Market Overview

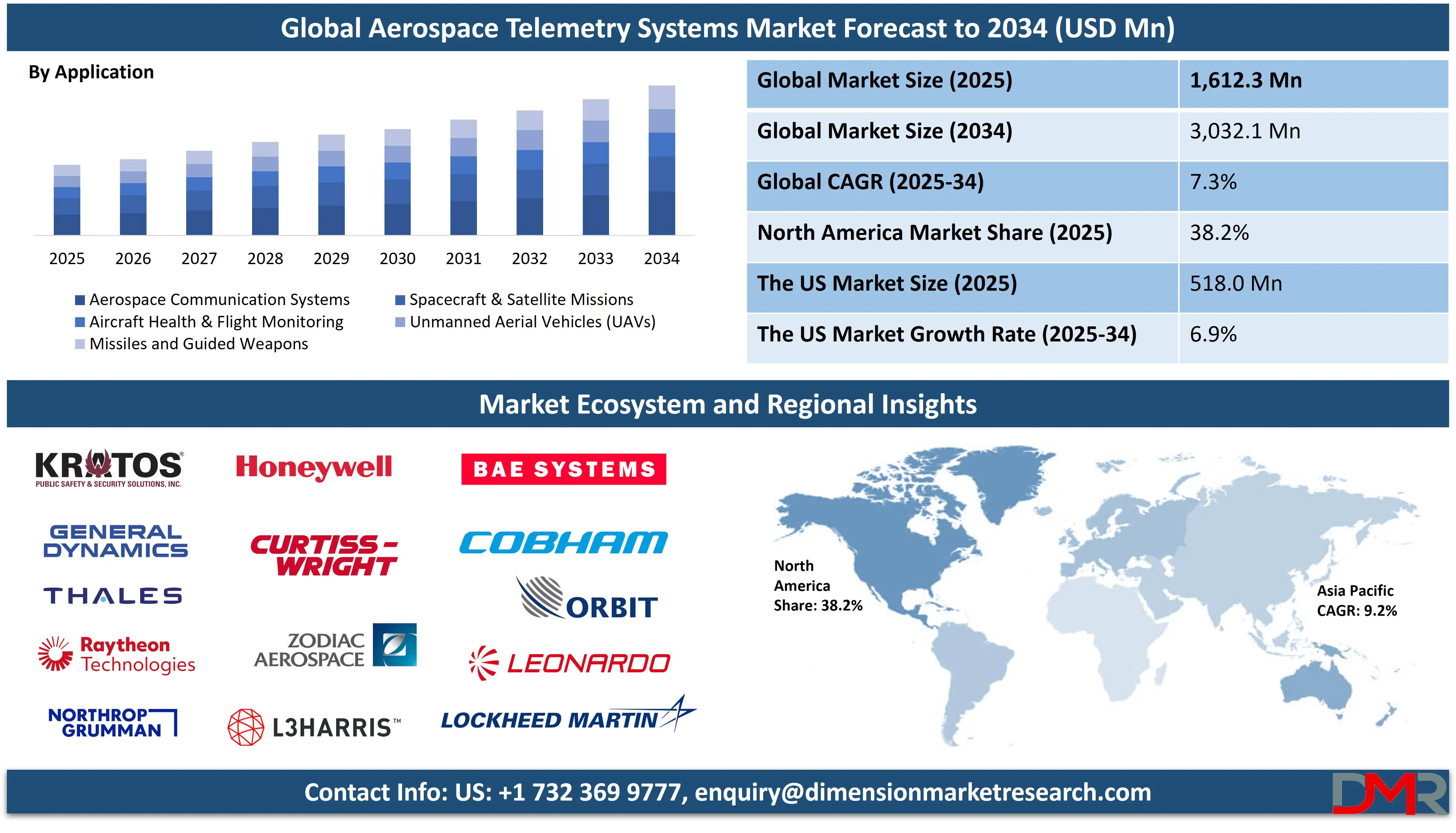

The Global Aerospace Telemetry Systems Market is projected to reach

USD 1,612.3 million in 2025 and grow at a compound

annual growth rate of 7.3% from there until 2034 to reach a value of

USD 3,032.1 million.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global aerospace telemetry systems market is witnessing strong growth due to the rising need for secure, real-time communication and monitoring across both commercial and defense aerospace platforms. The evolution of aircraft systems, space missions, and unmanned aerial vehicles (UAVs) demands telemetry solutions that can transmit vital data efficiently and reliably. Technological trends such as miniaturization of components, integration of AI for predictive analytics, and increased reliance on wireless and satellite communication are transforming how aerospace telemetry systems are developed and deployed.

There is a significant opportunity in the development of modular and lightweight telemetry systems tailored for small satellites and UAVs. The emergence of reusable launch vehicles, privatization of space missions, and increasing deployment of high-altitude long-endurance (HALE) UAVs further widens the scope. The need for telemetry in aircraft health monitoring and mission-critical defense applications creates demand for highly secure, high-throughput systems. The expansion of commercial aviation in emerging economies also creates room for telemetry-enabled fleet modernization.

Nevertheless, the market is not without constraints. High development and integration costs continue to deter adoption, particularly among small and mid-tier aerospace OEMs. Strict aerospace regulations and the need for rigorous testing and validation lengthen product cycles. Additionally, increasing cybersecurity concerns present challenges in securing the transmission and storage of sensitive telemetry data from hostile threats and data breaches.

Despite these barriers, the long-term outlook remains robust. Demand is expected to rise steadily due to increased aerospace activity, digital transformation across aviation systems, and growing government and commercial investments in space and defense technologies globally.

The US Aerospace Telemetry Systems Market

The US Aerospace Telemetry Systems Market is projected to reach USD 518.0 million in 2025 at a compound annual growth rate of 6.9% over its forecast period.

The United States is a global leader in aerospace telemetry systems, backed by strong governmental support, a robust defense infrastructure, and an advanced aerospace manufacturing base. With an expansive network of defense contractors and space agencies, the country continuously drives innovation in telemetry technologies. The U.S. Department of Defense prioritizes telemetry solutions in missile guidance, aircraft systems, and unmanned platforms to ensure real-time situational awareness and command-control superiority in modern warfare environments.

According to the U.S. Department of Transportation and the Federal Aviation Administration (FAA), the U.S. operates the world’s largest and most complex aviation system, which benefits significantly from advanced telemetry for air traffic management, flight diagnostics, and communication systems. Furthermore, NASA's deep space missions rely extensively on telemetry to support spacecraft operations and gather scientific data across vast distances.

The country’s vast geography and high defense expenditure create a natural advantage for continuous R&D in telemetry systems for airborne, ground-based, and space-based platforms. The increasing use of telemetry in civilian sectors such as commercial aviation, urban air mobility, and drone logistics further expands market potential.

The U.S. is also home to leading aerospace companies that design integrated telemetry modules, ensuring constant upgrades and faster adoption of secure, encrypted telemetry in defense and civil aviation. The U.S. demographic advantage includes a large skilled engineering workforce, advanced academic research in aerospace, and a dense network of government-funded technology incubators, all of which foster innovation and commercialization of cutting-edge aerospace telemetry systems.

The European Aerospace Telemetry Systems Market

The European Aerospace Telemetry Systems Market is estimated to be valued at USD 283.76 million in 2025 and is further anticipated to reach USD 440.21 million by 2034 at a CAGR of 5.0%.

Europe holds a strong position in the global aerospace telemetry systems market due to its collaborative defense projects, space exploration initiatives, and established commercial aviation ecosystem. The presence of multinational aerospace giants and organizations like the European Space Agency (ESA) fosters the development and deployment of advanced telemetry systems for a wide range of applications, including satellite operations, missile testing, and aircraft diagnostics.

European countries benefit from structured defense cooperation, such as through NATO and the Permanent Structured Cooperation (PESCO), which enhances collective investment in real-time telemetry for surveillance and defense readiness. With increasing investments in next-generation fighter jets, UAV programs, and missile systems across France, Germany, Italy, and the UK, there is a growing demand for secure, robust telemetry communication links.

Europe’s emphasis on sustainable aviation and digital modernization is also a key driver. Initiatives like the Clean Sky and SESAR (Single European Sky ATM Research) programs support telemetry in greener, more efficient aircraft systems and traffic management. Telemetry enables aircraft manufacturers and operators to monitor real-time emissions, fuel consumption, and system health, facilitating data-driven maintenance and operational efficiency.

The region’s demographic advantage includes a highly educated workforce, mature R&D infrastructure, and strong cross-border collaborations between academia, defense institutions, and private aerospace firms. Furthermore, Europe's investment in cyber-resilient telemetry solutions reflects its commitment to securing critical communication channels from emerging threats. As space ambitions expand and commercial air traffic rebounds, Europe is expected to see steady growth in telemetry system integration across military and civilian aerospace platforms.

The Japan Aerospace Telemetry Systems Market

The Japan Aerospace Telemetry Systems Market is projected to be valued at USD 96.74 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 170.51 million in 2034 at a CAGR of 6.5%.

Japan is an important player in the aerospace telemetry systems market, driven by its strategic focus on space exploration, missile defense, and aviation modernization. The country’s technological infrastructure, government-backed space programs, and growing defense budget are major catalysts for the expansion of telemetry system deployment across national platforms.

The Japan Aerospace Exploration Agency (JAXA) plays a pivotal role in telemetry development for satellite missions, deep space probes, and atmospheric research vehicles. Japan’s strong emphasis on miniaturized, high-performance satellite systems has led to the adoption of compact telemetry modules capable of transmitting vast quantities of data with minimal delay. These systems are essential in managing Japan’s growing fleet of Earth observation and communications satellites.

On the defense front, the Ministry of Defense continues to invest in telemetry technologies for applications such as missile tracking, airborne surveillance, and radar systems. The country’s layered missile defense architecture, developed in collaboration with international allies, relies heavily on high-fidelity telemetry to track incoming threats and support precision interception systems.

Japan’s demographic strength lies in its skilled engineering workforce and mature electronics sector. Additionally, strong ties between government agencies, private aerospace companies, and leading universities enable continuous innovation and testing of advanced telemetry platforms. With growing focus on space security, commercial satellite services, and the development of autonomous defense platforms, Japan’s demand for high-bandwidth, real-time telemetry systems is set to rise steadily. The country's push toward smart aviation and integration of UAVs into civilian airspace will further accelerate market growth.

Global Aerospace Telemetry Systems Market: Key Takeaways

- The Global Market Size Insights: The Global Aerospace Telemetry Systems Market size is estimated to have a value of USD 1,612.3 million in 2025 and is expected to reach USD 3,032.1 million by the end of 2034.

- The US Market Size Insights: The US Aerospace Telemetry Systems Market is projected to be valued at USD 518.0 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 940.9 million in 2034 at a CAGR of 6.9%.

- Regional Insights: North America is expected to have the largest market share in the Global Aerospace Telemetry Systems Market, with a share of about 38.2% in 2025.

- Key Players: Some of the major key players in the Global Aerospace Telemetry Systems Market are Lockheed Martin, L3Harris, Honeywell, General Dynamics, Thales, BAE Systems, Northrop Grumman, Raytheon, Leonardo, Cobham, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 7.3 percent over the forecasted period of 2025.

Global Aerospace Telemetry Systems Market: Use Cases

- Satellite Health Monitoring: Telemetry systems track vital performance parameters of satellites such as thermal levels, energy output, system voltages, and component status, enabling ground stations to manage satellite functions remotely and address faults promptly to avoid mission failures.

- UAV Flight Control & Surveillance: Unmanned aerial vehicles (UAVs) rely on telemetry to relay flight metrics such as altitude, speed, orientation, and GPS location back to the operator, facilitating real-time adjustments and ensuring reliable surveillance or reconnaissance missions in defense or disaster zones.

- Missile and Guided Weapon Tracking: Telemetry provides missile command centers with trajectory, acceleration, and system health data during missile launches and testing. This ensures precise control and evaluation for improved accuracy, targeting, and post-launch performance diagnostics of guided weapons.

- Flight Testing & Aircraft Diagnostics: During prototype testing or live missions, aircraft telemetry systems transmit engine parameters, airframe stress levels, fuel usage, and avionics status to ground control, allowing engineers to evaluate performance and quickly respond to anomalies or faults.

- Space Mission Control Communications: Telemetry enables mission control centers to monitor the operational status of spacecraft systems, instruments, and environmental conditions encountered in space. This data stream supports remote operations, course corrections, and onboard system optimization during extended interplanetary missions.

Global Aerospace Telemetry Systems Market: Stats & Facts

- NASA: In 2023, NASA achieved a milestone by transmitting data at a rate of 200 gigabits per second from a satellite using optical communication technology, marking the highest data rate ever for optical communications.

- Federal Aviation Administration (FAA): The FAA's Next Generation Air Transportation System (NextGen) improvements are estimated to save 2.8 billion gallons of fuel through 2030 and reduce carbon emissions by more than 650 million metric tons from 2020 to 2040. The FAA completed the installation of new ground radio infrastructure in 2014, providing coverage in all 50 states, Guam, Puerto Rico, the Gulf of Mexico, and areas off both coasts.

- UK Space Agency (UKSA): The UKSA anticipates a significant shift to optical communication in orbit as standard by the start of the next decade, enabling vast amounts of data transmission globally.

- European Space Agency (ESA): ESA has been actively involved in advancing optical communication technologies, collaborating with various partners to enhance data transmission capabilities from space to ground stations.

- Japan Aerospace Exploration Agency (JAXA): JAXA continues to invest in the development of advanced telemetry systems to support its growing number of satellite launches and space exploration missions.

- Department of Defense (DoD), USA: The U.S. Department of Defense emphasizes the integration of advanced telemetry systems in its defense strategies to ensure real-time situational awareness and command-control superiority.

- European Defence Agency (EDA): The EDA supports collaborative defense projects among European nations, focusing on the development and deployment of advanced telemetry systems for various military applications.

- India Space Research Organisation (ISRO): ISRO has been enhancing its telemetry capabilities to support its increasing number of satellite missions and to ensure reliable data transmission for space exploration activities.

- Australian Space Agency: The Australian Space Agency is investing in the development of ground stations and telemetry infrastructure to support its growing involvement in space missions and satellite operations.

- Canadian Space Agency (CSA): The CSA collaborates with international partners to advance telemetry technologies, ensuring efficient data communication for its space missions and satellite programs.

- German Aerospace Center (DLR): DLR focuses on research and development of telemetry systems to support Germany's aerospace initiatives, including satellite operations and space exploration missions.

- French Space Agency (CNES): CNES is actively involved in the development of optical communication technologies to enhance data transmission rates from space to Earth, collaborating with companies like Cailabs.

- South African National Space Agency (SANSA): SANSA is working on improving its telemetry infrastructure to support satellite tracking and data reception, contributing to global space research efforts.

- Brazilian Space Agency (AEB): AEB is investing in telemetry systems to support its satellite programs and to enhance data communication capabilities for space missions.

Global Aerospace Telemetry Systems Market: Market Dynamics

Driving Factors in the Global Aerospace Telemetry Systems Market

Expanding Satellite Launch Programs and Space MissionsA significant driver for the aerospace telemetry systems market is the exponential rise in global satellite launches, driven by both governmental space agencies and private spaceflight companies. The miniaturization of satellite technology, particularly the proliferation of CubeSats and small satellites, has democratized access to space. These platforms are now used for a wide range of applications, including Earth observation, remote sensing, communication, and scientific research. Each satellite launch requires robust telemetry infrastructure to monitor system health, orbital dynamics, payload performance, and communication with ground stations.

Furthermore, deep-space missions to the Moon, Mars, and beyond necessitate advanced telemetry systems capable of handling vast distances and harsh space environments. Agencies such as NASA, ISRO, and CNSA, along with private firms like SpaceX and Blue Origin, are continuously expanding their telemetry capabilities to meet the rising number of launch campaigns. This surge in satellite activities fuels demand for both ground-based and spaceborne telemetry components like antennas, receivers, and data acquisition units. As space becomes more commercialized and globally collaborative, the need for interoperable and high-performance telemetry systems will continue to accelerate.

Defense Modernization and Surveillance Programs

The modernization of defense infrastructure and rising defense budgets globally are acting as a major catalyst for the growth of aerospace telemetry systems. Modern warfare increasingly depends on precision, real-time intelligence, and autonomous mission capabilities. Telemetry systems play a central role in providing command centers with real-time data from airborne platforms, guided missiles, and surveillance drones. Many nations, particularly in North America, Europe, and Asia-Pacific, are actively upgrading their aerospace defense systems to include telemetry-enabled hypersonic missiles, ISR drones, and secure battlefield communications.

Programs such as the U.S. Department of Defense’s Next Generation Air Dominance (NGAD) and NATO’s joint ISR initiatives reflect this trend. Additionally, countries are investing in secure telemetry solutions with anti-jamming capabilities and encrypted communication protocols to counter emerging threats in cyber warfare and electronic attacks. As geopolitical tensions heighten and asymmetric threats evolve, aerospace telemetry systems will remain a strategic necessity for national security, border surveillance, and tactical superiority.

Restraints in the Global Aerospace Telemetry Systems Market

High Capital and Operational Costs of Telemetry Infrastructure

Despite its technological importance, the aerospace telemetry systems market is constrained by significant capital and operational expenditures. Developing, deploying, and maintaining telemetry infrastructure, including ground stations, satellite communication relays, antennas, and data processing units, requires substantial investment. For emerging space programs and smaller aerospace firms, these costs can be prohibitive. Additionally, telemetry systems must undergo rigorous testing and certification to ensure they meet the safety and reliability standards demanded by space and defense applications. The operational cost of telemetry includes continuous monitoring, real-time data processing, system upgrades, and cybersecurity defenses.

These expenses are compounded in deep-space missions, which require long-range, high-power systems that can withstand extreme environmental conditions. Budgetary constraints in government-funded projects and cost-sensitive defense procurement programs often delay or scale back telemetry investments. Consequently, although the demand for telemetry systems is growing, cost considerations pose a substantial barrier to widespread adoption, particularly in developing regions or small-scale aerospace ventures.

Regulatory and Frequency Spectrum Allocation Challenges

One of the most critical restraints in the aerospace telemetry domain is the issue of frequency spectrum allocation and regulatory compliance. Telemetry systems rely heavily on specific radio frequencies to transmit data between airborne/spaceborne platforms and ground stations. However, the global RF spectrum is increasingly congested due to the explosive growth of wireless communication, satellite services, and mobile networks.

This congestion leads to interference issues and limits the availability of dedicated telemetry bands. Moreover, international regulatory bodies such as the International Telecommunication Union (ITU) and regional authorities impose strict licensing protocols, frequency use limitations, and compliance standards. These regulations can vary significantly across countries, complicating global telemetry deployment for multi-national missions. Additionally, emerging aerospace markets face bureaucratic delays in frequency allocation and certification. The transition to alternative technologies like optical telemetry partially mitigates this challenge but introduces its own set of regulatory and technical barriers. Overall, spectrum scarcity and complex regulatory landscapes inhibit seamless telemetry operation and expansion.

Opportunities in the Global Aerospace Telemetry Systems Market

Commercialization of Space and Private Sector Involvement

The rapid commercialization of space is presenting substantial growth opportunities for the aerospace telemetry systems market. An increasing number of private firms, ranging from satellite internet providers to commercial space tourism companies, are entering the aerospace domain. These companies require advanced telemetry infrastructure to ensure the safe operation, data relay, and health monitoring of their airborne and spaceborne assets. SpaceX, OneWeb, and Amazon’s Project Kuiper, for example, are deploying massive satellite constellations that necessitate sophisticated telemetry to manage hundreds or even thousands of satellites in real time.

Additionally, the rise of spaceports, reusable launch vehicles, and orbital logistics hubs underscores the need for continuous telemetry coverage across all mission phases from launch and flight to orbit and reentry. This trend is further supported by public-private partnerships and relaxed regulatory frameworks in countries like the U.S., U.K., and UAE. As space becomes more accessible and commercially viable, telemetry providers stand to benefit from increased demand for scalable, modular, and interoperable solutions tailored for commercial missions.

Development of AI-Enabled Telemetry Systems for Predictive Maintenance

Another promising opportunity lies in the integration of artificial intelligence and machine learning into telemetry systems. AI-enabled telemetry platforms can analyze vast streams of real-time data to detect anomalies, predict component failures, and optimize mission performance. This approach is particularly useful in aerospace applications where early detection of malfunctions can prevent mission failure or loss of expensive assets. For example, in aircraft and UAVs, AI can interpret telemetry signals to identify engine wear, fuel inefficiency, or sensor degradation well before they manifest operationally.

These insights support condition-based maintenance strategies that extend the lifecycle of aerospace assets and reduce maintenance costs. Moreover, the integration of edge computing allows telemetry systems to process and respond to data at the source, minimizing latency and enhancing autonomy. AI-powered telemetry is also gaining traction in space missions, where long communication delays make onboard decision-making essential. This evolution toward smart, predictive telemetry represents a critical shift in aerospace operations and will drive future market expansion.

Trends in the Global Aerospace Telemetry Systems Market

Integration of Optical Communication in Aerospace Telemetry Systems

The adoption of optical communication technologies in aerospace telemetry systems is emerging as a transformative trend. Optical telemetry offers significantly higher bandwidth, lower latency, and better resistance to electromagnetic interference compared to traditional radio frequency (RF) systems. This is particularly critical for deep space missions and high-resolution satellite imaging that demand the transmission of large volumes of data in real time. Agencies like NASA and ESA are actively piloting laser communication systems for future satellite constellations and space exploration missions.

Additionally, private sector players are developing spaceborne optical terminals to enable faster data downloads from low-earth orbit satellites to ground stations. The implementation of optical telemetry also addresses the challenge of RF spectrum congestion, offering a secure and scalable communication alternative. As optical technology matures, its integration into mainstream aerospace telemetry systems will become essential to meet the demands of real-time communication, surveillance, and data analytics in increasingly congested airspace and orbital domains.

Deployment of Real-Time Telemetry in UAVs and Hypersonic Platforms

The trend toward real-time telemetry deployment in unmanned aerial vehicles (UAVs) and hypersonic systems is reshaping aerospace missions. These platforms require telemetry systems that can operate under extreme velocities, high altitudes, and variable atmospheric conditions, while delivering instantaneous data transmission. Real-time telemetry ensures mission-critical updates on vehicle performance, health parameters, and trajectory, allowing for dynamic adjustments during flight. In military UAVs, such capabilities enable command centers to execute precision surveillance or strike operations based on real-time intelligence.

Similarly, in hypersonic vehicles, real-time telemetry is vital for navigation and environmental sensing, helping guide these systems through the edge of space at speeds exceeding Mach 5. The integration of machine learning algorithms with telemetry data feeds further enhances the predictive maintenance and autonomy of aerospace systems. This trend reflects a broader industry shift toward smart, responsive aerospace platforms capable of real-time diagnostics and adaptive mission execution.

Global Aerospace Telemetry Systems Market: Research Scope and Analysis

By Component Analysis

The transmitter segment is expected to dominate the Aerospace Telemetry Systems Market due to its critical role in ensuring seamless data relay from airborne, ground-based, or spaceborne platforms to monitoring stations. Telemetry transmitters serve as the backbone of real-time data transmission in a wide array of aerospace applications, ranging from missile testing to satellite health monitoring. Their function is indispensable in capturing onboard data such as speed, altitude, pressure, and system integrity, and sending it in real time to receivers for analysis. This is essential across both the Aircraft Monitoring Systems Market and the UAV Telemetry Equipment Market, where uninterrupted data flow ensures mission safety and operational efficiency.

Modern transmitters are designed with miniaturized, ruggedized, and high-frequency components, allowing their deployment in advanced systems such as hypersonic vehicles and deep-space missions. With the evolution of the Space Telemetry Market, transmitters have also become vital for interplanetary communication, satellite orbit adjustments, and environmental monitoring in space. Furthermore, the integration of AI-powered modulation techniques has made transmitters more adaptive and power-efficient, meeting the demands of the next-generation Real-Time Telemetry Solutions Market.

Their dominance is further supported by their extensive use in defense modernization programs, aerospace R&D facilities, and multi-orbit satellite systems. Ground-based receivers are only as effective as the signal they receive, making robust and high-speed telemetry transmitters essential for capturing and maintaining communication fidelity. Given these capabilities, the transmitter remains the most deployed and revenue-generating component in aerospace telemetry infrastructure worldwide, consolidating its leadership in this dynamic market segment.

By Telemetry Type Analysis

Radio telemetry is poised to lead the Aerospace Telemetry Systems Market as the most established and reliable data transmission method in aerospace operations. Its dominance is rooted in its long-standing adoption across both military and civilian aerospace missions. Radio telemetry supports secure and continuous communication between aircraft, satellites, UAVs, and ground stations through electromagnetic wave propagation, making it indispensable for real-time flight data acquisition. In the UAV Telemetry Equipment Market, radio telemetry is especially favored for its low latency and long-range capabilities, allowing mission operators to track drones in real time with minimal data loss.

Additionally, in the Aerospace Communication Systems Market, radio telemetry is utilized extensively in missile guidance systems, telemetry-equipped munitions, and atmospheric sounding rockets, where speed and reliability are paramount. One of its key advantages is its adaptability to various frequency bands from UHF to S-band, ensuring compatibility with diverse platforms in both terrestrial and space environments. As congestion in the RF spectrum increases, advanced spread-spectrum and frequency-hopping techniques are now being deployed to enhance performance under electronic warfare and jamming conditions.

In the Real-Time Telemetry Solutions Market, radio telemetry continues to evolve, incorporating higher bandwidths and digital encoding for transmitting large telemetry datasets with improved accuracy and integrity. Despite emerging technologies such as optical telemetry, radio telemetry retains its leadership due to its mature infrastructure, global standardization, and regulatory support from defense agencies and aviation bodies. Its cost-effectiveness, flexibility, and integration into multi-platform communication protocols further consolidate its supremacy in this segment of the global telemetry market landscape.

By Communication System Analysis

Ground-to-air communication is expected to hold the dominant position in the Aerospace Telemetry Systems Market owing to its pivotal role in ensuring mission control, surveillance, and safety of flight operations across military, commercial, and space platforms. This communication pathway forms the backbone of all aerospace missions where terrestrial command centers need continuous access to telemetry data from aircraft, UAVs, and missiles. In both the Aircraft Monitoring Systems Market and the UAV Telemetry Equipment Market, ground-to-air systems allow operators to receive real-time feedback on critical parameters such as altitude, engine temperature, fuel status, and structural integrity.

The widespread application of aerospace communication systems in defense and commercial aviation, particularly for air traffic control, pilot-to-ground instructions, and real-time threat identification, further drives the demand for ground-to-air telemetry. These systems utilize high-frequency and satellite-assisted networks, ensuring uninterrupted communication even during long-haul flights or combat missions in GPS-denied environments. In space operations, ground-to-space variants of this system are integral to the Space Telemetry Market, particularly during launch, staging, and orbital maneuvers.

The scalability of ground-to-air communication systems also supports next-generation aerospace platforms such as hypersonic vehicles and urban air mobility (UAM) crafts. Modern deployments feature dynamic link switching, encrypted data paths, and AI-based decision systems for adaptive response, strengthening their presence in the Real-Time Telemetry Solutions Market. Given their mission-critical function and technological evolution, ground-to-air systems remain the most strategically important and commercially dominant telemetry communication configuration globally.

By Platform Analysis

Ground stations are anticipated to dominate the Aerospace Telemetry Systems Market as they serve as the central node for receiving, decoding, storing, and analyzing telemetry data from airborne and spaceborne platforms. Whether supporting a satellite in orbit, a reconnaissance drone in flight, or a deep-space probe, ground stations form the communication bridge between mission assets and human operators. Their capacity to interface with a wide range of platforms across the Space Telemetry Market, Aircraft Monitoring Systems Market, and UAV Telemetry Equipment Market ensures versatility and scalability, making them indispensable in modern aerospace operations.

Equipped with advanced parabolic antennas, signal amplifiers, and data processing systems, ground stations are now capable of managing multi-frequency communication with multiple platforms simultaneously. They support real-time tracking, payload data reception, system health monitoring, and command execution, making them essential for the Real-Time Telemetry Solutions Market. In defense operations, they enable ground-based commanders to receive instantaneous updates from airborne assets, enhancing situational awareness and mission control.

Moreover, with the global expansion of low-earth orbit (LEO) satellite constellations, the demand for automated, globally distributed ground stations has surged. This infrastructure is now transitioning to hybrid cloud-based models to support high-volume data analytics, predictive diagnostics, and rapid command relay across global aerospace networks. Governments and commercial players are heavily investing in ground station upgrades to support future missions involving reusable launch vehicles and interplanetary exploration. This strategic and operational centrality makes ground stations the most dominant and enduring platform in the global aerospace telemetry ecosystem.

By Application Analysis

Aerospace communication systems are projected to represent the leading application segment in the Aerospace Telemetry Systems Market due to their foundational role in enabling real-time data exchange between aircraft, satellites, UAVs, and ground stations. These systems integrate telemetry sensors, RF transmitters, antennas, and processors to create a dynamic communication loop essential for safe flight operations, navigational accuracy, and mission-critical decision-making. Their dominance stems from their widespread use in both commercial and defense aviation as well as space exploration activities.

In the Aircraft Monitoring Systems Market, aerospace communication systems transmit continuous updates on avionics health, atmospheric conditions, and structural load to ground-based operations centers. Similarly, in the UAV Telemetry Equipment Market, they allow for remote piloting, real-time video relay, and coordinated strike or reconnaissance missions. These systems are also instrumental in supporting satellite telemetry in the Space Telemetry Market, where they facilitate communication links across thousands of kilometers between spacecraft and Earth-based stations.

Furthermore, aerospace communication systems are central to advancements in the Real-Time Telemetry Solutions Market, offering encrypted, low-latency, and fault-tolerant data transmission frameworks. The integration of AI and edge computing enhances these systems’ capability to prioritize data, conduct onboard analytics, and provide early warnings. Their adaptability across rotary and fixed-wing aircraft, LEO satellites, and suborbital launch vehicles ensures a broad application footprint. Given their ability to support high-speed, reliable, and mission-specific communication protocols, aerospace communication systems remain the most valuable and dominant telemetry application in the aerospace sector.

The Global Aerospace Telemetry Systems Market Report is segmented on the basis of the following

By Component

- Transmitters

- Receivers

- Antennas

- Data Acquisition Units

- Sensors & Actuators

- UAV Telemetry Modules

By Telemetry Type

- Radio Telemetry

- Satellite Telemetry

- Wireless Telemetry

- Wired Telemetry

- Real-Time Telemetry Systems

By Communication System

- Ground-to-Air Communication

- Satellite-Based Communication

- Air-to-Air Communication

- Secure Defense Communication Networks

By Platform

- Ground Stations

- Airborne Platforms

- Space Platforms

- Naval & Marine Systems

- Weapon Systems

By Application

- Aerospace Communication Systems

- Spacecraft & Satellite Missions

- Aircraft Health & Flight Monitoring

- Unmanned Aerial Vehicles (UAVs)

- Missiles and Guided Weapons

Global Aerospace Telemetry Systems Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the Aerospace Telemetry Systems Market as it commands over 38.2% of total market revenue by the end of 2025, due to its robust aerospace and defense infrastructure, long-standing government investments, and technological leadership in avionics, satellite telemetry, and missile testing. The United States, home to NASA, the Department of Defense (DoD), and major aerospace primes such as Lockheed Martin, Northrop Grumman, and Raytheon, allocates a significant portion of its federal budget to aerospace R&D. These investments drive the demand for advanced real-time telemetry solutions, particularly in missile defense, hypersonic vehicle development, and space exploration missions.

The region has extensive telemetry ground station networks and command centers that enable seamless aerospace communication systems and aircraft monitoring systems. The U.S. Air Force and Navy also operate highly specialized UAV telemetry systems, boosting the UAV telemetry equipment market. Additionally, the integration of telemetry systems into commercial aircraft for predictive maintenance and performance tracking further expands market penetration. The region’s early adoption of AI, secure communication protocols, and edge telemetry analytics gives it a strategic advantage, making North America the undisputed leader in global aerospace telemetry systems deployment and revenue share.

Region with the Highest CAGR

The Asia-Pacific region is projected to register the highest CAGR in the Aerospace Telemetry Systems Market, driven by a surge in indigenous aerospace programs, rising defense budgets, and rapid modernization of military communication networks. Countries such as China, India, Japan, and South Korea are aggressively expanding their satellite constellations, space launch programs, and UAV fleets, creating high demand for space telemetry and UAV telemetry equipment.

China’s focus on developing reusable launch vehicles and deep-space exploration, along with India’s ISRO missions and DRDO missile telemetry projects, further accelerates regional market growth. Japan’s investments in civilian aircraft telemetry and real-time monitoring systems also contribute to technological diversification. Moreover, growing regional tensions and border surveillance needs have prompted strategic investments in ground-to-air communication systems for defense applications.

The influx of private aerospace startups and manufacturing capabilities, particularly in China and India, supports local telemetry component production. These factors, combined with a supportive regulatory and innovation ecosystem, position Asia-Pacific as the fastest-growing market globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Aerospace Telemetry Systems Market: Competitive Landscape

The Global Aerospace Telemetry Systems Market features a competitive landscape dominated by major defense contractors, aerospace OEMs, and specialized telemetry solution providers. Leading companies such as Lockheed Martin Corporation, Northrop Grumman, BAE Systems, L3Harris Technologies, and Raytheon Technologies are at the forefront, offering integrated telemetry subsystems for missiles, aircraft, satellites, and UAVs. These firms benefit from longstanding government contracts, particularly with agencies such as NASA, DoD, and ESA, ensuring a continuous pipeline of advanced aerospace projects.

Mid-sized firms and niche technology providers contribute to innovation through modular telemetry components such as rugged transmitters, encryption-enabled receivers, and AI-enhanced signal processors. Companies like Curtiss-Wright and Safran Data Systems are renowned for their precision instrumentation and data acquisition solutions. In the commercial space sector, organizations such as SpaceX and Blue Origin are also developing in-house telemetry systems to support launch vehicle recovery and satellite health monitoring.

M&A activities, strategic defense contracts, and international collaborations are shaping the market, with increasing investments in next-generation real-time telemetry solutions, cybersecurity, and cloud-based ground station networks. The competitive landscape is also being influenced by growing participation from Asia-Pacific and European players, intensifying innovation and cost competition in the global telemetry ecosystem.

Some of the prominent players in the Global Aerospace Telemetry Systems Market are

- Lockheed Martin Corporation

- L3Harris Technologies, Inc.

- Honeywell International Inc.

- General Dynamics Corporation

- Thales Group

- BAE Systems plc

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Leonardo S.p.A.

- Cobham Limited

- Curtiss-Wright Corporation

- Safran S.A.

- Teledyne Technologies Incorporated

- Maxar Technologies Inc.

- Orbit Communications Systems Ltd.

- Kongsberg Gruppen ASA

- Kratos Defense & Security Solutions, Inc.

- Ultra Electronics Holdings plc

- Moog Inc.

- AstroNova Inc.

- Other Key Players

Recent Developments in the Global Aerospace Telemetry Systems Market

- April 2025: Lockheed Martin and Northrop Grumman announced a new collaboration to develop an advanced telemetry and data acquisition system for missile defense programs. This system will enhance real-time data analysis and improve tracking accuracy for hypersonic weapons.

- March 2025: NASA successfully tested its new telemetry system for the Artemis mission, which aims to return humans to the moon. The system is designed for high-frequency data transmission between the lunar surface and Earth, supporting real-time mission tracking and crew health monitoring.

- January 2025: L3Harris Technologies launched a next-generation telemetry system capable of real-time analytics for UAVs and aircraft. The system integrates AI-based predictive maintenance capabilities, enabling better aircraft health monitoring.

- December 2024: The Indian Space Research Organisation (ISRO) completed the successful deployment of its newly developed satellite telemetry system, designed to monitor the health and performance of its upcoming deep-space exploration missions.

- November 2024: Boeing unveiled a new telemetry platform that integrates satellite, UAV, and manned aircraft telemetry systems into a unified communication framework. This platform aims to improve overall operational efficiency across both commercial and defense sectors.

Investments in the Aerospace Telemetry Systems Market

- April 2025: Raytheon Technologies invested $100 million to enhance its aerospace telemetry solutions for defense applications. The investment will fund the development of secure, high-bandwidth telemetry systems for next-generation hypersonic missiles and aircraft.

- March 2025: SpaceX made a strategic investment in AI-driven telemetry analytics technology to improve the efficiency of its satellite constellation and crewed missions. This investment is part of SpaceX’s ongoing mission to reduce operational costs and enhance performance monitoring.

- January 2025: Northrop Grumman announced a $50 million investment to expand its telemetry infrastructure, which will include enhanced satellite telemetry systems and ground-based data centers to support future space exploration missions.

- December 2024: China’s government-backed aerospace initiatives allocated a $75 million investment towards the development of indigenous telemetry systems to support its growing space and UAV programs, including satellite communications and real-time flight data transmission.

- November 2024: BAE Systems announced a significant investment to modernize its telemetry systems for military applications. The investment will focus on improving the data acquisition and transmission capabilities for advanced missile defense and UAV operations.

Collaborations in the Aerospace Telemetry Systems Market

- April 2025: Lockheed Martin and Airbus collaborated to develop a cross-platform telemetry system aimed at enhancing satellite-to-aircraft communication. This collaboration integrates aerospace telemetry systems to provide seamless data exchange between air and space platforms.

- March 2025: Thales Group and L3Harris Technologies signed a strategic partnership agreement to develop advanced real-time telemetry solutions for defense applications, including secure satellite and UAV telemetry systems for military use.

- January 2025: The European Space Agency (ESA) and the Indian Space Research Organisation (ISRO) entered into a collaborative agreement to exchange telemetry technologies and support joint missions for satellite communications and space exploration.

- December 2024: The U.S. Department of Defense (DoD) and Boeing formed a joint venture to accelerate the development of secure defense communication networks and next-generation telemetry systems for hypersonic weapons testing.

- November 2024: Raytheon Technologies and the U.S. Air Force collaborated on a cutting-edge telemetry project focused on enhancing missile performance tracking and monitoring using advanced satellite telemetry systems.

Expos/Conferences in the Aerospace Telemetry Systems Market

- April 2025: The Aerospace Telemetry and Communications Expo 2025, held in Washington, D.C., showcased the latest innovations in satellite telemetry and real-time telemetry solutions. Key players such as L3Harris Technologies and Lockheed Martin presented their new advancements in defense telemetry systems.

- March 2025: The Global Aerospace Technology Conference held in Los Angeles included a series of workshops and discussions on the evolution of aircraft monitoring systems and next-gen telemetry integration across military and civilian aerospace sectors.

- January 2025: The Space and Aerospace Innovation Summit in London highlighted breakthroughs in space telemetry systems and the integration of AI-driven telemetry analytics for UAV telemetry equipment and aircraft health monitoring systems.

- December 2024: The International Aerospace & Defense Telemetry Symposium held in Berlin brought together industry leaders to discuss emerging trends in wireless telemetry systems and secure defense communication networks.

- November 2024: The Aerospace Industry Expo in Tokyo focused on the latest telemetry systems for UAVs, missiles, and spacecraft. Several cutting-edge companies, including Japan Aerospace Exploration Agency (JAXA), showcased advancements in space and aircraft telemetry.

Mergers in the Aerospace Telemetry Systems Market

- April 2025: Raytheon Technologies and Honeywell Aerospace announced a merger to create a new division focused on developing the next generation of aerospace telemetry systems and advanced real-time telemetry solutions for defense and space applications.

- March 2025: Northrop Grumman and L3Harris Technologies merged their telemetry and satellite communication divisions, consolidating expertise in ground-to-air communication and expanding their footprint in the defense and aerospace sectors.

- January 2025: Boeing acquired the telemetry division of Rockwell Collins, expanding its capabilities in aircraft monitoring systems and strengthening its market position in aerospace communication systems for both military and commercial applications.

- December 2024: Curtiss-Wright Corporation merged with Safran Data Systems to combine their strengths in data acquisition units and telemetry sensors & actuators, providing a comprehensive range of solutions for aerospace, defense, and space applications.

- November 2024: Airbus and Thales Group completed a merger to form a joint venture aimed at developing advanced satellite telemetry systems and secure communications platforms for aerospace and space exploration.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1,612.3 Mn |

| Forecast Value (2034) |

USD 3,032.1 Mn |

| CAGR (2025–2034) |

7.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 518.0 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Transmitters, Receivers, Antennas, Data Acquisition Units, Sensors & Actuators, UAV Telemetry Modules), By Telemetry Type (Radio Telemetry, Satellite Telemetry, Wireless Telemetry, Wired Telemetry, Real-Time Telemetry Systems), By Communication System (Ground-to-Air Communication, Satellite-Based Communication, Air-to-Air Communication, Secure Defense Communication Networks), By Platform (Ground Stations, Airborne Platforms, Space Platforms, Naval & Marine Systems, Weapon Systems), By Application (Aerospace Communication Systems, Spacecraft & Satellite Missions, Aircraft Health & Flight Monitoring, Unmanned Aerial Vehicles (UAVs), Missiles and Guided Weapons) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Lockheed Martin, L3Harris, Honeywell, General Dynamics, Thales, BAE Systems, Northrop Grumman, Raytheon, Leonardo, Cobham, Curtiss-Wright, Safran, Teledyne, Maxar, Orbit Communications, Kongsberg, Kratos Defense, Ultra Electronics, Moog, AstroNova., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the Global Aerospace Telemetry Systems Market?

▾ The Global Aerospace Telemetry Systems Market size is estimated to have a value of USD 1,612.3 million in 2025 and is expected to reach USD 3,032.1 million by the end of 2034.

What is the size of the US Aerospace Telemetry Systems Market?

▾ The US Aerospace Telemetry Systems Market is projected to be valued at USD 518.0 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 940.9 million in 2034 at a CAGR of 6.9%.

Which region accounted for the largest Global Aerospace Telemetry Systems Market?

▾ North America is expected to have the largest market share in the Global Aerospace Telemetry Systems Market, with a share of about 38.2% in 2025.

Who are the key players in the Global Aerospace Telemetry Systems Market?

▾ Some of the major key players in the Global Aerospace Telemetry Systems Market are Lockheed Martin, L3Harris, Honeywell, General Dynamics, Thales, BAE Systems, Northrop Grumman, Raytheon, Leonardo, Cobham, and many others.

What is the growth rate in the Global Aerospace Telemetry Systems Market in 2025?

▾ The market is growing at a CAGR of 7.3 percent over the forecasted period of 2025.