The term agricultural biotechnology refers to the use of scientific methods and instruments to modify living organisms, mainly plants and animals, for agricultural production, which brings together several different fields, including genetics, molecular biology, genomics, and bioinformatics, to develop crops and livestock that possess the characteristics that are wanted.

These features may include a growth in production, an enhancement in nutritional value, resistance to pests and diseases, tolerance to environmental challenges like drought or salinity, and better post-harvest characteristics.

Agriculture biotechnology markets are seeing significant innovation with genetically modified (GM) crops designed to increase yield, pest resistance, drought tolerance and disease resilience. Increased research and development investment has created more resilient crop varieties which address global food security concerns - an emergence that's being spurred on by

CRISPR technology advances.

Governments around the world are supporting agriculture biotech with policies aimed at increasing agricultural productivity and sustainability. Given climate change concerns and resource scarcity issues, biotech solutions are seen as essential for food security purposes - creating opportunities for businesses and startups operating in this space to collaborate with research institutes.

Consumer demand for environmentally sustainable agricultural practices is driving market expansion. Biotech crops are helping reduce pesticide usage, improve soil health and lower environmental footprints while simultaneously following the trend towards sustainable food production, which has attracted both regulatory and consumer support in emerging markets.

Precision farming is another trend driving market growth. By employing advanced biotechnology techniques for crop management, precision farming techniques enable more effective crop care management. By optimizing inputs such as water, fertilizers, and pesticides to increase both yields and cost efficiency in agriculture, precision farming techniques are creating demand for biotech innovations that boost both crop yields and cost efficiencies - shaping its future through agriculture. As these innovations grow, they also spur demand in the

agriculture equipment for smart devices and precision tools tailored for biotech-integrated practices.

The US Agriculture Biotechnology Market

The US Agriculture Biotechnology Market is projected to reach USD 50.1 billion in 2024 at a compound annual growth rate of 6.5% over its forecast period.

The US agriculture biotechnology market has growth opportunities in advancing gene-editing technologies, improving crop resilience to climate change, and developing sustainable farming practices. With strong research & development capabilities, the US can lead innovations in biotech crops and bio-stimulants. In addition, partnerships between biotech firms and agricultural stakeholders can drive market expansion and technological advancements.

Further, the major growth driver is the quick development of gene-editing technologies and sustainable farming practices, which improve crop productivity and resilience. However, a major challenge is the regulatory hurdles and public skepticism surrounding genetically modified organisms (GMOs), which can slow down the adoption and development of biotech innovations.

Key Takeaways

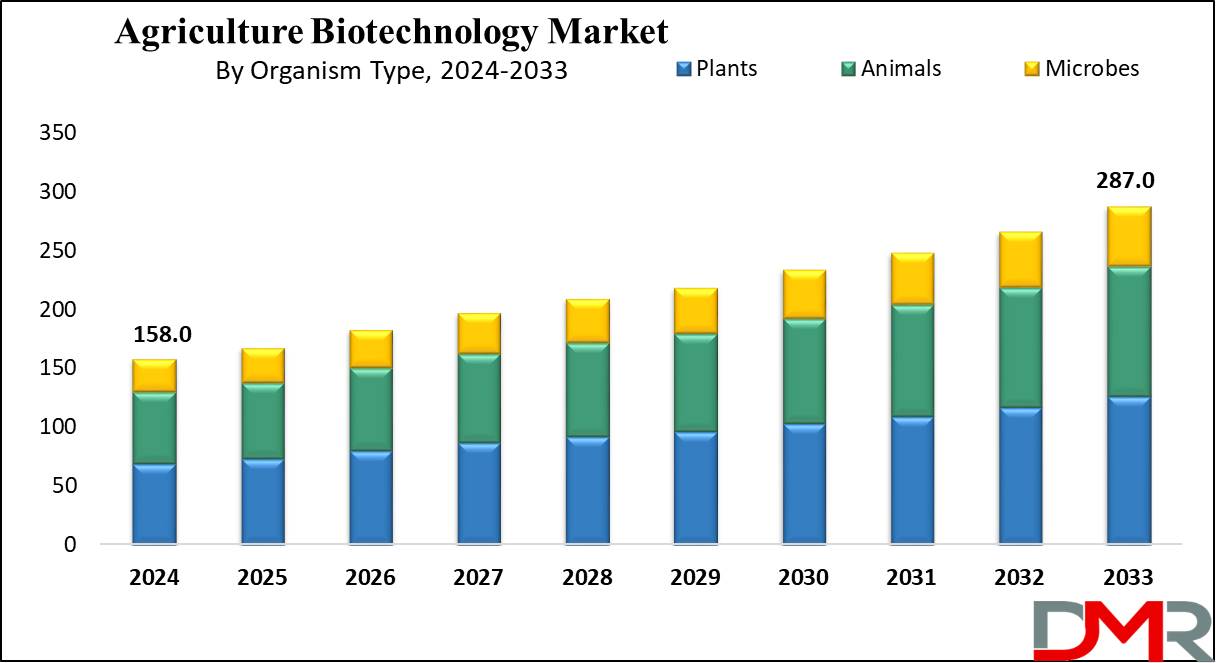

- Market Growth: The Agriculture Biotechnology Market size is expected to grow by 119.3 billion, at a CAGR of 6.9% during the forecasted period of 2025 to 2033.

- By Organism Type: The plant segment is expected to lead in 2024 with a majority & is anticipated to dominate throughout the forecasted period.

- By Technology: The synthetic biology segment is expected to be leading the market in 2024

- By Application: The transgenic seeds and crops segment is expected to get the largest revenue share in 2024 in the Agriculture Biotechnology Market.

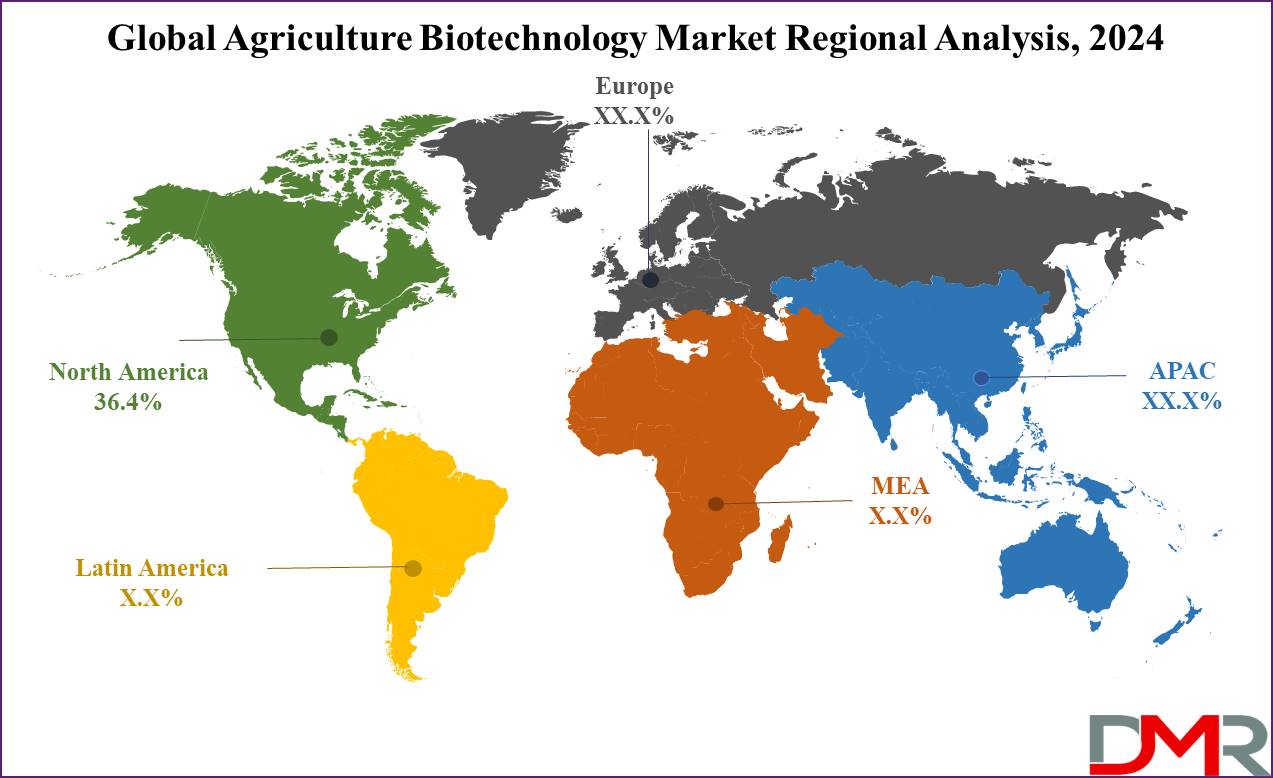

- Regional Insight: North America is expected to hold a 36.4% share of revenue in the Global Agriculture Biotechnology Market in 2024.

- Use Cases: Some of the use cases of Agriculture Biotechnology include disease resistance, improved nutritional content, and more.

Use Cases

- Genetically Modified (GM) Crops: Crops are developed for traits like pest resistance, drought tolerance, and better yield. Like, Bt cotton produces a toxin that deters pests, reducing the need for chemical pesticides.

- Disease Resistance: Biotechnology assists in developing plants resistant to viruses, bacteria, and fungi, which highly reduces crop losses, For example, biotech is used to create bananas resistant to Panama disease.

- Improved Nutritional Content: Biotechnology can improve the nutritional value of crops, like Golden Rice, which is genetically modified to produce vitamin A, supporting efforts to address malnutrition in regions dependent on rice as a staple.

- Sustainable Farming Practices: Biotechnology allows the development of crops that utilize less water and fertilizers, enhancing resource efficiency and reducing the environmental footprint of farming, such as drought-tolerant maize for water-scarce areas.

Market Dynamic

Driving Factors

Rising Demand for Food Security

With an increase in the global population, there is a growing demand to produce more food efficiently. Agricultural biotechnology supports improved crop yields, reduces crop losses, and enhances nutritional quality, driving the demand for biotech solutions in agriculture.

Climate Change Adaptation

Biotechnology provides tools to create crops that are resilient to climate change, such as drought-tolerant, heat-resistant, and pest-resistant varieties, which is crucial in maintaining agricultural productivity in the face of changing environmental conditions, and boosting market growth.

Restraints

Regulatory and Ethical Concerns

Strict regulatory frameworks, along with public concerns over the safety and environmental impact of genetically modified organisms (GMOs), can halt the adoption of biotechnology in agriculture. Ethical debates surrounding genetic manipulation also pose challenges to market growth.

High R&D Costs

Developing biotech crops and solutions demands significant investment in research and development. The high costs associated with innovation, testing, and regulatory approval processes can be prohibitive for smaller companies and may limit the pace of market expansion.

Opportunities

Advances in Gene Editing Technologies

New techniques like CRISPR-Cas9 create more precise, efficient, and affordable genetic modifications. These innovations open doors for developing better crops with enhanced traits such as better disease resistance, higher yields, and improved nutritional content, creating significant market opportunities.

Sustainable Agricultural Practices

With an increase in emphasis on sustainable farming and environmental conservation, biotechnology provides solutions that reduce the need for chemical inputs (like pesticides and fertilizers), conserve water, and improve crop resilience, which aligns with the global trend towards eco-friendly agriculture, driving demand for biotech applications.

Trends

Precision Agriculture Integration

The combination of biotechnology with precision farming technologies, like drones, sensors, and AI, enables farmers to optimize crop production by using genetically modified crops more efficiently, which improves resource use efficiency, reduces waste, and maximizes yields.

Focus on Climate-Resilient Crops

There is a major focus on developing biotech crops that can withstand extreme weather conditions, such as droughts, floods, and temperature fluctuations. These climate-resilient crops are becoming increasingly important as global climate change affects agricultural productivity. Many of these crops are being adapted for use in the

controlled environment agriculture, where stability and resilience are essential.

Research Scope and Analysis

By Organism Type

The global agricultural

biotechnology is divided into three main segments based on organisms: plants, animals, and microbes. In 2024, the plant's segment is expected to get the highest revenue and is anticipated to maintain its leading position throughout the forecast period. However, the animal segment is predicted to experience the fastest growth in the coming years.

Agricultural biotechnology uses a wide range of modern tools to create products with better traits, improving the quality and efficiency of agricultural production. In addition, conventional breeding techniques have long been used to modify the genomes of plants and animals. However, developments in genetic engineering now allow scientists to control the genetic alterations introduced into organisms with greater precision.

New biotechnology tools have made it possible to transfer genes between unrelated species, to optimize agricultural output or produce valuable pharmaceutical compounds. Common targets for genetic engineering like farm animals, crops, and soil bacteria, showcase the broad applications of biotechnology in improving both agricultural productivity and the development of bio-based products.

By Technology

The agricultural biotechnology market includes numerous technologies like genome editing, synthetic biology, marker-assisted breeding, plant breeding, genetic engineering, genome editing, germplasm, and others. Among these, synthetic biology is expected to be the largest segment in 2024 owing to its higher potential to transform crop productivity and resilience.

This field includes the usage of advanced techniques like genetic engineering, CRISPR technology, and synthetic DNA to mainly modify crops for enhanced traits. The innovations brought by synthetic biology have led to major progress in sustainable agriculture, enhancing pest resistance, increasing crop yields, and promoting environmentally friendly farming practices.

In addition, a large integration of synthetic biology into agriculture acts as an important step for tackling global food security issues while promoting eco-friendly farming methods. Further, collaboration among key players in the market, such as the establishment of joint labs to develop bio-stimulant products, highlights the industry's commitment to sustainable agriculture.

These collaborations help in the expansion of the synthetic biology segment forward, contributing to a positive outlook for the agricultural biotechnology market. As more developments are made, synthetic biology is expected to continue driving innovation and offering new solutions to improve the efficiency and sustainability of agricultural practices.

By Application

The transgenic seeds and crops segment is expected to account for a significant market share in the coming years. Transgenic seeds are commonly have stacked traits. These seeds do not contain the output produced by the plants, but only the seeds themselves. A well-known GM seed type contains the Bacillus thuringiensis (Bt) variety found in crops like corn, soybeans, and cotton. These seeds contain a gene from the Bt bacterium, making the crops resistant to pests, which helps farmers reduce pesticide use.

However, despite the benefits of GM seeds, there are challenges in some regions, mainly in Europe and parts of the Middle East and Africa (MEA), where bans and restrictions on GM crop production and imports have been implemented.

Also, many, activist groups, like the Global Genetically Modified Organism (GMO)-Free Coalition and Moms Across America, have been actively campaigning against the use of GM crops, which could impact the demand for transgenic seeds in other areas. While the transgenic seeds segment is anticipated to see major growth, the activism and regulatory barriers in certain regions may limit their broad adoption.

The Agriculture Biotechnology Market Report is segmented based on the following

By Organism Type

- Plants

- Conventional Techniques

- Established Genetic Modification

- New Breeding Techniques

- Animals

- Conventional Techniques

- Established Genetic Modification

- New Breeding Techniques

- Microbes

- Conventional Techniques

- Established Genetic Modification

- New Breeding Techniques

By Technology

- Synthetic Biology

- Genome Editing

- Germplasm

- Plant Breeding

- Market-Assisted Breeding

- Genetic engineering

- Others

By Application

- Transgenic Crops & Animals

- Antibiotic Development

- Biofuels

- Vaccine Development

- Nutritional Supplements

- Flower Culturing

Regional Analysis

North America is expected to hold the largest share of revenue i.e.

36.4% in the agricultural biotechnology market, mainly due to its variety of range of agro-climatic zones and crops, along with a significant portion of the global Genetically Modified (GM) planted area. The U.S. and Canada together account for the majority of the global GM area and a significant part of the world’s overall planted area.

The major crops grown in about 70% of North America's cultivated land include soybeans, corn, and wheat, followed by other vital crops like cotton, alfalfa, canola, and barley. In addition, the Asia Pacific region is expected to experience the fastest growth during the forecast period, due to political and economic systems, cultural differences, and languages. The agricultural industry ranges from highly advanced technology adoption in countries like Japan to more basic farming practices in nations like India.

Asia Pacific is a highly promising market, accounting for a majority of the global cropped area, with rice being a crucial crop in the region. The region produces most of the world’s rice, with China and India alone contributing around 50% combined of the total rice-cultivated area, respectively. However, food security remains a major concern for many governments in this region, where rice is often provided at highly subsidized rates to ensure affordable access for the population.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the global agriculture biotechnology market is shaped by constant innovation and development in technologies like genetic engineering, genome editing, and synthetic biology. Companies are aiming on developing better crop traits like pest resistance, drought tolerance, and higher yields to meet growing food demands.

Strategic partnerships, research collaborations, and investments in sustainable agriculture are major drivers in this market. In addition, players are aiming to create eco-friendly solutions that reduce chemical inputs, promoting environmentally conscious farming practices while improving productivity.

Some of the prominent players in the global Agriculture Biotechnology are

- BASF SE

- Bayer AG

- ADAMA Agriculture Solution

- Corteva

- Syngenta

- Evogene

- DuPont

- Vilmorin

- Isagro SPA

- Benson Hill

- Other Key Players

Recent Developments

- In July 2024, Syngenta Biologicals and Intrinsyx Bio introduced a partnership to bring a new biological solution to agricultural markets globally, which will boost farmers’ access to a custom selection of Intrinsyx Bio’s proprietary endophyte formulations.

- In June 2024, Corteva Agriscience launched its biological business in the Greater China region, strengthening its effort to contribute to China's sustainable agricultural transformation, as the region became Corteva's first market in the Asia-Pacific to commercialize the biological business, highlighting the company's commitment to expanding its investment in China.

- In February 2024, Syngenta Crop Protection and Lavie Bio Ltd. announced a collaboration for the discovery and development of new biological insecticidal solutions, which will utilize Lavie Bio's unique technology platform to quickly identify and optimize bio-insecticide candidates, along with Syngenta’s extensive global research, development, and commercialization capabilities.

- In November 2023, PepsiCo completed three year of its global agriculture program, the Positive Agriculture Outcomes (PAO) Accelerator which provides local farming communities with co-investment to accelerate diverse and results-driven Positive Agriculture projects, along with funding for ag-tech start-ups that provide proven products or technology with the potential to scale, along with new developments building resiliency through climate-related analysis, improving soil health, and strengthening farms' climate resilience across many countries like India, Australia and more.

- In October 2023, BASF announced its plans to invest in a high double-digit million EUR in a new fermentation plant for biological and biotechnology-based crop protection products at its Ludwigshafen site. The plant will produce products that bring value to farmers, like biological fungicides and biological seed treatment. Further, the company also plans to use the plant to produce the main building block of Inscalis, which is planned to commence during the second half of 2025.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 158.0 Bn |

| Forecast Value (2033) |

USD 287.0 Bn |

| CAGR (2024-2033) |

6.9% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 50.1 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Organism Type (Plants, Animals, and Microbes), By Technology (Synthetic Biology, Genome Editing, Germplasm, Plant Breeding, Market-Assisted Breeding, Germplasm, and Others), By Application (Transgenic Crops & Animals, Antibiotic Development, Biofuels, Vaccine Development, Nutritional Supplements, and Flower Culturing) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

BASF SE, Bayer AG, ADAMA Agriculture Solution, Corteva, Syngenta, Evogene, DuPont, Vilmorin, Isagro SPA, Benson Hill, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |