Market Overview

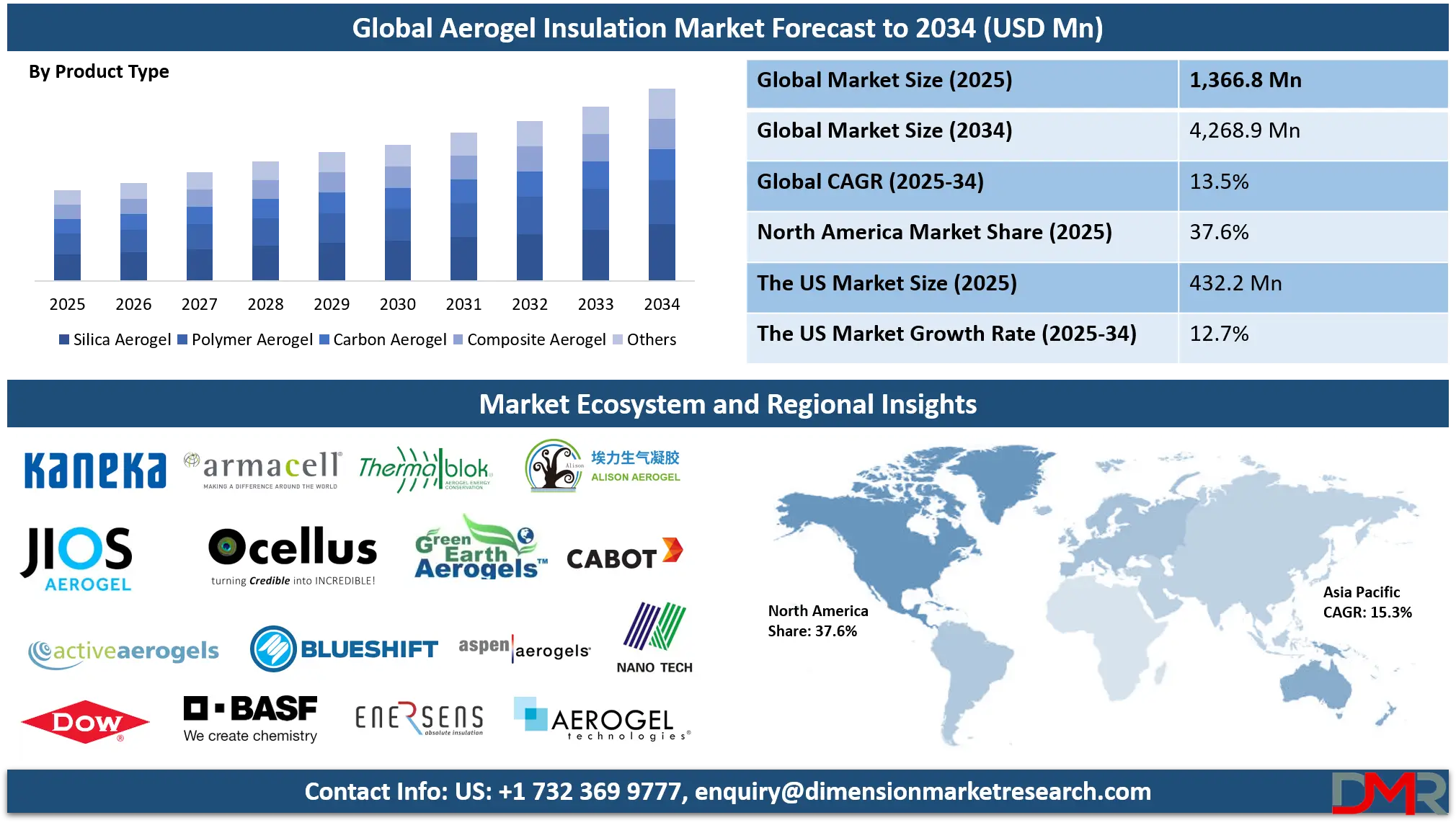

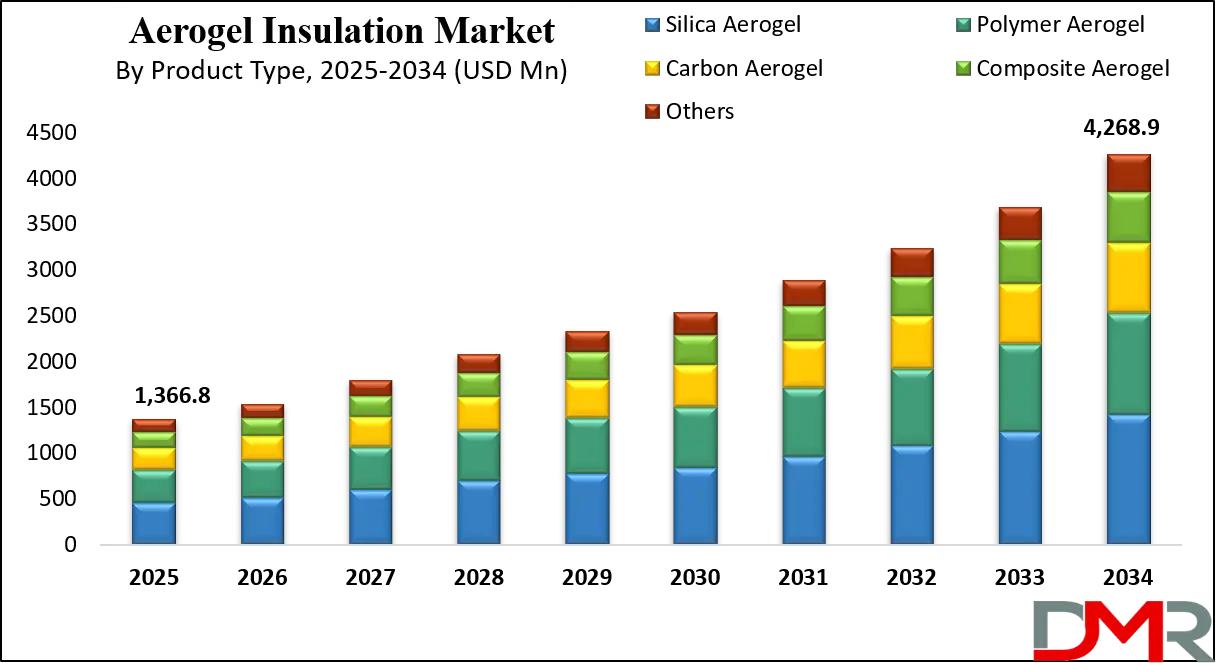

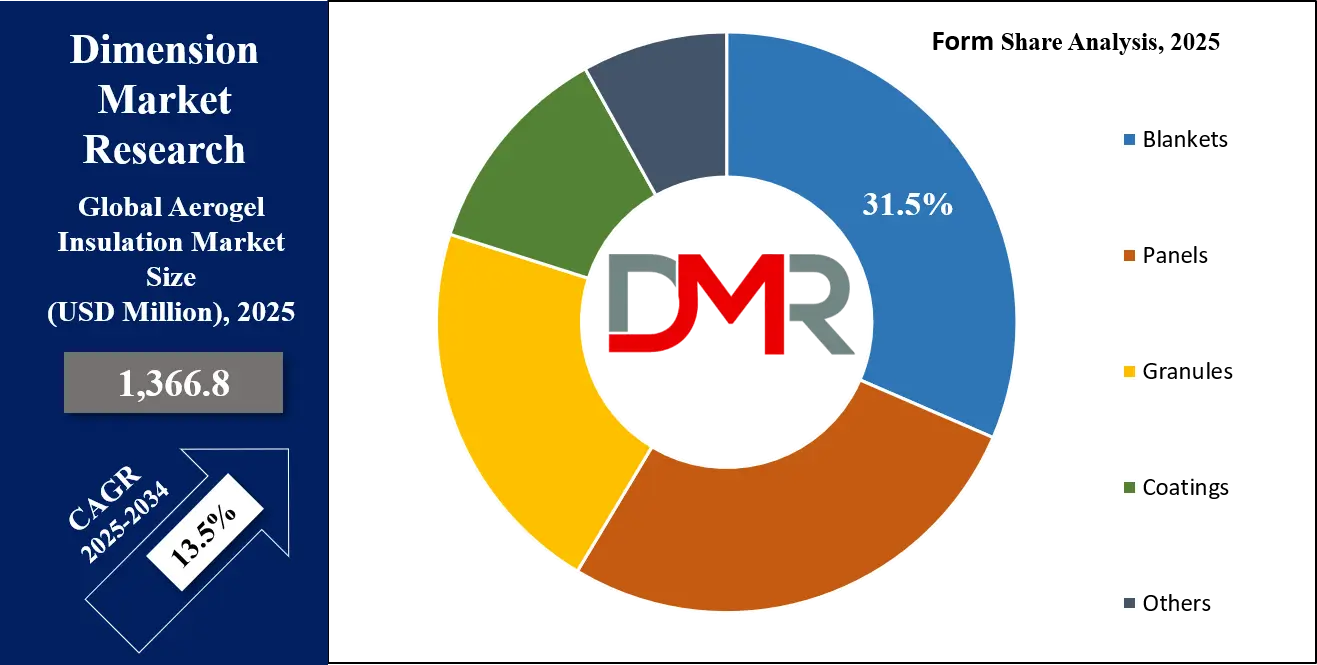

The Global Aerogel Insulation Market is anticipated to reach USD 1,366.8 million by 2025 and is projected to expand at a robust CAGR of 13.5% from 2025 to 2034, attaining a market value of USD 4,268.9 million by 2034. This strong growth trajectory is driven by the increasing adoption of lightweight, high-performance insulation materials across industries such as oil & gas, construction, automotive, aerospace, and electronics. Aerogels are widely valued for their low thermal conductivity, superior energy efficiency, environmental sustainability, and durability compared to conventional insulation materials.

Rising demand for green building solutions, stringent energy-efficiency regulations, and advancements in nanotechnology-based aerogel production are further fueling market expansion. Moreover, the market is witnessing heightened investments in flexible blanket aerogels, particle-based aerogels, and polymer composites, catering to applications that require thermal, acoustic, and fire-resistant insulation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global acrylic resin market is experiencing steady growth, driven by increasing demand in the construction, automotive, packaging, electronics, and paints & coatings sectors. Acrylic resins are valued for their durability, weather resistance, adhesion, and chemical stability, making them indispensable across industrial and consumer applications. A key trend is the transition toward waterborne and eco-friendly acrylic formulations, driven by environmental regulations on VOC emissions and customer preference for sustainable coatings. The push for energy-efficient housing and infrastructure projects globally is also fueling demand, particularly in architectural coatings, sealants, and adhesives.

Opportunities are emerging in lightweight automotive manufacturing, where acrylic resins support advanced coatings, plastics, and composites that contribute to fuel efficiency. The growing electronics and consumer appliances sector is also creating a strong pull for high-performance acrylics due to their optical clarity and electrical insulation. Packaging is another vital growth area, with acrylic resin-based solutions enabling food safety, extended shelf life, and better recyclability.

Restraints include fluctuating crude oil and petrochemical prices, which directly affect raw material costs for acrylic production. Environmental concerns over solvent-based acrylics remain, pushing manufacturers to accelerate research into bio-based or recyclable alternatives. The market also faces competitive pressure from substitutes such as polyurethane and epoxy, particularly in high-performance applications.

Statistically, the global acrylic resin industry is projected to rise significantly, with Asia-Pacific driving the largest share due to construction and industrial development. Growth prospects remain strong, with new investments in smart cities, EV production, and sustainable packaging. Collaborative R&D between manufacturers and end-use industries is expected to deliver innovative acrylic solutions that enhance performance and reduce ecological impact, ensuring continued momentum for the market in the coming decade.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

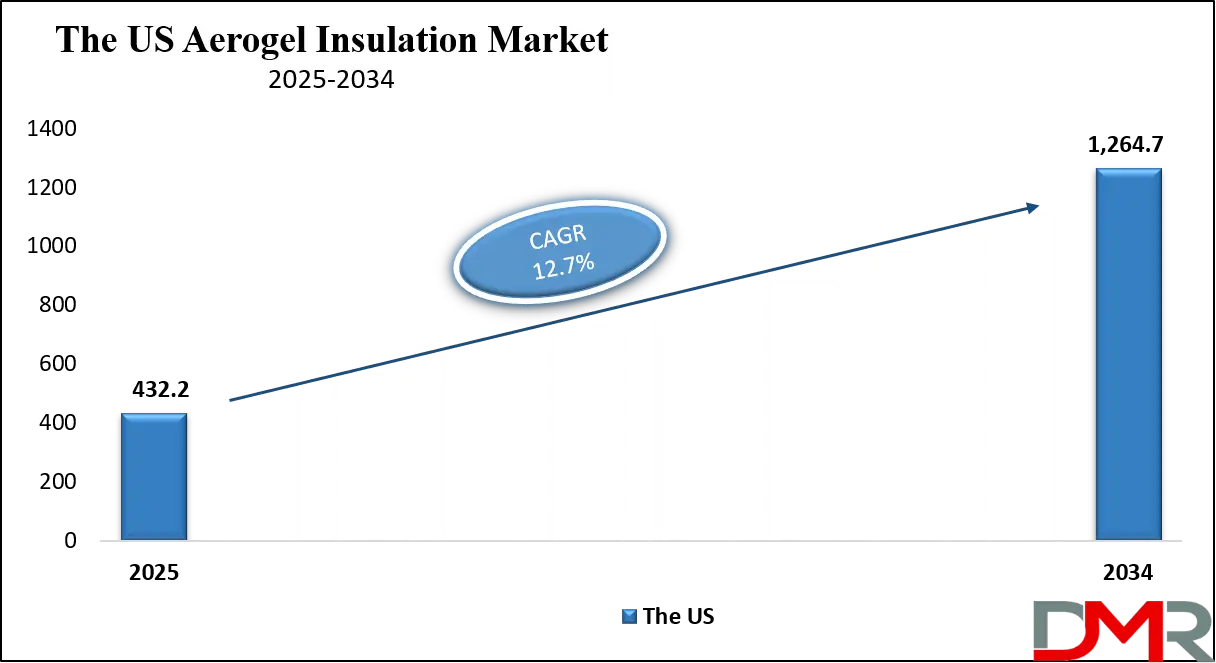

The US Aerogel Insulation Market

The US Aerogel Insulation Market is projected to reach USD 432.2 million in 2025 at a compound annual growth rate of 12.7% over its forecast period.

The U.S. acrylic resin market is shaped by diverse industrial demand across construction, automotive, aerospace, and packaging sectors. According to the U.S. Census Bureau, construction spending exceeded USD 1.9 trillion in 2023, highlighting a robust pipeline for paints, coatings, adhesives, and sealants where acrylic resins are critical. Federal investment in infrastructure modernization under the Bipartisan Infrastructure Law further increases resin demand for durable coatings and repair materials. In addition, the Department of Energy promotes advanced manufacturing technologies and lightweight materials, indirectly boosting the use of acrylic polymers in energy-efficient vehicles and appliances.

The Environmental Protection Agency’s (EPA) strict regulations on VOC emissions have accelerated the adoption of waterborne acrylic coatings, which now dominate the paints and coatings industry. This regulatory framework provides a competitive advantage for sustainable acrylic resins, encouraging innovation in green chemistry. U.S. automotive manufacturing, supported by the Bureau of Economic Analysis data showing over 14 million vehicles produced in 2023, creates steady demand for acrylic resin-based plastics, coatings, and adhesives.

A demographic advantage comes from urbanization and rising housing needs. U.S. Census projections indicate household formations continue to grow steadily, ensuring long-term demand for construction materials with acrylic-based finishes. The packaging industry is another driver, with the U.S. Department of Agriculture emphasizing safe and sustainable packaging innovations, where acrylic resins play a role in coatings and barriers. Collectively, the strong industrial base, sustainability push, and regulatory framework position the U.S. market as a key hub for advanced acrylic resin applications.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Aerogel Insulation Market

The Europe Aerogel Insulation Market is estimated to be valued at USD 205.0 million in 2025 and is further anticipated to reach USD 483.4 million by 2034 at a CAGR of 10.0%.

Europe’s acrylic resin market benefits from strict sustainability policies and advanced industrial demand. The European Commission’s Green Deal and Circular Economy Action Plan strongly support bio-based and recyclable resin innovations. This regulatory alignment is steering manufacturers toward eco-friendly acrylic formulations, particularly waterborne systems, that comply with VOC reduction mandates across the European Union. The construction sector remains vital, with Eurostat reporting building construction output growth in multiple EU states, sustaining demand for acrylic-based coatings and sealants in architectural and infrastructure projects.

Germany, France, and Italy contribute significantly to automotive and industrial applications. Data from the European Automobile Manufacturers’ Association shows that over 10 million cars were produced in the EU in 2023, requiring high-performance coatings, adhesives, and lightweight composites made with acrylic resins. The electronics and renewable energy sectors are also expanding, with acrylic polymers supporting insulation, protective films, and photovoltaic panel applications.

The demographic advantage lies in Europe’s aging building stock. The European Commission emphasizes energy-efficient renovation programs to reduce carbon footprints, fostering demand for durable, low-maintenance acrylic coatings. Packaging is another growth area, with the European Environment Agency encouraging materials that reduce waste and enhance recyclability, which acrylic-based coatings support effectively.

Resin innovation is further supported by strong R&D networks across Europe, backed by Horizon Europe funding programs. This integration of policy, industrial output, and sustainability goals ensures that Europe will remain a critical market for acrylic resins, with steady growth focused on high-performance and environmentally responsible solutions.

The Japan Aerogel Insulation Market

The Japan Aerogel Insulation Market is projected to be valued at USD 82.0 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 209.7 million in 2034 at a CAGR of 11.0%.

Japan’s acrylic resin market is underpinned by strong industrial diversification across construction, automotive, electronics, and consumer goods. The Ministry of Land, Infrastructure, Transport, and Tourism highlights continuous investment in resilient infrastructure projects, supporting steady demand for acrylic-based adhesives, paints, and coatings. Japan’s strong housing renovation market also drives acrylic resin usage in architectural coatings due to their weather resistance and durability.

The automotive sector is another pillar. According to the Japan Automobile Manufacturers Association, over 7.8 million vehicles were produced in Japan in 2023. Acrylic resins find extensive use in lightweight plastic parts, protective coatings, and adhesives that support efficiency in hybrid and electric vehicles. This aligns with Japan’s Green Growth Strategy, which promotes carbon neutrality by 2050, pushing manufacturers toward advanced resin systems that reduce environmental impacts.

Electronics and display technologies also play a crucial role. The Ministry of Economy, Trade, and Industry emphasizes innovation in consumer electronics and semiconductors, where acrylic resins are used in protective films, encapsulation, and optical components due to their clarity and insulation properties. Packaging demand remains steady, with the Food Sanitation Act requiring high-performance, safe materials, giving acrylic-based solutions a consistent role in protective coatings and containers.

A demographic driver is Japan’s aging population, fueling healthcare and medical device markets. Acrylic resins are increasingly used in medical adhesives, dental materials, and equipment coatings. Combined with Japan’s advanced R&D ecosystem, government policies, and industrial strengths, the market is positioned for innovation-led growth in sustainable, high-value acrylic resin applications.

Global Aerogel Insulation Market: Key Takeaways

- Global Market Size Insights: The Global Aerogel Insulation Market size is estimated to have a value of USD 1,366.8 million in 2025 and is expected to reach USD 4,268.9 million by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 13.5 % over the forecasted period of 2025.

- The US Market Size Insights: The US Aerogel Insulation Market is projected to be valued at USD 432.2 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,264.7 million in 2034 at a CAGR of 12.7%.

- Regional Insights: North America is expected to have the largest market share in the Global Aerogel Insulation Market with a share of about 37.6% in 2025.

- Key Players: Some of the major key players in the Global Aerogel Insulation Market are Aspen Aerogels Inc., Cabot Corporation, Armacell International S.A., Aerogel Technologies LLC, Nano Tech Co. Ltd., Svenska Aerogel AB, Enersens SAS, and many others.

Global Aerogel Insulation Market: Use Cases

- Architectural Coatings: Acrylic resins are applied in exterior paints and protective coatings to enhance weather resistance, durability, and color retention, enabling cost-effective maintenance of residential, commercial, and infrastructure buildings worldwide.

- Automotive Applications: Lightweight acrylic polymers replace metals in vehicle components, while resin-based coatings and adhesives ensure corrosion resistance and fuel efficiency in conventional, hybrid, and electric vehicles.

- Electronics Manufacturing: Acrylic resins provide insulation, optical clarity, and protective films for displays, semiconductors, and consumer electronics, supporting miniaturization and durability in advanced electronic devices.

- Packaging Solutions: Acrylic resin-based coatings extend food shelf life, enhance moisture resistance, and enable recyclable packaging, meeting global demand for safe and sustainable food-grade materials.

- Healthcare Materials: Medical adhesives, dental prosthetics, and coatings for medical equipment utilize acrylic resins due to their biocompatibility, clarity, and sterilization resistance, making them vital in modern healthcare systems.

Global Aerogel Insulation Market: Stats & Facts

U.S. Census Bureau

- The total value of construction put in place in the U.S. in 2023 was USD 1,978.7 billion.

- Private construction value in 2023 was USD 1,541.0 billion.

- Residential construction put in place in 2023 was USD 864.9 billion.

- Public construction spending in 2023 totaled USD 437.7 billion.

- In November 2023, monthly construction spending at a seasonally adjusted annual rate exceeded USD 2 trillion.

Eurostat (European Commission statistics)

- Construction production (volume) across the EU rose by more than 10% over 2021–2023.

- In December 2023, production in construction was +1.9% in the euro area year-on-year and +2.4% in the EU versus December 2022.

- Several EU countries (Italy, Greece) reported double-digit construction output growth 2021–2023 (Italy >60%, Greece ~50%).

United Nations / World Bank

- Over half the world’s population now lives in urban areas (>4 billion people).

- The UN projects ~68% of the world population will live in urban areas by 2050.

- World Bank data: global urban population share ~57–58% (2023–2024 range).

International Energy Agency (IEA)

- Rapid growth in the global electric car stock is increasing demand for thermal management materials.

- Battery-electric vehicle shares and stock are rising sharply year-on-year, supporting high-performance automotive resin demand.

Japan Automobile Manufacturers Association (JAMA)

- Motor vehicle production in Japan in 2023 was 8.99 million units.

- Passenger car production in Japan in 2023 was ~7.77 million units.

ACEA (European Automobile Manufacturers’ Association)

- EU passenger car production in 2023 was ~12.2 million cars.

- Approximately 93.9 million motor vehicles are produced globally per year.

U.S. Environmental Protection Agency (EPA)

- EPA’s architectural-coatings VOC rule is estimated to reduce VOC emissions by about 103,000 megagrams/year.

- Regulatory push on VOCs has driven adoption of waterborne coatings, a major shift for acrylic resin formulations.

U.S. Bureau of Labor Statistics / FRED

- Employment indices for chemical manufacturing (NAICS 325) in 2023–2024 are around 109 (2017=100).

- FRED series for All Employees, Chemical Manufacturing provides monthly workforce data supporting acrylic resin production.

- BLS occupational reports highlight tens of thousands of specialized chemical-industry jobs in chemical engineering and plant operations.

UNIDO / OECD

- UNIDO manufacturing production indices show resilient chemical and manufacturing production across major economies.

- OECD TiVA datasets show manufacture of chemicals and pharmaceuticals is a significant contributor to manufacturing value chains in OECD economies.

World Health Organization / Healthcare

- Increased medical device production and renovation demands support the use of acrylics in medical adhesives, dental materials, and equipment coatings.

USDA / Food & Agriculture

- USDA and food-safety authorities emphasize packaging safety and shelf-life improvements, supporting acrylic-based coatings in food-grade applications.

Global Aerogel Insulation Market: Market Dynamic

Driving Factors in the Global Aerogel Insulation Market

Expansion in Construction and Infrastructure

The construction and infrastructure sectors are primary drivers of acrylic resin demand. Residential, commercial, and industrial building projects worldwide utilize acrylic resins extensively in paints, coatings, sealants, adhesives, and protective finishes due to their durability, weather resistance, and aesthetic versatility. In North America and Europe, government investments in infrastructure modernization, retrofitting, and smart city initiatives have increased the use of advanced coating systems that incorporate acrylic resins.

The U.S. Census Bureau reported construction spending of nearly USD 1.98 trillion in 2023, highlighting the massive potential for acrylic-based products. Additionally, urbanization and population growth in the Asia-Pacific have led to heightened residential and commercial construction, stimulating demand for sustainable and high-performance coatings. These developments create a stable consumption base for acrylic resins.

Furthermore, emerging trends in green building and energy-efficient construction drive the adoption of waterborne and low-VOC acrylic resins. Collectively, the scale and growth of construction projects directly fuel the adoption of acrylic resins globally, ensuring long-term market growth.

Automotive and Transportation Sector Growth

The automotive industry is another significant growth driver for acrylic resins. With rising vehicle production and the shift toward lightweight and electric vehicles, manufacturers increasingly rely on acrylic resins for coatings, adhesives, and polymer-based components. According to ACEA and JAMA, EU and Japan vehicle production exceeded 12 million and 8.9 million units in 2023, respectively, reflecting sustained market demand.

Acrylic resins are preferred due to their resistance to UV, chemicals, and corrosion, and for providing aesthetic finishes. In electric vehicles, acrylic-based thermal management solutions for battery enclosures and insulation materials are becoming critical, offering both performance and durability. Additionally, automotive interior applications, including dashboards, panels, and trims, increasingly incorporate acrylic polymers to reduce weight and enhance safety. The growth of global vehicle production, coupled with technological evolution in the EV segment, strongly drives acrylic resin demand, making transportation a key end-use contributor to the market.

Restraints in the Global Aerogel Insulation Market

Volatility in Raw Material Prices

One of the primary restraints in the acrylic resin market is the volatility of raw material prices, particularly those derived from petrochemicals such as acrylic acid and esters. Fluctuating crude oil prices directly impact the production costs of acrylic monomers and resins, affecting margins for manufacturers. Global economic uncertainty, geopolitical tensions, and supply chain disruptions exacerbate cost instability.

Small and medium-scale manufacturers are particularly vulnerable to these price swings, which can lead to temporary production cuts or increased end-product costs. Price volatility also affects downstream applications, such as paints, coatings, adhesives, and packaging, potentially restraining demand if costs are passed on to consumers. Moreover, dependence on limited feedstock sources in certain regions introduces supply risk, as any disruption can significantly affect production continuity. Managing raw material procurement and exploring alternative bio-based monomers remain critical strategies to mitigate this restraint.

Competition from Alternative Polymers

Another restraint is the competitive pressure from substitute polymers, such as polyurethane, epoxy, vinyl, and polyester resins. These alternatives sometimes offer higher chemical resistance, thermal stability, or mechanical strength, making them suitable for specific industrial or specialty applications. For example, epoxy resins are preferred in electronics or high-temperature coatings, while polyurethane is favored in flexible coatings and adhesives.

As a result, acrylic resin manufacturers face challenges in retaining market share in certain high-performance segments. Cost competitiveness is also an issue, as some alternative polymers may provide similar performance at lower price points.

Additionally, evolving material technologies, such as bio-based polymers or nanocomposites, may substitute conventional acrylics in niche applications. This competitive environment necessitates continuous innovation, value-added formulations, and performance differentiation to sustain growth in the face of alternative polymer adoption.

Opportunities in the Global Aerogel Insulation Market

Adoption in Packaging and Food Safety Applications

Acrylic resins offer significant growth opportunities in packaging, particularly food-grade applications. Rising consumer awareness of food safety and sustainability is driving demand for coatings, films, and barrier layers made with acrylic resins that extend shelf life, maintain freshness, and comply with hygiene standards. Government regulations, such as the USDA’s food safety standards and packaging guidelines, are promoting the use of high-performance, non-toxic acrylic coatings in containers, bottles, and flexible packaging. Innovations in acrylic resin chemistry enable superior moisture, oxygen, and UV barrier properties while maintaining transparency and recyclability.

Additionally, the increasing adoption of sustainable and recyclable packaging across Europe, North America, and the Asia-Pacific opens new avenues for acrylic resins. This opportunity is amplified by e-commerce growth, which requires durable, lightweight, and protective packaging. As global demand for sustainable and safe packaging grows, acrylic resin manufacturers can capitalize on these trends to expand product offerings and penetrate high-value packaging markets.

Expansion in Healthcare and Medical Applications

The healthcare and medical industries present a lucrative opportunity for acrylic resins. Acrylic polymers are increasingly used in medical adhesives, dental materials, prosthetics, equipment coatings, and protective films due to their biocompatibility, clarity, and sterilization resistance. The aging global population, particularly in developed regions like Europe, Japan, and North America, is driving higher demand for medical devices and equipment that rely on acrylic-based materials.

Regulatory frameworks, including FDA and EU Medical Device Regulations, favor safe and reliable polymeric materials, further boosting adoption. Innovations in acrylic resin formulations tailored for sterilizable, lightweight, and transparent applications create opportunities for niche product development. Additionally, the pandemic highlighted the importance of medical-grade materials for protective equipment and hospital infrastructure, where acrylic resins can provide durability, chemical resistance, and hygiene compliance. This sector offers a consistent growth pathway due to continuous advancements in medical technology and global healthcare expansion.

Trends in the Global Aerogel Insulation Market

Shift Toward Eco-Friendly and Waterborne Acrylics

One of the most notable trends in the acrylic resin market is the shift from solvent-based formulations to eco-friendly, waterborne acrylic resins. Regulatory pressures, particularly stringent VOC emission limits in regions like North America and Europe, are driving manufacturers to develop low-VOC or zero-VOC alternatives. Waterborne acrylic resins offer superior adhesion, weather resistance, and color retention while minimizing environmental impact.

Additionally, end-users increasingly demand sustainable solutions across architectural coatings, automotive finishes, and packaging applications. This trend is supported by technological advances in polymerization techniques that improve performance characteristics, such as faster drying times, enhanced durability, and improved mechanical strength.

Adoption of these waterborne resins is expanding rapidly, especially in retrofitting projects, industrial coatings, and residential construction, where green building standards are increasingly enforced. The trend also fosters innovation in hybrid acrylic formulations that blend bio-based polymers with synthetic resins to meet both performance and sustainability goals, creating a paradigm shift in the market toward environmentally responsible materials.

Integration of Acrylic Resins in Advanced Applications

Another major trend is the integration of acrylic resins into high-performance and technologically advanced applications. This includes usage in lightweight automotive parts, electronic devices, photovoltaic panels, and protective coatings in the aerospace industry. Manufacturers are leveraging acrylic resin properties such as optical clarity, chemical stability, thermal resistance, and mechanical strength to enhance product functionality. For instance, in automotive applications, acrylic resins are used in coatings, adhesives, and lightweight components to improve fuel efficiency while providing corrosion resistance.

In electronics, acrylic-based encapsulants and protective films enable miniaturization and improved thermal management. The rise of electric vehicles has further accelerated this trend, as battery enclosures, thermal insulation layers, and interior components increasingly rely on acrylic resins for performance optimization. Across industries, this trend demonstrates a growing preference for multifunctional acrylic materials that combine durability, aesthetic appeal, and environmental compliance, positioning acrylic resins as essential components in next-generation products.

Global Aerogel Insulation Market: Research Scope and Analysis

By Product Type Analysis

Silica Aerogel is projected to dominate the product type segment due to its superior thermal insulation performance, extremely low thermal conductivity, and high porosity, which enable it to achieve better energy efficiency than other aerogel types. Silica aerogels are widely used across building, industrial, and oil & gas applications, especially where space constraints demand thin yet highly effective insulation. Their chemical stability, non-flammability, and lightweight nature make them suitable for harsh environmental conditions, including cryogenic pipelines and industrial furnaces.

While polymer and carbon aerogels offer advantages like flexibility or electrical conductivity, silica aerogels maintain broader industrial applicability. Composite aerogels are emerging but currently occupy a smaller market share due to higher manufacturing costs and limited large-scale production. Manufacturers such as Aspen Aerogels and Cabot Corporation focus heavily on silica-based products for commercial and industrial markets.

In building and construction, silica aerogel blankets and panels are preferred for retrofitting and energy-efficient designs, while in oil & gas, silica aerogels provide insulation for high-temperature pipelines and storage tanks. Their dominance is further reinforced by ongoing R&D efforts aimed at enhancing mechanical strength, hydrophobicity, and processability, making silica aerogel the most commercially viable and widely adopted product type in the global market.

By Form Analysis

Blankets are anticipated to dominate the aerogel insulation form segment due to their unmatched versatility, ease of installation, and adaptability across a wide range of industrial, commercial, and residential applications. Aerogel blankets combine high flexibility with superior thermal insulation, allowing them to conform to irregular surfaces, pipes, ducts, and complex structural geometries, which is particularly valuable in retrofit projects where pre-existing infrastructure limits the use of rigid panels.

Unlike panels or coatings, blankets can be cut, wrapped, or layered without losing insulation efficiency, making them suitable for both large-scale new constructions and targeted renovation initiatives. In the oil & gas sector, blankets are applied extensively to pipelines, storage tanks, and processing units, providing efficient thermal management, reducing heat loss, and lowering operational energy costs. In the building and construction sector, blankets improve wall, roof, and facade insulation while maintaining slim profiles critical for retrofitting historical buildings or urban spaces with limited thickness allowances.

Although panels are increasingly used for modular installations and coatings are applied for specialized surface protection, blankets remain preferred due to their lightweight nature, easy handling, and cost-effectiveness in installation. Granules and other forms have niche applications requiring specialized equipment or custom formulations. Leading manufacturers such as Aspen Aerogels, Cabot Corporation, and Armacell prioritize blankets because they deliver the highest market penetration and return on investment. Continuous R&D efforts focus on enhancing water resistance, fire retardancy, and mechanical durability, ensuring blankets maintain dominance as the most commercially viable form in the global aerogel insulation market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Temperature Range Analysis

Medium temperature insulation (100°C – 500°C) is poised to dominate the aerogel insulation market because it caters to the broadest spectrum of industrial, commercial, and energy-related applications. This range includes HVAC systems, oil & gas pipelines, chemical processing units, automotive exhaust components, and industrial equipment, providing optimal thermal performance while maintaining mechanical stability and resistance to environmental stressors such as vibration, moisture, and thermal cycling.

Low-temperature insulation (<100°C) is mainly used in cryogenic or specialized laboratory applications, which limits its market potential to niche segments. High-temperature insulation (>500°C) is critical for aerospace, power generation, and industrial furnaces but occupies a smaller market due to high production costs, limited end-user adoption, and stricter engineering requirements. Medium-temperature aerogel insulation offers a cost-performance balance, making it attractive to manufacturers and end-users seeking high efficiency without the prohibitive costs of extreme-temperature solutions.

Silica aerogel blankets and panels engineered for medium-temperature environments dominate because they combine energy efficiency, long-term fire resistance, low thermal conductivity, and mechanical durability. Applications in oil & gas, industrial insulation, and building energy efficiency projects further reinforce this dominance. With ongoing adoption in retrofitting, sustainable construction, and industrial energy management, medium-temperature insulation remains the most commercially significant category, benefiting from technological advances in aerogel production, hydrophobic treatments, and modular deployment solutions.

By End Use Dominance Analysis

Building & construction is poised to dominate the aerogel insulation end-use segment due to growing global energy efficiency mandates, urbanization trends, and the increasing need for space-saving insulation solutions. Aerogel insulation enhances thermal performance in walls, roofs, and facades while maintaining minimal thickness, making it ideal for both new construction projects and renovations, especially in urban environments with limited wall or roof space.

Green building initiatives in North America, Europe, and Asia-Pacific encourage the adoption of aerogel insulation, supporting energy savings, sustainable design, and compliance with LEED and BREEAM certifications. While oil & gas remains a major sector for thermal efficiency in pipelines and storage systems, the volume and reach of building applications are significantly higher due to large-scale residential and commercial construction activities worldwide. Aerospace and automotive sectors are experiencing growth, particularly in high-performance applications where weight reduction and heat management are critical, but their cumulative market share is lower than construction.

Industrial insulation uses aerogels for high-temperature and chemical-resistant applications, while the electronics sectors utilize aerogels for thermal management and protective coatings. Manufacturers such as Aspen Aerogels, Cabot Corporation, and Armacell produce blankets, panels, and coatings tailored for building applications, ensuring optimal thermal efficiency, durability, and fire resistance. With increasing urban population, retrofitting demand, and regulatory pressure for energy-efficient buildings, building & construction is set to remain the dominant end-use segment in the global aerogel insulation market.

The Global Aerogel Insulation Market Report is segmented on the basis of the following:

By Product Type

- Silica Aerogel

- Polymer Aerogel

- Carbon Aerogel

- Composite Aerogel

- Others

By Form

- Blankets

- Panels

- Granules

- Coatings

- Others

By Temperature Range

- Low temperature insulation (100°C)

- Medium temperature insulation (100°C – 500°C)

- High temperature insulation (>500°C)

By End Use

- Building & construction

- Oil & gas

- Aerospace

- Automotive

- Industrial insulation

- Electronics

- Others

Impact of Artificial Intelligence in the Global Aerogel Insulation Market

- Optimized Material Formulation: Artificial Intelligence enables the simulation and prediction of aerogel properties, allowing manufacturers to optimize formulations for thermal conductivity, mechanical strength, and hydrophobicity. This reduces trial-and-error R&D, shortens product development cycles, and enhances overall material performance for diverse industrial applications.

- Advanced Manufacturing Automation: AI-driven automation in aerogel production improves precision, reduces human error, and increases yield. Machine learning algorithms monitor process parameters such as temperature, pressure, and drying times in real time, ensuring consistent product quality, lower waste, and cost-effective high-volume production.

- Predictive Maintenance of Equipment: AI-powered predictive maintenance systems analyze operational data from production equipment, detecting early signs of wear or faults. This reduces downtime, prevents production delays, extends machinery lifespan, and lowers operational costs, enabling continuous and efficient aerogel manufacturing at scale.

- Intelligent Supply Chain Management: AI optimizes supply chain operations for aerogel materials, including raw material sourcing, inventory management, and logistics. Predictive algorithms forecast demand trends, reduce lead times, and ensure timely delivery to end-users in construction, industrial, aerospace, and automotive sectors.

- Enhanced Product Design & Application: AI-driven simulations allow engineers to design custom aerogel insulation solutions tailored to specific thermal, mechanical, or spatial requirements. Applications in buildings, pipelines, and aerospace benefit from optimized insulation performance, reduced energy losses, and cost-efficient deployment.

Global Aerogel Insulation Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the aerogel insulation market with 37.6% of the total revenue in 2025, due to a combination of technological leadership, regulatory frameworks, and established industrial infrastructure. The U.S. and Canada have high adoption rates of advanced insulation materials in construction, aerospace, and oil & gas industries. Regulatory mandates focused on energy efficiency, such as the U.S. Department of Energy’s building energy codes, drive the adoption of high-performance insulation solutions, including aerogels.

Additionally, North America has a mature industrial base with significant investments in R&D and manufacturing capabilities from leading players like Aspen Aerogels, Cabot Corporation, and Armacell. These companies continuously innovate in blanket, panel, and coating forms, optimizing thermal performance and fire resistance. The region’s aerospace sector also contributes to market dominance, as aerogel materials are essential for lightweight, thermally efficient components in aircraft and spacecraft. Oil & gas applications, particularly in pipelines, storage tanks, and refineries, benefit from aerogel’s space-saving properties and high-temperature stability.

Further, North America has a high per-capita construction expenditure, coupled with strong retrofitting demand in commercial and residential projects, and expanding aerogel usage in building insulation. Robust supply chains, technological know-how, and government incentives collectively establish North America as the leading regional market in terms of revenue and adoption of aerogel insulation solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

Asia Pacific is expected to register the highest CAGR in the aerogel insulation market due to rapid urbanization, industrialization, and infrastructural expansion. Countries like China, India, Japan, and South Korea are investing heavily in energy-efficient buildings, smart cities, and industrial modernization, creating significant demand for high-performance insulation materials.

The region’s booming construction sector, supported by government initiatives promoting green buildings and energy conservation, drives aerogel adoption in walls, roofs, and facades. The growing oil & gas and petrochemical industries in the Asia Pacific further accelerate the market, as aerogel blankets and panels are increasingly used in pipelines, storage tanks, and processing units to reduce heat loss and improve energy efficiency.

Additionally, expanding automotive and electronics manufacturing hubs in the region utilize aerogels for thermal management, lightweight components, and energy-saving solutions. Rising environmental awareness, coupled with stringent energy-efficiency regulations, compels manufacturers to adopt innovative aerogel solutions. The presence of emerging local players, combined with partnerships, joint ventures, and investments from global aerogel producers, strengthens market penetration.

Furthermore, the affordability of labor and growing technological capabilities enable cost-effective production of aerogel insulation products, supporting rapid growth. With increasing urbanization rates, infrastructure development, and industrial demand, the Asia Pacific’s aerogel insulation market is projected to experience the highest growth rate globally over the forecast period.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Aerogel Insulation Market: Competitive Landscape

The global aerogel insulation market is highly competitive, with several key players dominating through innovation, strategic partnerships, and geographic expansion. Aspen Aerogels, Cabot Corporation, and Armacell are market leaders, focusing on high-performance aerogel blankets, panels, and coatings for building, industrial, oil & gas, and aerospace applications. These companies invest heavily in R&D to develop solutions with enhanced thermal efficiency, fire resistance, and durability.

Lydall, Inc. and BASF SE are also significant players, emphasizing specialty aerogel composites and customized insulation solutions tailored for niche applications. AkzoNobel and Wacker Chemie AG leverage their chemical expertise to produce polymer- and silica-based aerogel materials for diverse industrial uses. Market participants adopt strategies such as mergers, acquisitions, joint ventures, and collaborations to expand their product portfolios and regional reach. For example, partnerships between global aerogel producers and construction or industrial firms accelerate product adoption and large-scale deployment.

Continuous technological advancements, including improvements in hydrophobicity, mechanical strength, and process scalability, are critical for competitive advantage. Additionally, companies focus on sustainability by introducing low-VOC and energy-efficient aerogel products to comply with evolving environmental regulations. Start-ups and emerging manufacturers contribute to innovation by offering cost-effective, high-performance solutions for medium- and high-temperature applications.

Regional expansion in the Asia Pacific, particularly in China, India, and Japan, is a priority for market leaders aiming to capitalize on rapid infrastructure and industrial growth. Overall, competition centers on product innovation, geographic penetration, and meeting industry-specific requirements while maintaining cost efficiency and regulatory compliance.

Some of the prominent players in the Global Aerogel Insulation Market are:

- Aspen Aerogels Inc.

- Cabot Corporation

- Armacell International S.A.

- Aerogel Technologies LLC

- Nano Tech Co. Ltd.

- Svenska Aerogel AB

- Enersens SAS

- BASF SE

- Dow Inc.

- Guangdong Alison Hi-Tech Co. Ltd.

- Blueshift International Materials Inc.

- Active Aerogels

- Thermablok Inc.

- Green Earth Aerogel Technologies (GEAT)

- Ocellus Inc.

- Jios Aerogel Corporation

- Kalwall Corporation

- Acoustiblok Inc.

- Kaneka Corporation

- Insulgel High-Tech

- Other Key Players

Recent Developments in the Global Aerogel Insulation Market

- May 2024:

- Collaboration: Aspen Aerogels, Inc. and TOPsoe, a global leader in carbon emission reduction technologies, announced a strategic collaboration. The focus is on integrating Aspen's PyroThin® aerogel thermal barriers into TOPsoe's solid oxide electrolyzer cells (SOEC) for large-scale hydrogen production. This is a significant move into the clean energy infrastructure market.

- April 2024:

- Investment/Expansion: Cabot Corporation announced a major expansion of its aerogel production capacity at its facility in the U.S. Gulf Coast. This multi-million dollar investment is aimed at meeting the growing demand from the energy infrastructure and battery electric vehicle (EV) markets, specifically for its LUMAT® and ENERGACEL® products.

- March 2024:

- Conference: The 7th International Aerogel Symposium was held, featuring presentations from leading manufacturers like Aspen Aerogels and Cabot Corporation on the latest advancements in aerogel technology for EVs, construction, and apparel.

- Product Launch: Green Earth Aerogel Technologies (GEAT) announced the development of a new flexible, non-fiber-reinforced aerogel blanket targeting the building and construction sector, emphasizing easier installation and superior performance.

- February 2024:

- Investment: Aerogel Technologies (manufacturer of Airgel®) closed a new funding round to scale up production of its proprietary polymer-aerogel composites for applications in life sciences, aerospace, and consumer goods.

- November 2023:

- Expo/Conference: The Advanced Materials Show in Europe featured several aerogel manufacturers showcasing new products for sustainable construction and industrial applications.

- October 2023:

- Investment/Expansion: SVOLT Energy Technology, a Chinese battery maker, announced a strategic investment in aerogel R&D for next-generation battery thermal runaway prevention, highlighting the critical role of aerogel in EV safety.

- September 2023:

- Collaboration: Aspen Aerogels, Inc. entered into a collaboration with a major European automotive OEM to develop custom aerogel solutions for battery pack thermal management in a new line of electric vehicles.

- July 2023:

- Investment: Jios Aerogel (now part of Armacell) secured additional funding to advance its production technology and expand its market reach in Asia-Pacific.

- June 2023:

- Merger/Acquisition: Armacell, a global leader in flexible insulation foams, completed the acquisition of Jios Aerogel, a prominent Chinese aerogel manufacturer. This was one of the most significant M&A activities in the market, allowing Armacell to integrate aerogel technology into its existing product portfolio.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1,366.8 Mn |

| Forecast Value (2034) |

USD 4,268.9 Mn |

| CAGR (2025–2034) |

13.5% |

| The US Market Size (2025) |

USD 432.2 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Silica Aerogel, Polymer Aerogel, Carbon Aerogel, Composite Aerogel, and Others), By Form (Blankets, Panels, Granules, Coatings, and Others), By Temperature Range (Low Temperature Insulation (100°C), Medium Temperature Insulation (100°C–500°C), and High Temperature Insulation (>500°C)), By End Use (Building & Construction, Oil & Gas, Aerospace, Automotive, Industrial Insulation, Electronics, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Aspen Aerogels Inc., Cabot Corporation, Armacell International S.A., Aerogel Technologies LLC, Nano Tech Co. Ltd., Svenska Aerogel AB, Enersens SAS, BASF SE, Dow Inc., Guangdong Alison Hi-Tech Co. Ltd., Blueshift International Materials Inc., Active Aerogels, Thermablok Inc., Green Earth Aerogel Technologies (GEAT), Ocellus Inc., Jios Aerogel Corporation, Kalwall Corporation, Acoustiblok Inc., Kaneka Corporation, Insulgel High-Tech., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Aerogel Insulation Market?

▾ The Global Aerogel Insulation Market size is estimated to have a value of USD 1,366.8 million in 2025 and is expected to reach USD 4,268.9 million by the end of 2034.

What is the growth rate in the Global Aerogel Insulation Market in 2025?

▾ The market is growing at a CAGR of 13.5 percent over the forecasted period of 2025.

What is the size of the US Aerogel Insulation Market?

▾ The US Aerogel Insulation Market is projected to be valued at USD 432.2 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,264.7 million in 2034 at a CAGR of 12.7%.

Which region accounted for the largest Global Aerogel Insulation Market?

▾ North America is expected to have the largest market share in the Global Aerogel Insulation Market with a share of about 37.6% in 2025.

Who are the key players in the Global Aerogel Insulation Market?

▾ Some of the major key players in the Global Aerogel Insulation Market are Aspen Aerogels Inc., Cabot Corporation, Armacell International S.A., Aerogel Technologies LLC, Nano Tech Co. Ltd., Svenska Aerogel AB, Enersens SAS, and many others.