Market Overview

The Global Agriculture Equipment Market size was valued at USD 153.0 billion in 2023, and it is further anticipated to reach a market value of USD 272.4 billion by 2033 at a CAGR of 5.9%. The market has seen a significant increase in the recent past and is predicted to grow significantly during the forecasted period as well.

Agricultural equipment finds application on farms to improve crop yield efficiently & quickly, reducing manual labor. Given the high expenses of farm labor, these tools provide a strategic advantage. Automation & semi-automation are harnessed to reduce labor expenditures while increasing yields, surpassing what can be achieved through human effort alone.

Agriculture equipment events and conferences in the USA serve as vital platforms for industry stakeholders, including manufacturers, dealers, farmers, researchers, and policymakers, to connect, share innovations, and explore emerging trends. These events often showcase the latest advancements in machinery, precision farming technology, irrigation systems, and sustainable agricultural practices.

Conferences typically feature expert-led discussions, workshops, and networking opportunities, fostering collaborations to address the evolving needs of modern agriculture. Some events also extend their focus into allied sectors such as

Construction Equipment and Dental Equipment manufacturing, where innovation and precision engineering offer crossover benefits in design and material usage.

Prominent events like the National Farm Machinery Show, the World Ag Expo, and the AgTech Innovation Summit attract attendees nationwide, highlighting cutting-edge solutions to improve productivity and efficiency. These gatherings are instrumental in shaping the future of the agriculture industry, offering a glimpse into the technologies that drive growth and sustainability.

The global population growth requires increased crop production, encouraging increased demand for agricultural equipment. The market now commands cutting-edge, contemporary farming tools to meet the growing food requirements. Moreover, farmers around the world are accepting innovative, technology-driven equipment to improve farm efficiency & output. For instance, sensor integration is extensive, allowing real-time monitoring of soil temperature, weather forecasts, crop surveillance, & more.

The global agriculture equipment market's significance is growing and is driven by the increase in the population's need for increased productivity to meet food demands. Increased purchasing power & fast agricultural sector industrialization are anticipated to further drive the market. The need for fertilizing & planting equipment is growing as an alternative to manual methods, with notable growth projected in fertilizer & planting technology. Self-propelled spreaders & sprayers offer efficiency & wide coverage, reducing costs & increasing yield by nutrient uniformity. These sprayers, available in manual, tractor-mounted, & aerial configurations, position with modern farmers' preferences for improved flexibility & productivity.

However, procuring & installing agricultural equipment includes high expenses, potentially lowering farm profitability. Further, the operation of multiple machines requires skilled supervision, while heavy equipment movement risks soil disturbance & crop damage. Dependency on modern tools can lead to excessive fertilizer use, harming plants. Equipment breakdowns disturb farming & increase costs. High-performance machines cause major maintenance & repair expenses, creating financial challenges for farmers. Similar cost concerns are seen in other domains, like

Sports Equipment and

Pickleball Equipment, where advanced materials and tech innovations add both performance benefits and financial burden.

The agricultural equipment sector is buzzing with developments. Key players like John Deere and AGCO are leveraging mergers and acquisitions to expand their market share, driven by growing food demand and innovation needs.

The AGRITECHNICA 2025 event in Germany will showcase cutting-edge machinery and sustainable solutions. Meanwhile, Gamaya and Terraview recently merged to focus on AI-powered tools for tropical crops, enhancing sustainability in overlooked sectors. Additionally, vertical farming companies, like Plenty, are scaling operations globally, reflecting a broader shift toward tech-driven agricultural advancements. These innovations are not just restricted to open-field farms but are also reshaping

Controlled Environment Agriculture landscapes with AI integration and automated resource management.

Key Takeaways

- Market Value: The Global Agriculture Equipment Market is projected to reach USD 252.3 billion by 2032, at a CAGR of 5.7% from the base value of USD 153.0 billion.

- Market Definition: The agriculture equipment comprises tools and machinery used on farms to enhance crop manufacturing, reduce manual labor, and increase efficiency, along with tractors, harvesters, irrigation systems, and planting equipment.

- By Type Segment Analysis: Agricultural tractors exert their dominance in the type segment with 34.2% of the market share in this market in 2023.

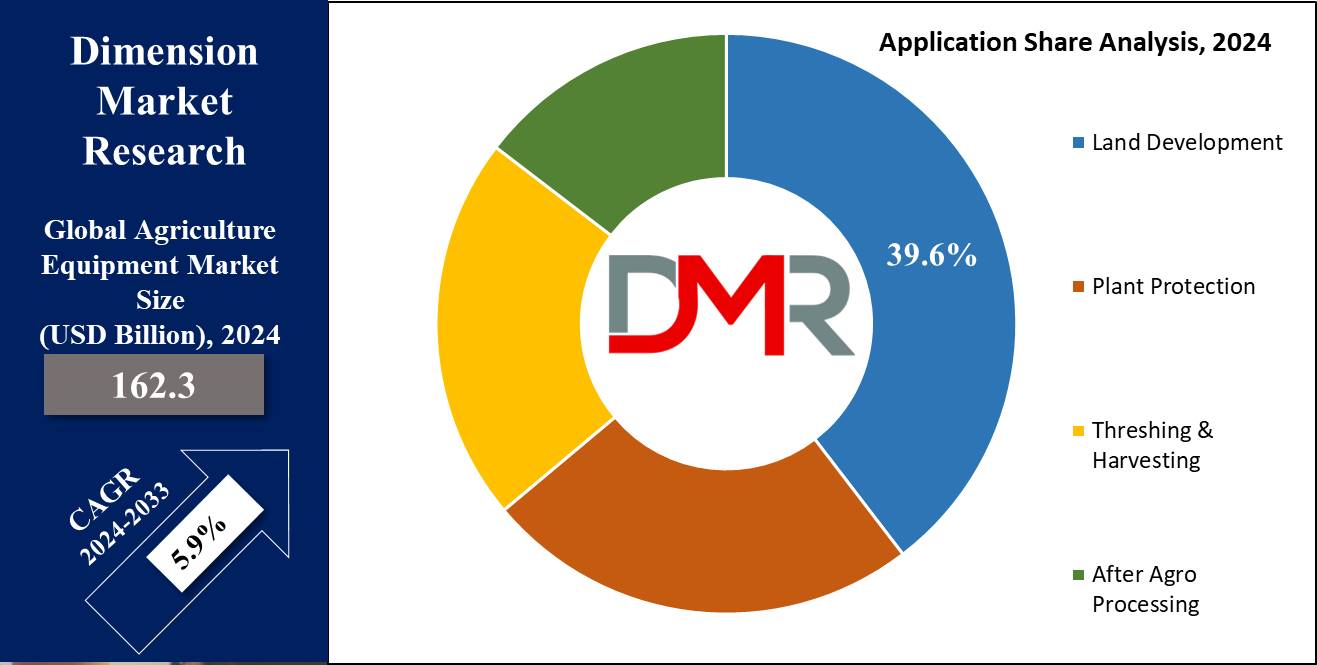

- By Application Segment Analysis: Land Development dominates the application segment in this market with the highest market share in 2023.

- Growth Factors: The global agriculture equipment market is propelled by an increasing populace that directly influences the rising demand for higher crop yields, technological improvements, adoption of modern farming tools, and economic growth, particularly in areas like Asia-Pacific.

- Regional Analysis: Asia Pacific commands the global agricultural equipment market with 37.4% of the market share in 2024 followed by North America as it shows significant growth potetial.

Use Cases

- Precision Agriculture: Utilizing GPS-guided tractors and drones for precise planting, fertilizing, and spraying, optimizing resource use and maximizing yield the same time as minimizing environmental impact by targeted application.

- Automated Harvesting: Implementing advanced combine harvesters equipped with sensors and actuators for real-time monitoring and precise control for the duration of harvesting, enhancing efficiency and lowering labor costs.

- Irrigation Management: Employing smart irrigation systems with soil moisture sensors and automatic controls to supply water exactly wherein and while needed, conserving water resources and enhancing crop health and yield.

- Soil Health Monitoring: Integrating soil sensors and digital platforms to constantly display soil temperature, moisture, and nutrient levels, enabling farmers to make data-driven decisions to optimize soil health.

- Supply Chain Traceability: Leveraging blockchain generation to track and trace agricultural equipment and products from farm to fork, ensuring transparency, quality control, and compliance with food safety standards.

Market Dynamic

Trends

Technological Advancements Driving Efficiency

The adoption of advanced agricultural robots such as surface-based sensors and autonomous tractors, is changing farming practices by increasing productivity and reducing labor costs, thus driving the demand for modern agricultural equipment.

Rise of Precision Farming

The growing shift in the

agriculture equipment market to precision farming through the use of Global Positioning System (GPS) guided machinery and sensor technology helps farmers to make resource use more efficient, improve operational excellence, and meet the increasing demand for food, and this practice signifies a growing trend in the agriculture industry.

Growth Drivers

Government Support and Subsidies

Along with government measures, for example, the farm loan waivers, the credit finance schemes are providing the farmers with the financial means and even encouraging investment in agricultural equipment, thus driving market growth by decreasing these barriers, and at the same time promoting agriculture mechanization.

Increasing Demand for Food

As the world population is increasing and the food demand is rising, farmers are under pressure to increase crop yields. This leads to the necessity of advanced techniques in space utilization and modern equipment, which in turn, provides agricultural equipment with a global booming demand.

Growth Opportunities

Expansion of the Rental Market

The growing trend of the fact that renting agricultural machinery has gained popularity in recent years leads to the growth of the market, mainly in emerging economies where small-scale farmers still lack the capital to purchase such equipment. The adoption of advanced technology in the rental machinery sector leads to the improvement of operational efficiency and the increase in profitability.

Government Subsidies and Loan Programs

One of the ways the government pushes agriculture expansion programs worldwide is through subsidies and credit programs. For example, governments such as the US Farm Service Agency and various Indian state governments provide farmers with small-scale access to agricultural equipment to enhance their production and lead the market.

Restraints

Emission Regulation Challenges

Fast-paced technological advances and resulting emission standards and regulations make things difficult for agricultural equipment manufacturers, necessitating substantial spending on research and development for adherence to regulations, which may lower sales and raise equipment prices.

Competition from the Rental Market

The growth of the rental market for agricultural machinery, which is caused by factors like the rise in labor wages and the cost-effectiveness of renting compared to purchasing, is a challenge to the sales of the equipment, especially in emerging economies where the small-scale farmers opt for the services to enhance their productivity.

Research Scope and Analysis

By Type

The agriculture tractors dominate the type segment with 34.2% of the market share in the global agriculture equipment market in 2023. This leading position owes its momentum to the inclusion of environmentally conscious & high-performance tractors, which offer economical usage solutions for a spectrum of agricultural operations, including plowing.

The accessibility of high-velocity tractors comes as a major driver in improving farmers' profitability by holding operational timelines & simultaneously strengthening overall yield through increased efficiency gains. Moreover, development in harvesting equipment is set to drive segment growth in the coming years.

The growing popularity of intelligent combine harvesters, along with the inclusion of smart actuators into operating models, adds to market growth. These advanced combine harvesters enable farmers to monitor grain flow & exercise precise control during harvesting. As a result, the growth towards smart combine harvesters over traditional ones is notably growing among farmers and contractors.

By Application

The land development application holds a dominant position in the overall revenue of the global agricultural equipment market in the context of application with 39.6% of the market share in 2023. This segment's growth is due to an increase in market demand for such equipment. Technological innovation & advancements specific to land development tools play a major role in driving the growth of this segment on a global scale.

The quick expansion of the land development sector is strengthened by directives like soil preservation, yield optimization, & soil quality enhancement. Further, the growing need for agricultural tractors is fueled by the demand to mechanize farming for grown food production, coupled with technologically advanced options. Urbanization-induced workforce shortages further drive the machinery adoption, which in return is contributing significantly towards the market growth.

The Agriculture Equipment Market Report is segmented on the basis of the following

By Type

- Agriculture Tractors

- By Product

- Sub-compact Utility Tractors

- Compact Utility Tractors

- Specialty Tractors

- By HP

- <30 HP

- 31- 100 HP

- 101-200 HP

- >200 HP

- Irrigation & Crop Processing Equipment

- Agriculture Spraying & Handling Equipment

- Seed Drills

- Planters

- Spreaders

- Sprayers

- Harvesting Equipment

- Combine Harvesters

- Forage Harvesters

- Threshers

- Reapers

- Soil Preparation & Cultivation Equipment

- Ploughs

- Harrow

- Cultivators and Tillers

- Others

By Application

- Plant Protection

- Land Development

- Threshing & Harvesting

- After Agro Processing

Regional Analysis

The Asia-Pacific region accounts for a significant

market share of 37.4%, as it solidifies its leadership in the Global Agriculture Equipment Market. This growth is anticipated for further expansion in the forecasted period. The Asia Pacific's dominance depends on the presence of powerful nations like China & India, responsible for a significant portion of global food demand.

Asia Pacific dominates the global agriculture equipment market due to several key factors. The region's robust market growth is driven by the presence of major players like China National Machinery Industry Corporation and New Holland Agriculture, coupled with favorable government policies supporting agricultural mechanization.

Market insights suggest that the demand for farm mechanized equipment in Asia Pacific is on the rise, further fueled by the Food and Agriculture Organization's initiatives promoting modern farming practices.

Additionally, the region's burgeoning agricultural sector, boosted by digitalization and the adoption of semi-automatic and automatic agriculture equipment, contributes significantly to its market dominance. With the largest share of the global agriculture equipment market revenue, Asia Pacific is projected to continue leading this market in terms of revenue.

Further, the economic growth in these countries boosts regional advancement, driving quick & efficient agricultural progress. The blend of technologies like digitalization, control capabilities, & electrical farming solutions is anticipated to cement the Asia Pacific's market dominance in the coming forecast period.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global agriculture equipment market is noticing intense competition as manufacturers look into providing innovative solutions, enhancing farm efficiency. Key players in the market emphasize R&D, strategic partnerships, & product diversification to meet changing farmer needs. Further, technological advancements, changing preferences, & regulations influence market dynamics. Emphasizing customer support, sustainability, & affordability is important for gaining a competitive advantage in this fast-growing market.

For instance, in June 2023, JCB announced its plan to launch an electric wheeled loader, designed to deliver zero-emission operations & least noise disruption, as this loader offers a range of wheel choices, including narrow & wide configurations, meeting the need for both agricultural & industrial use scenarios. This strategic move shows JCB's dedication to environmentally conscious innovations in the market.

Some of the prominent players in the Global Agriculture Equipment Market are

- JCB

- Deere & Company

- CNH Industrial NV

- Mahindra & Mahindra Ltd

- AGCO Corp

- Escorts Ltd

- APV GmbH

- ISEKI & Co Ltd

- SDF Spa

- CLAAS kGaA

- Other Key Players

Recent Developments

- In February 2024, Sonalika announced the release of its wide range of TIGER tractors in India in the 40 to 75 HP segment catering to various agricultural needs.

- In July 2023, Deere & Company revealed its acquisition of Smart Apply, Inc., aiming to utilize Smart Apply’s precision spraying technology to aid growers in tackling challenges related to input costs, labor, regulations, and environmental objectives.

- In July 2023, CLAAS KGaA mbH introduced its high-performance XERION 12 Series tractors, integrating a highly efficient low-engine speed drive concept 2.0 into the two new tractor models.

- In June 2023, JCB disclosed plans to launch its inaugural electric wheeled loader, boasting zero-emission capabilities and minimal noise disruption. The loader offers a range of wheel and tire options suitable for both agricultural and industrial applications.

- In June 2023, Mahindra Group’s Swaraj Tractors unveiled the ‘Swaraj Target’, a lightweight compact tractor equipped with first-in-class functionalities, unmatched performance, and cutting-edge technology tailored to meet the specific requirements of Indian farmers.

- In May 2023, AMAZONE announced additions to its precision seeders business range with the introduction of advanced trailed models, Precea 12000-TCC and 9000-TCC, designed specifically for large-scale farms and contractors.

- In April 2023, AGCO Corporation announced a strategic partnership with Hexagon to expand AGCO’s factory-fit and aftermarket guidance offerings. The collaboration aimed to commercialize the new guidance system, known as Fuse Guide, on Valtra and Massey Ferguson tractors.

- In April 2023, HORSCH inaugurated its new plant in Curitiba, Brazil, housing the single grain seed drill assembly line, tillage machines line, and a development facility for crop care technology.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 162.3 Bn |

| Forecast Value (2033) |

USD 272.4 Bn |

| CAGR (2024-2033) |

5.9% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Agriculture Tractors, Irrigation & Crop Processing Equipment, Agriculture Spraying & Handling Equipment, Harvesting Equipment, Soil Preparation & Cultivation Equipment, and Others), By Application (Plant Protection, Land Development, Threshing & Harvesting, and After Agro Processing) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

JCB, Deere & Company, Mahindra & Mahindra Ltd, CNH Industrial NV, AGCO Corp, Escorts Ltd, APV GmbH, ISEKI & Co Ltd, SDF Spa, CLAAS kGaA, and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |

Frequently Asked Questions

The Global Agriculture Equipment Market size was valued at USD 153.0 billion in 2023, which is further expected to reach USD 272.4 billion by 2033.

Asia Pacific dominates the Global Agriculture Equipment Market with a share of 37.4% in 2024.

Some of the major key players in the Global Agriculture Equipment Market are Deere & Company, JCB, AGCO Corp, and many others.

The market is growing at a CAGR of 5.9 percent over the forecasted period.