Market Overview

The Global

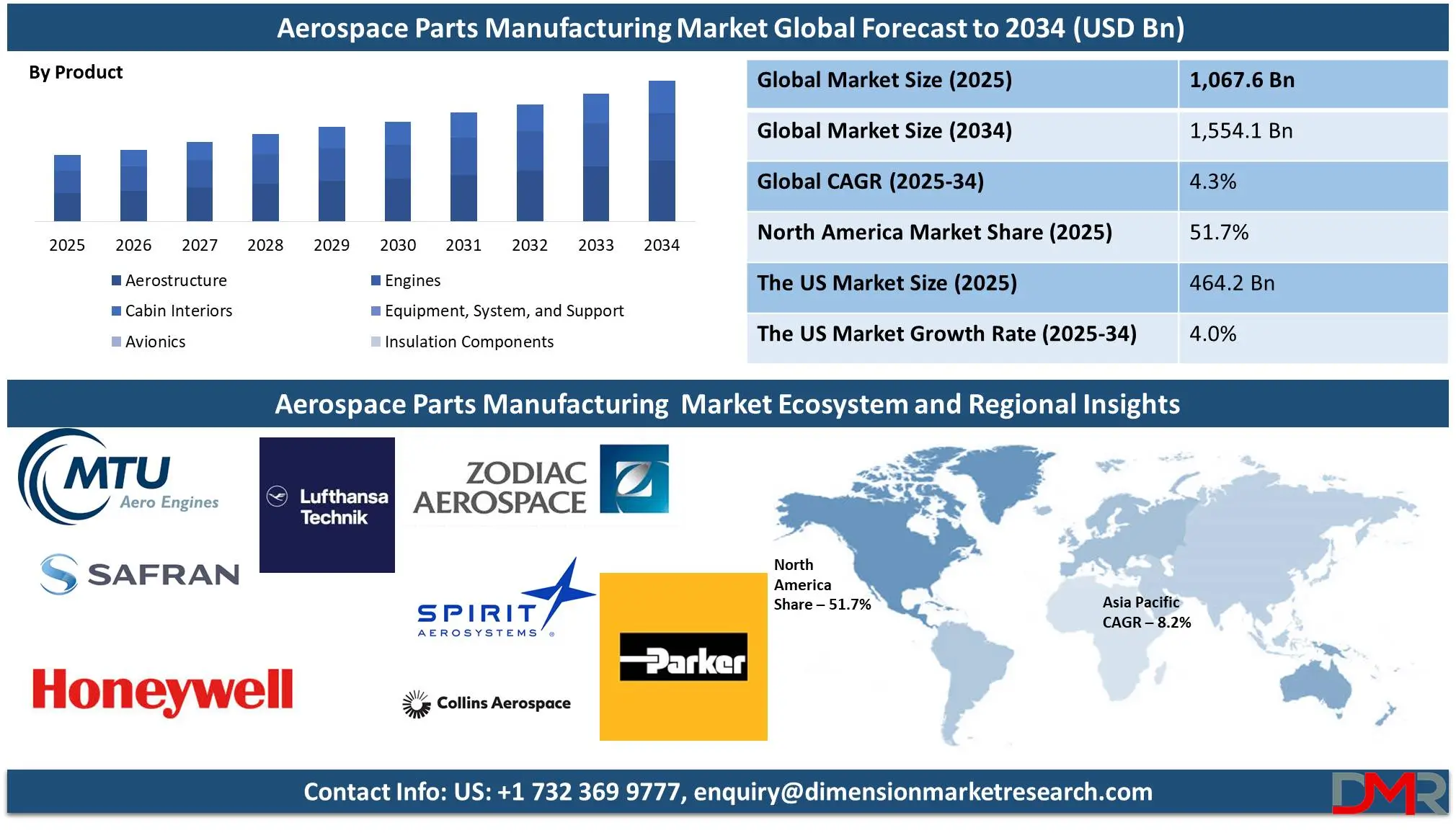

Aerospace Parts Manufacturing Market size is estimated at

USD 1,067.6 billion in 2025 and is expected to

reach USD 1,554.1 billion by 2034, at a

CAGR of 4.3% during the forecast period of 2025 to 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Aerospace parts manufacturing is a critical sector driven by the need for higher quality standards, superior technology, and efficiency. The industry involves producing advanced components for aircraft that require strict quality control and compliance with rigorous regulatory requirements. Manufacturers, often working through provider agreements and internal production facilities, supply parts that meet the evolving demands of airlines for enhanced performance, fuel efficiency, and passenger comfort.

As the global aviation market expands and older aircraft are replaced, demand for new parts grows. Continuous innovation and upgrades in aircraft, along with the need for reliable, cost-effective parts, fuel long-term growth in aerospace manufacturing.

The US Aerospace Parts Manufacturing Market

The US Aerospace Parts Manufacturing market is projected to be valued at USD 464.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 663.0 billion in 2034 at a CAGR of 4.0%.

The U.S. aerospace parts manufacturing market is propelled by robust passenger transportation growth, necessitating increased production of aircraft components. Established players such as Boeing, Lockheed Martin, and United Technologies bolster the market's dominance through advanced manufacturing capabilities and innovative designs.

The global preference for U.S.-sourced aerospace parts, including wings, fasteners, and fuselages, stems from their proven airworthiness, long-standing industry legacy, and superior technological standards. The adoption of Industry 4.0 technologies, including automation, 3D printing, and IoT, is revolutionizing production processes, ensuring precision and scalability. Increased investment in sustainable aviation initiatives, like electric and hybrid propulsion systems, is influencing part design and manufacturing.

Key Takeaways

- Market Growth: The global Aerospace Parts Manufacturing market is anticipated to expand by USD 9.2 billion, achieving a CAGR of 4.3% from 2026 to 2034.

- Product Analysis: Aerostructures are likely to lead the market based on end users with the largest revenue share by 2025.

- End User Analysis: The commercial sector is projected to dominate the global market with the highest revenue share of 51.5% by 2025 in terms of application.

- Regional Analysis: North America is projected to dominate the global Aerospace Parts Manufacturing market, holding a market share of 51.7% by 2025.

Use Cases

- Aircraft Structural Components: Aerospace manufacturers produce various structural parts, such as fuselage sections, wing components, and tail sections. These parts must meet stringent safety, durability, and performance standards to withstand extreme conditions encountered during flight.

- Engine Components: The manufacturing of engine parts, including turbine blades, compressors, and combustion chambers, is critical in ensuring the efficiency, reliability, and safety of aircraft engines.

- Avionics and Electrical Systems: Aerospace parts manufacturing also includes the production of avionics components such as flight control systems, radar, communication systems, and sensors.

- Space Exploration Components: In addition to aviation, aerospace manufacturing extends to space exploration. This includes the production of spacecraft parts, rocket engines, satellite components, and launch vehicle structures.

Stats & Facts

According to Airbus SE, a France-based provider of aeronautics, defense, and space-related services, in January 2023, commercial aircraft were sold to 202184 clients in 2022, an increase of 8% from 2021, with 661 deliveries. There are 7,239 aircraft in backlog and 1,078 gross commercial orders (820 net). Therefore, the growing demand for commercial aircraft is driving the growth of the aerospace parts manufacturing market.

Market Dynamic

Driving Factors

Defense Modernization Programs Global investments in defense modernization are one of the primary forces driving aerospace parts manufacturing markets. Governments around the globe are expanding military capabilities by purchasing advanced aircraft, missiles, and defense systems from aerospace manufacturers. As a result, there is an ever-increasing need for essential aerospace components used for manufacturing defense equipment production. It creates steady demand from government procurement initiatives which requires critical aerospace parts components for production of defense gear. These defense program provide opportunities to aerospace producers who supply these essential pieces and fuel growth and innovation within military technologies.

Growing Space Exploration Initiatives

A surge in space exploration activities is contributing significantly to growth within the aerospace parts manufacturing market. Government agencies like NASA and private space companies require various specialized components, including propulsion systems, satellite parts and spacecraft structures as part of their ambitious missions; therefore driving demand for top quality aerospace manufacturing processes. With space exploration becoming an integral component of all space programs this rise in activity contributes significantly towards expansion within this sector of industry.

Restraints

Geopolitical Tensions and Trade Restrictions

Geopolitical tensions and trade disputes wreak havoc in the aerospace parts manufacturing market by disrupting supply chain delays, raising tariff costs due to sanctions or tariffs and restricting market access. Such challenges hinder goods flow while creating uncertainty over trade policies as well as complicate investment and operational planning, ultimately hindering company expansion plans while creating further barriers that stymy overall industry growth. As such manufacturers face difficulties maintaining efficiency as they expand into new markets thereby impeding overall industry growth prospects.

Compliance and Quality Assurance

Aerospace manufacturers face daunting compliance and quality assurance demands that can put a strain on resources such as equipment, personnel, and testing procedures. Failure to abide by regulatory compliance may have severe legal and financial repercussions as well as damage their brand image; noncompliance could have serious legal ramifications which damage brand loyalty as well. Furthermore, such stringent standards increase operational costs as well as complicate production processes which reduce output while hindering manufacturers' scaling capability.

Opportunities

Increased Demand for Aircraft Production and Fleet Expansion

As more emerging economies expand and air transport volumes rise, so too does demand for advanced aircraft. Replacing fleets at an approximate replacement rate of about three percent annually further drives demand. Furthermore, airlines expanding fleets to meet passenger and cargo demands are creating long-term growth opportunities within this industry for aerospace parts manufacturers.

Technological Advancements in Aerospace Production

Increased defense spending and an emphasis on aircraft efficiency have created opportunities for aerospace parts manufacturers in terms of R&D investment and innovation. Modern aircraft are offering substantial cost savings compared to older models while offering improved fuel economy, creating opportunities for manufacturers. As companies drive innovation forward they create opportunities for manufacturers of advanced, cutting-edge components; lightweight materials, more fuel-efficient engines, and intelligent systems all drive demand for cutting-edge parts which manufacturers can take advantage of as demand for these advances increases.

Trends

Adopt Additive Manufacturing for Lightweight and Complex Components

Aerospace part manufacturers are turning increasingly to additive manufacturing (3D printing) as an efficient and lightweight means of producing lightweight components with complex geometries and enhanced design flexibility for aircraft development projects. This trend can be explained by additive manufacturing's ability to reduce material waste while increasing design flexibility and producing intricate geometries that were once challenging or impossible with traditional production techniques - significantly contributing towards creating aircraft with enhanced performance and efficiency. AM adoption contributes significantly towards this advancement process and advances aircraft with increased performance efficiency and performance capabilities.

Shift towards On-Demand Production and Shorter Lead Times

Additive manufacturing has enabled manufacturers of aerospace parts to streamline their supply chains while improving production efficiencies by offering on-demand production capabilities, eliminating large inventories, and meeting dynamic market needs more rapidly with shorter lead times and quicker prototype and production times. It allows aerospace parts suppliers to streamline supply chains while optimizing efficiency by responding quickly. In turn, rapid prototyping helps meet tight deadlines at reduced costs which further fuelling market expansion along with market growth.

Research Scope and Analysis

By Product

Aerostructures is expected to dominate the aerospace parts manufacturing market with 54.3% market share by 2024 due to their integral part in aircraft assembly and substantial contribution towards overall industry revenue share. The airframe, fuselage, wings, door pairings, and airframe components comprise this segment and form the core of aircraft manufacturing. Aerostructures play a significant role in the manufacturing and assembly of aircraft ranging from large commercial planes and business jets, all the way down to regional planes and regional jets. Furthermore, this segment encompasses aircraft prototypes, conversions, and comprehensive overhauls - emphasizing its importance for innovation and lifecycle management. Leading firms in this domain such as Boeing are producing essential components and freighters highlighting its strategic worth.

Aerostructures continue to play an increasingly critical role in the aerospace manufacturing ecosystem. By harnessing advanced materials that reduce weight while upholding structural integrity, they help boost aircraft performance - cementing aerostructures' presence within this ecosystem. Engine manufacturing represents one of the two primary markets within aerospace parts manufacturing, due to their integral function as power sources of an aircraft and ability to enable high-speed travel while providing durability. Aircraft engines require cutting-edge technology and precise manufacturing to comply with stringent performance and safety standards.

By End User

The commercial sector is predicted to dominate the aerospace parts manufacturing market with a 51.5% revenue share by the end of 2025. This dominance can be attributed to increasing passenger and cargo services demand as well as international trade expansion boosting demand for passenger aircraft components and components that support them. Airlines investing in advanced aircraft to meet operational efficiency targets while decreasing emissions levels and enhance passenger experiences has propelled this growth significantly, spurring on commercial sector's overall expansion.

Additionally, the proliferation of low-cost carriers and expanding air routes worldwide contribute to sustained demand for commercial aircraft parts. The second segment, business, and general aviation aircraft, is also experiencing growth due to its advantages like higher mobility, increased productivity, and time efficiency. These aircraft cater to corporate travel, private leisure, and short-haul commercial transportation, offering significant time savings over other modes of travel. The rising demand for air taxis and commuter airliners further fuels this segment's expansion.

The Aerospace Parts Manufacturing Market Report is segmented based on the following

By Product

- Aerostructure

- Engines

- Cabin Interiors

- Equipment, System, and Support

- Avionics

- Insulation Components

By End User

- Commercial Aircraft

- Business Aircraft

- Military Aircraft

- Other Aircraft

Regional Analysis

North America is predicted to lead the aerospace parts manufacturing market

with a 51.7 % revenue share by 2025, due to significant investments made into advanced manufacturing technology and its highly qualified labor pool. Aging aircraft fleets present an ideal economic climate for aircraft manufacturing companies as airlines needing to maintain efficient operations must replace older models to maintain efficiency and revenue stability.

Research and development infrastructure strengthens its position further, driving increased investments to drive innovation in aerospace technology. North America's high per capita income spurs air travel demand, increasing aircraft and component needs. When coupled with its robust aviation ecosystem, this ensures North American predominance in aerospace parts manufacturing market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global aerospace parts manufacturing market is becoming increasingly competitive, driven by the growing demand from the aircraft manufacturing sector. This demand is fueled by the rising production of commercial and military aircraft, coupled with the increasing emphasis on fuel efficiency and advanced technologies.

The expansion of the airline industry, especially in emerging economies, has further heightened the need for innovative aerospace parts. A significant trend in the aerospace parts market is the strategic collaboration among major companies to establish joint ventures for product development. These collaborations help mitigate the risks and substantial costs associated with the development and manufacturing of new aerospace components, including engines, landing gears, and avionics.

Some of the prominent players in the global Aerospace Parts Manufacturing are

- GE Aviation

- Rolls Royce plc

- Pratt & Whitney

- Lockheed Martin

- Honeywell International, Inc.

- Collins Aerospace

- MTU Aero Engines AG

- Safran Group

- Lufthansa Technik AG

- Spirit Aerosystems, Inc.

- Zodiac Aerospace

- Parker-Hannifin Corporation

- Other Key Players

Recent Developments

- In May 2024, Boeing heavily invested in digital twin technology, a system that creates virtual replicas of physical assets to facilitate real-time monitoring, simulation, and optimization. This technology supports predictive maintenance and data-driven decision-making, leading to reduced downtime and improved operational efficiency.

- In April 2023, Boeing revealed plans to invest USD 1 billion in its aerospace parts manufacturing operations across the United States. This funding aims to increase production capacity and enhance the efficiency of these facilities.

- In March 2023, GE Aviation announced a USD 1 billion agreement with Spirit AeroSystems to provide engine components for Boeing's 787 Dreamliner.

- In February 2023, Airbus disclosed its commitment to invest USD 1.5 billion in its European aerospace parts manufacturing facilities. The investment focuses on expanding production capacity and optimizing efficiency at these locations.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 1,067.6 Bn |

| Forecast Value (2033) |

USD 1,554.1 Bn |

| CAGR (2024-2033) |

4.3% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 464.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Aerostructure, Engines, Cabin Interiors, Equipment, System, and Support, Avionics, and Insulation Components), By End User (Commercial Aircraft, Business Aircraft, Military Aircraft, and Other Aircraft) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

GE Aviation, Rolls Royce plc., Pratt & Whitney, Honeywell International, Inc., Collins Aerospace, MTU Aero Engines AG, Safran Group, Lufthansa Technik AG, Spirit Aerosystems, Inc., Zodiac Aerospace, Parker-Hannifin Corporation, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Aerospace Parts Manufacturing Market?

▾ The Global Aerospace Parts Manufacturing Market size is estimated to have a value of USD 1,067.6 billion in 2024 and is expected to reach USD 1,554.1 billion by the end of 2033.

Which region accounted for the largest Global Aerospace Parts Manufacturing Market?

▾ North America is expected to be the largest market share for the Global Aerospace Parts Manufacturing Market with a share of about 51.7% in 2024.

Who are the key players in the Global Aerospace Parts Manufacturing Market?

▾ Some of the major key players in the Global Aerospace Parts Manufacturing Market are GE Aviation, Rolls-Royce plc., Pratt & Whitney, and many others.

What is the growth rate in the Global Aerospace Parts Manufacturing Market?

▾ The market is growing at a CAGR of 4.3 percent over the forecasted period.

How big is the US Aerospace Parts Manufacturing Market?

▾ The US Aerospace Parts Manufacturing Market size is estimated to have a value of USD 464.2 billion in 2024 and is expected to reach USD 663.0 billion by the end of 2033.