Market Overview

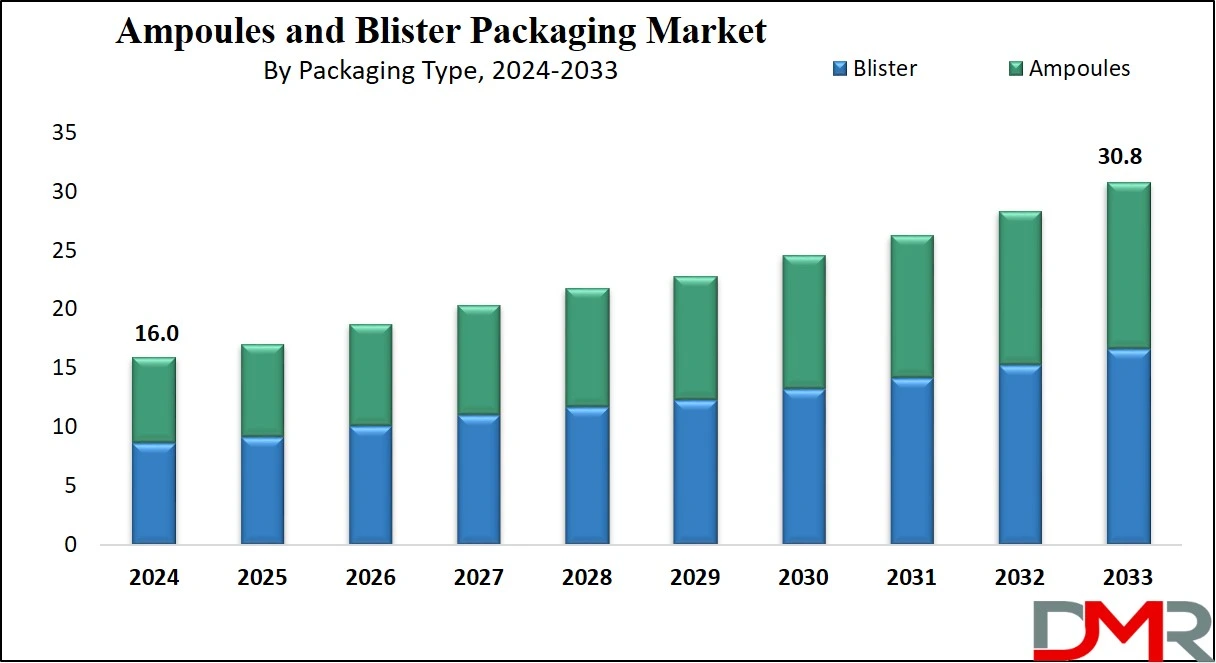

The Global Ampoules and Blister Packaging Market is projected to reach

USD 16.0 billion in 2024 and grow at a compound annual growth rate of

7.6% from there until 2033 to reach a value of

USD 30.8 billion.

Ampoules and blister packaging are highly used in the pharmaceutical industry to ensure the safety and integrity of medicines. Ampoules are small, sealed containers made of glass or plastic used to store liquid medications, mostly for injections.

They are airtight & protect the contents from contamination, light, and air. Further, blister packaging includes individual compartments, mainly made of plastic and sealed with foil or paper backing, mostly used for tablets, capsules, and other small medical items, ensuring easy access and maintaining product quality.

Moreover, the demand for ampoules and blister packaging has grown steadily, driven by the increase in the need for pharmaceutical products. The aging global population and the growth in the number of chronic diseases like diabetes and heart conditions have led to higher medication consumption, expanding the demand for secure packaging solutions.

Stricter safety regulations from health authorities also encourage manufacturers to opt for advanced packaging methods. In addition, the convenience and accuracy of unit-dose packaging make blister packs appealing to healthcare providers and patients.

Also, in recent years, the market has experienced several trends. Sustainability is a major focus with companies adopting environmentally friendly materials, like biodegradable plastics and recyclable components, to minimize waste.

Automation in manufacturing and packaging is becoming more extensive, improving efficiency and consistency while reducing costs. The integration of smart technologies, like QR codes or NFC tags, is also gaining momentum, allowing better tracking of medicines and improving patient engagement by providing dosage reminders or product information.

Safety features like tamper-evident and child-resistant packaging are increasingly in demand.

Moreover, there are major developments and collaborations between pharmaceutical companies and packaging innovators. Events like Pharmapack Europe and Interphex highlight technological breakthroughs in the sector.

Regulatory agencies are constantly updating guidelines, pushing the industry toward better safety, efficiency, and sustainability. The growth of pharmaceutical industries in emerging markets, like India and China, has opened new opportunities for ampoule and blister packaging solutions, with companies expanding production capacities to meet regional demands.

Also, ampoules and blister packaging are vital for ensuring medication safety, improving patient compliance, and meeting stringent regulatory requirements. The industry's future depends on innovation, with a major focus on sustainable materials and smart technologies. The increasing use of pharmaceuticals globally will continue to drive demand for these packaging solutions.

Companies investing in automation, eco-friendly packaging, and advanced safety features are expected to lead the way. With ongoing developments, ampoules and blister packaging will remain integral to the pharmaceutical and healthcare sectors.

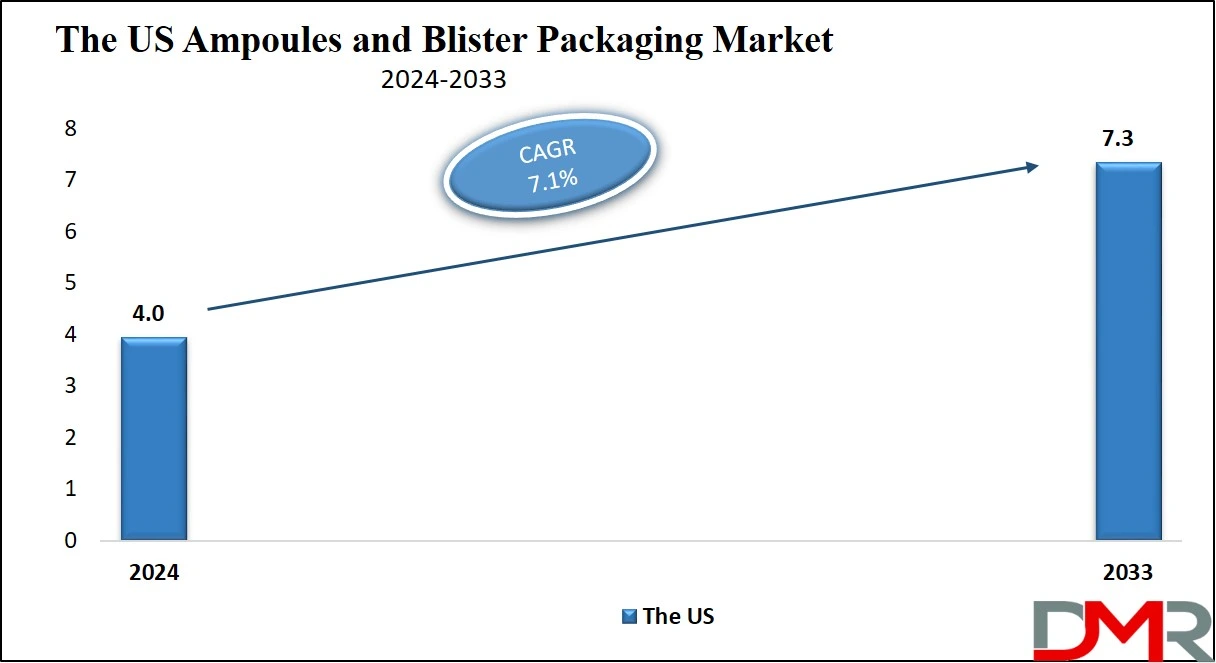

The US Ampoules and Blister Packaging Market

The US Ampoules and Blister Packaging Market is projected to reach

USD 4.0 billion in 2024 at a compound annual growth rate of

7.1% over its forecast period.

The US provides many growth opportunities in the ampoules and blister packaging market due to its advanced healthcare infrastructure and growth in demand for secure, tamper-evident packaging. Increase in pharmaceutical production, the need for sustainable solutions, and stringent regulatory requirements drive innovation in packaging. In addition, growing consumer awareness of safety and convenience further boosts market expansion in the region.

Further, the market is driven by growing pharmaceutical production, strict regulatory requirements, and growing demand for tamper-evident, patient-friendly packaging. However, a key restraint is the high cost of sustainable materials and advanced technologies, which can challenge smaller manufacturers. Balancing innovation with affordability remains critical for sustained growth in this market.

Ampoules and Blister Packaging Market Key Takeaways

- Market Growth: The Ampoules and Blister Packaging Market size is expected to grow by 13.8 billion, at a CAGR of 7.6% during the forecasted period of 2025 to 2033.

- By Packing Type: The blister segment is anticipated to get the majority share of the Ampoules and Blister Packaging Market in 2024.

- By End User: The Pharmaceutical and Healthcare is expected to be leading the market in 2024

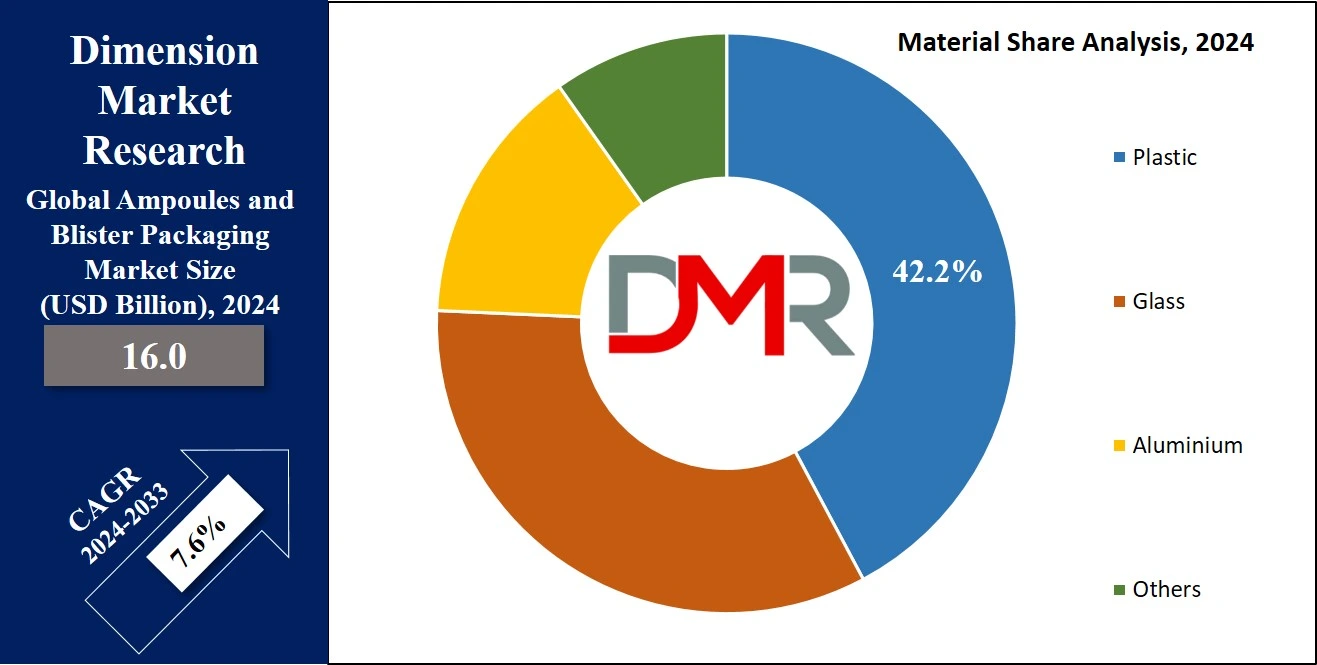

- By Material: The plastic segment is expected to get the largest revenue share in 2024 in the Ampoules and Blister Packaging Market.

- Regional Insight: Asia Pacific is expected to hold a 33.1% share of revenue in the Global Ampoules and Blister Packaging Market in 2024.

- Use Cases: Some of the use cases of Ampoules and Blister Packaging include medication safety, tamper evidence, and more.

Ampoules and Blister Packaging Market Use Cases

- Medication Safety: Ampoules protect liquid medicines from contamination, air, and light, while blister packs maintain the integrity of tablets and capsules, ensuring their safety and efficiency.

- Unit-Dose Convenience: Blister packaging provides single-dose compartments, making it easy for patients to take the correct dosage and minimizing the risk of medication errors.

- Tamper Evidence: Both ampoules and blister packs provide tamper-evident features, enhancing security and ensuring the product has not been altered.

- Extended Shelf Life: The airtight and protective nature of ampoules and blister packs helps preserve the shelf life of pharmaceutical products by shielding them from moisture, air, and light.

Ampoules and Blister Packaging Market Statistics

- According to Meyers, 94% of consumers are more likely to stay loyal to brands that provide complete transparency, as it strengthens brand image and encourages honest feedback.

- Further, 72% of American consumers say that product packaging design impacts their purchasing decisions, with 67% indicating that the choice of packaging materials also plays a role.

- Packaging is the first thing consumers see when shopping, whether in-store or online. An attractive and compelling design creates a positive perception of the brand, influencing buying behavior

- FMCG producers and retailers are highly adopting sustainable packaging, incorporating recycled content like post-consumer resin (PCR), driven by consumer demand and evolving regulations.

- Also, 50% of US consumers are willing to pay more for sustainable packaging, reflecting growing awareness of environmental issues like pollution and ocean litter.

- Sustainable products are growing 2.7 times faster than traditional goods, despite their higher price premiums, as consumers increasingly prioritize sustainability in their purchasing decisions.

- Policymakers worldwide are implementing regulations on single-use packaging and extended producer responsibility (EPR), with Europe leading the way and other regions like North America and Asia-Pacific following suit.

Ampoules and Blister Packaging Market Market Dynamic

Driving Factors

Rising Pharmaceutical Demand

The rise in the number of chronic diseases, aging populations, and growth in access to healthcare in developing countries are driving the need for safe & reliable packaging solutions. Ampoules and blister packaging ensure medication safety and efficacy, making them indispensable for meeting the growing demand for pharmaceuticals across the world. The rising trend of self-medication and over-the-counter (OTC) drugs further boosts the adoption of user-friendly blister packaging.

Stricter Regulatory Requirements

Regulatory bodies like the FDA and EMA have implemented strict guidelines for pharmaceutical packaging to ensure product safety, tamper resistance, and accurate dosing, which adopt advanced ampoule and blister packaging solutions. The demand for compliance with child-resistant and tamper-evident packaging features, along with eco-friendly materials, is further driving growth in this sector.

Restraints

High Production Costs

The innovative materials and technologies required for ampoules and blister packaging, like tamper-evident features and sustainable materials, can highly increase production costs, which creates a challenge, mainly for smaller pharmaceutical companies operating with limited budgets. In addition, the investment in specialized machinery for automation and customization adds to the overall expense, potentially limiting the adoption of these solutions in cost-sensitive markets.

Environmental Concerns

Traditional blister packaging depends highly on plastic, which has drawn criticism for its environmental impact. As global awareness about sustainability grows, the industry experiences pressure to develop eco-friendly alternatives. However, transitioning to biodegradable or recyclable materials is complex and costly, requiring extensive research, development, and adaptation of existing production processes, which can slow down market growth.

Opportunities

Sustainable Packaging Innovations

There is a growing opportunity for the ampoules and blister packaging market to explore eco-friendly alternatives. Developing biodegradable plastics, and recyclable materials, and reducing the carbon footprint of packaging production aligns with global sustainability goals. As consumer and regulatory demand for green packaging increases, companies that invest in these innovations can not only meet environmental expectations but also differentiate themselves in a competitive market, capturing eco-conscious customers.

Smart Packaging Integration

The growth of digital technologies presents many opportunities for integrating smart features into ampoules and blister packaging. Adding QR codes, RFID tags, or NFC allows components to improve patient compliance by providing dosage reminders, tracking product authenticity, and providing detailed usage information, which not only improves the user experience but also aligns with the growing trend of data-driven healthcare solutions, opening new avenues for the market to expand.

Trends

Adoption of Sustainable Materials

A key recent trend in the ampoules and blister packaging market is the transformation towards sustainable packaging materials. As the demand for eco-friendly solutions grows, manufacturers are exploring substitutes like recyclable plastics, biodegradable materials, and plant-based resins, which is being driven by increasing environmental concerns, stricter regulations on plastic waste, and a rising preference among consumers for sustainable products. Companies adopting these materials can not only meet regulatory standards but also appeal to environmentally conscious consumers.

Smart and Digital Packaging Solutions:

Another emerging trend is the integration of smart technology into packaging. Blister packs and ampoules are now being improved with features like QR codes, near-field communication (NFC), and radio-frequency identification (RFID) tags.

These technologies allow better tracking, monitoring, and authentication of pharmaceutical products, providing added security and ensuring product quality. Smart packaging also enhances patient compliance by delivering reminders, dosage information, or instructions directly to the user's smartphone, creating a more connected and efficient healthcare experience.

Research Scope and Analysis

By Packaging Type

In the ever-evolving world of packaging solutions, the ampoules and blister packaging market plays a major role, with each packaging type offering unique benefits to meet industry demands. Blister packaging will emerge as the dominant choice in 2024, capturing a significant share of the market.

Known for its design featuring individual compartments and mostly a transparent cover, blister packaging is widely used for solid dosage forms like tablets and capsules. Its popularity stems from its ability to provide excellent protection against moisture, light, and contaminants, making sure of the product's quality.

In addition, its user-friendly design allows consumers to access products easily, while its tamper-evident features improve safety and build trust. These attributes make blister packaging a go-to solution for pharmaceutical and consumer goods companies looking for a reliable, practical, and appealing option.

Further, ampoules act in a more specialized role, mainly in the medical and pharmaceutical sectors. These small containers, made of glass or plastic, are designed to maintain the sterility of injectable medications and liquid substances.

Ampoules are mainly valued for their ability to preserve the integrity of critical substances, ensuring they remain safe and effective until use. While blister packaging dominates the market due to its versatility and broad applications, ampoules remain indispensable for niche uses where sterility and precision are paramount.

By Material

In the ampoules and blister packaging market, material choice is a major factor, with plastic being set to be the leading option in terms of being used in 2024. Plastic packaging is favored for its affordability, versatility, and lightweight nature, making it an ideal solution across numerous industries. It is commonly used in the pharmaceutical, cosmetics, and consumer goods sectors due to its ability to develop tamper-evident seals and provide strong barriers against moisture and contaminants.

These qualities make plastic mainly effective for protecting sensitive products. In addition, plastic packaging is highly customizable, providing opportunities for creative designs and branding, which appeals to companies looking to stand out in competitive markets. Its adaptability and practicality continue to make it a top choice for manufacturers and consumers alike.

Further, even after plastic's dominance, materials like glass and aluminum remain relevant and continue to serve important roles in packaging. Glass ampoules are largely valued in the pharmaceutical industry because of their inert and non-reactive properties, which ensure that medications remain pure and uncontaminated.

Also, aluminum blister packaging is known for its exceptional ability to shield products from light, moisture, and oxygen, making it a popular option in the food and beverage industry. Both materials look into specific needs that plastic may not fulfill, ensuring their ongoing use in markets that prioritize product integrity and protection from external elements.

By Technology

Thermoforming plays a major role in the growth of the ampoules and blister packaging market by providing a cost-effective and efficient method to create durable and customized packaging solutions, which includes heating plastic sheets until they become pliable & then shaping them into specific forms using molds, making it ideal for producing blister packs with better compartments for tablets, capsules, and other products.

Thermoforming includes consistent quality, high production speed, and design flexibility, allowing manufacturers to create packaging that meets both functional and aesthetic needs. Its ability to incorporate tamper-evident and child-resistant features further improves product safety and consumer trust.

As the need for innovative, secure, and visually appealing packaging continues to rise, thermoforming remains a vital driver in advancing the ampoules and blister packaging market.

Further, cold-forming technology is important for the growth of the ampoules and blister packaging market, mainly for products requiring superior protection.

Unlike thermoforming, cold forming uses aluminum-based materials shaped without heat, providing excellent barriers against moisture, light, and oxygen, which it ideal for packaging sensitive pharmaceutical products that need maximum preservation. While slower and more material-intensive than other methods, its ability to ensure product safety and extended shelf life makes cold forming an essential choice in specialized packaging applications.

By End User

The pharmaceutical and healthcare industry remains the dominant force in the ampoules and blister packaging market and is expected to hold a significant share in 2024. The importance of these packaging solutions in this sector is immense, as they are vital for maintaining the safety, sterility, and integrity of pharmaceutical products.

Ampoules and blister packaging are developed to meet strict regulatory standards, providing tamper-evident and hermetically sealed options to ensure medicines remain uncontaminated and effective. These solutions are indispensable for storing & distributing medications, mainly those that depend on precision and protection from external elements. The market’s growth is further driven by growth in global healthcare demands, driven by aging populations, the prevalence of chronic diseases, and greater awareness of healthcare standards worldwide.

Further, the consumer goods and personal care sectors also contribute significantly to the demand for ampoules and blister packaging. These industries depend on secure and attractive packaging to protect and showcase a variety of products, from cosmetics and skincare items to small electronics. Blister packaging, with its transparent compartments, allows consumers to view the product before purchase, while ampoules ensure liquids are safely stored and protected.

The integration of product visibility, safety, and convenience makes these packaging solutions highly appealing to both manufacturers and consumers. As a result, ampoules and blister packaging have become integral to meeting the diverse demands of these sectors, focusing their versatility and importance across industries.

The Ampoules and Blister Packaging Market Report is segmented based on the following

By Packaging Type

By Material

By Technology

- Thermoforming

- Cold Forming

- Injection Molding

- Blow Molding

- Sealing Technology

By End User

- Pharmaceutical and Healthcare

- Consumer Goods

- Personal Care

- Others

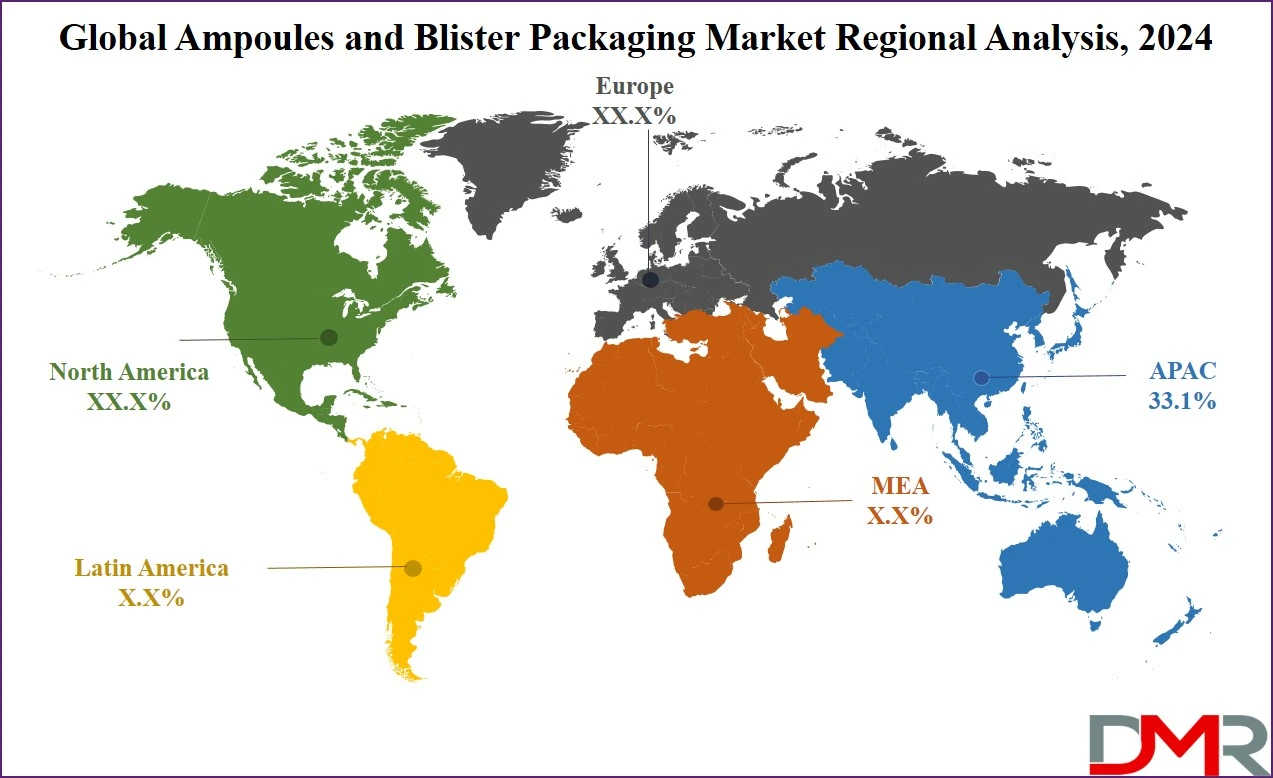

Ampoules and Blister Packaging Market Regional Analysis

The Asia Pacific region has solidified its position as a leader in the ampoules and blister packaging market, holding an impressive

33.1% market share in 2024, which is driven by various factors contributing to its rapid growth. The region’s large population and urban expansion have highly increased the demand for healthcare services and pharmaceutical products.

The increase in income levels across many countries in the region, particularly in China and India, has boosted spending on healthcare, further driving the demand for efficient and secure packaging solutions like ampoules and blister packs. The strong growth of the pharmaceutical industries in these nations has also played a major role in expanding the market for these packaging technologies.

Also, the Asia Pacific region is making major strides in improving healthcare infrastructure and supporting pharmaceutical research and development. Governments in countries like Japan, South Korea, and India have implemented policies to promote investments in the healthcare sector, creating a favorable business environment for packaging manufacturers. These efforts, combined with the rise in focus on regulatory compliance and patient safety, have expanded the demand for innovative and reliable packaging.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The ampoules and blister packaging market is highly competitive, with various players aiming on innovation to meet evolving consumer and industry needs. Companies compete by providing advanced packaging solutions that ensure product safety, sustainability, and compliance with regulatory standards. There is an increase in focus on eco-friendly materials, tamper-evident designs, and customizable options to meet diverse industries like pharmaceuticals, healthcare, and consumer goods.

Regional manufacturers often focus on affordable solutions, while global players invest in research and development for cutting-edge technologies, which drives continuous advancements, ensuring the market adapts to changing demands and remains dynamic and growth-oriented.

Some of the prominent players in the Global Ampoules and Blister Packaging are

- AMCOR

- Sonoco Pentaplast Group

- Klockner Pentaplast Group

- WestRock Company

- Constantia Flexibles International GmbH

- Schott AG

- J.Penner Corp.

- Nipro Corp

- Perlen Packaging AG

- Schott AG

- Other Key Players

Recent Developments

- In November 2024, Adragos Pharma, a Contract Development & Manufacturing Organisation (CDMO), has highly improved its production capabilities with the completion of a new ampoule filling line at its Livron-sur-Drôme site in France. Further, the company invested EUR 13 million to boost the facility’s output by 30%, allowing the company to manufacture over 160 million ampoules annually and to meet the growing demand in global pharmaceutical markets for sterile injectables.

- In October 2024, Bayer launched a first-of-its-kind in the healthcare industry, polyethylene terephthalate (PET) blister packaging on its renowned brand, Aleve. Further, made in partnership with pharma packaging specialist Liveo Research, this innovative solution minimizes the carbon footprint of this packaging by 38% and marks a stride in environmental stewardship by eliminating the use of polyvinyl chloride (PVC).

- In October 2024, Nipro PharmaPackaging launched its innovative D2F™ (Direct-to-Fill) glass vials. These vials, featuring Stevanato Group’s advanced EZ-fill® technology, provide a high-quality ready-to-use (RTU) solution designed to meet the rigorous standards and growth in requirements of the pharmaceutical industry.

- In September 2024, Stevanato Group S.p.A. together with Gerresheimer AG and SCHOTT Pharma AG & Co. KGaA unveiled that they have entered into a strategic industry alliance ("Alliance for RTU") to help market adoption of Ready-to-Use (RTU) vials and cartridges.

- In July 2024, Aluflexpack unveiled the development of a new product: the 4∞ Form, which is designed mostly for the pharmaceutical industry, is constructed entirely of lacquered aluminum, providing a sustainable and recyclable alternative to traditional multi-material packaging. Also, the 4∞ Form solution addresses growing concerns about the environmental impact within the pharmaceutical packaging sector.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 16.0 Bn |

| Forecast Value (2033) |

USD 30.8 Bn |

| CAGR (2024-2033) |

7.6% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 4.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Packaging Type (Ampoules and Blister), By Material (Plastic, Glass, Aluminum, and Others), By Technology (Thermoforming, Cold Forming, Injection Molding, Blow Molding, and Sealing Technology), By End User (Pharmaceutical and Healthcare, Consumer Goods, Personal Care, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

AMCOR, Sonoco Pentaplast Group, Klockner Pentaplast Group, WestRock Company, Constantia Flexibles International GmbH, Schott AG, J.Penner Corp, Nipro Corp, Perlen Packaging AG, Schott AG, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Ampoules and Blister Packaging Market size is expected to reach a value of USD 16.0 billion in 2024 and is expected to reach USD 30.8 billion by the end of 2033.

Asia Pacific is expected to have the largest market share in the Global Ampoules and Blister Packaging Market with a share of about 33.1% in 2024.

The Ampoules and Blister Packaging Market in the US is expected to reach USD 4.0 billion in 2024.

Some of the major key players in the Global Ampoules and Blister Packaging Market are AMCOR, Sonoco Pentaplast Group, Klockner Pentaplast Group, and others

The market is growing at a CAGR of 7.6 percent over the forecasted period.