Micro turbine engines are a hybrid power source for mini unmanned aerial vehicles and VTOLs, and is used for stationary energy generation applications. These are the combustion turbine that develops both heat and electricity on a relatively small scale, and are usually less than 100 pounds thrust and have a simple built with only one moving part: the rotor/compressor unit.

Micro turbine engines for aircraft have seen tremendous expansion as demand grows for more effective, lightweight, and eco-friendly engines. Technological innovations in turbine technology are making engines smaller and fuel-efficient—essential features when designing electric or hybrid aircraft as well as unmanned aerial vehicles (UAVs). The adoption of micro gas turbine engines within next-generation aviation platforms continues to support this growth.

Companies across industries are investing heavily in developing next-generation micro turbine engines with emissions-cutting and performance enhancing properties in mind. Urban air mobility (UAM), however, has driven an upsurge in demand for smaller yet more energy-efficient turbine engines for vertical take-off and landing (VTOL) aircraft as an integral element in future aviation technologies. This shift aligns with the broader evolution of advanced aviation powerplants supporting UAM and hybrid-electric systems.

Market growth has also been propelled by increasing military and defense applications of micro turbine engines in unmanned aerial systems (UASs) and drones, where micro turbine engines provide high thrust-to-weight ratios that make them suitable for surveillance, reconnaissance, combat missions. Thus, expanding their application in defense sectors.

As solar and renewable energy technologies continue to advance, new opportunities are emerging in the aircraft micro turbine engine market. While aerospace manufacturers are increasingly focused on achieving carbon-neutral aviation, micro turbine engines alongside evolving alternatives such as

Aircraft Piston Engine technologies are expected to play a vital role in powering sustainable aircraft. Moreover, the growing interest in hybrid-electric propulsion systems for commercial aviation further strengthens the long-term growth prospects for these engines.

As per statista The global aircraft engine manufacturing industry, valued at approximately 80 billion U.S. dollars in 2019, is vital to aviation. With growing demand for air travel and cargo, the market is anticipated to exceed 97 billion U.S. dollars by 2026, driven by the increasing need for efficient and reliable aircraft engines.

Among the leading manufacturers, Rolls Royce's Trent XWB engine is expected to generate around 41 billion U.S. dollars in revenue from 2020 to 2029, solidifying its position as a dominant player in the widebody aircraft engine market. This forecast highlights the significant role of this engine in the industry's growth.

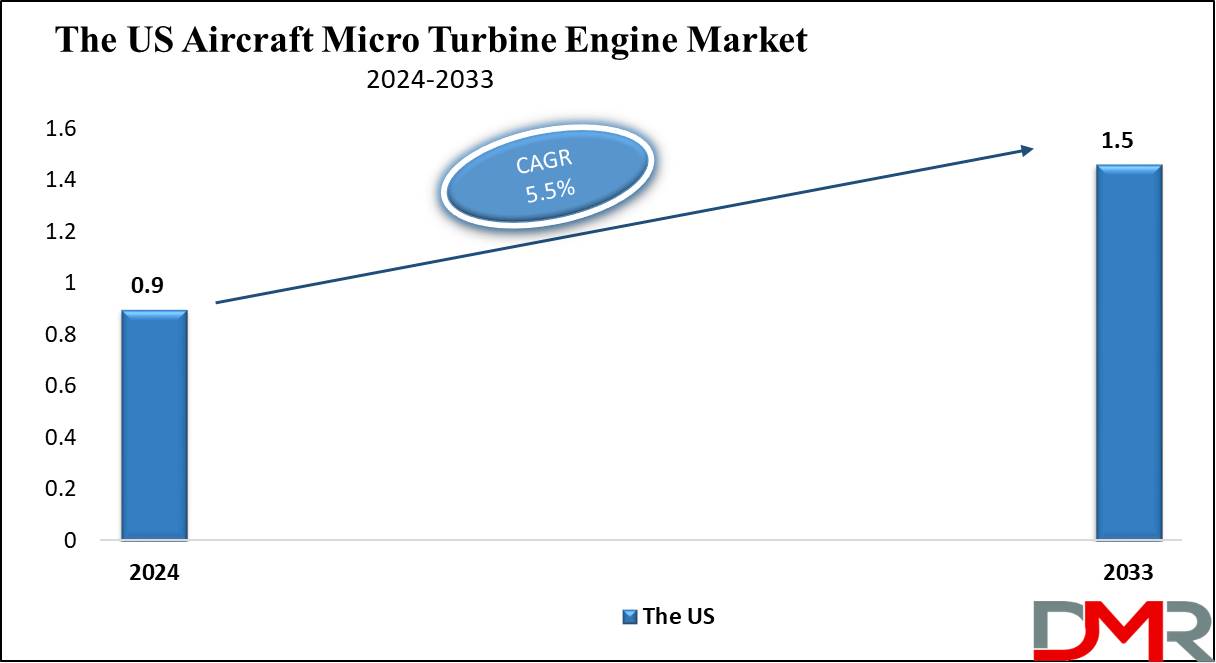

The US Aircraft Micro Turbine Engine Market

The

US Aircraft Micro Turbine Engine Market is projected to reach

USD 0.9 billion in 2024 at a compound annual growth rate of

5.5% over its forecast period.

The US Aircraft Micro Turbine Engine market offers strong growth opportunities driven by rising demand for unmanned aerial vehicles (UAVs), hybrid-electric propulsion systems, sustainable aviation technologies, and expanding segments such as

Drone Insurance. With significant government support for military drones, advanced aviation programs, and initiatives aimed at reducing emissions, the U.S. is well-positioned to lead innovation and strengthen its presence in the global aerospace landscape.

Further, the growth in the Aircraft Micro Turbine Engine market is driven by growing demand for UAVs, hybrid-electric aircraft, and sustainable aviation technologies. However, the market experiences restraints due to high development costs & regulatory challenges in certifying new technologies, which can slow the adoption of micro turbine engines in both commercial and military sectors.

Key Takeaways

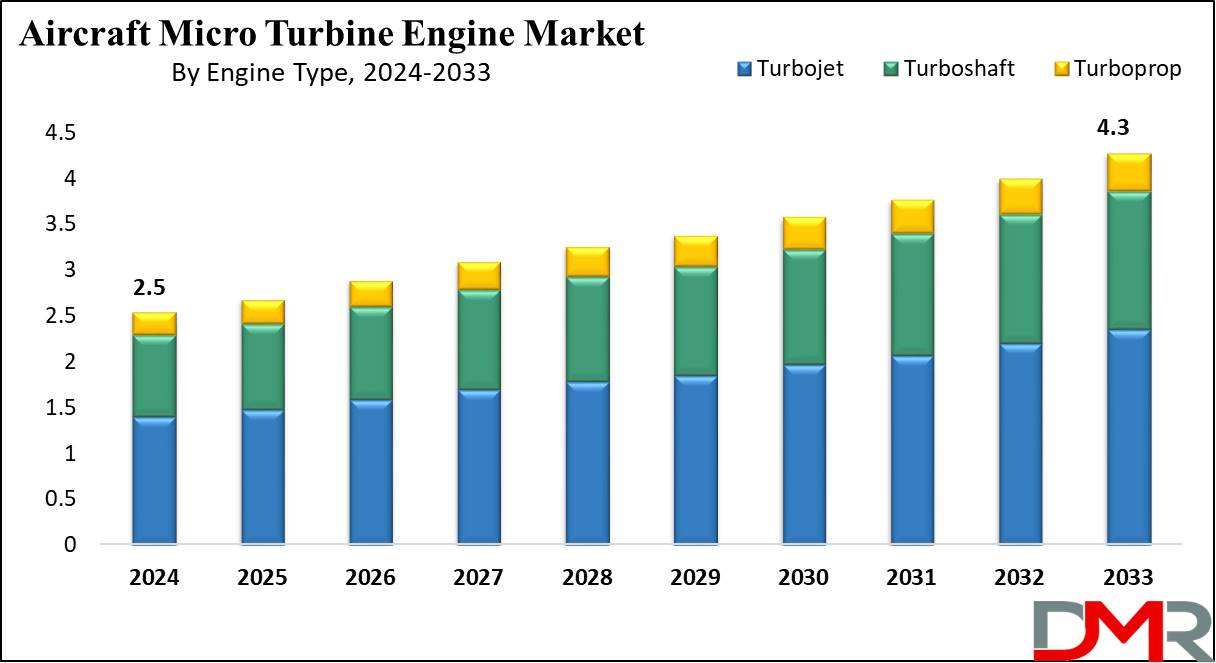

- Market Growth: The Aircraft Micro Turbine Engine Market size is expected to grow by USD 1.8 billion, at a CAGR of 5.9% during the forecasted period of 2025 to 2033.

- By Engine Type: The Turbojet segment is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

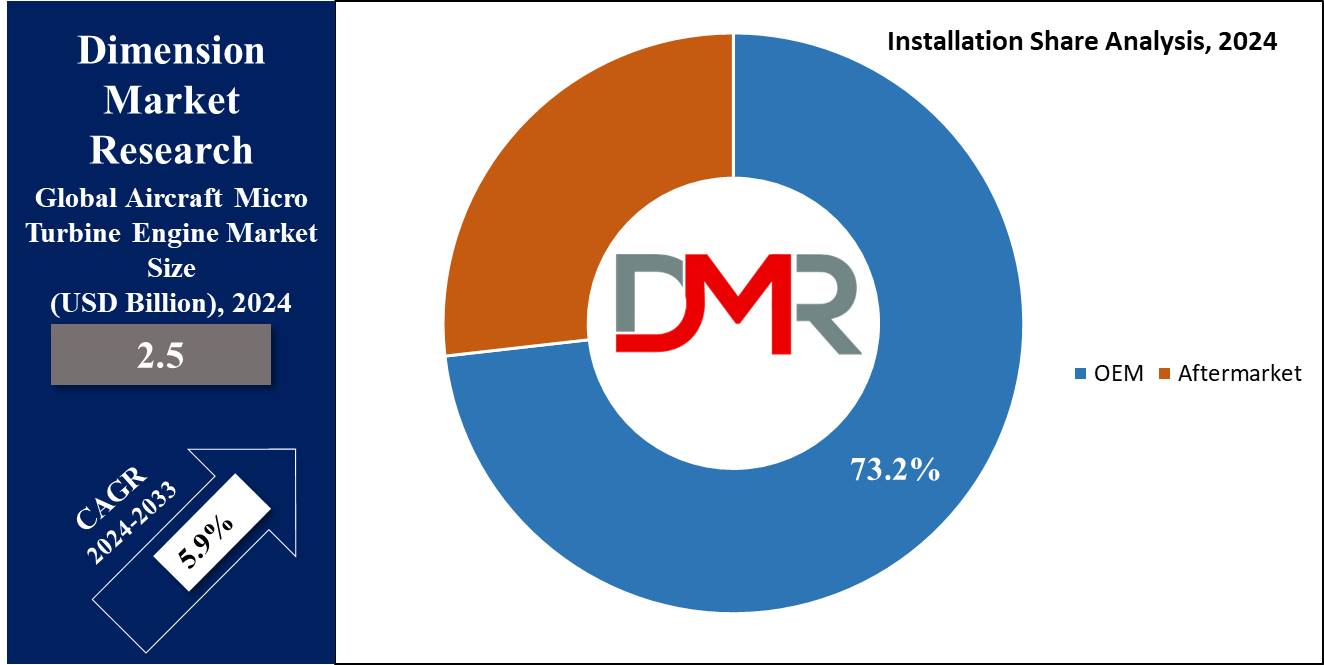

- By Installation: OEM segment as installation is expected to be leading the market in 2024

- By Application: Propulsion segment is expected to get the largest revenue share in 2024 in the Aircraft Micro Turbine Engine Market.

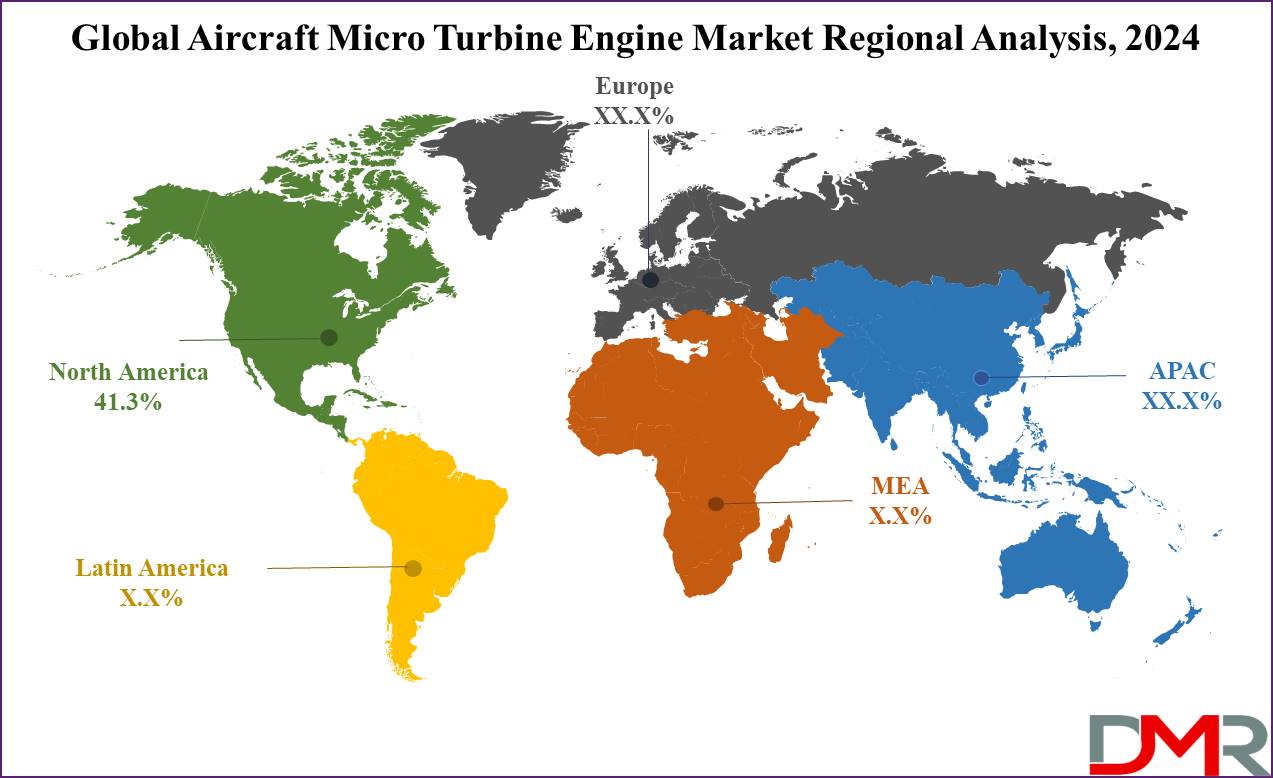

- Regional Insight: North America is expected to hold a 41.3% share of revenue in the Global Aircraft Micro Turbine Engine Market in 2024.

- Use Cases: Some of the use cases of Aircraft Micro Turbine Engine include hybrid propulsion systems, unmanned aerial vehicles, and more.

Use Cases

- Unmanned Aerial Vehicles (UAVs): Micro turbines are ideal for powering UAVs due to their lightweight, high power-to-weight ratio, & efficient fuel consumption. They allow large flight durations and high-speed capabilities for both military and commercial drones.

- Auxiliary Power Units (APUs): Micro turbine engines act as compact & efficient APUs in small aircraft. They deliver power for onboard electrical systems while the main engines are off, improving fuel economy and operational efficiency.

- Hybrid Propulsion Systems: Utilized in hybrid-electric propulsion systems for light aircraft, micro turbines generate electricity to power electric motors, improving fuel efficiency and reducing emissions in small, regional aircraft.

- Experimental and Hobby Aviation: With their small size and relative simplicity, micro turbine engines are popular in experimental aviation projects & high-performance radio-controlled aircraft. They provide hobbyists with high thrust and advanced aerodynamics.

Market Dynamic

Driving Factors

Increasing Demand for Unmanned Aerial Vehicles (UAVs)The expanding use of UAVs in military, commercial, and recreational sectors is driving demand for efficient, lightweight power sources. Micro turbine engines provide high power-to-weight ratios, making them ideal for UAV applications, mainly in long-endurance or high-performance drones.

Rising Focus on Fuel Efficiency and Emission Reduction

With the aviation industry driving for greener technologies, micro turbine engines are gaining attention for their ability to provide better boost efficiency and lower emissions compared to traditional piston engines, which aligns with the global trend toward sustainability in aerospace, mainly in small and regional aircraft.

Restraints

High Initial Costs and Limited Production

Micro turbine engines can be costly to create and manufacture, primarily due to their advanced materials & precision engineering requirements, which can be a barrier to broader adoption, mainly among smaller operators or in cost-sensitive markets.

Technological Limitations

While micro turbine engines offer certain advantages, they are less effective at less power compared to traditional piston engines, which limits their applicability in certain segments of the market, like small, low-speed aircraft, where more fuel-efficient options might be preferred.

Opportunities

Expansion in Hybrid-Electric Propulsion Systems

The growing trend toward hybrid-electric aircraft offers significant opportunities for micro turbine engines, which can be used to generate electricity for electric propulsion systems. This technology is particularly promising for regional and short-haul aircraft, where lower emissions and higher fuel efficiency are critical goals.

Growing Demand for Urban Air Mobility (UAM)

The growth of urban air mobility solutions, like air taxis and personal aerial vehicles, provides a new market for micro turbine engines. These engines provide compact, powerful, and efficient propulsion options that align with the demands for lightweight, high-performance engines in next-generation urban transport solutions.

Trends

Adoption of Hybrid and Electric Propulsion Systems

There is an increasing trend toward integrating micro turbine engines with hybrid-electric propulsion systems. These engines are being used as range extenders or to generate electricity for electric propulsion in small aircraft, UAVs, and urban air mobility (UAM) vehicles, aligning with the aviation industry's push for sustainable and fuel-efficient technologies.

Advancements in Materials and Manufacturing Techniques

Recent developments in lightweight, high-temperature materials and additive manufacturing (3D printing) are making micro turbine engines more effective, durable, and affordable. These innovations are helping to improve engine performance while minimizing overall production costs.

Research Scope and Analysis

By Engine Type

The turbojet segment is expected to dominate the aircraft micro turbine engine market in 2024, mainly due to its high-speed capabilities. These engines, known for reaching speeds of up to 65,000 rpm & providing a maximum thrust of 600 N, are mainly prominent in high-speed drones and small manned aircraft.

Their compact size, lightweight design, and higher efficiency make them a preferred choice, mainly in the military sector where high-performance engines are vital. In addition, turbojet engines produce lower emissions, aligning with the global transformation toward environmentally friendly technologies.

As a result, the demand for these engines is expected to grow significantly over the coming years.

Further, turboshaft engines are a specialized type of micro turbine engine developed to generate shaft power instead of thrust, making them ideal for powering helicopters and certain drones.

These engines are small, powerful, and lightweight, making them applicable for applications requiring long-range flying, like light aircraft and vertical take-off and landing (VTOL) vehicles. With the growing utilization of helicopters, drones, and VTOL aircraft, the turboshaft segment is expected to see rapid growth in the coming years, driven by its versatility and wide range of applications across various sectors.

By Fuel Type

The aircraft micro turbine engine market is segmented by fuel type into JET-A-1, Diesel, Natural Gas, and Sustainable Aviation Fuel (SAF). Among these, the JET-A-1 is anticipated to have the major revenue share in 2024, as it is a mostly used aviation turbine fuel in both commercial & military aircraft.

Jet A and Jet A-1 are the standard fuels for commercial aviation worldwide, known for their high flash point, lower freezing temperatures, and affordability in comparison to Avgas. These qualities make them the preferred choice for modern aircraft & drones, with the rise in the number of air passengers and the rise in the demand for military aircraft, like drones and UAVs, as it is expected to maintain its dominance in the market over the coming year.

Further, SAF is becoming a major focus in the aviation industry’s efforts to minimize the environmental impact. SAF is seen as a main component in achieving climate goals and minimizing carbon emissions in aviation.

However, governmental assistance and policies are vital to promoting the broad adoption of SAF. As regulations around environmental sustainability tighten & the industry looks for greener alternatives, the demand for SAF is likely to grow. With growth in the interest in reducing the aviation industry's carbon footprint, SAF represents a major opportunity for future growth in the market.

By Installation

The OEM (Original Equipment Manufacturer) segment is expected to play a major role in the growth of the aircraft micro turbine engine market. As aircraft manufacturers constantly develop advanced airplanes, as they depend on OEMs to provide advance high-performance micro turbine engines.

The need for new aircraft around the world, integrated with the demand for reliable and efficient engines, strengthens the dominant position of the OEM segment. OEMs are the go-to choice for manufacturers looking for top-quality propulsion solutions, and this segment is anticipated to constantly drive growth in the market as the industry advances.

Further, the aftermarket segment is anticipated to be the fastest-growing area in the market. Airlines and operators are highly looking for affordable ways to improve the performance and extend the lifespan of their existing aircraft, leading to a growth in demand for aftermarket services and replacement micro turbine engines.

As aircraft fleets grow and technology transforms and innovates, the need for innovative aftermarket solutions is expanding, and its focus on meeting distinctive customer needs provides a major growth opportunity in the market. With its ability to deliver customized services and products, the aftermarket segment is set to become a key player in the future of the aircraft micro turbine engine industry.

By Platform

The advanced air mobility segment is set to experience the fastest growth throught the forecasted period, driven by the growth in urban populations, which is promoting the development of hybrid air taxis and unmanned cargo delivery systems. Many companies are highly working on air taxi designs, which are anticipated to be commercialized in the coming years.

These air taxis, capable of both manual and autonomous flight, can take off and land in a vertical direction, making them ideal for crowded urban environments. Their ability to access tight spaces in cities provide a promising solution for efficient transportation.

In addition, hybrid power systems are becoming the preferred choice for intercity travel and cargo deliveries, mainly as the need for quick, point-to-point transport increases. With the introduction of Beyond Visual Line of Sight (BVLOS) regulations, the utilization of drones for delivering cargo and passengers is set to grow.

Also, many countries are already testing large drones for freight transport, like Japan. In Switzerland, organizations like Swiss Post and Swiss WorldCargo are exploring drone-based air freight solutions, further encouraging the potential of this technology to revolutionize cargo and passenger transport in the coming years.

By Horsepower

The 50 to 100 horsepower (HP) range plays an important role in driving the growth of the aircraft micro turbine engine market, mainly in small aircraft, drones, and unmanned aerial vehicles (UAVs). Engines in this power range provide a good balance of performance, fuel efficiency, &lightweight design, making them ideal for applications requiring compact yet powerful propulsion systems.

They are broadly used in military and commercial drones, along with in experimental aircraft. As the need for UAVs and other small, agile aircraft grows, the demand for efficient and reliable engines in this HP range is increasing, which is driving innovation and development, contributing to the overall expansion of the aircraft micro turbine engine market.

Further, engines with more than 200 horsepower (HP) are vital for powering larger aircraft and advanced unmanned aerial vehicles (UAVs). These high-power engines provide the thrust demand for heavier loads, longer flight durations, and more demanding operations. As the aviation industry pushes for larger UAVs and more capable aircraft, the need for over 200 HP micro turbine engines is growing, driving significant growth in the market.

By Application

In the Aircraft Micro Turbine Engines Market, the Propulsion segment is set to lead the application categories in 2024, capturing the majority of the market share, as it’s the critical role micro turbine engines play in powering aircraft, providing the necessary thrust for takeoff, climbing, and cruising.

These engines are crucial for an aircraft's forward movement & overall performance, making propulsion the most important part of the market, as the growth in the demand for reliable and efficient propulsion systems constantly solidifies this segment's strong market position.

Further, the auxiliary Power Units (APUs), though important, held a smaller market share in comparison to propulsion. APUs are secondary power sources that supply electricity & pneumatic power to assist many aircraft systems, like lighting, air conditioning, and avionics, mainly when the main engines are turned off.

While their market share is not as large, APUs are crucial for maintaining aircraft functionality, mainly when the aircraft is on the ground or during specific phases of flight. They play a major role in ensuring that aircraft systems operate smoothly, even when the primary engines are not in use.

The Aircraft Micro Turbine Engine Market Report is segmented on the basis of the following:

By Engine Type

- Turbojet

- Turboshaft

- Turboprop

By Fuel Type

- JET-A1

- Diesel

- Natural Gas

- SAF

By Installation

By Platform

- General Aviation

- Light Aircraft

- Business Jets

- Commercial Aviation

- Military Aviation

- Military Aircraft

- Military Drones

- Advanced Air Mobility

By Horsepower

- Below 50 HP

- 50 – 100 HP

- 100 – 200 HP

- More than 200 HP

By Application

- Propulsion

- Auxiliary Power Units (APUs)

Regional Analysis

North America is projected to lead in the Aircraft Micro Turbine Engines Market,

holding over 41.3% of the market share in 2024, largely due to the region’s strong aviation industry, with various aircraft operators and manufacturers driving a steady need for micro turbine engines.

The demand for engine replacements and the integration of new technologies further drives this demand. In addition, strict environmental regulations and an aim for sustainable aviation have boosted the adoption of eco-friendly micro turbine engines. Further companies like Honeywell International Inc. and others have played a key role in advancing this trend with their environmentally conscious engine solutions.

Further, Europe is also expected to hold a significant share of the market, with a strong focus on minimizing emissions and enhancing fuel efficiency, which aligns well with the benefits of micro turbine engines, which has led to better use of these engines, mainly in smaller aircraft and regional aviation.

In addition, in the Asia-Pacific (APAC) region, is expected to show promising growth potential, as growing air travel demand, expanding commercial aviation, and government efforts to modernize aviation infrastructure have contributed to the growth in the adoption of micro turbine engines. The business and general aviation segments in APAC, in major, have seen significant growth, driven by the need for fuel-efficient and reliable engines.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Aircraft Micro Turbine Engine market is highly consolidated, with several key players focusing on innovation and advanced technology to improve engine performance, fuel efficiency, and sustainability. Companies are funding in R&D to create more efficient, lightweight, and eco-friendly engines to meet increase in demand in both commercial and military aviation.

Strategic partnerships, collaborations, and acquisitions are common strategies used to expand market presence and drive growth, while catering to the increasing demand for hybrid and electric propulsion systems.

Some of the prominent players in the Global Aircraft Micro Turbine Engine are

- Honeywell International

- General Electric

- Raytheon Technologies

- UAV Turbines

- Safran SA

- Turbotech SAS

- PBS Group

- Kratos Defense & Security Solutions

- Elliott Company

- AeroDesignWorks GmbH

- Other Key Players

Recent Developments

- In July 2024, UAV Propulsion Tech signed an agreement with AMT-Advanced Micro Turbines to bring its advanced micro turbine solutions to the U.S. unmanned aerial vehicle (UAV) market, which are designed for high-speed target drones and advanced UAV applications. All motors are based on AMT’s customized developed and distinct axial flow turbine, achieving high thrust-to-weight ratios with low fuel consumption and rapid acceleration times.

- In April 2024, Rolls-Royce unveiled it has successfully kicked off the flight test campaign for its newest aero engine for the business aviation market, the Pearl 10X, on the company’s dedicated Boeing 747 flying testbed, as it has been selected by French aircraft manufacturer Dassault to mainly power its brand-new flagship aircraft, the Falcon 10X.

- In April 2024, Aurora Labs successfully 3D printed a micro gas turbine, which is designed for small propulsion systems or power plants in unmanned aerial vehicles, and underwent rigorous development and testing. Using 3D metal printing, the company expedited the prototyping process, delivering an advanced product in under four months.

- In April 2024, Aurora Labs Limited announced the newest development of its 200N Class gas turbine. The new model, providing a lightweight propulsion system for usage in a wide range of markets, will be available as early as May 2024. Also, the development of a 400N Class model is progressing well. A micro gas turbine is a combustion engine at the center of a small propulsion system or power plant that can convert natural gas or other liquid drives mechanical energy for requirements in applications, like unmanned aerial vehicles or instant power generation.

- In February 2024, Raghu Vamsi Machine Tools Private Limited introduced its complete indigenous Micro Turbojet Engine “INDRA RV25: 240N” in alignment with the Atma Nirbhar Bharat, which signifies a major achievement for India’s aerospace sector, as RVMT demonstrates its commitment to innovation, self-sufficiency, and technological prowess.