Market Overview

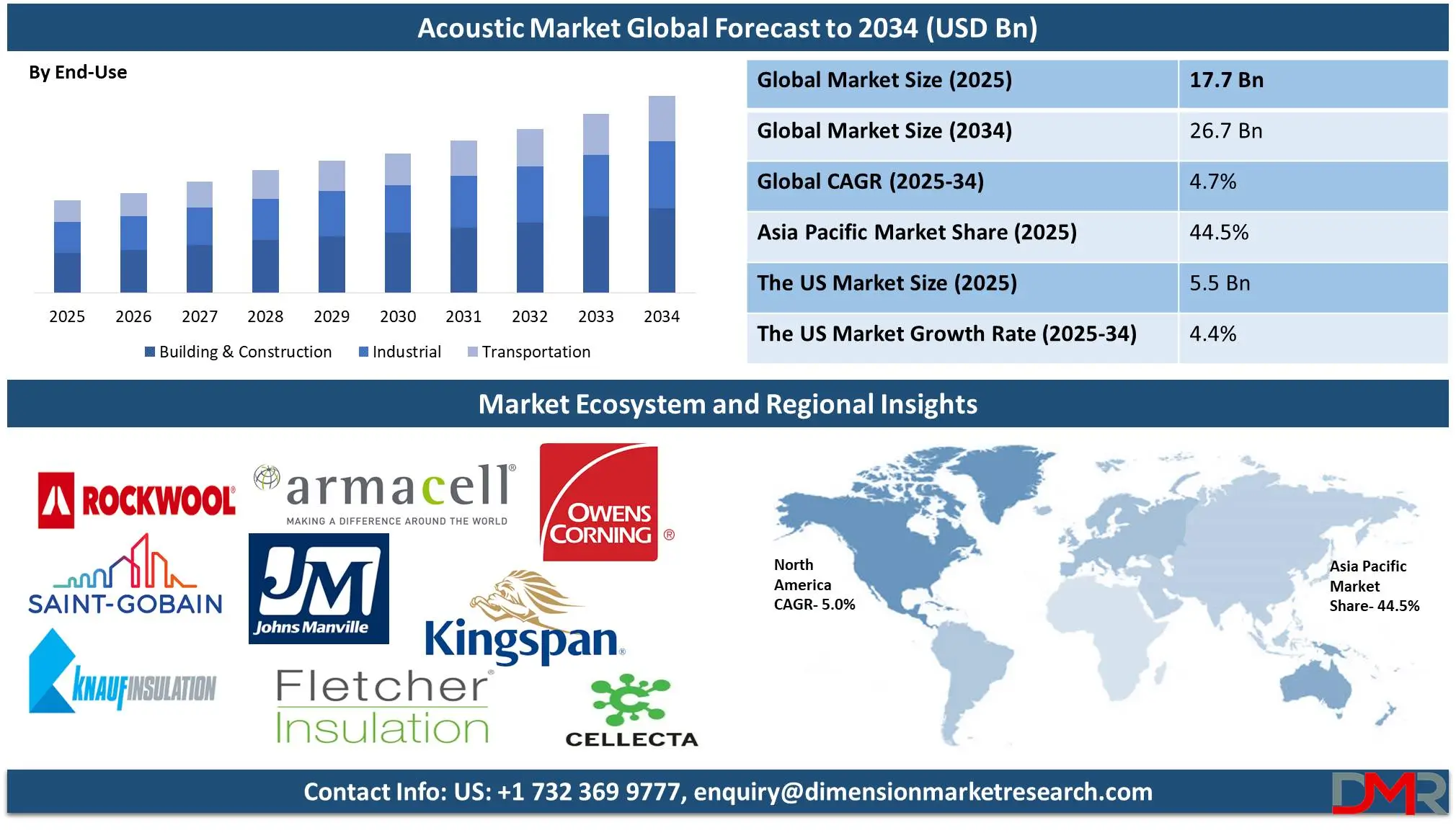

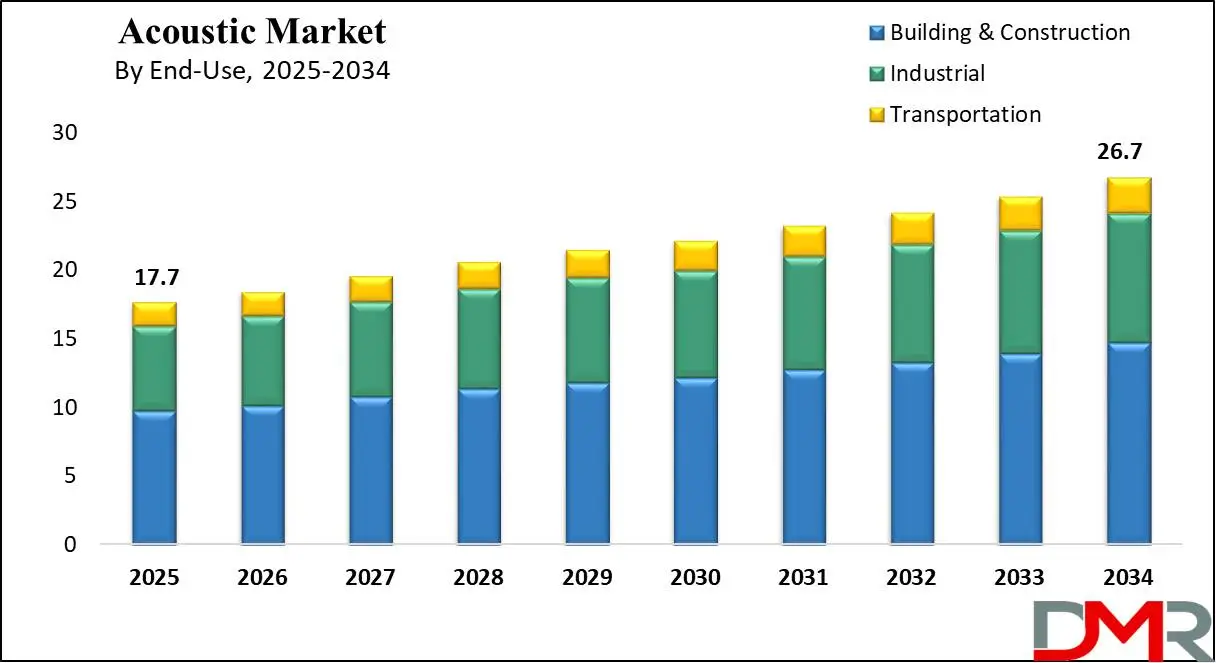

The Global Acoustic Market size is expected to be valued at

USD 17.7 billion in 2025, and it is further anticipated to reach a market value of

USD 26.7 billion by 2034 at a

CAGR of 4.7%.

The global acoustic market encompasses an industry dedicated to designing, producing, and implementing technologies, solutions, and materials that manage sound in different environments. Applications range from soundproofing and noise reduction through sound enhancement across sectors such as construction, automotive manufacturing, healthcare services, consumer electronics manufacturing, and industrial production. Products and solutions focused on providing comfort mitigation and auditory experience upgradation are an important element of modern infrastructure and technology.

One of the primary drivers of the global acoustic market is an increased focus on noise pollution control. Urbanization and industrialization have significantly raised ambient noise levels, negatively affecting human health and well-being. Governments and organizations globally are introducing stricter regulations to limit noise pollution specifically in urban, industrial, and residential areas with sound barriers, noise-reducing panels, and insulation materials serving an integral role in adhering to regulations and ensuring compliance. This has generated strong interest across industries, particularly construction and transportation where noise control remains a key issue.

Consumer demand for advanced sound quality has significantly expanded the acoustics market, particularly within electronics. Headphones, speakers, and sound systems all rely on advanced acoustic technologies to deliver premium audio experiences. Artificial intelligence-powered solutions now ensure seamless voice recognition and clarity as consumers increasingly demand innovative experiences with immersive sounds. In response to consumer preferences for more immersive and innovative sound experiences manufacturers are investing heavily in R&D to produce cutting-edge acoustic products.

Healthcare is another significant application area within the acoustics market. Acoustic solutions are used in medical devices, hearing aids, and soundproofing in healthcare facilities to improve patient comfort and staff efficiency. With advances in medical technology continuing to rise rapidly, acoustics is becoming more crucial than ever for accurate diagnostics and improved patient care.

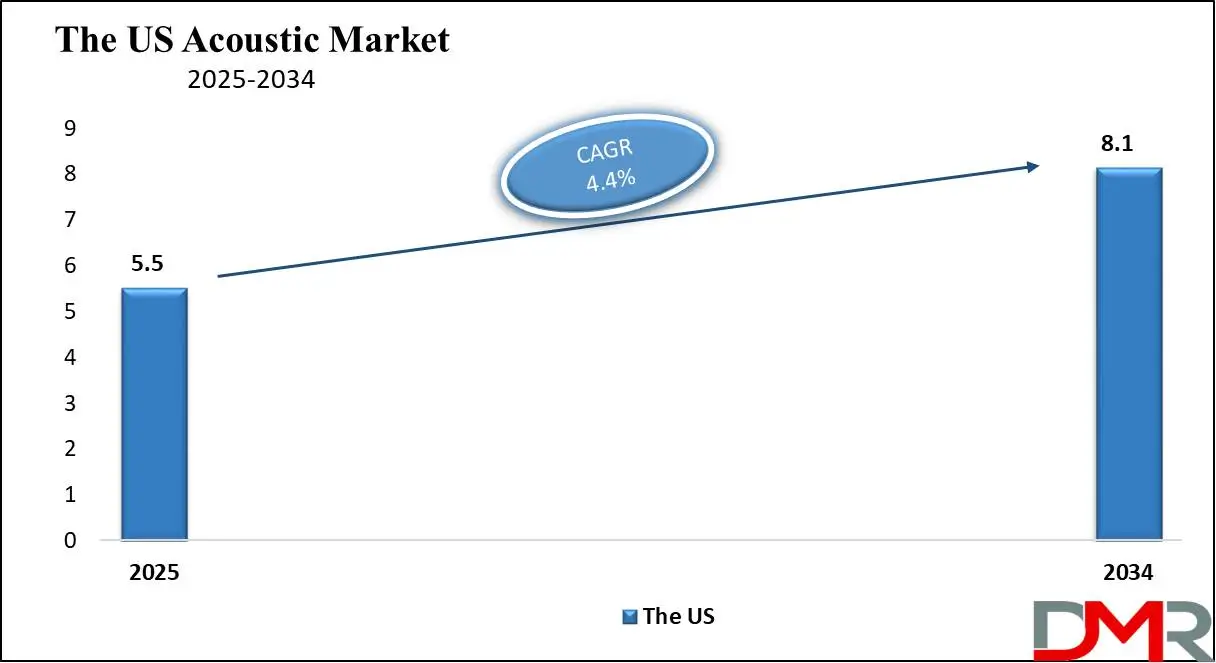

The US Acoustic Market

The US Acoustic Market is projected to be valued at USD 5.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 8.1 billion in 2034 at a CAGR of 4.4%.

The US acoustic market is an integral part of the global acoustic industry, driven by advanced infrastructure development, stringent noise regulations, and a focus on improving sound quality across multiple applications. Furthermore, its strong economy, well-established industries, and ongoing technological innovations position it as an invaluable contributor to the global acoustics landscape.

Construction projects are one of the primary drivers of the U.S. acoustic market. Residential, commercial, and industrial building projects prioritize noise control and soundproofing solutions as part of their design, especially in urban areas where noise pollution is an increasing concern. Acoustic panels, ceilings, and insulation materials are widely utilized within office spaces, schools, hospitals, and residential buildings as acoustically-treated offices create comfortable and productive working environments. Further driving adoption through stringent building codes established by the Environmental Protection Agency (EPA) or local authorities propelling advanced acoustic solutions into construction projects.

Consumer electronics in the US market display strong demand for premium acoustic products such as headphones, speakers, and smart audio devices such as voice-activated devices and smart home technologies that use voice-activation to access audio content has increased this trend. Companies operating within this space invest heavily in research and development to meet consumer preferences.

As healthcare advances with more attention to patient comfort and advanced diagnostics, demand for precise yet effective acoustic technologies increases. New York City, Los Angeles, and Chicago represent high-demand urban centers due to dense populations and significant construction activity. Furthermore, these cities often face increased noise pollution issues that necessitate the implementation of advanced acoustic solutions.

Global Acoustics Market: Key Takeaways

- Market Value: The global acoustics market size is expected to reach a value of USD 26.7 billion by 2035 from a base value of 17.7 USD billion in 2025 at a CAGR of 4.7%.

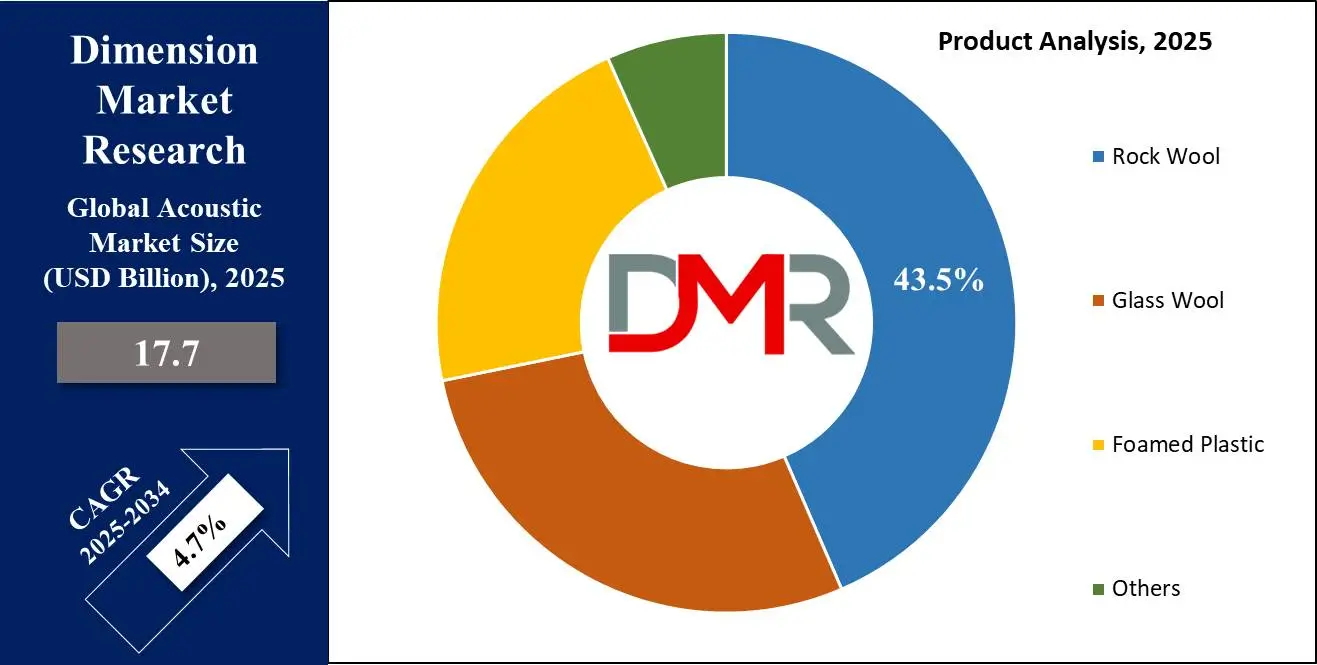

- By Product Type Segment Analysis: Rock Wool is projected to maintain its dominance in the product type segment, capturing 43.5% of the market share in 2025.

- By End-Use Type Segment Analysis: Building & Construction is poised to maintain its dominance in the end-use type segment capturing 55.0% of the total market share in 2025.

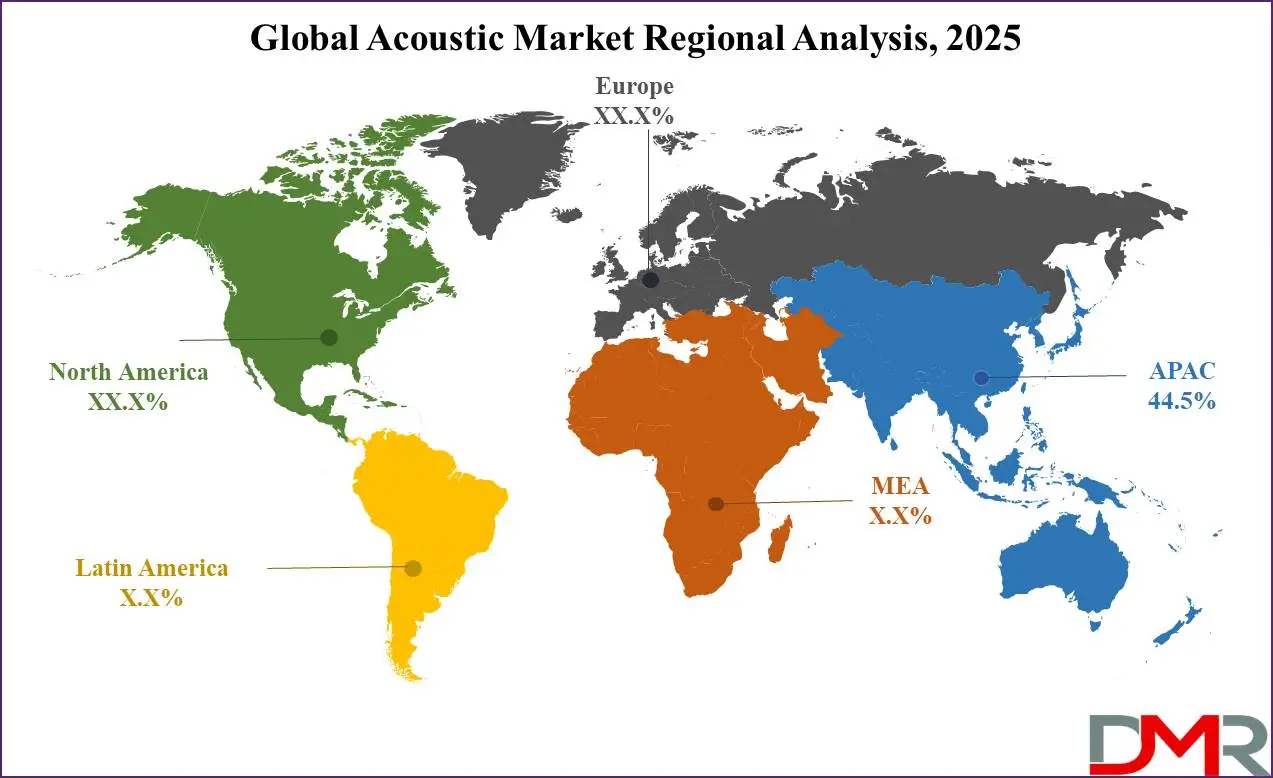

- Regional Analysis: Asia-Pacific is anticipated to lead the global acoustics landscape with 44.5% of total global market revenue in 2025.

- Key Players: Some major key players in the global acoustics market are, ROCKWOOL A/S, Saint-Gobain SA., Knauf Insulation, Armacell International S.A., Johns Manville Inc.BASF Polyurethanes GmbH, Other Key Players.

Global Acoustics Market: Use Cases

- Automotive Industry: The acoustic market plays a vital role in the automotive sector, where it is used to enhance soundproofing and reduce noise, vibration, and harshness (NVH). Applications include advanced audio systems, sound-dampening materials, and acoustic sensors for improved driving comfort and vehicle performance.

- Consumer Electronics: Acoustic technologies are widely applied in consumer devices such as smartphones, headphones, smart speakers, and hearing aids. The market caters to the demand for high-quality audio experiences, noise cancellation, and miniaturized components for portable electronics.

- Building and Construction: The use of acoustic materials and systems in residential, commercial, and industrial buildings helps improve sound insulation, noise reduction, and overall comfort. This includes applications in theaters, auditoriums, conference rooms, and home soundproofing solutions.

- Healthcare and Medical Devices: In the healthcare industry, acoustic technologies are integrated into medical devices like ultrasound machines, stethoscopes, and hearing aids. These innovations improve diagnostic capabilities, patient comfort, and treatment outcomes, making the market essential in this sector.

Global Acoustics Market: Stats & Facts

- According to the National Centers for Environmental Information, The National Oceanic and Atmospheric Administration (NOAA) utilizes passive acoustic monitoring to detect and characterize sounds produced by marine life, as well as ambient and anthropogenic noises in the ocean environment.

- According to Energy Efficiency & Renewable Energy, The U.S. Department of Energy states the potential applications of acoustic technologies in marine energy, highlighting their role in underwater communications infrastructure critical to global data transmission.

- As per the US Food & Drug Administration, they are responsible for providing guidelines on the marketing clearance of diagnostic ultrasound systems, detailing the acoustic output labeling and safety standards required for medical devices.

Global Acoustics Market: Market Dynamic

Global Acoustics Market: Driving Factors

Increasing Demand for Noise Control Solutions in Urban AreasThe global acoustic market is driven by rising demands for noise control solutions in urban settings. As urbanization accelerates globally, noise pollution has become a rising concern that negatively affects the quality of life, health, and productivity of city residents. Governments, industries, and consumers are realizing the significance of noise pollution mitigation, creating an insatiable demand for innovative acoustic solutions. According to the World Bank, over

56.0% of the world population now resides in urban areas, this proportion is projected to increase to

68.0% by 2050. With increasing populations living there is a rising number of noise pollution from traffic, construction activities, industrial operations, and social events that create additional problems with noise pollution levels.

The World Health Organization (WHO) has recognized noise pollution as a serious public health risk, linking prolonged exposure to adverse health outcomes such as hearing impairment, cardiovascular diseases, stress, and sleep disorders. The acoustic industry has responded quickly and decisively, producing highly effective noise control solutions. Such products as sound-absorbing panels, acoustic barriers, and noise-canceling devices have become integral parts of modern living across various applications. Advancements such as active noise control systems that use sound waves to counteract unwanted noise have further expanded market potential and adoption rates.

Acoustic solutions have found widespread application in various industries and applications, like construction in an industry where soundproofing materials play a crucial role in creating quieter and more relaxing spaces for residents and guests. Automotive manufacturers are turning to acoustic technologies to decrease noise, vibration, and harshness within vehicles and increase passenger comfort.

Technological Advancements in Acoustic Materials and Systems

Technological advances are driving the global acoustics market forward, as innovations in materials and systems continue to enhance noise control efficiency and expand application areas. Aiming to achieve superior acoustic performance has resulted in groundbreaking developments such as sound-absorbing materials, active noise control systems, and smart acoustic devices, revolutionizing industry practice. Companies are investing heavily in research and development efforts to produce noise-reduction materials that are lightweight, durable, and eco-friendly. This investment meets the evolving demands of industries as well as consumers as they seek better acoustic performance in their environments or products.

An important focus of these technological advancements has been the creation of advanced soundproofing and noise absorption materials. Porous materials, multilayer composites, and micro-perforated panels have transformed how sound is managed in various settings. These materials have become widespread across a variety of applications ranging from residential and commercial construction projects to automotive and aerospace sectors, providing improved acoustic comfort without limiting design flexibility. Additionally, recycled and biodegradable materials have become more widespread, reflecting rising concerns over sustainability and environmental impact.

Global Acoustics Market: Restraints

High Costs of Advanced Acoustic Technologies

Technology advances are one of the primary factors contributing to the global acoustic market's expansion, as new materials and systems continue to enhance noise control efficiency while expanding application areas. Aiming to achieve advanced acoustic performance has resulted in innovative sound-absorbing materials, noise control systems, and smart devices. Companies are investing heavily in research and development to produce materials that not only reduce noise effectively but are lightweight, durable, and eco-friendly. These innovations are key in meeting the evolving demands of both industry leaders and consumers looking for improved acoustic performance in their environments and products.

An important goal of these technological advancements is the development of advanced soundproofing and noise absorption materials. Porous materials, multilayer composites, and micro-perforated panels have transformed how sound is managed in various settings. These materials have become common across industries from residential and commercial construction, to automotive, and aerospace to ensure increased acoustic comfort without compromising design flexibility. Recycled and biodegradable materials have also gained momentum, reflecting growing concerns over environmental impact and sustainability. This shift towards eco-friendly solutions not only aligns with global sustainability goals but also resonates with environmentally aware consumers fueling market expansion.

Lack of Standardized Regulations Across Regions

One key barrier in the global acoustic market is a lack of uniform regulations and guidelines governing noise control and performance. Different countries and regions have implemented their noise control laws and standards, which often differ significantly, leading to inconsistencies that impede the global adoption of acoustic solutions and compliance for manufacturers, as well as hindering seamless integration between technologies across markets. European Union (EU) and North American regulations like the Environmental Noise Directive and the US Noise Control Act provide clear benchmarks for combatting noise pollution. Such regulations often lead to the adoption of advanced acoustic materials and technologies to meet mandated noise levels across residential, industrial, and commercial settings.

The lack of international standard harmonization further compounds this problem.

Criteria for sound insulation in buildings or acceptable noise levels in workplaces vary greatly between countries, making it challenging for manufacturers to design products to meet diverse requirements across markets. Furthermore, inconsistency increases production costs and complexity as companies must customize products specifically to specific markets. Eventually, this leads to slow adoption rates of acoustic technologies in regions with less stringent regulations, restricting global market growth potential.

Global Acoustics Market: Opportunities

Growing Demand for Acoustic Solutions in Emerging Markets

One of the greatest opportunities for the global acoustic market lies in its rapidly increasing demand for noise control solutions in emerging markets. As countries in Asia-Pacific, Latin America, the Middle East, and Africa experience rapid economic development and urbanization, their need for effective noise-reducing technologies becomes ever more evident. These regions are experiencing massive infrastructure development projects, industrial expansion efforts, and rising consumer awareness of noise pollution issues which provide fertile grounds for market expansion opportunities.\

Emerging markets are experiencing rapid urbanization, with large sections of their populations moving to cities and towns. According to UN estimates, approximately 90.0% of projected urban population growth between now and 2050 will come from Asia and Africa. This urban boom has led to a rise in construction activity, including residential complexes, commercial buildings, transportation infrastructure, and industrial facilities.

These developments are driving demand for acoustic materials and systems to ensure noise compliance, improve living standards, and create positive working environments. Builders and developers in these regions increasingly incorporate soundproofing and noise reduction measures into their projects providing manufacturers with a lucrative opportunity.

Integration of Acoustic Technologies in Smart Infrastructure

Integrating acoustic technologies into smart infrastructure represents a huge growth opportunity for the global acoustic market. As society moves towards advanced spaces, demand for advanced acoustic solutions that improve comfort, efficiency, and functionality is increasing dramatically, particularly within smart cities, intelligent buildings, and connected transportation systems where these innovations have become indispensable. Governments and urban planners globally are taking an increasing interest in noise management as part of smart city initiatives, to meet challenges posed by urbanization while improving residents' quality of life.

Real-time noise monitoring systems are being installed in major metropolitan areas to collect and analyze noise pollution data collected via sensors connected via the Internet of Things (IoT). With such insights available to authorities, they can implement targeted noise control measures more easily. Companies specializing in developing or integrating such technologies are well-positioned to take advantage of this increasing demand. Acoustic technologies are playing a vital role in intelligent buildings, helping create energy-efficient and comfortable environments. Smart buildings include advanced soundproofing materials, active noise control systems, and adaptive acoustic environments that respond dynamically to changing noise levels.

Global Acoustics Market: Trends

Adoption of Sustainable and Eco-Friendly Acoustic Materials

One notable trend in the global acoustic market is the increasing adoption of sustainable and eco-friendly acoustic materials. As environmental concerns and sustainability goals gain priority across industries, companies are turning more frequently towards developing eco-friendly noise control solutions. This trend coincides with global efforts to lower carbon footprints while simultaneously encouraging environmentally sustainable practices across construction, manufacturing, and other fields requiring noise control measures. Traditional acoustic materials, like synthetic foams and fiberglass, have long been criticized for their environmental impact due to their dependence on non-renewable resources and disposal challenges.

Construction industry users, a key market for acoustic solutions, have taken the lead in adopting eco-friendly materials such as soundproofing solutions that comply with environmental standards. Environmental certification programs like LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method) incentivize this adoption through green building certification.

Integration of Smart Acoustic Solutions with IoT and AI Technologies

Integration of smart acoustic solutions with IoT and Artificial Intelligence (AI) technologies has become an emerging trend in the global acoustic market, revolutionizing noise control across various sectors while offering improved user experiences through more personalized, cost-efficient solutions. Integrating IoT into noise management systems enables real-time, data-driven noise control systems.

Acoustic sensors connected to IoT networks can monitor and analyze sound levels in any space in real time and automatically adjust noise control systems accordingly. For instance, soundproofing solutions using this approach may detect unwanted noise and use IoT-enabled noise-canceling devices or adjust soundproofing elements accordingly for maximum comfort in smart homes. Similarly, commercial or industrial spaces use similar systems to manage HVAC systems or machinery noise in real time to improve work environments and employee productivity.

AI technologies are rapidly revolutionizing smart acoustic solutions. AI algorithms can process vast amounts of sound data to identify patterns, predict noise disruptions, and adjust noise control measures proactively. AI-powered acoustic systems in office settings can learn user preferences and adjust background sound levels accordingly for focus or relaxation depending on real-time conditions and individual requirements. Such adaptability is driving demand for intelligent AI acoustic solutions in spaces where optimal acoustic performance is key for productivity and well-being.

Global Acoustics Market: Research Scope and Analysis

By Product Type

Rock Wool is projected to maintain its dominance in the product type segment, capturing 43.5% of the market share in 2025, which can be attributed to several factors including its superior acoustic properties, versatility, and cost-effectiveness compared with alternative materials used for sound insulation and noise reduction. Rock wool is widely known for its superior sound absorption capabilities, making it an excellent material to control noise in various applications.

Rock wool is widely known for its superior sound absorption capabilities, making it an excellent material to control noise in various applications. Due to its fibrous structure, rock wool can effectively absorb sound waves to minimize echo and reverberation (an ability that makes rock wool particularly suitable for use in industries requiring sound control such as construction, automotive, and industrial sectors).

Rock wool's ability to reduce airborne and impact noise while improving both commercial and residential spaces has led to its widespread usage. Its insulating application stands out as both an acoustic and fire-retardant option, making it attractive in construction applications that demand stringent fire safety regulations. Due to this inherent fire resistance, it gives rock wool an advantage over other materials like foam-based solutions which may not meet these safety regulations in certain regions.

Additionally, rock wool's natural mineral origin such as basalt or diabase rocks makes it more eco-friendly than synthetic insulation products. Cost plays an integral part in material selection for large construction projects or industrial applications, including rock wool. Rock wool stands out among its counterparts like fiberglass or composite materials by being more affordable.

By End Use

The building and Construction industry is poised to maintain its dominance in the end-use type segment capturing 55.0% of the total market share in 2025. This dominance is attributable to several key factors, such as global urbanization's steady rise, increasing noise pollution problems, and increasing awareness of the importance of acoustic comfort for residential, commercial, and industrial buildings. Urbanization has been one of the primary drivers of expansion within the building and construction sector.

United Nations projections project that by 2030, 60.0% of the global population will live in urban areas, creating unprecedented demand for housing, infrastructure, and public spaces. As cities grow, there is a rise in demand for high-quality acoustic solutions to manage noise in residential, commercial, and industrial buildings. Noise pollution has become an acute health threat in densely populated urban areas.

To counteract it builders are installing advanced materials such as soundproofing insulation panels or noise barriers into new builds to create more comfortable living and working environments for residents. Commercial construction relies heavily on noise control for creating productive and pleasant working environments. Offices, retail spaces, educational institutions, healthcare facilities, and other commercial structures all rely on noise reduction solutions to enhance acoustics and increase performance.

Noise disruptions have been shown to impact employee productivity, learning outcomes, and patient recovery times negatively. As a result, commercial buildings are increasingly adopting acoustic materials, further cementing building and construction's dominance in the acoustics market.

The Acoustic Market Report is segmented on the basis of the following

By Product

- Glass Wool

- Rock Wool

- Foamed Plastic

- Others

By End Use

- Building & Construction

- Industrial

- Transportation

Global Acoustics Market: Regional Analysis

Asia-Pacific is anticipated to lead the global acoustics landscape with

44.5% of total global market revenue by the end of 2025, due to factors including rapid urbanization, increasing construction activities, growing awareness about noise pollution, and strong industrial and technological development in this region. China, India, Japan, South Korea, and Australia are driving this surge, with their expanding infrastructure projects, manufacturing industries, and residential developments all contributing significantly towards the demand for acoustic solutions. One of the primary drivers of Asia-Pacific's acoustic market is rapid urbanization. As urban populations in China and India continue to expand, the demand for soundproofing solutions increases in both residential and commercial applications.

Multi-family housing complexes, commercial complexes, and high-rise buildings often experience noise transmission challenges. Noise pollution has become a serious problem in densely populated cities, prompting greater focus on noise control in building design and construction. This trend is anticipated to continue as urban populations increase and more people move into city centers. Asia-Pacific industrial production continues to expand, driving demand for effective soundproofing solutions and contributing to an expanding acoustic market in this region. Manufacturing plants, factories, and industrial facilities often generate excessive levels of noise which has detrimental impacts on worker health and productivity. Creating safer spaces with reduced machinery noise levels, vibrations, and reverberation levels is important in maintaining safer work environments.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Acoustics Market: Competitive Landscape

The global acoustics market comprises of group of global companies, regional players, and emerging businesses serving various end-use industries. As demand for noise control solutions from various sectors like construction, automotive, aerospace, and consumer electronics grows steadily, competition in this market has intensified. Companies are taking advantage of innovation, product diversification, and strategic partnerships to expand their presence and market share. Leading global acoustic market players include major corporations like Saint-Gobain, Rockwool International, Owens Corning, 3M, and BASF. These companies enjoy an outstanding presence in the market due to their expansive product offerings and distribution networks across multiple regions.

Saint-Gobain, for example, is an industry leader when it comes to manufacturing soundproofing materials for use in construction and industry applications. Rockwool International stands out with its mineral wool-based acoustic insulation products, making them popular choices in construction and industrial settings. Competition within the global acoustic market has been intensified further with the emergence of regional players who specialize in local market dynamics and offer tailored solutions tailored to specific requirements.

Regional players typically focus on product affordability, customer service excellence, and quick market responsiveness to compete against larger multinational corporations. KORE Insulation in India and Nippon Steel in Japan have both found great success by offering cost-effective acoustic solutions designed specifically to local regulations and consumer preferences in their regions.

Some of the prominent players in the Global Acoustic Market are

- Rockwool A/S

- Saint-Gobain SA

- Knauf Insulation

- Armacell International S.A.

- Johns Manville Inc. BASF Polyurethanes GmbH

- Fletcher Insulations

- Owens Corning Corporation

- Kingspan Group

- Cellecta Ltd.

- Other Key Players

Global Acoustics Market: Recent Developments

- October 2024: Saint-Gobain, a global leader in construction materials, launched a new line of high-performance acoustic insulation solutions for residential and commercial buildings. The products are designed to enhance soundproofing while improving energy efficiency, aligning with the increasing demand for sustainable construction solutions.

- June 2024: Owens Corning, a leading manufacturer of insulation products, acquired a regional acoustic insulation company based in the Asia-Pacific region. This acquisition is aimed at strengthening its market presence in the rapidly growing Asia-Pacific acoustic market, enabling Owens Corning to offer tailored solutions for local construction needs.

- March 2024: 3M invested significantly in R&D to develop advanced acoustic materials for the automotive industry. The company introduced a new range of sound-damping solutions designed to reduce road noise and improve in-car comfort.

- January 2024: Rockwool entered into a strategic partnership with a major global construction firm to integrate their advanced acoustic insulation products into large-scale commercial and residential projects. This collaboration is expected to boost Rockwool's market share in both the North American and European acoustic insulation markets.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 17.7 Bn |

| Forecast Value (2034) |

USD 26.7 Bn |

| CAGR (2025-2034) |

4.7% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 5.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

ROCKWOOL A/S, Saint-Gobain SA., Knauf Insulation, Armacell International S.A., Johns Manville Inc.BASF Polyurethanes GmbH, and Other Key Players |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Daigas Group, Kuraray Co. Ltd., Haycarb Plc, Basf SE, Albemarle Corporation, Kureha Corporation, Ingevity, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The global acoustics market size is estimated to have a value of USD 17.7 billion in 2025 and is expected to reach USD 26.7 billion by the end of 2034.

The US acoustics market is projected to be valued at USD 5.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 8.1 billion in 2034 at a CAGR of 4.1%.

Asia Pacific is expected to have the largest market share in the global acoustics market with a share of about 44.5% in 2025.

Some of the major key players in the global acoustics market are ROCKWOOL A/S, Saint-Gobain SA., Knauf Insulation, Armacell International S.A., Johns Manville Inc.BASF Polyurethanes GmbH, and many others.

The market is growing at a CAGR of 4.7 percent over the forecasted period.