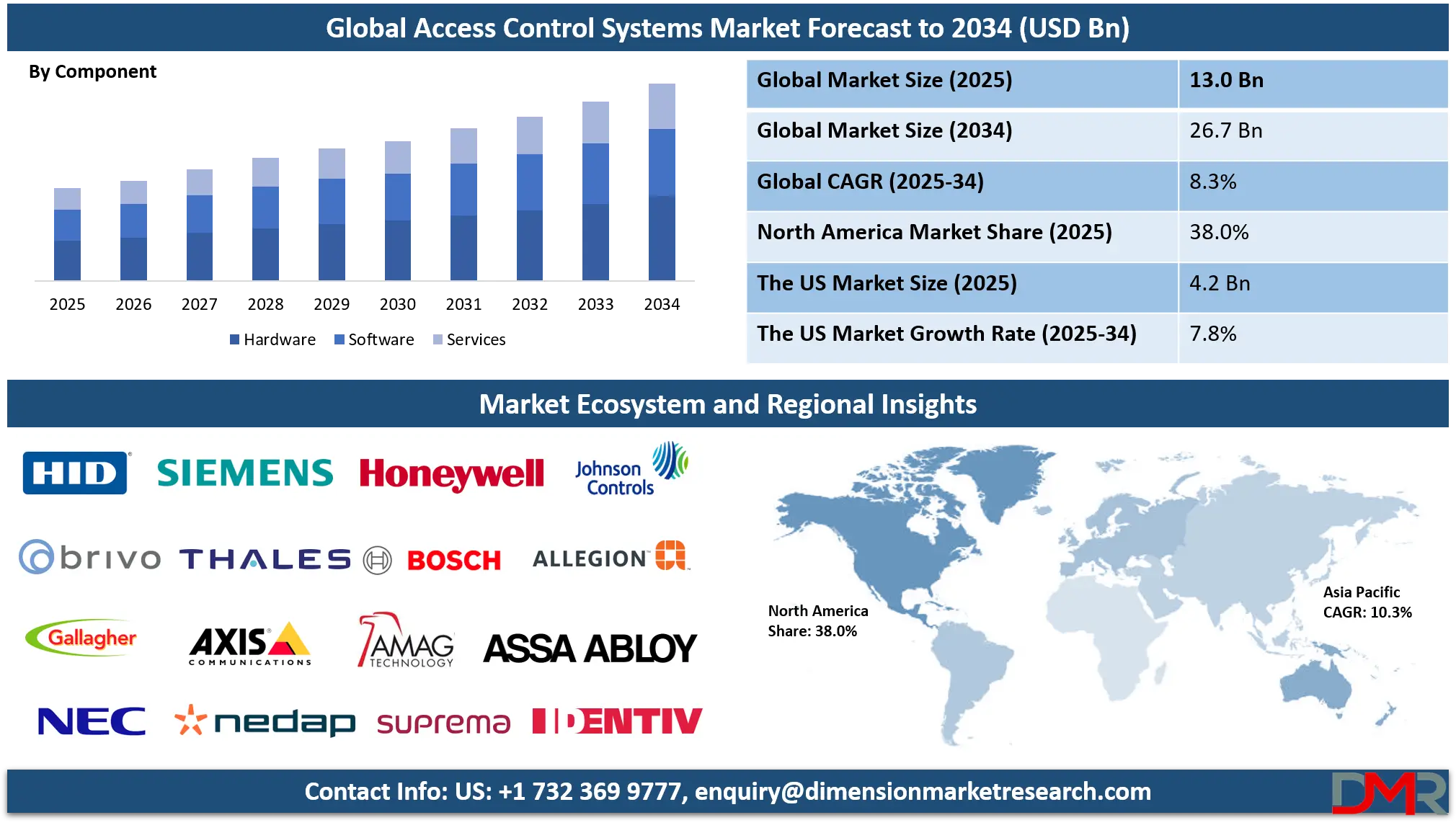

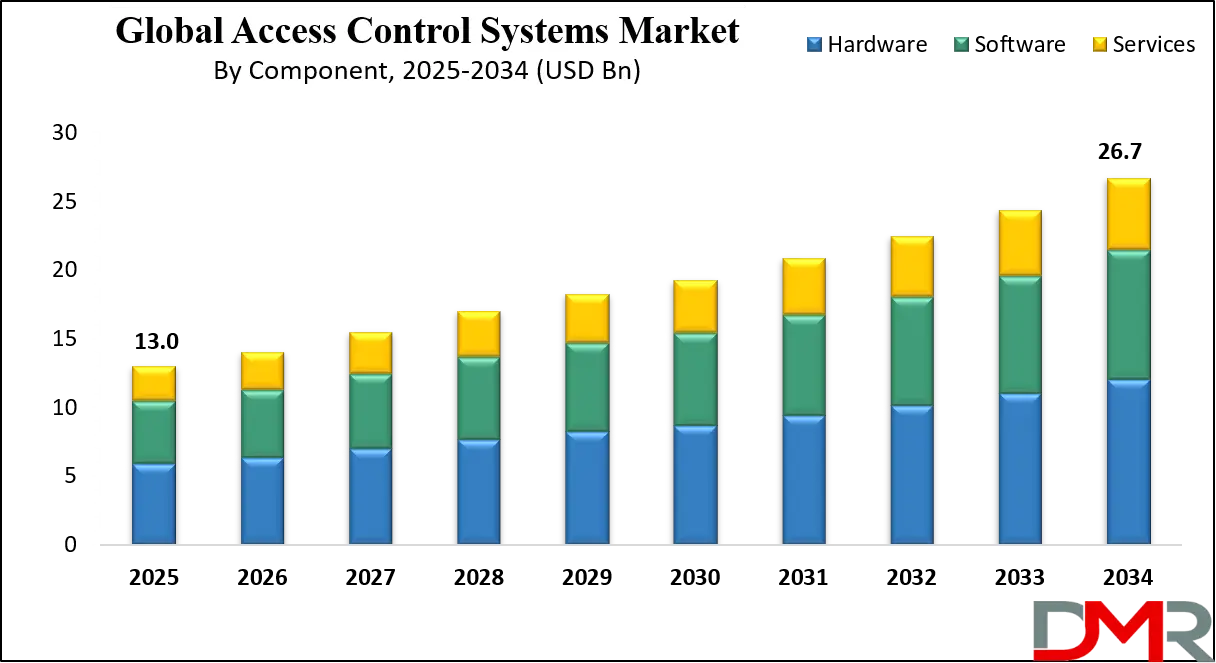

The Global Access Control Systems Market is expected to reach USD 13.0 billion by 2025 and expand at a compound annual growth rate (CAGR) of 8.3%, achieving an estimated USD 26.7 billion by 2034.

The global access control systems market is transforming as organizations align physical security with digital identity frameworks. Enterprises, governments, and institutions increasingly view access as an identity-centric function rather than a collection of hardware devices. This has pushed the adoption of integrated systems that combine card readers, biometric authentication, mobile credentials, and cloud-based management platforms.

A notable trend is the convergence of access control with IT security policies, driven by the rise of hybrid workforces, smart buildings, and resilient critical infrastructure.

Artificial intelligence is also being embedded to enhance anomaly detection, minimize false alarms, and streamline operational decision-making.

Opportunities lie in upgrading legacy mechanical locks and standalone systems to interoperable, software-driven platforms. Healthcare, logistics, and energy facilities are at the forefront of adopting systems that deliver auditable records, multi-site monitoring, and multi-factor authentication. The rise of access control as a service provides flexibility, particularly for small and medium enterprises, by reducing capital expenditure while ensuring scalability. Mobile-based solutions using Bluetooth Low Energy and ultra-wideband signals also open pathways for contactless and seamless user experiences, appealing to end-users prioritizing convenience and hygiene.

Restraints persist in the form of interoperability issues, where older installations cannot seamlessly integrate with modern platforms. Privacy concerns surrounding biometric data remain significant, especially in regions with strict data-protection frameworks. Supply chain challenges for semiconductor components and secure controllers can also delay deployments, while fragmented regulations across regions complicate multinational rollouts.

Despite these challenges, growth prospects are strong. Rising emphasis on workplace safety, stricter compliance requirements, and the modernization of transport and public facilities all reinforce steady investment. Over the coming years, the ecosystem will be increasingly defined by hybrid deployments that balance local control with cloud orchestration, while analytics-driven and identity-centric solutions become the industry standard.

The US Access Control Systems Market

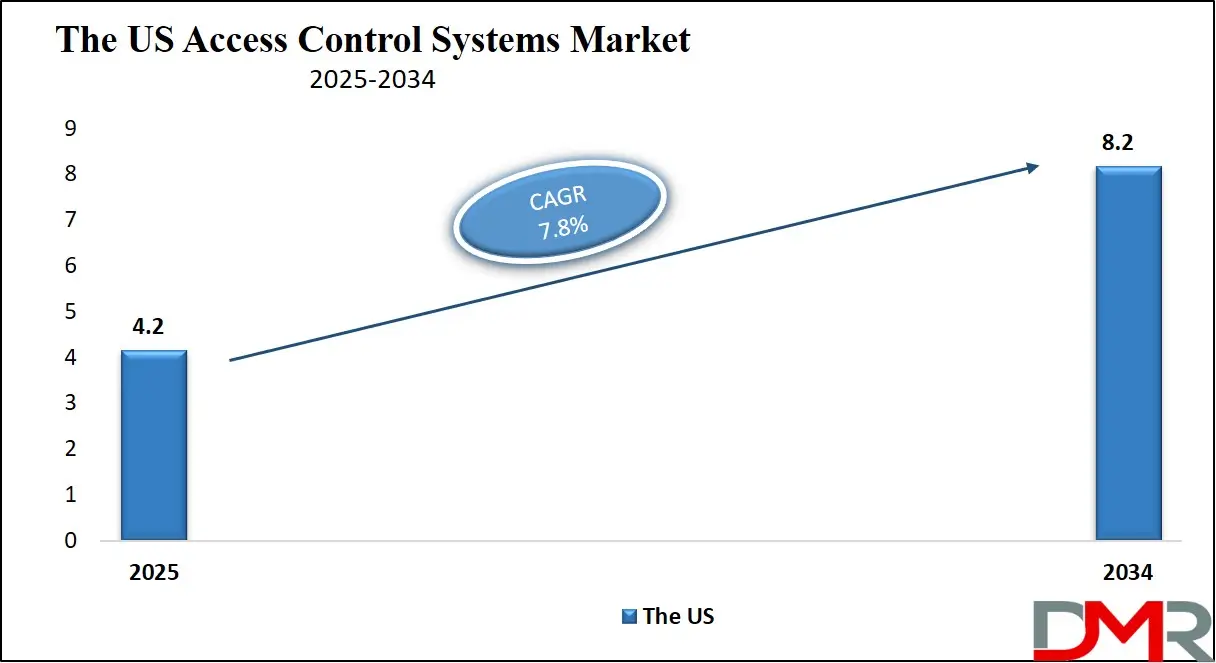

The US Access Control Systems Market is projected to reach USD 4.2 billion in 2025 at a compound annual growth rate of 7.8% over its forecast period.

The United States represents a diverse and strategically important market for access control systems, shaped by its demographic scale, complex infrastructure, and strong regulatory frameworks. According to the U.S. Census Bureau, population growth continues to drive construction in education, healthcare, and residential sectors, each demanding robust security solutions to manage high traffic volumes and protect sensitive facilities. Urban centers such as New York, Los Angeles, and Chicago, with their dense, multi-tenant buildings, create demand for scalable, interoperable systems that integrate with video surveillance and IT identity management platforms.

Government guidance from agencies such as the National Institute of Standards and Technology provides standardized frameworks for access control and identity management. These recommendations directly influence procurement, encouraging adoption of multi-factor authentication and interoperability across federal and state facilities. The Cybersecurity and Infrastructure Security Agency similarly emphasizes resilience in physical and cyber security, pushing organizations in critical infrastructure, energy, and transportation to adopt layered access policies. These official guidelines accelerate market maturity by aligning private-sector investments with national security objectives.

Demographic diversity and geographic spread further shape demand. Large campuses, airports, and logistics hubs require advanced systems with centralized oversight, while smaller businesses prioritize cloud-based and mobile credential solutions that reduce upfront investment. Federal and state initiatives to strengthen school safety, secure healthcare facilities, and modernize transportation nodes reinforce long-term demand. The U.S. advantage lies in its policy-driven environment, where clear standards and demographic scale foster both widespread adoption and innovation in identity-driven security solutions.

The Europe Access Control Systems Market

The Europe Access Control Systems Market is estimated to be valued at USD 1,950.0 million in 2025 and is further anticipated to reach USD 3,898.0 million by 2034 at a CAGR of 8.0%.

Europe’s access control environment is shaped by its dense urban population, advanced infrastructure, and strong regulatory landscape. According to Eurostat, the European Union represents more than 440 million people, creating demand for security systems in commercial buildings, residential complexes, and public facilities. The region’s high level of urbanization—over 75% of citizens living in cities—means transport hubs, housing estates, and mixed-use developments all require scalable access control systems that balance convenience with compliance.

Regulation plays a defining role in market growth. The EU’s General Data Protection Regulation (GDPR) sets strict guidelines for biometric data usage, while the NIS2 Directive mandates heightened security for essential services and critical infrastructure. These frameworks encourage investment in advanced authentication methods while ensuring user privacy and vendor accountability. Pan-European transport corridors, cross-border trade, and migration flows also push governments and businesses toward solutions that are interoperable across member states and capable of handling diverse credential types.

Demographic trends reinforce these needs. Aging populations in several countries increase reliance on automated, contactless systems that reduce staffing requirements, while growing multicultural populations in major cities create demand for flexible, multilingual solutions. Urban centers such as Paris, Berlin, and Madrid emphasize secure mobility within public transit and smart-building ecosystems, further stimulating innovation. The combination of regulatory pressure, demographic diversity, and concentrated infrastructure ensures Europe continues to prioritize access control solutions that are both technologically advanced and socially responsible.

The Japan Access Control Systems Market

The Japan Access Control Systems Market is projected to be valued at USD 780.0 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1,695.0 million in 2034 at a CAGR of 9.0%.

Japan represents a unique access control landscape shaped by demographic realities and a culture of technological innovation. Official statistics highlight an aging population and shrinking workforce, which increases reliance on automation and contactless technologies in both residential and commercial settings. Smart buildings and intelligent infrastructure projects in Tokyo, Osaka, and other metropolitan areas are leading the adoption of mobile credentialing, biometric authentication, and AI-enhanced monitoring systems to reduce operational burden and improve user experience.

Urban density drives demand for scalable systems in high-rise buildings, transportation networks, and healthcare facilities, where efficient and secure flow of people is critical. Japan’s Ministry of Economy, Trade and Industry (METI) also emphasizes the importance of technology standards and resilience in critical infrastructure, guiding procurement decisions in sectors such as manufacturing, logistics, and defense. The country’s strong industrial policy and emphasis on supply chain security foster local development of certified hardware and secure credential management systems.

Cultural and demographic characteristics create distinctive requirements for the market. A strong preference for reliability and longevity encourages the adoption of robust systems with low maintenance needs. At the same time, societal emphasis on privacy shapes how biometric solutions are deployed, requiring vendors to balance high security with compliance and social acceptance. The integration of access control with building management, energy optimization, and disaster preparedness aligns with Japan’s broader smart city and resilience goals, ensuring continued demand for advanced and adaptive security infrastructure.

Global Access Control Systems Market: Key Takeaways

- Global Market Size Insights: The Global Access Control Systems Market size is estimated to have a value of USD 13.0 billion in 2025 and is expected to reach USD 26.7 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 8.3 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Access Control Systems Market is projected to be valued at USD 4.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 8.2 billion in 2034 at a CAGR of 7.8%.

- Regional Insights: North America is expected to have the largest market share in the Global Access Control Systems Market with a share of about 38.0% in 2025.

- Key Players: Some of the major key players in the Global Access Control Systems Market are ASSA ABLOY, dormakaba Group, Johnson Controls, Allegion plc, Honeywell International, Identiv Inc., Nedap N.V., Suprema Inc., Bosch Security Systems, and many others.

Global Access Control Systems Market: Use Cases

- Corporate Security and Workforce Management: Enterprises deploy access control systems to regulate employee entry, integrate time-attendance, and ensure secure access to sensitive areas. Biometric authentication and smart cards reduce insider threats, support compliance with data protection regulations, and enhance workplace productivity through seamless monitoring.

- Healthcare Facility Access and Patient Safety: Hospitals adopt access control systems to safeguard critical areas like ICUs, pharmacies, and data rooms. Multi-factor authentication ensures only authorized medical staff gain access, reducing medication theft, protecting patient records, and enhancing overall hospital safety and regulatory compliance.

- Transportation Hubs and Critical Infrastructure: Airports, metro stations, and seaports leverage advanced access control solutions for passenger, staff, and cargo management. Biometric readers, RFID, and video integration ensure smooth transit operations, prevent unauthorized entry, and enhance public safety across large-scale transportation infrastructures.

- Residential and Smart Home Security: Smart locks, mobile credentials, and wireless authentication systems provide homeowners with greater control over entry points. Remote access via mobile apps enhances convenience, while real-time alerts and integration with surveillance systems strengthen perimeter security in modern residential complexes and smart homes.

- Government and Defense Installations: Military bases and government offices utilize access control systems to secure classified information and restricted facilities. Multi-layered authentication, such as iris scans and card-based systems, prevents espionage, enhances national security, and ensures compliance with defense cybersecurity and data protection protocols.

Global Access Control Systems Market: Stats & Facts

U.S. Census Bureau

- U.S. population reached approximately 340.1 million by December 2024, reflecting steady national demographic expansion.

- Between 2023 and 2024, the United States recorded around 1% year-on-year population growth.

- The senior population aged 65+ in the United States rose to about 61.2 million.

Federal Aviation Administration / Bureau of Transportation Statistics

- The United States maintains 19,482 airports, demonstrating extensive infrastructure requiring enhanced access control technologies.

- Among these, 5,146 are public airports, necessitating advanced security and monitoring access systems nationwide.

- The U.S. operates 527 airport control towers, each demanding strict access security and monitoring solutions.

Cybersecurity & Infrastructure Security Agency (CISA) / U.S. DHS

- U.S. Department of Homeland Security recognizes 16 critical infrastructure sectors requiring robust access control protection.

Eurostat (European Commission)

- The European Union population stood at 450.4 million as of January 2025, highlighting demand.

- Germany, France, Italy, and Spain together comprise over 259 million EU residents needing secure facilities.

- In 2023, 45.2% of EU enterprises reported purchasing cloud computing services for operations.

- Around 39.2% of the EU population lives in urban cities, demanding stronger access solutions.

National Center for Education Statistics (NCES), U.S. Dept. of Education

- In Fall 2022, U.S. public schools enrolled 49.6 million elementary and secondary-level students.

- Approximately 99,200 operating public schools functioned across the U.S. during the 2021–2022 academic year.

- Enrollment across U.S. public K–12 schools is projected to decline 5% between 2022–2031.

International Telecommunication Union (ITU)

- Approximately 5.5 billion people were online in 2024, representing 68% of the global population.

- Around 80% of the global population owns mobile phones, reinforcing mobile-based security credentials adoption.

- Over half the world population has 5G network coverage, supporting next-generation access control systems.

- ITU data reports 93.1% of Americans use the internet, requiring strong digital access security.

OECD

- SMEs account for about 99% of firms in OECD economies, demanding efficient, secure systems.

- OECD notes Amazon and Microsoft together hold 80% market share in several OECD countries.

FBI — Internet Crime Complaint Center (IC3) / U.S. Department of Justice

- Cybercrime and internet fraud cost victims USD 16.6 billion in 2024, emphasizing rising threats.

- Ransomware complaints rose 9% in 2024, creating urgent demand for multi-factor access control solutions.

- Victims aged 60+ reported USD 4.885 billion in 2024 losses from 147,127 cybercrime complaints.

World Health Organization (WHO) / World Bank

- WHO recommends around 2 health facilities per 100,000 population, necessitating secure hospital access management.

- Japan provides 12.6 hospital beds per 1,000 people, versus 2.7 beds in the U.S.

Japan — Government / Statistics

- Japan has around 36.25 million citizens aged 65+, demanding healthcare, residential, and secure facilities.

- Roughly 30% of Japan’s population is elderly, highlighting the increasing need for advanced security systems.

Eurostat / OECD (Cloud Usage Details)

- 75.3% of EU enterprises have adopted cloud advanced services like security applications and hosting.

- Denmark leads cloud adoption, with about 70% of enterprises purchasing cloud services in 2023.

Global Access Control Systems Market: Market Dynamics

Driving Factors in the Global Access Control Systems Market

Rising Urbanization, Infrastructure Expansion, and Smart City Initiatives

Urbanization and the expansion of infrastructure across global economies are key drivers for access control systems adoption. As cities modernize, governments and private stakeholders are investing heavily in smart city projects, advanced transportation hubs, and digital public infrastructure.

Urban population growth increases demand for secure residential complexes, educational institutions, hospitals, and commercial properties, each requiring advanced perimeter and access control solutions. Smart city projects integrate surveillance cameras, access control panels, and biometric authentication into centralized command centers for real-time monitoring and incident response.

Additionally, critical infrastructure projects, including airports, energy grids, and defense facilities, mandate strict regulatory compliance for physical security and identity management. The rise of coworking spaces and hybrid workplaces further accelerates demand for scalable, cloud-based access control systems capable of handling fluctuating occupancy levels. The need to balance safety, efficiency, and sustainability in urban environments is therefore fueling large-scale investments in intelligent, networked access systems globally.

Regulatory Compliance, Data Security Concerns, and Critical Infrastructure Protection

Governments worldwide are enforcing stricter regulations to safeguard critical infrastructure, sensitive data, and public safety. Industries such as healthcare, BFSI, defense, and energy must comply with mandates like GDPR in Europe, HIPAA in the United States, and various cybersecurity standards emphasizing identity verification and access management. Non-compliance results in heavy penalties and reputational damage, pushing organizations to adopt advanced access control solutions with multi-factor authentication, biometric verification, and encrypted data transfer.

Additionally, the rising frequency of cyber-physical threats targeting utilities, financial institutions, and government facilities necessitates layered access management integrating both digital and physical identity protection. Critical infrastructure operators are deploying next-generation access control systems with AI-based threat detection, smart locks, and intrusion alarms to protect against sabotage and insider risks.

Restraints in the Global Access Control Systems Market

High Initial Costs and Complex Integration Challenges

Despite technological advancements, high installation and integration costs remain a significant barrier to widespread adoption of advanced access control systems. Deploying biometric readers, electronic locks, and centralized panels requires substantial capital expenditure, making it challenging for small and medium enterprises with limited budgets. In addition, integration with legacy IT systems, surveillance infrastructure, and building management systems often demands extensive customization, increasing project timelines and costs. Many enterprises also face challenges in aligning access control deployments with existing cybersecurity policies and operational frameworks.

For multinational organizations, deploying standardized access control systems across geographies can become even more complicated due to differing compliance requirements. Maintenance and upgrading of systems to keep pace with evolving threats also add recurring expenses. These financial and technical complexities hinder market penetration, particularly in cost-sensitive regions, limiting adoption to larger enterprises or highly regulated industries with mandated security compliance needs.

Privacy Concerns and Resistance to Biometric Adoption

The growing use of biometric authentication methods in access control is facing resistance due to privacy concerns and ethical debates. Employees and users are often hesitant to provide sensitive biometric data, fearing misuse, data theft, or surveillance overreach. In regions with strong privacy regulations, such as the European Union, strict compliance under GDPR complicates large-scale biometric deployments, particularly where data storage and sharing are involved. Cases of biometric database breaches have also raised questions about whether highly personal data can ever be adequately safeguarded.

Moreover, cultural differences and public perceptions in certain countries slow the adoption of face or iris recognition technologies. Organizations must therefore balance the benefits of biometric security with strong privacy-preserving frameworks, such as anonymization, secure storage, and transparent consent processes. Resistance from end users and regulatory restrictions can significantly limit adoption rates, despite the technological superiority of biometric access systems.

Opportunities in the Global Access Control Systems Market

Integration with Cloud-Delivered Services and Access Control-as-a-Service (ACaaS)

The growing preference for cloud computing presents immense opportunities for Access Control-as-a-Service (ACaaS) models. Traditional on-premises systems often involve high installation and maintenance costs, but cloud-hosted access solutions provide scalability, real-time updates, and centralized monitoring. Organizations can implement subscription-based models, significantly lowering upfront capital expenditure while ensuring continuous compliance with evolving security requirements. Cloud integration also facilitates global deployments, where multinational firms can standardize access protocols across multiple sites from a unified dashboard.

Furthermore, ACaaS integrates seamlessly with enterprise IT ecosystems, allowing interoperability with HR management systems, visitor tracking platforms, and cybersecurity frameworks. Enhanced features such as analytics dashboards, mobile credential management, and AI-powered behavioral monitoring create opportunities for providers to expand value-added services.

Expansion of Biometrics and Next-Generation Authentication Technologies

Biometric authentication covering fingerprint, facial recognition technology, iris scanning, and multimodal systems—presents significant growth opportunities in the access control systems market. As cyber-physical threats escalate, enterprises and governments are adopting advanced biometric solutions to secure sensitive locations such as research labs, defense installations, and healthcare facilities. Unlike traditional cards or PINs, biometrics provide a unique, immutable identity, reducing risks of theft, cloning, or unauthorized sharing.

Multimodal systems combining two or more biometric traits further enhance accuracy and reliability in high-security contexts. Emerging technologies like vein recognition, 3D facial mapping, and behavioral biometrics are expanding applications into airports, border control, and banking. Additionally, consumer acceptance of biometric technologies in smartphones and personal devices accelerates their adoption in workplaces, residential complexes, and educational institutions.

Trends in the Global Access Control Systems Market

Convergence of Access Control with AI, IoT, and Cloud Ecosystems

The global access control systems market is witnessing a major trend in the convergence of artificial intelligence (AI), Internet of Things (IoT), and cloud ecosystems into physical security frameworks. Traditional card-based or keypad systems are being enhanced with intelligent video analytics, biometric verification, and IoT-enabled devices that communicate seamlessly across enterprise environments. AI-driven predictive analytics helps identify anomalies and prevent intrusions proactively, while cloud-based access solutions support real-time data sharing, remote system monitoring, and scalable deployments for organizations with geographically dispersed locations.

For example, multi-factor authentication integrated with AI-powered facial recognition ensures more robust security than legacy systems, while IoT-enabled smart locks and sensors provide data insights for facility management. Cloud-first deployments further enable Access Control-as-a-Service (ACaaS), reducing infrastructure costs and providing easier updates. This trend reflects the market’s shift from static security frameworks toward dynamic, data-driven ecosystems that blend cyber and physical security while enhancing user experience, operational efficiency, and compliance readiness.

Rising Demand for Mobile-Based Access and Contactless Authentication

A significant trend reshaping the access control landscape is the widespread adoption of mobile-based access and contactless authentication methods. Smartphones, wearables, and Bluetooth Low Energy (BLE)-enabled devices are increasingly replacing physical ID cards, tokens, and key fobs. Mobile credentialing offers greater convenience, reduces reliance on physical infrastructure, and provides enhanced flexibility for employees, visitors, and contractors. Enterprises are also moving toward QR code-based temporary passes, virtual badges, and biometric-enabled mobile apps, making access management highly customizable and scalable.

NFC, BLE, and ultra-wideband technologies now support encrypted, real-time communication between devices and access readers, reducing fraud risks. Moreover, integration of mobile credentials into enterprise applications such as HR, visitor management, and employee scheduling enhances efficiency by creating centralized identity management systems. This trend highlights the market’s transition toward digital-first, frictionless access experiences that balance security with seamless usability.

Global Access Control Systems Market: Research Scope and Analysis

By Component Analysis

Hardware is projected to form the cornerstone of the access control systems market, making it the most dominant component category. Devices such as biometric readers, electronic locks, controllers, and smart panels remain indispensable for physical identity verification and entry management. Biometric readers, including fingerprint, iris, and facial recognition systems, are in high demand across high-security industries like healthcare, banking, and government institutions, where accuracy and reliability are paramount. Electronic locks, from magnetic strip to smart wireless locks, have gained traction in residential and commercial buildings due to their ability to offer both enhanced protection and user convenience.

Controllers and panels remain central to system integration, enabling real-time communication with software and databases. Hardware is further benefiting from technological innovations such as IoT sensors, AI-based recognition modules, and wireless connectivity, which increase scalability and adaptability across environments. Despite the growing prominence of cloud and software-based models, organizations continue prioritizing tangible, on-premise hardware investments as the first layer of security infrastructure. This tangible nature reassures organizations that their critical assets are directly protected by physical devices, ensuring ongoing demand.

By Access Control-as-a-Service (ACaaS) Deployment Analysis

Managed ACaaS is anticipated to dominate this deployment segment due to its comprehensive service model, which outsources the management, upgrades, and monitoring of security systems to professional providers. This approach appeals particularly to enterprises, government institutions, and regulated industries that face strict compliance requirements. For example, banks, utilities, and healthcare organizations prefer managed ACaaS because it ensures adherence to security standards while reducing the burden on in-house IT teams. The 24/7 monitoring capabilities of managed service providers address real-time vulnerabilities, helping protect against sophisticated cyber-physical threats.

Moreover, these solutions often integrate advanced capabilities such as AI-powered threat detection, biometric credential management, and mobile-based access controls, delivering enterprise-grade protection without extensive capital investment. Managed ACaaS is also cost-effective, offering predictable subscription-based pricing that eliminates high upfront hardware costs. As cyber threats and regulatory complexities grow, organizations increasingly favor outsourcing to trusted vendors who can ensure robust, compliant, and continuously updated access management. This shift aligns with a broader enterprise trend toward managed IT and security services.

By Authentication Method Analysis

Multi-factor authentication (MFA) is projected to emerge as the dominant authentication method, reflecting a global shift toward layered security approaches that minimize vulnerabilities. Unlike single-factor systems that rely solely on passwords, cards, or PINs, MFA requires two or more credentials, such as biometric verification combined with smart cards or mobile-based tokens. This dramatically reduces risks of credential theft, phishing, or insider misuse, which have become prevalent in today’s digital-first environment. Industries handling sensitive data, such as banking, financial services, government, and healthcare, are leading adopters due to stringent regulations like HIPAA and GDPR.

Enterprises with hybrid or remote workforces also rely on MFA to secure distributed access points while maintaining user convenience through mobile credentialing and biometrics. Additionally, technological advancements have made MFA increasingly user-friendly, cost-efficient, and compatible with cloud platforms, encouraging adoption by mid-sized organizations. With cyberattacks growing in frequency and sophistication, MFA serves as a crucial compliance and resilience strategy, ensuring secure access in both digital and physical environments.

By Connectivity Technology Analysis

RFID and NFC are poised to dominate the connectivity technology segment because of their extensive adoption in high-traffic commercial and industrial environments. RFID cards and NFC-enabled smartphones allow seamless contactless access, reducing entry bottlenecks in locations like airports, corporate campuses, and metro stations. These technologies are highly scalable, making them ideal for organizations with thousands of employees or daily visitors.

NFC’s integration into smartphones and wearables further strengthens its dominance, as users prefer mobile-based access over physical cards. RFID and NFC systems also support multi-function credentials, enabling integration with applications such as time attendance, cafeteria payments, and parking access management.

Compared to newer technologies like UWB, RFID, and NFC are more cost-effective, standardized, and widely compatible with existing systems. They also deliver strong reliability, making them the preferred choice for enterprises seeking affordable yet scalable solutions. Their ability to blend security, convenience, and efficiency ensures ongoing dominance in modern access control ecosystems across both developed and emerging markets.

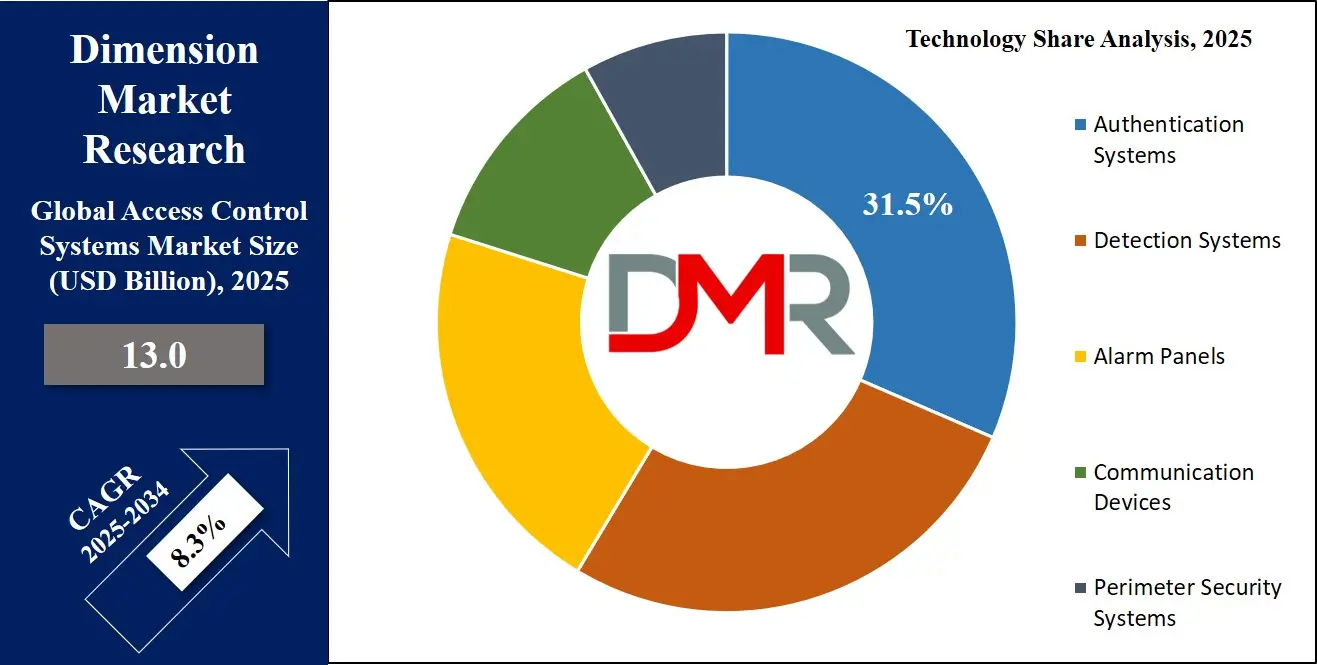

By Technology Analysis

Authentication systems are expected to dominate the technology segment, as they form the frontline defense of access control infrastructures. These systems encompass biometric authentication, smart card readers, mobile credentialing, and PIN-enabled devices that verify user identity before granting access. Biometric and mobile credential systems are replacing legacy card-based models due to their higher security, convenience, and adaptability. In industries such as defense, research, and critical infrastructure, authentication systems are often mandated by regulatory frameworks to ensure only authorized personnel gain entry.

Mobile credentialing has accelerated this dominance further, as smartphones and wearables now act as secure digital keys. These solutions also align with workplace modernization, supporting hybrid offices and smart building ecosystems. Advances in AI, machine learning, and cloud integration continue to enhance the sophistication of authentication systems, making them more resilient against spoofing and identity fraud. As threats become more advanced, authentication remains the most crucial and widely adopted technology within access control systems.

By End-Use Vertical Analysis

Commercial buildings are anticipated to lead the end-use vertical segment, as they represent the largest concentration of employees, contractors, and visitors requiring secure and seamless access daily. Office complexes, IT parks, coworking spaces, and retail outlets rely on scalable systems to ensure smooth operations and compliance with workplace security regulations. Card-based RFID and NFC solutions dominate in corporate environments due to their cost-effectiveness and ease of management, while advanced biometric authentication is increasingly adopted in IT, finance, and legal firms where data protection is paramount. Coworking spaces drive additional demand for mobile-enabled solutions that allow flexible, short-term credentialing integrated with booking platforms.

The retail sector also contributes significantly, leveraging access control for securing stockrooms, inventory management areas, and customer-facing sections. Moreover, the growing adoption of smart building technologies allows access control to integrate seamlessly with HVAC, surveillance, and energy systems, enhancing operational efficiency. With urbanization, hybrid work models, and smart office trends expanding globally, commercial buildings will continue to dominate adoption.

The Global Access Control Systems Market Report is segmented on the basis of the following:

By Component

- Hardware

- Card / Proximity / Smart-card Readers

- Biometric Readers

- Fingerprint

- Face

- Iris

- Multimodal

- Electronic Locks

- Magnetic

- Electric Strike

- Deadbolt

- Wireless Smart Lock

- Controllers and Panels

- Authentication Systems

- Biometric

- Card-Based

- Touch Screen & Keypads

- Detection Systems

- Motion Detector

- Glass Break Detector

- Door/Window Sensors

- Intruder Alarm Systems

- Door Contacts

- Software

- Access Control Management Suites

- Video Management Integration Plug-ins

- Services

- Training & Consulting

- Installation & Integration

- Maintenance & Support

- Access Control as a Service (ACaaS)

By Access Control-as-a-Service (ACaaS) Deployment

- Hosted ACaaS

- Managed ACaaS

- Hybrid ACaaS

By Authentication Method

- Single-Factor Authentication

- Multi-Factor Authentication

- Mobile Credential / Bluetooth LE

By Connectivity Technology

- RFID / NFC

- Smart Cards (125 kHz, 13.56 MHz)

- Bluetooth Low Energy (BLE)

- Ultra-Wideband (UWB)

By Technology

- Authentication Systems

- Detection Systems

- Alarm Panels

- Communication Devices

- Perimeter Security Systems

By End-Use Vertical

- Commercial Buildings

- Industrial & Manufacturing

- Government & Public Sector

- Military & Defense Installations

- Transport & Logistics

- Healthcare Facilities

- Residential & Smart Homes

- Education & Research

- Energy & Utility Infrastructure

- Hospitality & Entertainment

- Retail & Customer-Facing

- Financial Institutions

- Other End User

Impact of Artificial Intelligence in the Global Access Control Systems Market

- Enhanced Biometric Authentication: AI improves the accuracy of facial, fingerprint, and iris recognition in real-time, minimizing false positives, preventing spoofing, and ensuring robust identity verification in high-security sectors such as BFSI, healthcare, government, and critical infrastructure.

- Intelligent Video Analytics: AI-powered video analytics integrate with access control systems, providing real-time anomaly detection, automated threat alerts, and proactive surveillance, strengthening security in airports, corporate campuses, educational institutions, and public-sector facilities.

- Predictive Facility Management: AI analyzes entry-exit patterns to anticipate maintenance, optimize access permissions, and improve operational efficiency while ensuring compliance, reducing costs, and enhancing security across commercial buildings, industrial facilities, and smart city infrastructure.

- Adaptive Authentication: AI enables context-aware authentication by adjusting access requirements based on behavior, device, or location, ensuring flexible yet secure multi-factor authentication for enterprises with hybrid workplaces and sensitive data environments.

- IoT and Smart Building Integration: AI seamlessly connects with IoT devices and smart systems, automating access decisions, coordinating alarms, surveillance, and communication devices, and supporting energy-efficient, fully integrated security management for large-scale commercial and industrial facilities.

Global Access Control Systems Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to hold the dominant position in the global access control systems market with 38.0% of the total market revenue by the end of 2025, driven by a combination of advanced technological adoption, stringent regulatory frameworks, and strong infrastructure investment. The United States, Canada, and Mexico are home to major enterprises, government institutions, and critical infrastructure facilities that prioritize security solutions incorporating multi-factor authentication, biometric readers, and AI-powered access management.

Regulatory standards such as the Health Insurance Portability and Accountability Act (HIPAA) in healthcare, the Federal Information Security Management Act (FISMA) for government facilities, and strict cybersecurity mandates in banking and finance require advanced access control solutions.

North American organizations also benefit from high IT penetration, skilled workforce, and widespread awareness of cyber-physical security risks, encouraging rapid deployment of integrated systems, including managed ACaaS and cloud-based authentication solutions. Urbanization, large-scale commercial and industrial construction, and smart building initiatives further drive adoption in corporate offices, airports, and educational campuses.

Additionally, North America is a hub for innovation and R&D in IoT, AI, and biometric technologies, which accelerates the development of next-generation access systems. The presence of leading global vendors such as Honeywell, Johnson Controls, and Allegion ensures the availability of high-quality solutions with robust support services.

Region with the Highest CAGR

Asia Pacific is expected to record the highest compound annual growth rate (CAGR) in the access control systems market due to rapid urbanization, industrialization, and increasing security awareness across emerging economies. Countries such as China, India, Japan, and South Korea are investing heavily in smart city initiatives, advanced commercial complexes, and digital infrastructure, all of which require scalable and integrated access control solutions.

The growing adoption of IoT-enabled systems, mobile credentials, and biometric authentication is fueled by government programs for public safety, critical infrastructure protection, and transportation modernization. Technological partnerships with leading North American and European vendors introduce advanced systems to the region, accelerating adoption rates. Rising urban populations and the shift toward hybrid workplaces create continuous demand for flexible and scalable access control technologies.

In addition, the rising number of multinational corporations, IT parks, and manufacturing hubs in the region drives demand for robust security frameworks that integrate cloud-based management, video analytics, and multi-factor authentication. Asia Pacific’s growth is further supported by favorable government incentives, regulatory modernization, and increasing cybersecurity awareness among businesses. SMEs and residential complexes are also adopting cost-efficient solutions like RFID/NFC and managed ACaaS to balance security with operational efficiency.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Access Control Systems Market: Competitive Landscape

The competitive landscape of the global access control systems market is characterized by a mix of established multinational corporations and emerging technology-focused vendors. Leading companies such as Honeywell International Inc., Johnson Controls International, Allegion PLC, ASSA ABLOY AB, and Bosch Security Systems dominate through extensive product portfolios spanning hardware, software, and managed services.

These players focus on innovation, mergers, acquisitions, and strategic partnerships to expand global reach and enhance technological capabilities. For instance, Honeywell integrates AI-driven video analytics and IoT-enabled devices into its access control solutions, while Johnson Controls emphasizes scalable and cloud-based ACaaS deployments for enterprises and government sectors.

Emerging players, particularly in the Asia Pacific, are leveraging cost-effective, mobile, and cloud-integrated solutions to penetrate small-to-medium enterprise segments. Companies like Hikvision Digital Technology Co. Ltd. and Suprema Inc. focus on biometric authentication, RFID, and multi-factor systems, emphasizing local compliance and affordability. Product differentiation is achieved through advanced authentication methods, connectivity technologies like Bluetooth Low Energy (BLE) and ultra-wideband (UWB), and comprehensive end-to-end service offerings including installation, maintenance, and managed ACaaS.

The market remains highly competitive due to rapid technological evolution, increasing demand for AI and IoT-enabled systems, and the need for robust cybersecurity in access control frameworks. Strategic collaborations, continuous R&D investments, and expanding service portfolios are essential for maintaining market leadership, ensuring companies stay ahead in both mature markets like North America and high-growth regions like the Asia Pacific.

Some of the prominent players in the Global Access Control Systems Market are:

- ASSA ABLOY

- dormakaba Group

- Johnson Controls

- Allegion plc

- Honeywell International

- Identiv, Inc.

- Nedap N.V.

- Suprema Inc.

- Bosch Security Systems GmbH

- Thales Group

- AMAG Technology

- Axis Communications AB

- NEC Corporation

- Gallagher Group Limited

- Brivo Systems, LLC

- SALTO Systems S.L.

- Genetec Inc.

- HID Global Corporation

- Siemens

- Cansec Systems

- Other Key Players

Recent Developments in the Global Access Control Systems Market

May 2024

- Investment: Fingerprint Cards (FPC) announced a strategic investment in Access of Things (AoT), a pioneer in passwordless, phish-proof multi-factor authentication. This move aims to integrate advanced biometrics into the rapidly growing Internet of Things ecosystem.

- Collaboration: HID, a worldwide leader in trusted identity solutions, and Thales announced a collaboration to accelerate the adoption of Mobile IDs. The partnership will enable seamless integration of Thales's digital identity wallet technology with HID's secure access control systems.

April 2024

- Conference/Expo: ISC West (April 9-12, Las Vegas, USA) was the largest security industry trade show in the U.S. for the year. Major themes included the proliferation of AI-powered video analytics integrated with access control, the emphasis on cyber-hardened readers and controllers, and new solutions for hybrid work environments.

- Product Launches: Major manufacturers like LenelS2 (carrier of Blue Diamond), Allegion, and Genetec unveiled new mobile credentialing platforms and enhanced multi-modal biometric readers.

- Merger/Acquisition: Motorola Solutions completed its acquisition of Noggin, a global provider of cloud-based business continuity and physical security management software. This acquisition strengthens Motorola's command center software portfolio by adding Noggin's integrated risk management, emergency management, and incident response capabilities.

March 2024

- Investment: Openpath, a division of Motorola Solutions, announced a significant expansion of its Partner Advantage Program, investing in enhanced training, support, and co-marketing funds for its network of security integrators to push the adoption of its mobile-first access control solutions.

- Collaboration: ASSA ABLOY announced a deeper integration between its CLIQ® mechatronic locking system and Bosch Building Technologies' access management system, providing a more seamless and secure experience for managing doors across large campuses.

February 2024

- Development/Product Launch: Verkada launched its new AC62 wireless door controller, significantly expanding its ecosystem for modern, cloud-based access control that integrates natively with its video security and environmental sensors.

January 2024

- Merger/Acquisition: ACRE (a holding company for brands like RS2, Open Options, and Feenics) acquired Siemens AG's Access Control System (ACS) product portfolio. This strategic move expands ACRE's product offerings and customer base, particularly in the European market.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 13.0 Bn |

| Forecast Value (2034) |

USD 25.7 Bn |

| CAGR (2025–2034) |

8.3% |

| The US Market Size (2025) |

USD 4.2 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software, Services), By ACaaS Deployment (Hosted, Managed, Hybrid), By Authentication Method (Single-Factor, Multi-Factor, Mobile Credential/Bluetooth LE), By Connectivity Technology (RFID/NFC, Smart Cards, Bluetooth Low Energy, Ultra-Wideband), By Technology (Authentication Systems, Detection Systems, Alarm Panels, Communication Devices, Perimeter Security Systems), By End-Use Vertical (Commercial Buildings, Industrial & Manufacturing, Government & Public Sector, Military & Defense, Transport & Logistics, Healthcare, Residential & Smart Homes, Education & Research, Energy & Utilities, Hospitality & Entertainment, Retail & Customer-Facing, Financial Institutions, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

ASSA ABLOY, dormakaba Group, Johnson Controls, Allegion plc, Honeywell International, Identiv Inc., Nedap N.V., Suprema Inc., Bosch Security Systems, Thales Group, AMAG Technology, Axis Communications, NEC Corporation, Gallagher Group, Brivo Systems, SALTO Systems, Genetec Inc., HID Global, Siemens, Cansec Systems., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Access Control Systems Market size is estimated to have a value of USD 13.0 billion in 2025 and is expected to reach USD 26.7 billion by the end of 2034.

The market is growing at a CAGR of 8.3 percent over the forecasted period of 2025.

The US Access Control Systems Market is projected to be valued at USD 4.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 8.2 billion in 2034 at a CAGR of 7.8%.

North America is expected to have the largest market share in the Global Access Control Systems Market with a share of about 38.0% in 2025.

Some of the major key players in the Global Access Control Systems Market are ASSA ABLOY, dormakaba Group, Johnson Controls, Allegion plc, Honeywell International, Identiv Inc., Nedap N.V., Suprema Inc., Bosch Security Systems, and many others.