Agricultural Biologicals are natural products derived from plants, animals, bacteria, or minerals used to enhance crop health and productivity. The Agricultural Biologicals market encompasses biopesticides, biostimulants, and biofertilizers. This sector represents a transformative approach to crop protection and yield enhancement, focusing on sustainability and minimizing ecological footprints.

In 2024, the Agricultural Biologicals market is poised for significant expansion. Growth opportunities are abundant, driven by increasing regulatory support for sustainable farming practices and rising consumer preference for organic products. For major industry players, leveraging advanced biotechnological research to develop efficacious and targeted biologicals will be crucial.

These enterprises can scale up production capabilities and expand their product portfolios to meet the diverse needs of large-scale operations. Meanwhile, new and entry-level businesses can carve out niches by specializing in regional crop needs or emerging biocontrol technologies. Collaborations with local agricultural communities and investment in community education programs can amplify their market presence and facilitate entry into competitive markets.

The Agricultural Biologicals market is also characterized by a fast-evolving regulatory landscape that encourages the use of environmentally friendly farming solutions. Small to medium-sized enterprises (SMEs) can exploit this by aligning with regulatory standards and focusing on the localized production of biologicals that cater to specific regional pests and soil conditions. These companies should focus on building robust distribution networks and forming strategic alliances with larger corporations to leverage their research and development capabilities.

Key trends shaping the Agricultural Biologicals market include technological innovation, the localization of product applications, and strategic industry alliances. Technological advancements in bioformulation and the genetic enhancement of microbial strains are increasing the efficacy and shelf-life of biological products.

This enhances their appeal compared to traditional chemical pesticides. Localization addresses specific regional challenges such as pest resistance and soil degradation, tailoring solutions to enhance adoption rates and effectiveness.

Another significant trend is the increase in strategic collaborations and acquisitions among companies to consolidate expertise and expand market reach. These partnerships are crucial for sharing technological, logistical, and market-oriented resources, thus speeding up the introduction of innovative products into the market.

Furthermore, sustainability initiatives driven by consumer demand and regulatory frameworks are pushing companies to adopt practices that contribute positively to environmental conservation, influencing product development and marketing strategies.

Supporting these observations are several compelling statistics. A 2023 survey by CropLife® magazine highlighted that biofertilizers have grown their market share among row crop growers from 30% in 2018 to 50% in 2023, and biostimulants usage has increased from 60% to 73% over the same period. However, it's noteworthy that biopesticides have seen a decline from 31% in 2018 to 19% in 2023, signaling a shift in grower preferences or possibly indicating areas requiring technological enhancement.

Globally, the market for plant biostimulants is experiencing robust growth, with a reported annual increase of 14%, reaching approximately USD 3.7 billion in 2022. This surge underscores the expanding scope and acceptance of these products in sustainable agriculture practices.

Additionally, data from the USDA reveals that over 165 million acres of U.S. cropland are plagued with resistant weeds, emphasizing the need for effective and sustainable weed management solutions that Agricultural Biologicals can provide. Furthermore, nearly 50% of Brazilian farmers are utilizing these biological products, showcasing Brazil as a leader in adopting agricultural biological technologies.

These data points underline the dynamic growth and adaptability of the Agricultural Biologicals market. As industry leaders or emerging businesses, aligning strategies with these trends and statistics will facilitate competitive advantages and sustainable growth in this burgeoning sector. Our team is equipped to guide you through these opportunities with comprehensive market insights and strategic advice tailored to your specific needs.

Key Takeaways

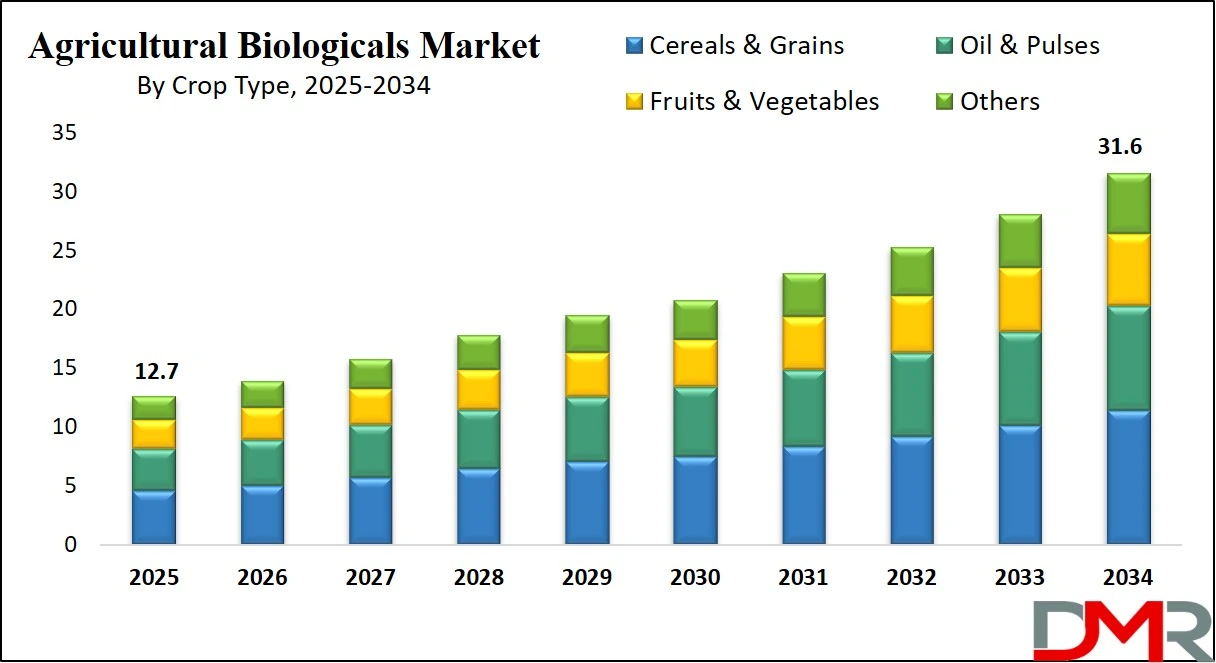

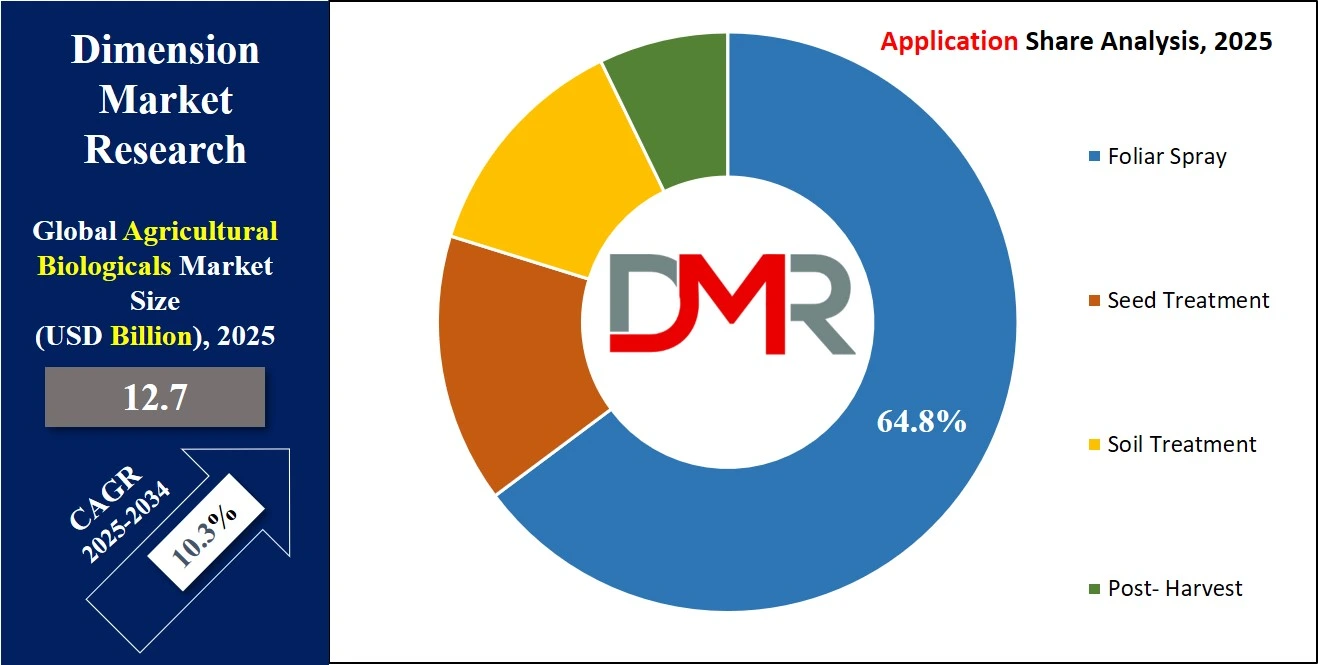

- The Agricultural Biologicals Market size is expected to grow by 31.6 Billion, at a CAGR of 10.3% during the forecasted period of 2025 to 2034.

- The cereals & grains segment is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- Crop protection is expected to lead the Agricultural Biologicals market in 2024

- The seed treatment segment is expected to get the largest revenue share in 2024 in the Agricultural Biologicals market.

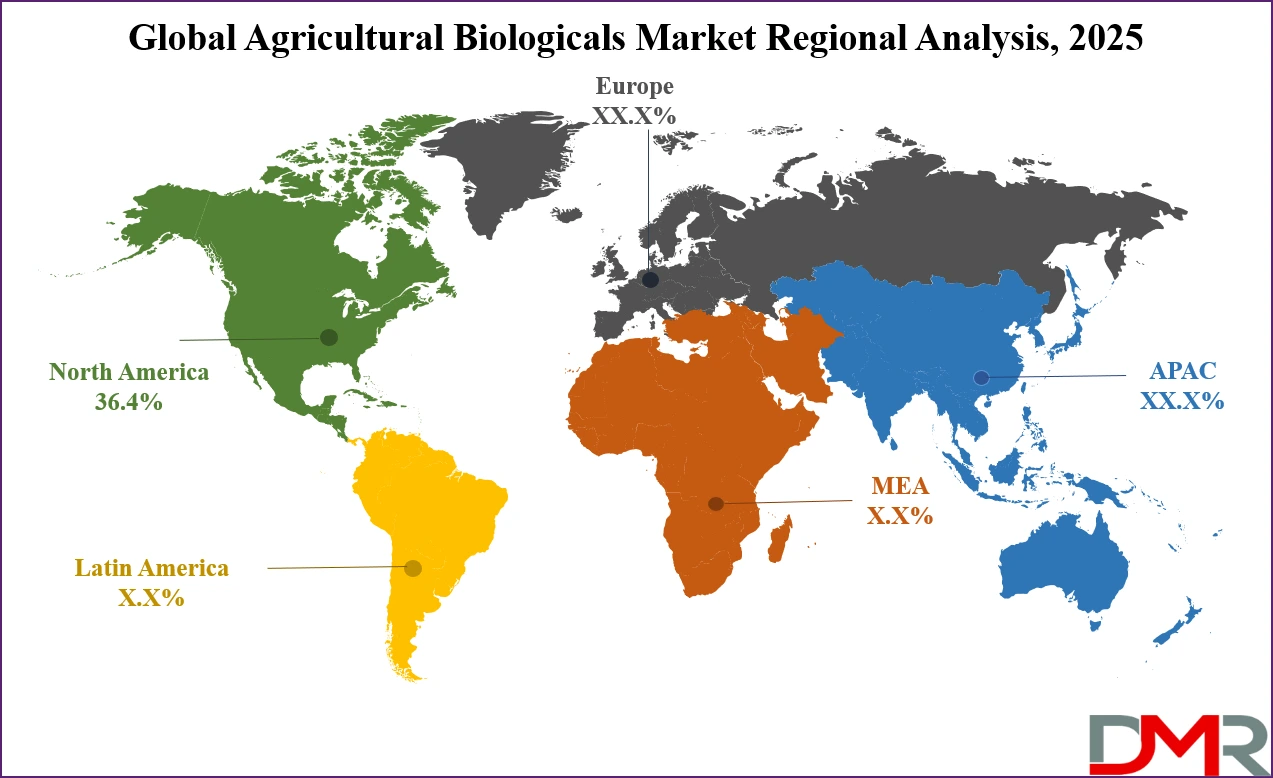

- North America is expected to hold a 36.4% share of revenue in the Global Agricultural Biologicals Market in 2024.

Use Cases

- Soil Health Improvement: Agricultural biologicals are used to improve soil health by promoting beneficial microbial activity, enhancing nutrient availability, and reducing soil degradation, thereby supporting sustainable agriculture practices.

- Pest and Disease Management: Biologicals serve as essential alternatives to synthetic pesticides and insecticides, controlling pests and diseases through the use of naturally occurring organisms or biochemicals, minimizing chemical residues in crops, and minimizing environmental impact.

- Seed Treatment: Agricultural biologicals are applied during seed treatment to improve seed germination, improve seedling vigor, and provide protection against soil-borne pathogens, contributing to higher crop yields & healthier plants.

- Post-Harvest Preservation: Biologicals play an important role in post-harvest preservation by controlling spoilage organisms, extending shelf life, and minimizing post-harvest losses, ensuring higher quality produce and better marketability for farmers.

Market Dynamic

Driving Factors

Environmental Sustainability

Increasing concerns regarding environmental degradation & the adverse effects of chemical-intensive agricultural practices are driving the need for agricultural biologicals. These products provide eco-friendly alternatives, minimizing chemical residues in soil and water, lowering harm to non-target organisms, and supporting biodiversity conservation.

Regulatory Support and Government Initiatives

Governments across the globe are implementing regulations to promote the use of agricultural biologicals, incentivizing farmers to adopt these products through subsidies, grants, & research funding. Initiatives aiming at sustainable agriculture, organic farming, and minimizing chemical inputs further drive the growth of the agricultural biologicals market.

Opportunities

Market Expansion in Developing Regions

A rise in awareness about the benefits of agricultural biologicals, along with growing government support for sustainable agriculture practices, provides major opportunities for market expansion in developing regions. Growth in adoption rates in countries with large agricultural sectors, like India, China, Brazil, and parts of Africa, provides substantial growth potential for agricultural biologicals manufacturers and suppliers.

Technological Advancements

Current R&D efforts are leading to the discovery of new microbial strains, innovative formulations, and advanced delivery systems for agricultural biologicals. These technological developments improve product efficacy, expand application options, and enhance compatibility with existing farming practices, driving further adoption and market growth globally.

Restraints

Limited Efficacy and Consistency

One restraint faced by the global agricultural biologicals market is the variability in efficiency and consistency of these products in comparison to traditional chemical inputs. Biologicals may not always provide consistent results around different environmental conditions or pest pressures, causing uncertainty among farmers about their reliability & effectiveness.

High Cost and Limited Availability

Agricultural biologicals mostly come with higher initial costs in comparison to conventional chemical inputs, making them less accessible to smallholder farmers or those operating on tight budgets. In addition, the availability of agricultural biologicals may be limited in certain regions, mainly in remote or underdeveloped areas, due to challenges in production, distribution, and market access. These factors can impact broad adoption and market penetration of agricultural biologicals.

Trends

Increasing Demand for Sustainable Agriculture

There is a major trend towards sustainable agriculture practices globally, driven by concerns over environmental degradation, food safety, and consumer preferences. Agricultural biologicals, with their eco-friendly nature and reduced environmental impact, are experiencing rising demand as farmers look for alternatives to conventional chemical inputs.

Technological Innovation and Product Development

Current developments in biotechnology and microbiology cause the development of new agricultural biological products with better efficacy, stability, and application methods. These innovations like new microbial strains, biostimulants, and biopesticides, along with advanced delivery systems and formulations, contributed to the expansion and diversification of the agricultural biologicals market.

Research Scope and Analysis

Crop Type Analysis

The cereals & grains segment will dominate the global agriculture biologicals market with a significant share in 2024, which can be accredited to the increasing global demand for wheat, corn, rice, barley, & millet. Moreover, developments in microbiology have resulted in determining the appropriate & accurate composition of agricultural biologicals for wheat cultivation, resulting in the growth in demand for biologics & driving segment growth.

Cultivation of cereals & grains requires a considerable quantity of many biologics, mainly biofertilizers, to ensure healthy crop growth. Studies done globally have shown that Azotobacter inoculation highly enhances cereal & grain crops' development by limiting their nitrogen needs. Furthermore, the effective growth of wheat is achieved via the use of phosphate solubilizing bacteria & Azotobacter inoculation as highly effective biofertilizers, leading to enhanced crop yield.

In several developing agricultural economies, including Japan, India, Indonesia, Thailand, and various Latin American countries, the need for technology related to agricultural-based product development is growing, which is aimed at boosting the growth of pulses and oilseeds to meet the rapidly growing demand in these regions.

The symbiotic performance of strain efficiency and host genotype highly influences the growth of pulses, directly impacting their yield. Agricultural organizations are taking measures to ensure high microbial strain testing to enhance pulse and oilseed production, which is expected to drive the need for many biological agents in this domain significantly during the forecast period.

Function Analysis

As a function, crop protection, primarily biopesticides is expected to command the largest share of the global agricultural biologicals market. Their dominance is expected to persist, driven by steady growth during the forecasted period, driven notably by higher adoption in foliage & soil management, mainly in Europe and North America.

Key products like aromatic plants and insect sex pheromones are used for pest attraction and trapping. Additionally, microbial pesticides, like strains of Bt (Bacillus thuringiensis), are highly used for pest control, mainly in crops like Bt Cotton, altering insect pH levels upon consumption to effectively eliminate pests.

Further, biofertilizers, like Azotobacter, Rhizobium, and Azospirillum, play an important role in nitrogen fixation for seed and soil treatment. Rhizobium, known for its symbiotic relationship with leguminous plants, is vital for their cultivation, while Azotobacter's neutral nature makes it versatile in various crops.

These biofertilizers are set to gain importance globally, majorly in North America, Europe, and South Asia, with nitrogen-fixing and phosphate-solubilizing variants leading the pack. In the domain of crop nutrition, biostimulants derived from biological sources, like amino acids and humic acid, are emerging as vital additives. These substances not only improve crop productivity and flexibility to stress but also enhance physical attributes, supporting sustainable farming practices and higher yields.

Application Analysis

The seed treatment sector will dominate the agricultural biologicals market in 2024 due to the growth in the adoption of biologicals focused on improving seed quality and strengthening crop yields. Biofertilizers play an important role in both soil & seed treatments, providing eco-friendly alternatives to synthetic fertilizers & chemical pesticides, which have led to a decline in soil quality across agricultural economies.

Further, to deal with environmental concerns coming from higher chemical use in agriculture, governments in countries like India, China, and Pakistan have made initiatives to promote the use of eco-friendly seed treatment products. Like, Pakistan has implemented programs like the Biopower Program and Humiphos/Biophos to incentivize farmers to use biofertilizers for seed treatment, with financial assistance from agricultural agencies.

Also, among many microbial agents, strains of Metschnikowia pulcherrima emerge as prominent pest-control solutions for post-harvest procedures. The growing popularity of agricultural biologicals in post-harvest stages is driven by past instances of major crop losses, prompting farmers to look for effective solutions to reduce losses and drive demand for such products in the future.

The Agricultural Biologicals Market Report is segmented based on the following

By Crop Type

- Cereals & Grains

- Oil & Pulses

- Fruits & Vegetables

- Others

By Function

- Crop Nutrition

-

Biofertilizer

- Biostimulants

- Organic Fertilizer

- Crop Protection (Biocontrol Agents, and Biopesticides)

- Biopesticides

- Biocontrol Agents

By Application

- Foliar Spray

- Seed Treatment

- Soil Treatment

- Post- Harvest

By Source

- Microbials

- Natural products

- Macrobials

- Semiochemicals

Regional Analysis

North America will take the lead in the global agricultural biologicals market in 2024,

with a significant share of 36.4%. Also, the region is expected to continue expanding over the forecast years because of the presence of leading agricultural product manufacturers, with a maximum number of producers residing in the U.S. The growth is further driven by the constant evolution of agriculture-related practices in the region, including techniques, ongoing research & development, technological developments, and government policies encouraging sustainable & suitable farming procedures.

Also, the Asia Pacific region is anticipated to witness the fastest growth rate during the forecasted period, being a center-point for many agriculture-dependent economies like Thailand, India, Japan, South Korea, Malaysia, and the Philippines, which depend on sustainable agricultural practices. Moreover, this trend is supported by growth in customer choices for organically developed food, along with initiatives to reform & regulate through various governments.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The key manufacturers in the agricultural biologicals market are consistently prioritizing new product developments, partnerships, mergers and acquisitions, and collaborations to effectively reach a broad customer base at an optimal distribution cost.

Companies like Bayer and BASF SE are streamlining their operations throughout the value chain to maintain their market positions. Meanwhile, new entrants in the industry are focusing on the establishment of long-term contracts with local and regional farming communities to expand their market presence and establish a strong foothold in the market.

Some of the prominent players in the global Agricultural Biologicals Market are:

- BASF SE

- Bayer AG

- UPL

- Novozymes A/S

- Corteva Agriscience

- Agri life

- Agrinose Inc.

- Lallemand, Inc.

- Syngenta AG

- CBF China Biofertilizer AG

- Biolchim Spa

- Valent Biosciences LLC

- Pro Farm Group Inc.

- Other Key Players

Recent Developments

- In December 2023, Syngenta introduced CERTANO, a new biological nematicide designed for the entire sugarcane cultivation cycle. Representing Syngenta's expansion into the biological segment for sugarcane, it provides a complete solution against pests and diseases.

- In November 2023, Lavie Bio Ltd., an Evogene Ltd. subsidiary unveiled the expansion of its microbiome-based product, named Yalos, to contain durum & barley after successful 2023 field trials. Yalos improves soil, minimizes stress, and increases yields in small grains.

- In July 2023, Syngenta introduced Syngenta Biologicals by integrating Valagro, which it acquired in 2020, through its in-house biologicals business, which promotes global reach, innovation, and proprietary technology for rapid growth in the biologicals market.

- In May 2023, Dhanuka Agritech Ltd., one of the major Indian agri-input companies announced its entrance into the agri-biological sector with its BiologiQ product line, which blends traditional and modern agricultural methods for enhanced crop & soil benefits.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 12.7 Bn |

| Forecast Value (2034) |

USD 31.6 Bn |

| CAGR (2025-2034) |

10.3% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2025 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Crop Type (Cereals & Grains, Oil & Pulses, Fruits & Vegetables, and Others), By Function (Crop Nutrition, and Crop Protection), and By Application (Foliar Spray, Seed Treatment, Soil Treatment, and Post- Harvest). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

BASF SE, Bayer AG, UPL, Novozymes A/S, Corteva Agriscience, Agri life, Agrinose Inc., Lallemand, Inc., Syngenta AG, CBF China Biofertilizer AG, Biolchim Spa, Valent Biosciences LLC, Pro Farm Group Inc., and Other Key Players. |

| Purchase Options |

Physio-Control Inc., Schiller, Medtronic, Abbott, Boston Scientific Corporation, Koninklijke Philips N.V., Zoll Medical Corporation, BIOTRONIK, Progetti Srl, LivaNova Plc, and Other Key Players |