Market Overview

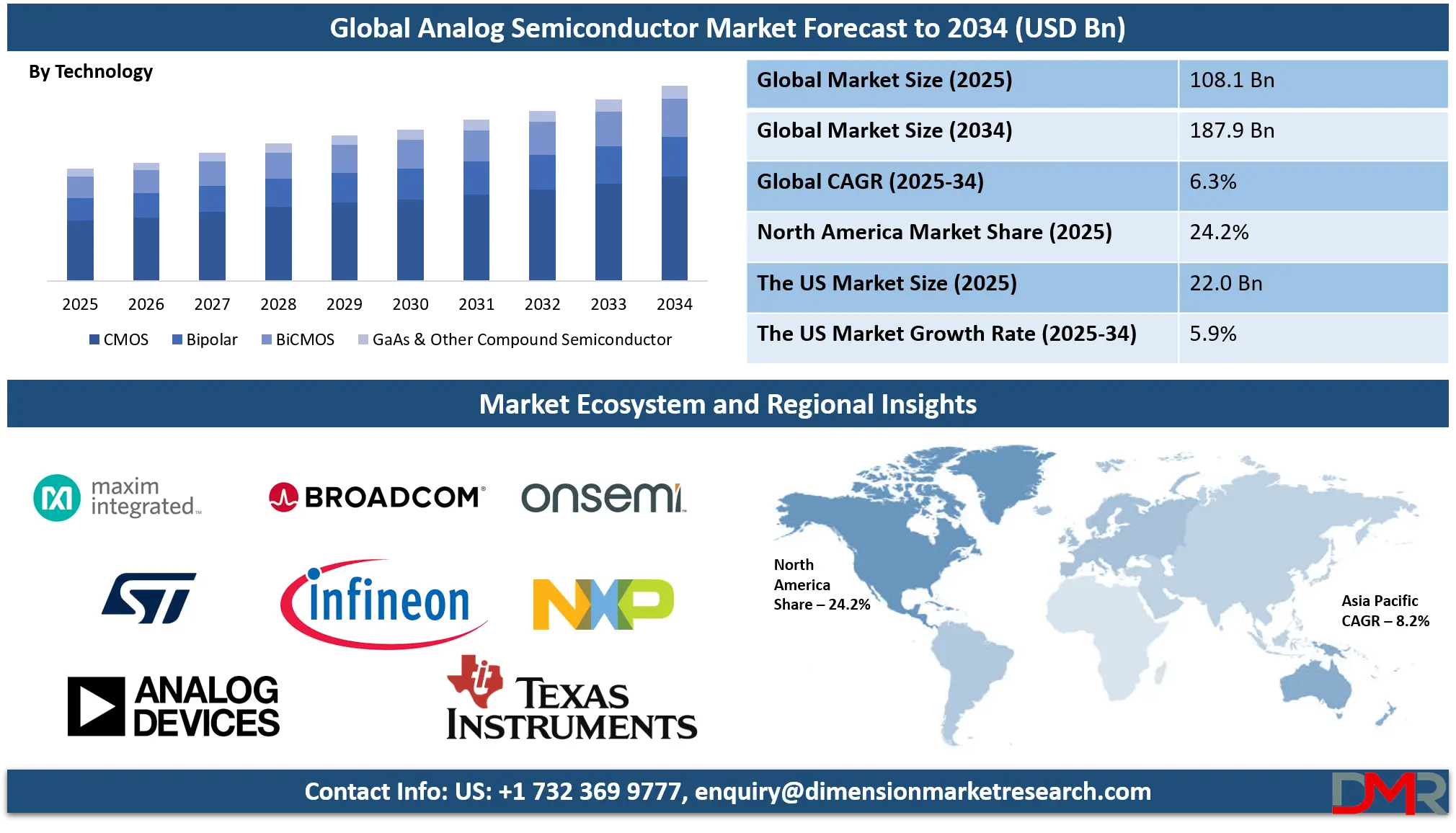

The Global Analog Semiconductor Market size is projected to reach USD 108.1 billion in 2025 and grow at a compound annual growth rate of 6.3% to reach a value of USD 187.9 billion in 2034.

Analog semiconductors are electronic components that process real-world signals, such as sound, light, temperature, and pressure, by converting them into electrical signals that devices can understand. Unlike digital semiconductors, which work with binary data (0s and 1s), analog chips deal with continuous signals. They are used in amplifiers, sensors, data converters, power management systems, and many other applications where interaction with the physical world is necessary. These components are essential in bridging the gap between real-life inputs and digital systems, making them a core part of modern electronics.

The growth in analog semiconductors is strongly linked to expanding industries such as consumer electronics, automotive, industrial automation, and telecommunications. The demand for advanced sensors in smart devices, energy-efficient power management in electric vehicles, and robust connectivity for communication networks is pushing manufacturers to innovate. The rise in renewable energy projects, smart grids, and portable devices has also created a consistent demand for analog chips that can efficiently handle power conversion and signal processing.

Several trends are shaping the analog semiconductor landscape. One is the increasing integration of analog and digital functions into mixed-signal chips, reducing size and cost while improving performance. There is also a growing focus on low-power designs to support battery-powered and energy-conscious devices. In addition, automotive-grade analog chips with enhanced durability are seeing high interest due to the shift toward electric and autonomous vehicles.

Advancements in manufacturing have enabled smaller, more efficient analog components that can handle higher performance with less heat. Wide bandgap materials like silicon carbide and gallium nitride are increasingly used in power electronics, improving efficiency and reliability. These innovations help meet the requirements of high-speed charging, fast data transfer, and compact device designs.

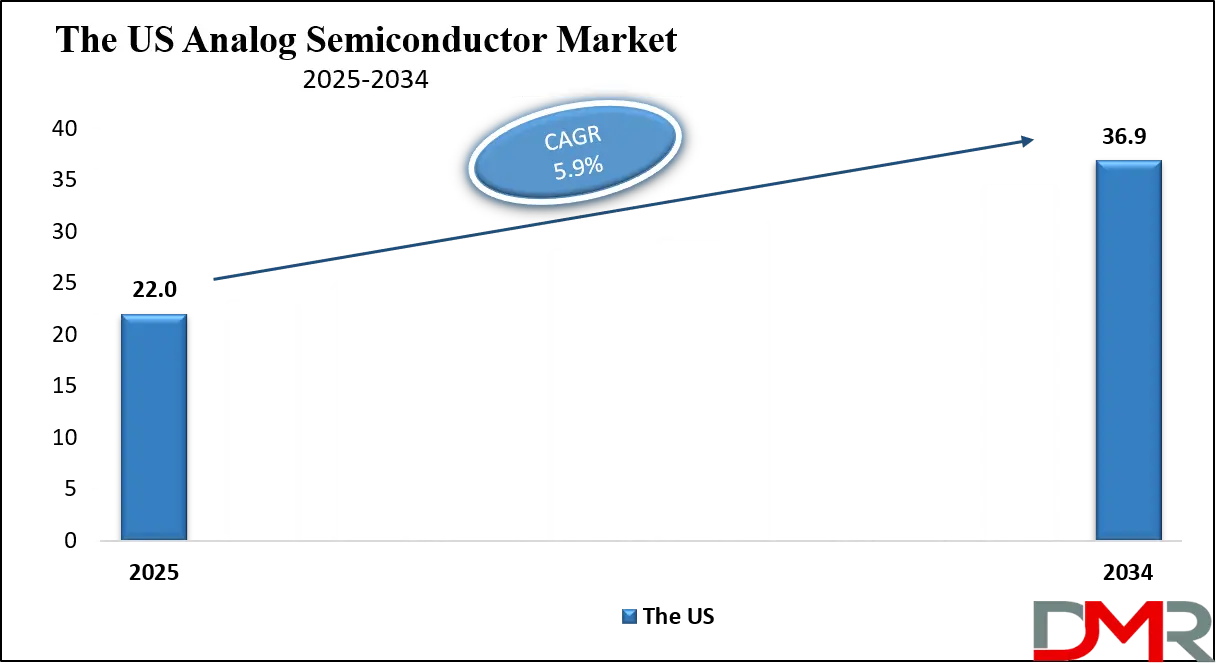

The US Analog Semiconductor Market

The US Analog Semiconductor Market size is projected to reach USD 22.0 billion in 2025 at a compound annual growth rate of 5.9% over its forecast period.

The US plays a major role in the analog semiconductor market, driven by its strong base of technology companies, advanced manufacturing capabilities, and leadership in research and development. It is home to many leading chip designers and innovators who supply products to global industries such as automotive, consumer electronics, industrial automation, and communications.

The US also leads in developing cutting-edge materials, mixed-signal integration, and power management solutions. Strong collaborations between industry, universities, and government programs support continuous innovation. Additionally, the US benefits from a large domestic market and close partnerships with global supply chains. Its focus on securing semiconductor manufacturing and reducing dependence on imports further strengthens its strategic position in the global analog semiconductor industry.

Europe Analog Semiconductor Market

Europe Analog Semiconductor Market size is projected to reach USD 21.7 billion in 2025 at a compound annual growth rate of 6.1% over its forecast period.

Europe holds a significant position in the analog semiconductor market, supported by its strong industrial base, advanced automotive sector, and emphasis on energy efficiency. The region is a leader in developing high-quality analog solutions for automotive electronics, industrial automation, renewable energy, and medical devices. European companies focus on producing reliable, durable, and energy-efficient chips to meet strict regional regulations and sustainability goals.

Research institutions and government initiatives actively support innovation and manufacturing within the semiconductor sector. Europe also plays a key role in specialty analog components, such as sensors and power management systems, used in electric vehicles and smart infrastructure. Its combination of technological expertise and policy-driven innovation ensures steady growth and competitiveness in the global market.

Japan Analog Semiconductor Market

Japan Analog Semiconductor Market size is projected to reach USD 10.8 billion in 2025 at a compound annual growth rate of 7.4% over its forecast period.

Japan plays a vital role in the analog semiconductor market, backed by its strong electronics industry, precision manufacturing, and expertise in high-quality component production. The country is known for developing advanced analog chips used in automotive systems, consumer electronics, robotics, and industrial equipment. Japanese manufacturers emphasize miniaturization, reliability, and energy efficiency, making their products highly valued in global markets.

The nation’s leadership in automotive technology, especially in hybrid and electric vehicles, drives significant demand for power management and sensor solutions. Strong collaboration between industry and research institutions supports continuous innovation. Japan’s focus on quality, long-term durability, and cutting-edge technology ensures its continued influence in the global analog semiconductor supply chain.

Analog Semiconductor Market: Key Takeaways

- Market Growth: The Analog Semiconductor Market size is expected to grow by USD 73.6 billion, at a CAGR of 6.3%, during the forecasted period of 2026 to 2034.

- By Technology: The CMOS is anticipated to get the majority share of the Analog Semiconductor Market in 2025.

- By Application: The Consumer electronics segment is expected to get the largest revenue share in 2025 in the Analog Semiconductor Market.

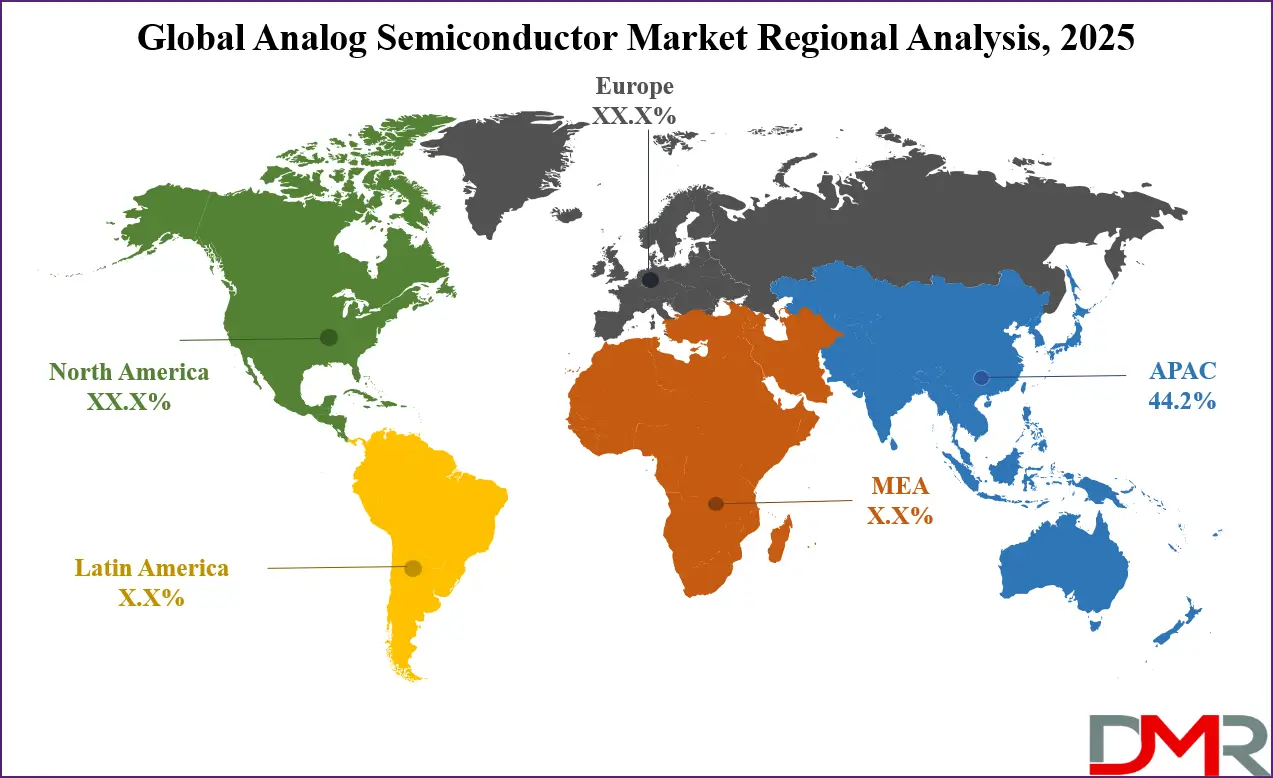

- Regional Insight: Asia Pacific is expected to hold a 44.2% share of revenue in the Global Analog Semiconductor Market in 2025.

- Use Cases: Some of the use cases of Analog Semiconductor include consumer electronics, industrial automation, and more.

Analog Semiconductor Market: Use Cases

- Automotive Systems: Analog semiconductors are used in vehicles for functions like power management, battery monitoring, and sensor signal processing. They enable safety features such as advanced driver-assistance systems and precise control of electric motors. As electric and autonomous vehicles grow, their role in ensuring reliability and efficiency becomes even more critical.

- Consumer Electronics: These chips manage audio, display, and power functions in smartphones, laptops, and wearables. They convert real-world signals like sound and touch into digital data for processing. Their low power consumption and compact design make them ideal for portable and battery-powered devices.

- Industrial Automation: Analog semiconductors help control motors, manage energy use, and process sensor data in factories. They support robotics, machine vision, and predictive maintenance systems. Their durability and accuracy are vital for operating in demanding industrial environments.

- Communication Infrastructure: They play a key role in base stations, network equipment, and signal transmission systems. Analog chips handle radio frequency signals and power regulation for reliable connectivity. With the rollout of advanced networks, they enable high-speed, stable communication.

Market Dynamic

Driving Factors in the Analog Semiconductor Market

Rising Demand from Automotive and Electric Vehicles

The automotive sector is becoming one of the strongest growth engines for the analog semiconductor market, driven by the increasing shift toward electric and hybrid vehicles. These vehicles require a wide range of analog chips for battery management systems, power conversion, motor control, and advanced driver-assistance systems. Safety and comfort features such as radar, lidar, and camera systems also depend heavily on analog signal processing. As regulations push for reduced emissions and greater energy efficiency, automakers are integrating more electronics, creating long-term demand. The transition toward autonomous driving further boosts the need for high-performance, reliable, and durable analog components.

Expansion of Consumer Electronics and IoT Devices

The rapid rise of smartphones, wearables, smart home products, and connected appliances has created a constant need for analog semiconductors. These chips manage critical functions such as audio processing, display control, battery charging, and signal conversion, enabling smooth interaction between the physical world and digital systems. With the Internet of Things (IoT) expanding into areas like healthcare, agriculture, and logistics, demand for compact, low-power, and efficient analog solutions is accelerating. Enhanced connectivity through advanced wireless standards further strengthens this trend, as devices require more sophisticated power management and signal integrity. This continuous adoption ensures steady growth in the market.

Restraints in the Analog Semiconductor Market

High Manufacturing Complexity and Cost

Producing analog semiconductors requires precise design, specialized equipment, and advanced testing to ensure performance and reliability. Unlike digital chips, analog devices cannot be easily scaled down using the same miniaturization techniques, making the manufacturing process more challenging. This complexity often results in longer development cycles and higher production costs. Smaller companies may struggle to compete due to the capital-intensive nature of production. Additionally, maintaining strict quality standards for use in industries like automotive and healthcare adds to expenses. These factors can limit the speed of innovation and create barriers for new entrants in the market.

Supply Chain Vulnerabilities and Material Constraints

The analog semiconductor market is highly dependent on a stable supply of raw materials and specialized components. Disruptions caused by geopolitical tensions, trade restrictions, or natural disasters can significantly impact production and delivery timelines. Certain critical materials used in manufacturing are sourced from limited regions, increasing the risk of shortages. Additionally, the growing global demand for semiconductors across multiple sectors intensifies competition for production capacity. These challenges can lead to delays, cost increases, and reduced availability for end-users, making supply chain resilience a key concern for manufacturers in the industry.

Opportunities in the Analog Semiconductor Market

Growth in Renewable Energy and Smart Grids

The expansion of renewable energy projects, such as solar and wind power, is creating significant opportunities for analog semiconductor applications. These chips are essential for power conversion, voltage regulation, and energy storage systems. In smart grids, analog components help monitor energy flow, manage loads, and improve efficiency. As global energy systems shift toward cleaner and more sustainable sources, the need for precise and reliable analog solutions will grow. Governments and industries are investing heavily in infrastructure upgrades, which will further drive demand. This trend opens doors for innovation in high-efficiency, durable, and environmentally friendly analog technologies.

Advancements in Healthcare and Medical Devices

The healthcare sector is rapidly adopting advanced electronics for diagnostics, monitoring, and treatment. Analog semiconductors play a vital role in devices such as patient monitors, imaging systems, hearing aids, and portable diagnostic tools. They ensure accurate signal processing from sensors that detect critical health parameters. With the rise of telemedicine and wearable health trackers, demand for compact, low-power, and reliable analog chips is accelerating. Aging populations and growing healthcare needs worldwide are fueling investment in medical technology. This creates long-term opportunities for analog semiconductor makers to develop specialized solutions for sensitive and life-critical applications.

Trends in the Analog Semiconductor Market

Integration of Analog and Digital Functions

A key trend in the analog semiconductor market is the increasing use of mixed-signal solutions, which combine analog and digital capabilities in a single chip. This integration helps reduce the size, cost, and power consumption of devices while improving performance. It also simplifies system design, making it easier for manufacturers to develop compact and efficient products. Mixed-signal chips are in high demand for applications like smartphones, automotive electronics, and IoT devices. As the need for seamless interaction between the physical and digital worlds grows, this trend is expected to become a central focus for innovation in the industry.

Adoption of Wide Bandgap Materials

Another emerging trend is the growing adoption of wide bandgap materials such as silicon carbide and gallium nitride in analog semiconductor production. These materials offer superior efficiency, faster switching speeds, and higher temperature tolerance compared to traditional silicon. They are especially beneficial in power electronics, electric vehicle charging, and renewable energy systems where performance and durability are critical. Manufacturers are investing in these materials to meet the rising demand for energy-efficient solutions. This shift is opening new possibilities for designing compact, high-performance analog components for demanding industrial and automotive applications.

Impact of Artificial Intelligence in Analog Semiconductor Market

- Enhanced Design and Development: AI is improving chip design processes by enabling faster simulations, optimizing layouts, and reducing development time for complex analog circuits.

- Predictive Maintenance in Manufacturing: AI-driven analytics help detect production issues early, improving yield rates and reducing defects in analog semiconductor manufacturing.

- Smarter Signal Processing: Integration of AI with analog chips allows for real-time data analysis and adaptive signal processing in applications like IoT devices, automotive systems, and medical equipment.

- Optimized Power Management: AI algorithms enhance energy efficiency by dynamically adjusting power usage in devices powered by analog semiconductors.

- Accelerated Innovation Cycles: Artificial Intelligence shortens research and testing phases, allowing manufacturers to bring advanced analog solutions to market faster.

Research Scope and Analysis

By Type Analysis

General Purpose Analog, leading in 2025 with a share of 40.5%, will be a major driver in the growth of the analog semiconductor market due to its wide range of applications across various industries. These versatile chips handle fundamental tasks such as amplification, signal conditioning, and data conversion, making them essential in consumer electronics, automotive systems, and industrial automation.

Their ability to support multiple functions with reliable performance and cost-effectiveness makes them popular among manufacturers. As demand for energy-efficient and compact devices grows, general purpose analog components will continue to evolve with improved integration and power management features. This broad applicability ensures steady adoption and significant contribution to the overall market expansion throughout the forecast period.

Application Specific Analog is expected to experience significant growth over the forecast period, driven by its tailored designs that meet unique requirements in industries like healthcare, automotive, and telecommunications. These specialized analog chips offer optimized performance for specific functions such as sensor interfaces, power management, and signal processing.

Their precision and efficiency make them critical in advanced applications like electric vehicles, medical devices, and smart infrastructure. With increasing demand for customized solutions that improve device functionality and reliability, application specific analog semiconductors will see expanding use and play a key role in market growth during the coming years.

By Device Format Analysis

Power management, leading in 2025 with a share of 30.6%, will play a crucial role in the growth of the analog semiconductor market as devices increasingly demand efficient energy use and longer battery life. These components regulate voltage, control power distribution, and protect circuits, making them essential in consumer electronics, automotive systems, and industrial equipment.

The rise of electric vehicles, portable gadgets, and renewable energy systems drives the need for advanced power management solutions that can handle higher efficiency and reliability. As energy-saving regulations and sustainability goals become more important, power management chips will continue to evolve with improved integration and smart features, supporting the growth of energy-efficient technologies across various applications throughout the forecast period.

Signal conversion is set to experience significant growth over the forecast period due to its vital role in translating real-world analog signals into digital data that electronic devices can process. These components, including analog-to-digital and digital-to-analog converters, are essential in applications such as communications, medical devices, and industrial automation. As the demand for precise data processing and faster communication speeds increases, signal conversion devices are becoming more sophisticated and efficient. Their ability to maintain signal integrity and support high-resolution data makes them critical in emerging technologies like IoT and smart infrastructure, driving steady market expansion during the coming years.

By Technology Analysis

CMOS technology, leading in 2025 with a share of 53.8%, will continue to drive growth in the analog semiconductor market due to its low power consumption, high integration capability, and cost-effectiveness. CMOS allows for the creation of smaller, more efficient analog chips that can be easily combined with digital circuits on the same chip, supporting the rise of mixed-signal devices. This technology is widely used in consumer electronics, automotive systems, and communication devices where energy efficiency and compact design are critical.

As demand grows for portable and battery-powered products, CMOS’s ability to deliver performance while conserving energy will remain a key advantage. Continuous improvements in CMOS manufacturing processes will further enhance chip speed, reliability, and functionality, ensuring its strong role in the analog semiconductor market’s expansion over the forecast period.

GaAs and other compound semiconductors are set to see significant growth during the forecast period, driven by their superior performance in high-frequency and high-power applications. These materials offer advantages such as faster electron mobility and better thermal stability compared to traditional silicon. They are especially valuable in telecommunications, radar systems, and advanced automotive sensors.

The demand for faster data transmission and reliable signal processing in 5G networks and satellite communications supports the rising use of GaAs and similar technologies. As industries seek more efficient and high-performance analog components, compound semiconductors will become increasingly important, complementing silicon-based solutions and contributing to the market’s overall growth.

By Application Analysis

Consumer electronics, leading in 2025 with a share of 27.5%, will continue to drive growth in the analog semiconductor market due to the increasing demand for smarter, smaller, and energy-efficient devices. Analog chips are essential in managing audio, display, power, and sensor functions in smartphones, laptops, wearables, and home appliances. As consumers look for better battery life and improved device performance, manufacturers rely on advanced analog semiconductors to meet these needs.

The rise of connected devices and the Internet of Things (IoT) further fuels demand for reliable signal processing and power management solutions. Continuous innovation and growing adoption of portable electronics ensure that consumer electronics will remain a key application area supporting the market’s steady expansion throughout the forecast period.

Automotive is set to experience significant growth over the forecast period, driven by the rising integration of electronics in vehicles for safety, comfort, and efficiency. Analog semiconductors play a crucial role in battery management, motor control, sensor interfaces, and advanced driver-assistance systems. The growing shift towards electric and autonomous vehicles increases the demand for reliable and energy-efficient analog components.

Additionally, stricter emission regulations and consumer preferences for smart features push automakers to adopt sophisticated electronic systems. This expanding use of analog technology in automotive applications ensures strong market growth and ongoing innovation in vehicle electronics throughout the coming years.

By End User Industry Analysis

OEMs, leading in 2025 with a share of 53.1%, will play a vital role in the growth of the analog semiconductor market as they integrate more advanced electronic components into their products. These original equipment manufacturers rely heavily on analog chips for power management, sensor interfaces, signal processing, and connectivity across various industries such as automotive, consumer electronics, and industrial machinery. The increasing demand for smarter, more energy-efficient devices and complex systems drives OEMs to adopt innovative analog semiconductor solutions.

Their focus on improving product performance, reliability, and user experience pushes the market forward. As OEMs continue to develop next-generation products with higher electronic content, their influence will be a key factor in expanding the analog semiconductor market throughout the forecast period.

Foundries and IDMs are set to see significant growth over the forecast period due to their essential role in manufacturing and designing analog semiconductor chips. Foundries provide advanced fabrication services that help meet the rising global demand for high-quality analog components, while IDMs focus on in-house design and production, ensuring tight control over technology and supply chains.

Both types of end users invest in improving manufacturing processes, increasing production capacity, and adopting new materials to deliver better performance and efficiency. Their combined efforts support faster innovation cycles and enable the market to meet diverse application needs across automotive, consumer electronics, and industrial sectors, driving steady growth in the analog semiconductor industry.

The Analog Semiconductor Market Report is segmented on the basis of the following:

By Type

- General Purpose Analog

- Data Converters

- Amplifiers

- Comparators

- Interface ICs

- Application-Specific Analog

- Power Management ICs (PMICs)

- RF ICs

- Automotive ICs

- Sensor ICs

By Device Function

- Power Management

- Signal Conversion

- Signal Conditioning

- Isolation

- Clock & Timing

By Technology

- Bipolar

- CMOS

- BiCMOS

- GaAs & Other Compound Semiconductors

By Application

- Consumer Electronics

- Automotive

- Industrial

- Telecommunications

- Healthcare

- Aerospace & Defense

By End User Industry

- OEMs

- EMS (Electronics Manufacturing Services)

- Foundries & IDMs

Regional Analysis

Leading Region in the Analog Semiconductor Market

Asia Pacific, leading in 2025 with a share of 44.2%, plays a central role in the growth of the analog semiconductor market due to its strong manufacturing base, rapid industrialization, and expanding consumer electronics sector. The region is home to major semiconductor fabrication hubs and a large number of end-user industries, including automotive, telecommunications, and industrial automation. Countries such as China, South Korea, Taiwan, and Japan drive innovation and large-scale production, meeting both domestic and global demand.

Rising adoption of electric vehicles, 5G infrastructure, and IoT devices further boosts the need for advanced analog components. Government initiatives supporting local semiconductor production and investments in R&D are strengthening the supply chain. Additionally, the region benefits from a vast consumer market and cost-effective manufacturing capabilities, making it a strategic center for both production and consumption of analog semiconductors, ensuring its dominant position in the global industry throughout the forecast period.

Fastest Growing Region in the Analog Semiconductor Market

The Middle East and Africa (MEA) region is showing significant growth over the forecast period in the analog semiconductor market, driven by expanding industrialization, infrastructure development, and increasing adoption of smart technologies. Investments in telecommunications, renewable energy projects, and automotive sectors are creating growing demand for analog components such as sensors, power management chips, and signal processors. The region's governments are focusing on improving local manufacturing capabilities and encouraging technology innovation to reduce reliance on imports. As smart cities and IoT applications gain momentum, the need for reliable and energy-efficient analog semiconductors rises. This combination of factors supports the steady expansion of the MEA market throughout the forecast period.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The analog semiconductor market is highly competitive, with many global and regional players focusing on innovation, performance, and cost efficiency. Companies compete by offering a wide range of products for industries like automotive, consumer electronics, industrial, and communications. The market sees continuous investment in research to develop smaller, faster, and more energy-efficient chips. Competition also extends to securing supply chain stability and building advanced manufacturing capabilities. Partnerships, mergers, and acquisitions are common strategies to expand technology expertise and customer reach. The rapid growth of emerging applications, such as IoT and renewable energy, is intensifying the race for market leadership.

Some of the prominent players in the global Analog Semiconductor are:

- Texas Instruments Incorporated (TI)

- Analog Devices, Inc. (ADI)

- Infineon Technologies AG

- STMicroelectronics N.V.

- NXP Semiconductors N.V.

- ON Semiconductor Corporation (onsemi)

- Renesas Electronics Corporation

- Microchip Technology Incorporated

- Skyworks Solutions, Inc.

- Maxim Integrated Products, Inc. (now part of Analog Devices)

- Rohm Semiconductor

- Broadcom Inc.

- Qorvo, Inc.

- Silicon Labs (Silicon Laboratories Inc.)

- Marvell Technology, Inc.

- Semtech Corporation

- Monolithic Power Systems, Inc. (MPS)

- Vicor Corporation

- Diodes Incorporated

- Power Integrations, Inc.

- Other Key Players

Recent Developments

- In August 2025, Celera Semiconductor, a startup focused on analog IC design automation, raised USD 20 million in a Series A round led by Maverick Silicon. The funding is to accelerate its custom analog chip offerings using its patented “Nestos” platform—a digital twin-based analog design library enabling rapid, precise analog IC development. The move targets demand from AI, edge computing, and OEMs needing quicker analog design cycles.

- In July 2025, Maieutic Semiconductor secured USD 4.15 million in seed funding, co-led by Endiya Partners and Exfinity Venture Partners. The startup is building a generative AI-first design platform to streamline analog IC design, reducing review cycles and automating complex trade-offs. Its aim is to speed up time-to-market for communications, automotive, and industrial analog chips, traditionally limited by manual design processes.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 108.1 Bn |

| Forecast Value (2034) |

USD 187.9 Bn |

| CAGR (2025–2034) |

6.3% |

| The US Market Size (2025) |

USD 22.0 Bn |

| Historical Data |

2019 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (General Purpose Analog, Data Converters, Amplifiers, Comparators, Interface ICs, Application-Specific Analog, Power Management ICs (PMICs), RF ICs, Automotive ICs, and Sensor ICs), By Device Function (Power Management, Signal Conversion, Signal Conditioning, Isolation, and Clock & Timing), By Technology (Bipolar, CMOS, BiCMOS, and GaAs & Other Compound Semiconductors), By Application(Consumer Electronics, Automotive, Industrial, Telecommunications, Healthcare, and Aerospace & Defense), By End User Industry (OEMs, EMS (Electronics Manufacturing Services), and Foundries & IDMs) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Texas Instruments Incorporated (TI), Analog Devices, Inc. (ADI), Infineon Technologies AG, STMicroelectronics N.V., NXP Semiconductors N.V., ON Semiconductor Corporation (onsemi), Renesas Electronics Corporation, Microchip Technology Incorporated, Skyworks Solutions, Inc., Maxim |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Analog Semiconductor Market size is expected to reach a value of USD 108.1 billion in 2025 and is expected to reach USD 187.9 billion by the end of 2034.

Asia Pacific is expected to have the largest market share in the Global Analog Semiconductor Market, with a share of about 44.2% in 2025.

The Analog Semiconductor Market in the US is expected to reach USD 22.0 billion in 2025.

Some of the major key players in the Global Analog Semiconductor Market are Texas Instruments, Broadcom, NXP Semiconductor, and others

The market is growing at a CAGR of 6.3 percent over the forecasted period.