Market Overview

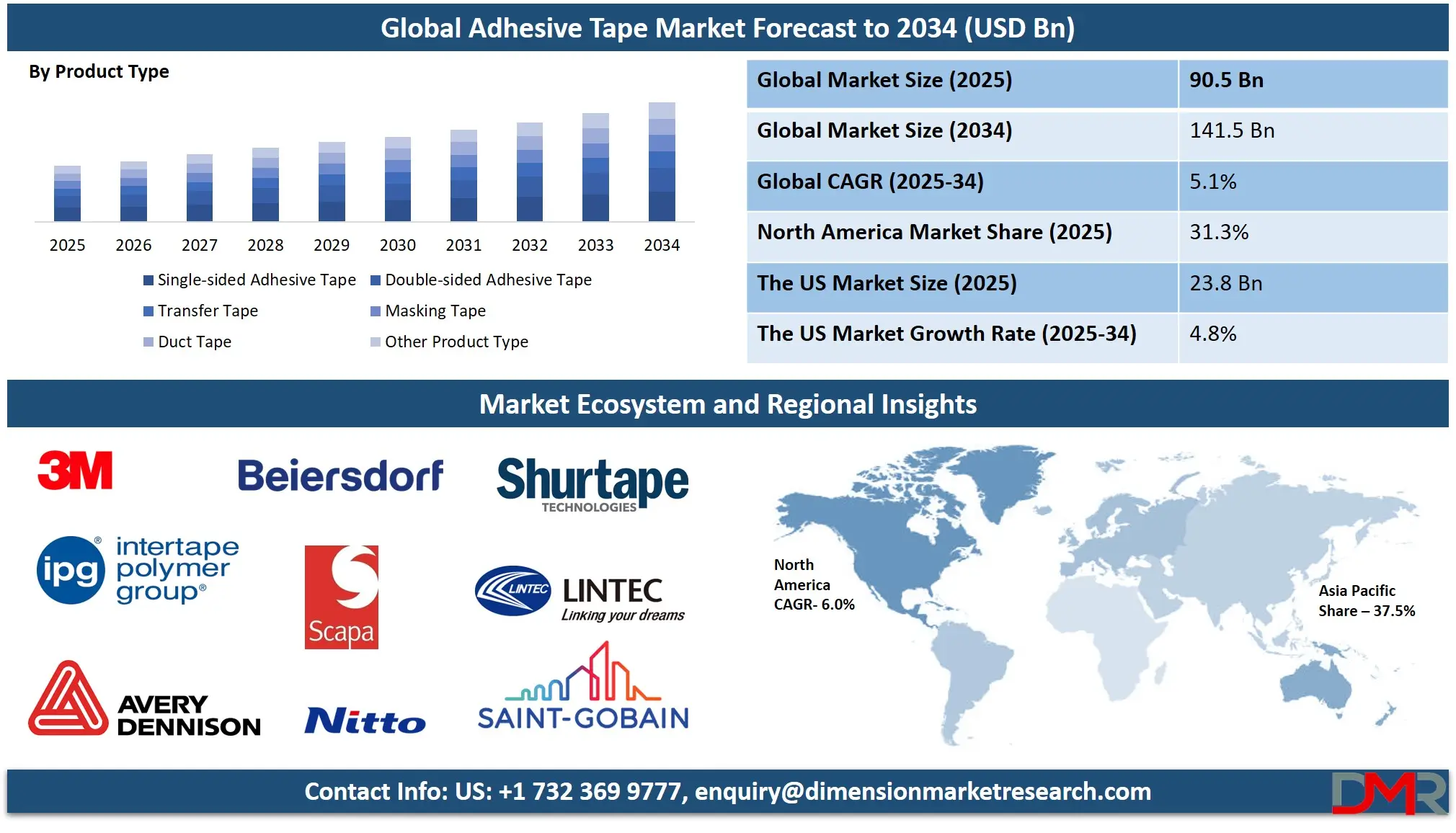

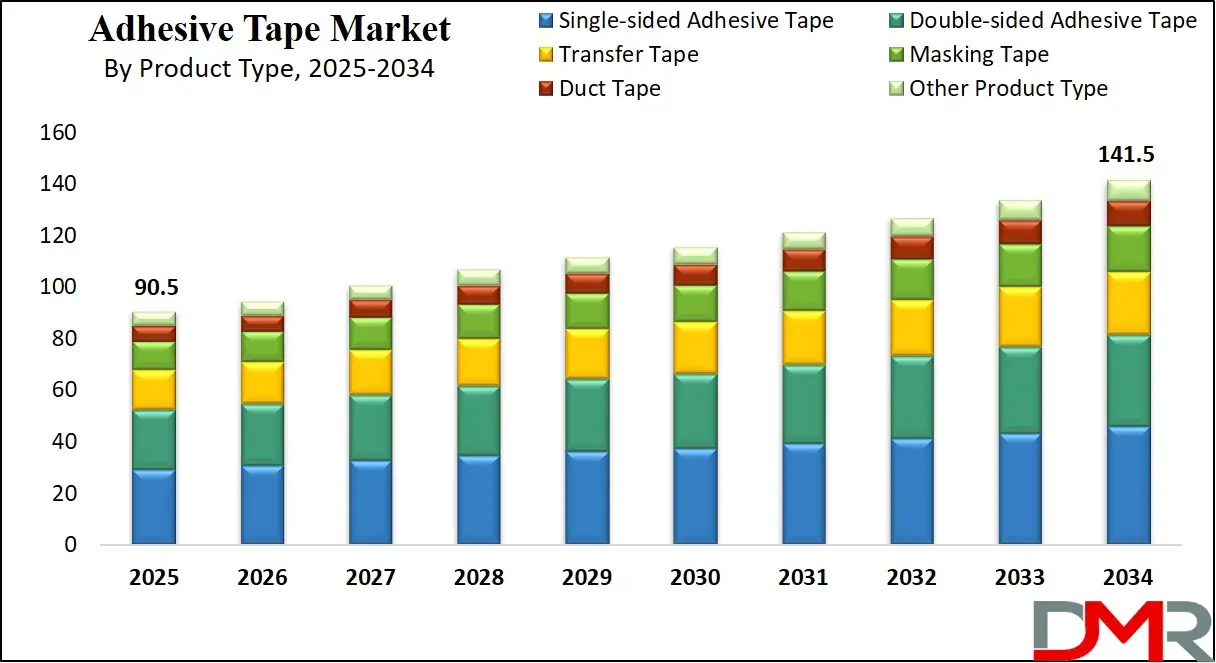

The Global Adhesive Tape Market is predicted to be valued at USD 90.5 billion in 2025 and is expected to grow to USD 830.9 million by 2034, registering a compound annual growth rate (CAGR) of 5.1% from 2025 to 2034.

The global adhesive tape industry demonstrates rapid expansion because numerous markets within packaging and healthcare, together with automotive and construction, demand adhesive materials. The market undergoes a substantial transformation due to rising customer demand for sustainable biodegradable adhesive materials throughout Europe and North America.

The industrial sector adopts high-performance tapes that demonstrate resistance to temperature and UV radiation, and chemicals. Underdeveloped markets contain new business possibilities because their expanding infrastructure projects and growing e-commerce sector create rising demand for packaging and building tape products. Plastic-based tape products and variations in raw material prices act as primary obstacles for the industry's development. Water-based and silicone adhesive innovations create novel growth prospects that will benefit electronics and medical devices as well as

electric vehicles.

The market sees a rapid rise in high-performance tape usage because these products excel at resisting heat and UV while offering chemical resistance that suits demanding industrial settings and advanced automotive work like EV production. The emerging economies of India, Brazil, and Southeast Asia support abundant business opportunities because these regions face a growing need for construction and electrical insulation tapes during their quick infrastructure build-up and urbanization, and digitalization.

The market potential faces restrictions due to the price volatility of raw materials and rising environmental concerns about plastic tapes. The advent of solvent-free and water-based, and silicone adhesive technologies leads to sustainable innovation paths. The market growth through next-generation adhesives extends into cleanroom electronics and medical diagnostics, as well as energy-efficient construction, which benefits both developing nations and industrialized regions.

The US Adhesive Tape Market

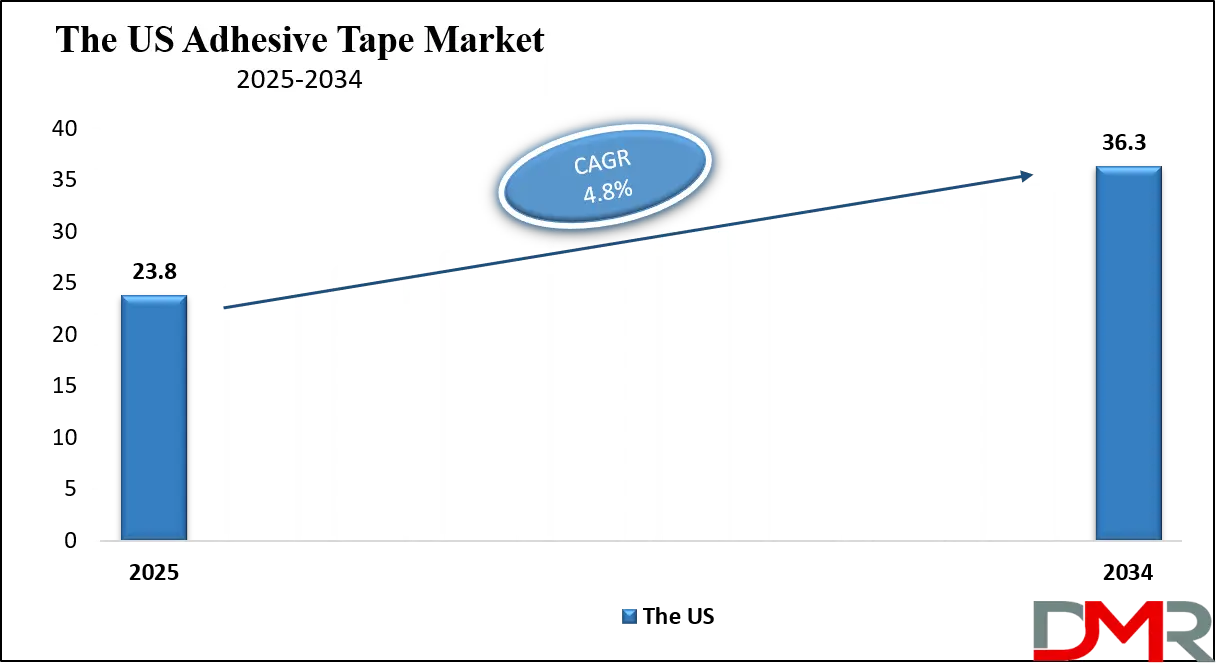

The US Adhesive Tape Market is projected to be valued at USD 23.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 36.3 billion in 2034 at a CAGR of 4.8%.

Global leadership in adhesive tape markets belongs to the U.S. because it possesses an advanced technological industry foundation along with strong consumer markets that are complemented by the growing medical and automotive, and packaging sector and electronics sector applications. Growing rates of population aging and chronic illnesses in the country, along with its established healthcare systems, drive rising demand for medical tapes for wound care applications and wearables, as well as surgical uses.

The rising market growth of online shopping drives industry requirements toward long-lasting packaging tapes, which also provide tamper-detection ability while remaining environmentally friendly. The market seeks sustainable adhesive solutions because regulatory bodies, alongside consumers, prioritize sustainability. The United States maintains excellent demographic conditions because its population includes a substantial number of healthy people alongside many older adults who drive up demand for innovative medical and consumer goods that require tapes throughout various market sectors.

The automotive and aerospace industries use lightweight, high-performance materials to implement solvent-free heat-resistant tapes that replace conventional fastening systems. Collaboration between manufacturing companies that draw back operations to the US alongside federal projects dedicated to infrastructure development strengthens the demand for construction and industrial tape applications.

Environmental regulations about VOC emissions have motivated manufacturers to dedicate funding toward the development of water-based and UV-cured as well as silicone adhesive systems. The innovations deliver both regulatory compliance together with modern market solution requirements. Long-term growth prospects for the U.S. adhesive tape sector look strong since companies maintain dedicated R&D efforts alongside local manufacturing capabilities and sustainable business practices, particularly for high-performance vital applications.

Global Adhesive Tape Market: Key Takeaways

- Global Market Size Insights: The Global Adhesive Tape Market size is estimated to have a value of USD 90.5 billion in 2025 and is expected to reach USD 141.5 billion by the end of 2034.

- The US Market Size Insights: The US Adhesive Tape Market is projected to be valued at USD 23.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 36.3 billion in 2034 at a CAGR of 4.8%.

- Regional Analysis: Asia Pacific is expected to have the largest market share in the Global Adhesive Tape Market with a share of about 37.5% in 2025.

- Key Players: Some of the major key players in the Global Adhesive Tape Market are 3M, Nitto Denko, Tesa SE, Avery Dennison, Intertape Polymer, Scapa, Shurtape, and many others.

- The Global Market Growth Rate Insight: The market is growing at a CAGR of 5.1 percent over the forecasted period of 2025.

Global Adhesive Tape Market: Use Cases

- Medical adhesive tapes function both for wound covering during dressing procedures and surgical applications, as well as to maintain wearable medical device attachment systems. The tape materials need to provide comfort to the skin and perform, as well as being air permeable and free from allergy-causing substances.

- The significant contributions of adhesive tapes can be found in hospital settings alongside home treatment and diagnostic operations because of the growing patients with chronic diseases and elderly populations, together with technological advances in health monitoring.

- Adhesive tapes serve three functions in contemporary vehicles, including the endeavor of wire harnessing alongside interior trimming applications and vibration control. Lightweight adhesives now serve as mechanical fastener alternatives while extending product design options and boosting vehicle performance, especially for electric vehicles needing non-conductive heat-resistant bonds.

- Technology produced adhesive tapes enable both component insulation protection and display module attachment and thermal control in mobile devices and wearable technology. Electronics have evolved into miniature high-powered devices, so tapes provide essential performance and durability features for 5G technology and semiconductor assembly lines.

Global Adhesive Tape Market: Market Dynamics

Driving Factors in the Global Adhesive Tape Market

Increase in E-Commerce and Retail Logistics

E-commerce platforms such as Amazon, Alibaba and Flipkart use pressure sensitive tapes extensively as packaging components; their millions of parcels that ship daily require pressure sensitive seals with secure sealing properties to provide secure sealing, tamper resistance, product integrity protection during transit as critical operational components; printed tapes have become even more widely demanded, contributing both brand visibility and supply chain tracking capabilities.

Omnichannel retailing has created an advanced logistics model requiring both bulk and customized packaging solutions, driving demand for versatile adhesive tapes further. Companies seeking cost savings by streamlining packaging processes have increased adoption of automated tape dispensers compatible with machine packaging processes, fuelling revenue growth in both developed economies as well as emerging ones alike. This structural change is driving consistent and large-volume demand from global retail.

Activity in Infrastructure Development and Construction in Emerging Markets

Massive investments in infrastructure development projects across Asia-Pacific, Latin America, and the Middle East are supporting the adhesive tape market expansion. Government projects involving highways, airports, metros, and smart cities necessitate high-performance tapes for bonding, sealing, insulation, and surface protection purposes.

Tape fasteners have several distinct advantages over their conventional counterparts; they are lightweight, simple to apply, cost-efficient, and help improve energy efficiency by sealing air leaks and insulation gaps that reduce energy waste. As urbanization and demand for modular construction increase, adhesive tape usage for HVAC systems, electrical insulation, flooring applications, and window sealants has increased substantially.

As green building certifications like LEED and BREEAM become increasingly prevalent, their rise has fostered an increased use of eco-friendly adhesive tapes with reduced volatile organic compound emissions (VOC). India, Vietnam, and Brazil are experiencing rapid economic expansion, as their construction boom, supported by foreign direct investments (FDIs) and government initiatives like "Housing for All" and the “Smart Cities Mission” is driving long-term demand. Furthermore, this growth driver is reinforced through prefabricated panelized construction methods relying heavily on adhesive-based bonding solutions for increased long-term demand.

Restraints in the Global Adhesive Tape Market

Fluctuating Prices and Availability of Raw Materials

One of the chief limitations to market growth for adhesive tape products is fluctuating raw material costs and supplies, which have proven detrimental. Production of adhesive tapes relies heavily on petroleum-derived components like acrylics, rubber, polyethylene glycol, polypropylene resin, and polyurethane resin. Price fluctuations for crude oil and its derivatives greatly impact manufacturing costs and profit margins. Supply chain disruptions caused by geopolitical conflicts, trade restrictions, or natural disasters may result in raw material shortages or delivery delays that impact raw material availability or delivery schedules.

COVID-19 Pandemic and Russia/Ukraine Tensions Expose Vulnerabilities. Red Sea Shipping Challenges have highlighted these vulnerabilities, making it more challenging for producers to secure timely and cost-effective sourcing of supplies. Some manufacturers have attempted to pass along increased costs to consumers; however, pricing pressure from large industrial buyers often limits this option. Companies must also abide by environmental regulations on emissions and waste disposal associated with raw material processing, further raising operational costs and impeding profitability, particularly among smaller or mid-sized players who lack scale.

Environmental Regulations on Solvent-Based Adhesives

Environmental regulations regarding solvent-based adhesives remain one of the largest impediments to their growth on the market. Solvent-based adhesive tapes emit volatile organic compounds (VOCs), contributing to air pollution and creating health hazards in poorly ventilated work areas for workers. As such, authorities in the U.S., Europe, and certain parts of Asia have implemented stringent VOC emission limits and disposal regulations. Agencies such as the U.S.

Protection Agency and European Chemicals Agency (ECHA) continue to tighten standards under programs like REACH and TSCA, raising compliance costs for manufacturers. An inability to obtain necessary safety certifications for chemical-based tapes can significantly delay time to market and limit usage in sensitive sectors like healthcare, food packaging, and electronics. Even as companies switch over to water-based and hot-melt technologies, performance parity remains an issue in demanding applications. Therefore, those heavily dependent on solvent-based products face two challenges when switching: technological adaptation and increased capital investment are two main concerns; both can hinder growth trajectory in regions subject to regulatory controls.

Opportunities in the Global Adhesive Tape Market

Expansion into High-Value Medical and Healthcare Applications

The medical and healthcare sectors represent an attractive growth opportunity for adhesive tape producers. This market provides high-margin growth opportunities with significant returns. With increased demand for surgical tapes, wound dressings, wearable sensors, and diagnostic devices that adhere to skin, moisture resistance and breathability are critical requirements for success. Aside from using specialist adhesive technologies to meet those criteria, skin compatibility must also be ensured through moisture resistance and breathability measures.

As global healthcare expenditures expand and chronic conditions like diabetes and cardiovascular diseases become more prevalent, wearable medical device tapes become a greater need. The growing aging populations in Japan, Germany, and the US are propelling increased adoption of tapes used for advanced wound care products as well as medical products targeting elder care needs. Single-use hygiene products for personal care use, as well as adhesive tapes designed for drug delivery patches, have seen similar successes.

Companies looking to meet regulatory and safety standards are turning their focus toward designing biocompatible, hypoallergenic, latex-free solutions to stay compliant. R&D partnerships between manufacturing firms and healthcare facilities stand to reap long-term supply contracts and market penetration into targeted niches within healthcare services.

Rising Demand for Specialty Tapes in EVs and Renewable Energy Systems

As globalization drives us toward cleaner forms of mobility and renewable energy sources, new opportunities for adhesive tape applications have opened up as part of its journey toward sustainability. Electric vehicles (EVs) rely on specialty tapes for battery insulation, wire harnessing, thermal management, and EMI shielding.

These tapes must withstand high voltages, extreme temperature conditions that cannot be effectively addressed using traditional fasteners or basic adhesives. With global EV sales passing 14 million in 2024 and expected to surge rapidly thereafter, adhesive tape usage per vehicle is on an exponentially ascendant path. Meanwhile, renewable energy sectors, specifically wind and solar use tape for cable wrapping, panel mounting, and sealing purposes.

Wind turbines, for instance, necessitate edge protection and structural bonding tapes to withstand harsh outdoor environments. Integration of adhesive tapes into next-generation batteries, solar modules, and inverters provides lucrative business opportunities for companies that offer tailored high-performance products. Government incentives encourage clean energy initiatives, creating exponential growth potential for innovative adhesive tape manufacturers.

Trends in the Global Adhesive Tape Market

Transition Toward Sustainable and Eco-Friendly Adhesive Solutions

One of the primary trends reshaping the adhesive tape market today is an increase in environmentally sustainable adhesive solutions. Manufacturers are responding to regulatory pressure and consumer expectations by developing tapes made of biodegradable, compostable, and recyclable materials, such as water-based adhesives, solvent-free bonding agents, and biodegradable backing materials such as paper or cellulose films, which meet these standards.

Europe, where stringent REACH regulations and the Single-Use Plastics Directive have spurred manufacturers to reduce plastic-based components, is seeing increased interest in recyclable tape packaging due to corporate sustainability goals and rising environmental awareness. North American firms, too, are seeing rising interest in recycling tape packaging options due to environmental awareness rising within corporations and individuals alike.

These eco-friendly alternatives have also become the go-to packaging solutions of choice among global e-commerce firms and could become market standards over time. As such, companies leveraging green chemistry and bio-based feedstocks are finding success investing in these areas across mature as well as emerging markets. Furthermore, sustainability certifications and eco-labels have proven invaluable marketing tools, strengthening brand reputation and customer retention.

Miniaturization and Customization in Electronics and Medical Devices

As device miniaturization becomes ever more prevalent among consumer electronics and wearable medical devices, so too has its associated demand for precision-engineered adhesive tapes. Tapes play an indispensable part in compact electronics like smartphones, tablets, and wearables - they bond components together, provide electromagnetic shielding protection, and manage thermal management effectively.

As devices become smaller and more complex, traditional fastening methods like screws and rivets are risingly being replaced with high-performance adhesive tapes that offer strength without adding bulk. Medical devices such as glucose monitors, cardiac sensors, and drug delivery patches require tapes to be skin-friendly and reliable under prolonged usage; for this to work smoothly and successfully, this requires innovations in silicone- and hydrocolloid-based adhesive technologies.

Customization has gained prominence, with customers demanding tapes tailored specifically to meet application-related needs in terms of shape, thickness, and adhesive strength. Manufacturers are adapting by adopting precision cutting technologies, providing multi-layered tape structures, and working closely with OEMs on developing application-specific adhesive solutions, driving differentiation while expanding margins simultaneously.

Global Adhesive Tape Market: Research Scope and Analysis

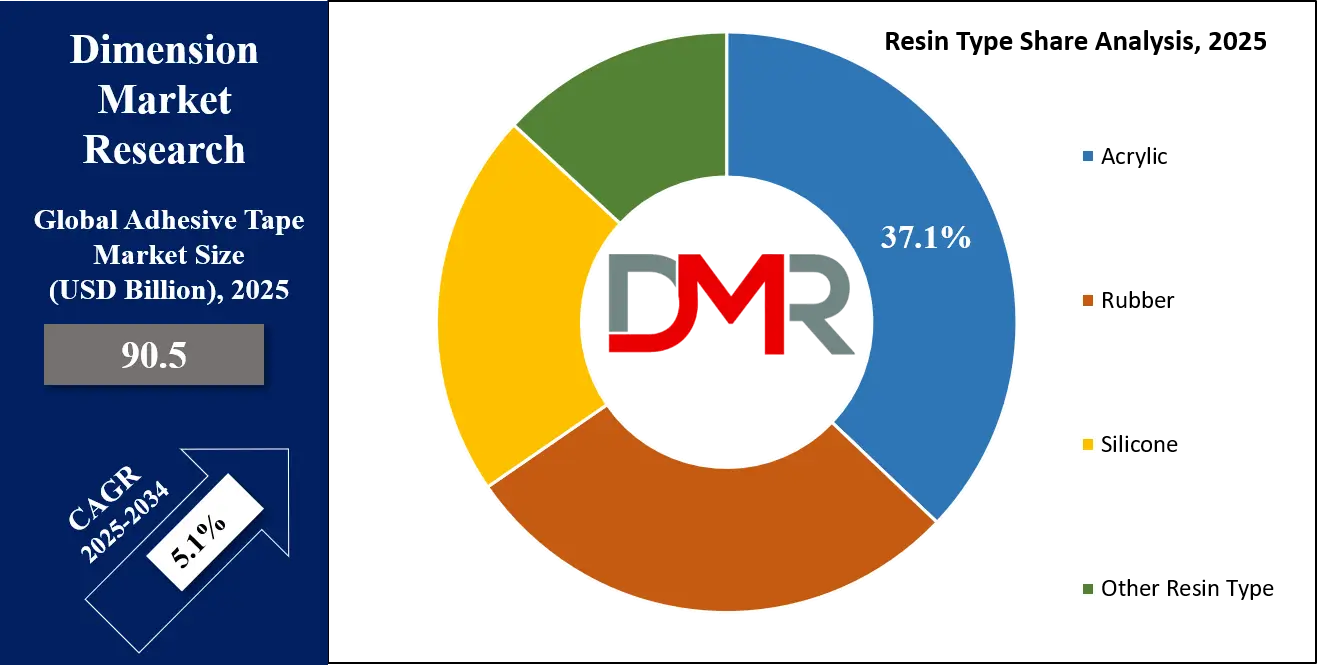

By Resin Type Analysis

Acrylic resin is projected to maintain its position as the leading adhesive tape material because it offers versatility, together with long-lasting strength in all environmental settings. Acrylic-based adhesives demonstrate strong protection against UV radiation while resisting oxidation along with temperature changes, thus becoming ideal for interior and exterior applications. Acrylic resin maintains a powerful connection to various substrates, including metal, glass, plastic, and painted materials, together with long-term bond retention properties. The automotive construction and packaging industries benefit greatly from its characteristics, which make them function optimally under stressful conditions.

The transparency of acrylic adhesive with stable color retention makes it suitable for packaging electronics and consumer goods because it delivers attractive visual features. Water-based acrylic versions of these products are becoming popular because they meet environmental regulations and produce minimal VOC emissions, which follows current sustainability trends worldwide. Acrylic adhesives maintain long-term consistency in medical and electronic applications to minimize product breakdowns that result in failures.

Manufacturers find acrylic adhesives economical to formulate since their availability and affordability stem from their simple production methods. Manufacturers select acrylic adhesives because they fit applications that require structural bonding, together with pressure-sensitive bonding. Acrylic dominates as a bonding solution because the aerospace and automotive sectors require lightweight and strong bonding technologies. The market segment dominated by waterborne and high-tack acrylics demonstrates continuous innovation, which will sustain its position as market leader in adhesive tape demand throughout the foreseeable period.

By Material

The adhesive tape market is anticipated to depend on polypropylene (PP) as its main material because PP shows a superior strength-weight balance, along with economical properties, and supports different adhesive systems. The strength of PP films makes them perfect as primary material for pressure-sensitive tapes, which are commonly used in packaging and sealing operations. The material provides exceptional performance against moisture, along with abrasions and chemicals, because of which polypropylene remains suitable for robust logistics transportation needs and industrial packaging requirements.

One of the key advantages of polypropylene is its ability to maintain flexibility and tensile strength under varying temperature conditions, making it suitable for both hot and cold environments. This feature is crucial for cold chain logistics, frozen food packaging, and outdoor construction use.

Additionally, PP exhibits excellent printability, making it valuable for branded and color-coded packaging tapes used in retail and warehousing. From a manufacturing perspective, polypropylene films are easily processable via extrusion and offer excellent yield per unit weight, reducing material costs. The availability of both biaxially oriented polypropylene (BOPP) and cast polypropylene (CPP) formats enables manufacturers to choose materials based on strength, clarity, and stiffness needs. PP’s recyclability and compatibility with eco-friendly adhesives further align it with sustainability goals, making it the preferred substrate in regions emphasizing green packaging.

By Technology

The global adhesive tape market uses solvent-based adhesive technology as it is projected to dominate this segment as the primary solution because of its strong bonding power, along with long shelf stability and dependable operability in harsh environmental settings. The formation process of solvent-based adhesives starts when rubber or acrylic, and other resins dissolve within organic solvents to create an adhesive that demonstrates enhanced tack and peel characteristics. These adhesives show unmatched suitability for applications that need high durability, such as robotics and automotive, together with aerospace and electronics.

The essential feature of solvent-based adhesives is their exceptional bond formation properties on low-energy surfaces, particularly plastics and metals that dominate modern production processes. These adhesives demonstrate outstanding resistance to water intrusion, together with chemical exposure and high-temperature operations, so they effectively maintain performance in demanding situations. The wetting capabilities combined with the fluidity of solvent-based adhesives allow them to produce superior bonds on imperfect or bumpy surfaces when compared to other adhesive technologies.

Sectors requiring high-performance adhesives sustain their use of solvent-based adhesives while environmental concerns continue to grow. These materials endure in heavy-duty packaging and automotive trim uses, and electrical insulation tape functions because of their vital contribution to essential applications.

By Product Type

Single-sided adhesive tapes are projected to control the global adhesive tape market since they serve numerous applications at affordable costs while meeting diverse industrial requirements. A single sticky side on these tapes lets users retain printing ability, writing access, or conduct functional layering, which is vital for packaging, labeling, masking, and insulation or medical use cases.

Single-sided adhesive tapes function efficiently in manual together with automated procedures since they offer easy installation and removal capabilities, which significantly decrease industrial operating and personnel expenses. The construction sector depends on these tapes for justifying their use in making vapor barriers and joint sealants, and insulation installations. As part of retail operations, they enable box sealing applications while fulfilling responsibilities for product branding requirements.

Single-sided tapes create outstanding adhesive attachments on paper, plastic, fabric, and metal due to flexible backing choices, together with various adhesive types. The ability of these tapes to work with solvent adhesive and water adhesive, and hot-melt adhesive systems increases their market value. The expansion of industrial applicability happens because manufacturers develop UV-resistant and flame-retardant product variants suitable for electrical and HVAC systems. Single-sided tapes keep their status as market leaders because of their adaptable characteristics and basic design, which makes them suitable for multiple industries.

By Application

The global adhesive tape market is projected to find its most prominent use in packaging because these tapes serve essential roles in all industries, as well as logistics operations as well and retail and e-commerce operations. The essential roles of adhesive tapes include protecting products alongside their duty to secure package delivery from one supply chain node to another. The adhesive tape market experiences growth thanks to the substantial increase in packaging tapes needed for e-commerce and last-mile delivery needs. The combination of BOPP film and pressure-sensitive adhesives in packaging tapes delivers practical use together with powerful binding and competitive pricing suitable for large-scale operations.

These tapes enable custom printing of logos or QR codes for both brand visibility needs and tracking purposes, making them serve both functional and strategic marketing functions. The rise of ecological packaging tape methods due to environmental and regulatory developments creates space for innovative development. Machine-compatible adhesive tapes gain more acceptance from companies due to their ability to improve packaging speed and consistency in modern, complex, and automated global supply chains. Water-activated and tamper-evident tapes prove increasingly attractive for pharmaceuticals and electronics since they ensure security and maintain product integrity.

By End-User Industry

Retail and logistics are projected to dominate the adhesive tape market's end-user segment, which holds the highest market share in 2025. These end-users control the adhesive tape market because their consumption requires a fast and secure packaging solution with branding features at consistently high volumes. The packaging industry directly depends upon adhesive tapes because they serve as critical elements for carton sealing while offering bundling functionality in addition to shipment labeling functions and pallet protection, and tamper prevention services. The rise of e-commerce giants Amazon and Alibaba, combined with the platform Shopify, has produced an enormous daily shipment volume, thus pushing adhesive tapes to become crucial operational equipment.

The distribution process from storage to transportation and final delivery owes its product security to pressure-sensitive and water-activated adhesive tapes. Retail establishments depend on printed tapes to enhance brand recognition, along with fighting counterfeits and building customer confidence. The adhesive tape products bring affordable application simplicity, which allows integration into automated packaging systems for large-scale operations. Adhesive tapes excel at streamlining operations in packaging while meeting the essential needs of business speed and dependability as retail delivers products with increasing urgency.

The retail market now needs environmentally friendly and biodegradable tape materials due to shifting environmental preferences. The growing number of retailers together with logistics providers implement such solutions because they help align their operations with ESG objectives as well as government environmental regulations. Smart adhesive tape innovation allows the sector to benefit through tracking and condition monitoring functions enabled by sensors and printed electronics.

The Global Adhesive Tape Market Report is segmented on the basis of the following:

By Resin Type

- Acrylic

- Rubber

- Silicone

- Other Resin Type

By Material

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Paper

- Foam

- Polyester (PET)

- Other Material

By Technology

- Solvent-based

- Hot-melt-based

- Water-based

- UV-cured

By Product Type

- Single-sided Adhesive Tape

- Double-sided Adhesive Tape

- Transfer Tape

- Masking Tape

- Duct Tape

- Other Product Type

By Application

- Packaging

- Masking

- Medical

- Electrical & Electronics

- Automotive

- Building & Construction

- Consumer Goods

- Other Application

By End-User Industry

- Healthcare

- Retail & Logistics

- Electrical & Electronics

- Automotive

- Construction

- Aerospace

- Consumer Goods

- Other End User Industry

Global Adhesive Tape Market: Regional Analysis

Region with the Highest Market Share in the Global Adhesive Tape Market

Asia Pacific is projected to dominate the global adhesive tape market as it holds 37.5% of the market share in 2025. Asia Pacific maintains its market leadership standing because it contains the world's largest manufacturing infrastructure, together with rising industrial expansion and major consumer electronics and automotive organizations. High-performance adhesive tapes sustain various production sectors of electronics, automobiles, and consumer products across China, Japan and South Korea, and India because these nations operate as global manufacturing centers for these industries for assembly, insulation, sealing, and packaging purposes.

The Asia-Pacific region gets its advantages from having low labor expenses alongside plentiful material resources, as well as supporting governmental action for manufacturing growth and infrastructure development. The tape manufacturers operating locally and globally in this region create intense market conditions that drive technological advancement and affordable pricing for tapes, thus speeding up their penetration into different applications.

The construction sector, together with retail establishments and healthcare facilities, experiences rising demand for adhesive tapes because of quick urban development and growing household earnings. The Chinese market leads as the biggest industry because Chinese producers offer high-capacity manufacturing along with export-oriented adhesive production. Asia Pacific maintains its position as the leading market segment because industry players invest more funding in technologies related to smart electronics, 5G infrastructure, electric vehicles, and sustainable packaging.

Region with the Highest CAGR in the Global Adhesive Tape Market

The North American adhesive tape segment is projected to exhibit the fastest growth rate globally because industries need sustainable, advanced adhesive solutions of superior performance. R&D investments in the region and quick adoption of innovative materials, including biodegradable items and flame retardants, along with medical-grade tapes, cause market expansion to accelerate. Telehealth systems and wearable healthcare devices, together with outpatient care procedures in the United States and Canada, drive the increasing demand for medical tapes that protect skin comfort and allow air circulation.

Following the accelerating growth of e-commerce businesses, there is an increasing need for tamper-evident packaging solutions, which drives further market expansion. The North American market grows from government regulations that require low-VOC and solvent-free adhesives, which drives the development of water-based and silicone adhesive systems. The market grows rapidly because manufacturing companies direct more funds toward electric vehicles and aerospace development, and smart building solutions, which all require specific types of tapes.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Adhesive Tape Market: Competitive Landscape

The global adhesive tape market is highly competitive, with a mix of multinational giants and regional manufacturers competing on innovation, pricing, quality, and customization. Leading companies such as 3M, Nitto Denko Corporation, Tesa SE, Avery Dennison, and Intertape Polymer Group dominate the landscape due to their vast product portfolios, global distribution networks, and R&D capabilities. These firms focus on developing advanced adhesive technologies that meet the needs of high-growth sectors like electronics, automotive, and healthcare.

Innovation is a key differentiator, with players investing in environmentally sustainable solutions such as recyclable tapes, biodegradable materials, and solvent-free adhesive formulations. Strategic partnerships, mergers, and acquisitions are common as companies seek to expand their geographic reach and enter emerging markets. For instance, collaborations with logistics providers and medical device manufacturers allow deeper market penetration.

Regional players, particularly in Asia Pacific, are gaining traction by offering cost-effective solutions tailored to local market demands. Private-label brands are also rising in popularity, particularly in the retail and construction sectors. Despite market saturation in mature economies, the competitive landscape remains dynamic, driven by technological advancements, shifting consumer preferences, and rising regulatory scrutiny around sustainability and product safety.

Some of the prominent players in the Global Adhesive Tape Market are:

- 3M Company

- Nitto Denko Corporation

- Tesa SE (Beiersdorf AG)

- Avery Dennison Corporation

- Intertape Polymer Group Inc.

- Scapa Group Ltd.

- Shurtape Technologies, LLC

- Lintec Corporation

- Saint-Gobain Performance Plastics

- Berry Global Inc.

- Henkel AG & Co. KGaA

- Lohmann GmbH & Co. KG

- ADDEV Materials

- PPM Industries S.p.A.

- CCT Tapes (Chase Corporation)

- DeWAL Industries (Rogers Corporation)

- Wuxi Canaan Adhesive Technology Co., Ltd.

- Yonghe Adhesive Products Co., Ltd.

- Tape-Rite Co., Inc.

- American Biltrite Inc.

- Other Key Players

Recent Developments in the Global Adhesive Tape Market

- In June 2025, APFE 2025 in Shanghai will feature over 900 brands across 53,000 sqm, spotlighting innovations in adhesive tapes, protective films, and optical film technologies for global stakeholders and buyers.

- In April 2025, the ASC Annual Convention & EXPO in Jacksonville gathered 80+ exhibitors and industry experts over three days, delivering insights into business strategies, adhesive innovations, and evolving regulatory environments.

- In January 2025, RX Greater China announced FILM & TAPE EXPO 2025 for October in Shenzhen, expecting 3,500+ exhibitors and 165,000+ visitors focused on advanced materials and next-gen adhesive tape technologies.

- In September 2024, FEICA 2024 convened over 700 delegates in the Netherlands, spotlighting “Economic Resilience through Sustainable Solutions” and advancing Europe’s sustainability agenda in adhesives and sealants industry innovation.

- In September 2024, ADEX India Bond Expo brought SMEs and global leaders together in Greater Noida to accelerate industrial growth, emphasizing sustainable adhesives, sealants, and bonding technologies within the Indian market.

- In June 2024, APFE 2024 in Shanghai showcased adhesive and die-cutting material innovations, reinforcing its position as a specialized international expo drawing global participants and spotlighting advanced bonding and protective film applications.

- In May 2024, Berry Global announced it would divest its specialty tapes business to streamline operations, sharpen its focus on core product lines, and enhance long-term shareholder value through targeted strategic portfolio optimization.

- In April 2024, the ASC Annual EXPO in Louisville hosted 90+ exhibitors, with sessions covering market trends, regulatory compliance, and cutting-edge adhesive technologies shaping North America’s adhesive and sealant sector.

- In March 2024, the EPA finalized a ban on specific toxic chemicals in adhesives, forcing manufacturers to adopt safer formulations and comply with heightened environmental safety standards across U.S. production processes.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 90.5 Bn |

| Forecast Value (2034) |

USD 141.5 Bn |

| CAGR (2025–2034) |

5.1% |

| The US Market Size (2025) |

USD 23.8 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Resin Type (Acrylic, Rubber, Silicone, Other), By Material (PP, PVC, Paper, Foam, PET, Other), By Technology (Solvent-based, Hot-melt-based, Water-based, UV-cured), By Product Type (Single-sided, Double-sided, Transfer, Masking, Duct, Other), By Application (Packaging, Masking, Medical, Electrical & Electronics, Automotive, Building & Construction, Consumer Goods, Other), and By End-User Industry (Healthcare, Retail & Logistics, Electrical & Electronics, Automotive, Construction, Aerospace, Consumer Goods, Other) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

3M, Nitto Denko, Tesa SE, Avery Dennison, Intertape Polymer, Scapa, Shurtape, Lintec, Saint-Gobain, Berry Global, Henkel, Lohmann, ADDEV Materials, PPM Industries, CCT Tapes, DeWAL Industries, Wuxi Canaan, Yonghe Adhesive, Tape-Rite, and American Biltrite, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Adhesive Tape Market size is estimated to have a value of USD 90.5 billion in 2025 and is expected to reach USD 141.5 billion by the end of 2034

The US Adhesive Tape Market is projected to be valued at USD 23.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 36.3 billion in 2034 at a CAGR of 4.8%.

Asia Pacific is expected to have the largest market share in the Global Adhesive Tape Market with a share of about 37.5% in 2025.

Some of the major key players in the Global Adhesive Tape Market are 3M, Nitto Denko, Tesa SE, Avery Dennison, Intertape Polymer, Scapa, Shurtape, and many others.

The market is growing at a CAGR of 5.1 percent over the forecasted period of 2025.