Market Overview

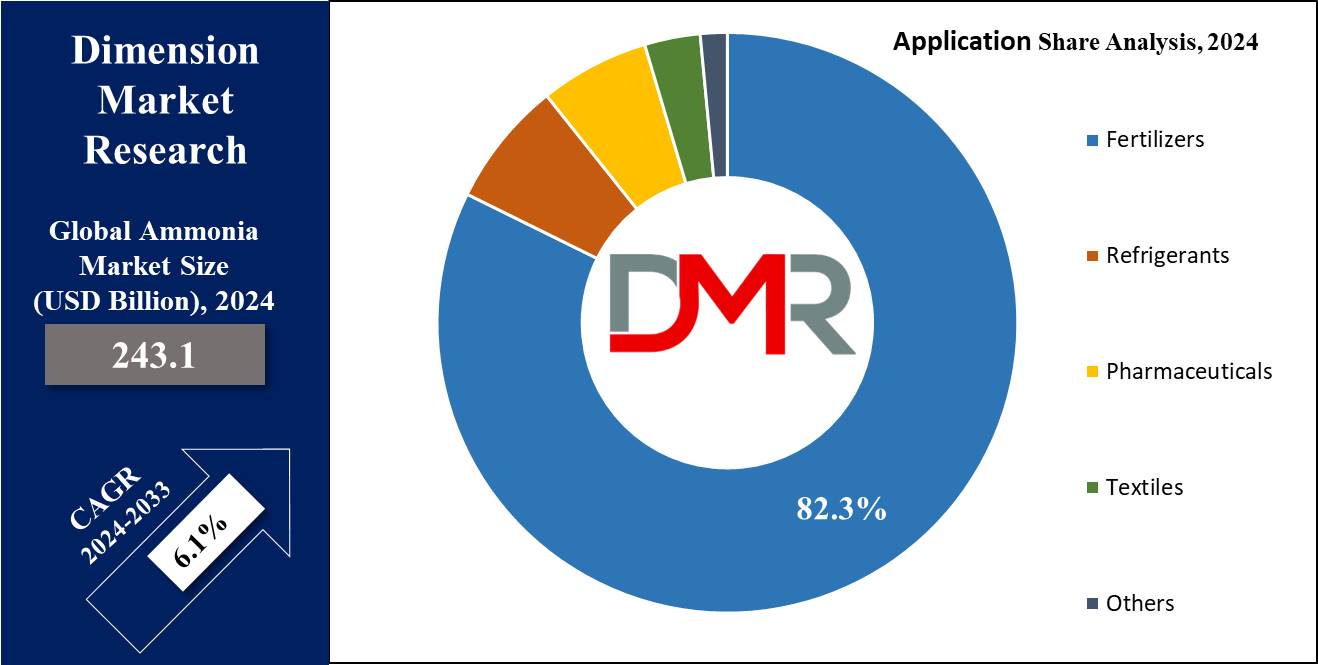

The Global Ammonia Market size is expected to reach a value of USD 243.1 billion by the end of 2024, and it is further anticipated to reach a market value of USD 415.3 billion by 2033 at a CAGR of 6.1%.

Nitrogen is essential for improved plant growth, but its gaseous form creates demanding situations. The Haber-Bosch method transforms atmospheric nitrogen into ammonia, a key thing in fertilizers, boosting crop productiveness. NH3 plays a prime role in enhancing germination, crop-soil separation, & nutrient availability.

The ammonium market is expected to grow, driven by textile industry demand and government initiatives, as government regulations impact ammonia costs globally due to complex production processes. Ammonia plays an important role in big cooling systems, existing in liquid and gas forms. It's cost-effective, around 10-20% less expensive than alternatives like CFCs, making it a first option for consumers.

Further, it is not only cost-efficient, but it is also environmentally friendly because it would not damage the ozone layer, has no direct impact on greenhouse gases, and is energy-efficient, which makes it a preferred alternative for refrigeration and air conditioning systems, especially in large-scale applications. Ammonia refrigeration systems are increasingly replacing synthetic refrigerants due to their eco-friendly performance and high thermodynamic efficiency.

However, the market experiences challenges, as it needs to create safer solutions for human & animal environments. Further, it has to deal with imbalances in supply & demand, mainly in areas heavily dependent on ammonia exports like North America. At the same time, new opportunities are emerging as green ammonia technologies integrate with

Energy Storage Systems, enabling renewable energy-based hydrogen production pathways for sustainable ammonia synthesis.

Key Takeaways

- Market Size: The Global Ammonia Market is expected to grow by USD 415.3 billion by 2033, at a CAGR of 6.1% during the forecasted period.

- Market Definition: Ammonia is a colorless, pungent gas composed of nitrogen and hydrogen (NH₃), ordinarily used in fertilizers, for industrial purposes, and as a refrigerant because of its excessive energy efficiency.

- By Product Segment Analysis: By product, the anhydrous ammonia segment is expected to lead in 2024 & is anticipated to dominate throughout the forecasted period.

- By Application Segment Analysis: By application, the fertilizer segment is expected to take the lead & drive the market in 2024.

- Regional Analysis: Asia Pacific is expected to hold a 58.5% share of revenue in the global ammonia market in 2024.

- Growth Drivers: This market encompasses the growing agricultural need for fertilizers, increasing industrial applications, increasing use in refrigeration, and advancements in sustainable ammonia manufacturing technologies.

Use Case

- Fertilizer Production: Ammonia is a key factor within the manufacturing of nitrogen-based fertilizers, like ammonium nitrate, urea, and ammonium sulfate, as farmers use these fertilizers to enhance soil fertility & promote plant growth, as nitrogen is an essential nutrient for plants.

- Refrigeration and Air Conditioning: Ammonia is highly used as a refrigerant in industrial refrigeration systems & large-scale air conditioning systems. Further, ammonia has excellent thermodynamic properties, high efficiency, & is environmentally friendly in comparison to some synthetic refrigerants, making it a preferred choice in certain applications.

- Cleaning Agent in the Food Industry: It is used as a bleaching and sanitizing agent in the food industry, especially in dairy and beverages, as it helps to remove fats, oils, and protein residues from processing equipment, creating a hygienic production environment.

- Emission Control in Power Plants: Ammonia can be used in selective catalytic reduction (SCR) systems to reduce nitrogen oxide (NOx) emissions from power plants and industrial facilities. It is injected into the exhaust gas, reacting with NOx on the catalyst to form nitrogen and water, reducing the environmental impact of the power plant emissions.

- Additionally, ammonia-based technologies are being explored in advanced Medical Devices, sustainable Construction Equipment, and specialized industrial applications such as Chemical Injection Pumps for oil & gas, showing its versatility beyond fertilizers.

Market Dynamic

Trends

Green Ammonia Technology

The adoption of green ammonia technology is unexpectedly gaining momentum as industries are looking for sustainable solutions. Green ammonia, produced using renewable energy sources, addresses environmental concerns and meets the rising need for sustainable and eco-friendly products. This trend is driven by the growing worldwide emphasis on reducing carbon footprints and the transition to a circular economy.

Rising Demand for Fertilizers

The worldwide agricultural sector is witnessing heightened demand for ammonia-based fertilizers. As the global populace continues to rise, the need for efficient food manufacturing techniques has emerged as critical. Ammonia, primarily used in fertilizers, is critical for boosting crop yields and supporting food security, driving market growth.

Growth Drivers

Increasing Demand for Food

The surge within the worldwide populace is a number one motive force for the ammonia marketplace. With the world population is projected to reach 9.7 billion by means of 2050, there is a pressing need to increase food production. Ammonia's function in fertilizers makes it quintessential for boosting agricultural output, thereby fueling market growth.

Technological Advancements in Ammonia Production

Innovations in ammonia production technology, which include more efficient and environmentally friendly processes, are propelling market expansion. Developments including electrochemical synthesis and the utilization of low-carbon hydrogen are making ammonia production more sustainable and cost-effective, assisting industry growth.

Growth Opportunities

Expansion in Asia Pacific

The Asia Pacific region offers significant growth opportunities for the ammonia marketplace, driven by growing agricultural activities and increasing industrialization. Countries like India and China, with massive agricultural sectors and growing populations, are major consumers of ammonia, creating a vast market potential.

Adoption of Ammonia as a Refrigerant

The use of ammonia as a refrigerant in industrial and commercial applications is gaining traction because of its efficiency and occasional environmental impact. Ammonia refrigeration systems are increasingly preferred for their sustainability benefits, opening new avenues for market growth.

Restraints

Environmental and Safety Concerns

Despite its benefits, ammonia poses major environmental and safety risks. Its production and handling contain high energy intake and potential hazards, together with toxicity and flammability. These concerns can restrict market growth due to stringent regulations and the need for sturdy safety measures.

Volatility in Natural Gas Prices

Ammonia production closely relies on natural gasoline as a feedstock. Fluctuations in natural gasoline charges can considerably affect production costs, posing a challenge for ammonia producers. Volatile energy markets and geopolitical tensions can result in unpredictable pricing, affecting profitability and market balance.

Research Scope and Analysis

By Product

Anhydrous Ammonia, under the segmentation of Product, is expected to dominate the market in 2024, commanding a substantial revenue share, because of its user-friendly handling & higher accessibility for agricultural participants. NH3-based nitrogen fertilizers, mainly in the anhydrous form, provide better crop productivity, efficient management of pests, & optimized cultivation cycles, mainly in hotter climates.

Also, its distinct features, like a strong odor & high heat vaporization, make it a valuable asset for refrigeration & solvent applications. In addition, the liquefied ammonia variant serves an important role in sectors like synthetic fiber production, metal extraction from ores, and medical formulation.

Furthermore, aqueous ammonia, featured as a combination of ammonia gas & water, functions as a potent cleansing agent, effectively dissolving & eliminating various kinds of contaminants such as oils, & residues from a diverse range of materials & surfaces, and is also expected to drive the market in coming future.

By Application

As an application, fertilizers are expected to show market dominance in 2024, contributing a significant share in terms of revenue collection, which can be because of its growing popularity among farmers, driven by the fast & efficient absorption features of nitrogenous fertilizers due to their enhanced solubility. Further, a majority of the global ammonia demand is due to nitrogen fertilizer production.

The adaptability of NH3-based fertilizers shines through their diverse formulations, made to fit distinct agricultural contexts & crop varieties. Like, ammonium nitrate functions as a rapid nitrogen source for crops such as corn & wheat, while urea serves crops leading to prolonged nitrogen release, like vegetables.

Beyond its agricultural role, NH3 finds strategic usage in niche refrigeration sectors, including cold storage facilities, ice rinks, & widespread installations in sectors such as petroleum, chemical, & gas processing, etc.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Ammonia Market Report is segmented on the basis of the following

By Product

- Anhydrous Ammonia

- Aqueous Ammonia

By Application

- Refrigerants

- Fertilizers

- Pharmaceuticals

- Textiles

- Others

Regional Analysis

The Asia Pacific region is anticipated to be a dominant force in the ammonia market in 2024, as it is expected to hold a substantial

58.5% share in terms of total revenue, which can be accredited to the presence of key agrarian nations within the APAC region, including major markets like Indonesia, Japan, Thailand, India, & the Philippines.

Further, China, as per the IEA (International Energy Agency), stands as the prominent global ammonia producer, contributing a good chunk of 30% to the overall production. China's status as the largest consumer of nitrogenous fertilizers globally is equally notable, accounting for one-third of the total global consumption. Apart from China, India also emerged as a prominent player in ammonia production, resulting in 8% production in the global production landscape.

India's ammonia manufacturing is due to direct conversion into urea, a vital fertilizer. The Asia Pacific region is dominant in the ammonia marketplace, with a high market share because of its huge agricultural base and increasing demand for ammonia fuel. The region's significant market growth is attributed to rapid industrialization, urbanization, and the rising demand for food.

Major ammonia producers in this area are investing in research and development to innovate and improve ammonia manufacturing methods, aiming to maintain competitive edges within the global marketplace. Key market tendencies include the growing utilization of ammonia in industrial applications beyond fertilizers, inclusive of the manufacturing of chemical substances, explosives, and refrigerants.

In the end, the ammonia marketplace is expected to attain new heights because of robust marketplace dynamics and market insights that factor towards sustained market increase. The ammonia marketplace studies highlight a positive outlook, with a sturdy emphasis on sustainability and performance enhancements, ensuring that the global ammonia market continues to develop at a healthy rate.

The market in Europe and North America also shows promising marketplace growth, pushed by means of technological advancements and increasing adoption of ammonia in various industrial processes.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The leading companies inside the market are worried about the extension of the product variety by developing special product grades that are appropriate for different end-use sectors. Also, the companies within this market are focusing on the production of the ammonia which is sustainable and environmental friendly.

This is a strategic move for them to lessen the carbon impact in the future. The global ammonia marketplace is projected to witness enormous growth within the foreseeable future, as a result of various market dynamics and growth factors. The market size of ammonia is expected to grow a lot, that's an outcome of the increasing need for ammonia in industries, particularly in the area of agriculture and industrial applications.

The primary use of ammonia is inside the agriculture region as it is a key aspect in fertilizers, and therefore it helps with the growth of food production which is in demand with the expanding global population.

This need for fertilizers is the primary purpose for the marketplace of ammonia increase. Besides, the ammonia industry is now shifting toward the manufacturing of renewable ammonia and green ammonia projects so it will be the very last blow to the ammonia marketplace by way of imparting extra sustainable manufacturing methods.

Some of the prominent players in the Global Ammonia Market are

- BASF SE

- CF Industries Holdings, Inc.

- Yara International ASA

- Nutrien Ltd.

- Acron

- Koch Fertilizer, LLC

- Qatar Fertilizer Company

- Rashtriya Chemicals and Fertilizers Limited

- Helm AG

- SABIC

- ACME Group

- EuroChem Group

- China National Petroleum Corporation

- Other Key Players

Recent Developments

- In January 2024, India’s Ministry of New & Renewable Energy announced two new auctions for subsidies to drive the uptake of green hydrogen in ammonia production & oil refining, which aggregate demand from industry & tender fixed payments for production and supply. Further, the auction would specifically subsidize green hydrogen producers supplying oil refineries, while the other pay companies that produce green ammonia, as long as the hydrogen is made in-house.

- In January 2024, INOX Air Products announced that the company signed a major deal with the Government of Maharashtra to construct a large-scale green ammonia plant with a planned outlay of USD 3.0 billion, which is set to be commissioned within a three to five-year timeline, and is expected to produce 500,000 metric tonnes per annum (MTPA) of renewable produced liquid ammonia.

- In December 2023, Sembcorp Green Hydrogen Pte Ltd, signed a memorandum of understanding (MoU) with Japanese conglomerate Sojitz Corp & energy major Kyushu Electric Power to pursue potential opportunities for green ammonia production in India for export to Japan.

- In November 2023, Adani Power announced that the company initiated a green ammonia combustion pilot project at its Mundra plant as part of its decarbonization efforts partnering with Japan’s IHI Corporation & Kowa, which aims to co-fire up to 20 percent green ammonia in the boiler of a conventional coal-fired 330MW unit at the Mundra Plant.

- In October 2023, Petroliam Nasional (Petronas) & Singapore's sovereign wealth fund GIC announced to invest in a project to produce 5 million tonnes of green ammonia annually in India by 2030, as Gentari, the renewable energy arm of Petronas & an affiliate of GIC, would invest in the project being developed by AM Green.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 243.1 Bn |

| Forecast Value (2033) |

USD 415.3 Bn |

| CAGR (2024-2033) |

6.1% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Anhydrous Ammonia and Aqueous Ammonia), By Application (Refrigerants, Fertilizers, Pharmaceuticals, Textiles, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

BASF SE, CF Industries Holdings, Inc., Yara International ASA, Nutrien Ltd., Acron, Koch Fertilizer, LLC, Qatar Fertilizer Company, Rashtriya Chemicals and Fertilizers Limited, Helm AG, SABIC, ACME Group, EuroChem Group, China National Petroleum Corporation, and Other Key Players |

| Purchase Options |

Physio-Control Inc., Schiller, Medtronic, Abbott, Boston Scientific Corporation, Koninklijke Philips N.V., Zoll Medical Corporation, BIOTRONIK, Progetti Srl, LivaNova Plc, and Other Key Players |

Frequently Asked Questions

How big is the Global Ammonia Market?

▾ The Global Ammonia Market size is estimated to have a value of USD 243.1 billion in 2024 and is expected to reach USD 415.3 billion by the end of 2033.

Which region accounted for the largest Global Ammonia Market?

▾ Asia Pacific is expected to have the largest market share in the Global Ammonia Market with a share of about 58.5% in 2024.

Who are the key players in the Global Ammonia Market?

▾ Some of the major key players in the Global Ammonia Market are BASF SE, CF Industries Holdings, Inc, Yara International ASA, and many others.

What is the growth rate in the Global Ammonia Market?

▾ The market is growing at a CAGR of 6.1 percent over the forecasted period.