Market Overview

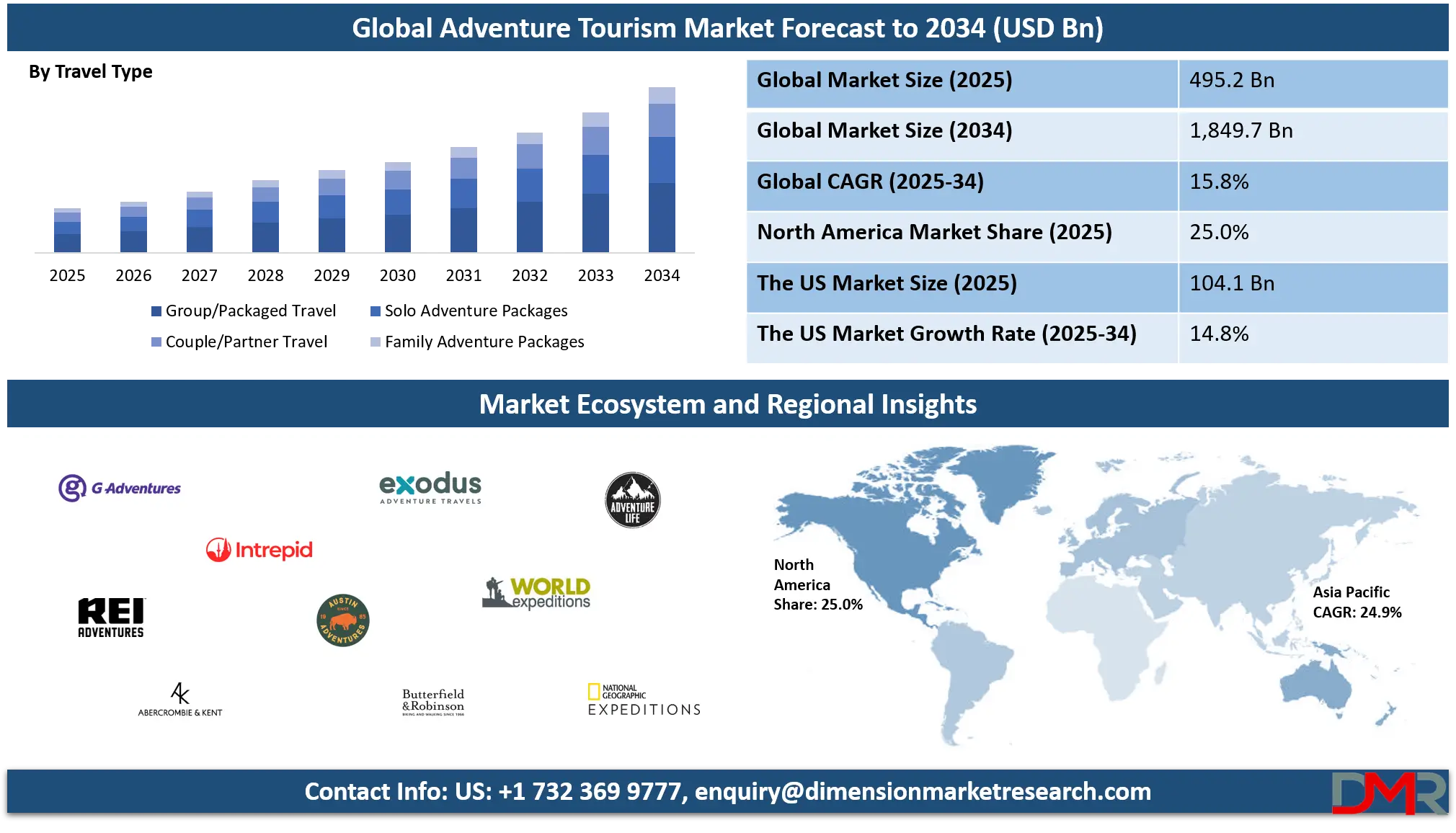

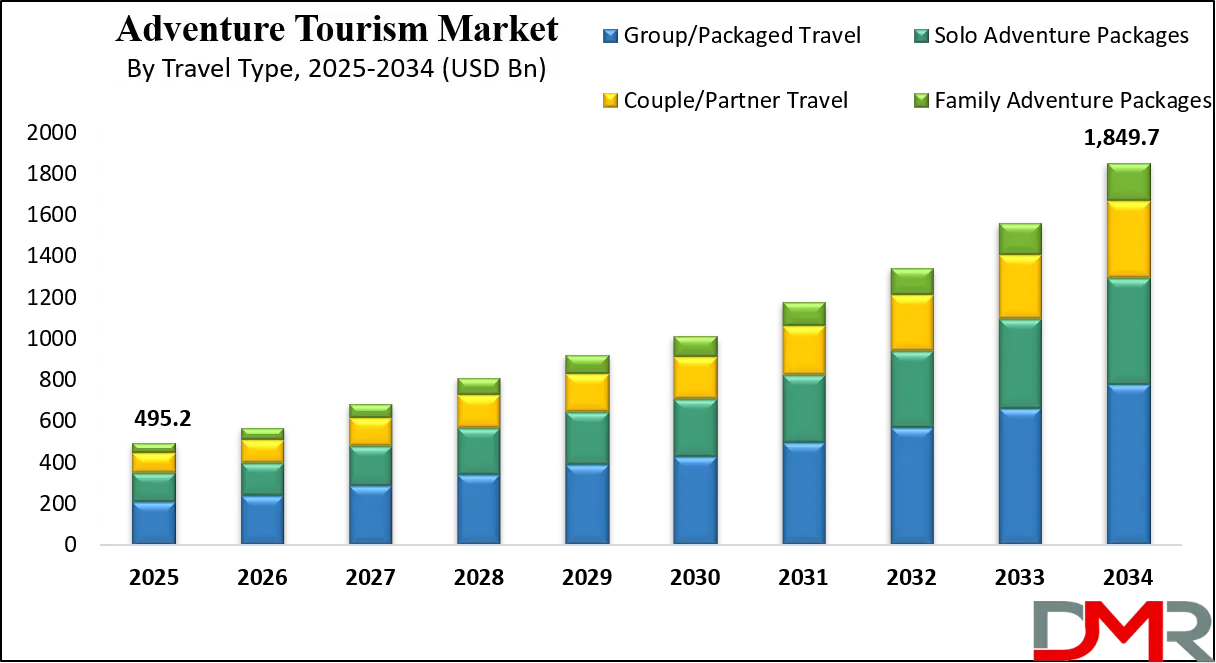

The global adventure tourism market is projected to reach USD 495.2 billion in 2025 and is expected to grow to USD 1,849.7 billion by 2034, expanding at a robust CAGR of 15.8%. This growth is driven by rising demand for experiential travel, eco-tourism, and soft adventure activities across emerging and developed markets.

Adventure tourism refers to a niche segment of the travel industry that involves exploration or travel with a certain degree of risk, physical exertion, and specialized skills. It encompasses a variety of outdoor and nature-based activities such as hiking, scuba diving, mountaineering, paragliding, and wildlife safaris, often set in remote or exotic destinations. This market appeals to travelers seeking immersive, transformative experiences that combine thrill, challenge, and cultural engagement. Adventure tourism blends ecotourism, cultural tourism, and experiential travel, fostering a deeper connection between the traveler and the environment while promoting sustainable tourism practices and responsible travel behavior.

The global adventure tourism market has experienced dynamic growth in recent years, driven by shifting traveler preferences toward personalized and experiential journeys. Modern tourists, particularly millennials and Gen Z, are prioritizing unique travel experiences that offer excitement, personal growth, and authenticity. The rising demand for active holidays and nature-centric travel has positioned adventure tourism as a vital segment within the broader tourism ecosystem. Governments and tourism boards across continents are actively investing in infrastructure, safety protocols, and marketing campaigns to promote adventure destinations, thereby contributing to the sector’s rapid development.

The international expansion of digital booking platforms, the growth of social media influence, and growing awareness around wellness and sustainable travel have further propelled the global adventure tourism market. With travelers seeking off-the-beaten-path destinations and eco-friendly itineraries, service providers are adapting their offerings to include guided tours, localized experiences, and customized packages.

Moreover, integrating smart tourism technologies and the rise of solo and female adventure travelers are reshaping how the market evolves. As climate consciousness grows, the emphasis on low-impact, conservation-oriented adventure travel is expected to remain a central theme in the future landscape of global tourism.

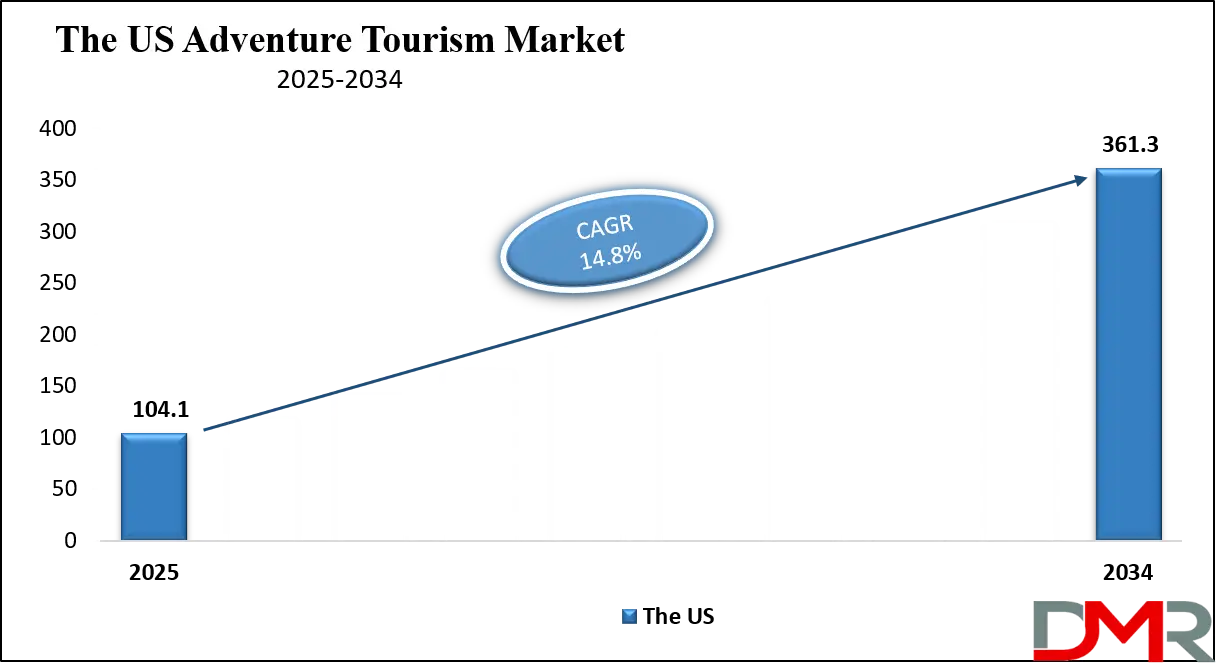

The US Adventure Tourism Market

The U.S. Adventure Tourism Market size is projected to be valued at USD 104.1 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 361.3 billion in 2034 at a CAGR of 14.8%.

The U.S. adventure tourism market is evolving rapidly as American travelers seek immersive and experience-driven journeys that go beyond traditional vacationing. From the rugged terrains of Alaska to the scenic trails of the Rocky Mountains, the country offers a diverse landscape that caters to both hard and soft adventure activities. Domestic tourism in the adventure segment is gaining momentum, with more individuals and families opting for outdoor recreation such as hiking, whitewater rafting, zip-lining, and wildlife exploration.

The growth of national park tourism, combined with a renewed interest in wellness travel and nature escapes, is fueling this upward trend. Moreover, local tour operators are tailoring packages to appeal to niche preferences like solo travel, sustainable tourism, and cultural immersion, thereby enhancing the overall market experience.

Another key factor shaping the U.S. adventure tourism landscape is the growing influence of digital platforms and social media in shaping travel choices. Adventure travelers are now more informed and connected, often relying on online reviews, video content, and travel communities to plan their itineraries. The rise of eco-conscious and responsible travel has also led to greater demand for low-impact activities that promote conservation and local community engagement.

State tourism boards and private stakeholders are investing in adventure infrastructure, safety training, and certified guides to accommodate this growing interest. With an expanding variety of options ranging from kayaking in coastal regions to biking trails in national forests, the U.S. continues to position itself as a leading destination for diverse and customized adventure travel experiences.

The Europe Adventure Tourism Market

The Europe adventure tourism market is projected to reach approximately USD 173.3 billion in 2025, reflecting its strong foothold as a leading region in the global adventure tourism landscape. This substantial market share is underpinned by Europe’s diverse and picturesque geography, which includes mountain ranges, coastal areas, forests, and historic sites that attract adventure enthusiasts from all over the world.

Countries like Switzerland, France, Spain, Italy, and Norway offer a wide variety of adventure activities such as hiking, skiing, cycling, and water sports, catering to both soft and hard adventure travelers. Europe’s well-developed tourism infrastructure, efficient transport networks, and safety standards enhance the overall travel experience, making it a preferred destination for adventure seekers seeking both thrill and cultural immersion.

The region’s robust growth is driven by a CAGR of 9.5%, highlighting growing consumer demand for sustainable and experiential travel options. Growing awareness around environmental conservation and responsible tourism is encouraging operators to design eco-friendly adventure packages, which are particularly popular among millennials and Gen Z travelers.

Moreover, the rise of digital platforms and online travel agencies is simplifying the booking process, expanding the reach of adventure tourism across Europe. Government initiatives supporting rural and regional tourism development, combined with the growing popularity of multi-day trekking, wildlife exploration, and nature-based activities, are further fueling market expansion. This dynamic growth trajectory positions Europe not only as a major revenue generator but also as an innovation hub for the future of adventure tourism globally.

The Japan Adventure Tourism Market

The adventure tourism market in Japan is expected to reach approximately USD 16.7 billion in 2025, reflecting its growing importance within the global adventure tourism sector. Japan’s unique blend of natural beauty, rich cultural heritage, and cutting-edge infrastructure makes it an attractive destination for adventure travelers. From the iconic trails of the Japanese Alps and the ancient pilgrimage routes like the Kumano Kodo to thrilling winter sports in Hokkaido and exploring volcanic landscapes, Japan offers a diverse range of activities that cater to both soft and hard adventure seekers. The country’s well-preserved natural parks, hot springs, and traditional villages further enrich the experience, drawing both domestic tourists and a growing number of international visitors eager to explore its off-the-beaten-path adventures.

Japan’s adventure tourism market is growing at a robust compound annual growth rate (CAGR) of 12.5%, signaling a rapidly expanding sector fueled by rising interest in experiential travel and wellness-focused adventure activities. The government's strategic focus on promoting tourism as part of its economic recovery plan, along with efforts to enhance connectivity and promote sustainable travel practices, is accelerating growth.

Additionally, Japan’s growing appeal as a safe, technologically advanced destination with easy access to nature is attracting younger travelers and solo adventurers seeking authentic and immersive experiences. The growth of digital booking platforms and customized travel solutions is also enabling wider accessibility to adventure tourism offerings, making Japan a fast-emerging hotspot in the global adventure tourism market.

Global Adventure Tourism Market: Key Takeaways

- Market Value: The global adventure tourism market size is expected to reach a value of USD 1,849.7 billion by 2034 from a base value of USD 495.2 billion in 2025 at a CAGR of 15.8%.

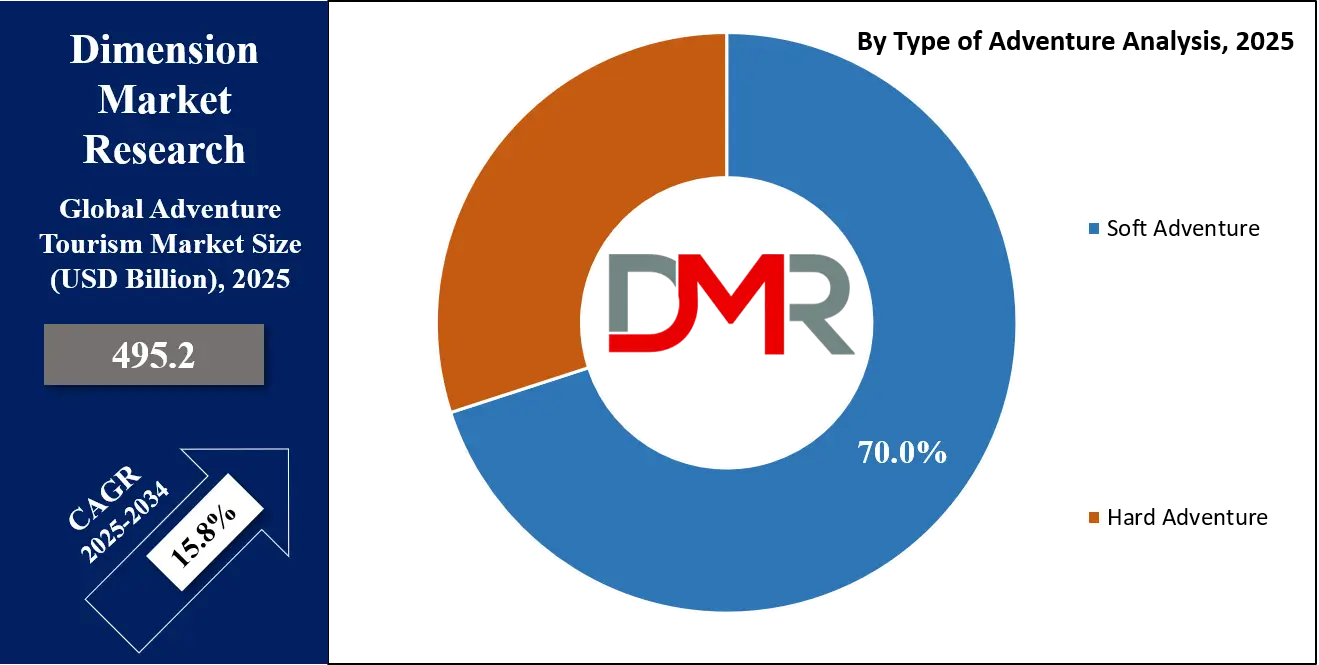

- By Type of Adventure Segment Analysis: Soft Adventure is poised to consolidate its dominance in the type of adventure segment, capturing 70.0% of the total market share in 2025.

- By Activity Type Analysis: Trekking & Hiking activities are expected to dominate the activity type segment, capturing 20.0% of the total market share in 2025.

- By Booking Channel Segment Analysis: Online Travel Agencies (OTAs) will lead the booking channel segment, capturing 50.0% of the market share in 2025.

- By Travel Type Segment Analysis: Group/Packaged Travel is anticipated to maintain its dominance in the travel type segment, capturing 42.0% of the total market share in 2025.

- By Pricing Tier Segment Analysis: Mid-range (USD 500–USD 1,000 per package) packages are projected to lead the pricing tier segment, capturing 40.0% of the total market share in 2025.

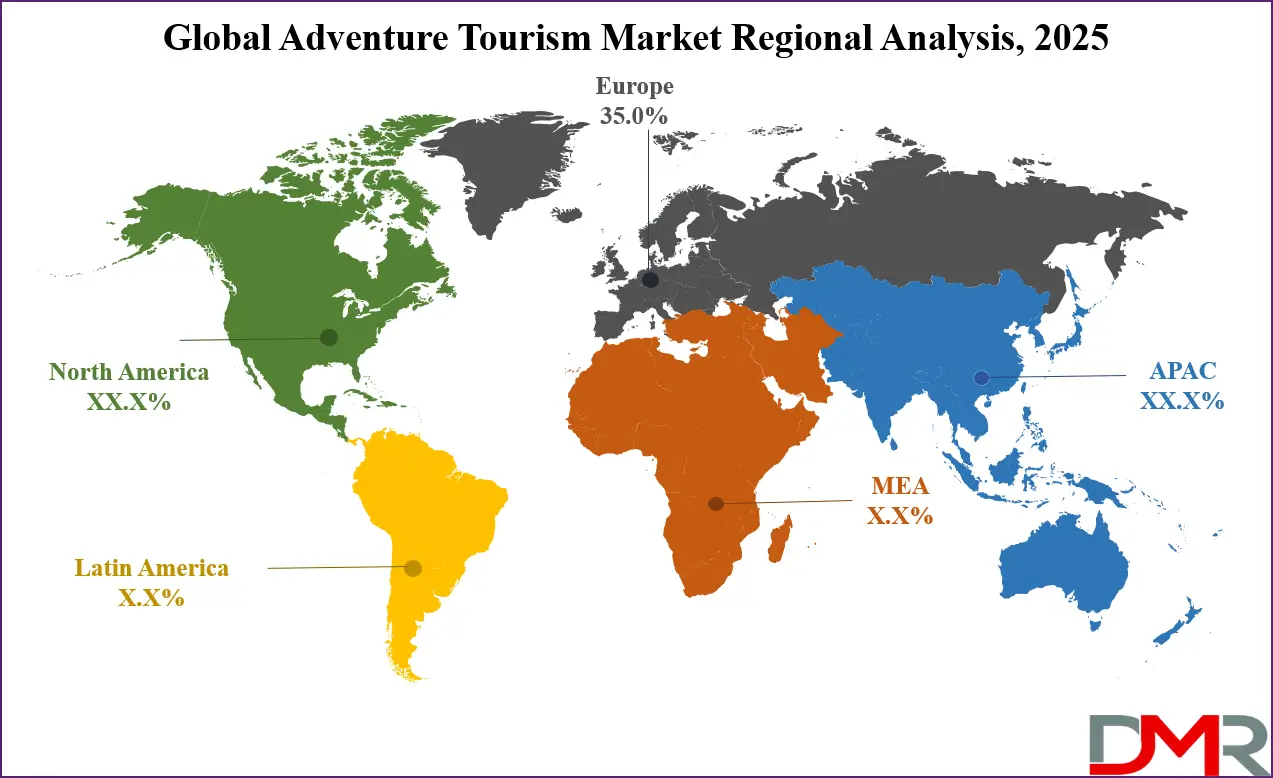

- Regional Analysis: Europe is anticipated to lead the global adventure tourism market landscape with 35.0% of total global market revenue in 2025.

- Key Players: Some key players in the global adventure tourism market are G Adventures, Intrepid Travel, REI Adventures, Abercrombie & Kent, Exodus Travels, Austin Adventures, Butterfield & Robinson, Adventure Life, World Expeditions, Explore Worldwide, National Geographic Expeditions, Wild Frontiers Adventure Travel, The Adventure Company, Trek Travel, Backroads, Mountain Travel Sobe, and other key players.

Global Adventure Tourism Market: Use Cases

- Destination Development for Emerging Economies: Governments in emerging economies are actively investing in adventure tourism to diversify their tourism offerings and boost local economies. By capitalizing on natural landscapes such as mountains, forests, deserts, and coastlines, countries like Costa Rica, Nepal, and Morocco are developing eco-tourism and adventure travel hubs. These regions attract international tourists seeking off-the-beaten-path experiences such as canyoning, trekking, and jungle expeditions. Local authorities and tourism boards are partnering with global tour operators to improve accessibility, develop infrastructure, and implement sustainable tourism practices. This strategy helps generate employment, stimulate rural development, and promote cultural preservation.

- Adventure Tour Operators Expanding Digital Booking Capabilities: Adventure travel companies are leveraging digital transformation to streamline operations and enhance customer experience. With the rise of online travel agencies (OTAs) and mobile-first travelers, tour operators are integrating e-commerce platforms, real-time booking engines, and customer relationship management (CRM) tools to offer personalized and instant booking options. Companies like Intrepid Travel and G Adventures use data-driven platforms to track traveler preferences and suggest curated itineraries based on activity type, travel duration, and environmental impact. This digitalization not only boosts revenue generation but also increases market reach to tech-savvy and younger audiences.

- Luxury Adventure Tourism for High-Net-Worth Individuals (HNWIs): The luxury segment of adventure tourism is experiencing rapid growth, with affluent travelers seeking bespoke, high-adrenaline experiences in remote and exclusive locations. Companies like Abercrombie & Kent and Quark Expeditions curate high-end travel offerings such as polar expeditions, private mountain guides, heli-skiing, and wildlife safaris in conservation areas. These packages emphasize privacy, safety, cultural immersion, and unique natural encounters, often supported by luxury accommodations and personalized services. The demand for exclusive adventure experiences is also driving innovation in travel gear, private transport, and concierge-level planning.

- Sustainable and Responsible Tourism Campaigns: Environmental sustainability and ethical travel practices are becoming core pillars in the adventure tourism sector. Tour operators, NGOs, and certification bodies are collaborating to create packages that minimize carbon footprints, protect biodiversity, and empower local communities. Adventure companies like Responsible Travel and Wild Frontiers Adventure Travel design itineraries that prioritize eco-lodges, local guides, zero-waste travel, and carbon offsetting. Educational components, such as cultural sensitivity briefings and wildlife conservation workshops, are also integrated to raise awareness among travelers. These campaigns align with the growing preference for green travel and position companies as leaders in sustainable tourism.

Global Adventure Tourism Market: Stats & Facts

United Nations World Tourism Organization (UNWTO)

- Adventure tourism accounts for nearly 20% of all international tourism arrivals globally.

- Nature-based and adventure tourism is one of the fastest-growing segments in the travel industry.

- Over 60% of adventure tourists participate in outdoor activities such as hiking, cycling, and wildlife viewing.

- Adventure tourists spend on average 30% more than standard leisure tourists.

- The Asia-Pacific region saw a 9% annual increase in adventure tourism arrivals between 2017 and 2022.

- Sustainable tourism policies are increasingly integrated into national tourism plans to support adventure tourism growth.

World Travel & Tourism Council (WTTC)

- Travel and tourism contributed 10.4% to global GDP in 2023, with adventure tourism being a significant growth driver.

- The sector supported over 320 million jobs worldwide in 2023, many linked to adventure and nature tourism activities.

- Adventure tourism is estimated to grow at a compound annual rate higher than the overall travel sector by 2027.

U.S. National Park Service (NPS)

- National parks in the U.S. received over 300 million visits in 2023, many linked to adventure tourism activities like hiking and camping.

- Adventure tourism-related spending in U.S. national parks generated more than USD 40 billion in economic output in 2023.

- Wildlife watching and nature-based tourism grew by 12% in U.S. parks over the last five years.

European Environment Agency (EEA)

- Over 60% of Europeans engage in outdoor recreational activities, with hiking and cycling being the most popular.

- Protected natural areas in Europe attract more than 50 million visits annually, many related to adventure tourism.

- Sustainable adventure tourism initiatives in Europe have reduced environmental impacts by up to 25% in certain regions.

Japan Tourism Agency

- Adventure tourism activities contributed to 15% of total inbound tourism spending in Japan in 2023.

- Mountain hiking and winter sports saw a 10% year-on-year increase in participation rates from international tourists in Japan.

- Local governments in Japan have invested over USD 100 million annually to develop adventure tourism infrastructure.

- Australia Department of Industry, Science, Energy and Resources

- Outdoor adventure activities contribute over AUD 20 billion annually to the Australian economy.

- The number of adventure tourists visiting Australia increased by 8% annually from 2018 to 2023.

- Adventure tourism supports more than 150,000 jobs in rural and regional Australia.

Canada Parks and Wilderness Society (CPAWS)

- Canada’s wilderness areas see over 100 million visits annually, with adventure tourism activities like kayaking and trekking growing rapidly.

- Indigenous tourism, often linked to adventure and cultural experiences, grew by 15% annually from 2019 to 2024.

New Zealand Ministry of Business, Innovation and Employment (MBIE)

- Adventure tourism contributes approximately NZD 2 billion annually to New Zealand’s economy.

- Over 30% of international visitors engage in at least one adventure activity during their stay.

- Adventure tourism supports over 20,000 direct jobs in New Zealand’s regional areas.

South African Tourism

- Adventure tourism accounts for nearly 25% of South Africa’s inbound tourism market.

- The number of tourists engaging in safaris and wildlife adventure activities has grown by 7% annually since 2018.

Brazilian Ministry of Tourism

- Adventure tourism contributes approximately 12% of Brazil’s tourism revenue, especially in the Amazon and Pantanal regions.

- The government has launched over 50 sustainable tourism projects promoting eco-adventure activities across Brazil since 2020.

Global Adventure Tourism Market: Market Dynamics

Global Adventure Tourism Market: Driving Factors

Rising Demand for Experiential and Transformational Travel

Travelers globally are shifting from conventional leisure vacations to immersive, experience-rich adventures that offer personal growth and meaningful engagement. Adventure tourism satisfies this growing appetite for physical activity, cultural immersion, and emotional enrichment. Consumers, particularly millennials and Gen Z, are prioritizing activities such as trekking, cultural exploration, wildlife encounters, and community-based tourism. This demand fuels the expansion of the market across both soft and hard adventure categories.

Government Support and Infrastructure Development

Governments in adventure-rich destinations are supporting this sector through policies, funding, and public-private partnerships aimed at developing adventure-friendly infrastructure. Initiatives include the development of national parks, eco-trails, safety regulations, and local guide certification programs. These efforts not only enhance the tourist experience but also create new revenue streams and employment opportunities for rural and indigenous communities.

Global Adventure Tourism Market: Restraints

Safety Concerns and Risk Perception

Adventure tourism inherently involves physical risk, which can deter potential tourists and limit market participation. Incidents such as accidents, natural hazards, or insufficient safety standards can damage the reputation of destinations and operators. Inconsistencies in emergency protocols and a lack of trained personnel in some regions further exacerbate this concern.

Environmental Degradation and Over-Tourism

The popularity of certain adventure destinations has led to environmental strain due to over-tourism, including trail erosion, wildlife disruption, and waste mismanagement. Without effective conservation policies, this can threaten biodiversity and undermine the long-term viability of eco-sensitive regions. Additionally, the carbon footprint from long-distance travel to remote adventure spots remains a significant ecological challenge.

Global Adventure Tourism Market: Opportunities

Expansion into Untapped and Remote Destinations

There is significant growth potential in promoting lesser-known or previously inaccessible regions for adventure tourism. Countries with underdeveloped tourism infrastructure but rich natural or cultural assets can attract explorers seeking unique, crowd-free experiences. This opens new markets for niche operators and helps spread tourism benefits beyond traditional hotspots.

Integration of Sustainable and Ethical Travel Models

The rising consciousness around climate change and ethical travel is creating demand for eco-certified adventures, wildlife-friendly tours, and community-based tourism programs. Operators who align their offerings with environmental and social responsibility stand to gain a competitive edge, particularly among millennials and environmentally aware travelers.

Global Adventure Tourism Market: Trends

Digital Disruption and Smart Adventure Planning

The integration of AI, AR/VR, GPS tracking, and mobile-based travel apps is transforming the way adventure trips are researched, booked, and experienced. Travelers now use digital tools for route planning, safety tracking, and real-time itinerary customization. Operators are leveraging digital content and influencer marketing to engage audiences.

Rise of Solo and Female Adventure Travel

There is a marked increase in solo travelers and women participating in adventure tourism. This shift is driven by greater access to information, supportive travel communities, and demand for self-discovery experiences. Operators are designing women-only expeditions, solo-friendly packages, and safety-conscious itineraries to cater to this trend.

Global Adventure Tourism Market: Research Scope and Analysis

By Type of Adventure Analysis

Soft Adventure is set to dominate the global adventure tourism market, commanding an estimated 70.0% market share in 2025. This dominance is driven by the segment’s broad appeal across age groups, skill levels, and physical fitness capacities. Soft adventure encompasses low-risk, non-extreme activities such as hiking, camping, wildlife safaris, snorkeling, cultural tours, and nature walks. These activities require minimal specialized training or equipment, making them accessible to families, solo travelers, senior tourists, and first-time adventurers alike.

Furthermore, the growing interest in eco-tourism, wellness tourism, and sustainable travel experiences contributes to the rising popularity of soft adventure trips. Tour operators and travel platforms have responded by offering curated, immersive, and culturally enriching packages that blend adventure with comfort, safety, and responsible travel practices. The inclusion of local storytelling, food trails, and community engagement has also enhanced the value proposition of soft adventure tourism.

On the other hand, Hard Adventure represents a more niche yet highly impactful segment of the market, catering to thrill-seekers and seasoned travelers who actively pursue physically demanding, high-risk activities. This segment includes pursuits such as mountaineering, rock climbing, scuba diving, paragliding, white-water rafting, and extreme trekking expeditions. Participation in hard adventure travel typically requires a higher level of technical skills, physical endurance, and safety training, often attracting younger demographics or experienced adventurers.

While the overall share of hard adventure is smaller compared to soft adventure, it commands premium pricing due to its intensity, specialized gear, expert guidance, and exclusive destination access. Growth in this segment is supported by the rise in adventure sports tourism, specialized expedition operators, and interest from niche travel communities seeking extreme, remote, and adrenaline-driven experiences. As safety standards improve and more travelers seek personal milestones or transformational travel, the hard adventure segment is expected to see steady, value-driven growth.

By Activity Type Analysis

Trekking and Hiking are projected to lead the global adventure tourism market in the activity type segment, accounting for approximately 20.0% of total market share in 2025. This segment’s dominance is attributed to its universal accessibility, health and wellness appeal, and the wide availability of scenic trails across regions such as the Himalayas, Andes, Alps, Rockies, and even lesser-known local paths. Trekking and hiking offer travelers the chance to disconnect from urban life, immerse themselves in nature, and engage in moderate physical exercise, making it popular among both soft and hard adventure tourists.

The activity also supports flexible formats, ranging from day hikes to multi-day treks, and can be customized based on difficulty level, age, and traveler experience. The rise of wellness tourism, demand for nature-based experiences, and a growing interest in eco-conscious, low-impact travel have made trekking and hiking one of the most sought-after activities in adventure packages. Operators are integrating cultural elements, guided nature walks, and sustainability themes to add value and differentiate their offerings.

Wildlife Safaris and Nature Tours, while slightly more niche in volume, represent a significant and steadily growing segment within adventure tourism. These experiences appeal to travelers seeking authentic, educational, and immersive encounters with biodiversity, conservation efforts, and untouched landscapes. Popular destinations include African savannahs for big game safaris, Amazon rainforests for biodiversity tours, and Arctic regions for polar wildlife viewing. Nature tours also include bird watching, marine life excursions, forest bathing, and volcano exploration, often conducted with local naturalists or conservation experts.

This activity type is particularly attractive to families, seniors, and responsible travelers due to its low-risk, high-reward nature and alignment with environmental stewardship. Additionally, growing awareness around climate change and conservation is motivating travelers to choose experiences that contribute to ecological protection and local community empowerment. Many tour providers in this segment focus on sustainable tourism practices, eco-lodges, and partnerships with wildlife reserves, ensuring minimal environmental impact and maximum educational value.

By Booking Channel Analysis

Online Travel Agencies (OTAs) are expected to dominate the booking channel segment in the global adventure tourism market, capturing 50.0% of total market share in 2025. This dominance is driven by the growing digitalization of travel planning and the convenience OTAs offer through centralized platforms that aggregate diverse tour options, customer reviews, price comparisons, and instant booking capabilities. Adventure travelers, particularly millennials and Gen Z, are using platforms like Viator, GetYourGuide, and Expedia to search for and reserve experiences such as hiking expeditions, scuba diving trips, and cultural adventure tours.

These platforms are optimized for mobile use, feature dynamic pricing, and offer flexibility with cancellations or modifications, all of which enhance user confidence. OTAs are also integrating AI-driven recommendation engines, multi-language support, and social proof elements, helping travelers make informed decisions based on real-time data. The ease of access, transparent pricing, and bundled deals, often including transportation and accommodations, make OTAs the preferred channel for planning adventure travel globally.

Direct Booking, while capturing a smaller portion of the market, remains a critical channel within the adventure tourism ecosystem. This method involves travelers booking experiences directly through the service provider's website, mobile app, or communication channels such as email or phone. Direct bookings are particularly common among seasoned travelers and repeat customers who seek personalized service, deeper engagement with local operators, or customized itineraries not always available on OTAs.

Many boutique adventure tour operators and local guides offer exclusive discounts, added perks, or bespoke trip designs for those who book directly, fostering long-term customer loyalty. Additionally, as awareness around supporting local businesses and sustainable tourism grows, travelers are bypassing intermediaries to ensure a larger share of the revenue stays with local operators and communities. Direct bookings also allow providers more control over branding, communication, and pre-trip orientation, which is particularly valuable in complex or high-risk adventure activities.

By Travel Type Analysis

Group/Packaged Travel is expected to retain its dominant position in the global adventure tourism market, accounting for approximately 42.0% of the total market share in 2025. This segment includes pre-arranged adventure itineraries typically covering transportation, accommodation, meals, guides, and activities, all bundled into a single purchase. It appeals strongly to travelers seeking convenience, cost-efficiency, safety, and a structured experience, particularly in remote or less-developed destinations where logistics can be complex.

Group tours are popular among first-time adventure travelers, families, students, and corporate teams looking for shared experiences like trekking, cultural immersion tours, or eco-adventure safaris. Tour operators like G Adventures, Intrepid Travel, and Exodus Travels have perfected this format by offering themed trips, ranging from nature expeditions to culinary and conservation-focused tours, often with small group sizes to balance personalization with group dynamics. Additionally, group travel reduces per-person costs and carbon footprint, aligning with the rising demand for affordable and sustainable adventure tourism.

Solo Adventure Packages, while catering to a more niche audience, are gaining rapid traction in the adventure travel landscape. This segment targets independent travelers, especially millennials, Gen Z, and solo female travelers, who seek flexible, self-guided or lightly guided experiences with opportunities for self-discovery, spontaneity, and deeper cultural connection. These packages typically offer customized itineraries that include curated adventure activities, local experiences, and minimal logistical support, allowing travelers to explore at their own pace.

The surge in digital nomadism, mental wellness tourism, and social media-driven travel inspiration has contributed significantly to the growth of solo adventure travel. Operators have responded by designing solo-friendly tours, offering shared accommodations to keep costs low, ensuring enhanced safety measures, and fostering community through optional group meetups. With solo travel empowering individuals to challenge themselves and engage more intimately with nature and local cultures, this segment is expected to grow steadily and redefine how independence and adventure intersect.

By Pricing Tier Analysis

Mid-Range Adventure Packages priced between USD 500 and USD 1,000 per package are projected to dominate the global adventure tourism market in the pricing tier segment, accounting for approximately 40.0% of the total market share in 2025. This segment strikes a balance between affordability and quality, attracting a broad consumer base that includes millennials, dual-income households, solo travelers, and small groups looking for meaningful yet cost-effective experiences. These packages typically offer a well-rounded adventure experience that includes guided activities such as trekking, diving, wildlife safaris, or cultural tours, along with decent accommodation, some meals, local transportation, and safety support.

The growing popularity of long weekend trips, digital detox retreats, and experiential tourism has made this pricing tier highly appealing. Many mid-range tours are designed to offer value-for-money itineraries, blending local authenticity with professional service, often through small-group formats that enhance both personalization and sustainability. Online Travel Agencies (OTAs) and DMCs bundle such packages with flight options and flexible booking terms, further driving demand.

Budget Adventure Packages, priced under USD 500, represent an important and fast-growing segment within the adventure tourism market. This tier primarily appeals to students, backpackers, solo travelers on a shoestring, and young professionals who prioritize experience over luxury. Budget packages often include low-cost accommodations such as hostels, camping, or guesthouses, and may focus on more accessible adventure activities like short hikes, urban exploration, nature walks, beach camping, or local cultural experiences. With the proliferation of affordable travel tools, mobile apps, and peer-to-peer platforms, budget-conscious travelers can now design personalized itineraries while keeping expenses in check.

Additionally, the rise of community-based tourism, voluntourism, and slow travel has made budget adventure travel not only feasible but meaningful. These offerings often promote responsible tourism, encourage interaction with local communities, and have a smaller environmental footprint. Budget packages are also gaining traction in emerging economies and secondary cities where adventure tourism is being developed with a focus on affordability and inclusivity.

The Adventure Tourism Market Report is segmented on the basis of the following:

By Type of Adventure

- Soft Adventure

- Hard Adventure

By Activity Type

- Trekking & Hiking

- Wildlife Safaris & Nature Tours

- Scuba Diving & Snorkeling

- Cycling & Biking Tours

- Paragliding, Skydiving & Aerial Sports

- Rafting & Kayaking

- Camping & Outdoor Survival

- Climbing & Mountaineering

- Winter Sports

- Others

By Booking Channel

- Online Travel Agencies (OTAs)

- Direct Booking

- Offline Tour Operator

- Others

By Travel Type

- Group/Packaged Travel

- Solo Adventure Packages

- Couple/Partner Travel

- Family Adventure Packages

By Pricing Tier

- Mid-range (USD 500–USD 1,000 per package)

- Budget (<USD 500)

- Premium (USD 1,000–USD 2,000)

- Luxury (>USD 2,000)

Global Adventure Tourism Market: Regional Analysis

Region with the Largest Revenue Share

Europe is projected to lead the global adventure tourism market in 2025, accounting for approximately 35.0% of total global market revenue. This regional dominance is driven by Europe's diverse geography, rich cultural heritage, and well-developed tourism infrastructure, which together support a wide array of adventure experiences, from alpine trekking in Switzerland and paragliding in Austria to coastal kayaking in Croatia and hiking in the Scottish Highlands. The region benefits from high interconnectivity, eco-conscious travelers, and strong governmental support for sustainable tourism initiatives.

Additionally, Europe's growing interest in soft adventure activities, cross-border cycling routes, and multi-day nature-based tours further enhances its appeal among domestic and international tourists. The availability of affordable transport, multilingual tour operators, and deep integration of digital booking platforms continues to position Europe as a global hub for both traditional and experiential adventure tourism.

Region with significant growth

The Asia Pacific region is expected to witness the highest CAGR in the global adventure tourism market during the forecast period, driven by a surge in domestic and international travel, an expanding middle-class population, and a growing appetite for experiential and nature-based tourism. Countries like India, China, Thailand, Indonesia, Vietnam, and Nepal are becoming hotspots for both soft and hard adventure activities, such as trekking in the Himalayas, scuba diving in Southeast Asia, and jungle safaris across the region.

Rapid improvements in infrastructure, digital travel platforms, and government-backed ecotourism initiatives are also fueling growth. Additionally, the rising influence of social media, adventure vlogging, and affordable travel options has made adventure experiences more accessible and aspirational for younger demographics, solidifying Asia Pacific’s position as the fastest-growing region in this market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Adventure Tourism Market: Competitive Landscape

The global competitive landscape of the adventure tourism market is characterized by a mix of established tour operators, niche travel agencies, and emerging digital platforms, all vying to capture a share of a rapidly expanding and experience-driven industry. Key players such as G Adventures, Intrepid Travel, and REI Adventures lead the market with diverse, sustainable, and culturally immersive offerings, while luxury operators like Abercrombie & Kent and Butterfield & Robinson focus on high-end, personalized experiences.

The market is highly fragmented, with regional operators and local guides playing a crucial role in destination-specific packages, often emphasizing eco-tourism, community-based travel, and low-impact adventures. Online Travel Agencies (OTAs) like GetYourGuide and Viator are reshaping distribution dynamics by offering instant booking, real-time reviews, and customizable packages. Additionally, the rise of direct-to-consumer booking channels, along with growing competition from specialized platforms targeting solo travelers, women explorers, and wellness seekers, is intensifying the push for innovation, quality service, and sustainability across the global adventure tourism value chain.

Some of the prominent players in the global adventure tourism market are:

- G Adventures

- Intrepid Travel

- REI Adventures

- Abercrombie & Kent

- Exodus Travels

- Austin Adventures

- Butterfield & Robinson

- Adventure Life

- World Expeditions

- Explore Worldwide

- National Geographic Expeditions

- Wild Frontiers Adventure Travel

- The Adventure Company

- Trek Travel

- Backroads

- Mountain Travel Sobek

- Travel Wild Expeditions

- KE Adventure Travel

- Responsible Travel

- Quark Expeditions

- Other Key Players

Global Adventure Tourism Market: Recent Developments

Product Launches

- May 2025: The Odisha government inaugurated the Dharoi Adventure Fest, a 45-day event at Dharoi Dam in Mehsana district, Gujarat. The festival features various outdoor recreational activities such as parasailing, rock climbing, trekking, mountain biking, and camping. This initiative aims to develop Dharoi Dam and the nearby regions into a sustainable tourism and pilgrimage hub.

- April 2025: Iconic Walks, co-founded by Peter Mooney and Rob Sherrard, announced plans for a unique walking experience on the Tasman Peninsula in Tasmania. This new offering aims to provide experiential travel in small, private groups, integrated with local cultures, and is part of their expansion in Tasmania.

Mergers & Acquisitions

- April 2024: Lindblad Expeditions Holdings, Inc. acquired Wineland-Thomson Adventures, Inc., including Tanzania safari specialist Thomson Safaris and the historic Gibb's Farm lodge. This acquisition expands Lindblad's portfolio in responsible nature-based adventure travel.

- August 2024: Active Adventures expanded its U.S. presence by acquiring Discovery Bicycle Tours, a Vermont-based company specializing in guided cycling tours. This move enhances Active Adventures' offerings in the North American market.

Funding Activities

- February 2025: Klook, a platform offering localized travel experiences, secured a $100 million investment to enhance its services, including last-minute bookings and free cancellations, catering to the growing demand in adventure tourism.

- September 2024: Italian traveltech startup Mapo Tapo raised €1.15 million in seed funding. The platform allows outdoor sports enthusiasts to book trips with certified guides and find adventure companions, aiming to expand its user base and technological capabilities.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 495.2 Bn |

| Forecast Value (2034) |

USD 1,849.7 Bn |

| CAGR (2025–2034) |

15.8% |

| The US Market Size (2025) |

USD 104.1 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type of Adventure (Soft Adventure, Hard Adventure), By Activity Type (Trekking & Hiking, Wildlife Safaris & Nature Tours, Scuba Diving & Snorkeling, Cycling & Biking Tours, Paragliding, Skydiving & Aerial Sports, Rafting & Kayaking, Camping & Outdoor Survival, Climbing & Mountaineering, Winter Sports, Others), By Booking Channel (Online Travel Agencies, Direct Booking, Offline Tour Operator, Others), By Travel Type (Group/Packaged Travel, Solo Adventure Packages, Couple/Partner Travel, Family Adventure Packages), and By Pricing Tier (Budget, Mid-range, Premium, Luxury) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

G Adventures, Intrepid Travel, REI Adventures, Abercrombie & Kent, Exodus Travels, Austin Adventures, Butterfield & Robinson, Adventure Life, World Expeditions, Explore Worldwide, National Geographic Expeditions, Wild Frontiers Adventure Travel, The Adventure Company, Trek Travel, Backroads, Mountain Travel Sobe, and other key players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global adventure tourism market size is estimated to have a value of USD 495.2 billion in 2025 and is expected to reach USD 1,849.7 billion by the end of 2034.

Europe is expected to have the largest market share in the global adventure tourism market, with a share of about 35.0% in 2025.

Some of the major key players in the global adventure tourism market are G Adventures, Intrepid Travel, REI Adventures, Abercrombie & Kent, Exodus Travels, Austin Adventures, Butterfield & Robinson, Adventure Life, World Expeditions, Explore Worldwide, National Geographic Expeditions, Wild Frontiers Adventure Travel, The Adventure Company, Trek Travel, Backroads, Mountain Travel Sobe, and other key players.

The market is growing at a CAGR of 15.8 percent over the forecasted period.

The US adventure tourism market is projected to be valued at USD 104.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 361.3 billion in 2034 at a CAGR of 14.8%.