Market Overview

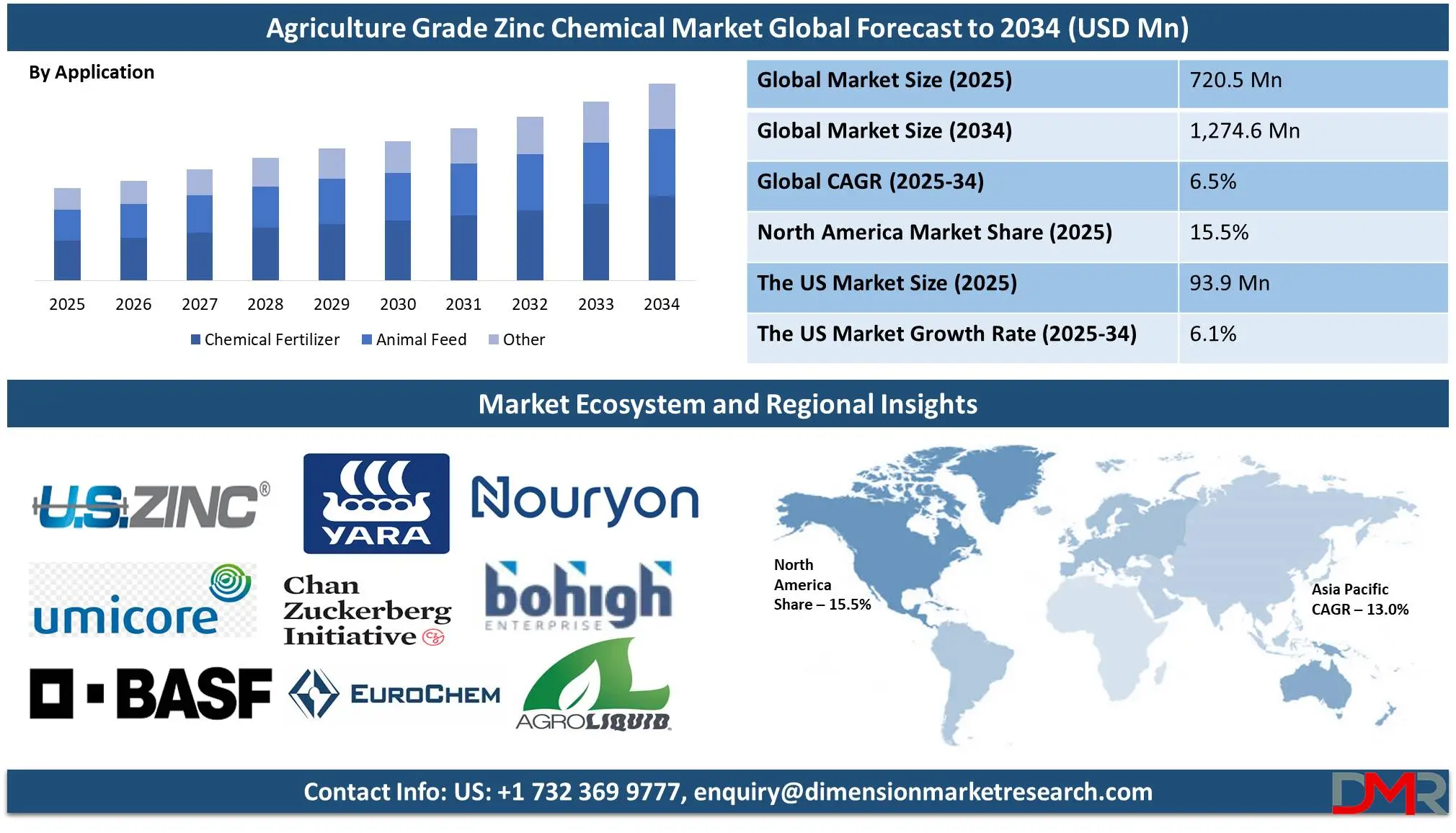

The Global Agriculture Grade Zinc Chemical Market is expected to be valued at

USD 720.5 million in 2025, and is further anticipated to reach

USD 1,274.6 million by 2034 at a

CAGR of 6.5%.

The global agriculture grade zinc chemical market plays an essential role in modern agricultural practices by providing micronutrients such as zinc for plant growth. Zinc plays a key role in numerous physiological processes related to enzyme activation, protein synthesis, and growth regulation. Zinc-based chemicals like zinc sulfate, oxide, and chelates are designed to increase crop yield and quality and are widely used as soil applications and foliar sprays, providing adequate plant nutrient uptake.

Agriculture grade zinc chemical market growth is driven primarily by an increasing global need for high crop yields to meet rising food requirements, and shrinking arable land. Population expansion and shrinkage have compounded this need, necessitating efficient agricultural inputs like zinc-based fertilizers and supplements in many agricultural regions, especially developing economies, where zinc deficiency is prevalent.

Additionally, growing awareness among farmers about micronutrients' importance is driving market adoption further. Technological innovations in fertilizer formulation and the introduction of chelated zinc products have accelerated market expansion. Chelated zinc chemicals have become more popular due to their higher bioavailability and efficiency for nutrient delivery, and innovations like controlled-release fertilizers and liquid micronutrient blends are improving performance and convenience of zinc fertilizers, helping farmers attain superior crop quality and yield through optimized nutrient management practices. Environmental sustainability and government initiatives encouraging balanced nutrient application are major determining factors of the agriculture grade zinc chemical market.

Numerous governments and agricultural bodies are offering programs to educate farmers about soil health management techniques and the advantages of micronutrient fertilizers, while regulations mandating eco-friendly agricultural products push manufacturers towards creating eco-friendly formulations of zinc chemical formulations which minimize environmental impact while improving soil fertility.

The global agriculture grade zinc chemical market is dominated by both multinational corporations and regional players, which rely on strategic collaborations, product innovations, and strategic mergers, to expand their market shares and meet the evolving needs of the agriculture sector. Furthermore, rising investments in research & development, expansion of distribution networks as well as precision agriculture are expected to further drive market expansion over the coming years.

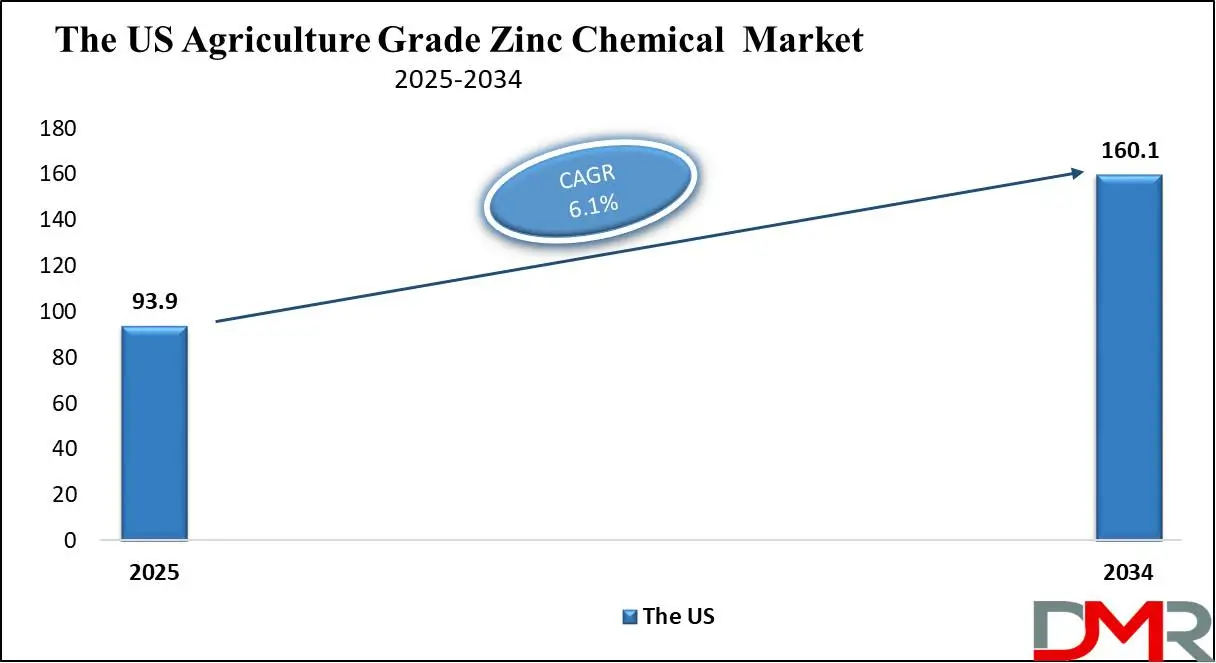

The US Agriculture Grade Zinc Chemical Market

The US Agriculture Grade Zinc Chemical Market is projected to be valued at USD 93.9 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 160.1 million in 2034 at a CAGR of 6.1%.

US agriculture grade zinc chemical market holds a dominant share globally due to the country's advanced agricultural infrastructure and increasing emphasis on crop productivity. Zinc deficiency is an issue plaguing many regions across the US, particularly Midwestern states like Illinois, Indiana, and Ohio where soils contain naturally low micronutrient levels.

As farmers seek to enhance soil health and maximize yields on major crops like corn, wheat, soybeans, and cotton for both domestic consumption as well as export markets, zinc-based fertilizers have experienced unprecedented demand in recent years. One factor driving their popularity has been rising domestic agricultural output, which in turn drives the use of zinc chemicals across this region.

Growing awareness about precision agriculture and micronutrients' role in crop management is revolutionizing the US market. Farmers are focusing on soil testing and customized nutrient management programs designed to optimize crop performance. Zinc chemicals like zinc sulfate and chelated zinc formulations play an integral part in these programs due to their ability to increase nutrient uptake while correcting deficiencies quickly. US manufacturers have created an environment marked by competition and innovation, driven by market dynamics.

Companies such as Yara North America, The Mosaic Company, and Compass Minerals are investing heavily in research and product development efforts for creating high-efficiency zinc formulations, while partnerships between agribusiness giants and technology providers enable liquid micronutrient blends with precision application technologies, further improving zinc fertilizers' efficacy.

Global Agriculture Grade Zinc Chemical Market: Key Takeaways

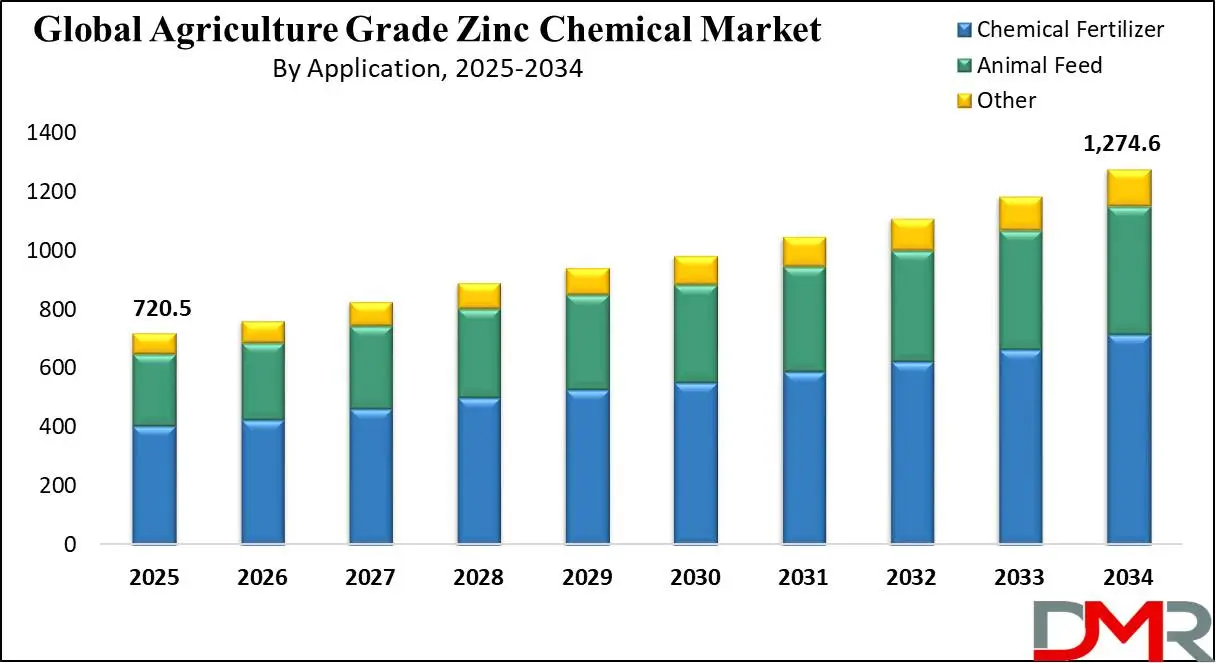

- Market Value: The global agriculture grade zinc chemical market size is expected to reach a value of USD 1,274.6 million by 2034 from a base value of USD 720.5 million in 2025 at a CAGR of 6.5%.

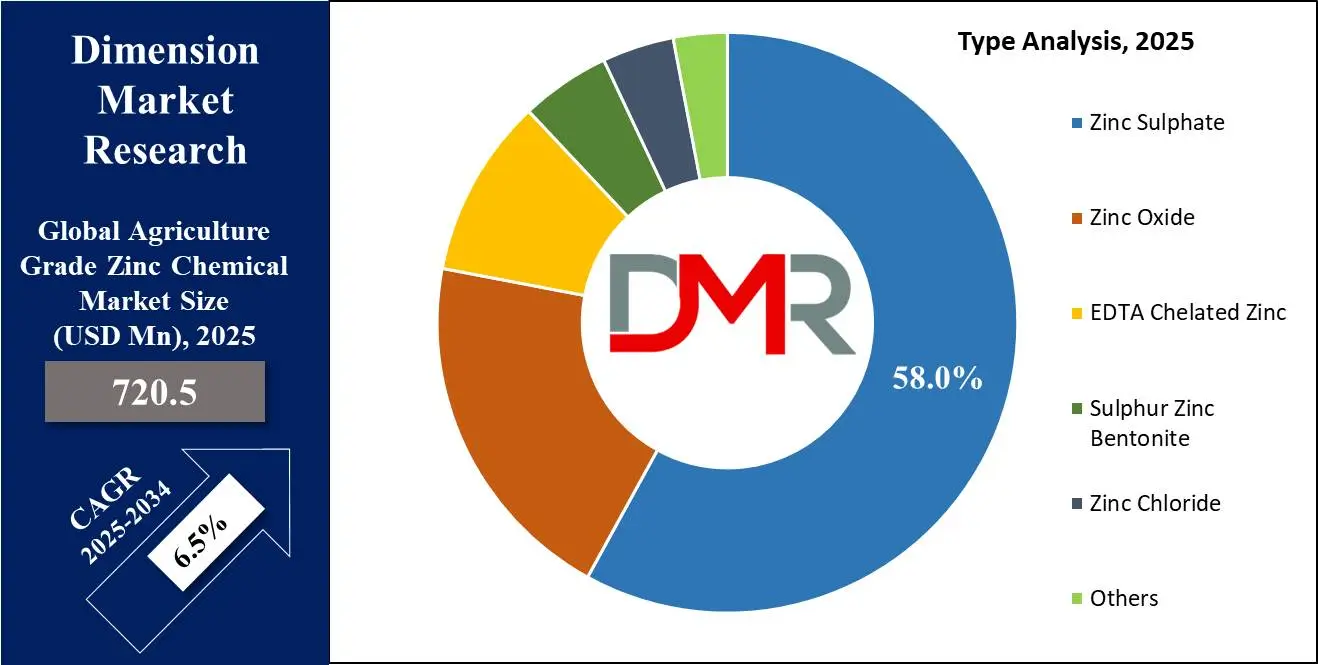

- By Type Segment Analysis: Zinc Sulphate is anticipated to lead in the type segment, capturing 58.0% of the market share in 2025.

- By Application Type Segment Analysis: Chemical Fertilizers are expected to maintain their dominance in the application type segment capturing 56.0% of the total market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global agriculture grade zinc chemical market landscape with 60.0% of total global market revenue in 2025.

- Key Players: Some key players in the global agriculture grade zinc chemical market are U.S. Zinc (Aterian Investment Partners), Umicore, BASF SE, Yara International ASA, Chelated Zinc International (CZI), EuroChem Groupand, and Other Key Players.

Global Agriculture Grade Zinc Chemical Market: Use Cases

- Crop Yield Improvement in Zinc-Deficient Soils: Agriculture grade zinc chemicals are widely used to correct zinc deficiencies in soils, particularly in regions with alkaline and calcareous soils like South Asia, North Africa, and parts of North America. Zinc sulfate and chelated zinc fertilizers are applied to crops such as wheat, rice, and maize, where deficiency symptoms like stunted growth, leaf chlorosis, and low yields are prevalent. The application of zinc chemicals helps boost crop productivity by enhancing enzyme function, hormone production, and nutrient absorption.

- Fortification of Staple Food Crops: Zinc chemicals play a critical role in biofortification programs aimed at addressing global malnutrition. Countries like India, Bangladesh, and Brazil are promoting the use of zinc-enriched fertilizers in staple crops such as rice, wheat, and maize to improve the zinc content in grains. This helps combat zinc deficiency disorders in human populations, particularly in regions where diets lack sufficient micronutrients.

- Precision Agriculture and Controlled Fertilizer Application: With the rise of precision agriculture technologies, zinc chemicals are being integrated into customized nutrient management systems. Chelated zinc and liquid zinc formulations are increasingly used in foliar sprays and drip irrigation systems, ensuring targeted nutrient delivery to plants. This method is highly effective in regions like North America and Europe, where farmers seek optimized yield with minimal environmental impact.

- Horticulture and Specialty Crop Cultivation: Zinc fertilizers are essential in fruit, vegetable, and vineyard cultivation to enhance crop quality and shelf life. In countries like Spain, Italy, and the U.S., zinc chemicals are applied to crops such as citrus fruits, grapes, and tomatoes to improve fruit size, uniform ripening, and resistance to diseases. Zinc foliar sprays are particularly popular in horticulture due to their ability to provide rapid nutrient absorption during critical growth stages.

Global Agriculture Grade Zinc Chemical Market: Stats & Facts

- According to Geoscience Australia, Zinc has never been found naturally in its pure form. It can be alloyed (mixed) with several other metals. Zinc is brittle at ordinary temperatures but is malleable and ductile (can be beaten and drawn into a wire) when heated to 1000°C. Zinc has a relatively low melting point and is a good electrical conductor. About 30.0% of zinc used in the Western World comes from recycled materials.

- According to Geoscience Australia, the main zinc mineral is sphalerite, which contains up to 67.0% zinc by mass. Smithsonite 52.0%, willemite 59.0% and hemimorphite 54.0% may occur in the near-surface weathered or oxidised zone of an orebody. In some cases, these secondary minerals are also zinc ores.

- According to Food and Agriculture Organization of the United States, an estimated 38.0 million babies are born with iodine deficiency, which is the most common cause of preventable brain damage (WHO, 2016b). Zinc deficiency affects about 30 percent of the world’s population.

- According to Food and Agriculture Organization of the United States, micronutrient deficiencies affect more than 2.0 billion people worldwide.

- According to World Bank, recently, high-Zn rice varieties were developed jointly by the International Rice Research Institute (IRRI) and national programs in India and Bangladesh, and one variety was released by the Bangladesh Rice Research Institute (BRRI).

- According to Food and Agriculture Organization of the United States, meat provides high-quality protein and a variety of micronutrients, such as iron, vitamin A, iodine and zinc, many of which are difficult to obtain in adequate quantities from foods of plant origin.

- According to the Food and Agriculture Organization of the United States, climate change is expected to also have direct impacts on food quality and nutrition. For example, the elevated levels of carbon dioxide in the atmosphere that are likely by 2050 are associated with substantial declines in the zinc, iron and protein content of wheat, rice, field peas and soybeans.

- According to the Zinc International Association, 13.5 million tons of special high-grade zinc were produced in 2019, and 6.0 million tons from recycled sources.

- According to the Zinc International Association, zinc is a USD 40.0 Billion per year market.

- The FAO's "Trade of Agricultural Commodities" report highlights that the value of global agricultural exports in 2023 was 1.7 times higher in nominal terms than in 2010. This underscores the expanding global trade in agricultural commodities, which may indirectly reflect the demand for agricultural inputs, including zinc-based products.

- The "Chemical and Petrochemical Statistics at a Glance-2023" report by India's Department of Chemicals and Petrochemicals indicates that the average Index of Industrial Production (IIP) for chemical and chemical products (excluding pharmaceuticals) for the fiscal year 2022–23 stood at 129.3, marking a 6.9% increase compared to the previous year. This growth reflects the overall expansion of the chemical sector, which encompasses various products, including agricultural-grade chemicals.

Global Agriculture Grade Zinc Chemical Market: Market Dynamic

Global Agriculture Grade Zinc Chemical Market: Driving Factors

Rising Global Demand for High Crop Yields to Meet Food Security Needs

Rapid population growth across Asia-Pacific, Africa, and Latin America has only amplified the need for higher agricultural production from limited arable land resources. Zinc deficiency in soil can severely limit crop yields, particularly for staple crops such as wheat, rice, maize, and barley that provide essential global food supplies. Demand for high crop yields to address global food security is the primary driver behind the expansion of the agriculture grade zinc chemical market.

With global population projections set to surpass 9.0 billion by 2050, pressure is mounting on agricultural producers to produce more on limited arable land resources while facing issues like soil degradation, climate change, and shrinking farmland availability. Zinc plays a significant role in increasing crop productivity by improving photosynthesis, protein synthesis, and enzyme activation that are essential processes required for plant growth and development.

Increasing Adoption of Micronutrient-Based Fertilizers for Soil Health Management

Due to intensive farming practices, excessive use of chemical fertilizers, and climate change causing soil quality degradation, leading to depleted essential nutrient reserves, such as zinc. As such governments, agricultural organizations, and farmers all strive towards balanced nutrient application strategies to restore fertility and increase crop productivity. Government initiatives, like India's Soil Health Card Scheme and North America's 4R Nutrient Stewardship Program, play an instrumental role in encouraging the balanced application of micronutrients such as zinc.

Both programs offer soil testing services, advisory support, and financial incentives to encourage farmers to adopt micronutrient-based fertilizers. Increasing attention paid to sustainable agriculture practices has further amplified demand for zinc sulfate, chelated zinc or liquid zinc formulations that replenish depleted soils without harming the environment. Consumer demand for organic and high-quality food products is also driving farmers towards adopting eco-friendly fertilizers that support both productivity and environmental sustainability.

Global Agriculture Grade Zinc Chemical Market: Restraints

High Cost of Chelated Zinc and Advanced Zinc Formulations

One key restraint on the global agriculture grade zinc chemical market is the high costs associated with chelated zinc fertilizers such as zinc EDTA and zinc DTPA, which boast superior nutrient absorption and efficiency compared to traditional zinc sulfate fertilizers. However, their higher production costs make them less accessible for small and marginal farmers in developing regions due to complex manufacturing processes that bind zinc molecules with organic compounds, which increases overall product prices and prevents their widespread adoption.

Liquid and controlled-release zinc formulations designed for precision agriculture often come at premium prices, making them more popular in developed markets such as North America and Europe than more price-sensitive regions like Asia-Pacific and Africa. Furthermore, inadequate government subsidies or financial support for micronutrient-based fertilizers in certain countries only further exacerbates affordability concerns, delaying penetration of advanced zinc products.

Limited Awareness and Knowledge among Farmers in Developing Regions

Another notable restraint in the global agriculture grade zinc chemical market is the limited awareness and knowledge among farmers, especially in developing and underdeveloped regions. Despite the proven benefits of zinc fertilizers in enhancing crop yield and quality, many farmers lack adequate information about zinc deficiency symptoms, appropriate application methods, and the long-term advantages of micronutrient-based fertilizers. This knowledge gap is particularly prevalent in rural areas of Africa, South Asia, and Latin America, where traditional farming practices dominate and the focus remains on macronutrient fertilizers like nitrogen, phosphorus, and potassium (NPK).

Additionally, due to a lack of soil testing facilities and agricultural extension services, identification of zinc-deficient soils remains limited, leading to underutilization of zinc-based fertilizers. Farmers tend to prioritize cost savings over balanced nutrient management, often perceiving micronutrient fertilizers as an optional addition rather than an essential component of plant health.

Global Agriculture Grade Zinc Chemical Market: Opportunities

Rising Demand for Biofortified Crops to Combat Micronutrient Deficiency

Biofortified crops offer agriculture grade zinc chemical markets a significant opportunity, as their growing demand addresses micronutrient deficiencies in human diets. Zinc deficiency is a serious global health concern, especially in developing regions like South Asia, Sub-Saharan Africa, and Latin America, where diets primarily consist of staple crops like rice, wheat, and maize. Biofortification process of increasing crop nutritional content through agricultural practices has gained popularity as an effective solution to enhance food quality.

Agriculture grade zinc chemicals, specifically zinc sulfate and chelated zinc formulations, play a vital role in maintaining zinc levels in staple crops to address health issues associated with zinc deficiency such as stunted growth, reduced immunity, and cognitive impairment. Numerous international organizations, including the Harvest Plus Program and World Health Organization (WHO), are supporting widespread adoption of zinc-enriched fertilizers to boost crop nutrition.

Expansion of Precision Agriculture and Smart Farming Technologies

Precision agriculture and smart farming technologies present an exciting opportunity for the global agriculture grade zinc chemical market. Precision farming entails using GPS mapping, remote sensing, drones, and IoT-based systems to customize nutrient applications designed specifically for individual crops, thereby improving crop health and yield. This trend has gained particular traction across North America, Europe, and parts of Asia-Pacific as farmers seek efficient yet sustainable nutrient management solutions.

Zinc chemicals in liquid and chelated forms are particularly ideal for precision agriculture systems as they can easily be integrated into drip irrigation, foliar spray, and fertigation techniques. As the emphasis shifts toward minimizing fertilizer wastage and increasing nutrient uptake efficiency, zinc-based micronutrients will likely become even more popular as manufacturers create smart nutrient formulations for automated systems.

Global Agriculture Grade Zinc Chemical Market: Trends

Growing Preference for Eco-Friendly and Organic Zinc Fertilizers

One notable trend in the global agriculture grade zinc chemical market is an increasing shift toward eco-friendly and organic zinc fertilizers driven by rising consumer demand for sustainable agriculture practices. Farmers are turning to bio-based zinc formulations containing natural chelating agents such as amino acids or humic acids as part of compliance with environmental regulations and organic farming standards.

This trend is particularly evident in Europe and North America, where strict environmental policies combined with growing consumer interest for organic food products is shifting consumer preference for fertilizer usage. Manufacturers are investing in sustainable innovations to develop biodegradable zinc fertilizers that minimize soil and water pollution, creating opportunities for sustainable farming inputs like these in both regenerative agriculture systems as well as certified organic farming operations.

Technological Advancements in Zinc Fertilizer Formulations

One trend in the global agriculture grade zinc chemical market is its continued advancement of zinc fertilizer formulations to maximize nutrient efficiency and crop performance. Manufacturers are creating nano zinc fertilizers and controlled-release formulations which increase bioavailability while decreasing nutrient loss, such technology also ensures consistent supply of micronutrients during key growth stages, ultimately increasing yield while decreasing environmental impact.

Nano zinc fertilizers have seen rapid adoption across Asia-Pacific and North America due to their higher absorption rates and lower application dosages compared with traditional zinc products. Research and development efforts into smart zinc products integrated with soil microbiomes or encapsulated delivery systems are further shaping the market while offering sustainable solutions that increase crop productivity and soil health.

Global Agriculture Grade Zinc Chemical Market: Research Scope and Analysis

By Type

Zinc Sulphate is projected to dominate the type segment of the agriculture grade zinc chemical market, accounting for approximately 58.0% of the market share by 2025. Zinc Sulphate has become an increasingly popular choice due to its cost-efficiency, water solubility, and ease of application. Zinc sulphate comes in both monohydrate and heptahydrate forms, both of which can be utilized for soil application or foliar sprays across numerous crops like cereals, pulses, fruits, and vegetables. Due to its ability to quickly address zinc deficiencies in soils, this product is especially popular in regions experiencing widespread micronutrient deficiency such as Asia-Pacific and Latin America.

Integrating it into nutrient management systems and blended fertilizers further solidifies its market dominance. Furthermore, rising demand for balanced crop nutrition solutions as well as government subsidy programs promoting zinc sulphate fertilizers should fuel its expansion over the coming years.

On the other hand, Zinc Oxide is emerging as a significant player in the agriculture grade zinc chemical market. Zinc oxide stands out from zinc sulphate by its insoluble nature and therefore makes for more suitable slow-release fertilizers and granulated blends, including coated formulations where gradual zinc release is essential for supporting crop growth over extended periods.

Zinc oxide fertilizer is an environmentally sustainable fertilizer solution in areas prone to soil erosion. Furthermore, the rising investment in advanced fertilizer technologies is driving the development of nano zinc oxide formulations, which offer higher bioavailability and faster nutrient uptake compared to conventional forms. This innovation is particularly beneficial in micronutrient-deficient soils and for crops requiring immediate zinc supplementation during critical growth stages. Additionally, the compatibility of zinc oxide with customized fertilizer blends enhances its application in precision agriculture systems, supporting targeted nutrient delivery.

By Application

By 2025, chemical fertilizers are anticipated to maintain their dominance in the application type segment, capturing approximately 56.0% of the total market share in the agriculture grade zinc chemical market. Chemical fertilizers have become widely adopted due to their demonstrated effectiveness at increasing crop yield, improving soil fertility, and compensating for widespread zinc deficiencies in agricultural fields. Chemical fertilizers that contain zinc chemicals are widely utilized because of their consistent delivery, cost-efficiency, and ease of application across diverse farming systems.

Fertilizers designed specifically to address rising food demands are especially popular among regions using intensive agricultural practices, as their high productivity rates help meet increasing food demands. Chemical fertilizers play an integral part in improving soil fertility by replenishing essential micronutrients such as zinc, which is essential for plant growth and development. Zinc chemicals like zinc sulfate, oxide, and chelated zinc are often added to customized blends or compound fertilizers as an effective means of providing balanced nutrition to plants.

Agriculture grade zinc chemicals applied through chemical fertilizers are especially essential to staple crops like wheat, rice, maize, and barley, which form part of global food supply chains. Zinc deficiency in crops hinders both plant growth and grain quality, leading to lower nutrition value and economic losses. To address this challenge, more farmers are turning to zinc-based chemical fertilizers as part of integrated soil fertility management programs.

These fertilizers enhance plant metabolism, enzyme activation, and chlorophyll production for improved crop yields and resistance to environmental stress. Furthermore, using zinc chemicals in chemical fertilizers supports biofortified crops production that are essential in combatting zinc deficiency disorders among human populations globally, particularly in developing nations.

The Agriculture Grade Zinc Chemical Market Report is segmented on the basis of the following:

By Type

- Zinc Sulphate

- Zinc Oxide

- EDTA Chelated Zinc

- Sulphur Zinc Bentonite

- Zinc Chloride

- Others

By Application

- Chemical Fertilizer

- Animal Feed

- Other

Global Agriculture Grade Zinc Chemical Market: Regional Analysis

The region with the largest Revenue Share

Asia Pacific is anticipated to lead the global agriculture grade zinc chemical market landscape, capturing approximately

60.0% of the total global market revenue by 2025. This dominance is due to Asia's robust agricultural activities, large farming population, and increasing awareness regarding micronutrient deficiencies in soils. Rapid population growth and rising food demands in the Asia Pacific countries have necessitated increasing agricultural productivity, making zinc-based micronutrient fertilizers an integral component to combating soil fertility challenges.

Asia Pacific holds a distinct advantage in agricultural production due to the prevalence of zinc-deficient soils throughout its territory, particularly in countries like India and China which rank among the highest producers globally. Studies reveal that over 50.0.0% of agricultural soils in India and nearly 40.0% in China suffer from zinc deficiency, leading to reduced crop yields and inferior produce.

The region with the highest CAGR

North America is expected to experience the highest compound annual growth rate over the forecast period of 2025 in agriculture grade zinc chemical market, due to a focus on sustainable farming practices, increased awareness about micronutrient deficiencies, and rapid adoption of advanced fertilizer technologies. The region's market expansion can be attributed to rising consumer demand for premium agricultural produce and an emphasis on improving soil health and crop productivity to meet both domestic and export demands.

The US leads this expansion, followed by Canada, and Mexico where farmers increasingly incorporate zinc-based fertilizers into their nutrient management plans. States such as California, Texas, Illinois, and Nebraska are the major producers of cereals, oilseeds, and horticultural crops that lack zinc, prompting farmers to turn to zinc sulfate, chelated zinc oxide, or zinc sulfate fertilizers as a means to restore soil fertility and increase yields.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Agriculture Grade Zinc Chemical Market: Competitive Landscape

The global agriculture grade zinc chemical market is marked by intense competition between established players and emerging companies competing for market share through product innovation, strategic partnerships, capacity expansions, and geographical diversification. This competitive environment is driven by rising demand for micronutrient-based fertilizers to improve crop yields and soil fertility across both developed and developing regions.

Leading players in the global zinc market are investing heavily in research and development to introduce cutting-edge zinc chemical formulations, such as nano zinc fertilizers, chelated zinc solutions, and controlled release zinc products. These cutting-edge formulations not only increase zinc bioavailability but also conform with growing sustainable farming trends.

Companies like Yara International, Nutrien Ltd., and BASF SE are at the forefront of such innovations, steadily expanding their product lines to provide high performance fertilizers that optimize crop nutrition while simultaneously minimizing environmental impacts. Strategic collaborations and partnerships are playing a pivotal role in shaping the competitive landscape, with companies entering into alliances with agricultural cooperatives, government bodies, and research institutions to promote the adoption of zinc-based fertilizers.

For instance, several market leaders are partnering with government agricultural development programs in regions like Asia-Pacific and Africa to provide subsidized zinc fertilizers and enhance soil fertility in zinc-deficient areas. These partnerships are particularly prominent in developing countries where government support is crucial for driving the widespread adoption of the micronutrient fertilizers.

Some of the prominent players in the global Agriculture Grade Zinc Chemical are:

- U.S. Zinc (Aterian Investment Partners)

- Umicore

- BASF SE

- Yara International ASA

- Chelated Zinc International (CZI)

- EuroChem Group

- Nouryon

- China Bohigh Zinc Product Co., Ltd.

- AgroLiquid

- Other Key Players

Global Agriculture Grade Zinc Chemical Market: Recent Developments

- July 2024: The Mosaic Company acquired Plant Response, a biotechnology firm specializing in crop stress management and nutrient efficiency. This acquisition aimed to integrate Plant Response's innovative technologies with Mosaic's existing product line, including zinc fertilizers, to offer comprehensive solutions for sustainable agriculture.

- August 2023: Yara International acquired the Vale Cubatão Fertilizer Complex in Brazil for USD 255.0 million. This strategic move expanded Yara's production capacity in Latin America, enabling the company to meet the growing demand for zinc-based fertilizers in the region.

- March 2022: Nutrien Ltd. acquired Actagro, a leading provider of soil and plant health solutions, for USD 340.0 million. This acquisition enhanced Nutrien's product offerings in the agriculture grade zinc chemical market, allowing the company to provide advanced nutrient solutions to improve crop yields.

- April 2021: Compass Minerals sold its South American specialty plant nutrition business to ICL Group for USD 418.0 million. This divestment allowed Compass Minerals to focus on its core markets, while ICL Group expanded its portfolio of zinc-based fertilizers in the South American region.

- February 2021: ICL Group acquired Growers Holdings, a digital agriculture company, to integrate advanced data analytics with its specialty fertilizers, including zinc-based products. This acquisition aimed to provide farmers with precise nutrient recommendations, optimizing the use of zinc fertilizers.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 720.5 Mn |

| Forecast Value (2034) |

USD 1,274.6 Mn |

| CAGR (2025-2034) |

6.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 93.9 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Zinc Sulphate, Zinc Oxide, EDTA Chelated Zinc, Sulphur Zinc Bentonite, Zinc Chloride, and Others), and By Application (Chemical Fertilizer, Animal Feed, and Other) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

U.S. Zinc (Aterian Investment Partners), Umicore, BASF SE, Yara International ASA, Chelated Zinc International (CZI), EuroChem Groupand, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The global agriculture grade zinc chemical market size is estimated to have a value of USD 720.5 million in 2025 and is expected to reach USD 1,274.6 million by the end of 2034.

The US firefighting chemicals market is projected to be valued at USD 93.9 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 160.1 million in 2034 at a CAGR of 6.1%.

Asia Pacific is expected to have the largest market share in the global agriculture grade zinc chemical market with a share of about 60.0% in 2025.

Some of the major key players in the global agriculture grade zinc chemical market are U.S. Zinc (Aterian Investment Partners), Umicore, BASF SE, Yara International ASA, Chelated Zinc International (CZI), EuroChem Groupand, and many others.

The market is growing at a CAGR of 6.5 percent over the forecasted period.