Aerospace materials, essential for aircraft OEMs and component manufacturers, have evolved. From the past use of wood & muslin to aluminum-dominated airliners, materials like aluminum, steel, and advanced composites contribute to modernized features in current times

Further, the market expands due to growth in demand for new aircraft, technological development, larger aircraft size, & high replacement rates. Also, the rising usage of composite materials & titanium alloys anticipates future need growth, with some providers using sensors in smart composite materials for better functionality. Interestingly, similar technological innovation trends can be observed in the Wearable Technology and Fitness Tracker sectors, where integration of real-time monitoring and connected devices drives user adoption.

Aerospace Raw Materials Market Key Takeaways

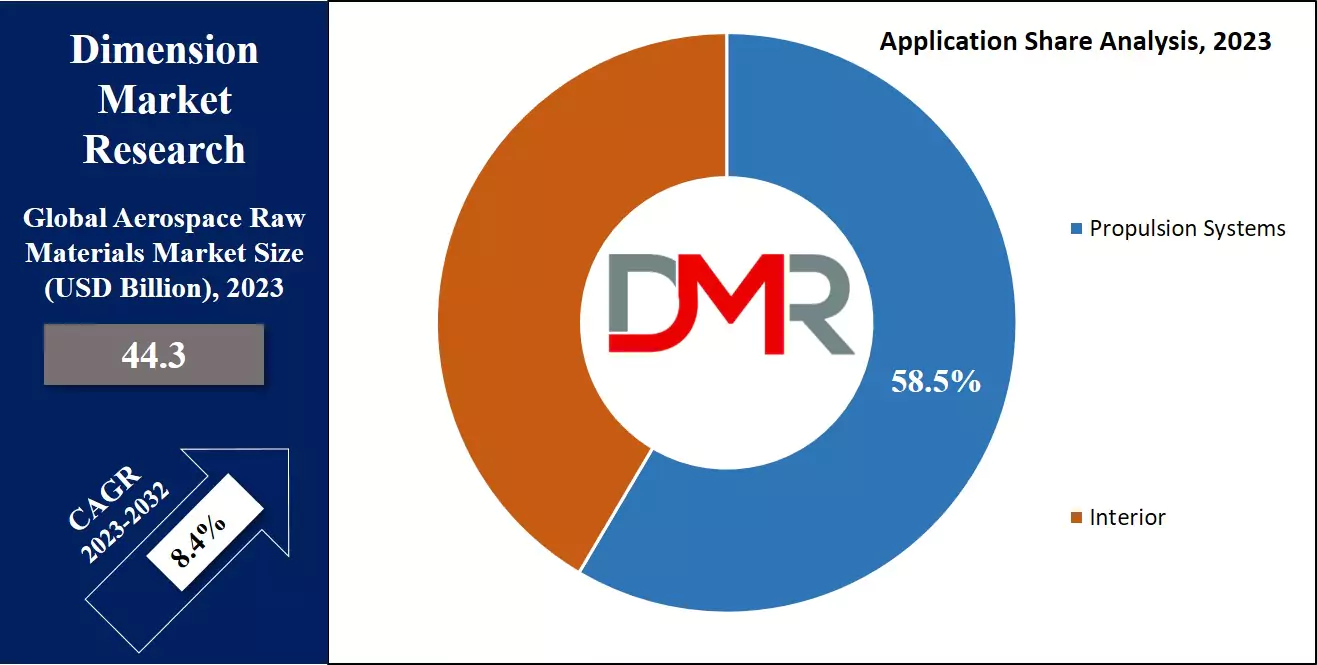

- The Aerospace Raw Materials Market is expected to reach a value of USD 91.7 billion by 2032 at a CAGR of 8.4%.

- By Type, the Composite segment is the lead in 2023 & is anticipated to dominate throughout the forecasted period.

- In addition, the Metal segment is expected to have significant growth over the forecasted period.

- By Application, the Propulsion System takes the lead & drives the market in 2023

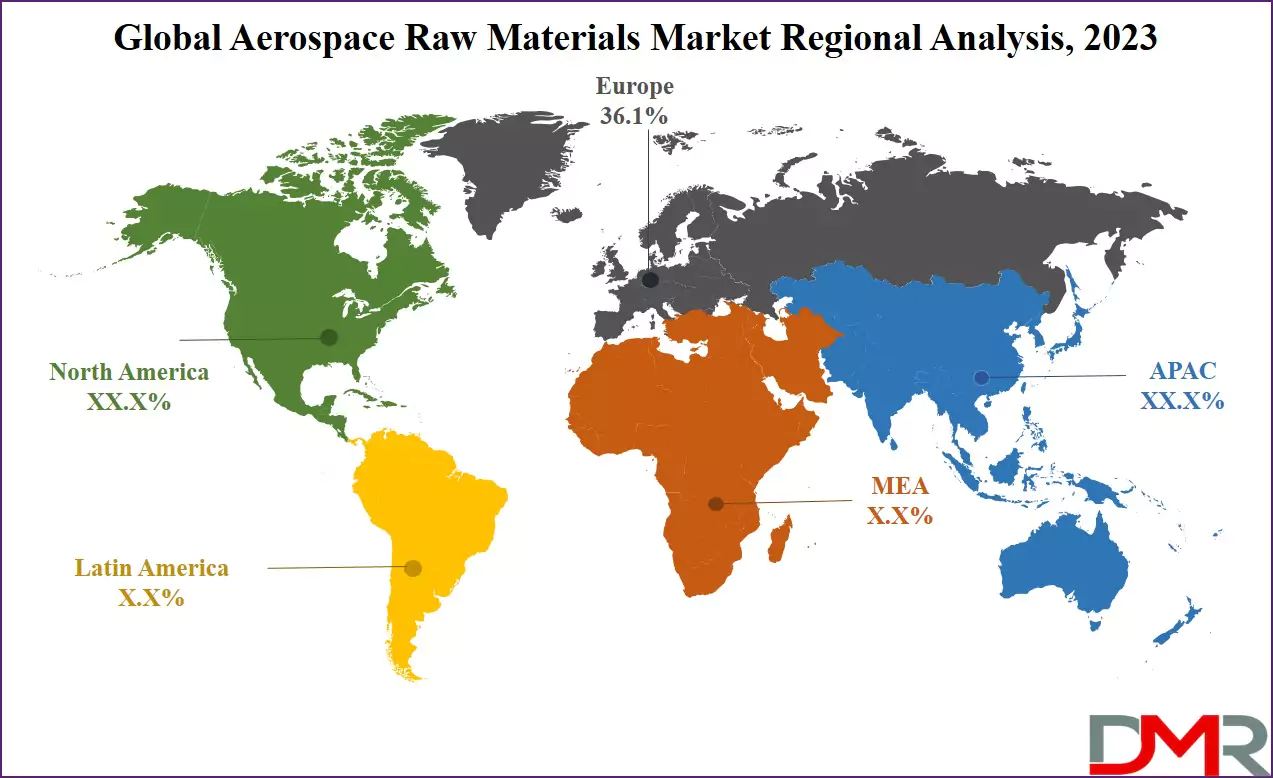

- Europe has a 36.1% share of revenue in the Global Aerospace Raw Materials Market in 2023

Aerospace Raw Materials Market Use Cases

- Aircraft Manufacturing: High-strength materials like titanium, aluminum, and composites are used to build lightweight, fuel-efficient aircraft structures.

- Engine Components: Superalloys and heat-resistant materials enhance the durability and performance of aircraft engines under extreme conditions.

- Spacecraft & Satellite Construction: Advanced composites and carbon fiber materials are used for lightweight yet strong spacecraft and satellite structures.

- Defense & Military Applications: High-performance alloys and stealth materials improve the durability and survivability of military aircraft and UAVs.

- Aircraft Interior Components: Lightweight polymers, composites, and flame-resistant materials enhance safety, comfort, and fuel efficiency in cabin interiors.

- Additive Manufacturing (3D Printing): Aerospace-grade metals and polymers are used in 3D printing for rapid prototyping and complex part manufacturing, reducing production costs and time.

Aerospace Raw Materials Market Dynamic

Aerospace resources, the materials used in crafting aircraft

parts, predominantly include aluminum alloys & other metals, with a growing presence of synthesized polymeric composites. These substances contribute to constructing different components like cabin interiors, structural frames, & propulsion systems, characterized by ideal traits such as high strength, lightweight, and resistance to high temperatures. As earlier, titanium and aluminum alloys comprised 80% of aeronautical construction elements.

However, trends see a rise in the use of composite materials like fiber-reinforced polymer, impacting the aerospace materials landscape. In addition, the integration of nanotechnology is influencing the development of aviation materials. Further the challenges & changes in the aerospace industry, particularly in maintenance, repair, & overhaul (MRO) services for aircraft made of composites.

Further, regulatory requirements & the unique maintenance requirements of composite materials pose challenges for MRO businesses, mainly as renowned manufacturers adopt advanced lightweight structures in their latest airplane models. Also, the decline in commercial aircraft deliveries could further impact the aerospace components market, considering passenger airliners' substantial material consumption. The influence of

Aerospace Telemetry Systems and sensor integration on materials performance also reflects the adoption of connected monitoring technologies similar to those in wearable fitness solutions.

Aerospace Raw Materials Market Research Scope and Analysis

By Type

Composites have emerged as a primary driver for the expansion of the global aerospace raw material market in 2023, representing a revolutionary material class for modern aircraft, which is witnessing international growth, driven by the increasing adoption of next-generation aircraft. Polymeric composites, known for their corrosion resistance and resilience against metal strain, outperform traditional aluminum and alloy steels.

Further, the metal segment, mainly aluminum alloys, experiences significant growth due to their essential role in crafting aircraft components like wings & fuselage. Further, aluminum alloys, valued for qualities like high tensile strength, oxidation resistance, & lesser weight, dominate the aviation material market.

By Aircraft Type

The global aerospace raw material market is mainly influenced by the commercial aircraft sector, which utilizes diverse materials like aluminum alloys, titanium alloys, & structural components in manufacturing, which holds the majority share in 2023 while accounting for over half of the overall demand for components in terms of quantity. Further, the growth in air travel, particularly in emerging nations, is driving a rise in the need for airplanes.

Further Business aircraft, serving purposes like freight transport and passenger travel, are anticipated to grow more in the coming years, as the growing number of air travelers & the rise of affordable air transportation contribute to the growing need for commercial planes. These materials find application in both the interior & structural elements of different aircraft, reflecting the industry's dynamic response to changing aviation demands.

By Application

The Aerospace Raw Materials Market sees a lot of application in the propulsion systems of aircraft as it contributes significantly to the growth of the market in 2023, and is anticipated to persist throughout the forecasted period.

Essential components like turbine blades, engine casings, & other critical parts necessitate materials with exceptional strength, heat resistance, &lightweight properties. Further, several materials, like advanced alloys & composites like titanium &carbon fiber, play a vital role in improving the efficiency and performance of propulsion systems.

As the aerospace industry continually grows for innovation & fuel efficiency, the demand for advanced materials in propulsion applications remains high, as well as the development & utilization of these raw materials contribute to the evolution of propulsion technologies, making aircraft engines meet strict performance standards while addressing environmental concerns. Similarly, the adoption of smart wearable devices and connected fitness devices in the

Wearable Fitness Technology Market showcases how monitoring, performance enhancement, and lightweight, high-performance materials are increasingly valued in consumer technology.

The Aerospace Raw Materials Market Report is segmented on the basis of the following:

By Type

- Composite

- Metal

- Plastic

- PEEK

- PMMA

- ABS

- PC

- PPS

- Others

By Aircraft Type

- Commercial Aircraft

- Business & General Aviation

- Military Aircraft

- Helicopters

- Others

By Application

- Interior

- Propulsion System

How Does Artificial Intelligence Contribute To Improve Aerospace Raw Materials Market ?

- Material Discovery & Development: AI accelerates the discovery of advanced materials by analyzing molecular structures and predicting performance.

- Supply Chain Optimization: AI enhances logistics and inventory management by forecasting raw material demand and reducing production delays.

- Predictive Maintenance: AI-powered analytics detect wear and degradation in aerospace materials, ensuring timely replacements and reducing failures.

- Quality Control & Defect Detection: AI-driven imaging and machine learning identify micro-defects in raw materials, improving reliability and safety.

- Process Automation & Smart Manufacturing: AI optimizes manufacturing processes by adjusting parameters in real-time for efficient material usage.

- Sustainability & Waste Reduction: AI-driven simulations minimize material waste by optimizing cutting patterns and recycling strategies.

- Performance Simulation & Testing: AI predicts how raw materials will perform under extreme aerospace conditions, reducing reliance on physical testing.

Aerospace Raw Materials Market Regional Analysis

Europe leads the aerospace raw material market with a 36.1% share, mainly due to the demand for commercial & corporate aviation, as Germany dominates commercial airliner production, followed by the US & France. The decline in Boeing 437 Max production in the US branches from manufacturing challenges. The US is a hub for major aerospace component manufacturers like Solvay, TenCate, VSMPO, SGL Carbon, & AMG NV.

Further, the need for composite materials in Europe is fueled by increased Boeing air transport needs, & the region is a significant producer of military helicopters. Thus, the European aerospace landscape remains dynamic, driven by development in technology, strategic collaborations, & the pursuit of sustainable solutions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Aerospace Raw Materials Market Competitive Landscape

The Aerospace Raw Materials Market is marked by intense competition as companies compete for market share, as key players focus on innovating material technologies, strategic partnerships, & global expansions to get a competitive edge. With a focus growing on sustainability, there is an increasing trend towards the development & use lightweight, eco-friendly materials, further strengthening the competition within the market.