Market Overview

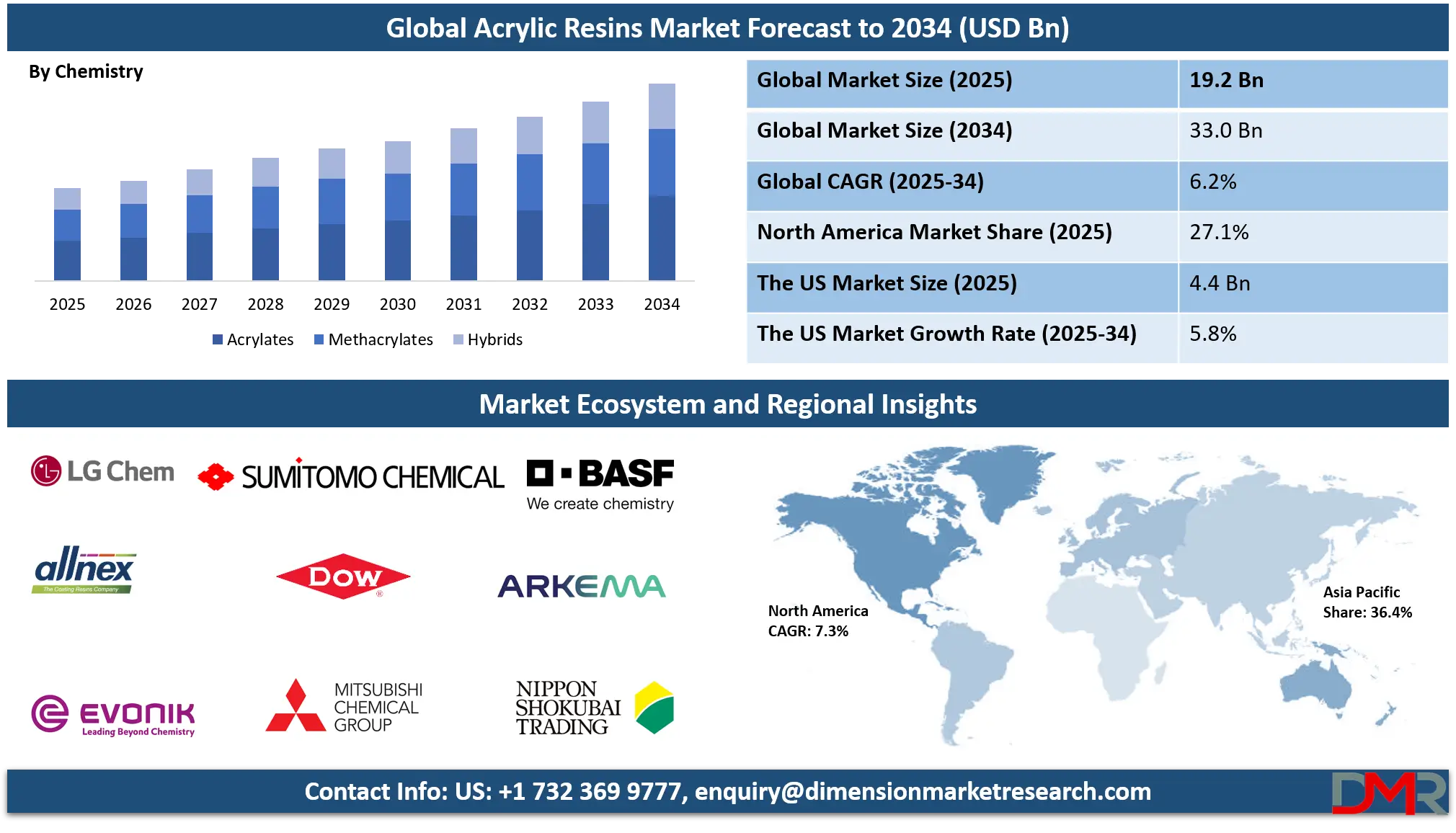

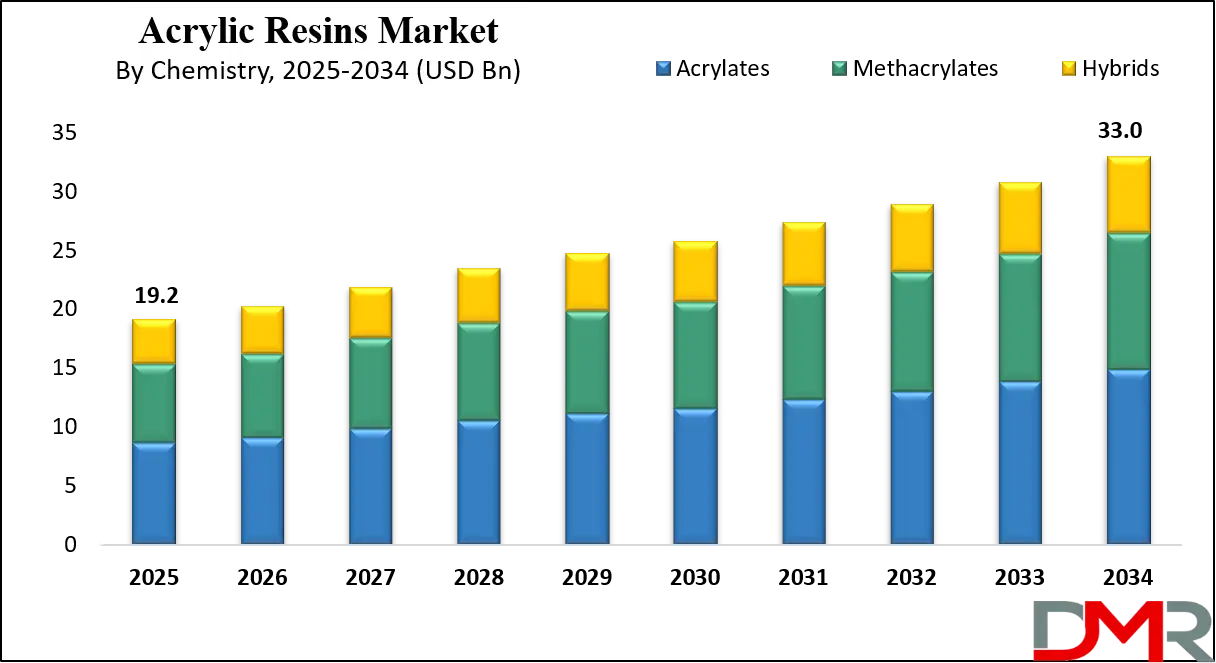

The Global Acrylic Resin Market is projected to reach USD 19.2 billion by 2025 and is anticipated to expand at a compound annual growth rate (CAGR) of 6.2% from 2025 to 2034, ultimately attaining a market size of USD 33.0 billion by 2034. Growth in this sector is being driven by rising demand for durable, weather-resistant, and eco-friendly coatings, the expanding use of water-based acrylic resins in architectural and industrial applications, and increasing adoption in automotive, packaging, adhesives, and construction industries.

Moreover, technological advancements in high-performance acrylic polymers, coupled with sustainability trends emphasizing low-VOC and bio-based formulations, are further supporting the market expansion. Emerging economies, rapid urbanization, and infrastructure development projects are expected to create strong growth opportunities throughout the forecast period.

The global acrylic resin market driven by acrylate and methacrylate chemistries, waterborne dispersions, and UV-curable systems is expanding as coatings, adhesives, and specialty plastics demand polymers with improved weathering, gloss retention, and low-VOC profiles; increasing urbanization and construction activity underpin demand for decorative and protective paints while automotive lightweighting and flexible packaging adoption push engineered acrylic copolymers and hybrid chemistries.

Key trends include migration from solvent-borne to water-based emulsions and dispersions, wider uptake of high-solid and low-temperature cure formulations, and integration of functional modifiers (anti-yellowing, antimicrobial, rheology modifiers) that enable performance-tuned elastomers, pigment dispersions, and protective laminates. Opportunities exist in formulation innovation for circularity bio-based monomers, recyclable thermoplastic acrylics, and post-consumer resin-compatible coatings and in emerging regional construction booms and retrofit markets that require durable, long-life coatings.

Restraints include feedstock volatility for acrylic monomers (influenced by propylene and ethylene price swings), regulatory pressures on solvent emissions in major geographies, and competition from alternative polymer families (epoxies, polyurethanes) in high-performance applications. Statistically, the market shows steady mid-single digit compound annual growth driven by paints & coatings and adhesives segments, with product innovations such as hybrid acrylic-polyurethane and methacrylate oligomers expanding share in specialty applications.

Growth prospects are strongest where industrial manufacturing rebounds, packaging shifts to high-barrier acrylic laminates, and waterborne technology delivers comparable performance to solvent systems. Strategic priorities for suppliers include scale-efficient emulsion polymerization, regional production footprints to reduce logistics carbon intensity, and co-development with OEMs to meet increasingly stringent durability and sustainability specifications across construction, automotive, electrical/electronics, and consumer goods applications.

The US Acrylic Resin Market

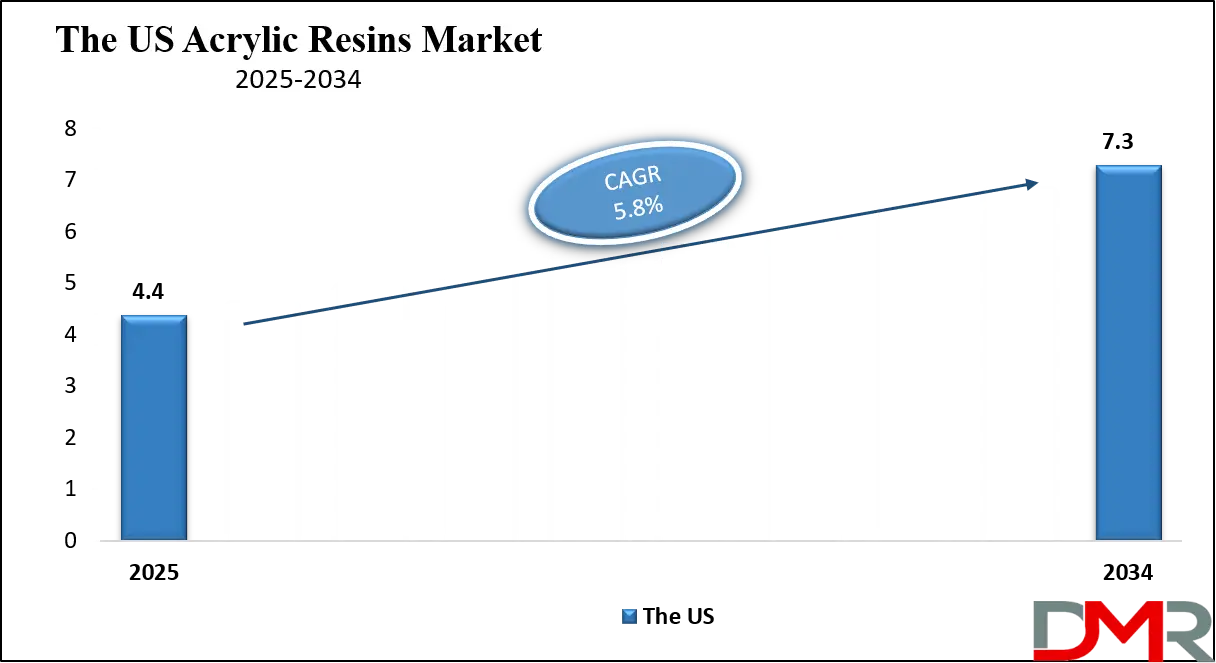

The US Acrylic Resin Market is projected to reach USD 4.4 billion in 2025 at a compound annual growth rate of 5.8% over its forecast period.

The U.S. acrylic resin market benefits from a large domestic construction and manufacturing base, broad industrial output, and demographic trends that sustain demand for coatings, adhesives, and specialty polymers; the United States’ sizable population and steady construction activity provide stable end-use markets for decorative paints, architectural coatings, and industrial finishes.

Government data show an aging population (growth in the 65+ cohort) and a large under-18 population balance that influences housing, renovation, and consumer-goods demand, while the U.S. Value of Construction Put in Place published monthly by the U.S. Census Bureau tracks multibillion-dollar construction spending that underpins paint and construction-grade resin demand.

The Census Bureau’s construction spending and population programs also provide manufacturers and formulators with timely regional demand signals used to allocate production and distribution. In addition, federal and state regulatory frameworks (EPA air quality and state VOC regulations) have pushed formulators toward water-based acrylic emulsions and high-solid, low-VOC systems, accelerating product reformulation and R&D investment in waterborne and UV-curable acrylic chemistries.

Industrial clusters for automotive, appliances, and coatings manufacturing in the Midwest and Southeast give the U.S. a logistical advantage proximity to OEMs, access to skilled labor, and established polymer processing infrastructure which lowers time-to-market for new grades and specialty copolymers. Finally, federal construction and infrastructure initiatives can spur demand for protective and anti-corrosive acrylic coatings in public works and transportation projects, creating medium-term growth corridors for resin suppliers and compounders.

The Europe Acrylic Resin Market

The Europe Acrylic Resin Market is estimated to be valued at USD 2.8 billion in 2025 and is further anticipated to reach USD 4.6 billion by 2034 at a CAGR of 5.5%.

Europe’s acrylic resin market is shaped by population centers, strong construction and renovation cycles, and targeted environmental regulation that favor low-VOC, high-performance waterborne coatings and sustainable polymer solutions. Eurostat reports an EU population of roughly 450 million (1 January 2025), and construction remains a material share of value added in many member states, giving a stable base for architectural and industrial coatings consumption.

The European construction sector’s measured production indices and short-term statistics (Eurostat) provide manufacturers with granular, country-level insight into where demand for paints, sealants, and building-grade acrylics is rising helpful for regional supply planning. Stringent EU chemical and emissions policy, plus national clean-air targets, have driven formulators toward emulsion polymerization, co-polymer acrylic dispersions, and hybrid acrylic-silane systems that deliver durability with reduced solvent release; these regulatory drivers also create opportunity for bio-monomer adoption and recyclable thermoplastic acrylics.

Europe’s dense urban populations and mature manufacturing clusters especially in Germany, France, Italy, and Spain favor localized production and just-in-time delivery models, lowering logistics costs for heavy liquid resins while enabling fast technical support for OEMs in automotive finishes, industrial coatings, and electrical insulation.

combination of demographic scale, accessible skilled labor, and regulated sustainability requirements creates a market environment where innovation in low-odor, low-VOC, and long-life acrylic formulations can capture premium segments in retrofitting, infrastructure maintenance, and high-value consumer goods finishing.

The Japan Acrylic Resin Market

The Japan Acrylic Resin Market is projected to be valued at USD 0.7 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1.9 billion in 2034 at a CAGR of 6.0%.

Japan’s acrylic resin market is distinguished by advanced manufacturing, high-quality coatings demand, and demographic factors that shape domestic consumption and industrial output; official population estimates and monthly industrial indices published by the Statistics Bureau and METI highlight a mature, high-density market with concentrated demand in electronics, automotive components, and precision industrial applications.

Japan’s detailed monthly population estimates (Statistics Bureau) and frequent updates to industrial production indices (METI’s Indices of Industrial Production) allow resin producers to align production schedules and specialty polymer rollouts with near-real-time shifts in manufacturing output. The country’s aging population and urban concentration sustain renovation and protective coatings demand for infrastructure and housing stock preservation, while a strong electronics and automotive manufacturing base drives requirements for low-outgassing encapsulants, high-purity acrylic adhesives, and dielectric coatings areas where Japan’s formulators and OEMs frequently co-develop high-performance methacrylate and hybrid acrylic systems.

Regulatory emphasis on product safety and material traceability, along with efficient supply chain clusters around Nagoya, Osaka, and Tokyo, gives manufacturers quick access to skilled technicians and testing labs, shortening development cycles for specialty acrylic oligomers and waterborne dispersions. Japan’s market rewards technical differentiation UV-curable methacrylate oligomers, acrylic-silicone hybrids, and transparent, weatherable coatings making it attractive for suppliers that offer high-precision, performance-graded resins tailored to electronics encapsulation, automotive exterior finishing, and industrial adhesives.

Global Acrylic Resin Market: Key Takeaways

- Global Market Size Insights: The Global Acrylic Resin Market size is estimated to have a value of USD 19.2 billion in 2025 and is expected to reach USD 33.0 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 6.2 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Acrylic Resin Market is projected to be valued at USD 4.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 7.3 billion in 2034 at a CAGR of 5.8%.

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Acrylic Resin Market with a share of about 36.4% in 2025.

- Key Players: Some of the major key players in the Global Acrylic Resin Market are BASF SE, Arkema S.A., The Dow Chemical Company, Mitsubishi Chemical Holdings Corporation, Evonik Industries AG, Nippon Shokubai Co., Ltd., Sumitomo Chemical Co., Ltd., Allnex Group, and many others.

Global Acrylic Resin Market: Use Cases

- Architectural & Decorative Coatings: Acrylic emulsions and high-solids acrylic resins provide weatherable, UV-stable binders for exterior and interior paints, delivering gloss retention, colorfastness, and low VOC emissions. Waterborne acrylic dispersions enable mildew resistance and fast recoatability in decorative finishes, while acrylic-urethane hybrids offer enhanced scratch and chemical resistance for premium architectural systems requiring long maintenance intervals.

- Adhesives & Sealants: Acrylic-based adhesives and methacrylate structural adhesives combine strong adhesion, UV resistance, and flexible modulus for bonding plastics, metals, and composites. Tackified acrylic pressure-sensitive adhesives serve packaging and labeling, while methyl methacrylate adhesive systems are chosen for high-load structural joining in automotive and construction, offering rapid fixture times and durable, weather-resistant bonds.

- Plastics & Thermoplastic Modifiers: Acrylic copolymers and impact modifiers improve clarity, weatherability, and toughness in PMMA, ABS blends, and PVC compounds. Acrylic graft copolymers and core-shell particles enhance impact performance of rigid plastics, while acrylic compatibilizers enable multi-layer films and recyclable thermoplastic constructions used in packaging and appliance housings.

- Textile & Fiber Coatings: Acrylic binders are essential in durable water repellent finishes, pigment printing pastes, and textile coating formulations that require wash-fastness and abrasion resistance. Modified acrylics provide hand, flexibility, and bonding to synthetic fibers, enabling performance textiles for outdoor apparel, upholstery, and industrial geotextiles that demand UV stability and long service life.

- Electrical, Electronics & Protective Coatings: High-purity acrylic encapsulants and conformal coatings protect printed circuit boards, sensors, and connectors from moisture and corrosion while minimizing ionic contamination. Low-outgassing methacrylate systems and UV-cure acrylics enable fast, solvent-free processing for electronics assembly, LED optics, and dielectric insulating layers requiring optical clarity, thermal stability, and long-term electrical reliability.

Global Acrylic Resin Market: Stats & Facts

OEC (Observatory of Economic Complexity)

- Global trade of Acrylic Polymers (HS 3906) reached USD 18.7 billion in 2023, a 12.4% decrease from 2022.

- For Polymethyl methacrylate (PMMA, HS 390610), leading exporters in 2023 included South Korea: USD 279 million, Germany: USD 200 million, Saudi Arabia: USD 174 million.

World Bank WITS / UN Comtrade (trade database)

- In 2023, Korea (Rep.) exported PMMA (HS 390610) valued at USD 247,683.79 thousand (≈USD 247.7 million) quantity 114,810,000 kg.

- In 2023, Singapore exported PMMA valued at USD 154,843.40 thousand (≈USD 154.8 million) quantity 80,626,500 kg.

- In 2023, Saudi Arabia exported PMMA valued at USD 133,955.03 thousand (≈USD 133.96 million) quantity 39,151,800 kg.

- In 2023, the United States exported PMMA valued at USD 123,099.91 thousand (≈USD 123.10 million) quantity 34,653,200 kg.

- In 2023, Japan exported PMMA valued at USD 106,047.60 thousand (≈USD 106.05 million) quantity 36,971,500 kg.

- The World Bank WITS shows China exported USD 16,791,833.73 thousand (≈USD 16.79 billion) of "chemical products and residual products of chem" in 2023 (HS grouping).

- In 2023, the European Union exported USD 2,290,645.92 thousand (≈USD 2.29 billion) of "Acrylic polymers prepared, in primary forms (nes)" quantity 746,105,000 kg.

- In 2023, the EU’s exports of that category to the UK were USD 360,026.42 thousand (≈USD 360.0 million) quantity 142,717,000 kg.

- In 2023, the EU’s exports of that category to the USA were USD 298,883.26 thousand (≈USD 298.9 million) quantity of 76,744,300 kg.

TrendEconomy / UN trade aggregates

- One compilation of customs-reported data shows world exports of “Acrylic polymers in primary forms” (HS 3906) at over USD 13.1 billion for a subset of reporting countries in 2023 (country coverage varies by dataset).

Eurostat (European Commission statistics)

- EU imports of chemicals and related products fell by 10.4% in 2023 compared with 2022.

- EU exports of chemicals and related products fell by 5.4% in 2023 compared with 2022.

- Over the period 2002 → 2023, EU imports of chemicals and related products rose from €97 billion to €325 billion (long-term growth).

UN Comtrade (United Nations commodity trade database)

- UN Comtrade stores more than 1 billion trade data records collected since 1962 (global, annual & monthly trade statistics).

UNIDO (United Nations Industrial Development Organization)

- UNIDO provides free access to manufacturing and trade databases (INDSTAT, Monthly Manufacturing Trade Database, IIP, etc.) databases publicly accessible as of February 2022.

- UNIDO’s manufacturing and industrialization reports document sectoral shifts that inform chemical/chemical-products policy and capacity planning (annual Industrial Development Report series).

CEFIC (European Chemical Industry Council)

- Cefic’s industry reporting noted that more than 11 million tonnes of chemical production capacity (across product categories) had been announced for closure in Europe for 2023–2024 (capacity reduction announcements affecting competitiveness).

American Chemistry Council (ACC)

- The ACC runs more than 30 statistical surveys of North American resin and plastics producers, publishing monthly and annual production, capacity, and sales statistics for major resin families.

- ACC statistical publications and the 2023 Guide to the Business of Chemistry compile historical U.S./North American plastics production and sales data stretching back to 1973 (multi-decade production series).

OECD (Organisation for Economic Co-operation and Development)

- The OECD estimates that the global chemical industry could grow roughly fourfold between 2020 and 2060 under current long-term scenarios indicating large structural demand growth for feedstocks and polymers.

- OECD chemical safety & data programs (e.g., Existing Chemicals Database, HPV/MAD) are used across member states to coordinate regulatory and safety testing priorities for industrial chemicals, including acrylates/methacrylates.

USITC / HTS nomenclature (U.S. International Trade Commission)

- The U.S. Harmonized Tariff Schedule (HTS) classifies Polymethyl methacrylate in primary forms under HS 3906.10.00 (HTS 390610) enabling precise customs/statistics reporting for PMMA trade.

World Integrated Trade Solution (WITS) selected trade flows

- In 2023, the EU (aggregate) exported USD 2,290,645.92 thousand of acrylic polymers prepared, in primary forms (see EU country breakdowns above)

- In 2023, global exporters of PMMA (HS 390610) showed year-on-year shifts: Korea’s PMMA exports fell from USD 268,917.81 thousand in 2022 to USD 247,683.79 thousand in 2023, indicating short-term trade volatility.

OEC / HS 390690 (other acrylic polymers)

- A related HS grouping (other acrylic polymers, HS 390690) shows global trade around USD 17.1 billion in 2023 for that category (customs-reported aggregation).

WITS chemicals trade to major markets

- In 2023, China exported approximately USD 2,951,955.32 thousand (≈USD 2.95 billion) worth of chemical products and residuals to the United States (selected HS groupings).

OECD / Data accessibility & indicators

- The OECD Data Explorer and TiVA releases provide 2023 trade-in-value-added (TiVA) indicators used to measure chemicals' contribution to global value chains (2023 edition released).

Global Acrylic Resin Market: Market Dynamic

Driving Factors in the Global Acrylic Resin Market

Expanding Construction and Infrastructure Development

The construction and infrastructure sectors are primary growth drivers for the acrylic resin market. Acrylic-based paints, coatings, adhesives, and sealants are essential for modern building materials due to their weatherability, UV resistance, and cost-effectiveness. Emerging economies in Asia-Pacific, Africa, and Latin America are witnessing rapid urbanization, leading to unprecedented demand for residential, commercial, and industrial infrastructure. Governments are investing heavily in large-scale housing, transportation networks, and smart city projects, where acrylic resins are vital for durable and aesthetically appealing finishes.

In developed markets like North America and Europe, renovation and energy-efficient building projects further boost demand for eco-friendly acrylic-based architectural coatings. The push for sustainable construction is also elevating the role of waterborne acrylic resins, as they align with green certifications and environmental regulations. Overall, robust global infrastructure spending, coupled with consumers’ preference for long-lasting, environmentally safe coatings, is creating strong demand momentum for acrylic resins across multiple construction-related applications.

Growth in the Automotive and Transportation Sector

The automotive and transportation industry represents another key growth driver for acrylic resins. With growing regulatory pressures to enhance vehicle efficiency and reduce emissions, automakers are turning to lightweight acrylic-based plastics and coatings. Acrylic resins provide excellent scratch resistance, gloss, and durability in automotive paints, making them a preferred material for vehicle exteriors and interiors.

Moreover, their ability to withstand harsh weather, UV exposure, and corrosive conditions ensures longer vehicle lifespans with reduced maintenance. The global shift toward electric vehicles (EVs) is further amplifying acrylic resin demand, as EV manufacturers require advanced coatings for battery casings, charging infrastructure, and lightweight components. Increasing automobile production in emerging markets like China, India, and Brazil is creating new opportunities for resin manufacturers.

Additionally, in aerospace and rail sectors, acrylic-based composites are gaining popularity for enhancing fuel efficiency and safety. This integration of acrylic resins into the automotive and transportation value chain continues to stimulate market expansion worldwide.

Restraints in the Global Acrylic Resin Market

Fluctuating Raw Material Prices and Dependence on Petrochemicals

One of the major restraints facing the acrylic resin market is its strong dependence on petrochemical-based feedstocks such as propylene and acrylic acid. These raw materials are derived from crude oil and natural gas, making their availability and pricing highly susceptible to global oil market volatility. Geopolitical tensions, trade disruptions, and supply chain bottlenecks can lead to unpredictable cost fluctuations, directly impacting acrylic resin production expenses and profit margins for manufacturers.

Additionally, as global attention shifts toward reducing fossil fuel reliance, the industry faces long-term sustainability challenges. Price instability discourages smaller manufacturers from entering the market, reducing competitiveness and innovation.

Furthermore, downstream industries such as construction and automotive often resist passing on higher costs to consumers, creating a ripple effect of reduced demand. Without stable and cost-effective raw material supplies, the acrylic resin industry faces significant hurdles in maintaining consistent growth and meeting the increasing demand across multiple end-use sectors.

Stringent Environmental Regulations on VOC Emissions

Environmental regulations represent another key restraint in the acrylic resin market. While acrylic resins are already favored for their relatively lower VOC emissions compared to alternatives, solvent-based variants still contribute to environmental pollution. Regulatory frameworks such as the U.S. Clean Air Act, the EU’s REACH policy, and global sustainability agreements are continuously tightening standards, forcing companies to adopt greener production technologies.

Transitioning to waterborne and bio-based resins requires substantial R&D investment, advanced production infrastructure, and process re-engineering, which may not be economically feasible for all manufacturers. Smaller firms, in particular, face barriers to compliance, limiting their competitive presence in the global market.

Furthermore, increased regulatory scrutiny on waste disposal and recycling adds complexity to supply chain management. While the move toward eco-friendly acrylic resins creates opportunities, the immediate pressure of compliance costs, technological adaptation, and consumer price sensitivity poses significant restraints to market growth in the near to medium term.

Opportunities in the Global Acrylic Resin Market

Advancements in Bio-Based and Sustainable Acrylic Resins

One of the most promising growth opportunities lies in the development of bio-based and recyclable acrylic resins. With the rising urgency to reduce carbon footprints and minimize reliance on petrochemicals, research into renewable feedstocks for acrylic production is accelerating. Manufacturers are investing in plant-derived monomers and bio-acrylic acid as sustainable alternatives to conventional petroleum-based raw materials. Bio-based resins offer comparable mechanical and chemical properties, making them suitable for coatings, adhesives, and packaging while aligning with global sustainability agendas.

The circular economy movement in regions like Europe and North America is further encouraging the adoption of recyclable resin solutions. Companies that pioneer bio-based acrylic resins will gain a significant competitive advantage, as industries and consumers prioritize eco-friendly materials. This shift not only creates opportunities for resin manufacturers but also enables downstream industries such as construction, automotive, and packaging to meet regulatory standards and consumer expectations for environmentally responsible products.

Rising Demand in Electronics and Renewable Energy Industries

The rapid expansion of the electronics and renewable energy industries presents lucrative opportunities for acrylic resin manufacturers. In electronics, acrylic resins are increasingly used as encapsulants, adhesives, and coatings to protect delicate circuits and components from moisture, thermal stress, and corrosion. The proliferation of consumer electronics, coupled with advancements in 5G networks and IoT devices, is driving consistent demand for high-performance protective materials.

Meanwhile, renewable energy systems such as wind turbines and solar panels require acrylic-based coatings to enhance efficiency and durability against extreme weather conditions. Growing government investments in clean energy infrastructure across regions like North America, Europe, and Asia-Pacific are fueling this demand. Acrylic resins also contribute to lightweight solutions in renewable applications, improving efficiency and cost-effectiveness. As the global transition toward sustainable energy accelerates, the role of acrylic resins in providing protective, high-performance solutions will open new avenues for growth across diverse industrial sectors.

Trends in the Global Acrylic Resin Market

Growing Demand for Eco-Friendly and Waterborne Acrylic Resins|

A prominent trend in the acrylic resin market is the rising adoption of waterborne acrylics and eco-friendly formulations, driven by tightening global environmental regulations. With agencies like the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) imposing restrictions on volatile organic compounds (VOCs), industries are shifting from solvent-based to low-VOC waterborne resins.

These alternatives provide comparable performance in coatings, adhesives, and sealants while offering better safety for workers and end users. End-use sectors such as automotive, construction, and packaging are integrating waterborne acrylic resins to align with sustainability goals and green building certifications like LEED. Furthermore, growing consumer awareness and corporate sustainability commitments are reinforcing demand for bio-based acrylics derived from renewable feedstocks. This trend is reshaping R&D investments, pushing manufacturers to innovate new acrylic formulations with lower carbon footprints while maintaining durability and high-performance characteristics. Overall, eco-friendly acrylic resin adoption is no longer optional but a market-defining trend ensuring competitiveness.

Rising Use of Acrylic Resins in High-Performance Applications

Another significant trend is the increasing use of acrylic resins in high-performance industries such as aerospace, electronics, and renewable energy. The resin’s superior weather resistance, adhesion, clarity, and chemical stability make it a preferred material in demanding applications. In aerospace, acrylic resins are used in protective coatings for turbine blades and aircraft components, helping enhance durability under extreme conditions. Similarly, in electronics, acrylic resins serve as encapsulants and adhesives, safeguarding sensitive components against moisture and thermal stress.

The renewable energy sector, particularly wind turbines and solar panels, is also adopting acrylic coatings to extend operational lifespans and reduce maintenance costs. Lightweight automotive components utilizing acrylic polymers contribute to fuel efficiency and emissions reduction, further driving this trend. With industries worldwide prioritizing performance, energy efficiency, and durability, the use of acrylic resins in advanced applications is expanding rapidly. This trend highlights the material’s versatility and its ability to adapt to evolving industrial requirements, supporting market resilience.

Global Acrylic Resin Market: Research Scope and Analysis

By Chemistry Analysis

Acrylates is projected to dominate the global acrylic resin market primarily because of their unmatched versatility and compatibility across industries. Their superior weatherability, chemical resistance, and durability make them the preferred choice in paints, coatings, adhesives, and sealants. In construction, acrylates are extensively used in exterior architectural coatings where UV resistance, gloss retention, and long-term performance are critical. Automotive industries also favor acrylates for high-performance coatings that provide protective and decorative finishes, ensuring both aesthetic value and resistance to harsh environmental conditions.

Packaging, textiles, and adhesives further reinforce their demand because acrylates enhance bonding, surface strength, and flexibility. Methacrylates, on the other hand, occupy specialized markets such as transparent sheets, automotive lighting, and display panels where high optical clarity, scratch resistance, and impact strength are necessary. Hybrid chemistries are emerging in niche markets where manufacturers seek to combine acrylates’ flexibility with additional hardness or scratch resistance, but adoption remains relatively limited compared to acrylates.

Environmental sustainability is another driver of acrylates’ dominance, as these resins perform exceptionally well in waterborne formulations, enabling compliance with global VOC emission regulations. With rapid urbanization, infrastructure projects, and rising demand for automotive refinishing, acrylates are expected to remain the most widely used chemistry. Their adaptability to both traditional and eco-friendly solutions ensures their long-term growth and market leadership.

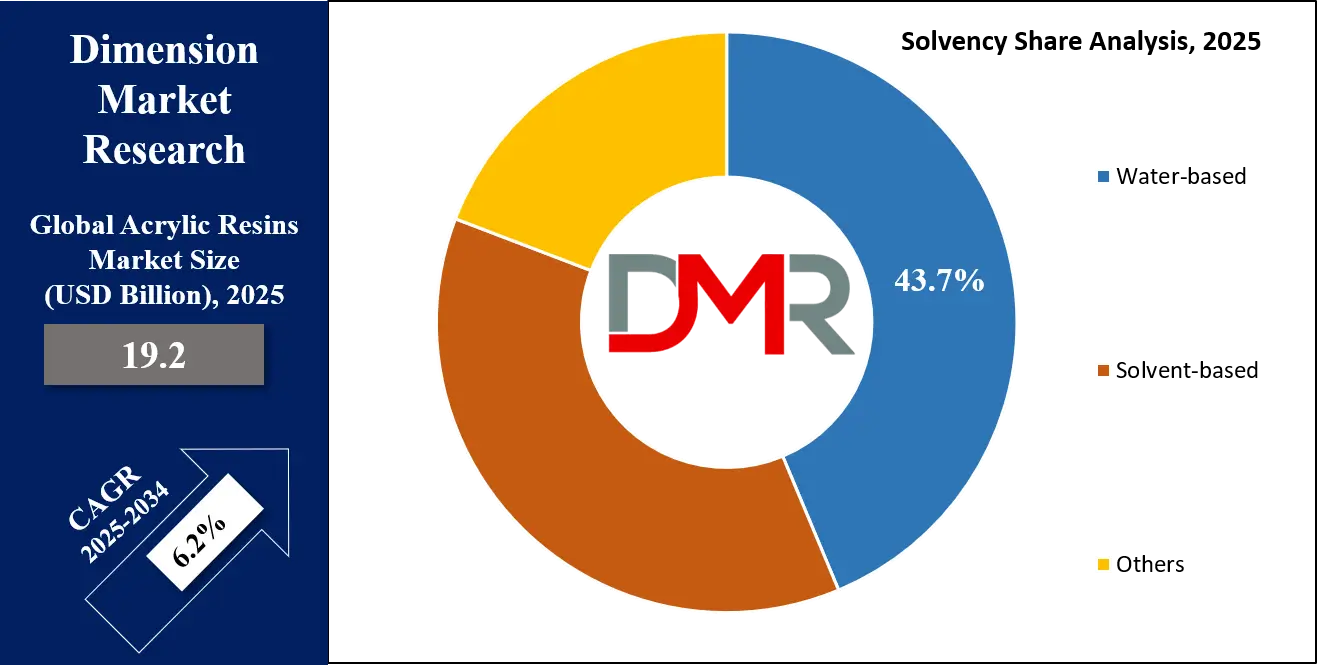

By Solvency Analysis

Water-based acrylic resins are anticipated to dominate the solvency segment, driven by global regulatory mandates and rising environmental awareness. Governments in regions such as North America, Europe, and the Asia-Pacific enforce stringent VOC emission standards, pushing industries toward sustainable alternatives. Waterborne acrylic resins offer exceptional adhesion, fast drying, and weather resistance while being safer for human health and less harmful to the environment. They have become the default choice in architectural paints and coatings, especially in building and construction, where long-term durability and surface protection are critical.

Automotive refinishing also benefits from waterborne resins, as they provide consistent performance and aesthetic appeal while meeting strict emission norms. Although solvent-based acrylics remain important in heavy-duty applications like marine, aerospace, and industrial coatings due to their superior toughness and chemical resistance, their overall market share is declining under regulatory pressure.

Emerging alternatives, including high-solid and powder-based resins, are gradually growing as niche, eco-friendly solutions where energy efficiency and ultra-low emissions are prioritized. However, water-based acrylics’ strong combination of performance, safety, and compliance cements their leading role in the global market. With continued innovation in waterborne formulations offering improved film formation, corrosion resistance, and application ease, this segment’s dominance will only intensify. Their growth aligns with global sustainability initiatives and industry transitions toward greener technologies.

By Application Analysis

Paints and coatings are expected to form the largest application segment in the acrylic resin market, accounting for the majority of demand globally. Acrylic resins are prized for their ability to deliver durability, gloss retention, UV protection, and adhesion across a range of substrates. In building and construction, acrylic-based architectural coatings are the most widely used because they can withstand extreme weather conditions, moisture, and chemical exposure, making them ideal for both interior and exterior surfaces.

Automotive coatings also rely heavily on acrylics for basecoats, topcoats, and clear coats that provide protective durability while maintaining vibrant finishes. Industrial coatings for machinery, pipelines, and protective layers further expand acrylics’ application base. Beyond these, the packaging industry uses acrylics in protective laminations for paper and board, while the DIY market has grown with consumer demand for decorative coatings, furniture finishes, and home improvement products.

Although adhesives and sealants constitute a significant share, their usage remains secondary compared to paints and coatings, while elastomers, plastics, textiles, and fibers are niche yet steadily expanding markets. Growth in global infrastructure development, rising automotive production, and the push for eco-friendly coatings provide robust long-term momentum. Innovations in waterborne and low-VOC acrylic coatings reinforce their dominance, as industries increasingly prioritize sustainability without compromising performance. Paints and coatings will continue to be the cornerstone of acrylic resin applications worldwide.

By End-Use Industry Analysis

Building and construction is poised to dominate the end-use industry segment for acrylic resins, supported by their widespread use in architectural paints, coatings, adhesives, and sealants. The sector benefits from acrylics’ durability, flexibility, and superior resistance to chemicals, UV radiation, and moisture. Exterior architectural coatings made with acrylics prevent chalking, cracking, and fading, ensuring longevity in both residential and commercial structures. Interior applications such as decorative coatings, flooring adhesives, and wall finishes further strengthen their role in the construction industry.

Rapid urbanization and infrastructure investments in emerging economies like India, China, and Southeast Asia have significantly expanded the demand for acrylics in this sector. Additionally, government-backed housing projects and smart city initiatives are fueling large-scale adoption of acrylic-based solutions. Automotive stands as the second-largest end-use industry, where acrylic resins are used in coatings that combine protective durability with aesthetic appeal. Industrial applications, such as protective coatings for machinery, pipelines, and equipment, also contribute substantially.

Packaging, textiles, consumer goods, and electronics represent smaller yet steadily growing end-use categories, benefiting from acrylics’ adaptability. The trend toward sustainable construction materials further strengthens acrylic resins’ dominance, particularly waterborne and low-VOC formulations. With global megacities expanding and stricter environmental policies in place, building and construction will remain the cornerstone of acrylic resin demand, shaping future growth across developed and emerging markets.

The Global Acrylic Resin Market Report is segmented on the basis of the following:

By Chemistry

- Acrylates

- Methacrylates

- Hybrids

By Solvency

- Water-based

- Solvent-based

- Others

By Application

- Paints & Coatings

- Adhesives & Sealants

- Elastomers

- Plastics

- Textiles & Fibers

- Paper & Paperboard

- DIY Coatings

- Others

By End-Use Industry

- Building & Construction

- Automotive

- Industrial

- Packaging

- Electrical & Electronics

- Paper & Paperboard

- Textiles & Fibers

- Consumer Goods

- Others

Impact of Artificial Intelligence in the Global Acrylic Resin Market

- Enhanced Demand Forecasting: AI-driven predictive analytics improves demand forecasting for acrylic resins, allowing manufacturers to align production with market needs, optimize inventory, reduce waste, and strengthen supply chain resilience amid global market uncertainties and disruptions.

- Smarter Quality Control: Machine learning algorithms in quality control identify microscopic inconsistencies in resin formulations in real time, ensuring product uniformity, minimizing production errors, and enhancing customer satisfaction across diverse acrylic resin applications worldwide.

- Optimized Manufacturing Efficiency: AI-enabled process automation increases manufacturing efficiency by lowering energy consumption and operating costs while upholding quality standards. This supports sustainability targets and compliance with global environmental regulations in the acrylic resin industry

- Accelerated R&D Innovation: Artificial intelligence accelerates R&D in acrylic resins by simulating chemical interactions, enabling the rapid design of advanced, eco-friendly, and high-performance polymers tailored for specialized industrial and consumer applications.

- Data-Driven Market Insights: AI-powered market intelligence tools examine consumer trends, competitor actions, and regulatory shifts, delivering insights that help companies customize acrylic resin solutions, strengthen global market positioning, and secure competitive advantages.

Global Acrylic Resin Market: Regional Analysis

Region with the Largest Revenue Share

Asia-Pacific is projected to dominate the global acrylic resin market with 36.4% of the total revenue by the end of 2025, primarily due to its strong industrial base, rapid urbanization, and expansive end-use industries. Countries such as China, India, Japan, and South Korea lead in consumption and production, driven by a combination of cost advantages, availability of raw materials, and growing domestic demand. The region’s booming construction sector, supported by large-scale infrastructure development, housing projects, and smart city initiatives, significantly boosts the demand for acrylic resins used in paints, coatings, adhesives, and sealants.

Additionally, the automotive industry in Asia-Pacific, particularly in China and India, plays a critical role in the high consumption of resins for vehicle coatings, interior applications, and lightweight plastic parts.

Furthermore, Asia-Pacific benefits from a strong manufacturing ecosystem, low production costs, and favorable government policies encouraging industrial growth and investment. The rising middle-class population with increasing disposable incomes further drives demand for consumer goods, textiles, and packaging applications where acrylic resins are widely used.

Rapid technological adoption and localized R&D advancements allow companies in the region to produce diverse, high-performance acrylic resin formulations tailored to regional requirements. In addition, the presence of key global and local resin manufacturers consolidates the region’s leadership position. Altogether, the synergy of industrial demand, cost advantages, and evolving infrastructure firmly establishes Asia-Pacific as the dominant force in the global acrylic resin market.

Region with the Highest CAGR

North America is poised to witness the highest CAGR in the global acrylic resin market due to its strong innovation-driven economy, regulatory emphasis on sustainability, and increasing demand for advanced materials across industries. The region’s construction sector is experiencing steady growth, particularly in the U.S., with rising demand for durable, low-VOC water-based coatings and adhesives that comply with stringent environmental policies. Moreover, the region is home to several leading multinational chemical companies and R&D hubs that invest heavily in developing bio-based and high-performance acrylic resins tailored for next-generation applications. This innovation-driven approach fosters market expansion at a faster pace compared to other regions.

The automotive sector in North America also significantly contributes to growth. With increasing adoption of electric vehicles (EVs), demand for lightweight, durable, and high-performance resin-based materials in coatings and structural components is accelerating. Furthermore, the rapid development of packaging innovations, combined with growing consumer preference for sustainable and recyclable materials, expands acrylic resin applications in North America.

Additionally, the region benefits from advanced manufacturing technologies, AI-driven optimization, and higher adoption of digital tools in production processes. These factors allow companies to scale quickly and improve operational efficiency. Supportive regulatory frameworks promoting sustainability and strong investment in infrastructure further enhance market prospects. This combination of innovation, regulatory alignment, and advanced industrial demand positions North America as the fastest-growing region in the acrylic resin market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Acrylic Resin Market: Competitive Landscape

The global acrylic resin market is highly competitive, with several multinational corporations and regional players striving to strengthen their market share through innovation, capacity expansion, and strategic partnerships. Key industry participants include BASF SE, Arkema, Mitsubishi Chemical Holdings, Dow Inc., Nippon Shokubai, and Sumitomo Chemical, alongside numerous specialized regional manufacturers. These companies are actively engaged in developing bio-based and waterborne acrylic resins to meet rising sustainability standards and regulatory requirements.

Intense competition is characterized by product differentiation, R&D investments, and customer-centric strategies. Many players are focusing on high-performance acrylic resins with enhanced durability, UV resistance, and eco-friendly formulations suitable for diverse applications in construction, automotive, packaging, and textiles. Additionally, technological integration, such as artificial intelligence for process optimization and predictive quality control, is enabling manufacturers to enhance efficiency while reducing costs.

Strategic mergers, acquisitions, and joint ventures are further shaping the landscape, allowing global players to expand their presence in fast-growing markets such as Asia-Pacific while maintaining innovation hubs in North America and Europe. Emerging regional manufacturers are leveraging cost advantages and proximity to raw materials to compete effectively against established players. With the rising demand for sustainable solutions, companies that can rapidly innovate and adapt to environmental standards are likely to secure long-term competitive advantages in this market.

Some of the prominent players in the Global Acrylic Resin Market are:

- BASF SE

- Arkema S.A.

- The Dow Chemical Company

- Mitsubishi Chemical Holdings Corporation

- Evonik Industries AG

- Nippon Shokubai Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Allnex Group

- LG Chem Ltd.

- Asahi Kasei Corporation

- Mitsui Chemicals, Inc.

- Royal DSM N.V.

- Solvay S.A.

- Huntsman Corporation

- DIC Corporation

- Lubrizol Corporation

- Showa Denko K.K.

- Wacker Chemie AG

- Clariant AG

- Celanese Corporation

- Other Key Players

Recent Developments in the Global Acrylic Resin Market

June 2024 - Investment/Expansion

- Nippon Shokubai announces plans to invest billions of yen to significantly increase its production capacity for superabsorbent polymers (SAP) and acrylic acid, a key acrylic resin feedstock, at its site in Cilegon, Indonesia.

May 2024 - Collaboration

- BASF and Siemens announce a collaboration to accelerate the digitalization of the chemical industry, focusing on using AI to optimize production processes for materials like acrylic resins, aiming for greater efficiency and sustainability.

April 2024 - Expo/Conference

- American Coatings Show (ACS) 2024 (Indianapolis, USA, April 30 - May 2). A major platform where companies like Arkema, Dow, and Allnex launched new generations of sustainable acrylic resins, including bio-based, low-VOC, and self-crosslinking technologies for coatings and adhesives.

March 2024 - Merger & Acquisition

- Arkema finalizes the acquisition of Glenmark Pharmaceuticals' adhesive business in India (March 2024), strengthening its position in specialty acrylic-based adhesives for the fast-growing South Asian market.

February 2024 - Investment/Expansion

- Mitsubishi Chemical Group (MCG) details a modernization project for its methyl methacrylate (MMA) and Polymethyl Methacrylate (PMMA) plants in the US and Japan, aimed at boosting output and energy efficiency throughout 2024.

January 2024 - Collaboration

- Dow announces a partnership with a major global brand to develop fully recyclable packaging using advanced acrylic polymer technology to improve barrier performance and circularity.

November 2023 - Expo/Conference

- CHINACOAT 2023 (Shanghai, China, November 15-17). The event served as a launchpad for Asian chemical giants like DIC Corporation and LG Chem to unveil new acrylic emulsion and resin products tailored for the electric vehicle and sustainable coatings markets.

October 2023 - Investment/Expansion

- LG Chem announces a major $ billion investment to construct a new integrated acrylate complex in Yeosu, South Korea, focusing on high-value SAP and high-purity acrylic resins for lithium-ion battery electrolytes.

September 2023 - Merger & Acquisition

- Sika AG successfully completes the acquisition of MBCC Group (September 2023), creating a global leader in construction chemicals and significantly impacting the market for acrylic resin-based admixtures, sealants, and repair mortars.

July 2023 - Collaboration

- Trinseo and Norge Mining sign a memorandum of understanding (July 2023) to secure a future supply of critical raw materials from Norway, aiming to create a more sustainable and localized supply chain for acrylics production in Europe.

May 2023 - Investment/Expansion

- DIC Corporation completes a capacity expansion project at its acrylic emulsions plant in Kashima, Japan (May 2023), specifically to meet rising demand for acrylic-based pressure-sensitive adhesives.

March 2023 - Expo/Conference

- European Coatings Show (ECS) 2023 (Nuremberg, Germany, March 28-30). The premier European event where sustainability was the key theme. Major producers showcased breakthrough acrylic binders designed for circular economy principles, including products made from recycled content.

February 2023 - Merger & Acquisition

- Toyo Ink SC Holdings Co. finalizes its acquisition of the laminating adhesives business of Ashland (February 2023), significantly enhancing its portfolio with high-performance acrylic adhesives for the flexible packaging industry.

January 2023 - Investment/Expansion

- Synthomer plc announces the successful completion of a debottlenecking project at its acrylic dispersions plant in Germany (January 2023), increasing its capacity to serve the European decorative and industrial coatings markets.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 19.2 Bn |

| Forecast Value (2034) |

USD 33.0 Bn |

| CAGR (2025–2034) |

6.2% |

| The US Market Size (2025) |

USD 4.4 Bn

|

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Chemistry (Acrylates, Methacrylates, and Hybrids), By Solvency (Water-based, Solvent-based, and Others), By Application (Paints & Coatings, Adhesives & Sealants, Elastomers, Plastics, Textiles & Fibers, Paper & Paperboard, DIY Coatings, and Others), By End-Use Industry (Building & Construction, Automotive, Industrial, Packaging, Electrical & Electronics, Paper & Paperboard, Textiles & Fibers, Consumer Goods, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

BASF SE, Arkema S.A., The Dow Chemical Company, Mitsubishi Chemical Holdings Corporation, Evonik Industries AG, Nippon Shokubai Co., Ltd., Sumitomo Chemical Co., Ltd., Allnex Group, LG Chem Ltd., Asahi Kasei Corporation, Mitsui Chemicals, Inc., Royal DSM N.V., Solvay S.A., Huntsman Corporation, DIC Corporation, Lubrizol Corporation, Showa Denko K.K., Wacker Chemie AG, Clariant AG, Celanese Corporation., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Acrylic Resin Market size is estimated to have a value of USD 19.2 billion in 2025 and is expected to reach USD 33.0 billion by the end of 2034.

The market is growing at a CAGR of 6.2 percent over the forecasted period of 2025.

The US Acrylic Resin Market is projected to be valued at USD 4.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 7.3 billion in 2034 at a CAGR of 5.8%.

Asia Pacific is expected to have the largest market share in the Global Acrylic Resin Market with a share of about 36.4% in 2025.

Some of the major key players in the Global Acrylic Resin Market are BASF SE, Arkema S.A., The Dow Chemical Company, Mitsubishi Chemical Holdings Corporation, Evonik Industries AG, Nippon Shokubai Co., Ltd., Sumitomo Chemical Co., Ltd., Allnex Group, and many others.