An engine is the primary power source that allows an aircraft to lift and fly through the air over long distances. A piston engine is a device that converts the heat energy of fuel into mechanical energy through internal combustion, also known as a reciprocating engine or internal combustion engine that uses one or more reciprocating pistons.

In addition,

Fuel Pump Rebuilding Service plays a crucial role in maintaining optimal engine performance by ensuring that fuel delivery systems remain efficient, reliable, and properly calibrated for safe aircraft operation, contributing significantly to overall aviation propulsion systems used in the broader general aviation engines sector.

Piston engines in aircraft can be seen in the configuration of two cylinders inline up to eight cylinders opposed and nine-cylinder radial and in diesel and with fuel injection system as well.

Aircraft Piston Engine Market growth can be attributed to rising interest for light aircraft and general aviation, with piston engines remaining cost-effective and dependable options for small private aircraft that make use of regional aviation as well as pilot training applications, further supporting expansion within the aerospace powerplant technology space.

Recent advancements in aircraft piston engine technology center around improving fuel efficiency, decreasing emissions emissions and improving reliability. Manufacturers are adopting more cutting edge materials and technologies - such as electronic fuel injection systems and turbocharging - in order to enhance engine performance while decreasing operational costs for users.

Aircraft piston engines have experienced unprecedented demand in both training and recreational flying sectors, due to the rising number of flight schools and private aviation enthusiasts requiring low maintenance engines that offer enhanced performance as well as environmental sustainability.

This market segment accounts for roughly one quarter of worldwide aircraft piston engine production; demand from both sectors exceeds supply by nearly 10 times each.

Opportunities in the market are expanding as manufacturers pursue integration of alternative fuels and hybrid propulsion systems, meeting growing environmental concerns by developing piston engines compatible with

biofuels or green alternatives, setting themselves up for innovation and long-term growth that align with aviation industry initiatives to bring sustainable solutions into play.

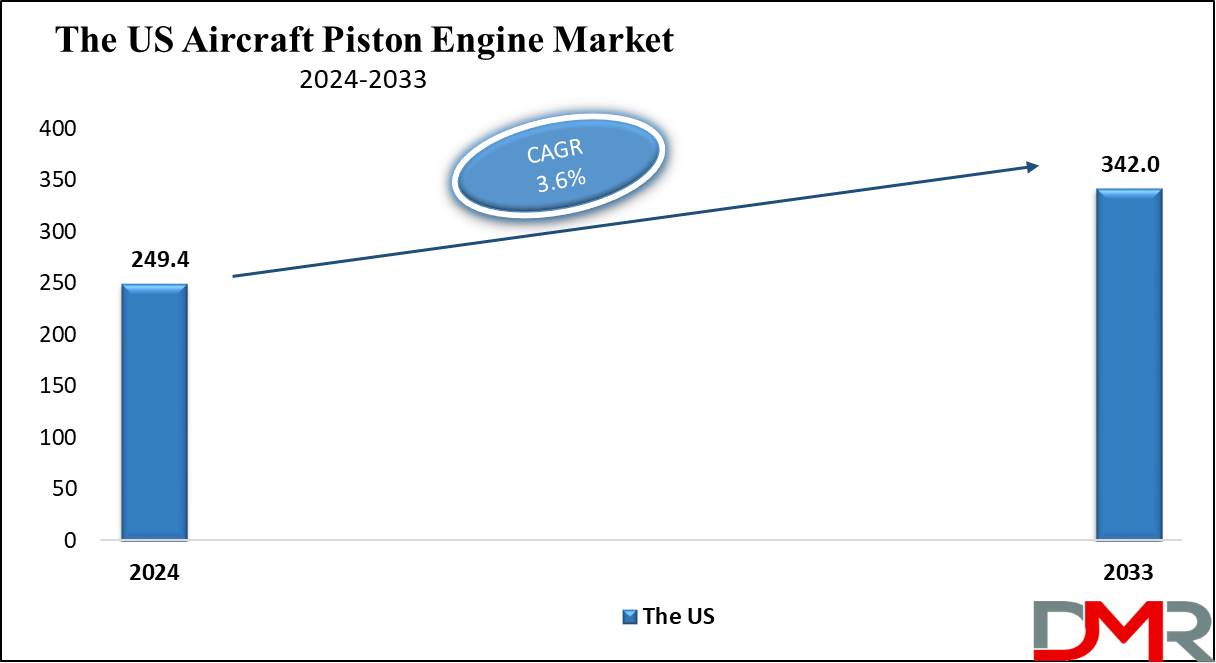

The US Aircraft Piston Engine Market

The

US Aircraft Piston Engine Market is projected to reach

USD 249.4 million in 2024 at a compound annual growth rate of

3.6% over its forecast period.

The US provides many growth opportunities in the aircraft piston engine market, driven by the higher demand for general aviation, expanding flight schools, and an advanced private aircraft sector. Developments in eco-friendly engines and the transformation to unleaded aviation fuels also provide opportunities for manufacturers. In addition, the rise of recreational flying and charter services boosts market potential.

Further, the market is driven by growth in demand for general aviation, flight training, and recreational flying. However, a major restraint is the rising environmental regulations, pushing for cleaner alternatives to traditional fuel. The market also experiences competition from turbine engines in larger aircraft, limiting piston engine use in some sectors.

Key Takeaways

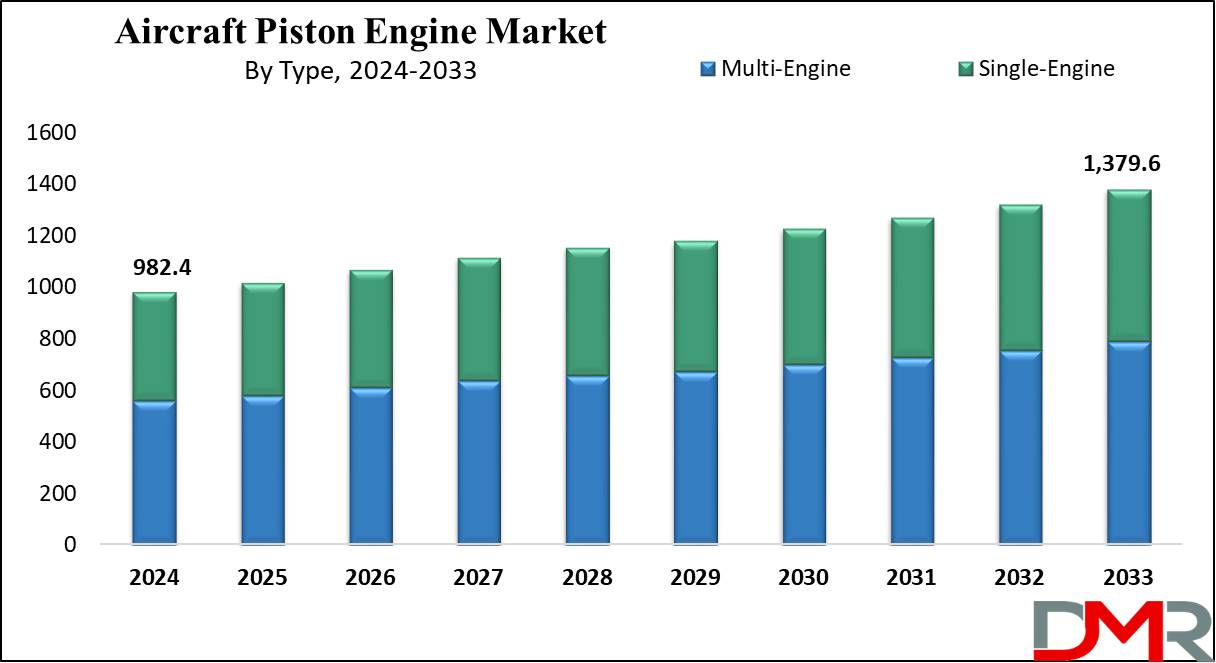

- Market Growth: The Aircraft Piston Engine Market size is expected to grow by USD 363.4 million, at a CAGR of 3.8% during the forecasted period of 2025 to 2033.

- By Type: The Multi-engine segment is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By Maximum Take-off Weight: More than 2000 kg is expected to be leading the market in 2024

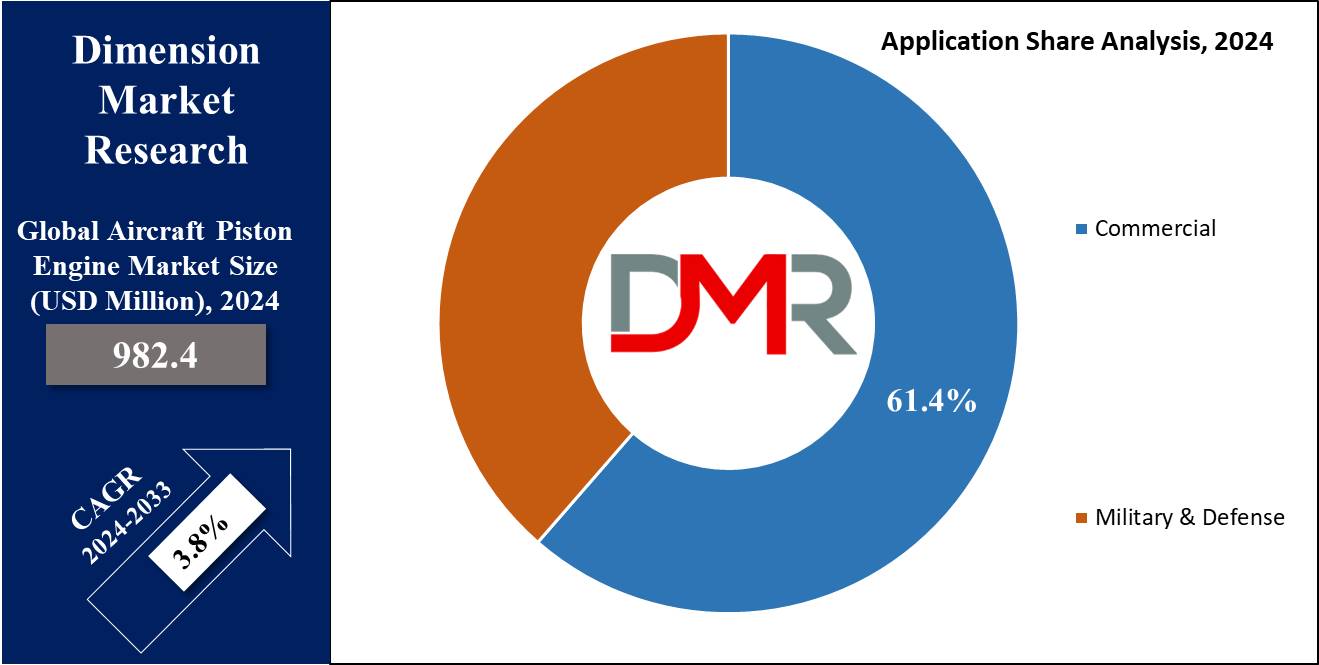

- By Application: The commercial segment is expected to get the largest revenue share in 2024 in the Aircraft Piston Engine Market.

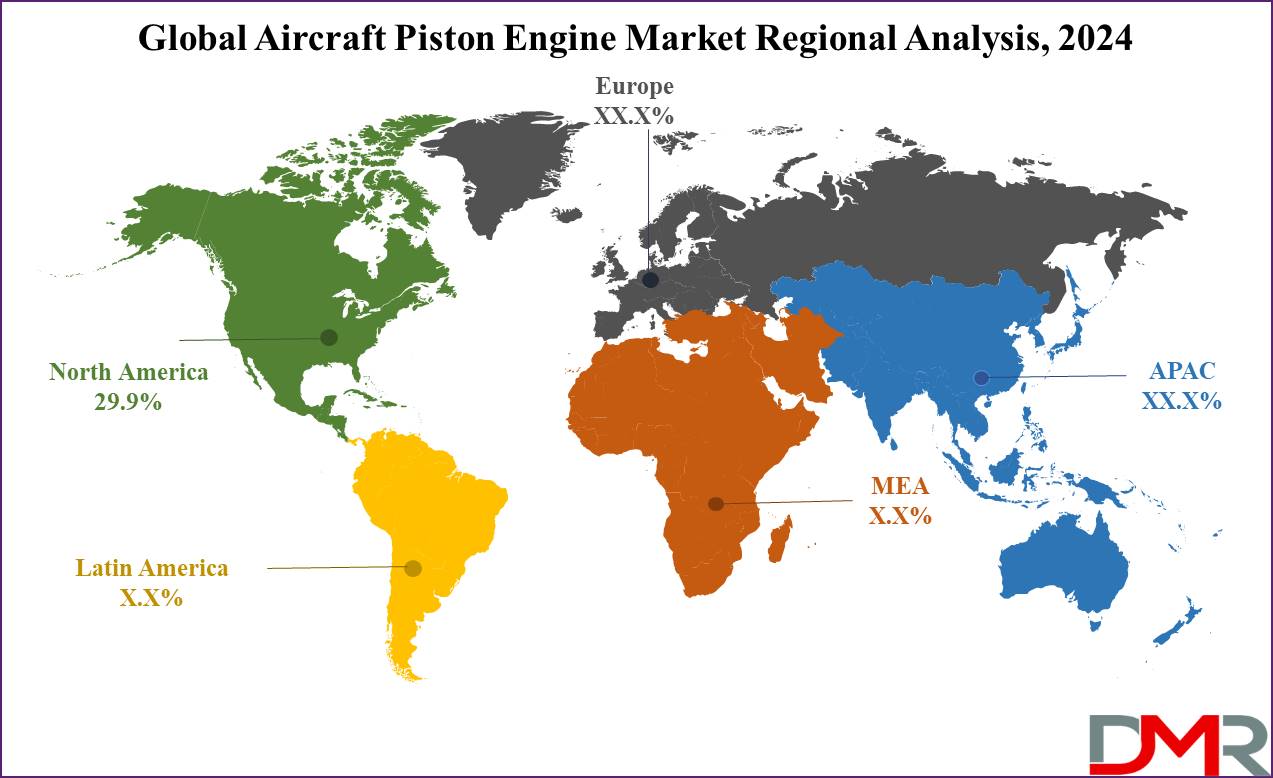

- Regional Insight: North America is expected to hold a 29.9% share of revenue in the Global Aircraft Piston Engine Market in 2024.

- Use Cases: Some of the use cases of Aircraft Piston Engine include helicopters, drones & UAVs, and more.

Use Cases

- Light General Aviation Aircraft: Piston engines are broadly used in small private planes and flight training aircraft, due to their simplicity, affordability, and ease of maintenance.

- Helicopters: Some small helicopters utilize piston engines because of their relatively lightweight and lower operational costs in comparison to turbine engines.

- Experimental and Homebuilt Aircraft: Piston engines are common in homebuilt aircraft, where affordable and ease of modification are essential for builders.

- Drones and UAVs: Certain drones and unmanned aerial vehicles (UAVs) use piston engines for sustained flight over long distances, providing a balance between fuel efficiency and power output.

Market Dynamic

Driving Factors

Rising Demand for General Aviation

As personal and recreational flying becomes more popular, along with an increase in flight schools, there is a growth in demand for light aircraft, which mainly use piston engines due to their cost-effectiveness and reliability.

Technological Advancements

Innovations in piston engine efficiency, performance, and minimizing the emissions are driving growth. Newer designs that provides better fuel efficiency and compliance with environmental regulations are making piston engines more attractive for modern aviation needs.

Restraints

Competition from Turbine Engines

Turbine engines, which are more efficient and powerful for larger aircraft, are highly preferred for many aviation applications, limiting the growth of piston engines, particularly in commercial and advanced sectors. Additionally, the increasing integration of

Aircraft Health Monitoring systems further emphasizes the shift toward modern turbine-powered platforms, as these advanced diagnostics enhance safety, performance, and predictive maintenance capabilities across newer aircraft fleets.

Environmental Regulations

Stricter emissions and noise regulations are a challenge for traditional piston engines, which often depend on leaded fuel and produce higher emissions in comparison to modern alternatives, leading to potential phase-outs or restrictions.

Opportunities

Development of Alternative Fuels

The transformation toward unleaded aviation drives and biofuels provides an opportunity for piston engine manufacturers to innovate and develop engines compatible with cleaner, eco-friendly fuel options, enhancing environmental sustainability.

Emerging Markets

Growth in general aviation and pilot training in developing regions enables a major opportunity for piston engine manufacturers to expand their market presence by meeting the demand for cost-effective, small aircraft engines.

Trends

Transition to Unleaded Fuels

A major trend is the transformation from leaded aviation fuel to unleaded alternatives, driven by environmental concerns & regulations. Manufacturers are designing engines compatible with cleaner, unleaded fuels to reduce emissions.

Hybrid and Electric Propulsion

There is an increase in interest in hybrid and electric propulsion systems in small aircraft. Some piston engines are being combined with electric power sources, offering a more fuel-efficient, lower-emission option for general aviation.

Research Scope and Analysis

By Type

The multi-engine piston aircraft segment is expected to dominate the market in 2024 by offering significant advantages over single-engine counterparts. These aircraft carry superior performance, higher payload capacity, and better safety features, mainly with the redundancy of having two engines, which is mainly important for flights over water or in remote areas where safety and reliability are critical.

Multi-engine aircraft are mostly selected for tasks that demand extra power and dependability, like advanced flight training, charter services, and operations in difficult environments. Their ability to handle heavier loads &provide a safety cushion in case one engine fails makes them a preferred choice in many challenging aviation scenarios.

Further, single-engine piston aircraft are known for their simplicity, affordability, and efficiency and are expected to grow at a significant rate over the forecasted period, as these are popular among individual owners, flight training schools, and smaller aviation operations. Their lower operating costs and easy handling make them an ideal option for novice pilots, mainly in flight training environments.

Single-engine aircraft are more affordable to operate and maintain, making them a go-to choice for many small-scale aviation needs. Their simplicity and affordability allow them to remain competitive, mainly in settings where training and budget considerations are prioritized.

By Maximum Take-Off Weight

The aircraft with a maximum take-off weight of more than 2000 kg is set to lead the aircraft piston engine market in 2024 due to its inclusion of high-performance, multi-engine aircraft. These planes can take longer flights, carry heavier payloads, and handle more complex operations. They are largely favored by commercial operators, charter services, and wealthier individuals who need larger aircraft's extra capabilities.

With the ability to accommodate more passengers, cargo, and advanced equipment, these aircraft are well-suited for various demanding tasks, including business travel, advanced flight training, and specialized aviation services. The added range, power, and functionality make these aircraft the top choice for those who need reliable, high-performance aviation solutions.

Further, the less than 1000 kg segment mainly aims at ultralight and light sport aircraft. These planes attract aviation enthusiasts, hobbyists, and beginner pilots due to their affordability and ease of access. Many regions also have fewer regulatory hurdles for this type of aircraft, making them even more appealing for recreational flying, personal use, and flight training.

Further, the 1000-2000 kg segment covers a broader range of aircraft used in general aviation. These aircraft are mostly more advanced than ultralights, making them suitable for experienced pilots, advanced flight training, and small-scale commercial operations. They provide better range, payload capacity, and versatility while still keeping operational costs relatively low.

By Application

The commercial segment is anticipated to get the largest share in the market for piston engine aircraft in 2024, as it covers a variety of activities like flight training, general aviation, charter services, and aerial tourism. Piston engine aircraft are prominent in the commercial sector due to their affordability, versatility, and ease of access.

These aircraft are largely used by many businesses and aviation service providers for their affordability and adaptability to different tasks. Flight schools, in mostly, depend on them for pilot training as they are easy to operate and have lower running costs. In addition, both businesses and individuals use piston-engine aircraft for travel, providing a convenient and time-saving alternative to commercial airlines, mainly for short and medium-distance flights.

Further, in the military and defense sector, piston-engine aircraft are used for several purposes, like pilot training, surveillance, light attack missions, and reconnaissance. Their key benefit in military applications is their affordability, ease of maintenance, and straightforward operation. These qualities make them ideal for training new pilots before them move on to more advanced military aircraft.

The ease and lower operating costs of piston-engine aircraft provide a practical solution for basic military tasks, allowing for effective training and mission performance without the higher expenses associated with more complex aircraft.

The Aircraft Piston Engine Market Report is segmented on the basis of the following:

By Type

- Single Engine

- Multi-Engine

By Maximum Take-Off Weight

- Less than 1000 kg

- 1000-2000 kg

- More than 2000 kg

By Application

- Commercial

- Military & Defense

Regional Analysis

North America is expected to be leading with a

29.9% share in 2024, as it a crucial role in the growth of the aircraft piston engine market due to its advanced aviation infrastructure and high demand for general aviation. The region has a large number of flight schools, private aircraft owners, and charter service providers, all of which largely rely on piston engine aircraft for their operations.

The US, mainly, has a vibrant general aviation sector, with many small aircraft used for personal travel, flight training, and business purposes. In addition, the region’s advanced technological capabilities assist innovation in piston engine designs, enhancing fuel efficiency and reducing emissions.

With a well-established network of aviation services and a rise in interest in recreational flying, North America continues to drive demand for piston engine aircraft, making it a key market for manufacturers and service providers.

Further, Asia Pacific is also anticipated to play a significant role in the growth of the aircraft piston engine market due to higher demand for general aviation and flight training. As more people in the region gain interest in aviation, there is a growth in the number of flight schools and private aircraft ownership. Countries like China and India are investing in aviation infrastructure, and the expanding tourism industry also fuels demand for small aircraft, contributing to the growth of piston engine aircraft in the region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the aircraft piston engine market is moderately fragmented with a mix of established manufacturers and emerging players, all looking to innovate and capture market share. Companies aim to enhance engine performance, and fuel efficiency, and minimize emissions to meet regulatory standards and customer demands.

The market is largely competitive, with manufacturers providing a range of engines catering to both single-engine and multi-engine aircraft. Ongoing developments in technology and the development of alternative, eco-friendly fuels are key factors shaping competition, as companies aim to stay ahead in a growing market.

Some of the prominent players in the global Aircraft Piston Engine are

- Piper Aircraft

- Cirrus Aircraft

- AVIC General

- Flight Design

- Textron Aviation

- Extra Aircraft

- BRP

- Safran SA

- Austro Engines

- Discovery Aviation

- Other Key Players

Recent Developments

- In July 2024, Textron Aviation Inc. launched its new military multi-engine training aircraft designed upon the versatile and reliable Beechcraft King Air 260 and is making its show and European debut at the Farnborough International Airshow (FIA). Further, it provides an excellent value for military multi-engine training owing to its acquisition and operation cost, integrated with excellent speed, range, and payload capacity.

- In April 2024, Textron Aviation reported its entry into service of its improved Cessna Skyhawk, Cessna Skylane, Turbo Skylane, and Turbo Stationair HD following first deliveries for each aircraft, which focuses on providing a modern and stylish tone that aligns with the latest Cessna Citation jets while maintaining the renowned comfort, durability, and performance of the iconic Cessna piston lineup. Further, the improvements provide better comfort, functionality, and style.

- In April 2024, Continental launched its newest Jet-A piston engine variant, the CD-170 to expand its CD-100 series to have the new CD-170R model mainly for rotorcraft applications. The company submitted the engine certification package to the European Union Aviation Safety Agency (EASA) and anticipates certification later by the end of the year. The 170-horsepower, turbocharged engine combines the advanced Full Authority Digital Engine Control (FADEC), resulting in lower fuel consumption and dual redundancy.

- In February 2024, DeltaHawk Engines announced that it added two new higher horsepower engine models to its jet-fueled piston engines, which are based on the architecture of the company’s majorly innovative DHK180. Further, the two new models are the DHK200, which produces Rated Take-Off Power (RTP) and Maximum Continuous Power (MCP) of 200 horsepower, and the DHK235, which produces an RTP and MCP of 235 horsepower.