Market Overview

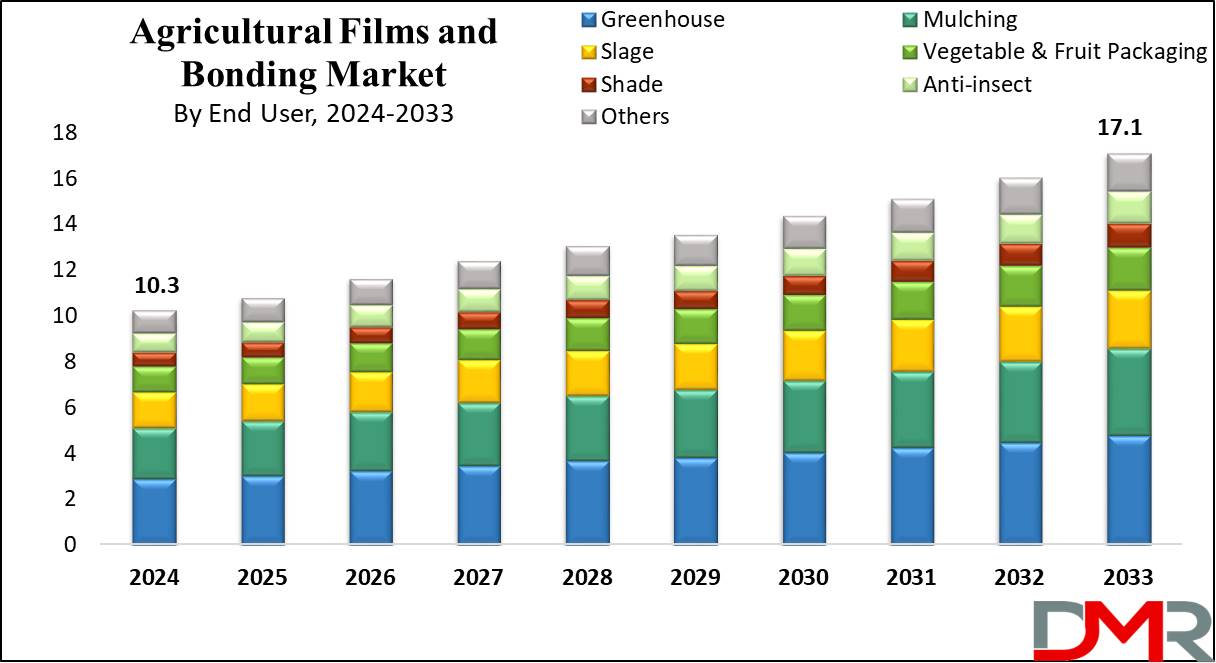

The Global Agricultural Films and Bonding Market is projected to reach a market value of USD 10.3 billion which will further be expected to reach USD 17.1 billion by 2033 at a CAGR of 5.8%.

Agricultural films refer to thin

plastic substances used in various agricultural applications, which include greenhouse covering, mulching, silage protection, and packaging. These films are generally crafted from polyethylene or other polymers and are designed to offer safety, insulation, and other benefits to plants and soil.

Bonding within the context of agriculture refers to the system of joining or sealing substances collectively using adhesives, tapes, or different bonding agents. Bonding is commonly utilized in agricultural applications for assembling

greenhouse structures, repairing plastic films, sealing silage baggage, and other purposes.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Agricultural inoculants and agricultural adjuvants—though distinct from films and bonding materials—play complementary roles in enhancing crop productivity and protection alongside these physical solutions. These biologically or chemically active products support plant health and efficiency, integrating well with sustainable farming practices that also rely on advanced plastic films and bonding technologies.

Key drivers include rising global food demand and sustainable farming solutions. Agricultural films help protect crops from pests, UV radiation and extreme weather conditions while bonding materials help control soil erosion control - these factors fueling market growth with both developed and emerging economies investing in such innovations.

Manufacturers and suppliers in this market can exploit its vast opportunities by offering eco-friendly solutions. There is increasing interest for biodegradable agricultural films and advanced bonding materials that contribute to sustainability, thanks to government incentives and rising awareness levels. With this backdrop, agricultural films market looks poised to capitalize on an upsurge of environmentally conscious farming practices.

Bonding market for agricultural applications was estimated to be worth USD 2.5 billion by 2022, growing at an annual compound annual growth rate (CAGR) rate of 5.4% between 2019-2023. Polyurethane- and silicone-based bonding materials continue to gain ground, accounting for 45% of market share respectively; Europe and North America together represent 40%. Technological advances and regulatory support of sustainable agriculture drive this market forward.

The agricultural films and bonding market offers significant opportunities in sustainable solutions, such as biodegradable films and eco-friendly bonding materials. As demand for efficient crop protection and climate-resilient farming increases, innovations in smart films and adhesives that enhance yield and reduce environmental impact are gaining traction, particularly in emerging markets like Asia and Latin America.

Key Takeaways

- The Global Agricultural Films and Bonding Market size is expected to reach USD 17.1 billion by the end of 2033.

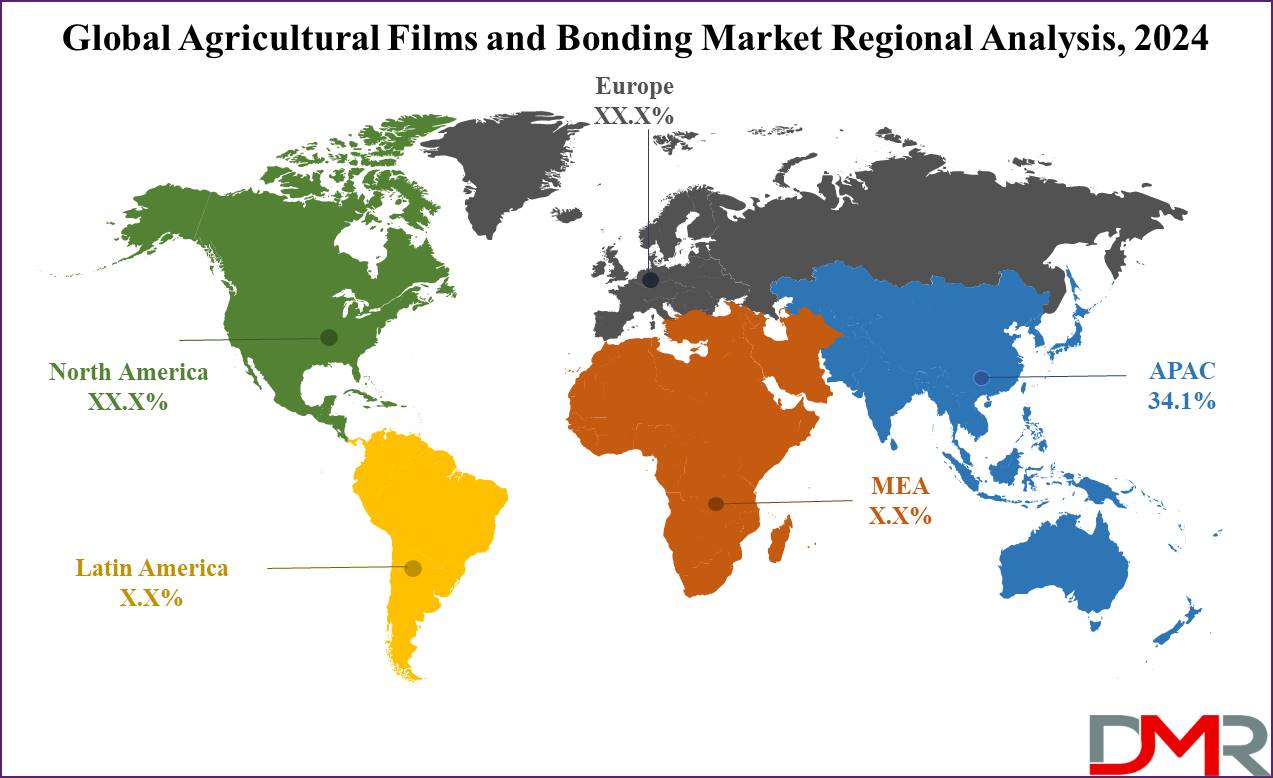

- Asia Pacific is expected to have the largest market share for the Global Agricultural Films and Bonding Market with a share of about 34.1% in 2024.

- The market is growing at a CAGR of 5.8 % over the forecasted period.

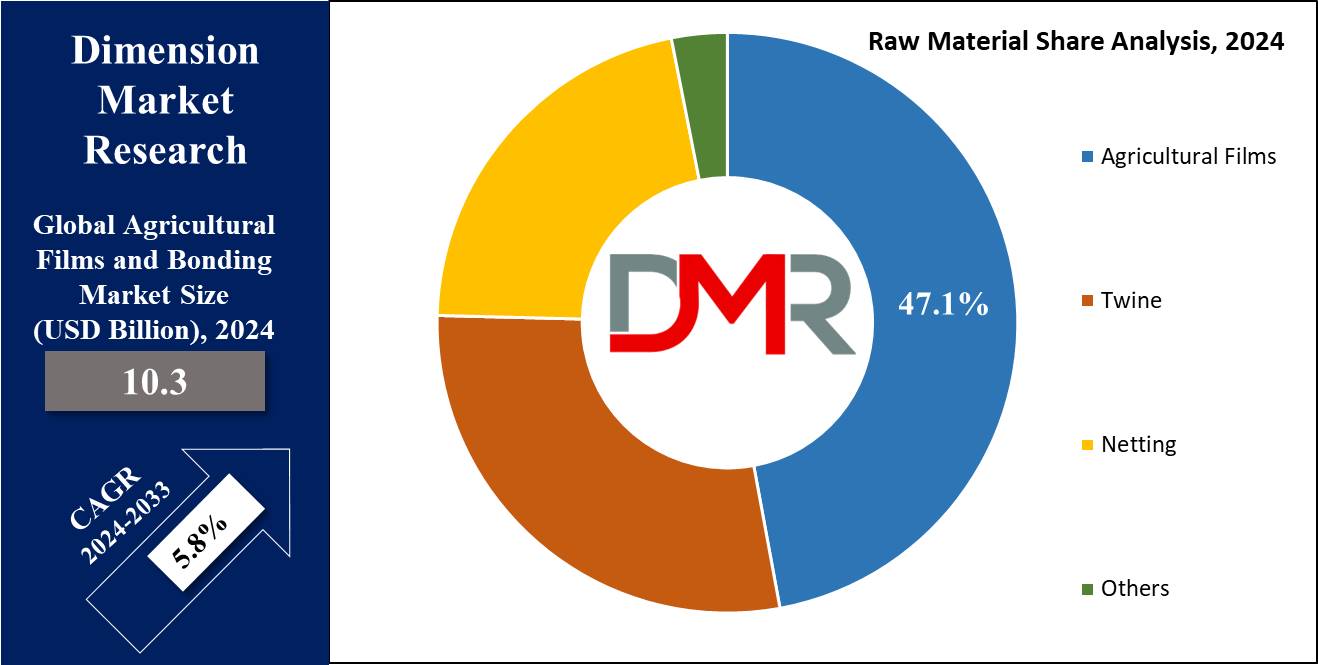

- Agricultural films are projected to show their dominance in this raw material segment in the global agricultural films and bonding market with 47.1% of the market share in 2024.

- The greenhouse is projected to dominate the agriculture films and bonding market in the end-user segment with 28.0% of the market share in 2024.

Use Cases

- Greenhouse Covering: Films create controlled environments for year-round cultivation, protecting crops from weather fluctuations and optimizing growth conditions.

- Mulching: Films suppress weeds, conserve moisture, regulate soil temperature, and enhance crop growth and yield.

- Silage Protection: Films wrap baled forage to preserve quality, prevent spoilage, and maintain nutrient content during storage.

- Packaging and Netting: Films package fruits and vegetables, while nets provide shade, anti-hail, and anti-insect protection for crops. Use of agricultural adjuvants in post-harvest treatments can complement these protective measures.

Market Dynamic

The agricultural films and bonding marketplace is affected by various dynamic elements. Rapid technological advancements cause innovative film materials and bonding solutions that improve crop safety, yield, and sustainability. Fluctuations in weather styles and the increasing frequency of severe climate events pressure the need for protective films, including those used in greenhouse farming and mulching.

Additionally, shifting consumer preferences towards organic and regionally sourced produce stimulates the adoption of green films and bonding agents. Government policies and rules promote sustainable agricultural practices also play a giant role in shaping market dynamics.

Moreover, the developing population and growing food demand worldwide necessitate green farming techniques, boosting the adoption of agricultural films and bonding substances. Overall, those factors make contributions to the dynamic nature of the market, riding innovation and growth within the agricultural area.

Research Scope and Analysis

By Raw Material

Agricultural films like LDPE and a few other raw materials is projected to show their dominance in this raw material segment in the global agricultural films and bonding market with

47.1% of market share in 2024.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Agricultural films dominate this marketplace because of their reliance on LDPE (Low-Density Polyethylene), a versatile and broadly used raw material. LDPE offers perfect houses such as flexibility, durability, and resistance to chemical compounds and moisture, making it best for agricultural programs. These films, commonly utilized in greenhouse overlaying, mulching, and silage protection, provide critical advantages like crop protection, moisture retention, and temperature regulation.

Additionally, LDPE films are cost-effective and easily customizable to in shape various farming needs. Their widespread adoption throughout the rural area, coupled with the non-stop innovation in the films, reinforces their dominance in this market. As agricultural practices evolve to meet developing demands, LDPE-based total films stay imperative for reinforcing crop yields, quality, and sustainability.

By Application

Agricultural films dominate this market in the context of application with the highest market share in 2024. Agricultural films dominate this section because of their critical position in improving crop productiveness, protection, and satisfaction through diverse programs. Greenhouse films provide managed environments for year-spherical cultivation, safeguarding vegetation from negative climate conditions and pests.

Mulch movies suppress weeds, conserve soil moisture, and adjust soil temperature, selling premier plant increase and yield. Silage movies resource in maintaining forage fine for the duration of storage, lowering spoilage and nutrient loss. Their versatility, effectiveness, and value-efficiency make agricultural films critical equipment for contemporary farming practices. With increasing demand for first-rate produce and sustainable agricultural solutions, the use of agricultural movies is anticipated to keep growing, reinforcing their dominance in this segment.

By End User

The greenhouse is projected to dominate the agriculture films and bonding market in the end-user segment with 28.0% of the market share in 2024. The greenhouse section dominates the rural films and bonding marketplace because of its pivotal position in present-day agriculture. Greenhouses provide controlled environments for year-round cultivation, and defensive plants from unfavorable weather, pests, and sicknesses.

Agricultural films and bonding substances are essential to greenhouse creation, imparting insulation, UV safety, and structural guide. Increasing demand for excessive-fee distinctiveness crops, climate variability, and technological improvements pressure the enlargement of greenhouse farming.

Moreover, greenhouses allow sustainable agricultural practices by optimizing aid use and minimizing environmental impact. These elements make contributions to the dominance of the greenhouse segment inside the agricultural movies and bonding marketplace, reflecting its significance in enhancing crop productiveness, excellence, and resilience.

The Agricultural Films and Bonding Market Report is segmented on the basis of the following:

By Raw Material

- Agricultural Films

- Low-Density Polyethylene

- Others

- Twine

- Sisal

- Polypropylene

- LDPE

- Fruit Packaging

- Bale

- Others

- Netting

- HDPE

- LDPE

- Polypropylene

- Others

- Others

By Application

- Agricultural Films

- Twine

- Vegetable Packing

- Fruit Packing

- Bale

- Others

- Netting

- Shading

- Anti-hail

- Anti-insect

- Others

- Others

By End User

- Greenhouse

- Mulching

- Slage

- Vegetable & Fruit Packaging

- Shade

- Anti-Insect

- Others

Regional Analysis

Asia Pacific is projected to dominate the global agricultural films and bonding market with

34.1% of the market share in 2024. The Asia-Pacific area dominates the worldwide agricultural films and bonding marketplace because of numerous elements.

Firstly, the vicinity has a large agricultural zone with a huge emphasis on enhancing crop yield and efficiency. Countries like China, India, and Southeast Asian countries have significant agricultural output and are major consumers of agricultural films and bonding products for packages consisting of mulching, greenhouse farming, & soil protection.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Additionally, speedy urbanization and industrialization within the Asia-Pacific vicinity have caused increasing demand for superior agricultural technology to meet the growing food demand. Agricultural films and bonding solutions assist farmers within the region deal with challenges inclusive of soil erosion, water shortage, and pest management, thereby boosting their adoption.

Moreover, favorable government regulations and initiatives promoting present-day agricultural practices and sustainability in addition power the need for agricultural films and bonding products in the Asia-Pacific area.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global agricultural films and bonding market oversees excessive competition among key gamers consisting of Berry Global Group, BASF SE, The Dow Chemical Company, ExxonMobil Corporation, Kuraray Co., Ltd., RKW SE, and Ginegar Plastic Products Ltd. These groups offer a numerous array of merchandise which include mulching films, greenhouse coverings, and bonding agents for various agricultural applications.

Competition centers on product innovation, great, pricing, distribution networks, and customer service. The growth strategies of this market consisting of partnerships, mergers, and acquisitions are commonplace for increasing marketplace presence and enhancing product portfolios. Overall, the marketplace is characterized by a dynamic panorama with players vying to address the evolving wishes of farmers and agricultural stakeholders globally.

Some of the prominent players in the Global Agricultural Films and Bonding Market are

- The Dow Chemical Company

- BASF SE

- Armando Alvarez Group

- Berry Plastics Group Inc.

- AB Rani Plast OY

- BP Industries (BPI)

- Barbier Group

- British Polythene Plc.

- Britton Group

- ExxonMobil Corporation

- Kuraray Co. Ltd.

- Plastika Kritis S.A.

- The RKW Group.

- Other Key Players

Recent Development

- In November 2023, Alberta Investment Management Corporation and New Agriculture acquire Kimberley Cattle Portfolio in Western Australia, focusing on sustainability and diversification. Financial details undisclosed.

- In September 2023, PRAN Agro secured Tk262 crore investment from MetLife via an eight-year bond to expand infrastructure, without guarantee, enhancing production capacity and job opportunities.

- In September 2023, NABARD raised Rs 1,000 crore in India's first social impact bond. It accepted bids worth Rs 10.40 billion, planning to raise Rs 10 billion with a coupon of 7.63%.

- In June 2023, LyondellBasell and AFA Nord formed a joint venture, LMF Nord GmbH, to recycle post-commercial plastic packaging waste into quality materials, aiming for production by early 2025.

- In April 2023, Harvest Returns, an agriculture investment platform, raised $30 million across 50 ventures, offering high-yield private credit deals to farmers and ranchers while providing secured income for investors.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 10.3 Bn |

| Forecast Value (2033) |

USD 17.1 Bn |

| CAGR (2023-2032) |

5.8% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Raw Material (Agricultural Films, Twine, Netting, and Others), By Application (Agricultural Films, Twine, Netting, and Others), By End User (Greenhouse, Mulching, Slage, Vegetable & Fruit Packaging, Shade, Anti-Insect, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

The Dow Chemical Company, BASF SE, Armando Alvarez Group, Berry Plastics Group Inc., AB Rani Plast OY, BP Industries, Barbier Group, British Polythene Plc., Britton Group, ExxonMobil Corporation, Kuraray Co. Ltd., Plastika Kritis S.A., The RKW Group, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Agricultural Films and Bonding Market?

▾ The Global Agricultural Films and Bonding Market size is estimated to have a value of USD 10.3 billion in 2024 and is expected to reach USD 17.1 billion by the end of 2033.

Which region accounted for the largest Global Agricultural Films and Bonding Market?

▾ Asia Pacific is expected to have the largest market share for the Global Agricultural Films and Bonding Market with a share of about 34.1% in 2024.

Who are the key players in the Global Agricultural Films and Bonding Market?

▾ Some of the major key players in the Global Agricultural Films and Bonding Market are The Dow Chemical Company, BASF SE, Armando Alvarez Group and many others.

What is the growth rate in the Global Agricultural Films and Bonding Market?

▾ The market is growing at a CAGR of 5.8 percent over the forecasted period.