Air conditioning systems are crucial for controlling air temperature and quality in various indoor environments, enhancing comfort.

The AC systems market includes diverse technologies like central air conditioners, window units, split systems, and portable models, catering to residential, commercial, and industrial users. The need for climate control in different settings drives this market.

The air conditioning market is poised for growth in 2024, fueled by increasing urbanization and rising global temperatures. This creates substantial opportunities for both existing companies and new market entrants. Large players can capitalize on their scale and existing customer relationships to introduce energy-efficient systems with smart technology, using their established infrastructure.

Additionally, advancements in

HVAC systems allow for the modernization of outdated systems, offering greener solutions that reduce environmental impact while meeting consumer demands for sustainability.

The focus for new and entry-level businesses could be on niche markets such as portable or solar-powered air conditioning units.

These companies can innovate quickly, addressing specific consumer demands that larger corporations might not prioritize. Smaller firms can capture significant market segments by leveraging unique selling propositions like customizable designs, eco-friendly materials, and IoT connectivity. Strategic partnerships with local distributors and e-commerce platforms can also boost their market reach.

A major trend in the cooling equipment market is the shift toward sustainability and energy efficiency. Increased consumer and regulatory awareness of the environmental impacts of traditional cooling systems is driving manufacturers to create more energy-efficient products with less harmful refrigerants. Innovations like dual inverter compressors, advanced blower technology, and smart thermostats are helping these systems meet strict global energy standards.

The integration of technology is revolutionizing air conditioning systems. With the advent of smart homes, AC systems that are smartphone-controllable and equipped with AI to learn user preferences are becoming standard. These smart ACs optimize energy use and automatically adjust to changing environmental conditions, improving both convenience and efficiency.

Additionally, there is a growing interest in alternative cooling solutions that move away from traditional mechanical methods. Technologies such as evaporative cooling, geothermal cooling, and phase change materials are on the rise. These not only reduce electricity use but also align with international efforts to minimize environmental impacts.

To underline the significance of these trends and opportunities, consider that 84% of all homes in the United States are equipped with air conditioning, with the US consuming more AC than all other nations combined. This high penetration underscores the potential for growth in retrofitting existing systems with more efficient technologies.

Furthermore, air conditioning's substantial energy consumption, which accounts for about 18% of the electricity used in US homes, highlights the urgent need for sustainable solutions. On a global scale, air conditioning represents 4% of greenhouse gas emissions, emphasizing the environmental impact and the potential benefits of innovating in eco-friendly cooling technologies.

These statistics not only illustrate the current landscape and challenges of the air conditioning market but also highlight the critical areas for innovation and development that can lead to substantial business growth in 2024 and beyond. Engaging with these trends, businesses can offer solutions that meet the dual demands of efficiency and sustainability, capturing customer interest and driving market expansion.

However, a significant challenge lies in making products more affordable. Balancing sustainability & cost-effectiveness remains challenging, as eco-friendly air conditioning systems often come at an expensive price due to high-end technologies. Integrating this affordability gap while maintaining sustainability is a major restraint for widespread adoption and a greener future for the market.

Key Takeaways

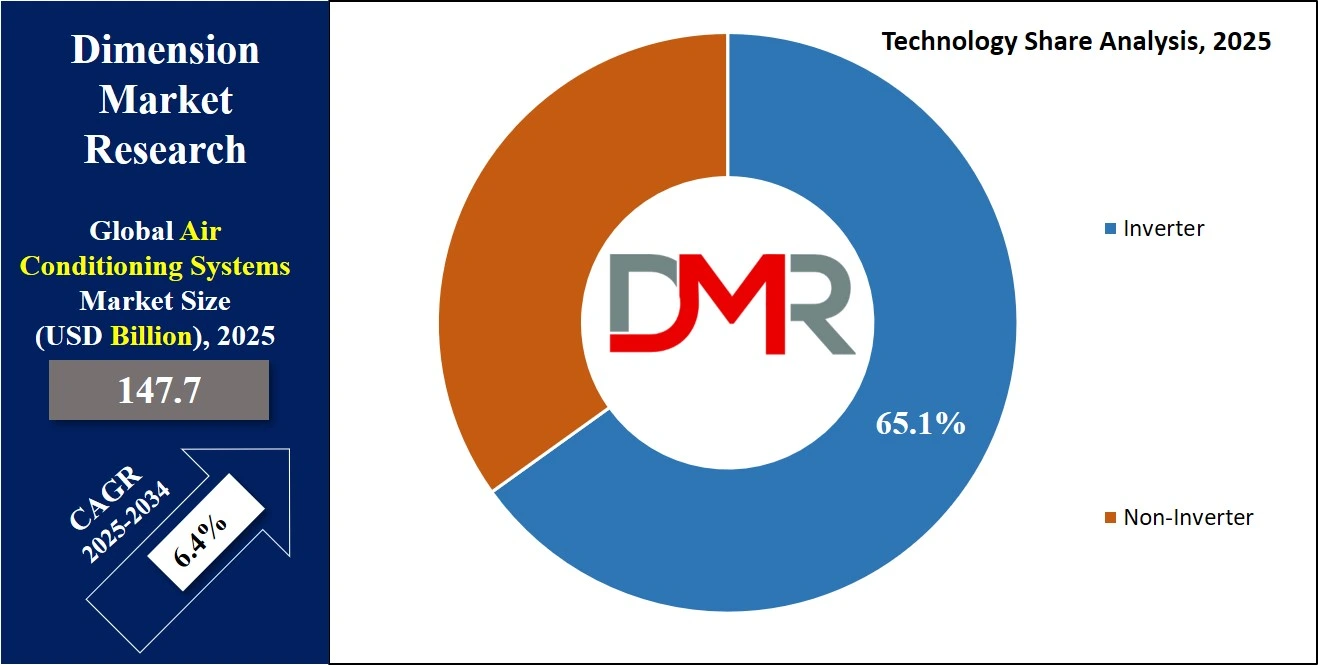

- The global air conditioning systems market is projected to reach USD 263.5 billion by 2034, at a CAGR of 6.4%.

- The global air conditioning systems market encompasses the manufacturing, distribution, and sales of HVAC units, serving residential, industrial, and commercial sectors, driven by climate control needs and technological advancements.

- Unitary air conditioners exert their dominance in this segment with 40.0% of the market share in 2024.

- Inverter technology shows its dominance in the technology in this market with 65.1% of the market share in 2024.

- The commercial sector dominates this market based on end users with the highest market share in 2024.

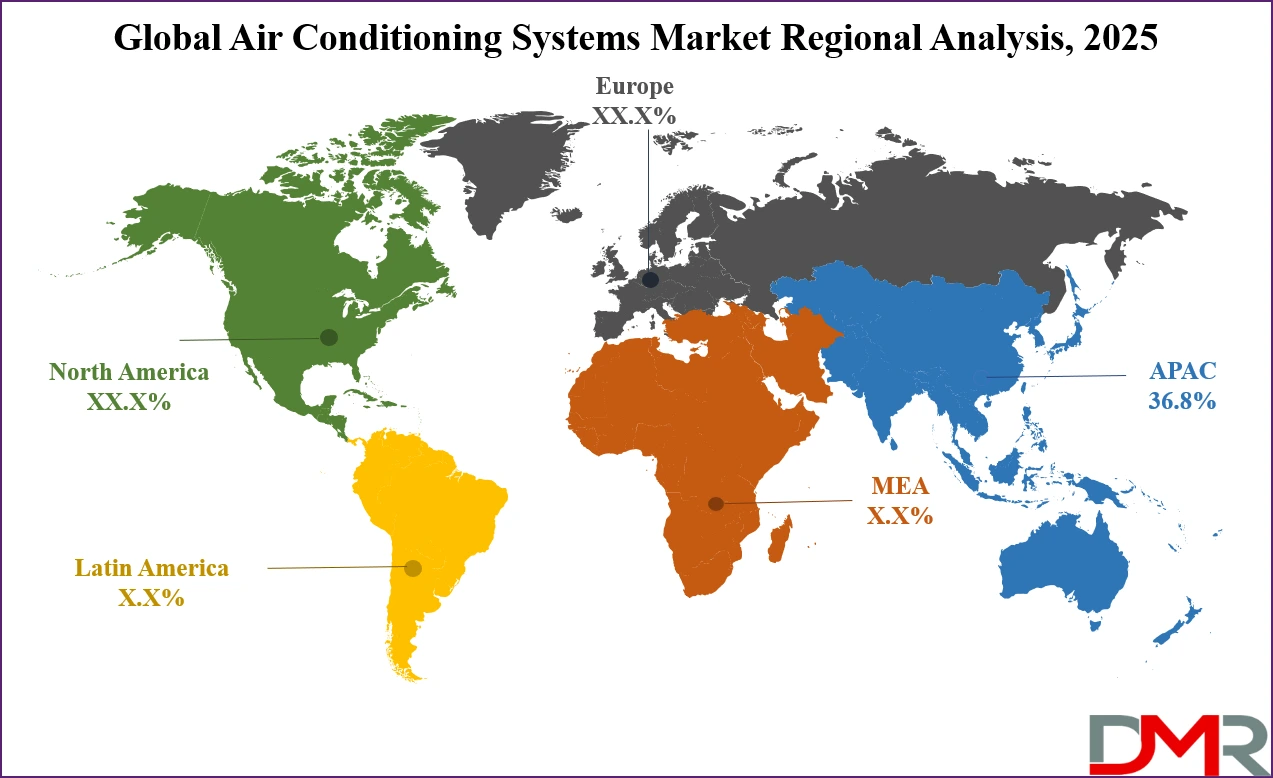

- Asia-Pacific dominates the global air conditioning equipment market with 36.8% of the market share in 2024.

Use Cases

- Residential Cooling: Rising urbanization and disposable income drive demand for efficient, smart air conditioners in houses, ensuring consolation and power savings amid growing global temperatures.

- Commercial Spaces: Offices, retail stores, and hotels utilize superior HVAC systems for optimal temperature management, enhancing employee productivity and customer satisfaction while adhering to environmental policies.

- Industrial Applications: Factories and warehouses require robust air conditioning systems to hold machinery performance, ensure worker protection, and observe strict climate control standards.

- Healthcare Facilities: Hospitals and clinics rely on precise climate control to maintain sterile environments, protect sensitive equipment, and provide comfort to patients and workers.

- Educational Institutions: Schools and universities enforce air conditioning to create conducive learning environments, improving student concentration and overall educational outcomes by managing indoor air quality.

Market Dynamic

Trends

Energy-Efficient Air Conditioning

The demand for energy-efficient air conditioning systems is increasing daily, as we are feeling the problems of global warming and tight environmental regulations. The market research indicates that the technology of air conditioning systems should be improved so that it uses less energy and leaves a smaller carbon footprint, which is the reason why the market pays attention to the issue of sustainability and eco-friendliness.

Smart Air Conditioning Systems

The application of smart technologies in air conditioning systems is not a new thing, but the trend is growing which enhances the user experience by giving the user the possibility to control the system from a distance, automate it, and manage energy. The fact that this trend is due to the increased number of IoT and

smart home system being used is resulting in the increase of the air conditioning system market that is projected to grow over the forecast period.

Growth Drivers

Global Warming and Climate Change

The greater the worldwide temperatures and the unpredictable climate change are the main reasons for the increased need for air conditioning systems. Global warming is still a problem, and as a result, both residential and commercial sectors are spending a lot of money on air conditioning solutions to maintain indoor air quality and comfort, thus, making the air conditioning market grow.

Urbanization and Industrialization

The rapid urbanization and industrial growth in developing countries are the main causes for the growth of the air conditioning system market. The construction of new residential, commercial, and industrial buildings needs the application of advanced air conditioning systems, which, thus, turn the market size expansion and provide the businesses the importance to the market players.

Growth Opportunities

Technological Advancements

Air conditioning technologies have been improved significantly, for instance, the emergence of energy-efficient and eco-friendly systems, that offer a great potential for further growth. The air conditioning companies that are operating in the industry are now working on the R&D of systems that will be used to meet consumer preferences as a result, the market for the air conditioning system will be expanded, and also the market outlook of the air conditioning system will be enhanced.

Emerging Markets

The growing middle class and the rise of income in emerging markets, especially in Asia-Pacific and Latin America, are the sources of these opportunities for expansion. The increasing demand for residential and commercial air conditioning systems in these regions is bound to be the cause of the global air conditioning system market growth, and thus, it will be the main factor in the marketing dynamics.

Restraints

High Initial Costs and Maintenance

The high initial cost of advanced air conditioning systems is one of the major hurdles to its general acceptance. A lot of consumers and businesses may not be ready to pay for the energy-efficient and smart air conditioning systems due to the initial costs, and thus they may not be able to launch the air conditioning market.

Environmental Concerns

Although air conditioning technology has improved, the present systems are still responsible for environmental problems, like increased energy consumption and the emission of greenhouse gases. The strict regulations and the environmental concerns about the impact of air conditioning equipment can be the factors that will prevent the market expansion, and this in turn will be a challenge for the manufacturers in the global air conditioner market.

Research Scope and Analysis

Type Analysis

In 2024, unitary air conditioners dominate the type segment share of the market by having a market share of about 40% and are projected to experience significant growth throughout the forecast period. These air conditioning systems are majorly utilized in residential settings, and the growing demand in the expanding residential sector is anticipated to experience the requirement for unitary air conditioning systems.

Furthermore, the seamless compatibility of unitary air conditioners with warm furnaces within the same ductwork, applicable to both commercial & residential buildings, is expected to contribute to the growth of this segment.

In addition to unitary air conditioners, the category comprises PTAC (Packaged Terminal Air Conditioners) & rooftop ACs. Mainly, the PTAC segment is also anticipated for significant growth during the forecasted period. This growth in PTAC is driven by its rising popularity in the hospitality &residential sectors. PTACs are also gaining attention owing to technological innovations like the integration of inverter technology, energy-efficient systems, & wireless connectivity.

Technology Analysis

The inverter technology for the global air condition system market holds a major market share in 2024 and is expected to experience a significant boost during the forecasted period. Further, the growth is majorly attributed to the capability of inverter air conditioners to regulate temperature effectively by stabilizing the speed of the compressor motor continuously. This technology adds to energy & power conservation through the usage of a variable-speed compressor.

Furthermore, the advantages of inverter technology, having stable temperature control, faster cooling, extended durability, along reduced noise levels compared to non-inverter ACs, are anticipated to fuel the demand for inverter-based air conditioning systems.

Further, the non-inverter technology is also expected to experience relatively moderate growth in comparison to its inverter counterpart. This can be due to many factors, including more energy utilization, fluctuating frequency operation, and a short lifespan. Yet, the affordability of these air conditioning systems may strengthen the segment's market presence.

End User Analysis

The commercial sector contributes significantly towards the growth of the market in 2024 and is anticipated to do so in the coming future as well, due to the rapid urbanization & growing need for commercial real estate. Commercial air conditioning systems, which typically need a large space, are commonly situated on the roofs of buildings like hotels, large restaurants, theaters, shopping malls, & commercial offices, and play an important role in optimizing energy consumption. Further, it is expected that the retrofitting & substitution of these units, aimed at lessening energy consumption, will significantly fuel the demand for air conditioning solutions within the commercial segment.

Further, the residential sector will remain a major focus for various market vendors, with substantial growth anticipated in the coming future. Recent years have seen an increase in temperatures in many countries due to climate change. This rise in temperatures has changed air conditioning systems from being seen as a luxury to becoming a necessity. Simultaneously, people around the world are largely deploying air conditioning systems in their homes, a trend that is anticipated to continue as global temperatures continue to rise. Given the changing climate conditions, residential air conditioning units are forecasted to experience robust growth during the projected period.

The Global Air Conditioning Systems Market Report is segmented based on the following

By Type

By Technology

By End User Industry

- Commercial

- Industrial

- Residential

Regional Analysis

In 2024, the Asia-Pacific region had a significant market share, accounting for

about 36.8% of the total revenue in the Global Air Conditioning Systems Market, and is further anticipated to dominate the overall market throughout the forecasted period.

The major requirement for air conditioning systems comes from the Asia-Pacific region, owing to the region's fast infrastructure expansion and the growing preference of residents for lifestyle-oriented products. Within the Asia-Pacific region, packaged air conditioners (PAC) & room air conditioners (RAC) hold a significant position in the market compared to other types of air conditioning systems.

Further, China stands as the biggest market for air conditioning systems in the world, with room air conditioners dominating the market in the country. Moreover, Japan & India also represent significant markets for global air conditioning manufacturers in the region which are essential to the overall growth of the global market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global air conditioning systems market features strong competition among various industry players. The market players constantly strive to innovate & emphasize energy efficiency & sustainability. Market dynamics are taking place caused by technological advancements, regulatory shifts, and evolving consumer preferences toward environmentally friendly and smart air conditioning solutions. Collaborations, mergers, and acquisitions are commonly opted strategies for expanding market presence and product offerings by the players in the market, reflecting the dynamic nature of competition in the industry.

For instance, in January 2022, the AHR (American Society of Heating, Refrigerating, and Air-Conditioning Engineers) Expo held in Las Vegas, saw LG Electronics USA unveil its latest 2022 range of HVAC solutions for residential, light commercial, and commercial applications in which the air conditioning system was a major part of the solution.

Some of the prominent players in the Global Air Conditioning Systems Market are

- Hitachi- Johnson Controls Air Conditioning Inc

- Midea Group Co Ltd

- Emerson Electric Company

- LG Electronics Inc

- Toshiba Corp

- Whirlpool

- Robert Bosch

- Haier Group Corp

- Daikin Industries Ltd

- Carrier

- Other Key Players

Recent Developments

- In February 2023, Carrier announced the availability of the reduced GWP (global warming potential) 515B refrigerant in their AquaEdge 19MV oil-free water-cooled chiller. The advanced AquaEdge 19MV performs efficiently under harsh, extreme, and unpredictable operational and meteorological conditions.

- In February 2023, Godrej Appliances introduced India’s first leak-proof split air conditioner, featuring innovative anti-leak technology. This intentional use of anti-leak technology highlights the company's dedication to improving user experience and offering unmatched value in the air conditioning market.

- In January 2022, LG Electronics U.S. showcased an extensive range of commercial, light commercial, and residential HVAC solutions at the 2022 AHR Expo in Las Vegas. This display highlighted LG's robust and comprehensive lineup of HVAC products catering to various market segments.

- In March 2022, Voltas, Inc., a prominent player in the HVAC industry, introduced its latest offering, the PureAir Inverter AC. This new range of air conditioners incorporates advanced technologies such as HEPA Filter technology, PM 1.0 Sensor, and AQI Indicator, which enhance indoor air quality and comfort for consumers. The launch of the PureAir Inverter AC further bolsters Voltas' portfolio of cooling products and home appliances.

- In January 2022, LG Electronics USA launched a broad range of ventilation, heating, and air conditioning solutions designed for light commercial, residential, and industrial applications at the 2022 AHR Expo in Las Vegas.

Report Details

|

Report Characteristics

|

| Market Size (2025) |

USD 147.7 Bn |

| Forecast Value (2034) |

USD 263.5 Bn |

| CAGR (2025-2034) |

6.4% |

| Historical Data |

2018 – 2024 |

| Forecast Data |

2025 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Unitary, PTAC, and Rooftop), By Technology (Non-Inverter and Inverter), By End-user Industry (Commercial, Industrial, and Residential) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Hitachi, Johnson Controls Air Conditioning Inc, Midea Group Co Ltd, Emerson Electric Company, LG Electronics Inc, Toshiba Corp, Whirlpool, Robert Bosch, Haier Group Corp, Daikin Industries Ltd, Carrier, and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |