Market Overview

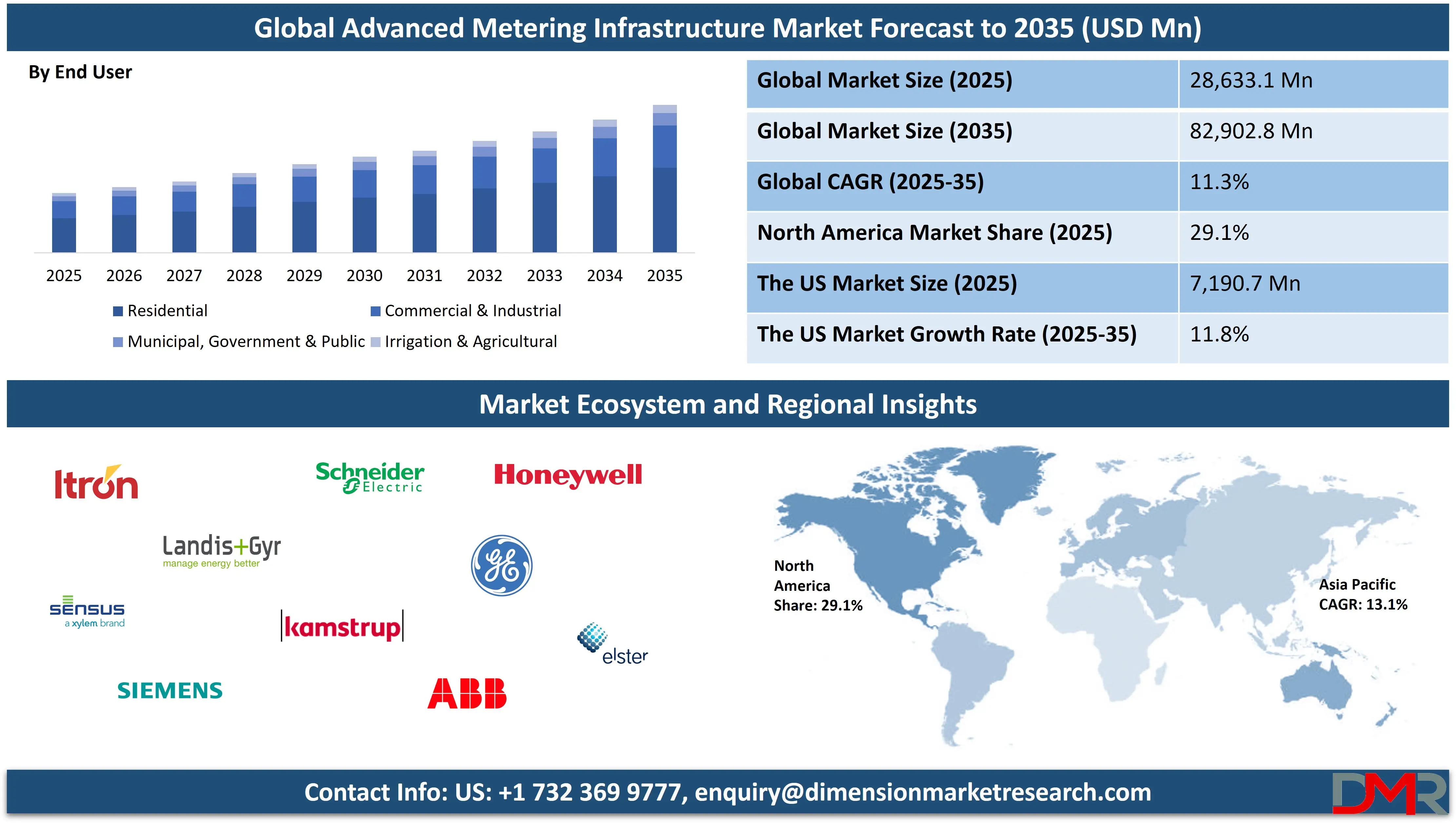

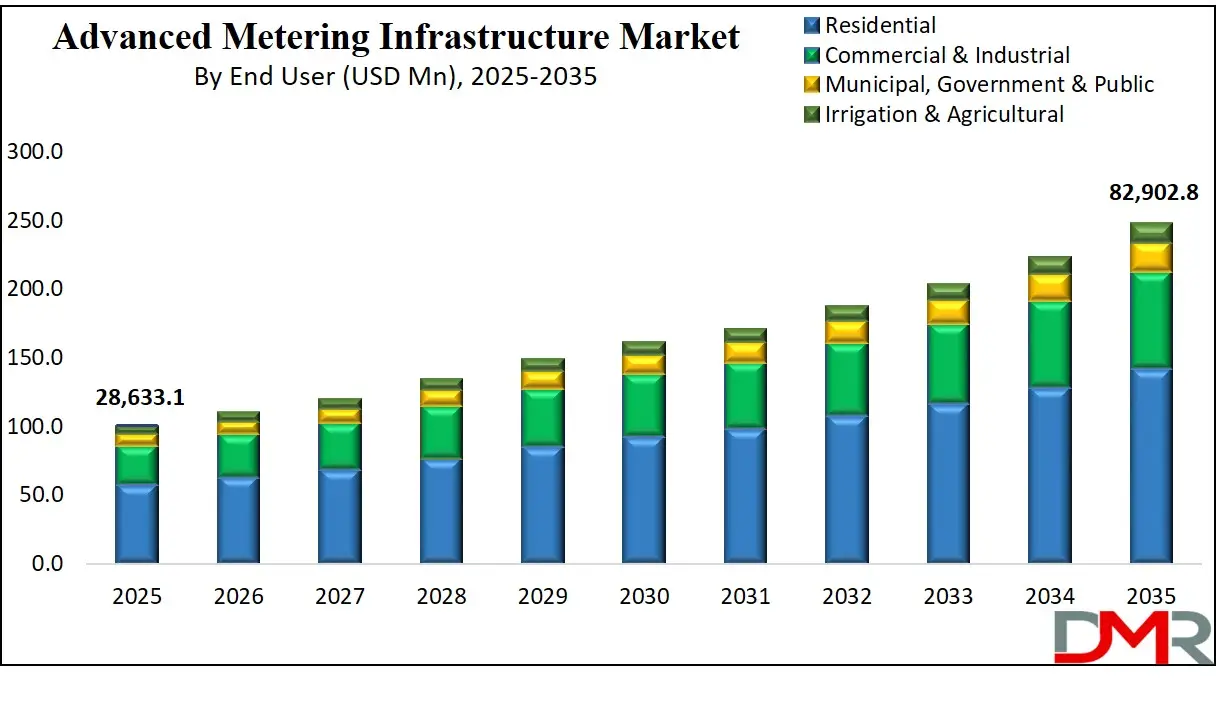

The global advanced metering infrastructure market is projected to reach USD 28,633.1 million in 2025 and expand to USD 82,902.8 million by 2035, registering a CAGR of 11.3%, driven by smart grid adoption, real-time energy monitoring, and growing investments in digital utility infrastructure.

Advanced Metering Infrastructure (AMI) refers to an integrated network of smart meters, communication systems, and data management platforms that enables two-way communication between utilities and end-users. It goes beyond traditional automated meter reading by providing real-time or near real-time data on energy, water, or gas consumption, enabling utilities to monitor, manage, and optimize resource distribution more effectively. Through its combination of advanced hardware, software, and communication technologies, AMI supports remote meter reading, outage detection, demand response, and energy efficiency programs while empowering consumers with detailed usage insights for better decision-making.

The global Advanced Metering Infrastructure (AMI) market represents a rapidly expanding segment of the smart grid ecosystem, driven by the growing need for accurate billing, energy efficiency, and real-time grid management. Growing adoption of smart grids, government mandates for energy conservation, and rising investments in digital utility infrastructure are pushing utilities to upgrade from legacy systems to AMI solutions. The technology’s ability to support predictive analytics, load forecasting, and integration of renewable energy sources makes it a vital component in modernizing utility operations across electricity, water, and gas sectors.

Market growth is further fueled by advancements in communication technologies such as RF mesh, PLC, and cellular IoT, alongside declining costs of smart meters and data management software. Emerging economies in Asia Pacific and Latin America are accelerating AMI deployments, while mature markets in North America and Europe focus on upgrading existing infrastructure for improved resilience and cybersecurity. With growing emphasis on sustainability, energy transition, and grid modernization, the AMI market is poised to play a critical role in shaping the future of utility management globally.

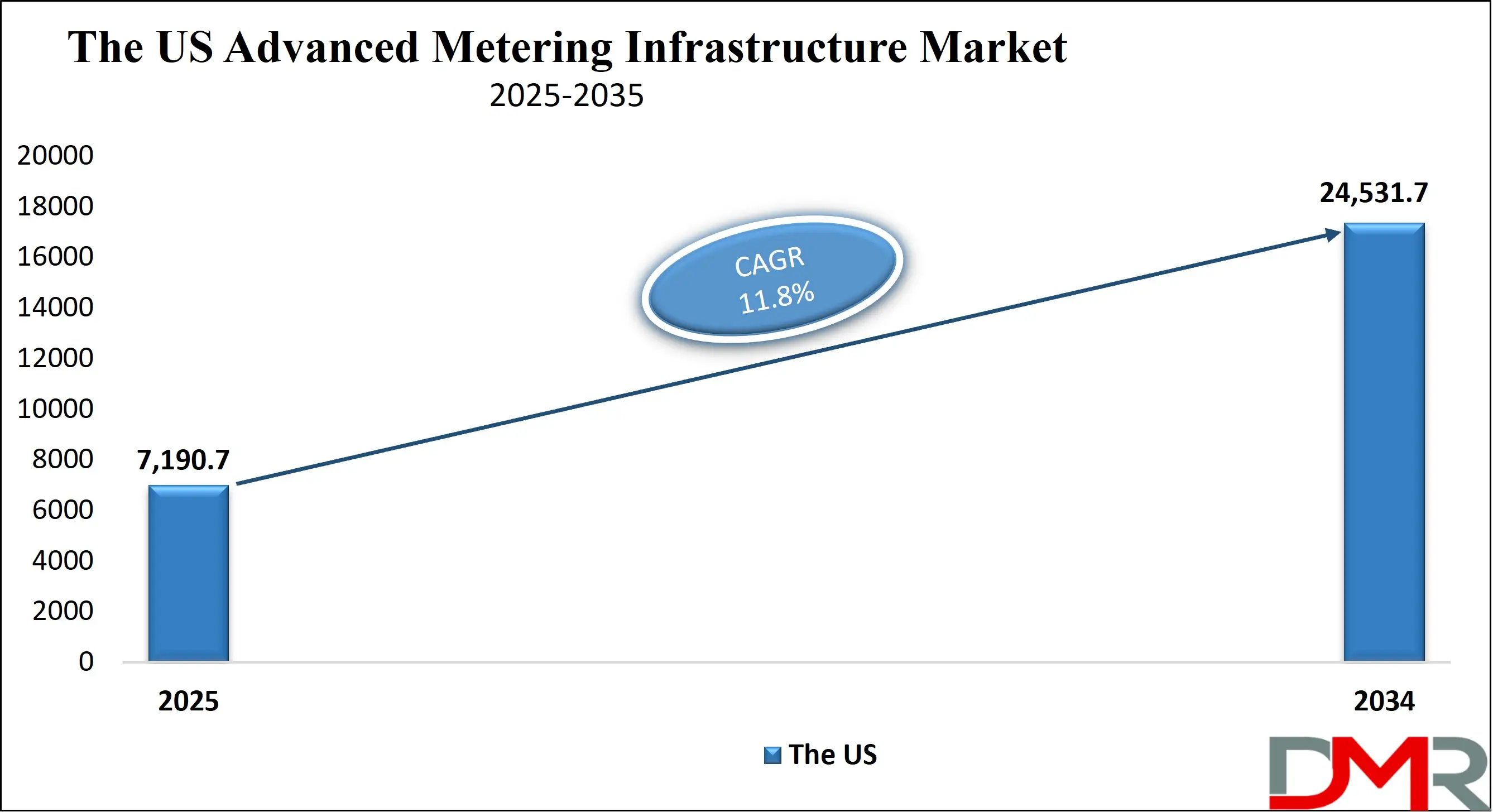

The US Advanced Metering Infrastructure Market

The U.S. Advanced Metering Infrastructure market size is projected to be valued at USD 7,190.7 million by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 24,531.7 million in 2035 at a CAGR of 11.8%.

The US advanced metering infrastructure market is witnessing robust growth, driven by large-scale smart meter deployments, grid modernization initiatives, and strong federal and state-level mandates promoting energy efficiency. Utilities across the country are increasingly investing in AMI solutions to replace legacy automated meter reading systems with advanced, two-way communication networks capable of delivering real-time consumption data, outage notifications, and demand response capabilities. This transition supports more accurate billing, enhances operational efficiency, and enables better integration of renewable energy sources such as solar and wind into the grid.

Additionally, programs by the U.S. Department of Energy and regional regulatory bodies are accelerating AMI adoption to strengthen grid reliability and support nationwide energy conservation goals.

The market’s expansion is further supported by technological advancements in RF mesh networks, PLC systems, and cellular IoT connectivity, which offer scalable and secure data transmission for millions of endpoints. Cybersecurity measures and advanced analytics platforms are becoming critical components, ensuring data integrity and enabling predictive maintenance for utility assets. With growing focus on sustainability, electrification of transportation, and decentralized energy generation, the US AMI market is evolving into a cornerstone of the country’s smart grid infrastructure. Leading industry players, partnerships between technology providers and utilities, and ongoing investment in digital utility transformation are expected to keep the US at the forefront of global advanced metering infrastructure innovation over the coming decade.

Europe Advanced Metering Infrastructure Market

Europe’s advanced metering infrastructure (AMI) market is projected to be valued at USD 6,213.4 million in 2025, accounting for a significant share of the global market. The region’s growth is strongly supported by stringent EU energy efficiency directives, large-scale smart meter deployment programs, and rapid modernization of grid infrastructure. Countries such as the UK, France, Italy, and Spain are leading adoption, driven by regulatory mandates and the push to meet climate goals. Additionally, the integration of renewable energy sources into national grids has increased the demand for real-time data monitoring and load management, further propelling AMI adoption across utilities in the region.

The European AMI market is expected to grow at a CAGR of 9.8% during the forecast period, reflecting consistent investments in advanced communication networks, IoT-enabled devices, and cybersecurity solutions for smart grids. The rise of decentralized energy generation, electric vehicle (EV) penetration, and energy trading platforms is also boosting the need for more sophisticated metering and analytics solutions.

Furthermore, growing collaboration between technology providers and utility companies outage detection and enhanced energy optimization for both residential and commercial sectors.is fostering innovation in meter data management systems, ensuring more accurate billing, better outage detection, and enhanced energy optimization for both residential and commercial sectors.

Japan Advanced Metering Infrastructure Market

Japan’s advanced metering infrastructure (AMI) market is projected to reach USD 1,132.9 million in 2025, driven by the country’s rapid push toward grid digitalization and energy efficiency improvements. Japan’s government and utility companies have been aggressively rolling out smart meters to enhance power distribution management, improve outage response times, and support the integration of renewable energy sources such as solar and wind.

The market is further bolstered by the nation’s commitment to achieving carbon neutrality by 2050, which has prompted large-scale investments in intelligent grid technologies. Utilities like Tokyo Electric Power Company (TEPCO) have already installed millions of smart meters, positioning Japan as one of the most advanced smart grid markets in Asia.

With a projected CAGR of 9.8%, Japan’s AMI market is set to benefit from innovations in IoT-enabled meters, AI-driven data analytics, and two-way communication technologies that enable real-time monitoring and demand-side energy management. The country’s aging infrastructure and vulnerability to natural disasters, such as earthquakes and typhoons, have also accelerated the adoption of AMI systems for better resilience and automated outage recovery.

Moreover, Japan’s growing electric vehicle market and the proliferation of decentralized energy resources are driving the need for precise consumption tracking, dynamic pricing models, and improved load balancing, ensuring a sustainable and reliable electricity supply across the nation.

Global Advanced Metering Infrastructure Market: Key Takeaways

- Market Value: The global advanced metering infrastructure market size is expected to reach a value of USD 82,902.8 million by 2035 from a base value of USD 28,633.1 million in 2025 at a CAGR of 11.3%.

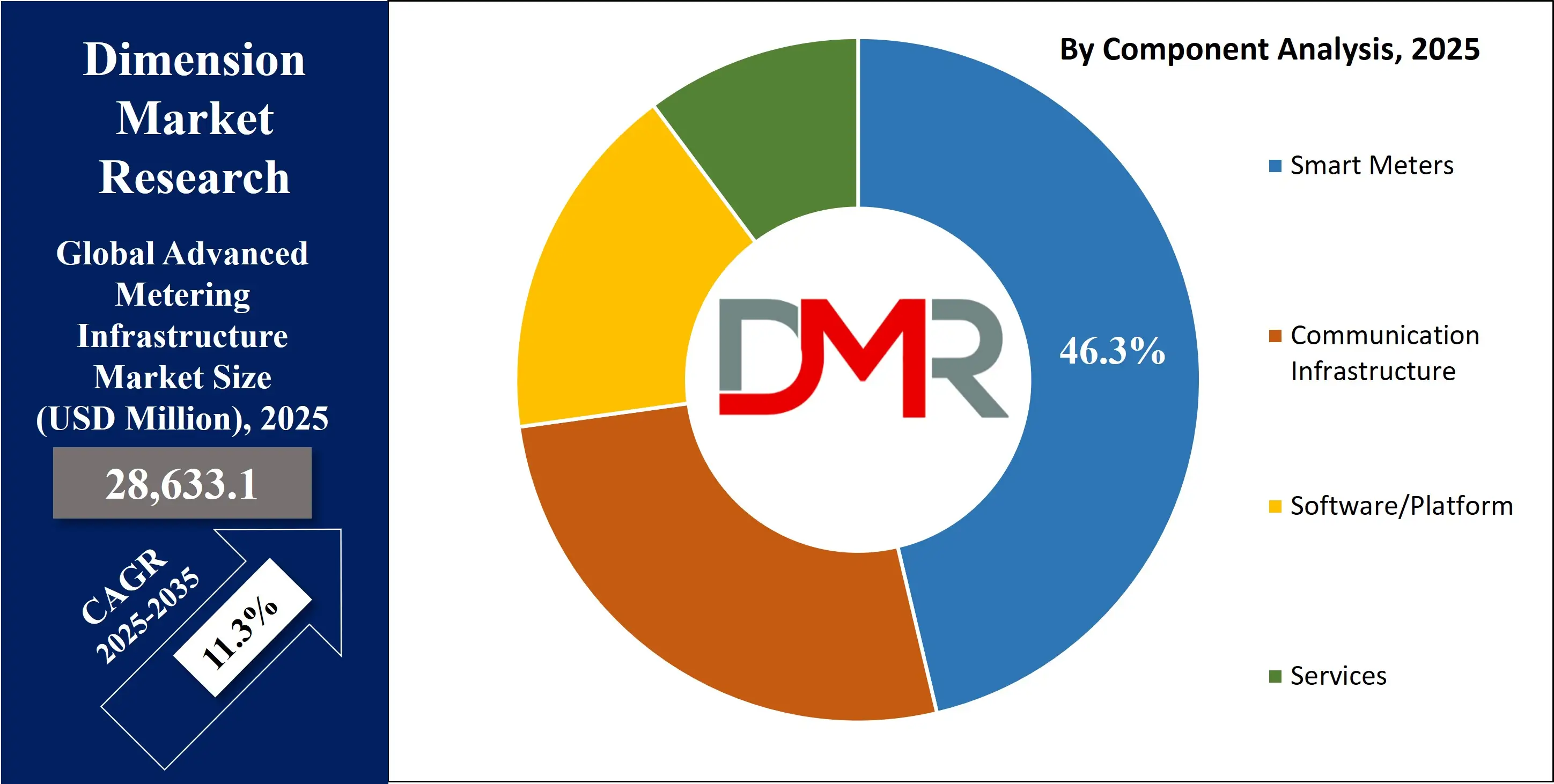

- By Component Segment Analysis: Smart Meters are anticipated to dominate the component segment, capturing 46.3% of the total market share in 2025.

- By End User Segment Analysis: Residential users are expected to dominate the end user segment, capturing 57.5% of the market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global advanced metering infrastructure market landscape with 36.3% of total global market revenue in 2025.

- Key Players: Some key players in the global advanced metering infrastructure market are Itron Inc., Landis+Gyr Group AG, Xylem Inc., Siemens AG, Schneider Electric SE, Hitachi Ltd., Toshiba Corporation, Hexing Electrical Co. Ltd., Genus Power Infrastructures Ltd., Tata Power Company Ltd., Iberdrola S.A., Larsen & Toubro Ltd., Osaki Electric Co. Ltd., ABB Ltd., Honeywell International Inc., Enel S.p.A., Badger Meter Inc., Wasion Group Holdings Limited, and Others.

Global Advanced Metering Infrastructure Market: Use Cases

- Real-Time Energy Monitoring and Billing Accuracy: Advanced metering infrastructure enables utilities to collect real-time consumption data from smart meters, ensuring accurate and transparent billing for residential, commercial, and industrial customers. By eliminating manual meter reading and estimated bills, utilities can reduce revenue losses and improve customer satisfaction. This real-time monitoring also allows consumers to track their energy usage patterns through online portals or mobile applications, empowering them to adopt energy-saving practices and reduce overall utility costs.

- Outage Detection and Faster Restoration: AMI systems provide instant notifications to utilities when outages occur, enabling quicker fault detection and restoration. Through two-way communication networks such as RF mesh and PLC, utilities can pinpoint the exact location of a power failure without relying on customer reports. This significantly reduces downtime, improves grid reliability, and enhances operational efficiency. In disaster-prone regions, AMI’s outage management capabilities are crucial for rapid recovery and maintaining service continuity.

- Demand Response and Load Management: With AMI, utilities can implement demand response programs that adjust or shift electricity usage during peak demand periods. Smart meters provide detailed load profiles, allowing utilities to send price signals or incentives to customers for reducing consumption when the grid is under stress. This not only helps prevent blackouts but also optimizes energy distribution, reduces the need for costly infrastructure upgrades, and supports the integration of renewable energy sources.

- Energy Theft Detection and Revenue Protection: Advanced metering infrastructure plays a key role in identifying unauthorized consumption, meter tampering, or energy theft. Continuous data monitoring and analytics allow utilities to detect irregular usage patterns or sudden drops in meter readings, triggering investigations before significant revenue losses occur. By reducing non-technical losses, utilities can improve their financial performance and maintain equitable billing for all customers while enhancing the overall security of the grid.

Impact of Artificial Intelligence on Advanced Metering Infrastructure Market

Artificial intelligence is transforming the advanced metering infrastructure market by enabling utilities to leverage smart meter data for deeper operational insights and predictive capabilities. Through AI-driven analytics, utilities can process vast volumes of consumption, voltage, and outage data in real time, identifying patterns that enhance grid reliability and efficiency. Machine learning algorithms help predict peak demand periods, detect anomalies, and optimize load balancing, which leads to better resource allocation and reduced operational costs. AI also supports integration with distributed energy resources, allowing utilities to manage renewable generation variability and improve demand-side management strategies.

In addition, AI-powered predictive maintenance is reducing equipment downtime by identifying potential failures in meters, transformers, or communication networks before they occur. Natural language processing and AI-enabled customer engagement tools improve user experience by delivering personalized energy-saving recommendations and interactive support. Cybersecurity is another critical area where AI enhances AMI resilience, detecting suspicious activities or cyber threats in real time and mitigating risks swiftly. As AI technologies mature, their integration into AMI platforms is expected to accelerate, driving smarter energy management, higher return on investment for utilities, and stronger customer satisfaction.

Global Advanced Metering Infrastructure Market: Stats & Facts

International Energy Agency (IEA)

- The European Commission’s "Digitalisation of the energy system" plan estimates EUR 170 billion (USD 184 billion) in smart grid digitalisation investment—covering smart meters, automated grid management, and digital metering—projected up to 2030.

- From 2020 to 2025, emerging markets are expected to deploy approximately 430 million smart meters, with China alone accounting for about half of that volume.

- Total investment expected in advanced metering infrastructure across emerging markets spans approximately USD 40.7 billion from 2020 to 2024, with smart grid infrastructure overall (including AMI) reaching up to USD 47.9 billion.

U.S. Department of Energy (DOE)

- The DOE’s Grid Modernization Initiative (GMI) is driving R&D, demonstrations, and deployment to support a resilient, secure, and decarbonized grid ecosystem, coordinated across multiple offices (OE, EERE, GDO, ARPA-E, etc.).

- Advanced Metering Infrastructure (AMI) is evolving into second-generation AMI 2.0 smart meters with distributed processing capabilities, enabling meters to perform autonomous actions based on centrally defined parameters.

- AMI enables utilities to implement time-of-use (TOU) electricity rates that vary throughout the day and year, potentially growing average price per kWh while reflecting real-time grid conditions.

Global Advanced Metering Infrastructure Market: Market Dynamics

Global Advanced Metering Infrastructure Market: Driving Factors

Growing Smart Grid Deployments

The rising adoption of smart grids is a major driver for the advanced metering infrastructure market, as utilities seek to modernize energy distribution networks and improve operational efficiency. AMI forms the backbone of smart grid architecture by providing real-time consumption data, enabling remote meter management, and supporting advanced functionalities such as load balancing and outage detection. Large-scale government initiatives in the US, Europe, and Asia Pacific to upgrade legacy infrastructure are accelerating the pace of AMI installations.

Increasing Focus on Energy Efficiency and Sustainability

Global emphasis on reducing carbon emissions and optimizing energy usage is boosting demand for AMI solutions. Smart meters and integrated communication networks allow utilities and end-users to monitor consumption patterns and adopt energy-saving measures. In regions with aggressive renewable energy targets, AMI facilitates the integration of solar, wind, and other distributed energy resources, ensuring stable grid performance while supporting long-term sustainability goals.

Global Advanced Metering Infrastructure Market: Restraints

High Initial Investment Costs

The substantial capital expenditure required for large-scale AMI deployment poses a significant barrier, particularly in emerging economies. Costs related to smart meters, communication infrastructure, and meter data management systems can strain utility budgets, especially where cost recovery through tariffs is slow or politically sensitive.

Data Privacy and Cybersecurity Concerns

As AMI systems collect and transmit detailed consumption data, concerns over data privacy and security are growing. Cyber threats targeting smart grids can compromise consumer information and disrupt energy distribution. Compliance with stringent regulatory frameworks and investment in advanced cybersecurity solutions remain critical challenges for market players.

Global Advanced Metering Infrastructure Market: Opportunities

Expansion in Emerging Markets

Rapid urbanization, growing electrification, and growing utility infrastructure in regions such as Asia Pacific, Latin America, and Africa present significant growth opportunities for AMI vendors. Government-backed programs aimed at reducing technical and non-technical losses are creating favorable conditions for large-scale AMI adoption in these markets.

Integration with Advanced Analytics and AI

The convergence of AMI with artificial intelligence and big data analytics opens new avenues for value creation. Utilities can harness predictive insights for demand forecasting, outage management, and energy theft detection, enhancing operational efficiency while offering personalized services to customers.

Global Advanced Metering Infrastructure Market: Trends

Rising Adoption of IoT-Enabled Smart Meters

The integration of IoT technologies with AMI is transforming how utilities interact with their infrastructure and consumers. IoT-enabled meters provide richer datasets, real-time alerts, and seamless integration with home energy management systems, fostering greater customer engagement and operational agility.

Shift Toward Cloud-Based Meter Data Management Systems

Utilities are increasingly migrating their meter data management platforms to cloud environments to enhance scalability, reduce IT infrastructure costs, and improve data accessibility. Cloud-based solutions support faster analytics, remote updates, and easier integration with third-party applications, positioning them as a key trend in next-generation AMI systems.

Global Advanced Metering Infrastructure Market: Research Scope and Analysis

By Component Analysis

Smart meters are expected to dominate the component segment of the advanced metering infrastructure market, holding 46.3% of the total market share in 2025. This leadership stems from the growing global shift toward digital utility infrastructure, where utilities aim to replace outdated mechanical meters with advanced, two-way communication devices. Smart meters provide precise and real-time consumption data, reducing errors in billing and enabling automated meter reading without the need for manual intervention. They also support advanced functions such as outage detection, peak load monitoring, and integration with renewable energy sources, making them essential for smart grid modernization. Additionally, their role in empowering end-users with detailed usage insights through mobile apps or online portals is encouraging energy conservation and better demand-side management, further boosting their adoption rate.

Communication infrastructure forms the backbone of the AMI ecosystem by enabling the secure and efficient transmission of data between smart meters, utility control centers, and meter data management systems. This segment includes technologies such as RF mesh networks, power line communication (PLC), and cellular IoT connectivity, each offering specific advantages in coverage, scalability, and reliability. RF mesh is widely used in urban deployments for its self-healing and high-density capabilities, while PLC leverages existing power lines for cost-effective communication in certain regions. Cellular connectivity, including NB-IoT and LTE-M, is gaining traction for remote or hard-to-reach locations where fixed networks are impractical. The quality and robustness of this communication infrastructure directly influence the performance of AMI systems, ensuring timely data delivery, supporting advanced analytics, and maintaining cybersecurity in increasingly complex grid environments.

By End User Analysis

Residential users are expected to dominate the end-user segment of the advanced metering infrastructure market, accounting for 57.5% of the market share in 2025. This dominance is driven by large-scale smart meter rollouts in households as part of government-led energy efficiency programs and utility modernization initiatives. Residential AMI installations enable real-time consumption monitoring, accurate billing, and better load management, allowing households to reduce energy costs and adopt more sustainable usage patterns. These systems also enhance grid stability by providing utilities with granular data on consumption trends, helping them predict demand fluctuations and optimize energy distribution. With growing consumer awareness about energy conservation and growing adoption of renewable energy at the household level, residential AMI deployment is set to expand steadily in the coming years.

The commercial & industrial segment represents another key area for AMI adoption, fueled by the need for accurate energy tracking, operational efficiency, and compliance with sustainability regulations in businesses. Smart meters in commercial buildings, retail outlets, and office complexes provide detailed consumption analytics, helping facility managers optimize energy use and reduce operational costs. AMI systems in this segment also enable demand response participation, allowing businesses to adjust usage during peak hours in exchange for cost incentives from utilities. Additionally, commercial users often require advanced monitoring features for multiple meters across various sites, making AMI’s centralized data management capabilities highly valuable. As energy costs remain a significant expense for commercial operations, adoption of AMI technology in this sector is expected to continue growing.

The Advanced Metering Infrastructure Market Report is segmented on the basis of the following:

By Component

- Electricity Meters

- Gas Meters

- Water Meters

- Heat/Thermal Meters

- Communication Infrastructure

- Radio Frequency (RF) Mesh

- Cellular

- Power Line Communication (PLC)

- Others

- Meter Data Management

- Meter Data Analytics

- Professional Services & System Integration

- Managed Services

By End User

- Residential

- Commercial & Industrial

- Municipal, Government & Public

- Irrigation & Agricultural

Global Advanced Metering Infrastructure Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is anticipated to lead the global advanced metering infrastructure market in 2025, capturing 36.3% of total market revenue, driven by large-scale smart grid initiatives, rapid urbanization, and government-backed programs promoting energy efficiency. Countries such as China, Japan, India, and South Korea are making significant investments in smart meter rollouts to modernize their utility infrastructure and reduce transmission and distribution losses. Rising electricity demand, growing integration of renewable energy sources, and strong regulatory support for digital utility transformation are further accelerating AMI adoption across the region.

Additionally, the presence of major technology providers and advancements in communication technologies like RF mesh and PLC are enabling scalable and cost-effective deployments, positioning Asia Pacific as the dominant hub for AMI growth.

Region with significant growth

North America is projected to witness significant growth in the advanced metering infrastructure market, supported by ongoing grid modernization projects, robust regulatory frameworks, and strong adoption of smart energy solutions. The United States and Canada are investing heavily in replacing aging meter infrastructure with advanced, data-driven systems that enhance operational efficiency and enable real-time energy management. Increasing demand for renewable energy integration, integrated with rising emphasis on energy conservation and demand response programs, is further fueling market expansion.

Additionally, the region benefits from the presence of established AMI technology providers and widespread adoption of communication technologies such as RF mesh and PLC, ensuring sustained growth momentum.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Advanced Metering Infrastructure Market: Competitive Landscape

The global competitive landscape of the advanced metering infrastructure market is characterized by the presence of a mix of established multinational corporations and emerging regional players competing to enhance market share through technological innovation, strategic partnerships, and large-scale deployments. Leading companies such as Itron Inc., Landis+Gyr Group AG, Sensus (Xylem Inc.), Siemens AG, and Schneider Electric SE are focusing on integrating advanced analytics, artificial intelligence, and IoT capabilities into their AMI solutions to provide enhanced energy management and real-time monitoring.

The market is witnessing increased collaboration between meter manufacturers, communication technology providers, and utility companies to develop interoperable and scalable systems. Furthermore, mergers, acquisitions, and long-term government contracts are common strategies to strengthen market presence, while continuous investment in R&D enables players to cater to the rising global demand for smart, sustainable, and secure metering infrastructure.

Some of the prominent players in the global advanced metering infrastructure market are:

- Itron Inc.

- Landis+Gyr Group AG

- Xylem Inc.

- Siemens AG

- Schneider Electric SE

- Hitachi Ltd.

- Toshiba Corporation

- Hexing Electrical Co. Ltd

- Genus Power Infrastructures Ltd

- Tata Power Company Ltd

- Iberdrola S.A.

- Larsen & Tourbro Ltd.

- Osaki Electric Co. Ltd.

- ABB Ltd.

- Honeywell International Inc.

- Enel S.p.A.

- Badger Meter, Inc.

- Wasion Group Holdings Limited

- Other Key Players

Global Advanced Metering Infrastructure Market: Recent Developments

- July 2025: Open-source billing and metering platform provider Flexprice raised USD 500,000 in funding led by TDV Partners, aimed at advancing its open-source infrastructure for usage-based billing and metering.

- July 2025: Rodan Energy Solutions acquired MEI Energy Solutions to bolster its advanced metering infrastructure deployment and energy optimization capabilities across Canada and the U.S.

- July 2025: Rodan Energy Solutions expanded its grid-edge capabilities by integrating MEI Energy Solutions’ engineering and deployment expertise to enhance its AMI deployment offerings and energy optimization platform across North America.

- December 2024: Private equity firms EQT and GIC agreed to purchase a majority stake in UK smart meter provider Calisen, valuing it at approximately £4 billion, signaling growing investor interest in smart metering infrastructure.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 28,633.1 Mn |

| Forecast Value (2035) |

USD 82,902.8 Mn |

| CAGR (2025–2035) |

11.3% |

| The US Market Size (2025) |

USD 7,190.7 Mn |

| Historical Data |

2019 – 2023 |

| Forecast Data |

2026 – 2035 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Smart Meters, Communication Infrastructure, Software/Platform, and Services), and By End User (Residential, Commercial & Industrial, Municipal, Government & Public, and Irrigation & Agricultural) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Itron Inc., Landis+Gyr Group AG, Xylem Inc., Siemens AG, Schneider Electric SE, Hitachi Ltd., Toshiba Corporation, Hexing Electrical Co. Ltd., Genus Power Infrastructures Ltd., Tata Power Company Ltd., Iberdrola S.A., Larsen & Toubro Ltd., Osaki Electric Co. Ltd., ABB Ltd., Honeywell International Inc., Enel S.p.A., Badger Meter Inc., Wasion Group Holdings Limited., and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global advanced metering infrastructure market size is estimated to have a value of USD 28,633.1 million in 2025 and is expected to reach USD 82,902.8 million by the end of 2035.

The US advanced metering infrastructure market is projected to be valued at USD 7,190.7 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 24,531.7 million in 2035 at a CAGR of 11.8%.

Asia Pacific is expected to have the largest market share in the global advanced metering infrastructure market, with a share of about 36.3% in 2025.

Some of the major key players in the global advanced metering infrastructure market are Itron Inc., Landis+Gyr Group AG, Xylem Inc., Siemens AG, Schneider Electric SE, Hitachi Ltd., Toshiba Corporation, Hexing Electrical Co. Ltd., Genus Power Infrastructures Ltd., Tata Power Company Ltd., Iberdrola S.A., Larsen & Toubro Ltd., Osaki Electric Co. Ltd., ABB Ltd., Honeywell International Inc., Enel S.p.A., Badger Meter Inc., Wasion Group Holdings Limited., and Others.

The market is growing at a CAGR of 11.3 percent over the forecasted period.