Market Overview

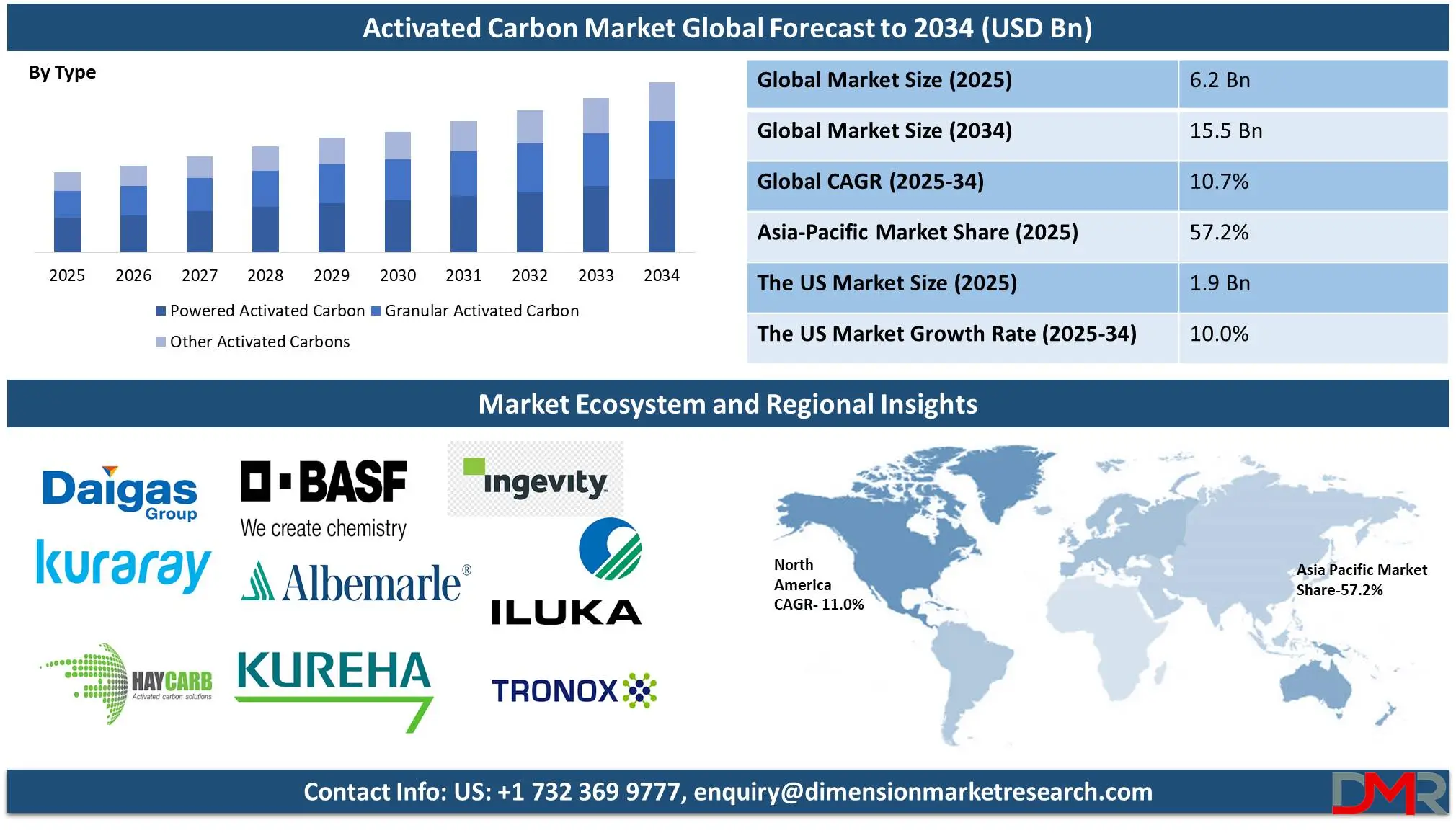

The Global

Activated Carbon Market size is expected to be valued at

USD 6.2 billion in 2025, and it is further anticipated to reach a market value of

USD 15.5 billion by 2034 at a

CAGR of 10.7%.

Activated carbon is widely utilized as an aid for water purification to remove chlorine, volatile organic compounds (VOCs), and other contaminants, and as medical treatments for poisons or toxins in the body. Activated carbon is widely adopted because of its versatility, effectiveness, and eco-friendliness. Within the water treatment industry, activated carbon is often used to filter out contaminants such as chlorine, heavy metals, and industrial pollutants from drinking water, thus making it safe to be consumed by consumers. Activated carbon is an invaluable ingredient in the food and beverage industry, serving two functions simultaneously - decolorization and flavor enhancement.

Furthermore, it is often utilized as activated carbon in emergency remedies against poisoning as it absorbs toxic substances from the stomach. Such widespread application emphasizes its relevance across numerous industries while driving market expansion. Air purification has experienced exponential growth over recent years due to rising pollution levels and strict air quality regulations globally, prompting both governments and industries to turn towards activated carbon for air filter systems. Industries including food, beverages, pharmaceuticals, automotive as well poison treatment services use activated carbon for decolorization, odor removal, or medical applications such as detoxifying poison.

Environmental concerns and an expanding population will drive increased demand for activated carbon purification applications like water and air purification systems, particularly as pollution, industrial contamination, and climate change create more of a need for clean drinking water sources. Urbanization continues across Asia Pacific regions where more industrial plants, municipal water systems, and households adopt activated carbon for filtering and purifying needs. Technological advances in activated carbon production, such as eco-friendlier manufacturing processes and regeneration techniques to reuse spent activated carbon, will further propel market expansion.

These advances often incorporate innovations involving

carbon dioxide reactivation processes, enhancing sustainability and cost-efficiency. Moreover, the use of automotive carbon fiber components in conjunction with activated carbon filters in lightweight vehicle designs helps improve fuel efficiency and emission standards in transportation.

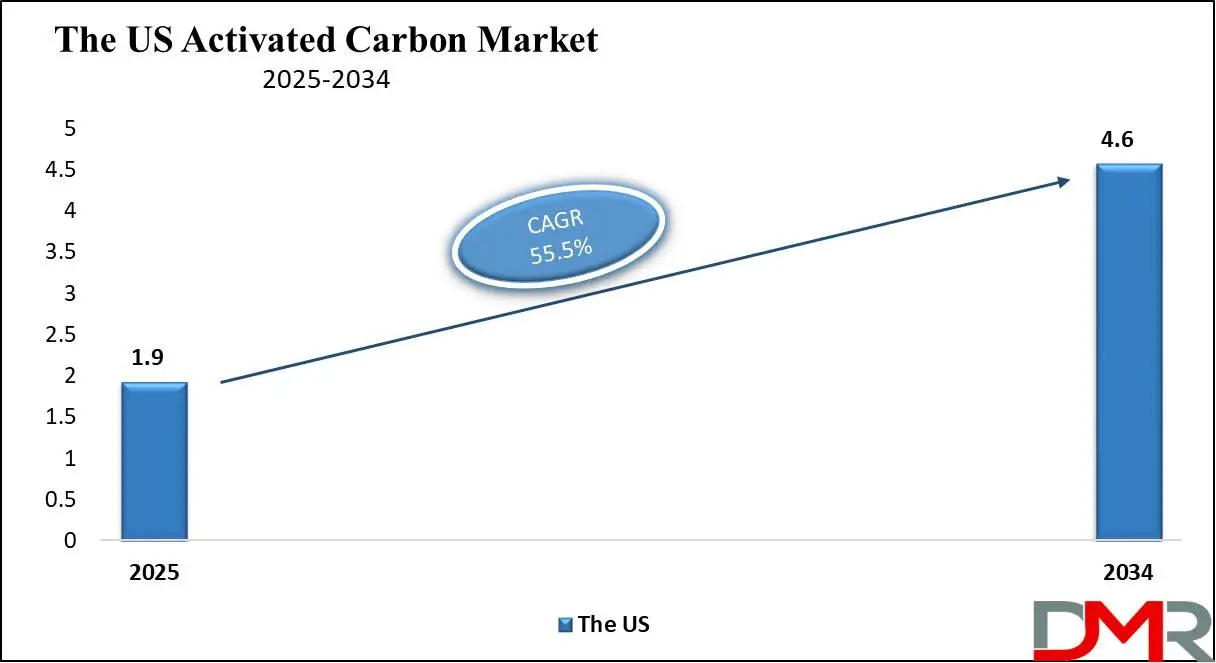

The US Activated Carbon Market

The

US Activated Carbon Market is projected to be valued at

USD 1.9 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds

USD 4.6 billion in 2034 at a

CAGR of 10.0%.

The U.S. activated carbon market is experiencing steady expansion, driven by demand from several key industries such as water treatment, air purification, automotive manufacturing, and industrial processes. Furthermore, strict environmental regulations that promote air and water quality encourage using activated carbon for filtering and purifying purposes. In the US, water treatment remains the largest application segment, as the growing concern over water contamination from industrial waste, pollutants, and aging infrastructure continues to drive investments in water purification technologies.

US automotive industries have also begun using activated carbon in cabin air filters and emission control systems, while its role is growing within pharmaceutical and food industries as demand increases for eco-friendly products. Rising health concerns further spur this market growth. Technological developments in activated carbon production, including advanced regeneration techniques and more efficient adsorption properties, should help the market remain more cost-competitive and sustainable. Even though raw material costs fluctuate frequently, the US activated carbon market is projected to expand at an impressive pace led by industrial needs, regulatory compliance initiatives, and environmental sustainability programs.

Key Takeaways

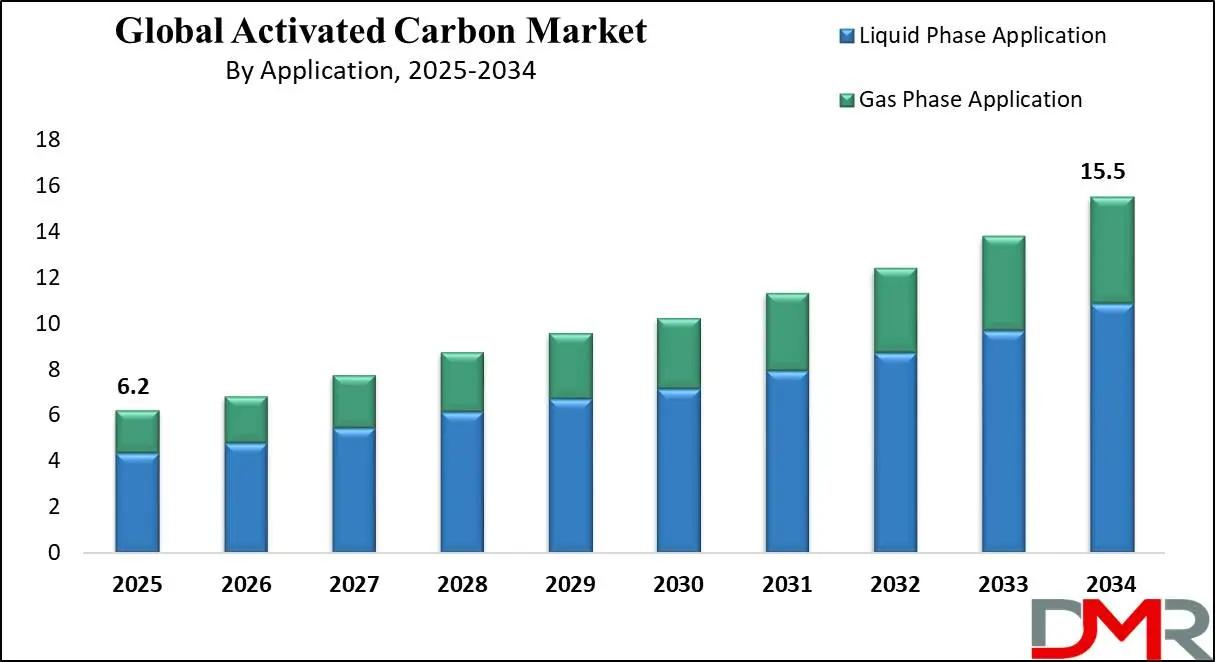

- Market Value: The global activated carbon market size is expected to reach a value of USD 15.5 billion by 2034 from a base value of USD 6.2 billion in 2025 at a CAGR of 10.7%.

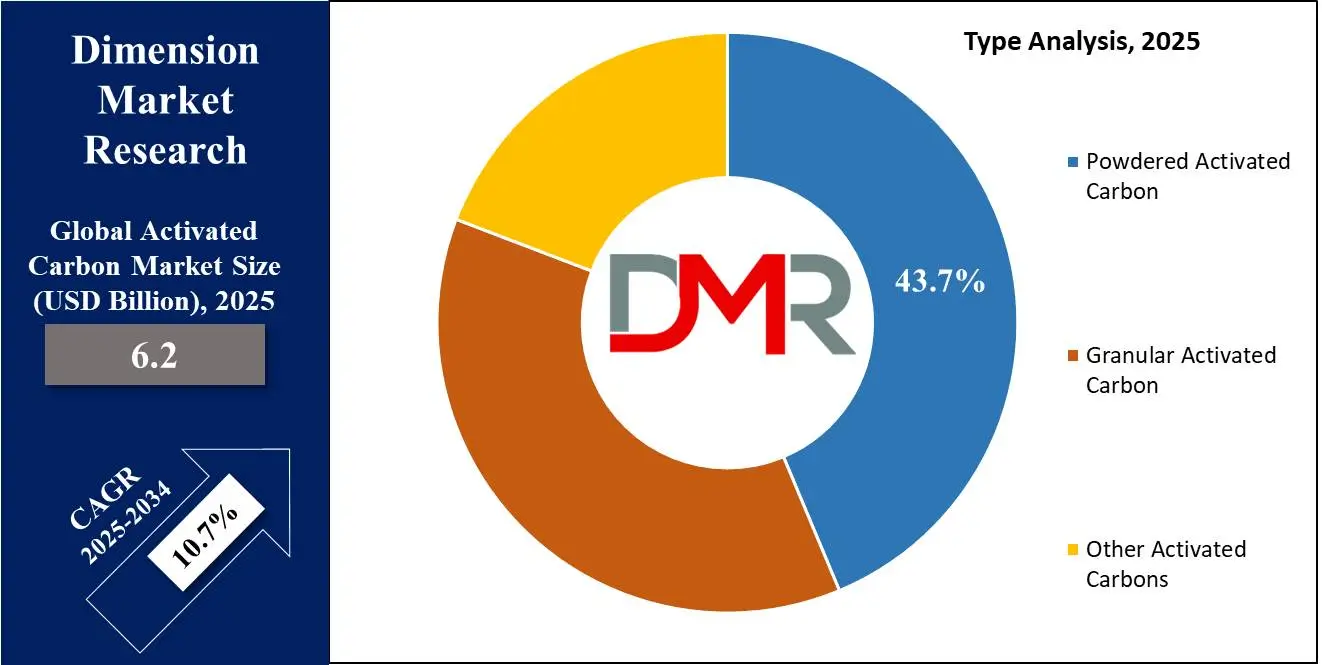

- By Type: Powdered Activated Carbon (PAC) is projected to maintain its dominance in the carbon type segment, capturing 43.7% of the market share in 2025.

- By Application: Liquid Phase Application is anticipated to capture the global activated carbon market with 70.0% of the market share in the application segment by 2025.

- By Raw Material: Coal is poised to maintain its dominance in the raw material type segment capturing 40.0% of the total market share in 2025.

- By End-Use: Drinking Water is expected to capture the global activated carbon market with 53.0% of the market share in the end-use type segment by 2025.

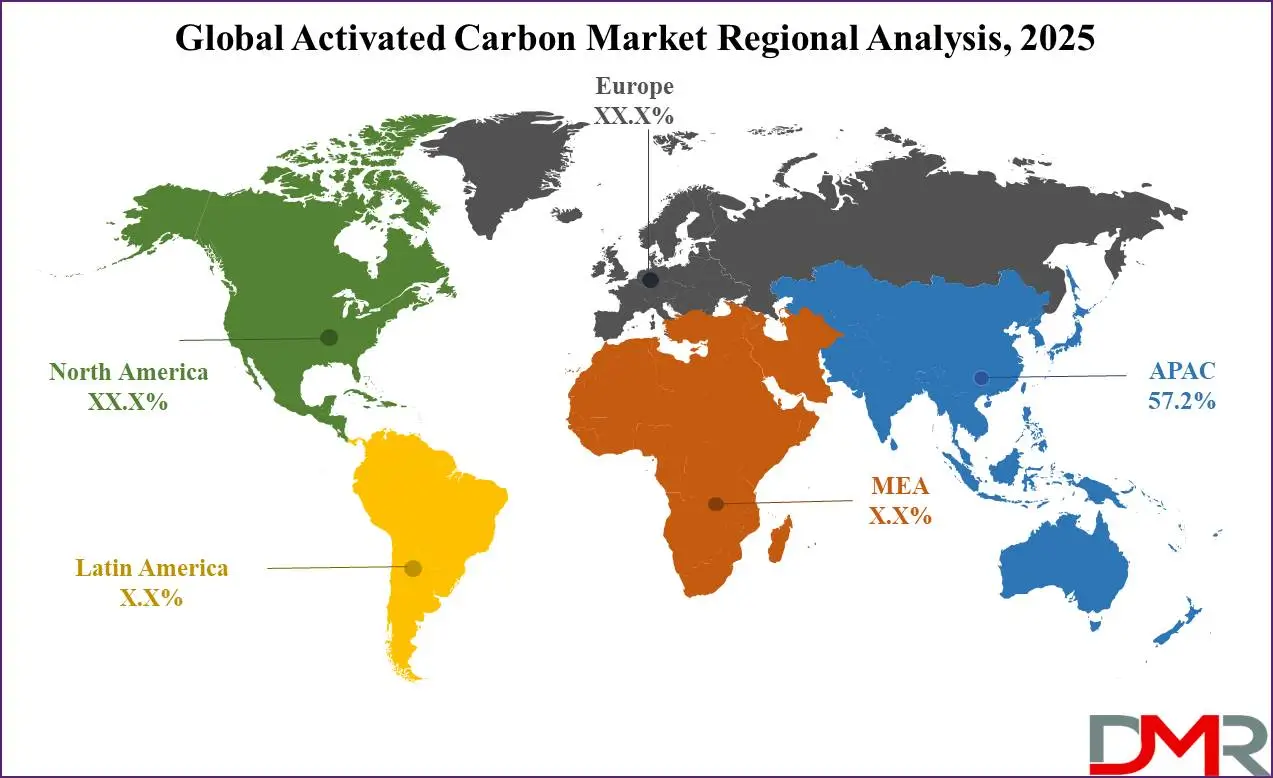

- By Region: Asia-Pacific is anticipated to lead the global activated carbon landscape with 57.2% of total global market revenue and it is further anticipated to maintain its dominance by 2025.

- Key Players: Some major key players in the global activated carbon market are, Daigas Group, Kuraray Co. Ltd., Haycarb Plc, Basf SE, Albemarle Corporation, Kureha Corporation, Ingevity, and Other Key Players.

Use Cases

- Water Treatment: Activated carbon is widely used in water purification to remove impurities, such as chlorine, volatile organic compounds (VOCs), heavy metals, and industrial pollutants. It plays a critical role in ensuring safe drinking water and is used in municipal water treatment plants, household water filters, and industrial applications to meet growing demands for clean, potable water.

- Air Purification: Activated carbon is highly effective in adsorbing gases, odors, and volatile organic compounds (VOCs) from the air. It is used in air filtration systems in residential, commercial, and industrial settings to improve air quality and meet regulatory standards. The growing concerns about air pollution, particularly in urban areas and industrial zones, are driving the adoption of activated carbon in air purifiers, vehicle emission control, and pollution control systems.

- Industrial and Chemical Processes: Activated carbon is extensively used in various industries for applications such as solvent recovery, decolorization of liquids, and purification of chemicals. It is crucial in refining edible oils, beverages, and pharmaceutical products, where it is used to remove unwanted impurities, decolorize liquids, and improve the quality of the final product. These uses are increasingly relevant in manufacturing automotive carbon fiber components where precision purification processes are essential.

Stats & Facts

- As per the National Library of Medicine (NLM), the adsorption function of activated carbon is determined by the loose microporous structure of the surface, and its adsorption characteristics are closely related to its particle size. Thus, the effect of activated carbon particle size on the decolorization rate (Dr, %) was first evaluated using a coal-activated carbon with an iodine value of 1000 at pH 7.0, 50 °C, 50 min, and 1% dosage.

- According to the National Library of Medicine, a new and simple method, based entirely on a physical approach, was proposed to produce activated carbon from longan fruit seed with controlled mesoporosity. This method referred to as the OTA, consisted of three consecutive steps of air oxidation, thermal destruction of the functional groups, and the final reactivation of the resulting carbon in carbon dioxide.

- As per the National Library of Medicine (NLM), Ultrasonic-assisted activated carbon separation (UACS) is used to improve product quality by regulating adsorption rate and removing bacterial endotoxin from salvia miltiorrhizae injection.

Market Dynamic

Driving Factors

Increasing Environmental Regulations and Sustainability InitiativesGlobal concerns over environmental issues like air and water pollution have resulted in strict environmental regulations being implemented across various industries. Globally governments are adopting stringent standards to curb emissions, improve air quality, and ensure access to safe drinking water supplies. As part of their air pollution control regulations, the European Union, North American, and Asian regions mandate that industries install air filtration systems capable of trapping toxic gases and particulate matter effectively.

Activated carbon's ability to capture various pollutants makes it a popular choice in air purification systems in response to regulatory mandates for emissions reduction and improved environmental conditions. Thus, its widespread adoption reflects industries' legal obligations of meeting their emissions reduction obligations while improving environmental conditions. The focus on

low carbon propulsion strategies further enhances the demand for activated carbon, particularly in automotive and transport sectors striving to reduce carbon dioxide output.

Rising Demand for Clean Drinking Water and Wastewater TreatmentRising demand for clean drinking water and effective wastewater treatment solutions is another factor bolstering the market expansion globally. Rapid urbanization, industrialization, and population growth have significantly increased water consumption and generated wastewater, striving for resources. As water scarcity and contamination continue to affect many regions globally, activated carbon has become a leading choice in providing advanced water purification systems encouraging advanced solutions for purification processes.

Climate change and rising drought events are increasing water scarcity issues, prompting the adoption of water treatment solutions in arid and semi-arid regions. There, activated carbon-based technologies are being utilized to desalinate and purify water to provide access to safe drinking, agricultural, and industrial usage.

Restraints

Fluctuations in Raw Material Availability and Costs

One of the biggest obstacles limiting global activated carbon market growth is the fluctuating availability and cost of raw materials. Most activated carbon production uses carbon-rich raw materials like coconut shells, wood, coal, and peat that may be subject to supply chain issues, seasonal variations, or geopolitical considerations that impact availability or pricing, creating vulnerabilities among manufacturers that increase production costs thereby decreasing market growth potential.

Coconut shells are an ideal raw material for producing high-grade activated carbon due to their renewable nature and superior absorption capabilities. Unfortunately, their availability can often depend on regional agricultural outputs and climatic conditions. Major producers of coconuts like India, Indonesia, and the Philippines often face fluctuations in supply due to natural disasters, droughts, or changing agricultural practices that disrupt production, forcing manufacturers of activated carbon products to increase costs or cut profit margins in production processes.

Competition from Alternative Technologies

An additional factor holding back the growth of the global activated carbon market is competition from alternative purification and filtration technologies. While activated carbon has long been recognized for its efficient removal of pollutants and contaminants, newer purification and filtration solutions like membrane filtration, biofiltration, AOPs, and ion exchange resins may provide industries with additional options that may offer advantages over activated carbon.

Membrane filtration has seen tremendous success in water treatment applications due to its ability to remove contaminants such as microorganisms without the use of chemical additives. Reverse Osmosis (RO) and ultrafiltration membranes are particularly popular for desalination and wastewater treatment as they offer high efficiency with low maintenance compared to activated carbon filter systems. Biofiltration and advanced oxidation processes (AOPs) have become more and more widely adopted methods for air and water treatment, especially as part of odor control or wastewater treatment systems.

Opportunities

Growing Adoption of Activated Carbon in Emerging Economies

Emerging economies represent a massive opportunity for activated carbon growth globally. Countries in Asia-Pacific, Latin America, and Africa are all witnessing rapid industrialization, urbanization, population growth, and environmental concerns that require cleaner air, water supplies, and industrial processes - driving demand for activated carbon to be widely adopted across multiple applications. Government initiatives for public infrastructure development provide favorable conditions for activated carbon usage.

Emerging markets and industrial sectors are also taking steps toward more eco-friendly practices. Food and beverage, pharmaceutical, and chemical companies have switched to activated carbon for purification and decolorization processes to meet global standards and consumer preferences, with exporting goods that comply with international environmental and safety regulations further driving this increase in demand.

Additionally, these regions' excessively low-cost raw materials and manufacturing capabilities create opportunities for local production and export of activated carbon. Indonesia and the Philippines with abundant supplies of coconut shells are well-positioned to become major producers serving both domestic and international markets encouraging investments and collaborations between global players looking to establish manufacturing facilities as well as expand market presence.

Advancements in Renewable and Bio-Based Activated Carbon Production

Renewable and bio-based activated carbon production advancements have provided opportunities for the global activated carbon market. Amid increasing concerns regarding environmental impact and sustainability, there has been an upsurge in demand for eco-friendly production methods and raw materials - prompting manufacturers to explore renewable resources like agricultural waste, biomass, and organic byproducts as sustainable feedstocks for activated carbon production.

Bio-based activated carbon production creates new opportunities in carbon credit markets. Companies using renewable feedstocks and adopting sustainable manufacturing practices can use carbon trading programs to lower their carbon footprint while potentially capitalizing on any environmental contributions made through carbon trading programs, providing economic motivation for adopting bio-based production technologies.

Demand for bio-based activated carbon is being driven by both consumer and regulatory preferences for environmentally-friendly products, and companies and governments around the world prioritizing sustainable solutions, creating an edge for bio-based activated carbon products in certain industries like water treatment, air purification, and pharmaceuticals that align with corporate and social responsibility goals while meeting stringent environmental regulations.

Trends

Increasing Adoption of Activated Carbon in Energy Storage Applications

One key trend in the global activated carbon market is its increasing usage for energy storage applications such as supercapacitors and batteries. As societies globally have transformed towards renewable energies and electrification, demand has risen exponentially for advanced energy storage solutions like activated carbon's high surface area, good conductivity, and superior absorption properties which are becoming essential components in energy storage technologies.

Activated carbon has also made great strides in lithium-ion and sodium-ion battery technology, playing a significant role as a component in both anodes and cathodes of these batteries, with major gains being seen in energy density, efficiency, lifespan, and charge storage/conductivity capabilities. As such, activated carbon is becoming an essential material in next-generation battery technologies used by grid energy storage systems as well as consumer electronics products.

This trend is furthered by advances in activated carbon production, with manufacturers developing customized activated carbon materials designed specifically for energy storage applications based on optimal porosity, surface area, and conductivity parameters to meet energy sector needs and create new growth avenues in the market.

Increasing Use of Activated Carbon in Green and Sustainable Technologies

One of the latest trends in the global activated carbon market is its growing use of green and sustainable technologies. As environmental concerns increase and governments and industries emphasize sustainability initiatives, demand is rising for eco-friendly solutions across various applications. Activated carbon has long been used as an adsorbent agent, drawing contaminants out of air, water, and industrial processes before being released back into nature.

Activated carbon is becoming an integral component of waste-to-energy and resource recovery processes that adhere to circular economy principles, for example in industrial waste treatment where activated carbon captures valuable byproducts or hazardous substances that could otherwise pose environmental hazards, thus facilitating their safe recovery or disposal without excessive environmental harm. Furthermore, activated carbon's ability to capture volatile organic compounds (VOCs), sulfur compounds, and other harmful chemicals is playing a crucial role in mitigating emissions while enabling cleaner production processes.

Research Scope and Analysis

By Type

Powdered Activated Carbon (PAC) is projected to maintain its dominance in the carbon type segment, capturing 43.7% of the market share in 2025. This is attributable to its outstanding adsorption properties, cost-effectiveness, versatility in meeting environmental and industrial challenges, and fine particle form which provides a better surface area to efficiently absorb contaminants from liquids and gases.

One of the major factors driving demand for PAC is its widespread application in water treatment. Municipal water treatment plants rely heavily on it to remove harmful contaminants like organic compounds, pesticides, and odor-causing substances to deliver safe drinking water to their communities. With its rapid mixing and adsorption capabilities it's particularly effective for emergency pollution control situations requiring quick results. Also, it is commonly used in wastewater treatment for pollution reduction as well as meeting stringent environmental discharge regulations.

Powdered Activated Carbon has emerged as the market leader due to its exceptional performance, versatility, and alignment with regulatory and sustainability needs. As industries prioritize clean water, air, and sustainable processes for their global initiatives, PAC will remain an invaluable component in meeting industry demands.

By Application

Liquid Phase Application is anticipated to capture the global activated carbon market with 70.0% of the market share in the application segment by 2025. This growth is attributable to activated carbon's use as an effective purifier of water treatment systems across various industries and applications. Due to its ability to effectively adsorb organic compounds, pollutants, and impurities, it plays an essential role in maintaining clean drinking water supplies. Major factors contributing to activated carbon's surge include its widespread usage in municipal and industrial water treatment facilities. Municipalities rely on activated carbon to eliminate contaminants like pesticides, chlorine, and other smelly substances from drinking water supplies.

Beyond water treatment, activated carbon has found widespread application in liquid phase applications in industries like food and beverage manufacturing, pharmaceutical research, and chemical production. Food manufacturers use activated carbon for decolorization, deodorization, and removal of impurities during production in sugar refining and beverage manufacturing this is used extensively to produce quality output. Meanwhile, e-pharmaceutical research utilizes activated carbon to purify active pharmaceutical ingredients and eliminate byproducts produced during drug formulation to ensure efficacy and safety for patient products. Similarly in chemical production activated carbon is used for solvent purification and extraction of valuable components from liquid streams.

By Raw Material

Coal is poised to maintain its dominance in the raw material type segment capturing 40.0% of the total market share in 2025. Coal's dominance depends largely on its availability, cost-effectiveness, and its ability to produce activated carbon with superior absorption characteristics. These qualities make it suitable for numerous industries ranging from water treatment to air purification, and industrial processing applications.

Coal-based activated carbon, particularly bituminous coal, is highly esteemed for its porous structure that creates an expansive surface area for adsorption, which is essential when applying various contaminants from liquids and gases. Furthermore, its denseness and hardness give this carbon an advantage in regeneration processes, making its cost-effectiveness over the long run even greater.

These properties make coal-based activated carbon an ideal material choice for gas-phase filtration, solvent recovery, and wastewater treatment applications where high-performance filtration is essential.

Coal's position as the raw material type segment for activated carbon is expected to remain strong as industries continue relying on activated carbon purifiers for air, water, and industrial purification, coal will remain the primary choice to meet global demand.

By End-Use

Drinking Water is expected to capture the highest market share of 53.0% in the end-use type segment in 2025 in the global activated carbon market, driven primarily by rising global demand for clean and safe drinking water as well as activated carbon's integral role in water purification and quality enhancement. Activated carbon is widely known for absorbing impurities like chlorine, volatile organic compounds (VOCs), pesticides, and unpleasant odors making it an invaluable component in both municipal water treatment plants and home filtration systems.

Concerns over water contamination and an increase in waterborne diseases have fueled demand for activated carbon in drinking water treatment applications, especially among developing nations with polluted sources or inadequate infrastructure for treatment. When faced with these obstacles, activated carbon is an invaluable solution that provides cost-effective, reliable, and effective removal of harmful contaminants, further fueling its usage within this sector.

Additionally, regulatory bodies and government organizations are enforcing more stringent regulations regarding water quality and its treatment for drinking purposes. For example, in the US the Environmental Protection Agency (EPA) and other global regulatory organizations have set acceptable levels of contaminants in drinking water supplies, and activated carbon plays an integral part in helping municipalities and private water treatment facilities to meet this standard.

The Global Activated Carbon Market Report is segmented on the basis of the following

By Type

- Powdered Activated Carbon

- Granular Activated Carbon

- Other Activated Carbon Types

By Application

- Liquid Phase Application

- Gas Phase Application

By Raw Material

- Coal

- Coconut

- Wood

- Peat

- Other Raw Materials

By End-Use

- Drinking Water

- Wastewater Treatment

- Food & Beverage

- Pharmaceutical & Medical

- Automotive

- Industrial

- Other end-use industries

Regional Analysis

Asia-Pacific is anticipated to lead the global activated carbon landscape with

57.2% of total global market revenue in 2025 and it is further anticipated to maintain its dominance in coming years, driven by rapid industrialization. As large manufacturing sectors in various industries such as chemicals, textiles, pharmaceuticals, food and beverages, and power generation expand their operations, there is a need for activated carbon in air and water purification, pollution control, and industrial emissions treatment.

China stands out as a top consumer of activated carbon with its extensive manufacturing base and stringent environmental regulations, designed to curb industrial pollution. As China expands industrial activity and works towards improving environmental standards, demand for activated carbon has increased for various applications ranging from wastewater treatment and air filtration systems, as well as VOC removal from industrial emissions.

Apart from industrial growth, Asia-Pacific's increasing focus on water treatment is driving demand for activated carbon. Water scarcity and contamination remain pressing concerns across many nations particularly developing areas like India and Southeast Asia. Due to increasing demands for quality water supplies and industrial wastewater treatment needs, activated carbon technologies are rapidly being adopted across industries and communities.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global activated carbon market is marked by several well-established players as well as emerging ones that aim to capitalize on its growing demand across various industries. The market is highly fragmented, with large multinational corporations as well as small to mid-sized firms competing for market share by expanding product offerings, improving manufacturing efficiencies, and discovering new applications of activated carbon products while adhering to stringent environmental and regulatory standards.

Sustainability is another significant competitive factor in the activated carbon market. As environmental concerns increase worldwide, manufacturers face greater pressure to create products that comply with strict environmental regulations and promote sustainability practices such as using renewable raw materials in production, increasing energy efficiency in manufacturing processes, and developing products that can easily regenerate or be recycled after use. Companies offering eco-friendly solutions could gain a distinct competitive edge in markets where eco-friendly alternatives are increasingly prioritized by both consumers and industries.

Some of the prominent players in the global activated carbon are

- Daigas Group

- Kuraray Co. Ltd.

- Haycarb Plc

- Basf SE

- Albemarle Corporation

- Kureha Corporation

- Ingevity

- Iluka Resources Limited

- Tronox Holdings Plc

- Evoqua Water Technologies LLC

- Norit

- Other Key Players

Recent Developments

- October 2024: Jacobi Carbons, expanded its operations in India by opening a new activated carbon production facility. This expansion aims to meet the growing demand for activated carbon in water purification, air filtration, and industrial applications within the Indian market. The new facility will also support Jacobi’s sustainability initiatives by utilizing locally sourced raw materials.

- August 2024: Kuraray Co., Ltd., the parent company of Calgon Carbon, announced the launch of a new line of activated carbon products designed specifically for pharmaceutical applications. The new product line aims to provide higher purity levels for the removal of contaminants in drug production processes, meeting the stringent regulatory requirements of the pharmaceutical industry.

- June 2024: Swiss Re agreed to purchase a minimum of 70,000 metric tons of biochar carbon removal credits from Carbonfuture over the next seven years. These credits will originate from Exomad Green’s biochar project in Riberalta, Bolivia, aligning with Swiss Re’s strategy to ensure a reliable, long-term supply of high-quality carbon removal credits.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 6.2 Bn |

| Forecast Value (2034) |

USD 15.5 Bn |

| CAGR (2025-2034) |

10.7% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.9 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Powered Activated Carbon, Granular Activated Carbon, and Other Activated Carbons), By Application (Liquid Phase Application, and Gas Phase Application), By Raw Material (Coal, Coconut, Wood, Peat, and Other Raw Materials), and By End-Use (Water Treatment, Food & Beverage, Pharmaceutical & Medical, Automotive, Industrial, and Other Industries) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Daigas Group, Kuraray Co. Ltd., Haycarb Plc, Basf SE, Albemarle Corporation, Kureha Corporation, Ingevity, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The global activated carbon market size is estimated to have a value of USD 6.2 billion in 2025 and is expected to reach USD 15.5 billion by the end of 2034.

The US-activated carbon market is projected to be valued at USD 1.9 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 4.6 billion in 2035 at a CAGR of 10.0%.

Asia Pacific is expected to have the largest market share in the global activated carbon market with a share of about 57.2% in 2024.

Some of the major key players in the global activated carbon market are Daigas Group, Kuraray Co. Ltd., Haycarb Plc, Basf SE, Albemarle Corporation, Kureha Corporation, Ingevity, and many others.

The market is growing at a CAGR of 10.7 percent over the forecasted period.