Market Overview

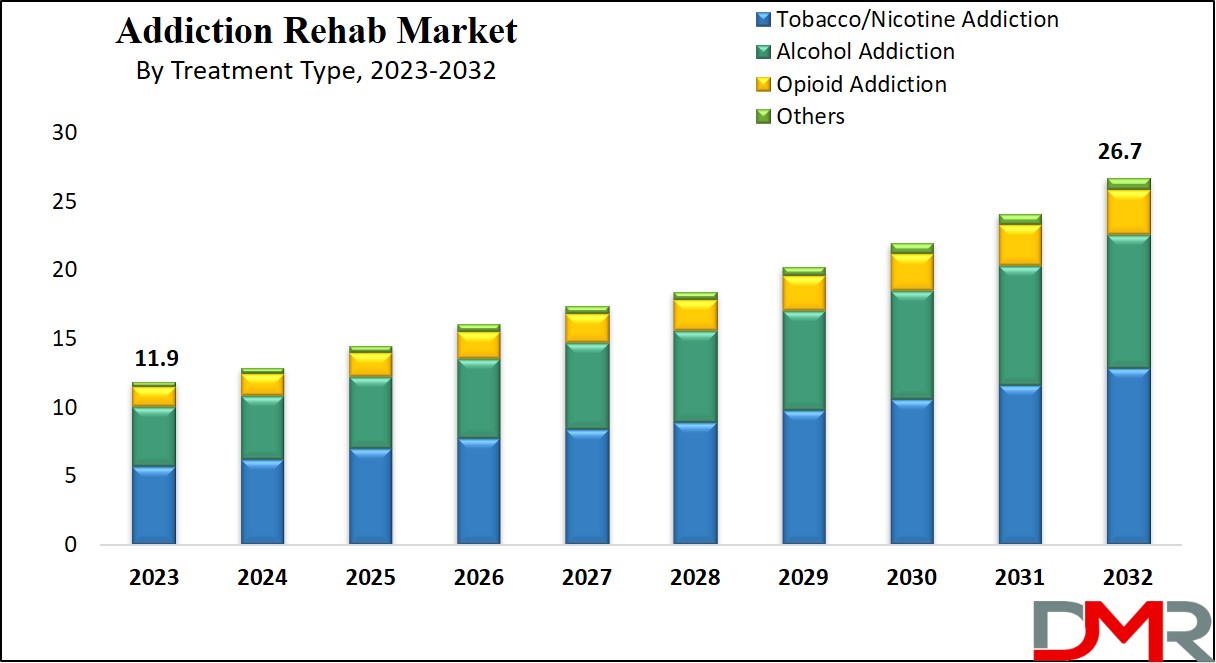

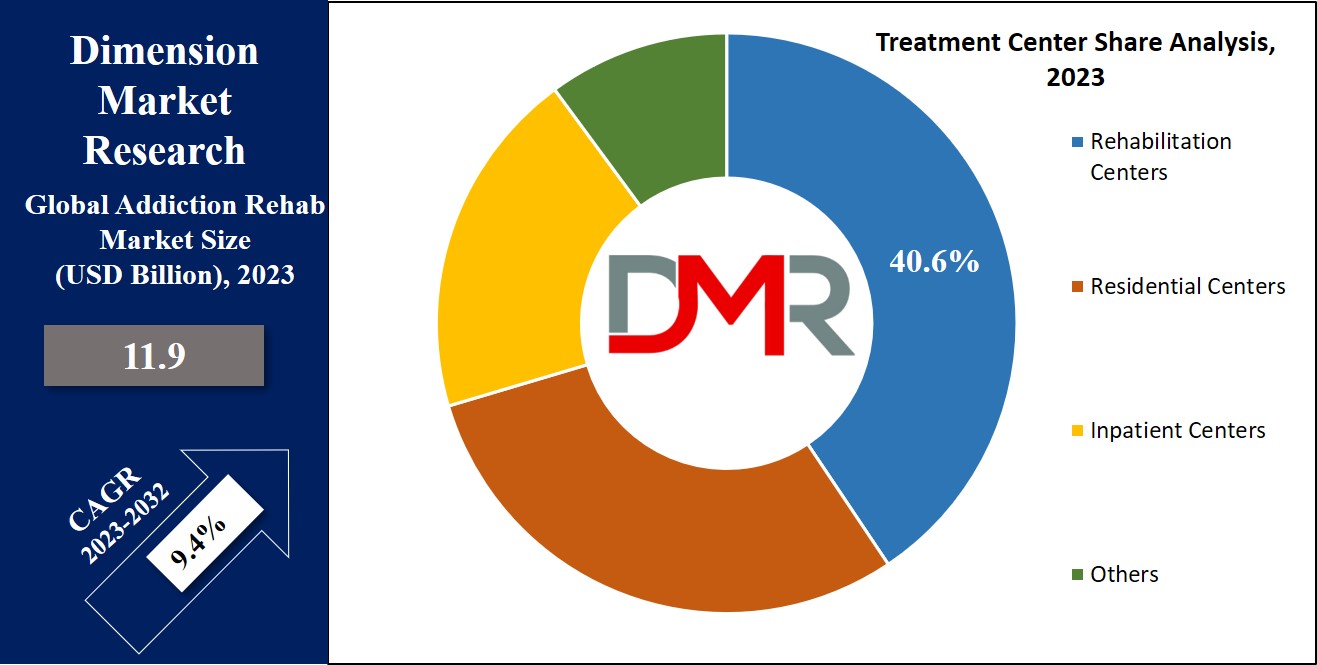

The Global Addiction Rehab Market is expected to reach a value of USD 11.9 billion in 2023, and it is further anticipated to reach a market value of USD 26.7 billion by 2032 at a CAGR of 9.4%. The market has seen significant growth over the past few years and is predicted to grow significantly during the forecasted period as well.

Drug rehabilitation includes medical & psychotherapeutic interventions focused on approaching dependency on psychoactive substances like alcohol, prescription drugs, & street drugs such as cannabis, cocaine, heroin, or amphetamines. This expansion of substance abuse treatment reflects rising demand for effective recovery methods across multiple demographics.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The primary goal is to empower patients to resist substance dependence where applicable & halt substance misuse, thus preventing potential psychological, legal, financial, social, & physical consequences. Further treatment comprises remedies for conditions like depression, counseling led by specialists, & the exchange of personal experiences among individuals struggling with addiction.

The addiction rehab market is experiencing extraordinary expansion driven by increasing awareness and innovative treatment approaches. An increase in cases of alcohol, opioid, and nicotine dependency is driving increased demand for comprehensive solutions such as awareness campaigns and accessible treatment programs that address social stigmas while encouraging recovery pathways.

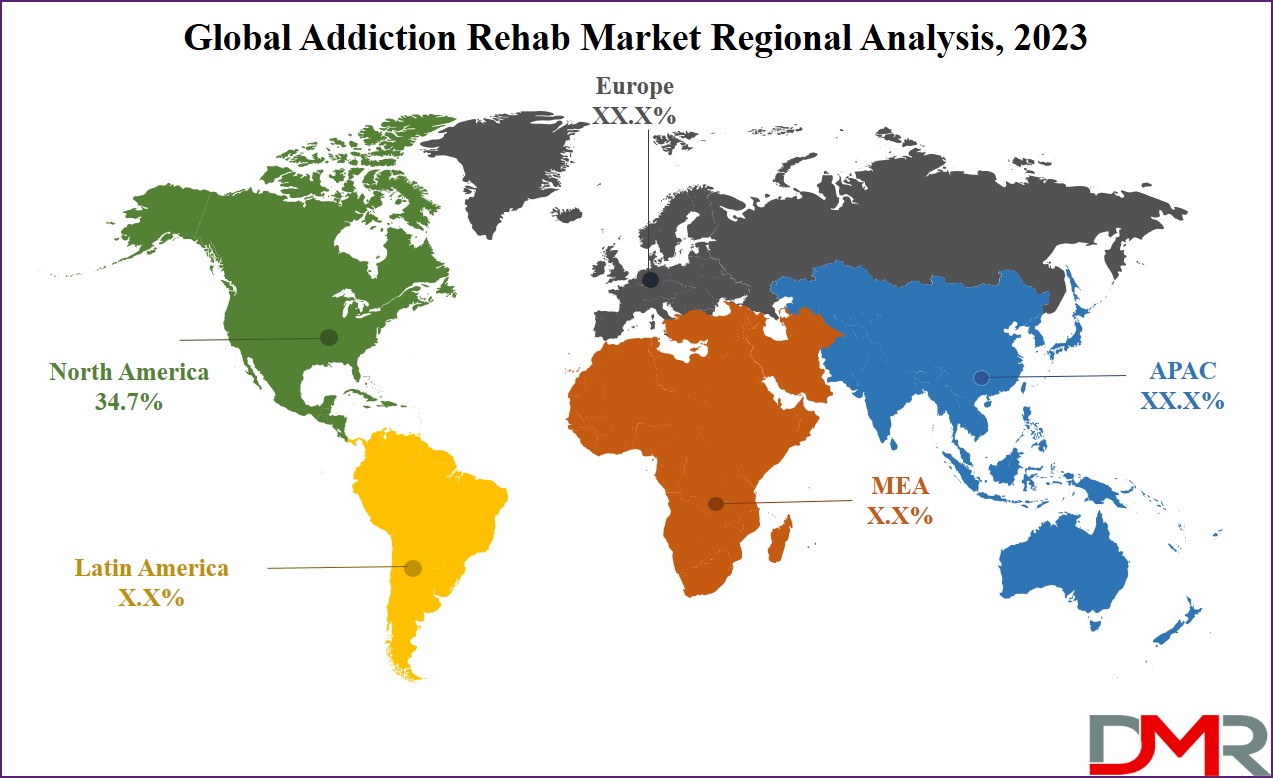

Key regions like North America and Asia-Pacific are leading this movement with extensive infrastructure investments and policy advancements that support addiction recovery programs.

Recent developments highlight the advancements made possible through technology-enhanced addiction treatment. Virtual programs, such as the PATH initiative in the US, offer access to at-home support via digital counseling and monitoring tools for patients. Medication-assisted treatments (MATs) that target opioid dependency are also gaining ground with improvements in outcomes while decreasing stigma.

Opportunities in this sector include expanding into underserved regions, particularly Asia-Pacific where addiction rates have been rising due to socioeconomic shifts. Improved healthcare infrastructure and cost-cutting treatment models present considerable investment potential; however, challenges still exist such as high rehabilitation center costs and limited public awareness campaigns in developing regions.

The Addiction World Conference (AWC) 2024, scheduled for September in San Francisco, will bring together global experts to explore advancements in addiction research and treatment. The event aims to foster collaboration among researchers, practitioners, and policymakers, focusing on innovative strategies to address addiction challenges globally.

Key Takeaways

- Market size & growth: The Global Addiction Rehab Market is valued at USD 11.9 billion (2023) and is projected to reach USD 26.7 billion by 2032, registering a 9.4% CAGR—driven by rising alcohol, opioid, and nicotine dependence alongside expanding awareness campaigns and supportive policies.

- Leading treatment segments & modalities: Tobacco/nicotine addiction treatments are poised for the fastest growth, supported by wider availability of nicotine-replacement therapies and smoking-cessation drugs; medication-assisted treatments (MATs) for opioid dependency and virtual/at-home programs (e.g., digital counseling, remote monitoring) are accelerating adoption and outcomes.

- Care settings & applications: Rehabilitation programs (inpatient, residential, rehab centers) are gaining traction globally through 12-step frameworks, therapy sessions, and community-led initiatives—helping severe-use patients re-integrate socially while expanding the addressable base for comprehensive recovery pathways.

- Distribution dynamics: Hospital pharmacies were the leading channel in 2023, offering broad formulary access and convenient initiation of therapies; retail and online pharmacies are complementary routes that improve reach and adherence management.

- Regional performance & outlook: North America leads with ~34.7% share (2023), with the U.S. advancing harm-reduction and access initiatives (e.g., free Narcan rollouts) and strong healthcare spending; Asia-Pacific presents the most attractive expansion opportunity as infrastructure investments and cost-efficient care models scale amid rising addiction rates.

Use Cases

- Residential Cleaning & Laundry Care: Growing urbanization and rising awareness of hygiene are driving the adoption of narrow range ethoxylates in household detergents and surface cleaners, as they provide high detergency, low residue, and better biodegradability, catering to eco-conscious consumers.

- Commercial & Institutional Cleaning: In offices, hotels, and public facilities, narrow range ethoxylates are used in floor care products, dishwashing solutions, and sanitation chemicals, offering cost efficiency, low-foaming, and enhanced cleaning performance—essential for maintaining hygiene standards in high-traffic environments.

- Industrial Manufacturing & Chemicals: Industrial applications leverage narrow range ethoxylates as emulsifiers, dispersing agents, and wetting agents in coatings, agrochemicals, and lubricants, where their superior solubility and controlled foaming properties improve process efficiency and product stability.

- Healthcare & Pharmaceuticals: Hospitals and pharmaceutical labs use formulations with narrow range ethoxylates in disinfectants, antiseptics, and drug solubilizers, driven by the need for safe, non-toxic, and highly effective surfactants that meet stringent regulatory standards for patient safety.

Market Dynamic

The growing drug awareness campaigns & the construction of addiction & rehab centers are playing a major role in driving the market growth, as these awareness campaigns & preventive programs are major factors contributing to the development of the addiction treatment market, which includes increasing patient knowledge, a greater demand for treatment driven by government initiatives, & efforts to regulate drug misuse in several countries.

However, a major challenge hampering revenue growth in the market is the major resistance exhibited by individuals dealing with substance use disorder. As per the National Survey on Drug Use and Health (NSDUH), in the recent past, only around 14% of individuals aged 12 & above with Substance-Use Disorder (SUD) actively followed treatment.

Additionally, the gradual increase in the count of individuals seeking assistance to improve their mental well-being due to addiction & excessive drug use emphasizes the hesitancy among patients to seek medical support, often considered to be societal taboos & nervousness regarding the repercussions of substance use.

Research Scope and Analysis

By Treatment Type

The growing popularity of cigarette smoking has significantly grown the potential for the tobacco & nicotine addiction treatment market in 2023 and is anticipated to grow at a high rate throughout the forecasted period, as the rise in cigarette smoking has led to increased instances of lung disorders & cardiovascular diseases. Fortunately, governments have acknowledged these risks & have carried out effective measures to reduce the consequences of substance addiction.

The growing awareness regarding these dangers has encouraged individuals to opt for smoking-ending medications, acting as a major driver for the global addiction treatment market. Furthermore, the increased availability of nicotine replacement products & specialized drugs focused on resisting tobacco & nicotine addiction will also contribute to the market's growth over the forecasted period.

By Treatment Center

In 2023 as an application, rehabilitation programs are gaining significant traction on a global scale, mainly for addressing the most seriously affected segment of the population dealing with substance abuse. These programs play a vital role in helping individuals regain control over their lives & successfully connect to society. Drug rehabilitation centers play a guiding role by providing comprehensive 12-step programs, therapeutic sessions, & similar interventions.

Moreover, the association of community leaders in crafting innovative addiction recovery initiatives is also anticipated to serve as the fuel to drive the market's growth in the coming future. Cross-sector integration with industries like Medical Aesthetics, Drug Discovery, and Pharmaceutical Drug Delivery also presents opportunities for collaborative approaches that strengthen patient outcomes and broaden the scope of treatment.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Distribution Channel

In terms of distribution channels, hospital pharmacies emerge as highly efficient and accessible venues for procuring addiction medication at the primary stages in 2023 as they contribute significantly towards global revenue of the addiction rehab industry market. These pharmacies provide a wide range of medications with different dosage strengths, aimed at easing symptoms & reducing the cravings associated with substance abuse. Hospital pharmacies present a convenient path for obtaining both prescribed & over-the-counter medications, meeting the needs of individuals struggling with addiction.

The Global Addiction Rehab Market Report is segmented on the basis of the following:

By Treatment Type

- Alcohol Addiction

- Tobacco/Nicotine Addiction

- Opioid Addiction

- Others

By Treatment Center

- Rehabilitation Centers

- Residential Centers

- Inpatient Centers

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Others

Regional Analysis

In 2023, the North American region has a significant market share, accounting for about 34.7% of the total revenue in the Global Addiction Rehab Market. Further, in North America, the United States is anticipated to lead the market owing to more people using tobacco & efforts by the government to lower substance abuse.

In addition, the United States is also taking steps to look & help people with addiction. For instance, in February 2022, the U.S. & the UK started providing a medication called Narcan for free in 16 areas to prevent overdose deaths.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

These efforts will allow addiction treatment to expand in the country. Moreover, the United States has a good healthcare system & spends a lot on healthcare. They're also funding research & finding ways to fight substance abuse, which is making it easier for Americans to get assistance for their addiction.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global addiction rehab market is quite competitive & is further evolving, owing to various established companies & new players. As these players are focused on creating advanced treatment programs, utilizing technology & proven therapies.

In addition, partnerships, collaboration, mergers, & telehealth solutions are common strategies to expand their reach. With increased attention to addiction treatment, competition is growing, pushing for innovative and complete approaches to effectively tackle substance abuse recovery. For instance, in May 2023, the Government of Telangana, India declared the successful establishment of at least one de-addiction center across each of 33 districts in the state.

These centers are exclusively to assist individuals battling with alcohol or substance addiction. Committed to giving free treatment, yoga therapy, and counseling, these initiatives were initiated in reaction to recent criticism from the High Court concerning the government's delay in addressing the need for such centers.

Some of the prominent players in the Global Addiction Rehab Market are:

- Pfizer Inc.

- Abbott

- Medtronic

- GSK Plc

- Stryker Corp

- BD

- Bayer AG

- Novartis AG

- Johnson & Johnson Services

- REGENXBIO Inc.

- Other Key Players

Recent Developments

- June 2025: Nest Health introduced Nest Rooted Recovery, a home-based Medication for Opioid Use Disorder (MOUD) program. It delivers family-centered addiction treatment—medical, behavioral, and social—directly to patients' homes through its integrated care model.

- May 2025: Oceans Healthcare acquired Haven Behavioral Healthcare, adding seven new locations across five states and expanding its operations into nine states overall. This deal was supported by private equity firm Webster Equity Partners.

- March 2025: AspenRidge Recovery and Colorado Medication-Assisted Recovery (CMAR) officially merged, combining their resources to broaden treatment offerings. The merged entity is headed by CMAR co-founder Cortland Mathers-Suter as CEO.

- March 2025: U.S. Congressman Chris Pappas led a call to restore over $12 billion in federal grants for public health and addiction treatment—funds that were canceled by the administration affecting SAMHSA and CDC programs.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 11.9 Bn |

| Forecast Value (2032) |

USD 26.7 Bn |

| CAGR (2023–2032) |

9.4% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Treatment Type (Alcohol Addiction, Tobacco/Nicotine Addiction, Opioid Addiction and Others), By Treatment Center (Rehabilitation Centers, Residential Centers, Inpatient Centers and Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Pfizer Inc, Abbott, Medtronic, GSK Plc, Stryker Corp, BD, Bayer AG, Novartis AG, Johnson & Johnson Services, REGENXBIO Inc, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Addiction Rehab Market?

▾ The Global Addiction Rehab Market size is estimated to have a value of USD 11.9 billion in 2023 and is expected to reach USD 26.7 billion by the end of 2032.

Which region accounted for the largest Global Addiction Rehab Market?

▾ North America dominates the Global Addiction Rehab Market with a share of 34.7% in 2023.

Who are the key players in the Global Addiction Rehab Market?

▾ Some of the key players in the Global Addiction Rehab Market are Pfizer Inc., BD, GSK Plc, and many others.

What is the growth rate in the Global Addiction Rehab Market?

▾ The market is growing at a CAGR of 9.4 percent over the forecasted period.