Market Overview

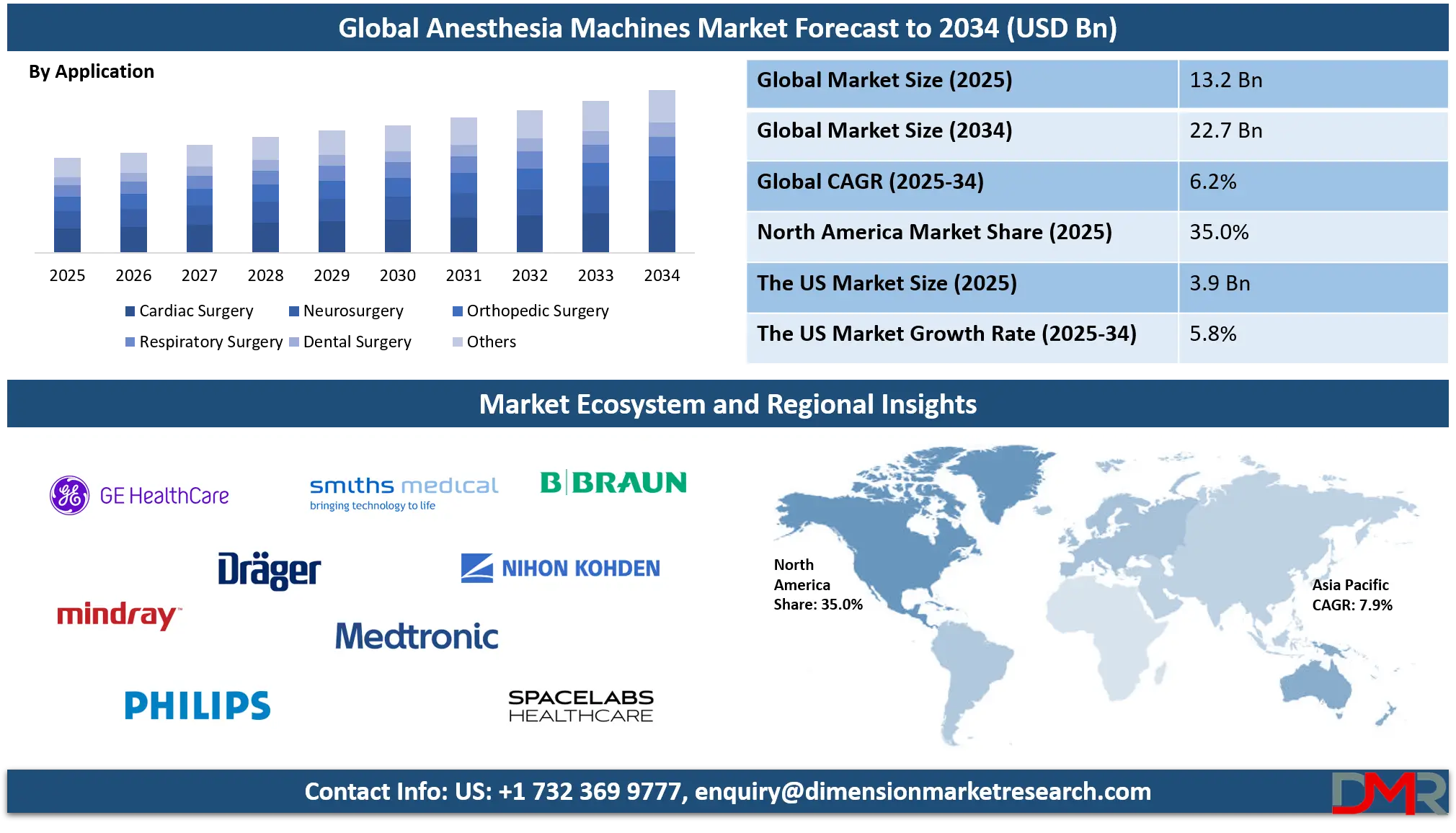

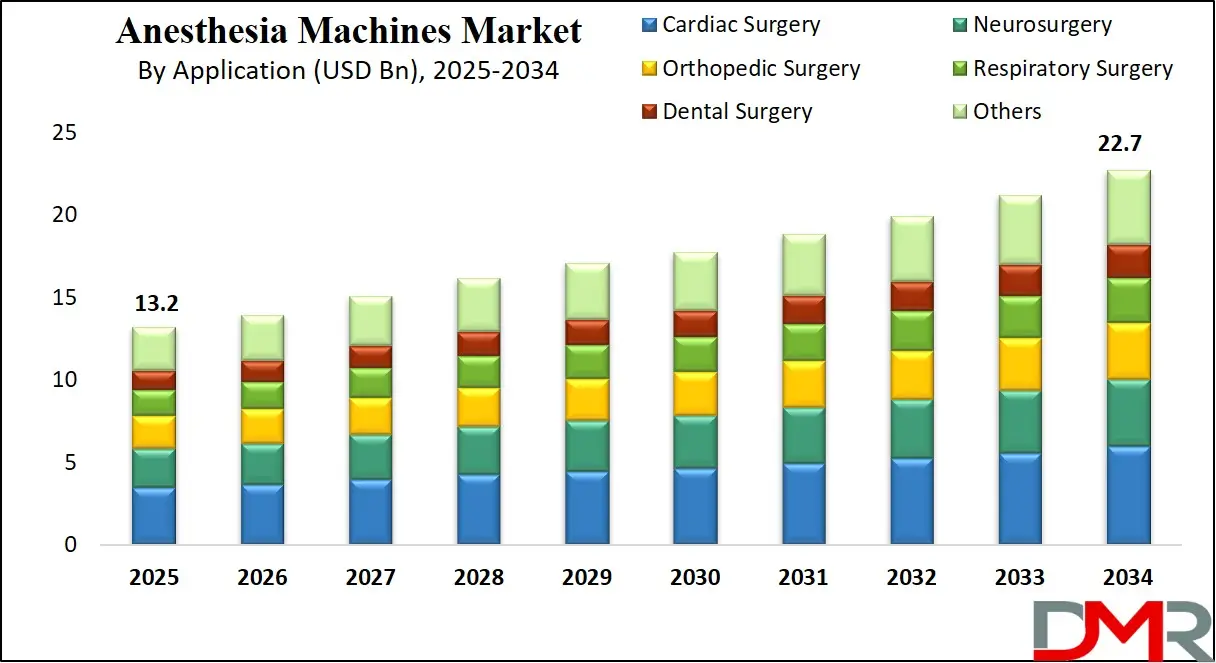

The global anesthesia machines market is projected to reach USD 13.2 billion in 2025 and is expected to grow at a CAGR of 6.2%, reaching USD 22.7 billion by 2034. Growth is driven by rising surgical volumes, demand for advanced anesthesia delivery systems, and growing adoption of integrated anesthesia workstations across hospitals and surgical centers.

An anesthesia machine is a sophisticated medical device used to deliver a precise and continuous supply of anesthetic gases to patients during surgical procedures. These machines are designed to ensure the safe administration of anesthesia by mixing medical gases such as oxygen and nitrous oxide with a controlled amount of anesthetic vapor.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

They are equipped with components such as vaporizers, flowmeters, breathing circuits, and ventilators to support the patient's respiration during anesthesia. Modern anesthesia machines also integrate patient monitoring systems and safety features to prevent hypoxia and other complications, making them essential in operating rooms, ambulatory surgical centers, and emergency care units.

The global anesthesia machines market encompasses the production, distribution, and technological advancement of devices used in the administration of anesthesia across diverse healthcare settings. With the rising number of surgical procedures globally, particularly in cardiology, orthopedics, and neurology, there is a growing demand for both standalone and integrated anesthesia workstations.

The market is significantly influenced by the adoption of minimally invasive surgeries, advancements in anesthesia delivery systems, and the growing need for improved perioperative care. Additionally, portable anesthesia machines are gaining traction in remote and field-based healthcare facilities, further expanding the scope of market penetration.

Emerging economies are playing a crucial role in fueling market expansion due to increased healthcare spending, hospital infrastructure development, and awareness of patient safety during surgical interventions. The market is also witnessing a shift toward digital anesthesia systems that incorporate artificial intelligence, automated dosage control, and real-time analytics.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Regulatory support for medical device innovations, combined with a rising focus on personalized anesthesia care, is contributing to a competitive and rapidly evolving landscape. As healthcare providers strive for higher operational efficiency and improved patient outcomes, the demand for technologically advanced, user-friendly, and compliant anesthesia machines is expected to continue growing steadily.

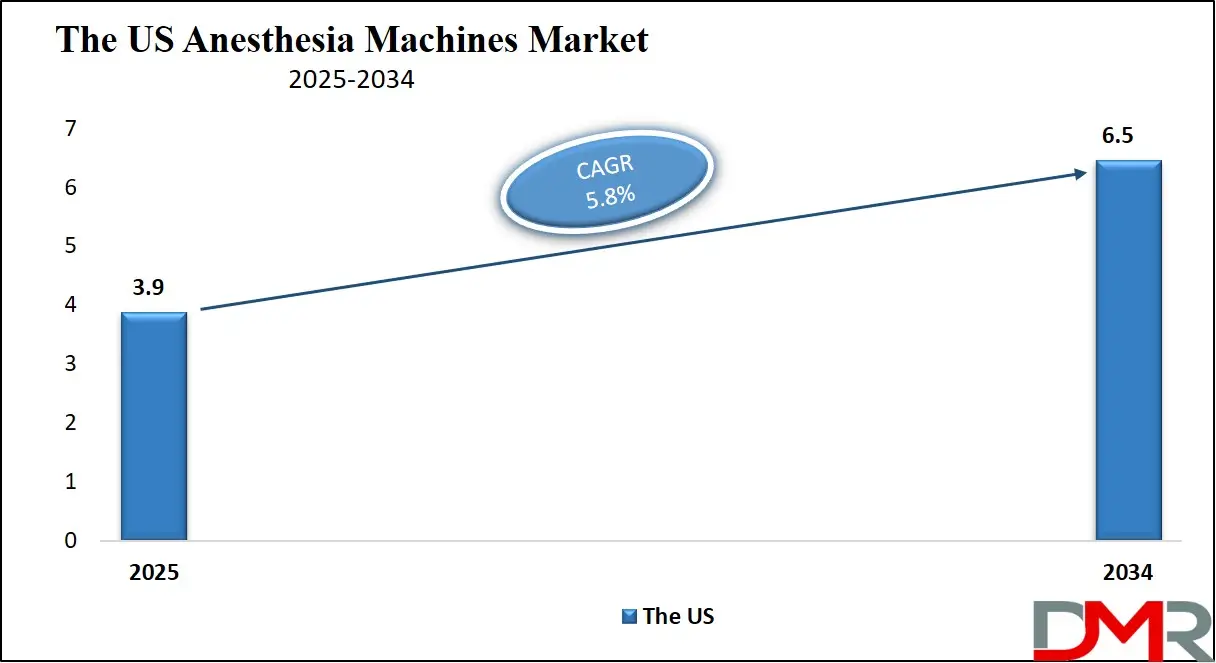

The US Anesthesia Machines Market

The U.S. Anesthesia Machines market size is projected to be valued at USD 3.9 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 6.5 billion in 2034 at a CAGR of 5.8%.

The United States anesthesia machines market represents one of the most mature and technologically advanced segments globally, driven by a high volume of surgical procedures, advanced hospital infrastructure, and strong regulatory oversight. The growing prevalence of chronic conditions such as cardiovascular diseases, cancer, and respiratory disorders has led to a growing number of complex and outpatient surgeries, boosting the demand for both portable and integrated anesthesia systems.

U.S. healthcare facilities are rapidly adopting digital anesthesia workstations equipped with automated ventilation, real-time monitoring, and electronic medical record integration to enhance surgical precision and patient safety. Additionally, the emphasis on value-based healthcare and patient-centric surgical care has further accelerated the adoption of smart anesthesia machines that enable efficient drug delivery and improved clinical outcomes.

The market is also supported by robust investments in medical device innovation, favorable reimbursement policies, and the presence of leading anesthesia equipment manufacturers such as GE HealthCare, Medtronic, and Dräger. Hospitals and ambulatory surgical centers in the U.S. are replacing legacy systems with advanced anesthesia delivery units that offer features like closed-loop feedback, AI-assisted anesthesia monitoring, and low-flow anesthesia capabilities.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Furthermore, regulatory standards set by agencies like the FDA ensure the continuous enhancement of anesthesia machine safety and performance. The growing trend of day-care surgeries and minimally invasive procedures in the U.S. has expanded the market for compact, mobile anesthesia machines tailored for ambulatory care and emergency settings.

Europe Anesthesia Machines Market

Europe is expected to capture a significant portion of the anesthesia machines market, with a projected market size of approximately USD 3.5 billion in 2025. This strong positioning is largely driven by the region's well-established healthcare systems, high surgical procedure volumes, and stringent patient safety protocols.

Major countries such as Germany, France, the United Kingdom, and Italy contribute heavily to market demand due to their continued investments in operating room modernization and adoption of advanced anesthesia delivery technologies. Public and private hospitals across Europe are replacing legacy systems with integrated and AI-enabled anesthesia workstations to enhance perioperative monitoring, optimize anesthetic drug delivery, and improve clinical workflow efficiency.

The European market is anticipated to grow at a steady CAGR of 5.7% from 2025 to 2034, supported by technological innovation, an aging population, and the growing preference for minimally invasive and outpatient surgeries. Additionally, regulatory support for high-quality medical device standards and increased healthcare spending under national health schemes are accelerating the adoption of both high-end and mid-range anesthesia systems.

The region is also witnessing rising demand for eco-friendly and low-flow anesthesia solutions, aligned with Europe’s broader focus on sustainability in healthcare. As hospitals and surgical centers continue to focus on patient safety and digital integration, the European anesthesia machines market is poised for consistent and long-term growth.

Japan Anesthesia Machines Market

Japan's anesthesia machines market is projected to reach a valuation of approximately USD 686 million in 2025, representing a modest yet stable share of the global landscape. The country’s advanced healthcare infrastructure, combined with a high prevalence of age-related surgical procedures, continues to drive steady demand for anesthesia systems.

Japanese hospitals place a strong emphasis on patient safety and precision medicine, fostering consistent adoption of high-performance anesthesia workstations with enhanced monitoring and control features.

Moreover, the integration of electronic health records (EHRs) and digital operating room technologies is encouraging the shift toward more connected and automated anesthesia delivery solutions in both urban and regional medical centers.

With a projected CAGR of 4.9% from 2025 to 2034, Japan's market is expected to grow steadily, albeit more slowly than some emerging economies. This growth is supported by gradual upgrades of existing systems, increased focus on perioperative care quality, and government initiatives aimed at improving surgical outcomes for the elderly.

However, market expansion is somewhat tempered by Japan’s mature healthcare system and rigorous regulatory pathways, which can delay the adoption of newer, AI-integrated technologies. Nevertheless, with continuous innovation by domestic and international manufacturers, including portable and energy-efficient machines tailored to Japan’s needs, the market remains a vital and strategic segment of the global anesthesia machines industry.

Global Anesthesia Machines Market: Key Takeaways

- Market Value: The global anesthesia machines market size is expected to reach a value of USD 22.7 billion by 2034 from a base value of USD 13.2 billion in 2025 at a CAGR of 6.2%.

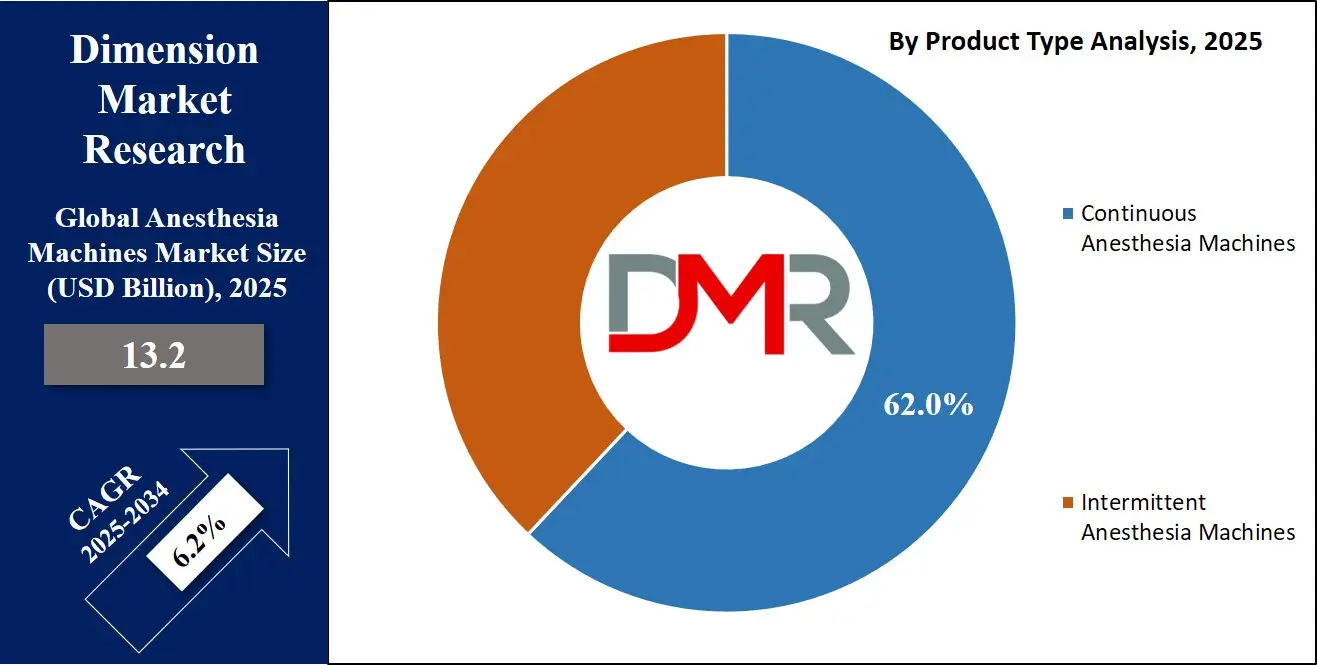

- By Product Type Segment Analysis: Continuous Anesthesia Machines are anticipated to dominate the product type segment, capturing 62.0% of the total market share in 2025.

- By System Type Segment Analysis: High-End Machines are expected to maintain their dominance in the system type segment, capturing 40.0% of the total market share in 2025.

- By Technology Segment Analysis: Standalone Machines are expected to consolidate their position in the technology segment, capturing 58.0% of the market share in 2025.

- By Application Segment Analysis: Cardiac Surgery applications will account for the maximum share in the application segment, capturing 26.0% of the total market value.

- By End-User Segment Analysis: Hospitals are expected to consolidate their dominance in the end-user segment, capturing 54.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global anesthesia machines market landscape with 35.0% of total global market revenue in 2025.

- Key Players: Some key players in the global anesthesia machines market are GE HealthCare, Draegerwerk, Mindray, Philips, Smiths Medical, Medtronic, B. Braun, Nihon Kohden, Spacelabs, Fisher & Paykel, HEYER Medical, Penlon, Aeonmed, Teleflex, and Others.

Global Anesthesia Machines Market: Use Cases

- High-Precision Anesthesia Delivery in Cardiac Surgery: Cardiac surgeries demand exceptional precision in anesthesia management due to the complexity and duration of the procedures. Advanced anesthesia machines play a crucial role in maintaining patient stability during bypass surgeries, valve replacements, and angioplasties. These machines are integrated with features like electronic vaporizers, automated ventilation, and real-time monitoring systems to track blood gases, cardiac output, and respiratory function. The use of closed-loop anesthesia delivery systems helps in minimizing dosage errors, ensuring consistent depth of anesthesia throughout the surgery. Hospitals in North America and Europe are investing in high-end anesthesia workstations to reduce intraoperative complications and improve postoperative recovery in cardiac patients.

- Portable Anesthesia Machines for Emergency and Field Use: In remote areas, disaster zones, and military settings, portable anesthesia machines offer life-saving capabilities. These compact devices are designed for mobility and can function with limited infrastructure, making them ideal for field hospitals and emergency surgical units. Equipped with battery-operated modules, oxygen concentrators, and manual ventilation systems, these machines provide essential support during trauma surgeries and critical interventions. The rising demand for mobile surgical units in emerging economies and the growing adoption of point-of-care medical devices are propelling the need for rugged and reliable portable anesthesia systems globally. This use case underlines the importance of flexibility and accessibility in modern anesthesia delivery.

- Integrated Workstations in Ambulatory Surgical Centers (ASCs): Ambulatory surgical centers are adopting integrated anesthesia workstations to enhance operational efficiency and improve patient turnover. These facilities handle a high volume of minimally invasive procedures, such as endoscopy, orthopedic arthroscopy, and cosmetic surgeries, which require short-acting anesthetics and rapid recovery. Integrated systems combine anesthesia vaporizers, gas flowmeters, patient monitors, and data management tools into a single platform, streamlining workflow and minimizing space usage. With rising outpatient surgical demand in countries like the United States, China, and Germany, the role of these machines in delivering efficient and cost-effective perioperative care is expanding significantly.

- Anesthesia Machines in Pediatric and Neonatal Care: Delivering anesthesia to infants and children involves unique challenges due to their smaller airways, sensitive physiology, and variable drug metabolism. Pediatric-focused anesthesia machines are equipped with precision flowmeters, low tidal volume settings, and specialized breathing circuits to safely administer anesthetic gases. In neonatal intensive care units (NICUs), these machines are essential for managing ventilation in premature babies undergoing procedures such as hernia repair, cardiac catheterization, or emergency intubation. The growing birth rate, prevalence of congenital conditions, and advancements in pediatric surgery are driving demand for customized anesthesia systems in children's hospitals and pediatric care units globally.

Impact of Artificial Intelligence on the Anesthesia Machine Market

Artificial Intelligence (AI) is significantly transforming the global anesthesia machine market by enhancing automation, precision, and patient safety in anesthesia delivery. Traditional anesthesia systems are being upgraded with intelligent algorithms that can interpret real-time patient data and optimize anesthetic drug dosages accordingly.

AI-powered anesthesia machines can continuously monitor vital signs such as oxygen saturation, end-tidal CO₂, and heart rate, and make predictive adjustments to maintain an optimal anesthesia depth. This reduces human error, improves intraoperative decision-making, and supports anesthesiologists in high-stress, time-sensitive environments. AI integration is particularly valuable in complex surgeries, where maintaining patient stability is critical.

Furthermore, AI-enabled anesthesia workstations offer features like closed-loop anesthesia control, voice-assisted commands, and clinical decision support systems (CDSS). These capabilities help standardize perioperative care and reduce variability across procedures and practitioners. Machine learning models are also being used to analyze large volumes of surgical patient monitoring data to forecast complications, assess recovery time, and personalize anesthesia plans based on patient profiles.

As healthcare systems prioritize digital transformation and smart operating rooms, AI’s role in anesthesia technology is expected to grow. This shift is not only enhancing clinical efficiency but also opening avenues for remote anesthesia monitoring, tele-anesthesia, and improved compliance with surgical safety protocols.

Global Anesthesia Machines Market: Stats & Facts

- As of 2023, over 70 low- and middle-income countries had fewer than 5 anesthesia providers per 100,000 population.

- A global shortfall of more than 136,000 anesthesia providers was reported to meet the minimum standards of care.

- WHO’s Emergency and Essential Surgical Care program projected that the global need for anesthesia equipment will rise sharply through 2025 due to surgical access expansion goals.

- U.S. Food & Drug Administration (FDA)

- In 2024, the FDA launched a medical device safety initiative focusing on earlier alerts for anesthesia delivery systems and ventilatory equipment recalls.

- In 2023–2025, the FDA’s device tracking system recorded increased vigilance around anesthesia workstation reliability, especially in hybrid OR settings.

- The FDA’s Sentinel Initiative expanded surveillance to include anesthesia machine-related adverse event reporting beginning in late 2023.

- Centers for Disease Control and Prevention (CDC)

- By 2024, over 310 million major surgeries requiring anesthesia will be performed globally on an annual basis.

- The U.S. alone recorded approximately 51.4 million inpatient surgical procedures in 2023, most requiring anesthetic administration.

- CDC's National Health Statistics Report (2023) noted a steady rise in outpatient surgical procedures, contributing to increased demand for portable anesthesia systems.

- European Medicines Agency (EMA) and EU Medical Device Coordination Group (MDCG)

- As of 2025, all anesthesia machines marketed in the European Union are subject to full compliance under the EU MDR (Medical Device Regulation) directive.

- A 2024 EU-wide assessment of anesthesia devices under MDR Class IIb classification led to re-certification processes for most legacy anesthesia systems.

- EMA and MDCG jointly projected a 20–25% increase in hospital procurement of advanced anesthesia systems between 2023 and 2026 across member states.

- Japan Ministry of Health, Labor and Welfare (MHLW)

- In 2025, Japan recorded a total anesthesia machine installed base of over 27,000 units in both public and private institutions.

- Japanese surgical volumes rose by 6.1% between 2023 and 2025, driving incremental procurement of new anesthesia equipment.

- MHLW confirmed that anesthesia equipment represents one of the top five capital medical device expenditures in urban tertiary hospitals as of 2024.

- As of 2024, over 92% of NHS hospitals in England reported using digital anesthesia workstations connected to electronic patient record systems.

- Between 2023 and 2025, the UK NHS allocated more than GBP 55 million toward upgrading legacy anesthesia machines across 120+ facilities.

- The NHS logged over 7.5 million general anesthesia procedures in 2024, with anesthesia machine utilization averaging 92% in surgical theatres.

- Health Canada – Medical Devices Directorate

- In 2023, Health Canada mandated full lifecycle traceability for anesthesia machines under revised post-market surveillance regulations.

- Canada reported a 13% increase in surgical procedure volume between 2023 and 2025, with anesthesia workstation use scaling proportionally.

- By 2025, over 60% of anesthesia machines in Canadian hospitals met ISO 80601-2-13 compliance standards for performance and safety.

Global Anesthesia Machines Market: Market Dynamics

Global Anesthesia Machines Market: Driving Factors

Growing Volume of Surgical Procedures Globally

The rising incidence of chronic diseases such as cardiovascular disorders, cancer, and orthopedic conditions is fueling the global demand for surgical interventions. This surge directly increases the need for advanced anesthesia delivery systems that ensure patient safety during both routine and complex procedures. As elective and emergency surgeries grow across hospitals and ambulatory surgical centers, the requirement for reliable and high-performance anesthesia machines becomes critical to support modern perioperative workflows.

Technological Advancements in Anesthesia Equipment

The market is witnessing rapid technological innovation, including the integration of electronic vaporizers, smart ventilation controls, and AI-assisted anesthesia monitoring. These advancements allow for automated drug dosage, low-flow anesthesia techniques, and improved patient data analysis in real time. Such innovations enhance surgical outcomes, reduce anesthesia-related complications, and drive adoption of next-generation anesthesia workstations across developed and emerging healthcare systems.

Global Anesthesia Machines Market: Restraints

High Cost of Advanced Anesthesia Machines

Despite their clinical benefits, high-end anesthesia systems are capital-intensive and often unaffordable for small clinics and healthcare providers in low- and middle-income countries. The cost of acquisition, maintenance, and staff training for these automated anesthesia machines can pose a significant barrier, especially in rural or underfunded hospital networks, thus limiting market penetration.

Regulatory Complexity and Product Approval Delays

Medical device regulations for anesthesia machines are stringent due to their direct impact on patient safety. Gaining approval from regulatory bodies like the FDA or EMA often involves extensive testing, documentation, and compliance with evolving safety standards. These long approval cycles and complex compliance frameworks can delay product launches and hinder market entry for new players.

Global Anesthesia Machines Market: Opportunities

Expanding Healthcare Infrastructure in Emerging Economies

Countries across Asia-Pacific, Latin America, and the Middle East are significantly upgrading their surgical care infrastructure. With increased government spending on healthcare and a growing number of tertiary care hospitals, there is a rising demand for basic to mid-tier anesthesia delivery systems. Manufacturers offering cost-effective and scalable solutions can tap into this large, underserved segment, especially where demand for general and emergency anesthesia equipment is growing.

Rise in Tele-anesthesia and Remote Surgical Support

The advent of telemedicine is creating new opportunities for remote anesthesia monitoring and cloud-based anesthesia data management. AI-powered systems and IoT-enabled anesthesia machines are enabling real-time decision support and remote supervision of anesthetic procedures. This capability is particularly valuable in rural hospitals and military settings where experienced anesthesiologists may not be physically present, opening a new frontier for market expansion.

Global Anesthesia Machines Market: Trends

Shift Toward Integrated Anesthesia Workstations

Healthcare providers are opting for integrated systems that combine ventilators, gas analyzers, patient monitors, and EMR connectivity into a unified platform. These workstations streamline perioperative workflows, enhance data accuracy, and reduce manual intervention. As hospitals aim to improve clinical efficiency and patient throughput, the demand for these integrated solutions continues to rise globally.

Increasing Focus on Low-Flow and Eco-Friendly Anesthesia

With rising environmental concerns and cost pressures, hospitals are adopting low-flow anesthesia techniques to minimize anesthetic gas consumption and reduce emissions. Anesthesia machines with advanced flow control mechanisms and gas-saving features are gaining popularity. This trend supports both sustainability goals and improved cost efficiency, aligning with global shifts toward greener healthcare practices.

Global Anesthesia Machines Market: Research Scope and Analysis

By Product Type Analysis

Continuous anesthesia machines are expected to hold the leading position within the product type segment of the global anesthesia machines market, accounting for approximately 62.0% of the total market share in 2025. This dominance can be attributed to their ability to deliver a steady and uninterrupted flow of anesthetic gases, which is crucial during lengthy and complex surgical procedures.

These machines are widely used in hospitals and surgical centers due to their advanced features such as integrated ventilators, precision monitoring, and automated gas delivery systems. Their reliability and compatibility with modern surgical workflows make them the preferred choice for anesthesiologists, especially in high-acuity cases like cardiac and neurological surgeries where consistent anesthesia depth is critical.

On the other hand, intermittent anesthesia machines operate by delivering anesthetic gases at specified intervals rather than a continuous flow. While these systems are simpler and more cost-effective, they are generally used in minor surgical procedures or facilities with limited infrastructure.

Intermittent machines are also more common in veterinary clinics, dental practices, or smaller ambulatory surgical centers that do not require high-end, fully integrated systems. Although they offer flexibility and basic functionality, their limited automation and lack of advanced monitoring capabilities restrict their adoption in large-scale hospital environments. As a result, their market share remains comparatively lower but still relevant in cost-sensitive and specialized use cases.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By System Type Analysis

High-end anesthesia machines are projected to lead the system type segment of the global anesthesia machines market, accounting for 40.0% of the total market share in 2025. These machines are equipped with advanced features such as integrated electronic monitoring systems, automated ventilation modes, closed-loop feedback mechanisms, and connectivity to hospital information systems.

Designed for complex and high-risk surgeries, high-end machines provide superior control, precision, and patient safety. Their growing adoption is driven by the growing demand for quality surgical care, particularly in developed countries where hospitals are investing in smart operating rooms and digital health technologies. These machines are also favored in academic medical centers and specialized surgical units where real-time analytics and data integration play a key role in clinical decision-making.

Mid-end anesthesia machines represent a balanced offering that combines essential functionality with moderate technological enhancements. These systems are widely used in general hospitals, outpatient centers, and mid-tier healthcare facilities where there is a need for reliable anesthesia delivery without the full complexity or cost of high-end models. Mid-end machines often include basic ventilation modes, integrated monitoring, and user-friendly interfaces, making them suitable for routine surgical procedures.

Their cost-effectiveness and ease of use make them popular in emerging markets and budget-conscious institutions aiming to upgrade from low-end systems. While they may lack some of the sophisticated features of high-end models, mid-end machines continue to gain traction due to their adaptability, clinical reliability, and favorable return on investment.

By Technology Analysis

Standalone anesthesia machines are anticipated to solidify their dominance in the technology segment of the global anesthesia machines market, capturing 58.0% of the total market share in 2025. These machines operate independently without integration into broader surgical or hospital networks, offering essential anesthesia delivery functions along with manual or semi-automated controls.

Their popularity stems from their affordability, ease of operation, and flexibility across a wide range of clinical settings, particularly in small to mid-sized hospitals, outpatient clinics, and facilities in developing regions. Standalone systems are often favored for their reliability and lower maintenance requirements, making them a practical solution where advanced digital infrastructure is lacking or unnecessary. They are particularly suitable for routine surgical procedures where basic anesthetic support is sufficient.

Integrated anesthesia machines, on the other hand, are designed to connect seamlessly with patient monitoring systems, electronic medical records, and surgical data platforms. These advanced systems combine anesthetic delivery, ventilation, and real-time analytics into a unified unit, enabling streamlined workflow and improved clinical decision-making.

Integrated machines are being adopted in tertiary care hospitals and specialized surgical centers where precision, efficiency, and data interoperability are critical. While their market share is lower compared to standalone units, integrated machines are gaining momentum due to the global shift toward digitized operating rooms and intelligent perioperative care. Their ability to enhance patient safety, reduce manual error, and support advanced surgical procedures positions them as a key growth area within the anesthesia machines market.

By Application Analysis

Cardiac surgery is projected to hold the largest share in the application segment of the global anesthesia machines market, accounting for 26.0% of the total market value in 2025. This dominance is attributed to the complexity and critical nature of heart surgeries, which require highly precise and uninterrupted anesthesia delivery throughout the procedure.

Cardiac surgeries, such as bypass grafting, valve replacements, and heart transplants, demand advanced anesthesia systems capable of continuous monitoring of cardiovascular parameters, ventilatory support, and drug dosage adjustments in real time. High-end anesthesia machines with features like integrated monitoring, low-flow capabilities, and closed-loop systems are widely used in cardiothoracic surgical units to ensure patient stability and optimize outcomes. The growing global burden of cardiovascular diseases and the rise in surgical interventions for aging populations are further fueling demand in this application segment.

Neurosurgery is another key application area driving the demand for technologically advanced anesthesia machines. These procedures often involve operating on the brain or spinal cord, requiring absolute precision in anesthesia depth to prevent complications and support neurological monitoring. Anesthesia machines used in neurosurgical settings must provide fine-tuned control over anesthetic gas levels and support features such as intracranial pressure monitoring and stable ventilation.

Even minor fluctuations in anesthesia delivery during neurosurgery can impact brain function and recovery outcomes, making accuracy and reliability essential. As neurosurgical procedures become more frequent due to the rise in brain tumors, spinal injuries, and neurodegenerative disorders, the demand for specialized anesthesia systems tailored for neurological care is expected to increase steadily across advanced healthcare systems.

By End-User Analysis

Hospitals are expected to retain their leading position in the end-user segment of the global anesthesia machines market, capturing 54.0% of the total market share in 2025. This dominance is largely due to the high volume of surgeries performed in hospital settings, including complex and emergency procedures that require continuous and highly regulated anesthesia delivery.

Hospitals typically invest in high-end anesthesia workstations that offer integrated monitoring, advanced ventilation modes, and electronic data connectivity. These machines are essential for maintaining patient safety during major surgical interventions such as cardiac, orthopedic, and neurological procedures.

Additionally, hospitals often have the infrastructure and budget to support the acquisition, maintenance, and training required for these technologically advanced systems, making them the primary consumers in the market.

Ambulatory Surgical Centers (ASCs) also represent a growing end-user segment in the anesthesia machines market, driven by the growing popularity of outpatient surgeries and minimally invasive procedures. These centers perform a wide range of surgeries in specialties like ophthalmology, orthopedics, ENT, and gynecology, all of which require efficient and reliable anesthesia support.

ASCs typically prefer mid-range or portable anesthesia machines that are compact, cost-effective, and easy to use, aligning with the fast-paced nature of outpatient care. The shift toward shorter hospital stays and cost-efficient surgical solutions is fueling the expansion of ASCs, especially in the United States, Europe, and parts of Asia. As these facilities continue to grow in number and capacity, their demand for versatile and maintenance-friendly anesthesia equipment is expected to rise steadily.

The Anesthesia Machines Market Report is segmented on the basis of the following:

By Product Type

- Continuous Anesthesia Machines

- Intermittent Anesthesia Machines

By System Type

- High-End Machines

- Mid-End Machines

- Low-End Machines

By Technology

- Standalone Machines

- Integrated Machines

By Application

- Cardiac Surgery

- Neurosurgery

- Orthopedic Surgery

- Respiratory Surgery

- Dental Surgery

- Others

By End-User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Clinics

- Others

Global Anesthesia Machines Market: Regional Analysis

Region with the Largest Revenue Share

North America is anticipated to dominate the global anesthesia machines market in 2025, accounting for 35.0% of the total market revenue. This leadership position is driven by the region’s advanced healthcare infrastructure, high surgical volumes, and widespread adoption of cutting-edge medical technologies.

The presence of major market players, strong investment in research and development, and favorable reimbursement policies contribute to the robust demand for high-end and integrated anesthesia workstations across hospitals and ambulatory surgical centers.

Additionally, the growing elderly population, the growing prevalence of chronic diseases, and ongoing upgrades in operating room technologies are further accelerating the use of automated and AI-powered anesthesia delivery systems in the United States and Canada, reinforcing North America's position at the forefront of the global market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia-Pacific region is expected to witness significant growth in the global anesthesia machines market over the forecast period, driven by rapidly expanding healthcare infrastructure, rising surgical procedure volumes, and growing government investments in public health systems.

Countries such as China, India, and Indonesia are experiencing a surge in demand for both basic and mid-range anesthesia delivery systems due to growing access to healthcare services and the rising burden of chronic and lifestyle-related diseases.

Additionally, the growing number of medical tourism hubs, integrated with the growing adoption of advanced surgical technologies in private hospitals, is fueling the demand for modern anesthesia equipment. As awareness around patient safety and perioperative monitoring improves, the region presents strong opportunities for manufacturers to expand their footprint through affordable, scalable, and technologically adaptive anesthesia solutions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Anesthesia Machines Market: Competitive Landscape

The global competitive landscape of the anesthesia machines market is characterized by the presence of both well-established multinational corporations and emerging regional players, creating a dynamic and innovation-driven environment. Leading companies such as GE HealthCare, Drägerwerk, Mindray, Medtronic, and Philips dominate the market with their broad product portfolios, global distribution networks, and continual investment in advanced anesthesia delivery systems.

These players focus on integrating artificial intelligence, real-time monitoring, and automation into their machines to enhance precision and patient safety. Meanwhile, regional manufacturers like Aeonmed and Comen are rapidly gaining ground in price-sensitive markets by offering cost-effective and portable anesthesia solutions.

Strategic collaborations, mergers, and acquisitions are becoming common as companies aim to expand their global reach and technological capabilities. The competitive intensity is further heightened by the push for regulatory compliance, product innovation, and tailored solutions for different surgical settings, making the market both complex and rapidly evolving.

Some of the prominent players in the global anesthesia machines market are:

- GE HealthCare

- Draegerwerk AG & Co. KGaA

- Mindray Medical International Limited

- Koninklijke Philips N.V.

- Smiths Medical

- Medtronic plc

- B. Braun Melsungen AG

- Nihon Kohden Corporation

- Spacelabs Healthcare

- Fisher & Paykel Healthcare

- HEYER Medical AG

- Penlon Limited

- Beijing Aeonmed Co., Ltd.

- Teleflex Incorporated

- Oricare, Inc.

- Koninklijke Vyaire Medical, Inc.

- Schiller AG

- Comen Medical Instruments Co., Ltd.

- Löwenstein Medical

- Siare Engineering International Group

- Other Key Players

Global Anesthesia Machines Market: Recent Developments

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 13.2 Bn |

| Forecast Value (2034) |

USD 22.7 Bn |

| CAGR (2025–2034) |

6.2% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 3.9 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Continuous Anesthesia Machines and Intermittent Anesthesia Machines), By System Type (High-End Machines, Mid-End Machines, and Low-End Machines), By Technology (Standalone Machines and Integrated Machines), By Application (Cardiac Surgery, Neurosurgery, Orthopedic Surgery, Respiratory Surgery, Dental Surgery, and Others), and By End-User (Hospitals, Ambulatory Surgical Centers, Clinics, and Others |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

GE HealthCare, Draegerwerk, Mindray, Philips, Smiths Medical, Medtronic, B. Braun, Nihon Kohden, Spacelabs, Fisher & Paykel, HEYER Medical, Penlon, Aeonmed, Teleflex, and Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global anesthesia machine market?

▾ The global anesthesia machines market size is estimated to have a value of USD 13.2 billion in 2025 and is expected to reach USD 22.7 billion by the end of 2034

What is the size of the US anesthesia machines market?

▾ The US anesthesia machines market is projected to be valued at USD 3.9 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 6.5 billion in 2034 at a CAGR of 5.8%.

Which region accounted for the largest global anesthesia machine market?

▾ North America is expected to have the largest market share in the global anesthesia machines market, with a share of about 35.0% in 2025.

Who are the key players in the global anesthesia machines market?

▾ Some of the major key players in the global anesthesia machines market are GE HealthCare, Draegerwerk, Mindray, Philips, Smiths Medical, Medtronic, B. Braun, Nihon Kohden, Spacelabs, Fisher & Paykel, HEYER Medical, Penlon, Aeonmed, Teleflex, and Others.

What is the growth rate of the global anesthesia machines market?

▾ The market is growing at a CAGR of 6.2 percent over the forecasted period.