Market Overview

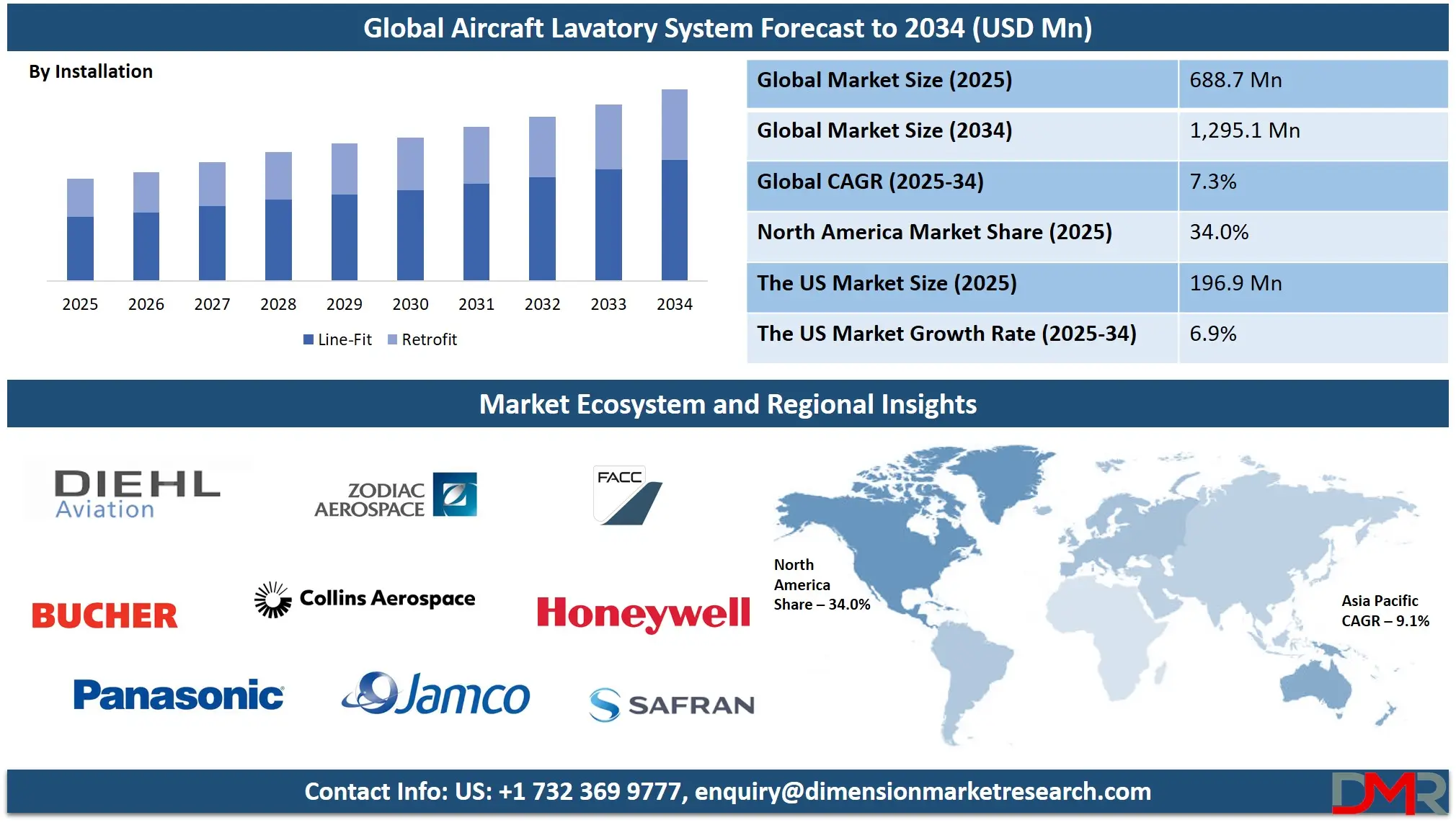

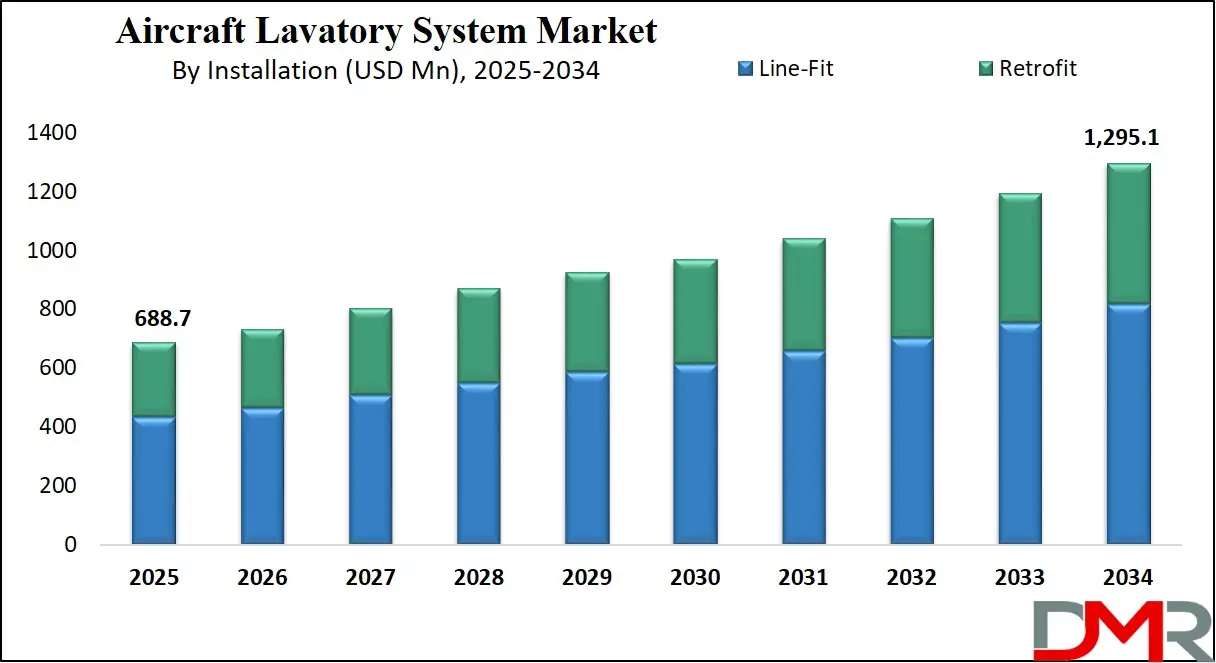

The Global Aircraft Lavatory System Market size is projected to reach USD 688.7 million in 2025 and grow at a compound annual growth rate of 7.3% to reach a value of USD 1,295.1 million in 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The aircraft lavatory system market encompasses the design, manufacture, and integration of the sanitation systems used aboard aircraft, including toilets, water and waste collection systems, pumps, valves, and control mechanisms. These systems must be lightweight, reliable, and efficient in terms of water usage and waste management, given the constraints of aircraft design. Lavatory systems have evolved significantly from early chemical-based toilets to modern vacuum and recirculating systems, improving both environmental performance and passenger comfort.

One important insight is that sustainability is a major driver: airlines are pushing for lavatory systems that reduce water intake and minimize waste weight, helping lower fuel consumption. Meanwhile, passenger hygiene expectations have increased, prompting avionics suppliers to adopt smarter technologies like sensor-based flush, antimicrobial surfaces, and automated cleaning. Key developments include the rise of vacuum flushing technologies, which use differential pressure to efficiently remove waste while conserving water. Recirculating systems, although older, still retain value particularly for retrofits.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Manufacturers are also innovating with modular lavatory designs that can be more easily installed during line-fit or upgraded in existing fleets. Partnerships between OEMs and lavatory system suppliers are helping accelerate the adoption of these advanced lavatory monuments. Furthermore, regulatory pressure around waste management and environmental impact is pushing the industry toward greener solutions, with lavatory system providers highlighting water reuse, reduced chemical usage, and lower overall system weight. Overall, the market reflects both the need for operational efficiency and rising expectations for airline hygiene and sustainability.

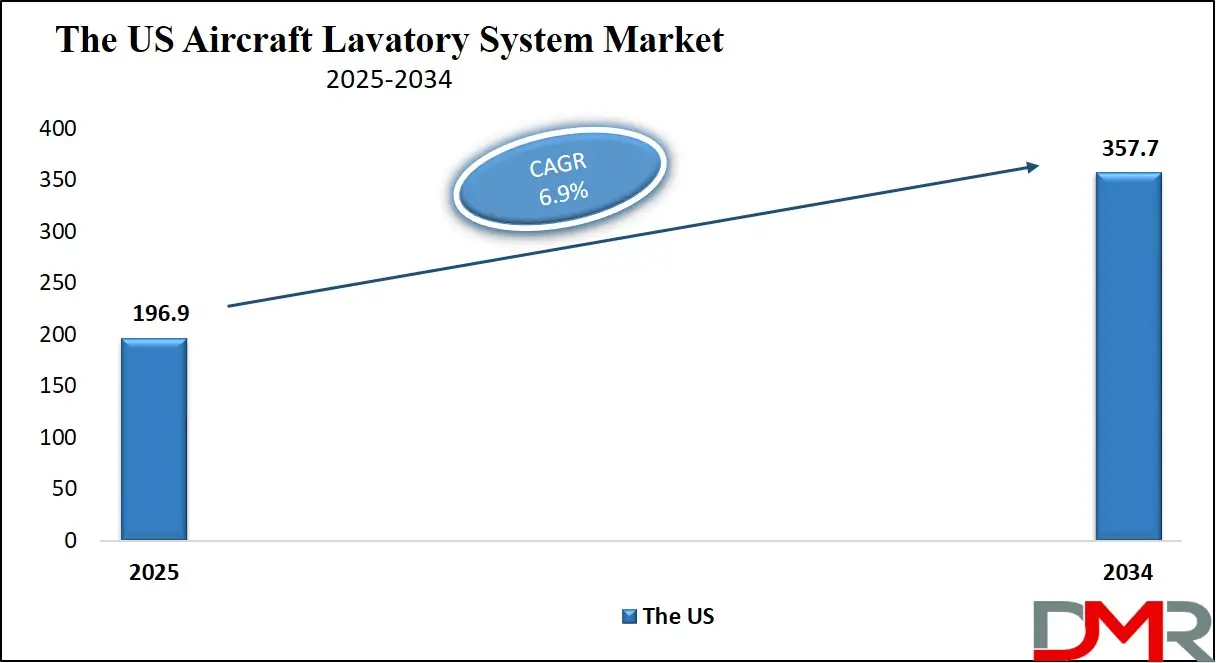

The US Aircraft Lavatory System Market

The US Aircraft Lavatory System Market size is projected to reach USD 196.9 million in 2025 at a compound annual growth rate of 6.9% over its forecast period.

In the United States, the aircraft lavatory system market is especially dynamic due to the country’s large commercial aviation sector and advanced defense industry. US airlines and aircraft manufacturers demand high-performance lavatory systems that combine water efficiency, low weight, and durability.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

With increasing regulation and focus on environmental sustainability, American carriers are increasingly specifying vacuum and recirculating systems that align with their long-term cost- and fuel-saving goals. Moreover, technological innovation, such as smart monitoring and predictive maintenance, is being adopted rapidly, driven by both OEMs and MRO providers.

Europe Aircraft Lavatory System Market

Europe Aircraft Lavatory System Market size is projected to reach USD 172.2 million in 2025 at a compound annual growth rate of 6.4% over its forecast period.

Europe’s market is characterized by strong sustainability mandates and a well-established aerospace manufacturing base. European regulators emphasize environmental performance, pushing airlines and system suppliers to adopt lavatory systems that use less water and reduce waste. Aerospace companies like Airbus collaborate with lavatory makers to develop compact, efficient, and lightweight lavatory modules designed for both narrow-body and wide-body aircraft. Meanwhile, retrofit demand is growing in Europe as legacy fleets are upgraded to meet more stringent hygiene and environmental standards.

Additionally, the region’s robust Aerospace Parts Manufacturing ecosystem supports these advancements by supplying high-precision components, lightweight materials, and modular structures that enable improved lavatory system integration and performance across both new-build and retrofit aircraft programs.

Japan Aircraft Lavatory System Market

Japan Aircraft Lavatory System Market size is projected to reach USD 34.5 million in 2025 at a compound annual growth rate of 7.5% over its forecast period.

Japan’s aviation sector emphasizes technological sophistication and quality. Japanese airlines and business jet operators lean toward lavatory systems that offer premium user experience and cutting-edge functionality. Local manufacturers and global suppliers compete to provide high-tech features like sensor-based flush, touchless systems, and antimicrobial materials. At the same time, Japan’s focus on sustainability influences the adoption of water-saving vacuums and recirculating systems. The Japanese market also benefits from rigorous maintenance culture, ensuring lavatory systems are optimized for both performance and longevity.

Aircraft Lavatory System Market: Key Takeaways

- Market Growth: The Aircraft Lavatory System Market size is expected to grow by USD 561.6 million, at a CAGR of 7.3%, during the forecasted period of 2026 to 2034.

- By Installation: The Line-Fit segment is anticipated to get the majority share of the Aircraft Lavatory System Market in 2025.

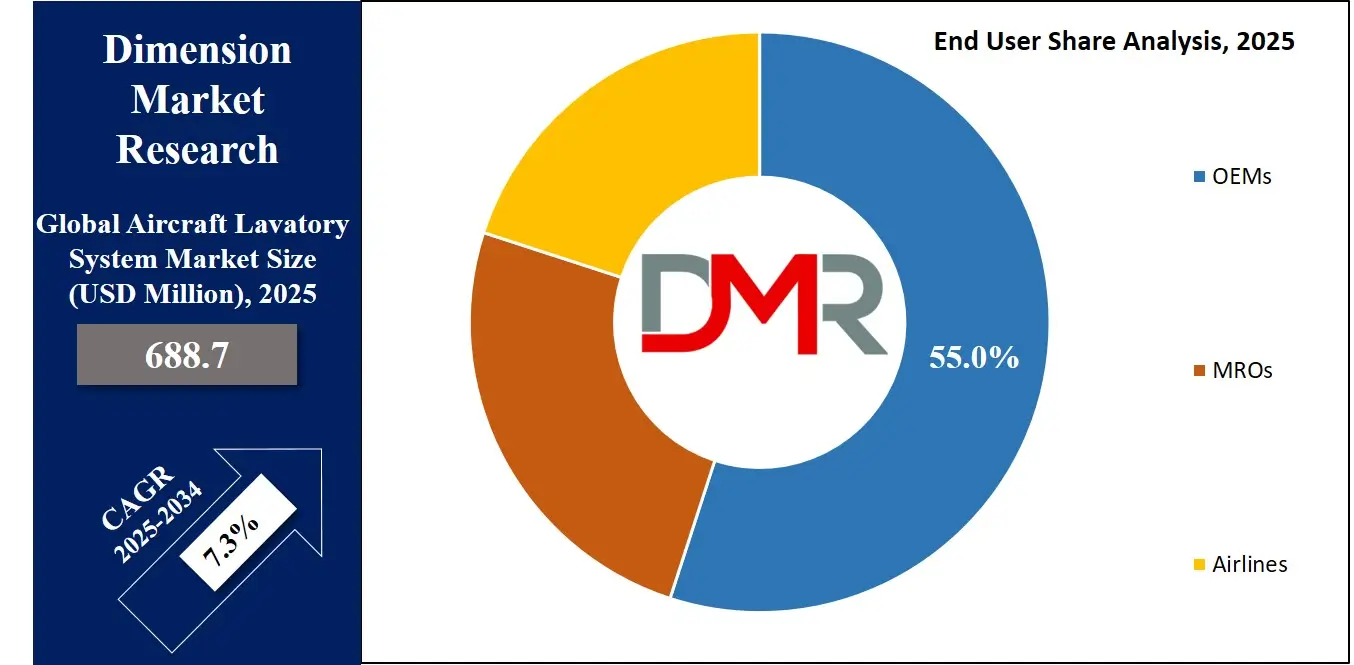

- By End User: The OEMs segment is expected to get the largest revenue share in 2025 in the Aircraft Lavatory System Market.

- Regional Insight: North America is expected to hold a 34.0% share of revenue in the Global Aircraft Lavatory System Market in 2025.

- Use Cases: Some of the use cases of the Aircraft Lavatory System include business jets, commercial aviation, and more

Aircraft Lavatory System Market: Use Cases:

- Commercial Aviation: Lavatories on commercial airliners support high passenger volumes, ensuring hygiene and comfort with water-efficient, space-saving designs.

- Military Aircraft: Military planes need robust lavatory systems that endure extreme conditions and long missions, prioritizing durability over aesthetics.

- Business Jets: Private and business aircraft often feature luxurious, custom lavatory systems with high-end finishes, touchless controls, and smart functionalities.

- Maintenance & Retrofit: MRO providers upgrade or replace lavatory systems in aging aircraft to meet evolving hygiene, regulatory, and environmental standards.

Stats & Facts

- According to IATA-ASF cabin waste audits (2023–2024), the average passenger generates 0.94 kg of waste per flight.

- IATA and ASF developed a standardized methodology for analyzing cabin waste to help airlines better quantify and reduce waste.

- The aviation sector is increasingly aligning with circular-economy principles, emphasizing reuse, recycling, and recovery of onboard waste.

- Aircraft manufacturers such as Airbus, Boeing, and Embraer account for over 97% of global commercial aircraft production, which strongly influences demand for lavatory systems.

Market Dynamic

Driving Factors in the Aircraft Lavatory System Market

Sustainability Pressures

Airlines and regulators are pushing for greener lavatory solutions. Vacuum and recirculating systems help reduce water consumption, minimize waste weight, and thereby lower fuel burn. Lavatory system manufacturers are innovating to meet these needs, offering lightweight, water-efficient modules and integrating environmentally friendly materials. This sustainability imperative is fueling long-term investments in lavatory R&D and adoption of next-generation systems.

Passenger Expectations & Hygiene

Rising hygiene standards among passengers are driving demand for more advanced lavatory systems. Touchless flush mechanisms, antimicrobial surfaces, and sensor-based monitoring enhance passenger comfort and reduce the risk of contamination. Furthermore, automation (like self-cleaning features) and real-time status monitoring allow airlines to maintain high cleanliness standards even on high-utilization flights, improving the overall travel experience.

Restraints in the Aircraft Lavatory System Market

High Capital Expenditure

Advanced lavatory systems—especially vacuum-based, sensor-rich, or modular designs—require significant initial investment. Airlines may be hesitant to retrofit older aircraft due to the costs of installation, certification, and downtime. For budget carriers, these costs can outweigh the long-term operational benefits, slowing large-scale adoption of next-gen lavatory systems.

Maintenance Complexity

More technologically advanced lavatory systems pose maintenance challenges. Systems with sensors, automated cleaning, or complex plumbing need specialized servicing and trained technicians. For MROs and airlines, sustaining availability while managing maintenance schedules can be difficult. Reliability must be ensured over time, especially for mission-critical flights, adding cost and operational burden.

Opportunities in the Aircraft Lavatory System Market

Eco-Innovative Solutions

There is a strong opportunity for manufacturers to develop and market lavatory systems that are highly eco-friendly. Solutions that recycle water within the cabin, minimize chemical usage, or leverage advanced filtration can attract airlines looking to improve their environmental footprint. These innovations are aligned with global decarbonization goals and may become a differentiator in bid cycles.

Premium & Customized Lavatories

The growing business aviation segment offers a window for customized, high-end lavatory systems. Business jets and first-class cabins increasingly demand luxurious, tech-enabled sanitation solutions. Lavatory makers can capitalize on this by designing bespoke modules with advanced finishes, smart functionalities, and ergonomic layouts, thereby commanding premium pricing and establishing strong partnerships with OEMs.

Trends in the Aircraft Lavatory System Market

Smart Systems & IoT Integration

The trend toward “smart lavatories” is gaining momentum. Sensors monitor waste levels, water usage, and system health in real time, enabling predictive maintenance and reducing unplanned downtime. IoT-connected lavatories can alert ground crews when servicing is required, optimizing turnaround times and improving efficiency.

Modular & Lightweight Architecture

Lavatory systems are increasingly being designed as modular units that integrate seamlessly into aircraft architecture. Use of lightweight composites and space-optimized designs helps OEMs reduce weight, freeing up space and improving fuel efficiency. Modular designs also facilitate easier retrofits, giving airlines flexibility when upgrading older aircraft.

Impact of Artificial Intelligence in Aircraft Lavatory System Market

- Predictive Maintenance: AI models analyze sensor data to forecast maintenance needs (waste tank levels, pump wear), reducing unexpected failures.

- Usage Optimization: Artificial Intelligence can track lavatory usage patterns per flight and adjust cleaning schedules or services accordingly.

- Design Simulation: Machine‐learning tools help engineers simulate more efficient lavatory layouts, minimizing space without compromising comfort.

- Automated Cleaning: AI-controlled robotics may automate cleaning cycles between flights, enhancing hygiene and reducing manual labor.

- Resource Efficiency: AI optimizes water usage by learning flush patterns and adjusting flush volumes dynamically.

Research Scope and Analysis

By Aircraft Type Analysis

Commercial aircraft remain the dominant segment in the aircraft lavatory system market, accounting for 45% of the total share in 2025. This leadership is driven by the extensive global fleet of narrow-body aircraft, which perform the majority of short- and medium-haul operations. These aircraft require lavatory systems that deliver a balance of durability, minimal water consumption, and optimized space usage due to high passenger turnover. As airlines increasingly prioritize operational efficiency and enhanced cabin experience, the demand for lightweight lavatory modules, touchless features, and improved sanitation technologies continues to rise. Furthermore, commercial fleet expansion—particularly in fast-growing aviation markets—supports the ongoing replacement and installation of upgraded lavatory systems tailored to regulatory and environmental standards, further solidifying this segment’s leading position.

Business jets represent the fastest-growing segment within the aircraft lavatory system market. Growth in this category is largely driven by rising demand for personalized, premium cabin experiences and the expansion of the global business aviation sector. Lavatory systems in business jets are often highly customized, incorporating luxury finishes, compact yet sophisticated layouts, and advanced sanitation technologies that cater to high-end travelers. The segment benefits from increased orders for long-range business jets which require more advanced lavatory capabilities to support extended travel durations. Upgrades, retrofits, and bespoke design services also contribute to expanding opportunities as operators seek to modernize cabins and match evolving expectations for comfort and hygiene.

By Lavatory Type Analysis

Vacuum lavatory systems lead the market with a 38% share in 2025, supported by their widespread adoption in commercial, business, and select military aircraft. These systems are favored for their ability to significantly reduce water use while maintaining strong flushing performance, a major advantage for airlines focused on weight reduction and fuel efficiency. Their compact architecture makes them ideal for modern cabin layouts requiring efficient space allocation. Additionally, advancements in vacuum technology—such as improved pumps, noise reduction mechanisms, and lightweight composite materials—enhance reliability and passenger experience. As sustainability becomes a central focus for aircraft manufacturers and airlines, vacuum systems continue to gain preference for both new-build installations and modernization programs across global fleets.

In parallel, the integration of Aerospace and Defense Telemetry is increasingly complementing these developments, providing real-time performance monitoring, system diagnostics, and data-driven maintenance insights that further enhance the operational efficiency and reliability of modern aircraft systems, including advanced vacuum lavatory solutions.

Recirculating lavatory systems are experiencing notable growth due to their compatibility with older aircraft models and retrofit programs. These systems are valued for their ability to operate effectively with minimal water supply, making them suitable for regions with limited water access or airlines managing legacy fleets. Their relatively simple installation and maintenance requirements also make them attractive for budget-conscious operators. Improvements in filtration, odor control, and material technology have increased the performance and appeal of recirculating systems, supporting their continued expansion, particularly in markets where modern vacuum systems may not yet be universally adopted.

By Component Analysis

Toilet assemblies represent the largest component category, accounting for 40% of the market in 2025. This segment’s dominance stems from the critical role toilet units play in defining sanitation performance, passenger experience, and overall lavatory system function. Manufacturers are increasingly utilizing lightweight materials, compact designs, and antimicrobial surfaces to enhance usability and hygiene while reducing aircraft weight. Innovations such as touchless flushing, self-cleaning coatings, and integrated sensors are becoming standard, driven by rising expectations for health and safety. Because every aircraft lavatory installation requires a central toilet assembly, demand remains consistently strong across commercial, business, and military platforms, ensuring this segment retains its leading position in both line-fit and retrofit applications.

Waste collection systems are expanding rapidly due to the shift toward more advanced vacuum and hybrid lavatory technologies. These systems are evolving with improvements such as composite waste tanks, enhanced vacuum generators, and better sealing technologies designed to minimize odor and reduce maintenance frequency. Growth is especially strong in retrofit markets where airlines are upgrading legacy waste systems to improve efficiency and reduce turnaround times. Development of smarter waste tanks equipped with monitoring sensors is also driving interest as airlines adopt predictive maintenance strategies.

By Installation Analysis

Line-fit installations account for 63% of the market in 2025, representing the preferred method for integrating lavatory systems into newly manufactured aircraft. Aircraft producers favor line-fit installations because they enable seamless integration of lavatory modules during assembly, reducing costs, certification complexity, and installation time.

Line-fit systems are designed to match aircraft structural layouts, optimize space usage, and comply with the latest airworthiness standards. Increasing aircraft production rates, especially for narrow-body models, continue to support the dominance of line-fit installations. Additionally, OEMs collaborate closely with lavatory system suppliers to co-develop next-generation lavatory units that improve hygiene, reduce weight, and support sustainability commitments.

Retrofit installations are expanding rapidly as airlines modernize existing fleets to enhance passenger experience and meet updated regulatory requirements. Retrofit solutions allow carriers to replace outdated lavatory systems with more efficient, water-saving technologies and modular units that improve cabin space utilization. The trend toward cabin refurbishment—driven by rising competition and passenger expectations—supports sustained growth in the retrofit market. Additionally, many older aircraft rely on lavatory upgrades to meet improved hygiene and sustainability benchmarks

By End User Analysis

OEMs hold the largest share of the market at 55% in 2025, due to the integration of lavatory systems directly into new aircraft during production. OEM partnerships ensure that lavatory modules are designed to align with aircraft architecture, material standards, and weight targets. This segment benefits from long-term contracts, predictable demand, and ongoing development of standardized lavatory units optimized for fuel efficiency and space usage.

Innovations created through OEM–supplier collaboration also enable faster adoption of advanced materials, touchless features, and integrated sensors. As global aircraft deliveries rise, OEM demand for lavatory systems continues to remain strong across both wide-body and narrow-body categories.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The MRO segment is growing steadily due to increasing demand for fleet refurbishments, interior upgrades, and modernization of lavatory systems. Airlines seek to extend the service life of aircraft, improve passenger comfort, and comply with updated environmental and hygiene standards. MRO providers are increasingly offering modular, quick-install lavatory kits that reduce aircraft downtime and simplify certification. Growth is also supported by rising global aircraft utilization, which naturally increases the need for component overhauls, replacements, and system performance upgrades.

The Aircraft Lavatory System Market Report is segmented on the basis of the following:

By Aircraft Type

- Commercial Aircraft

- Narrow-Body Aircraft

- Wide-Body Aircraft

- Regional Jets

- Business Jets

- Military Aircraft

By Lavatory Type

- Vacuum Lavatory Systems

- Recirculating Lavatory Systems

- Non-Vacuum Lavatory Systems

- Self-Contained Lavatory Systems

By Component

- Toilet Assembly

- Waste Collection System

- Water System

- Sensors & Controls

- Pumps & Valves

By Installation

By End User

Regional Analysis

Leading Region in the Aircraft Lavatory System Market

North America is expected to remain the leading region in the aircraft lavatory system market, accounting for approximately 34% of global demand in 2025. This dominance is primarily due to the region’s large aircraft manufacturing base, including major OEMs such as Boeing. Additionally, North American airlines operate extensive commercial fleets and maintain rigorous maintenance programs, driving both line-fit and retrofit lavatory installations.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The region also leads in terms of innovation, with strong investment in smart lavatory systems, sustainability, and lightweight designs. MRO providers in North America are highly active, offering advanced lavatory upgrades and services, contributing significantly to the market’s value. Regulatory frameworks and environmental targets in the U.S. further encourage adoption of water-efficient and environmentally friendly lavatory technologies.

Fastest Growing Region in the Aircraft Lavatory System Market

The Asia-Pacific region is projected to be the fastest-growing market for aircraft lavatory systems. Rapid air traffic growth, fleet expansion, and modernization in countries such as China and India are major drivers. Many airlines in the region are placing large aircraft orders, fueling demand for both new lavatory systems (line-fit) and retrofits. Additionally, rising environmental consciousness is pushing carriers in this region to adopt more sustainable lavatory technologies, including vacuum and smart systems. The growth of low-cost carriers and regional air travel, combined with increasing MRO capabilities, makes the Asia-Pacific region a high-opportunity market for lavatory system manufacturers.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the aircraft lavatory system market is defined by a diverse set of participants, including major aerospace OEMs, specialized lavatory system developers, and MRO service providers. Companies in this space focus heavily on innovation to deliver lighter, smarter, and more sustainable lavatory modules that meet evolving airline requirements.

Strategic collaborations with aircraft manufacturers are essential for securing line-fit integration, while growing partnerships with maintenance and retrofit providers support the expanding aftermarket demand. Competition is intensifying as manufacturers prioritize advancements such as improved vacuum technologies, modular and space-optimized designs, automated and sensor-driven functionalities, and the use of eco-friendly materials. With rising emphasis on sustainability and passenger hygiene, market players are differentiating themselves through technological capability, design efficiency, and long-term operational value.

Some of the prominent players in the global Aircraft Lavatory System are:

- Collins Aerospace

- Safran

- Jamco

- Diehl Aviation

- Boeing Interior Responsibility Center

- Panasonic Avionics

- Zodiac Aerospace (now part of Safran)

- Honeywell Aerospace

- Yokohama Aerospace

- B/E Aerospace (now part of Collins)

- Aviointeriors

- Triumph Group

- FACC

- Bucher Group

- AIM Altitude

- EnCore Aerospace

- C&D Zodiac

- Lufthansa Technik

- ST Engineering Aerospace

- ATS (Aviation Technical Services)

- Other Key Players

Recent Developments

- In June 2025, Diehl Aviation acquired a lavatory systems startup specializing in lightweight modular lavatory pods, enabling faster retrofit solutions and reducing the certification time for airlines upgrading older fleets.

- In March 2025, Collins Aerospace announced a strategic investment in a next-generation vacuum lavatory system that integrates antimicrobial surfaces and AI-based predictive maintenance. This move aims to bring more sustainable and automated lavatory modules to new aircraft.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 688.7 Mn |

| Forecast Value (2034) |

USD 1,295.1 Mn |

| CAGR (2025–2034) |

7.3% |

| The US Market Size (2025) |

USD 196.9 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Aircraft Type (Commercial Aircraft, Business Jets, and Military Aircraft), By Lavatory Type (Vacuum Lavatory Systems, Recirculating Lavatory Systems, Non-Vacuum Lavatory Systems, Self-Contained Lavatory Systems), By Component (Toilet Assembly, Waste Collection System, Water System, Sensors & Controls, and Pumps & Valves), By Installation (Line-Fit and Retrofit), By End User (OEMs, MROs, and Airlines) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Collins Aerospace, Safran, Jamco, Diehl Aviation, Boeing Interior Responsibility Center, Panasonic Avionics, Zodiac Aerospace (now part of Safran), Honeywell Aerospace, Yokohama Aerospace, B/E Aerospace (now part of Collins), Aviointeriors, Triumph Group, FACC, Bucher Group, AIM Altitude, EnCore Aerospace, C&D Zodiac, Lufthansa Technik, ST Engineering Aerospace, ATS (Aviation Technical Services), and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Aircraft Lavatory System Market?

▾ The Global Aircraft Lavatory System Market size is expected to reach a value of USD 688.7 million in 2025 and is expected to reach USD 1,295.1 million by the end of 2034.

Which region accounted for the largest Global Aircraft Lavatory System Market?

▾ North America is expected to have the largest market share in the Global Aircraft Lavatory System Market, with a share of about 34.0% in 2025.

How big is the Aircraft Lavatory System Market in the US?

▾ The Aircraft Lavatory System Market in the US is expected to reach USD 196.9 million in 2025.

Who are the key players Aircraft Lavatory System Market?

▾ Some of the major key players in the Global Aircraft Lavatory System Market include Safran, FACC, ATS and others.

What is the growth rate in the Global Aircraft Lavatory System Market?

▾ The market is growing at a CAGR of 7.3 percent over the forecasted period.