Market Overview

It is Anticipated that the U.S. Market for Acellular Dermal Matrices will reach a market value of 3.7 USD billion in 2024 and will surge higher to USD 9.8 billion by 2033 at a CAGR of 11.4% in the forecast period (2024 - 2033).

Acellular dermal matrices are a type of Biological Material that is derived from human or animal skin tissue that has been treated to extract as many cells as possible while leaving behind ECM components available for use. The extracellular matrix (ECM) which consists of structural proteins such as collagen, elastin, and glycosaminoglycans is the natural scaffold onto which the tissue regeneration and repair takes place, making it a cornerstone of Regenerative Medicine.

ADMs are an important tool for several surgical operations, which include

wound care, breast reconstruction, hernia repair, and facial reconstruction.

Key Takeaways

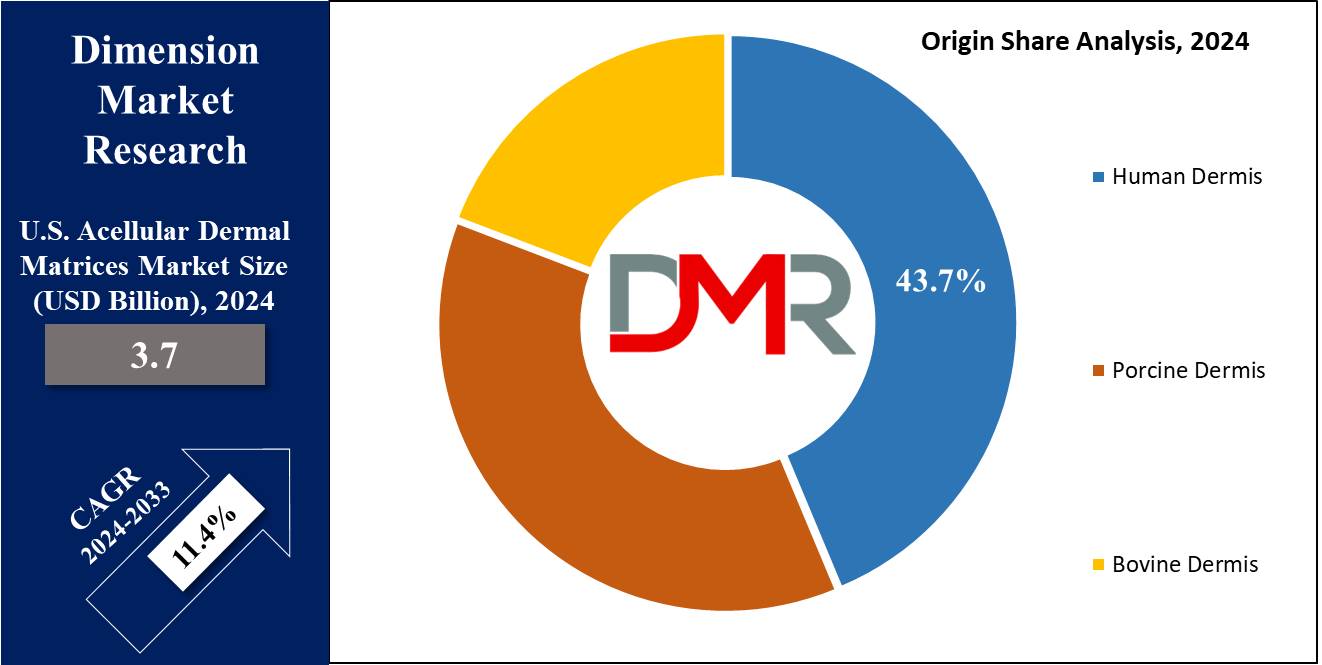

- Human dermis is expected to dominate the United States acellular dermal matrices market based on origin as they hold 43.7% of the market share by the end of 2024.

- Reconstruction procedures are anticipated to command a substantial portion of the United States acellular dermal matrices market in 2024.

- Hospitals are projected to dominate the end-user segment in the United States acellular dermal matrices market with 66.9% of the market share by the end of 2024.

- The U.S. Acellular Dermal Matrices Market size is estimated to have a value of USD 3.7 billion in 2024 and is expected to reach USD 9.8 billion by the end of 2033.

- The market is growing at a CAGR of 11.4 percent over the forecasted period.

Use Cases

- Breast Reconstruction: ADMs aid in breast reconstruction post-mastectomy, imparting aid and contour at the same time as minimizing donor website site morbidity, and enhancing the results.

- Wound Care: ADMs help in the healing of persistent wounds like diabetic ulcers by imparting a scaffold for mobile migration and tissue regeneration, a key application in Advanced Wound Care.

- Hernia Repair: Used in hernia repair surgical procedures, ADMs improve weakened belly walls, reduce recurrence rates, and support tissue ingrowth for durable repairs.

- Facial Reconstruction: ADMs facilitate facial reconstruction following trauma or most cancers resection, restoring tissue, contour, and characteristics while minimizing scarring, which is also a focus in Medical Aesthetics.

Market Dynamic

The acellular dermal matrices market in the United States is growing rapidly due to the rise in demand for these matrices in surgical procedures like breast reconstruction and hernia. This generates innovation among manufacturers who compete to have their products at the best price to get a market share within the industry. Surgeons and healthcare providers determine what product to buy by looking at the effectiveness of the product and its safety.

Furthermore, regulatory policies like FDA approval standards maintain product quality and safety control, which might influence market dynamics as well as entry barriers. Progress in

biotechnology creates avenues of biotechnological innovations resulting in the development of newly improved products and a greater diversity in their clinical application. Furthermore, the demographic trends with an aging population and more people with long-term illnesses contribute to market development. In general, the US market for ADMs market has been seeing changes in the background of these factors as the effect of the demand trend, deadlock on competition, and regulatory influence and also due to technology development.

Research Scope and Analysis

By Origin

Human dermis is expected to dominate the United States acellular dermal matrices market based on origin as they hold 43.7% of the market share by the end of 2024. The nature of the raw materials from which these ADMs are made, also ensures they are intrinsically biocompatible, thus lowering risks of undesirable reactions and immunity flares that might be triggered if an equally performed composite were implanted instead. Biostimulators that follow the host tissue's composition of natural tissues pose the lowest risk of triggering immune responses against them when used for transplantation. This is in contrast to xenogeneic counterparts.

The application of a strict screening and filtering approach substantially prevents spreading the of diseases that often pose a big problem in terms of security. ADMs that are derived from humans promote a more integral restoration of tissue and regeneration, accelerated by the presence of structural and chemical similarities to our native tissue. The innate and acquired immune response, followed by enhanced cellular infiltration, vascularization, and remodeling are the key features of implant integration that improve tissue functionality and long-term stability in tissue reconstructions. The measures of strict safety strongly appeal to the healthcare providers and the patients about the potential effectiveness and safety of this hum dermis-derived ADM.

By Application

Reconstruction procedures are anticipated to command a substantial portion of the United States acellular dermal matrices market in 2024. The reconstructive procedures are highly popular among individuals who want to restore their damaged tissues as the reconstructive procedures can mimic the constitution and look of the natural tissue. ADMs are going to have widespread roles in surgeries such as breast reconstruction after mastectomy, reconstruction after an accident, or cancer resection while undergoing abdominal wall rehabilitation due to a hernia.

ADMs act as a matrix for tissue regeneration which leads to cell ingrowth and to the native tissue remodeling that would be crucial in achieving optimal outcomes. The biomechanical properties of the implants, which have been designed to be strong and flexible, will offer the needed support for the regenerated tissue. Above all, the multifunctionality of ADMs enables them to be used for a wide range of different types of anatomical defects and surgical sites, implying their dominance in diverse reconstructive operations.

By End User

Hospitals are projected to dominate the end-user segment in the United States acellular dermal matrices market with 66.9% of the market share by the end of 2024. Hospitals are the most popular place for surgeries with ADM features because they have a higher level of surgical facilities and highly trained staff. They provide complete care as a comprehensive model integrating preoperative and postoperative services with specialist care into their network.

The intensity of inpatient care, including nursing and constant monitoring, can be employed when necessary. The hospital is also strengthened by existing referral networks to the primary caregivers and specialists which further bolster its dominant status. Hospitals have the benefit of diverse health services, which enables them to offer a smooth experience for patients who go through complicated reconstructive surgeries or other processes where ADMs are involved, thus making sure that the treatment is safe, effective, and continuous.

The U.S. Acellular Dermal Matrices Market Report is segmented on the basis of the following:

By Origin

- Human Dermis

- Porcine Dermis

- Bovine Dermis

By Application

- Reconstruction Procedures

- Abdominal Wall Procedures

- Breast Procedures

- Orthopedic Procedures

- Others

- Chronic Wounds

- Diabetic Foot Ulcers

- Venous Leg Ulcers

- Pressure Ulcer

- Others Acute Wounds

- Burns

- Trauma

- Cancers

- Infections

By End User

- Hospitals

- Ambulatory Surgical Centers

- Office Based

Competitive Landscape

The competitive landscape of the United States acellular dermal matrices market is tremendously competitive as healthcare is an industry that is intricately linked with regenerative medicine and tissue engineering. The matrices that have the absence of cellular components are involved in complex surgical procedures of different levels such as reconstructing the breast, repairing the hernia, and providing care to wounds.

This area is home to some well-recognized pharmaceutical brand names including Allergen, Integra LifeScience, Acelity, MiMedx Smith & Nephew, and many others. Like the subsidiary of AddVie, Allergan emerges as a leading player in the United States acellular dermal matrices market due to its widely popular product Alloderm which is used in reconstructive surgeries. Another method the U.S. market players are expanding their influence is by utilizing organic and inorganic growth strategies like mergers, collaborations, acquisitions, research, and development to improve their product portfolio and market position.

Some of the prominent players in the U.S. Acellular Dermal Matrices Market are

- Integra Life Sciences Corporation

- AbbVie Inc.

- Johnson & Johnson

- Hans BioMed

- Becton, Dickinson and Company

- Smith & Nephew Plc.

- Reprise Biomedical

- Organogenesis Holdings Inc.

- Tissue Regenix

- Zimmer Biomet Holdings Inc.

- Stryker Corporation

- PolyNovo Limited

- Fidia Pharma USA Inc.

- Baxter International Inc.

- Other Key Players

Recent Development

- In November 2023, the FDA granted IDE to RTI Surgical for a breast reconstruction device trial. Trial to start H1 2024 in US sites, testing safety/effectiveness of dermal matrix.

- In October 2023, MTF Biologics gained FDA approval for a clinical study on FlexHD Pliable in breast reconstruction, marking a milestone for human acellular dermal matrix use.

- In March 2023, Bimini Health Tech acquired exclusive rights to Acellular Dermal Matrix (ADM) technology for reconstructive surgery, expanding its product portfolio and aiming for global leadership.

- In November 2022, Meccellis Biotech closed $8.25M Series B funding to launch its biological implant tech in the US, with Ocean Participations and other investors contributing.

- In March 2022, Smith&Nephew's study in Advances in Wound Care Journal shows that GRAFIX Cryopreserved Placental Membrane halves DFU recurrence rates compared to leading cellular therapies for Medicare patients.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 3.7 Bn |

| Forecast Value (2033) |

USD 9.8 Bn |

| CAGR (2023-2032) |

11.4% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Origin (Human Dermis, Porcine Dermis, and Bovine Dermis), By Application (Reconstruction Procedures, Chronic Wounds, Others Acute Wounds), By End User (Hospitals, Ambulatory Surgical Centers, and Office Based) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Integra Life Sciences Corporation, AbbVie Inc., Johnson & Johnson, Hans BioMed, Becton, Dickinson and Company, Smith & Nephew Plc., Reprise Biomedical, Organogenesis Holdings Inc., Tissue Regenix, Zimmer Biomet Holdings Inc., Stryker Corporation, PolyNovo Limited, Fidia Pharma USA Inc., Baxter International Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The U.S. Acellular Dermal Matrices Market size is estimated to have a value of USD 3.7 billion in 2024 and is expected to reach USD 9.8 billion by the end of 2033.

Some of the major key players in the U.S. Acellular Dermal Matrices Market are Smith & Nephew Plc., Reprise Biomedical, Organogenesis Holdings Inc., Tissue Regenix, and many others.

The market is growing at a CAGR of 11.4 percent over the forecasted period.

Contents

1.1.Objectives of the Study

1.3.Market Definition and Scope

2.U.S. Acellular Dermal Matrices Market Overview

2.1.Global U.S. Acellular Dermal Matrices Market Overview by Type

2.2.Global U.S. Acellular Dermal Matrices Market Overview by Application

3.U.S. Acellular Dermal Matrices Market Dynamics, Opportunity, Regulations, and Trends Analysis

3.1.1.U.S. Acellular Dermal Matrices Market Drivers

3.1.2.U.S. Acellular Dermal Matrices Market Opportunities

3.1.3.U.S. Acellular Dermal Matrices Market Restraints

3.1.4.U.S. Acellular Dermal Matrices Market Challenges

3.2.Emerging Trend/Technology

3.4.PORTER'S Five Forces Analysis

3.6.Opportunity Map Analysis

3.11.Supply/Value Chain Analysis

3.12.Covid-19 & Recession Impact Analysis

3.13.Product/Brand Comparison

4.Global U.S. Acellular Dermal Matrices Market Value ((US$ Mn)), Share (%), and Growth Rate (%) Comparison by Origin, 2017-2032

4.1.Global U.S. Acellular Dermal Matrices Market Analysis by Origin: Introduction

4.2.Market Size and Forecast by Region

5.Global U.S. Acellular Dermal Matrices Market Value ((US$ Mn)), Share (%), and Growth Rate (%) Comparison by Application, 2017-2032

5.1.Global U.S. Acellular Dermal Matrices Market Analysis by Application: Introduction

5.2.Market Size and Forecast by Region

5.3.Reconstruction Procedures

6.Global U.S. Acellular Dermal Matrices Market Value ((US$ Mn)), Share (%), and Growth Rate (%) Comparison by End User, 2017-2032

6.1.Global U.S. Acellular Dermal Matrices Market Analysis by End User: Introduction

6.2.Market Size and Forecast by Region

6.4.Ambulatory Surgical Centers

10.Global U.S. Acellular Dermal Matrices Market Value ((US$ Mn)), Share (%), and Growth Rate (%) Comparison by Region, 2017-2032

10.1.1.North America U.S. Acellular Dermal Matrices Market: Regional Analysis, 2017-2032

10.2.1.Europe U.S. Acellular Dermal Matrices Market: Regional Trend Analysis

10.3.1.Asia-Pacific U.S. Acellular Dermal Matrices Market: Regional Analysis, 2017-2032

10.3.1.7.Rest of Asia-Pacifc

10.4.1.Latin America U.S. Acellular Dermal Matrices Market: Regional Analysis, 2017-2032

10.4.1.5.Rest of Latin America

10.5.Middle East and Africa

10.5.1.Middle East and Africa U.S. Acellular Dermal Matrices Market: Regional Analysis, 2017-2032

11.Global U.S. Acellular Dermal Matrices Market Company Evaluation Matrix, Competitive Landscape, Market Share Analysis, and Company Profiles

11.1.Market Share Analysis

11.3.2.Financial Highlights

11.3.5.Key Strategies and Developments

11.4.Integra Life Sciences Corporation

11.4.2.Financial Highlights

11.4.5.Key Strategies and Developments

11.5.2.Financial Highlights

11.5.5.Key Strategies and Developments

11.6.2.Financial Highlights

11.6.5.Key Strategies and Developments

11.7.2.Financial Highlights

11.7.5.Key Strategies and Developments

11.8.Becton, Dickinson and Company

11.8.2.Financial Highlights

11.8.5.Key Strategies and Developments

11.9.2.Financial Highlights

11.9.5.Key Strategies and Developments

11.10.2.Financial Highlights

11.10.3.Product Portfolio

11.10.5.Key Strategies and Developments

11.11.Organogenesis Holdings Inc.

11.11.2.Financial Highlights

11.11.3.Product Portfolio

11.11.5.Key Strategies and Developments

11.12.2.Financial Highlights

11.12.3.Product Portfolio

11.12.5.Key Strategies and Developments

11.13.Zimmer Biomet Holdings Inc.

11.13.2.Financial Highlights

11.13.3.Product Portfolio

11.13.5.Key Strategies and Developments

11.14.Baxter International Inc.

11.14.2.Financial Highlights

11.14.3.Product Portfolio

11.14.5.Key Strategies and Developments

12.Assumptions and Acronyms