Market Overview

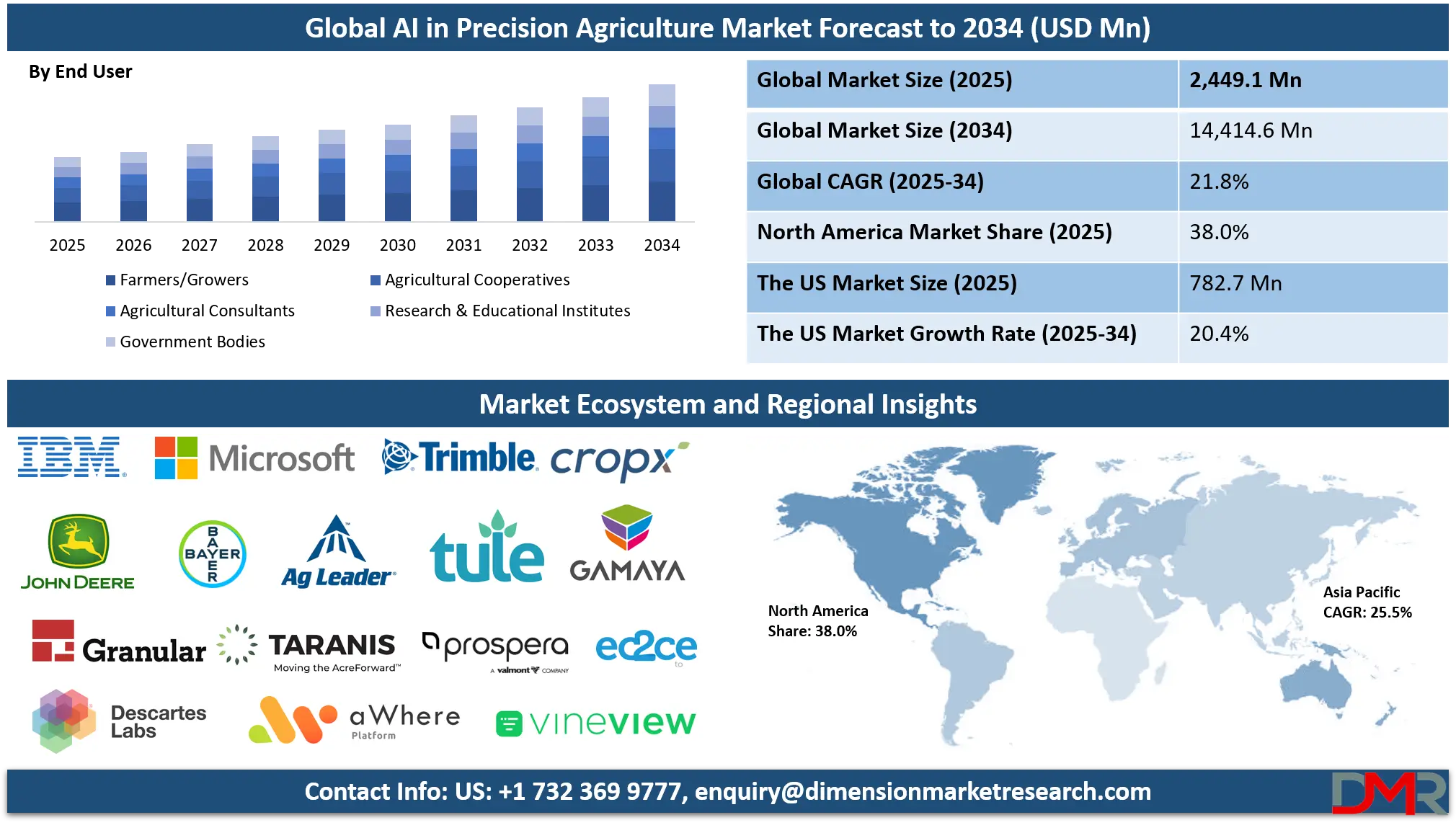

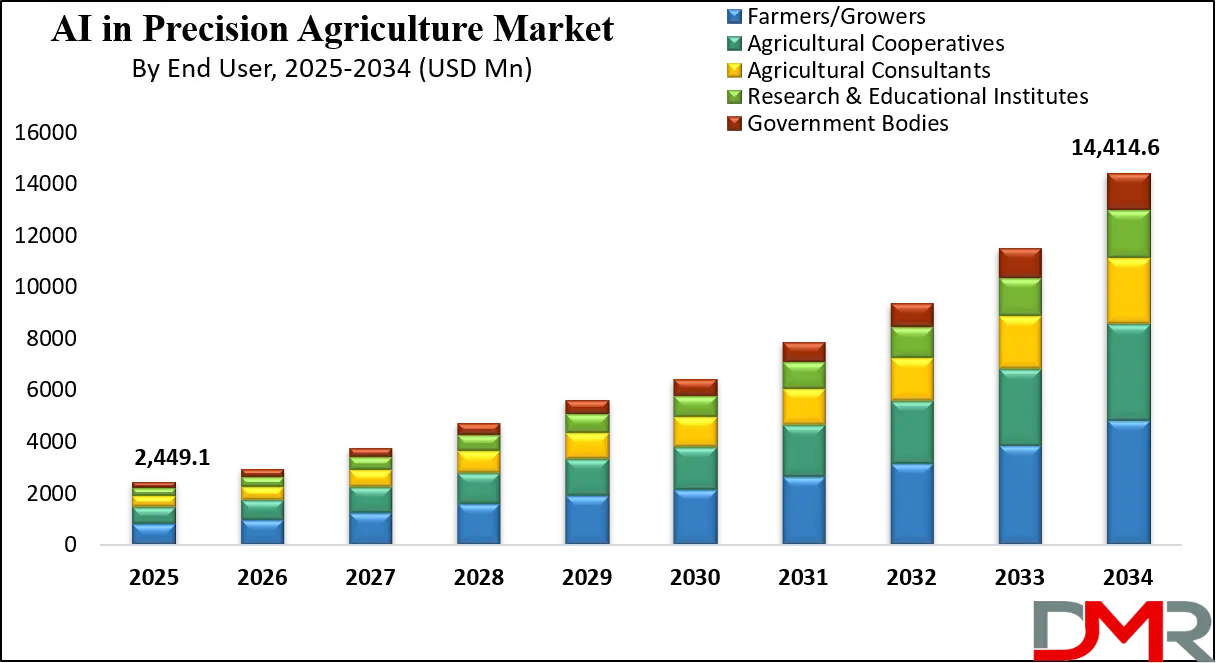

The Global AI in Precision Agriculture Market is expected to be valued at USD 2,449.1 million in 2025 and is anticipated to expand at a CAGR of 21.8% through 2034, ultimately reaching USD 14,414.2 million.

The global AI in precision agriculture market is experiencing a significant transformation, driven by the urgent need to enhance food security for a growing population. Key trends include the integration of machine learning algorithms with IoT sensors and drones to enable real-time monitoring of crop health, soil conditions, and pest infestations. This allows for hyper-localized application of resources, a practice known as variable rate technology, which maximizes yield while minimizing environmental impact. The proliferation of big data analytics is further empowering farmers to move from reactive to predictive decision-making, fundamentally changing traditional farming practices.

Substantial opportunities for market expansion lie in the development of AI-powered robotic systems for automated harvesting, weeding, and pruning, which address critical labor shortages. Furthermore, the advent of cloud-based AI solutions is making these advanced technologies accessible to small and medium-sized farms, democratizing data-driven agriculture. The growing consumer demand for transparency and sustainably produced food also creates a compelling market opportunity for AI systems that provide verifiable traceability from farm to fork, adding value to the end product.

Despite the promising outlook, the market faces notable restraints. The high initial capital investment required for AI infrastructure, including sensors, drones, and connectivity solutions, presents a significant barrier to adoption, particularly in developing regions and for individual smallholder farmers. A lack of technical expertise and digital literacy among the global farming community further hinders widespread implementation. Data privacy and ownership concerns regarding the information collected from fields also remain a contentious issue that the industry must address to build trust.

In terms of growth prospects, the market is poised for robust expansion. The increasing severity of climate change-induced weather events makes AI's predictive capabilities indispensable for risk mitigation and ensuring stable production. Supportive government initiatives and policies worldwide that promote smart farming techniques are providing a further tailwind. As AI models become more sophisticated and context-aware for different crops and geographies, their value proposition will only strengthen, solidifying AI not as a luxury but as a core component of modern, resilient agriculture.

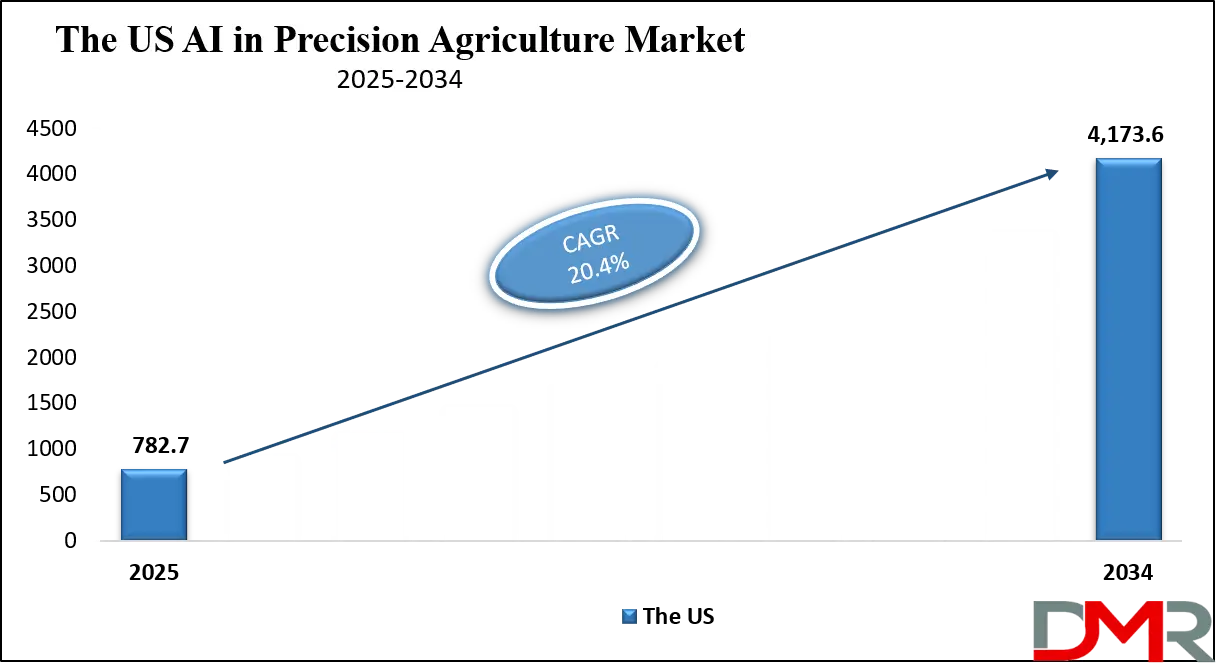

The US AI in Precision Agriculture Market

The US AI in Precision Agriculture Market is projected to reach USD 782.7 million in 2025 at a compound annual growth rate of 20.4% over its forecast period.

The United States holds a position as a frontrunner in the adoption of AI for precision agriculture, a status bolstered by strong federal support and a robust agricultural data ecosystem. The U.S. Department of Agriculture (USDA) plays a pivotal role through agencies like the National Institute of Food and Agriculture (NIFA) and the Economic Research Service (ERS), which fund research and compile vast public datasets on crop yields, soil health, and climate patterns.

This publicly available data serves as a critical foundation for training and refining AI algorithms. Furthermore, the USDA’s commitment to expanding high-speed internet access in rural America, as outlined by initiatives like the ReConnect Program, is directly addressing the connectivity barrier essential for deploying AI technologies in the field.

The nation's demographic and structural advantages are significant. The U.S. is characterized by large-scale farm operations, which provide the economic scale necessary to justify investments in advanced AI and automation systems. This is coupled with a strong culture of innovation and a dense network of agricultural technology companies, research institutions, and land-grant universities, such as those partnered with the USDA Agricultural Research Service (ARS).

These institutions continuously drive development and extension services, facilitating the transfer of technology from lab to field. The combination of extensive, data-rich farmland and a synergistic relationship between government, academia, and the private sector creates a uniquely fertile environment for the growth and sophistication of AI-driven farming solutions.

The Europe AI in Precision Agriculture Market

The Europe AI in Precision Agriculture Market is estimated to be valued at USD 367.4 million in 2025 and is further anticipated to reach USD 1,896.8 million by 2034 at a CAGR of 20.0%.

The European market for AI in precision agriculture is shaped by a strong regulatory framework and a clear policy direction towards sustainability. The European Union’s Common Agricultural Policy (CAP) for the 2023-2027 period explicitly incentivizes the adoption of digital and precision farming techniques through its eco-schemes, positioning AI as a key tool for meeting ambitious environmental goals under the European Green Deal and the Farm to Fork Strategy.

The Copernicus Earth observation program, managed by the European Commission, provides a powerful, free, and open data stream of satellite imagery and in-situ data. This vast resource is instrumental for developing AI applications for large-scale monitoring of crop development, soil moisture, and land use changes across the member states.

Europe’s demographic advantage lies in its diverse agricultural landscape, which ranges from highly efficient large plains in countries like France and Germany to numerous small-to-medium-sized farms specializing in high-value crops. This diversity drives innovation in AI solutions that must be adaptable to various scales and production systems.

The strong emphasis on data sovereignty and privacy, governed by regulations like the GDPR, influences the development of federated learning and other AI models that can operate within strict data governance frameworks. Collaboration is a hallmark of the European approach, with multi-country initiatives funded by Horizon Europe fostering innovation and ensuring that AI solutions are developed to address shared continental challenges like biodiversity loss and climate resilience.

The Japan AI in Precision Agriculture Market

The Japan AI in Precision Agriculture Market is projected to be valued at USD 146.9 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1,896.8 million in 2034 at a CAGR of 20.2%.

Japan’s adoption of AI in precision agriculture is fundamentally driven by pressing demographic necessities, namely a severely aging farmer population and a shrinking agricultural workforce. In response, the Japanese government has actively promoted Society 5.0 and its agricultural component, Smart Agriculture, through the Ministry of Agriculture, Forestry and Fisheries (MAFF). MAFF has been instrumental in establishing demonstration farms and providing subsidies to accelerate the adoption of autonomous machinery and AI-based management systems, aiming to create a new model of high-tech, labor-efficient farming that can be sustained by a smaller workforce.

The country’s demographic challenges are paradoxically its greatest advantage in market development, creating an urgent and non-negotiable demand for automation and AI solutions. Japan’s focus is particularly strong on developing compact, autonomous robots for tasks like planting, harvesting, and weeding, suitable for its predominantly small-scale farms and terraced fields.

Furthermore, the tradition of cultivating high-value, specialty crops like rice, fruits, and vegetables provides a strong economic incentive for implementing AI to optimize quality and premium yields. National research bodies, including the National Agriculture and Food Research Organization (NARO), are central to this effort, developing and validating AI models tailored to Japan’s specific crops, pests, and microclimates, ensuring these technologies deliver tangible benefits for its unique agricultural sector.

Global AI in Precision Agriculture Market: Key Takeaways

- Global Market Size Insights: The Global AI in Precision Agriculture Market size is estimated to have a value of USD 2,449.1 million in 2025 and is expected to reach USD 14,414.6 million by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 21.8 % over the forecasted period of 2025.

- The US Market Size Insights: The US AI in Precision Agriculture Market is projected to be valued at USD 782.7 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 4,173.6 million in 2034 at a CAGR of 20.4%.

- Regional Insights: North America is expected to have the largest market share in the Global AI in Precision Agriculture Market with a share of about 21.3% in 2025.

- Key Players: Some of the major key players in the Global AI in Precision Agriculture Market are IBM Corporation, Microsoft Corporation, Deere & Company (John Deere), Bayer AG (Climate Corporation), Trimble Inc., Granular Inc., and many others.

Global AI in Precision Agriculture Market: Use Cases

- Predictive Yield Mapping: AI analyzes satellite and drone imagery with historical data to forecast crop yields field-by-field, optimizing harvest logistics and informing market decisions well before the season ends.

- Precision Weed Control: Computer vision on autonomous tractors distinguishes crops from weeds in real-time, enabling robotic arms or micro-sprayers to apply herbicide only to unwanted plants, reducing chemical use by over 90%.

- Livestock Health Monitoring: AI-powered computer vision systems analyze drone footage to monitor cattle behavior and body condition, automatically identifying signs of illness, injury, or lameness for early veterinary intervention.

- AI-Powered Irrigation: Machine learning models process data from soil moisture sensors and weather forecasts to create dynamic irrigation schedules, delivering the precise amount of water needed to each zone, conserving a critical resource.

- Automated Harvesting Robots: AI-driven robots use advanced vision systems to identify ripe fruits (e.g., apples, strawberries) and precisely manipulate robotic arms to pick them without damage, overcoming labor shortages.

Global AI in Precision Agriculture Market: Stats & Facts

U.S. Department of Agriculture (USDA)

- The USDA's National Agricultural Statistics Service (NASS) reported that in 2021, 25% of U.S. farms used precision agriculture practices to manage crops or livestock, a significant increase over previous years.

- USDA data shows that the average age of the principal farm operator is 57.5 years, highlighting the demographic need for AI and automation to reduce physical labor.

- The USDA's Economic Research Service (ERS) states that farms with USD 1 million or more in sales account for over 40% of the value of production, indicating the financial capacity of large operations to invest in AI technologies.

- USDA's Natural Resources Conservation Service (NRCS) has provided funding for over 150,000 conservation contracts since 2018, many of which now include precision agriculture and data-driven management components.

European Union (EU) & European Commission

- The European Commission's Digital Economy and Society Index (DESI) 2022 reported that only 26% of EU farms use digital technologies for precision farming, indicating a significant growth opportunity.

- The EU's Common Agricultural Policy (CAP) has allocated a minimum of 25% of its direct payments budget to eco-schemes for the 2023-2027 period, many of which incentivize the adoption of precision agriculture technologies.

- According to EU Eurostat data, only 4% of EU farms utilize robot milking systems, a key AI application in livestock management.

- The European Union's Copernicus Land Monitoring Service provides over 12 terabytes of free, open Earth observation data daily, which is a foundational resource for developing and training agricultural AI models.

- The EU's Farm to Fork Strategy aims to reduce the overall use and risk of chemical pesticides by 50% by 2030, a target directly driving the adoption of AI for integrated pest management.

Food and Agriculture Organization of the United Nations (FAO)

- The FAO estimates that to feed the world's population in 2050, global agricultural production must increase by almost 50% from 2012 levels, creating a pressing need for AI-driven yield gains.

- FAO studies indicate that up to 40% of global crop production is lost annually to pests and diseases, a problem AI-based monitoring aims to mitigate.

- The FAO reports that agriculture accounts for 70% of global freshwater withdrawals, highlighting the critical importance of AI-powered irrigation optimization.

- According to the FAO, the global food system employs over 1 billion people, representing a massive user base that could be impacted by AI-driven efficiency tools.

- The FAO's International Code of Conduct on Pesticide Management promotes "the use of integrated pest management (IPM)... and the use of precision pest management technologies."

Government of Japan (Ministry of Agriculture, Forestry and Fisheries - MAFF)

- MAFF reports that the percentage of core agricultural workers aged 65 and over was 70% in 2020, a key driver for AI and robotic automation.

- MAFF data shows the number of agricultural management entities in Japan has decreased by over 40% in the last two decades, increasing the average farm size and potential ROI for AI investment.

- The Japanese government's "Green Food System Strategy" aims to have 50% of all staple field crops cultivated using smart agriculture technologies by 2050.

- MAFF's survey on the introduction of smart agriculture machinery found that the usage rate of GPS-equipped tractors and combines reached approximately 15% in 2021.

- Japan's National Agriculture and Food Research Organization (NARO) has developed over 20 different AI models for specific applications, from fruit sorting to predicting rice quality.

Other Governmental & International Bodies

- The International Telecommunication Union (ITU) reports that only 51% of the world's rural population has access to the internet, a major barrier to cloud-based AI agriculture solutions.

- The World Bank states that agriculture accounts for an average of 4% of global GDP, and over 25% in some least developed countries, underlining the sector's economic importance for AI transformation.

- The United Nations Environment Programme (UNEP) notes that fertilizer runoff is a primary cause of eutrophication in freshwater systems, an environmental issue addressed by AI-powered variable rate application.

- The U.S. Government Accountability Office (GAO) found that the U.S. federal government invested over USD 1.6 billion in agricultural research and development in a recent fiscal year, with a growing portion dedicated to AI and data science.

- The Canadian government's "Canadian Agricultural Partnership" program has allocated CUSD 3 billion for innovation, including projects for AI and automation in farming.

- Australia's Commonwealth Scientific and Industrial Research Organisation (CSIRO) has developed an AI model that can predict optimal cattle slaughter times with 99% accuracy, improving supply chain efficiency.

- The Indian government's "Digital Agriculture Mission" aims to support projects based on new technologies like AI and blockchain, with an initial pilot underway.

- The German Federal Ministry of Food and Agriculture (BMEL) has funded over 70 digital experimental fields ("Experimentierfelder") on farms to test and demonstrate AI technologies in real-world conditions.

- The French government's "France 2030" investment plan has earmarked €2.2 billion to accelerate the robotics and digital transformation of its agricultural sector.

- The Netherlands' Wageningen University & Research, a state-funded institution, has published over 500 scientific papers in the last five years involving AI and machine learning in agri-food applications.

Global AI in Precision Agriculture Market: Market Dynamics

Driving Factors in the Global AI in Precision Agriculture Market

Critical Need for Enhanced Global Food Security and Productivity

The paramount driver is the urgent imperative to increase agricultural output to feed a growing global population projected to reach nearly 10 billion by 2050, all while the amount of arable land per capita declines. AI in precision agriculture is a direct response to this challenge, offering a sustainable pathway to intensify production without expanding farmland. By enabling hyper-efficient use of inputs like water, fertilizers, and pesticides, AI systems directly boost crop yields and quality. This technology is no longer optional but is becoming a critical tool for ensuring stable food supplies, mitigating the risks of climate volatility, and achieving the productivity gains necessary for long-term global food security, thus compelling its adoption.

Strong Governmental and Institutional Support and Policies

Widespread adoption is being significantly accelerated by supportive policies and funding from governments and international bodies. Initiatives like the European Union's Common Agricultural Policy (CAP) eco-schemes directly incentivize farmers to adopt digital and precision technologies that have environmental benefits. In the United States, USDA programs provide grants and support for expanding rural broadband, which is essential for cloud-based AI, and fund research through institutions like NIFA. Similarly, national strategies like Japan's "Smart Agriculture" push are designed to counter demographic decline. This top-down support de-risks investment for farmers, funds crucial R&D, and creates a regulatory environment conducive to the growth of AI-driven farming solutions.

Restraints in the Global AI in Precision Agriculture Market

High Initial Investment and Complex Total Cost of Ownership

The most significant barrier to widespread adoption is the substantial capital expenditure required for a fully integrated AI precision agriculture system. This includes not only the cost of the AI software but also the necessary hardware infrastructure: sensors, drones, autonomous machinery, and high-performance computing equipment. For many farmers, particularly smallholders and those in developing economies, this investment is prohibitive. Furthermore, the total cost of ownership extends beyond purchase price to include ongoing expenses for data connectivity subscriptions, software licensing fees, and specialized technical support for maintenance and troubleshooting, creating a complex financial hurdle that slows market penetration.

Lack of Standardization, Data Sovereignty Concerns, and Skills Gap

The market is fragmented with numerous proprietary platforms that often cannot communicate with each other, leading to data silos and limiting the holistic value of AI insights. This lack of interoperability is a major restraint. Concurrently, farmers express deep concerns about data ownership, privacy, and sovereignty; they ultimately own and control the highly detailed data collected from their fields. Finally, a profound skills gap exists; many farmers lack the digital literacy required to effectively implement, interpret, and act on the complex outputs generated by AI systems. This necessitates extensive training and support, adding another layer of cost and complexity to adoption.

Opportunities in the Global AI in Precision Agriculture Market

Expansion into High-Value Specialty Crops and Diversified Farming

While early AI applications focused on broadacre crops like corn and wheat, a major growth opportunity lies in adapting these technologies for high-value specialty crops such as fruits, nuts, vegetables, and vineyards. These crops have higher profit margins, making the ROI for AI and robotics more immediately attractive. AI-powered vision systems can monitor grapevine health for premium wine production, while harvesting robots designed for apples or asparagus can solve extreme labor shortages. Furthermore, AI models are being developed for complex, diversified systems like organic farms or polycultures, offering tailored insights that were previously impossible to generate at scale, thereby opening vast new market segments.

Development of AI-as-a-Service (AIaaS) and Fintech Integration

The high upfront cost of AI technology presents a barrier, which itself creates a significant opportunity for innovative business models. AI-as-a-Service (AIaaS) platforms, where farmers pay a subscription fee for insights without major capital investment, can democratize access for small and medium-sized farms. This cloud-based model provides continuous updates and lower entry costs.

Additionally, integrating AI-generated data with financial technology (fintech) creates powerful new opportunities. For instance, verified data on field health and predicted yields can be used to secure lower-interest insurance premiums or loans, creating a direct financial incentive for adoption beyond mere agronomic benefits.

Trends in the Global AI in Precision Agriculture Market

Proliferation of Predictive and Prescriptive Analytics

The market is rapidly evolving beyond descriptive analytics, which simply tells what happened in a field, towards predictive and prescriptive models. Advanced machine learning algorithms now process historical yield data, real-time satellite imagery, and hyperlocal weather forecasts to predict future outcomes with remarkable accuracy. This includes forecasting potential pest outbreaks, predicting optimal harvest windows to maximize yield and quality, and anticipating yield volumes for superior supply chain planning. The next frontier is prescriptive analytics, where AI doesn't just predict a problem like a nutrient deficiency but also automatically generates a precise recommendation for remedial action, such as a variable rate application recipe for fertilizer, fundamentally transforming decision-making from reactive to proactive.

Rise of Autonomous Robotic Systems and Swarm Farming

A significant trend is the move from decision-support tools to fully autonomous field operations. This is driven by the maturation of AI-powered computer vision, which allows robots to perform delicate tasks with superhuman precision. We are seeing the development of autonomous tractors for planting and spraying, robotic weeders that distinguish crops from weeds to eliminate herbicides mechanically, and harvesting robots that can pick delicate fruits like strawberries without bruising. The concept of "swarm farming," where multiple smaller, coordinated autonomous robots work simultaneously on a field, is gaining traction. This approach minimizes soil compaction and allows for 24/7 operation, directly addressing critical labor shortages and increasing operational efficiency.

Global AI in Precision Agriculture Market: Research Scope and Analysis

By Offering / Component Analysis

The software component is projected to be the undisputed core and dominant segment of the AI in precision agriculture market. Its supremacy stems from its role as the central "brain" that transforms raw data into actionable intelligence. While hardware like sensors, drones, and GPS-guided tractors are crucial for data collection and execution, it is the sophisticated software platforms that perform the complex analytics, machine learning, and decision-making.

These cloud-based Farm Management Information Systems (FMIS) integrate disparate data streams from satellite imagery, soil sensors, equipment telematics, and weather stations into a single, coherent dashboard. This enables functionalities like predictive modeling for yield, prescriptive recommendations for input application, and real-time monitoring of field conditions.

The scalability of software is a key advantage; a powerful algorithm can be deployed across a thousand acres or ten, making advanced analytics accessible to operations of varying sizes without the need for proportional capital expenditure on physical hardware. Furthermore, the software segment is characterized by rapid innovation cycles, allowing for continuous improvement in algorithm accuracy and the introduction of new features, ensuring that the digital intelligence driving modern farming is constantly evolving and increasing in value for the end-user.

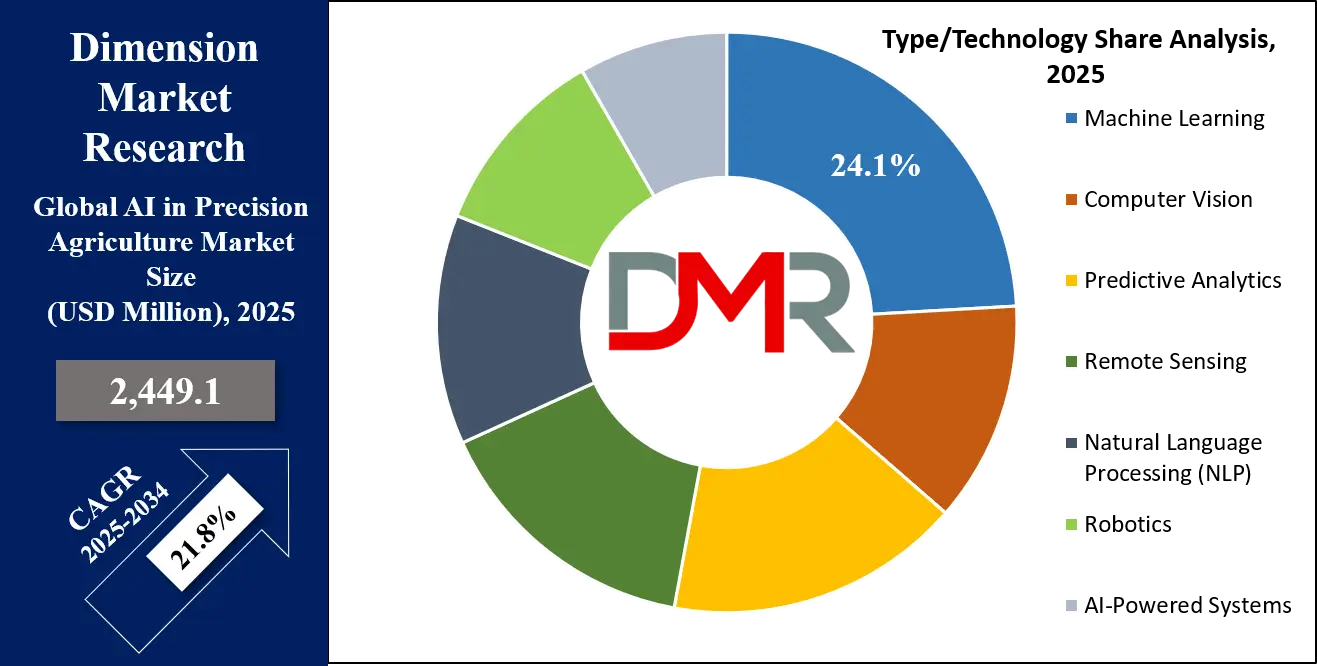

By Type / Technology Analysis

Machine Learning (ML), projected to dominate this segment, particularly due to its subsets of deep learning and computer vision, is the foundational and most prevalent technology within the AI in precision agriculture landscape. Its dominance is due to its unparalleled ability to learn from vast and complex agricultural datasets to identify patterns and make accurate predictions. Unlike rule-based systems, ML algorithms continuously improve their performance as they process more data. This capability is directly applied to the most critical and valuable farming challenges.

For instance, ML models are trained on millions of images to accurately detect and classify crop diseases, nutrient deficiencies, and weed infestations with a precision that surpasses the human eye. In yield forecasting, ML algorithms analyze historical yield data alongside real-time satellite vegetation indices and weather patterns to predict output months in advance, revolutionizing supply chain and marketing decisions.

Furthermore, ML is the engine behind resource optimization, calculating the precise amount of water, fertilizer, or pesticide needed down to the square meter, thereby maximizing efficiency, reducing environmental impact, and delivering a clear return on investment. Its versatility and predictive power make it the most essential and widely integrated AI technology in the sector.

By Application Analysis

Crop monitoring is poised to represent the largest and most impactful application segment for AI in agriculture because it tackles the most fundamental and persistent questions a farmer faces: How are my crops growing? Are they healthy? What do they need? AI-powered crop monitoring solutions, utilizing drones and satellites equipped with multispectral and hyperspectral sensors, provide answers at unprecedented scale, speed, and accuracy. This application moves beyond sporadic manual scouting to offer continuous, field-wide surveillance.

Sophisticated computer vision algorithms can detect early signs of biotic stress (from pests and diseases) and abiotic stress (from water or nutrient lack) long before they are visible to the naked eye, enabling targeted intervention that can save entire harvests. This capability provides an immediate and tangible return on investment by preventing crop loss and minimizing unnecessary input costs.

Furthermore, AI-driven monitoring tracks crop growth stages, estimates biomass, and assesses overall plant health throughout the season, informing critical decisions from irrigation scheduling to determining the optimal harvest time. By directly addressing the core imperative of protecting and maximizing yield, AI for crop monitoring has become the most compelling and widely adopted application.

By End User Analysis

Farmers and growers are anticipated to constitute the primary and largest end-user segment for AI in precision agriculture solutions, as they are the ultimate decision-makers and beneficiaries at the field level. They are driven to adopt these technologies by the direct economic pressures of needing to enhance productivity, optimize input costs, and mitigate risks to ensure the profitability and sustainability of their operations. For large-scale farming enterprises, AI is a tool for achieving operational excellence and economies of scale across vast acreages.

For small and medium-sized growers, the emergence of scalable, subscription-based software models makes this technology accessible to improve their competitive edge. This group includes owner-operators, farm managers, and agronomists who are directly responsible for day-to-day crop production decisions.

They utilize AI-driven insights to make informed choices on planting, irrigation, fertilization, and harvesting. Their hands-on experience means they demand practical, reliable tools that deliver a clear ROI, whether through increased yields, reduced expenditure on water and chemicals, or labor savings. As the direct recipients of both the risks and rewards of farming, growers are the central audience for which these innovative solutions are designed and marketed.

The Global AI in Precision Agriculture Market Report is segmented on the basis of the following:

By Offering / Component

- Hardware

- Sensors (Soil, Weather, Crop Health)

- Drones

- Cameras

- Robotic Equipment

- Software

- Farm Management Systems

- Data Analytics Platforms

- AI Decision-Support Tools

- AI-as-a-Service

- Cloud-Based Platforms

- Subscription Models

- Services

- Consulting

- Integration

- Maintenance & Support

By Type / Technology

- Machine Learning

- Supervised Learning

- Unsupervised Learning

- Reinforcement Learning

- Computer Vision

- Image Recognition

- Pattern Detection

- Object Tracking

- Predictive Analytics

- Yield Forecasting

- Weather Prediction

- Market Pricing Models

- Remote Sensing

- Satellite Imaging

- Drone-Based Imaging

- Natural Language Processing (NLP)

- Chatbots for Farmer Support

- Voice Recognition Systems

- Robotics

- Autonomous Tractors

- AI Drones

- Harvesting Robots

- AI-Powered Systems

- Smart Irrigation Systems

- Climate Monitoring Systems

By Application

- Crop Monitoring

- Disease Detection

- Nutrient Management

- Growth Tracking

- Yield Prediction

- Production Forecasting

- Harvest Optimization

- Soil & Irrigation Management

- Moisture Monitoring

- Smart Irrigation Scheduling

- Pest & Disease Detection

- Insect Monitoring

- Early Disease Warning Systems

- Livestock Monitoring

- Health Tracking

- Behavior Analysis

- Drone Analytics

- Field Mapping

- Crop Scouting

- Weather Forecasting

- Short-Term Forecasts

- Long-Term Climate Projections

- Automation / Robotics

- Automated Seeding

- Robotic Harvesting

- Weed Control

By End User

- Farmers/Growers

- Agricultural Cooperatives

- Agricultural Consultants

- Research & Educational Institutes

- Government Bodies

Global AI in Precision Agriculture Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the global AI in precision agriculture market with 38.0% of the total revenue by the end of 2025, due to a powerful convergence of structural, economic, and technological factors. The region is characterized by the prevalence of large-scale farm operations with vast, contiguous landholdings. This scale provides a clear economic rationale for investing in high-cost AI and automation technologies, as the per-acre cost is lowered and the return on investment becomes significantly more compelling.

Furthermore, North America possesses a mature and robust technological ecosystem, including widespread high-speed rural internet connectivity, a critical enabler for cloud-based AI platforms and real-time data transfer from field to cloud. This is complemented by strong governmental support from agencies like the USDA, which funds research and development and promotes adoption through grants and extension services.

A culture of early technology adoption, a high degree of mechanization, and the presence of a thriving agtech startup scene alongside established agricultural giants create a fertile innovation environment. The pressing issue of labor shortages in agriculture further accelerates the demand for AI-driven autonomous solutions, making North America a mature and deeply penetrated market where these technologies are moving from optional to essential tools for maintaining competitive advantage.

Region with the Highest CAGR

The Asia Pacific region is poised to register the highest Compound Annual Growth Rate (CAGR) in the AI precision agriculture market, driven by overwhelming necessity and transformative government initiatives. The core driver is the immense pressure to achieve food security for its massive and growing population, coupled with the challenge of limited and often declining arable land. Governments across the region, particularly in China, India, and Japan, are actively championing smart farming as a national priority. Japan’s "Society 5.0" and India’s "Digital Agriculture Mission" are examples of top-down strategies that provide funding, subsidies, and policy frameworks to accelerate adoption, specifically to address a critically aging farmer demographic and labor migration to cities.

While the average farm size is small, the proliferation of affordable AI-as-a-Service (AIaaS) models and mobile-based solutions is democratizing access for millions of smallholder farmers. This allows them to leapfrog traditional stages of technological development. The urgent need to boost yields, optimize scarce water resources, and combat the acute impacts of climate change on farming creates a potent catalyst for the rapid uptake of AI solutions, positioning Asia Pacific as the world's fastest-growing and most dynamic future market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global AI in Precision Agriculture Market: Competitive Landscape

The competitive landscape of AI in the precision agriculture market is fragmented and highly dynamic, characterized by a diverse mix of established agricultural machinery giants, specialized technology startups, and major cloud computing platforms. Leading companies like Deere & Company (John Deere) and CNH Industrial have pursued a strategy of acquisition and integration, embedding AI capabilities directly into their equipment to create smart, autonomous machinery ecosystems.

Conversely, agile startups such as Farmers Edge, Prospera (acquired by Valmont), and Taranis focus on developing best-in-class, independent software platforms that offer advanced analytics for crop monitoring, yield forecasting, and pest detection, often operating across multiple hardware brands. Tech titans like Microsoft (Azure FarmBeats), Google, and IBM leverage their immense cloud infrastructure and AI expertise to provide the foundational computing power and AI tools upon which many solutions are built.

Competition is intensifying not just on algorithm accuracy but also on data interoperability, user experience, and the ability to provide clear, actionable insights that demonstrate a tangible return on investment. Partnerships are commonplace, as players seek to combine strengths. Hardware manufacturers partner with software firms, and both collaborate with research institutions to refine AI models. The key differentiators for long-term success will be proving reliability in the field, building farmer trust, and creating scalable solutions that address the specific challenges of diverse global agricultural systems.

Some of the prominent players in the Global AI in Precision Agriculture Market are:

- IBM Corporation

- Microsoft Corporation

- Deere & Company (John Deere)

- Bayer AG (Climate Corporation)

- Trimble Inc.

- Granular Inc.

- Taranis

- Prospera Technologies

- Ag Leader Technology

- CropX Technologies

- Gamaya

- Descartes Labs

- ec2ce

- aWhere Inc.

- VineView

- PrecisionHawk

- Ceres Imaging

- Resson Aerospace

- Tule Technologies

- SlantRange Inc.

- Other Key Players

Recent Developments in the Global AI in Precision Agriculture Market

- June 2024: Greeneye Technology secured $20M to expand its AI-powered precision spraying technology into new markets across North America and Europe.

- May 2024: John Deere partnered with Germany's SSSC to collaboratively research AI for analyzing crop root systems and improving plant health.

- March 2024: Verdant Robotics received a strategic investment from Syngenta Ventures to scale its AI-driven laser weeding and crop care robots.

- April 2024: AGCO launched a new AI-powered grain yield optimization system for its Fendt IDEAL combines, utilizing real-time sensor data to automate adjustments for maximum efficiency.

- February 2024: CNH Industrial partnered with the agricultural AI startup Hummingbird Technologies to integrate its drone-based crop analytics platform into the Case IH AFS farm management system.

- January 2024: AGCO acquired 20% of OneSoil's precision ag platform, aiming to integrate its AI-powered field scouting and data analytics technology.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2,449.1 Mn |

| Forecast Value (2034) |

USD 14,414.6 Mn |

| CAGR (2025–2034) |

21.8% |

| The US Market Size (2025) |

USD 782.7 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Offering/Component (Hardware, Software, AI-as-a-Service, Services), By Type/Technology (Machine Learning, Computer Vision, Predictive Analytics, Remote Sensing, Natural Language Processing (NLP), Robotics, AI-Powered Systems), By Application (Crop Monitoring, Yield Prediction, Soil & Irrigation Management, Pest & Disease Detection, Livestock Monitoring, Drone Analytics, Weather Forecasting, Automation/Robotics), and By End User (Farmers/Growers, Agricultural Cooperatives, Agricultural Consultants, Research & Educational Institutes, Government Bodies)

|

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

IBM Corporation, Microsoft Corporation, Deere & Company (John Deere), Bayer AG (Climate Corporation), Trimble Inc., Granular Inc., Taranis, Prospera Technologies, Ag Leader Technology, CropX Technologies, Gamaya, Descartes Labs, ec2ce, aWhere Inc., VineView, PrecisionHawk, Ceres Imaging, Resson Aerospace, Tule Technologies, SlantRange Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global AI in Precision Agriculture Market size is estimated to have a value of USD 2,449.1 million in 2025 and is expected to reach USD 14,414.6 million by the end of 2034.

The market is growing at a CAGR of 21.8 percent over the forecasted period of 2025.

The US AI in Precision Agriculture Market is projected to be valued at USD 782.7 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 4,173.6 million in 2034 at a CAGR of 20.4%.

North America is expected to have the largest market share in the Global AI in Precision Agriculture Market with a share of about 21.3% in 2025.

Some of the major key players in the Global AI in Precision Agriculture Market are IBM Corporation, Microsoft Corporation, Deere & Company (John Deere), Bayer AG (Climate Corporation), Trimble Inc., Granular Inc., and many others.