Market Overview

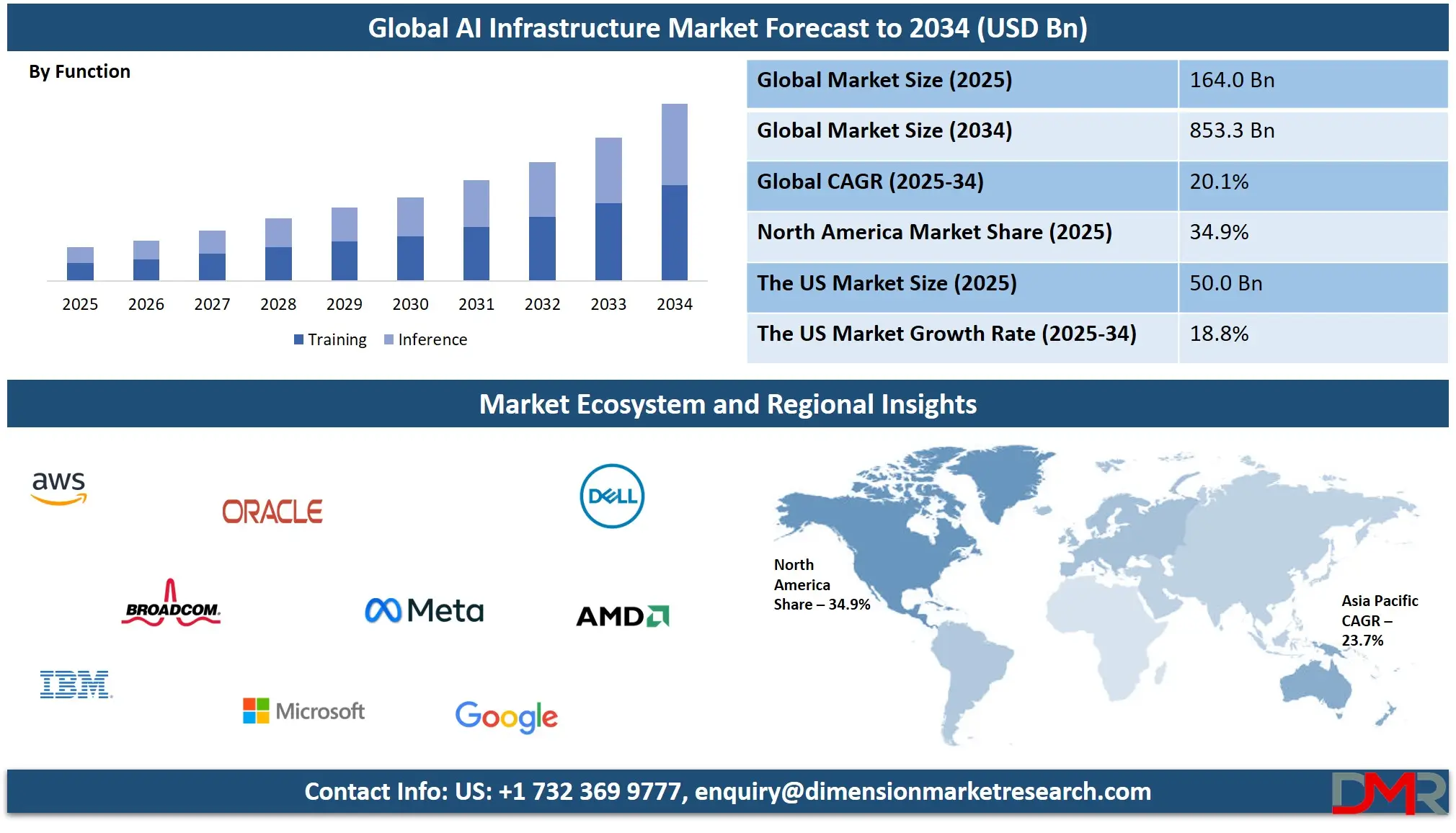

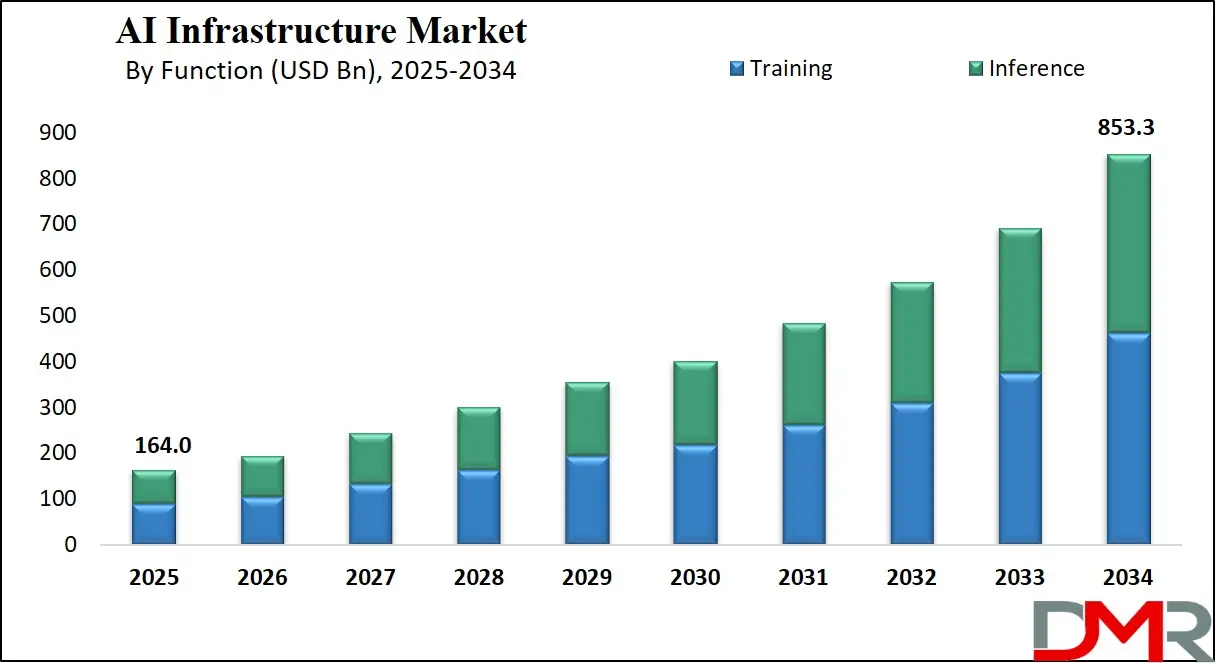

The Global AI Infrastructure Market size is projected to reach USD 164.0 billion in 2025 and grow at compound annual growth rate of 20.1% from there until 2034 to reach a value of USD 853.3 billion.

AI infrastructure refers to the foundation of hardware and software systems that enable the development, training, deployment, and scaling of artificial intelligence (AI) applications. It includes data centers, high-performance computing (HPC), specialized chips like GPUs and TPUs, cloud platforms, and frameworks that support machine learning (ML), deep learning, and other AI models. The infrastructure must handle large volumes of data, offer high computing power, and ensure low-latency performance for real-time processing. With AI being adopted across industries from healthcare and finance to retail and manufacturing the demand for robust infrastructure continues to grow.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In recent years, the demand for AI infrastructure has grown rapidly as companies seek to use AI for automation, decision-making, and better customer experiences. Cloud providers have responded by offering AI-as-a-service, allowing businesses to access AI capabilities without building their own infrastructure. At the same time, enterprises with large-scale AI needs are building private AI infrastructure to maintain control, security, and compliance. With growing AI adoption in language models, recommendation engines, robotics, and computer vision, the need for faster processing and more storage has become a key driver of infrastructure development.

Key trends shaping AI infrastructure include the rise of edge AI, where processing happens closer to the data source such as in Internet of Things (IoT) devices or autonomous vehicles reducing the need to transfer large data to central servers. There's also increasing use of hybrid cloud systems that combine private and public cloud environments, allowing flexibility and scalability. Another major trend is the focus on energy-efficient hardware, as running large AI models consumes significant power. Companies are also working on software optimizations that make AI workloads run faster and more efficiently on available hardware.

Important events have influenced the direction of AI infrastructure. Leading tech companies have released custom AI chips designed specifically for training and inference. Cloud platforms have introduced pre-built AI development environments to simplify AI deployment. Major partnerships between chipmakers, cloud providers, and AI firms have accelerated the growth of new AI systems. Regulatory developments around data privacy and AI governance have also shaped how companies design and manage their infrastructure to stay compliant.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

One of the most important insights is that AI infrastructure is becoming more democratized. Small startups can now access advanced tools that were once only available to tech giants. Open-source software libraries and cloud platforms have lowered the entry barrier. At the same time, big enterprises are investing heavily in custom AI infrastructure to train proprietary models that give them a competitive edge. This shift is pushing both innovation and standardization across the industry.

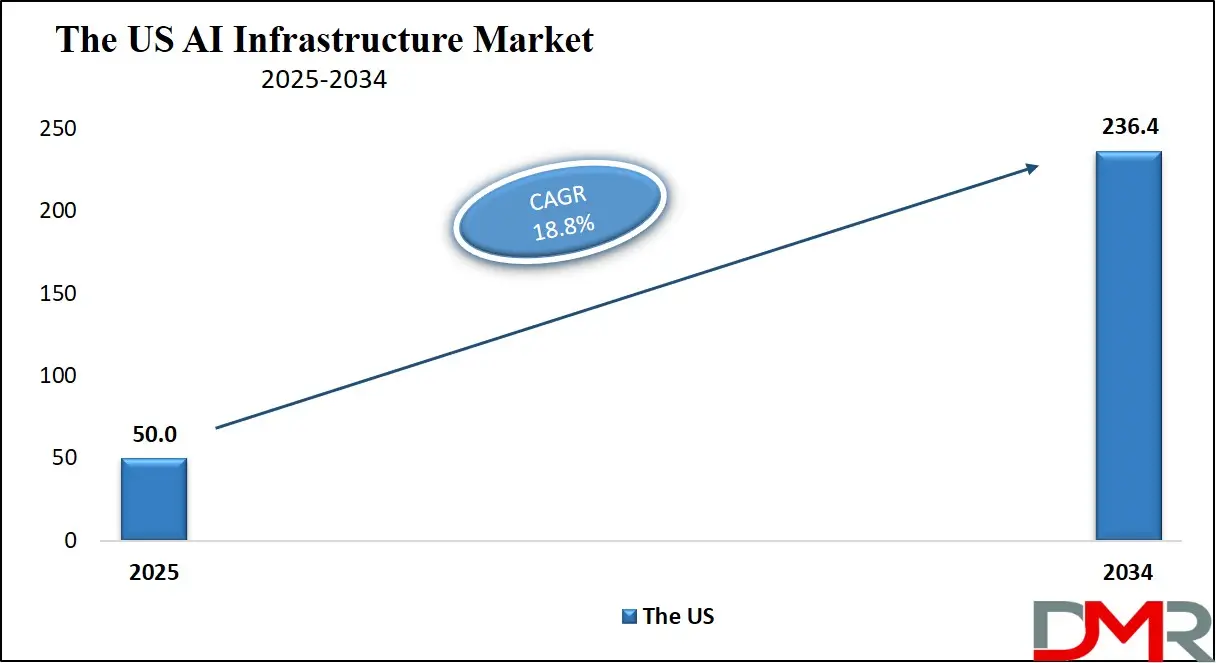

The US AI Infrastructure Market

The US AI Infrastructure Market size is projected to reach USD 50.0 billion in 2025 at a compound annual growth rate of 18.8% over its forecast period.

The US plays a leading role in the global AI infrastructure market, driven by its advanced technology ecosystem, strong investment landscape, and presence of major cloud and chip companies. It is home to cutting-edge research in AI and high-performance computing, fueling demand for powerful infrastructure solutions.

The US also sets the pace in innovation through custom AI hardware, large-scale data centers, and next-gen networking technologies. Its robust startup ecosystem and government support further strengthen its position. With widespread AI adoption across industries like healthcare, finance, defense, and retail, the US continues to influence global trends and standards. Its leadership in AI model development also increases the need for scalable and secure infrastructure across public and private sectors.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe AI Infrastructure Market

Europe AI Infrastructure Market size is projected to reach USD 41.0 billion in 2025 at a compound annual growth rate of 18.3% over its forecast period.

Europe plays a vital role in the AI infrastructure market by focusing on data privacy, regulatory compliance, and ethical AI development. The region is investing in sovereign cloud solutions and building AI infrastructure that aligns with strict data protection laws like GDPR. European countries are working together to create shared digital infrastructure and support innovation through public-private partnerships and research funding.

The demand for AI infrastructure is growing across sectors such as manufacturing, automotive, healthcare, and energy. Europe also emphasizes energy-efficient and sustainable infrastructure solutions, making green AI a regional priority. With its focus on responsible AI and digital sovereignty, Europe is shaping the future of AI infrastructure while ensuring trust, transparency, and regional independence in AI technologies.

Japan AI Infrastructure Market

Japan AI Infrastructure Market size is projected to reach USD 9.8 billion in 2025 at a compound annual growth rate of 21.0% over its forecast period.

Japan plays a major role in the AI infrastructure market by leveraging its expertise in high-tech manufacturing, advanced electronics, and precision engineering. The country supports the development of specialized components essential for data centers, including power systems, cooling technologies, and high-speed connectivity. Japan is also home to powerful supercomputing projects that enhance AI research and development across sectors.

The government actively promotes AI and digital transformation through strategic investments and national policies aimed at building robust, secure infrastructure. Industries such as automotive, robotics, and healthcare drive demand for AI infrastructure, as they integrate intelligent systems into operations. Japan’s balanced focus on innovation, quality, and efficiency strengthens its position in shaping the future of global AI infrastructure.

AI Infrastructure Market: Key Takeaways

- Market Growth: The AI Infrastructure Market size is expected to grow by USD 689.3 billion, at a CAGR of 20.1%, during the forecasted period of 2026 to 2034.

- By Function: The Training is anticipated to get the majority share of the AI Infrastructure Market in 2025.

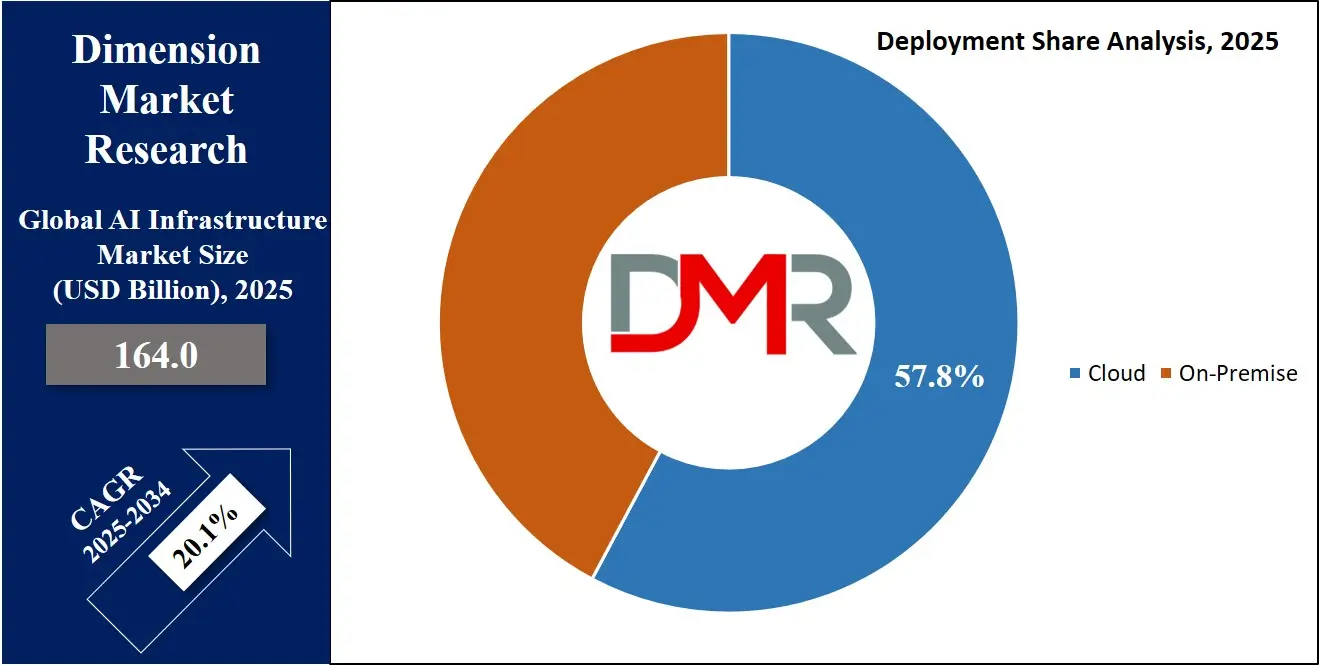

- By Deployment: The Cloud segment is expected to get the largest revenue share in 2025 in the AI Infrastructure Market.

- Regional Insight: North America is expected to hold a 34.9% share of revenue in the Global AI Infrastructure Market in 2025.

- Use Cases: Some of the use cases of AI Infrastructure include smart manufacturing, autonomous vehicles, and more.

AI Infrastructure Market: Use Cases:

- Smart Manufacturing: AI infrastructure supports predictive maintenance, quality inspection, and automation in factories. With powerful computing and real-time data analysis, manufacturers can reduce downtime, improve product quality, and increase efficiency. Edge computing also enables fast decision-making on the factory floor.

- Autonomous Vehicles: Self-driving cars rely on AI infrastructure to process data from cameras, sensors, and radar. High-performance computing systems allow real-time decision-making for navigation, obstacle detection, and traffic response. Cloud and edge integration ensures both training and in-vehicle operations are supported smoothly.

- Healthcare Diagnostics: Hospitals use AI infrastructure to support imaging analysis, disease prediction, and personalized medicine. Large volumes of patient data are processed through AI models, requiring powerful GPUs and storage systems. This improves accuracy and speeds up diagnostic procedures.

- Financial Fraud Detection: Banks and financial institutions use AI infrastructure to monitor transactions and detect unusual patterns. Real-time analytics powered by scalable computing platforms help prevent fraud and ensure regulatory compliance. These systems must process massive data volumes with low latency.

Stats & Facts

- According to WEKA

- AI adoption is advancing rapidly, moving beyond small experimental teams to become a widely implemented and strategic function within many enterprises.

- The majority of organizations now say AI is deeply embedded in their operations, with its presence clearly linked to driving core business value and not just isolated testing.

- A notable 42% of surveyed enterprises are prioritizing AI to improve product or service quality, signaling a clear focus on customer-facing innovation.

- Around 41% of businesses are using AI to streamline IT operations, boost system performance, and manage increasingly complex digital environments more effectively.

- With 40% of respondents applying AI to enhance workforce productivity, it's clear that automation and intelligent tools are helping employees focus on higher-value work.

- Revenue growth is also a leading goal, with 39% of organizations investing in AI to directly support sales expansion and competitive advantage.

- Innovation cycles are speeding up as 39% of respondents report using AI to accelerate product development and bring new solutions to market faster.

- Compared to last year, there’s been a major shift in AI maturity; in 2023 most firms were still exploring or piloting, but in 2024, most report enterprise-wide AI use.

- On average, organizations have 10 AI projects in pilot testing and 16 in limited rollout stages, but only 6 have scaled across the enterprise—highlighting deployment challenges.

- Poor data foundations are the main reason why so many AI projects struggle to scale, with outdated or fragmented data systems standing in the way of production-level adoption.

- Access to quality, consistent data remains a top roadblock, as teams often know what data is relevant but lack the integration and availability needed to use it effectively.

- A full 35% of organizations cite storage and data management as their top infrastructure challenge when deploying AI, outranking compute, security, and networking concerns.

- In comparison, only 26% of businesses name compute as the main barrier, showing that raw processing power is less of an issue than data flow and access.

- Security is seen as a critical but secondary concern, mentioned by 23% of respondents, while networking infrastructure was cited by 15% as a limiting factor in scaling AI.

- Overall, modernizing data architecture has emerged as a critical enabler of AI success, far more so than simply expanding hardware or upgrading cloud resources.

Market Dynamic

Driving Factors in the AI Infrastructure Market

Surging Demand for High-Performance Computing in AI Applications

One of the main growth drivers of the AI infrastructure market is the increasing need for high-performance computing (HPC) to support complex AI and machine learning tasks. AI models, especially deep learning algorithms, require vast processing power and storage to analyze large datasets quickly and accurately. Industries such as healthcare, finance, automotive, and retail are deploying AI to gain insights, automate tasks, and enhance user experiences.

This pushes demand for specialized hardware like GPUs and TPUs, along with robust data centers and networking systems. As AI models become more advanced and data-hungry, the market for powerful, scalable, and efficient infrastructure continues to expand. The need for real-time processing and decision-making further boosts investment in edge computing and hybrid computing environments.

Expansion of AI Across Diverse Industry Verticals

The rapid integration of AI technologies across various sectors is another key driver accelerating the growth of AI infrastructure. From smart cities and autonomous systems to voice assistants and healthcare diagnostics, AI is becoming essential in everyday business operations and services. Each of these applications requires reliable infrastructure to support fast computing, data management, and secure deployment. Organizations are investing in both cloud-based and on-premises infrastructure to meet specific business and compliance needs. Additionally, the growing focus on automation, personalization, and digital transformation across industries fuels the adoption of AI tools that rely heavily on a strong backend setup.

Restraints in the AI Infrastructure Market

High Cost of Deployment and Maintenance

One of the major restraints in the AI infrastructure market is the high cost associated with setting up and maintaining advanced systems. Building AI-ready infrastructure involves significant investment in high-performance hardware like GPUs, TPUs, specialized servers, and large-scale storage.

Additionally, maintaining data centers and ensuring optimal energy usage further adds to operational costs. For many small and medium-sized enterprises, these costs can be a major barrier to entry. While cloud-based services offer some relief, recurring subscription and data processing charges can still be expensive. The cost factor often slows down AI adoption, especially in developing regions where funding and technical expertise may be limited. This financial challenge can restrict market growth and innovation in resource-constrained environments.

Complexity in Integration and Scalability

Another key restraint is the complexity involved in integrating AI infrastructure with existing IT systems. Many organizations struggle to align new AI workloads with legacy systems, leading to operational disruptions and inefficiencies. Ensuring smooth data flow between storage, computing, and software layers requires advanced architecture and skilled personnel. As AI models and applications evolve, companies also face challenges in scaling infrastructure to keep up with demand. Without proper planning and flexibility, rapid expansion can lead to bottlenecks or underutilized resources.

Additionally, managing security, compliance, and data governance across distributed systems adds to the complexity. This integration difficulty can delay AI deployment timelines and reduce overall effectiveness, especially for organizations without deep technical capabilities.

Opportunities in the AI Infrastructure Market

Rising Adoption of Edge AI and IoT Integration

The growing use of edge computing and Internet of Things (IoT) devices presents a significant opportunity for the AI infrastructure market. As more devices generate data at the edge—like cameras, sensors, and wearables—there is a need for infrastructure that can process this information locally with low latency. Edge AI helps in faster decision-making, improves data privacy, and reduces the load on central data centers. This trend is especially useful in sectors like smart manufacturing, autonomous vehicles, healthcare, and agriculture.

Companies are now exploring infrastructure solutions that combine cloud and edge capabilities for greater flexibility. This opens up new opportunities for vendors to develop compact, energy-efficient AI hardware and software. The shift to real-time edge processing is expected to drive infrastructure innovation and deployment.

Expansion of AI in Emerging Economies and New Sectors

As digital transformation accelerates globally, emerging economies are increasingly adopting AI technologies to boost productivity, streamline operations, and improve public services. Governments and businesses in these regions are investing in smart infrastructure, healthcare systems, education platforms, and transportation networks powered by AI. This rising adoption creates a growing need for localized AI infrastructure that is cost-effective, scalable, and adaptable to regional requirements.

Additionally, sectors like agriculture, logistics, and energy—traditionally slower in adopting digital technologies—are now turning to AI to solve long-standing challenges. These untapped or underexplored areas offer immense potential for AI infrastructure providers to introduce tailored solutions. As awareness and accessibility increase, these opportunities can lead to substantial market expansion and diversification.

Trends in the AI Infrastructure Market

Hybrid and Multi‑Cloud Deployments

A major trend in AI infrastructure is the widespread adoption of hybrid and multi‑cloud architectures. Businesses are blending on‑premises systems with public and private clouds to achieve greater flexibility and control. This approach allows organizations to store sensitive data in-house while leveraging cloud resources for burst workloads and development. It supports seamless scaling and avoids vendor lock‑in, giving companies the freedom to optimize performance, cost, and compliance. As AI workloads continue to evolve in size and complexity, hybrid setups enable smoother transitions between environments, making deployment faster and more efficient across different platforms.

Energy‑Efficient and Purpose‑Built Hardware

Another growing trend is the shift toward energy‑efficient and purpose‑built AI hardware. As computational demands soar, organizations seek chips and systems that deliver high performance while consuming less power and producing less heat. This has led to specialized designs that focus on inference workloads, lower-cost training, and cooling innovations. Vendors are introducing hardware tailored to specific industries—like vision processing for factories or sensor fusion for autonomous systems—enabling more cost‑efficient and sustainable AI operations. This movement is driving innovation in chip architecture, cooling systems, and server design to support greener, more optimized AI infrastructure.

Research Scope and Analysis

By Offering Analysis

Processor will be leading the AI infrastructure market in 2025 with an estimated share of 44.7%, as it plays a central role in powering AI workloads that require high-speed data processing and complex computation. With the rise in machine learning, deep learning, and real-time analytics, processors designed specifically for AI tasks—such as GPUs, TPUs, and custom AI chips—are becoming essential. These processors enable faster training and inference of AI models, making them ideal for applications in industries like healthcare, automotive, and finance.

The shift toward edge computing and the demand for energy-efficient processing are also driving innovation in AI-specific processors. It is expected that the continued development of processor architectures focused on speed, power optimization, and scalability will support the growing need for efficient and powerful AI infrastructure solutions across the globe.

Networking is expected to experience significant growth over the forecast period in the AI infrastructure market, as seamless and high-speed connectivity becomes crucial for supporting AI operations. As AI workloads often run across distributed systems and rely on cloud or edge computing, efficient data transfer between devices, data centers, and computing nodes is critical.

Networking components such as switches, routers, and high-bandwidth interconnects help manage this data flow without delays or bottlenecks. The growth of smart applications, IoT ecosystems, and real-time AI services further pushes the demand for low-latency and scalable network infrastructure. Enhanced networking not only supports faster data movement but also improves the performance and reliability of AI platforms across various sectors.

By Deployment Mode Analysis

Cloud deployment is set to lead the AI infrastructure market in 2025 with an expected share of 57.8%, driven by its flexibility, scalability, and lower upfront costs. Organizations of all sizes are turning to cloud-based solutions to support AI workloads without the need for heavy investments in physical infrastructure. Cloud platforms offer powerful computing resources, large storage capacity, and access to pre-built AI tools, making it easier to develop, test, and scale applications.

The growing need for remote access, collaborative environments, and rapid deployment further boosts cloud adoption. As more businesses integrate AI into their daily operations, cloud deployment becomes a preferred choice due to its ability to handle dynamic and high-volume workloads. This growing demand supports continuous improvements in cloud-based AI infrastructure services across various industries.

On-premise deployment is projected to witness significant growth over the forecast period in the AI infrastructure market, particularly among large enterprises with strict data privacy and security needs. Unlike cloud-based systems, on-premise infrastructure gives companies full control over their hardware, software, and data management.

This is especially important in sectors like defense, healthcare, and finance, where sensitive information must remain within local systems. On-premise setups also help reduce latency for real-time AI applications and allow for customization based on specific operational needs. While it involves higher initial costs, organizations favor it for its ability to deliver stable, secure, and high-performance AI environments. The trend toward hybrid models further supports on-premise adoption as part of a broader deployment strategy.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Function Analysis

Training is projected to lead the AI infrastructure market in 2025 with an estimated share of 54.1%, as it forms the core of developing intelligent systems. This function involves feeding large volumes of data into AI models to help them learn patterns, make predictions, and improve over time. Training requires massive computing power, high-speed processors, and large-scale storage systems, making it a major driver for AI infrastructure development.

Businesses and research institutions across sectors are investing in robust training environments to support applications like natural language processing, image recognition, and autonomous decision-making. The growing complexity of AI models demands more powerful infrastructure setups. This rising demand for accurate and efficient model training continues to fuel growth in data center capacity, custom hardware designs, and software frameworks that support high-performance computing.

Inference is expected to see significant growth over the forecast period in the AI infrastructure market, especially as more AI models move from development to real-world use. Inference refers to the process where trained models are used to make predictions or decisions based on new data. This function requires fast, reliable, and often low-power infrastructure, especially in edge environments like mobile devices, vehicles, and smart appliances.

Companies are optimizing their infrastructure to support inference in real-time, helping power services like voice assistants, fraud detection, and recommendation engines. The shift toward more responsive and scalable AI services continues to expand the need for dedicated inference hardware and software. As demand grows across various sectors, the role of inference will become even more central to AI infrastructure planning.

By End User Analysis

IT & Telecom will be leading the AI infrastructure market in 2025 with an expected share of 21.9%, fueled by rising demand for faster data processing, real-time analytics, and smart communication systems. As telecom companies expand 5G networks and IT firms roll out cloud and AI services, the need for robust infrastructure to manage large data volumes and high-speed connections is increasing.

AI is being used in network optimization, predictive maintenance, customer support automation, and cybersecurity, all of which rely on powerful computing and data storage systems. These advancements push organizations to invest in scalable and energy-efficient AI infrastructure. With rapid growth in data usage and smart connectivity, IT and telecom companies are setting the pace for AI infrastructure innovation and deployment, making the sector a key contributor to the market’s overall expansion in the coming years.

Retail & E-commerce is anticipated to experience significant growth over the forecast period in the AI infrastructure market, as businesses use AI to enhance customer experiences and improve operations. This industry relies heavily on personalized recommendations, real-time inventory updates, dynamic pricing, and fraud detection—all powered by AI.

To support these capabilities, companies need scalable infrastructure that can process large amounts of data quickly and reliably. With growing online shopping trends and customer expectations for faster service, AI infrastructure becomes essential for managing user behavior data, logistics, and supply chain optimization. As digital retail channels expand, retailers are increasingly adopting cloud-based and edge solutions to stay competitive, making this vertical a strong driver for AI infrastructure growth.

The AI Infrastructure Market Report is segmented on the basis of the following:

By Offering

- Processor

- Memory

- Storage

- Networking

By Deployment Mode

By Function

By Industry Vertical

- BFSI

- IT & Telecom

- Healthcare

- Retail & E-commerce

- Automotive

- Government

- Manufacturing

- Energy & Utilities

- Media & Entertainment

- Others

Regional Analysis

Leading Region in the AI Infrastructure Market

North America is leading the AI infrastructure market in 2025 with a share of 34.9%, driven by strong technological development, heavy investments, and widespread adoption of AI across industries. The region is home to many global technology leaders and startups that continuously push the boundaries in cloud computing, data centers, and advanced chip designs. There is a growing need for high-performance computing systems to support large-scale AI applications such as autonomous systems, predictive analytics, and natural language processing.

It is also expected that increasing use of AI in sectors like healthcare, retail, and finance will further boost infrastructure needs. Governments and private companies are actively supporting research and development in AI hardware and software, making the region a hub for innovation. In addition, favorable regulatory policies and a strong digital ecosystem contribute to market growth. With continued focus on building scalable, secure, and energy-efficient AI infrastructure, North America remains at the center of global AI development in 2025..

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the AI Infrastructure Market

Asia Pacific is showing significant growth in the AI infrastructure market over the forecast period, supported by rapid digital transformation, strong government support, and rising demand for smart technologies. Countries across the region are investing heavily in high-performance computing, data centers, and next-generation networking to power artificial intelligence applications.

It is expected that sectors like manufacturing, transportation, healthcare, and telecommunications will increasingly rely on AI-based systems, boosting the need for scalable and efficient infrastructure. The region also benefits from a growing tech-savvy population, expanding cloud services, and the development of custom AI hardware. These factors are creating a strong foundation for continued growth in AI infrastructure across Asia Pacific.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The AI infrastructure market is highly competitive, with many companies working to offer faster, smarter, and more efficient systems to support growing AI needs. This includes cloud providers, chip manufacturers, data center operators, and software platform developers, all aiming to improve computing speed, reduce energy use, and handle large volumes of data. The competition is not just about performance but also about offering flexible, cost-effective, and easy-to-scale solutions.

Some focus on building hardware that supports heavy AI workloads, while others offer tools and platforms that make AI easier to develop and deploy. Partnerships, innovation, and global expansion are common strategies in this space, as players race to meet the rising demand for AI across different industries and regions.

Some of the prominent players in the global AI Infrastructure are:

- NVIDIA

- Intel

- AMD (Advanced Micro Devices)

- Google (Alphabet)

- Microsoft

- Amazon Web Services (AWS)

- IBM

- Meta (Facebook)

- Oracle

- Dell Technologies

- Cisco Systems

- Broadcom

- Qualcomm

- Samsung Electronics

- Huawei

- Apple

- Arm Ltd.

- Micron Technology

- HPE (Hewlett Packard Enterprise)

- Fujitsu

- Other Key Players

Recent Developments

- In June 2025, OpenAI is in talks with the Indian government to collaborate on developing AI infrastructure in the country, including expanding local data center capacity, under its global ‘OpenAI for Countries’ initiative. As part of this effort, OpenAI has partnered with MeitY’s IndiaAI Mission to launch its first international developer training program—the OpenAI Academy—to enhance India’s AI talent. Inspired by its approach in the UAE, OpenAI is also exploring the possibility of co-investing in AI infrastructure with national governments, aligning with both U.S. policy and local tech goals.

- In May 2025, Cisco announced its collaboration with the AI Infrastructure Partnership (AIP), a coalition led by BlackRock, GIP, MGX, Microsoft, NVIDIA, and xAI. As a new technology partner, Cisco joins existing energy collaborators like GE Vernova and NextEra Energy, further enhancing AIP’s mission to develop secure, efficient, and scalable infrastructure for AI workloads. AIP aims to unlock USD 30 billion in capital from investors, asset owners, and corporations, which is expected to generate up to USD 100 billion in total investment potential when including debt financing.

- In March 2025, xAI and chipmaker Nvidia joined a USD 30 billion AI infrastructure initiative led by the AI Infrastructure Fund, backed by BlackRock, Microsoft, and Abu Dhabi’s MGX. Announced on March 19, the fund aims to raise USD 100 billion to support global AI development. NVIDIA emphasized that AI infrastructure will drive economic growth and innovation across industries. The fund, launched by Microsoft and BlackRock last year, focuses on building data centers and securing energy sources to power the AI ecosystem.

- In January 2025, At Microsoft AI Tour in Bengaluru announced a USD 3 billion investment in India over the next two years to expand cloud and AI infrastructure. Microsoft also unveiled plans to train 10 million people by 2030, supporting India’s vision to become an AI-first nation. Its research division launched the AI Innovation Network to speed up the transition from research to business solutions. Additionally, Microsoft partnered with SaaSBoomi to boost India’s AI and SaaS ecosystem, aiming to support 5,000 startups and 10,000 entrepreneurs

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 164.0 Bn |

| Forecast Value (2034) |

USD 853.3 Bn |

| CAGR (2025–2034) |

20.1% |

| The US Market Size (2025) |

USD 50.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Offering (Processor, Memory, Storage, and Networking), By Deployment Mode (On-Premise and Cloud), By Function (Training and Inference), By Industry Vertical (BFSI, IT & Telecom, Healthcare, Retail & E-commerce, Automotive, Government, Manufacturing, Energy & Utilities, Media & Entertainment, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

NVIDIA, Intel, AMD (Advanced Micro Devices), Google (Alphabet), Microsoft, Amazon Web Services (AWS), IBM, Meta (Facebook), Oracle, Dell Technologies, Cisco Systems, Broadcom, Qualcomm, Samsung Electronics, Huawei, Apple, Arm Ltd., Micron Technology, HPE (Hewlett Packard Enterprise), Fujitsu, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global AI Infrastructure Market?

▾ The Global AI Infrastructure Market size is expected to reach a value of USD 164.0 billion in 2025 and is expected to reach USD 853.3 billion by the end of 2034

Which region accounted for the largest Global AI Infrastructure Market?

▾ North America is expected to have the largest market share in the Global AI Infrastructure Market, with a share of about 34.9% in 2025.

How big is the AI Infrastructure Market in the US?

▾ The AI Infrastructure Market in the US is expected to reach USD 50.0 billion in 2025.

Who are the key AI Infrastructure Market?

▾ Some of the major key players in the Global AI Infrastructure Market are IBM, Intel, NVIDIA and others

What is the growth rate in the Global AI Infrastructure Market?

▾ The market is growing at a CAGR of 20.1 percent over the forecasted period.