As we move into 2024, the agricultural adjuvants market presents significant growth opportunities. Big players in the market, such as BASF, Dow Chemical, and Syngenta, are focused on expanding their product offerings by investing in research and development to develop more effective, environmentally friendly, and sustainable adjuvants. These companies have the resources to enhance product innovation, improve formulations, and meet the evolving regulatory standards for agricultural chemicals.

Startups can explore opportunities by creating adjuvants that support biopesticides, focusing on environmentally-conscious solutions, or leveraging digital technologies to improve the application and effectiveness of agricultural chemicals. The growth of

precision farming and the increasing need for higher crop yields amid global food security concerns offer ample opportunities for new entrants to thrive.

A combination of regulatory changes, consumer preferences, and technological advancements shapes key trends in the agricultural adjuvants market. One significant trend is the rising demand for sustainable farming practices, which has prompted the development of eco-friendly adjuvants that reduce environmental impact.

Governments worldwide are tightening regulations on pesticide usage and promoting sustainable farming solutions, which has led to increased demand for adjuvants that improve the efficiency and safety of chemical applications. These regulations also affect related segments like the

agricultural ventilation fans, which is essential for maintaining ideal environmental conditions in greenhouses and livestock areas where chemical applications are common.

In terms of market data, countries in Europe and beyond are seeing increasing pesticide consumption, which directly impacts the demand for agricultural adjuvants. For instance, in Estonia, a significant amount of pesticides, 713.5 tonnes, were placed on the market in 2023.

Similarly, in France, Spain, and Germany, large quantities of herbicides, fungicides, and insecticides are sold each year, with France alone seeing 64,000 tonnes sold in 2022. Such statistics highlight a growing market for crop protection products, and as these products require the use of adjuvants, the agricultural adjuvants market is positioned for continued growth, especially in regions with robust agricultural practices.

The increasing pesticide usage in markets like Estonia and Latvia indicates that there is ample opportunity for suppliers and businesses to capitalize on this rising demand by offering innovative adjuvant solutions that complement pesticide use and improve agricultural productivity.

Agricultural adjuvants Market Key Takeaways

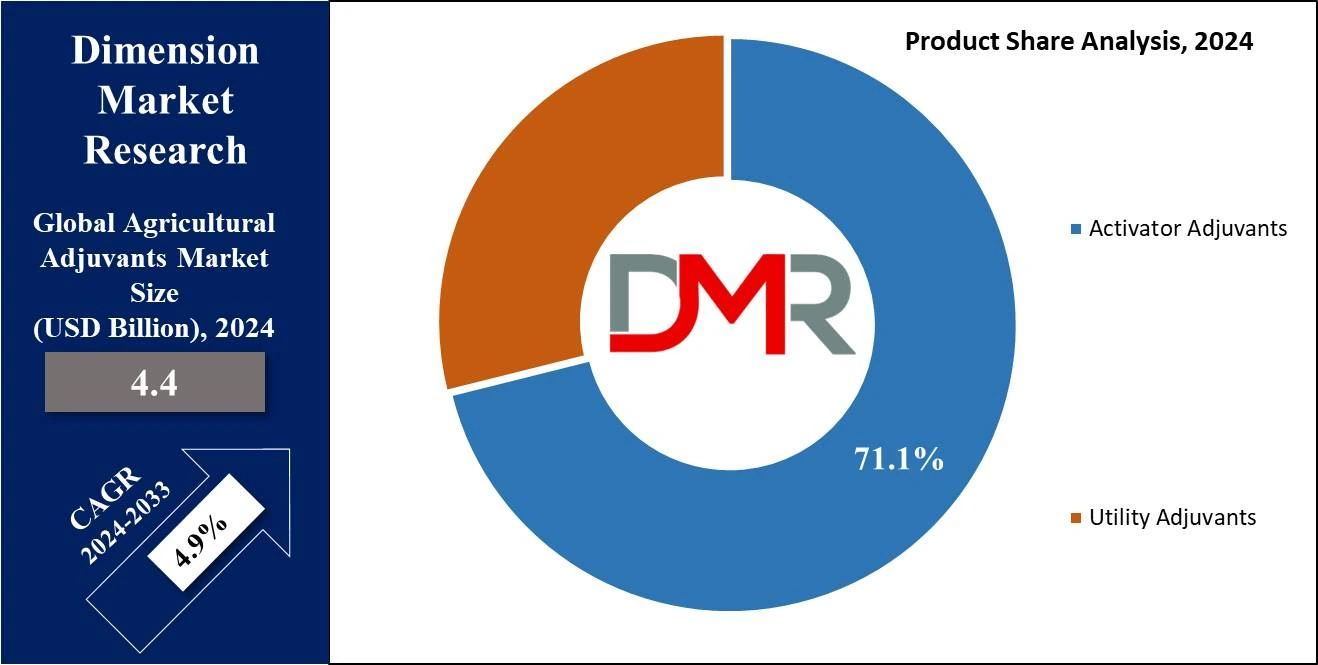

- The Global Agricultural Adjuvants Market size is expected to reach USD 6.8 billion by the end of 2033.

- Asia Pacific is projected to have the largest market share for the Global Agricultural Adjuvants Market with a share of about 38.1% in 2024.

- The market is growing at a CAGR of 4.9 percent over the forecasted period.

- Activator adjuvants are expected to dominate the agricultural adjuvant market in the context of products as they hold 71.1% of the market share in 2024.

- Suspension concentrates are projected to command the agricultural adjuvants market on the basis of adjuvant formulation by the end of 2024.

- Herbicides are projected to dominate this market in terms of application with 51.3% of market share in 2024 due to their extensive use in modern agriculture practices.

Agricultural adjuvants Market Use Cases

- Enhance Effectiveness: Agricultural adjuvants enhance the effectiveness of insecticides, herbicides, and fungicides by aiding their dispersion, adhesion, & penetration.

- Reduce Drift: Adjuvants help decrease spray flow during software, making sure that agrochemicals attain goal regions while minimizing environmental contamination.

- Improve Coverage: They do the uniform distribution of agrochemicals on plant surfaces, maximizing their insurance & absorption property for more advantageous pest and weed manipulation.

- Extend Residual Activity: Adjuvants can lengthen the residual activity of agrochemicals, growing their sturdiness and efficacy in protective plants in opposition to pests, illnesses, and weeds.

- Optimize Compatibility: Agricultural adjuvants help in enhancing the compatibility between exclusive agrochemical formulations, improving their effectiveness while implemented together.

Agricultural adjuvants Market Dynamic

The global agricultural adjuvant marketplace is laid low with a range of things however the major aspect that is pushing the growth of this marketplace as well as emerging as the primary challenge is the adoption of herbicide-resistant genetically modified crops. This vegetation is not tormented by herbicides which push the need for agricultural adjuvants and push the growth of this marketplace.

Another aspect that is pushing the growth of the adjuvants marketplace is the rise in international population that's immediately proportional to the rising need for food production which pushes the demand for the agrochemicals like herbicides, pesticides, and fungicides.

The upward push in the need for agrochemicals additionally pushes the increase of this market as it's far used to enhance the efficacy of the agrochemicals. Precision agriculture techniques are gaining traction worldwide due to their functionality to optimize input usage, enhance crop yields, and decrease environmental impact.

Agricultural adjuvants play a critical characteristic in precision agriculture by improving the efficacy and overall performance of agrochemicals, thereby supporting the adoption of this technology. These precision practices often work in conjunction with developments in the

Agricultural Inoculants and innovations in agricultural ventilation fans market that help regulate growing conditions in smart farms and controlled environments.

Research Scope and Analysis

By Product

Activator adjuvants are expected to dominate the agricultural adjuvant market in the context of products as

they hold 71.1% of the market share in 2024.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In this sector, activator adjuvants are significantly prevalent mainly due to their pivotal assistance in boosting the action and result of agrochemicals. Surfaced adjuvants and oil-infused adjuvants are the principal forms within the spectrum of activator adjuvants.

Surfaced adjuvants, a specific category within activator adjuvants, are elements that diminish surface tension & enhance the dampening, distribution, and absorption of agrochemicals on plant exteriors.

They are instrumental in assuring consistent coating and incorporating of pesticides, herbicides, and fungicides, as a result, escalating their efficiency in tackling pests, unwanted vegetation, and ailments. Oil-infused adjuvants, which form another variation of activator adjuvants, are composed of petroleum-derived or vegetable-sourced oils.

These adjuvants augment the intrusion of agrochemicals through the plant's outer layer, thereby enriching their assimilation and movement across the plant. Furthermore, oil-infused adjuvants also contribute to lowering evaporation and extending the residual activity of agrochemicals.

By Source

Petroleum-based agricultural adjuvants dominate this market based on source as they hold the highest market share in 2024. Their dominance can be due to their easy availability, reliability, and low cost. For large-scale production of the agricultural adjuvant, petroleum-based raw materials are the primary choice as they are readily available on a large scale.

Furthermore, adjuvants derived from petroleum frequently provide outstanding results, including exceptional dissolving capabilities, harmony with diverse types of agricultural chemicals, and resilience in different environmental scenarios. These qualities are the reason for their popular usage and endorsement by both agriculturalists and producers of agrochemicals.

By Formulation

Suspension concentrates are projected to command the agricultural adjuvants market based on adjuvant formulation by the end of 2024. The versatile and easy-to-use nature of suspension concentrates is the primary reason behind its dominance in this segment. In this formulation, the active ingredients are mixed in the liquid medium which results in a stable suspension.

The suspension concentrates can be used in spray solutions after diluting with water. This simple application method of the suspension concentrates plays a major reason behind their dominance in the formulation segment.

Additionally, SCs are ideal for transportation and long storage due to their physically stable property which prevents the sedimentation of active ingredients. This property plays a major factor in their popularity as it ensures their consistent performance and effectiveness.

By Application

Herbicides are projected to dominate this market in terms of application with 51.3% of market share in 2024 due to their extensive use in modern agriculture practices. Herbicides are used to control weeds that compete with other crops for basic nutrients, water & sunlight to survive.

The primary function of herbicides is to improve and penetrate the tissue of plants so they can grow at a good speed without being affected by weeds, but in some cases, they are not that effective. For such instances, the adjuvants play a crucial role as when they are mixed with the herbicides they improve their tissue adhesion properties.

Also, the extensive use of herbicide-resistant genetically modified crops has further boosted the demand for adjuvants to use with herbicides for agriculture purposes. Consequently, the dominance of herbicides inside the agricultural adjuvants marketplace is pushed through their vital role in weed control and crop protection, making them integral additives of present-day farming practices.

The Agricultural Adjuvants Market Report is segmented on the basis of the following

By Product

Surfactants

Oil-based Adjuvants

Compatibility Agents

Drift Control Agents

Buffering Agents

Water Conditioning Agents

Others

By Source

- Petroleum-based

- Bio-based

By Formulation

- Suspension Concentrates

- Emulsifiable Concentrates

By Application

- Herbicides

- Insecticides

- Fungicides

- Others

Regional Analysis

Asia Pacific is projected to dominate the global agricultural adjuvants market with

38.1% of the market share by the end of 2024. This region has various developing countries like India, China, and Japan which are known for their extensive agricultural landscape that is pushing the demand for agricultural adjuvants in this region.

The speedy industrialization in this place is pushed with the aid of technological advances inside the agriculture region wherein farmers are adopting modern farming practices. Growth in adjacent sectors such as the

Agricultural Films And Bonding and Agricultural Inoculants Market is also contributing to the broader regional transformation of farming infrastructure and crop productivity enhancement.

The increase and adoption of such technology are pushing the increase of this marketplace in this region. This region has various supportive government policies that encourage the adoption of agricultural adjuvants to improve their crop yield, which is driving the growth of this market. This region acts as the center of agriculture and is famous for various local crops, which gives manufacturers another opportunity to develop products that are specific to the crop.

The mixture of a large agricultural base, developing demand for food, supportive policies, and technological improvements positions the Asia-Pacific place as a dominant force within the worldwide agricultural adjuvants market. Additionally, insights from the united states agricultural adjuvants market further emphasize the global relevance and application of these solutions across key agricultural economies.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Agricultural adjuvants Market Competitive Landscape

The competitive situation of the agricultural adjuvants is noticeably aggressive with the presence of diverse essential producers like BASF SE, DowDuPont Inc., Solvay S.A., Clariant AG, Evonik Industries AG, Croda International Plc, Huntsman Corporation, Nufarm Limited, Helena Agri-Enterprises LLC and others. The growth of this marketplace is pushed through non-stop research for the development of greater advanced adjuvants so that you can enhance the performance of the agrochemical.

This marketplace is relatively tormented by different factors like regulatory regulations, sustainability projects, and the shift in purchaser desire. Companies put money into research and development to introduce new products that meet the converting wishes of farmers and agribusinesses. Regional gamers and niche corporations additionally make contributions to the market's dynamism, fostering opposition and riding innovation in addition.

Some of the prominent players in the Global Agricultural Adjuvants Market are

- Clariant AG

- Solvay SA

- The Dow Chemical Company

- Huntsman International LLC

- Evonik Industries AG

- Ingevity

- Nufarm Limited

- Corteva Agriscience

- Croda International PLC

- BASF SE

- Miller Chemical & Fertilizer, LLC.

- Helena Chemical Company

- Winfield United

- Wilbur-Ellis Holdings, Inc.

- Stepan Company

- Other Key Players

Recent Development

- In February 2024, Attune Agriculture's Ampersand adjuvant enhanced soil-applied pesticides' effectiveness which boost its control over pests and diseases, backed by research trials showing significant improvements.

- In December 2023, The Brazilian Association of Agricultural Adjuvant Manufacturers (APLICA) aims to enhance the industry through collaboration, certification, & innovation.

- In August 2023, Botanical Solution Inc. secured a $7 million investment to scale up QS-21 vaccine adjuvant production, gratifying agreements with Croda and expanding Quillibrium biofungicide.

- In February 2023, HAL Investments invested €140 million in Koppert, a leader in agricultural biological solutions, to boost global expansion and enhance research and development for sustainable agriculture.

- In January 2023, Lavoro, Brazil’s largest agricultural input retailer, acquired a majority stake in Cromo Química, aiming to strengthen Crop Care’s position in the agricultural enhancers market.