Market Overview

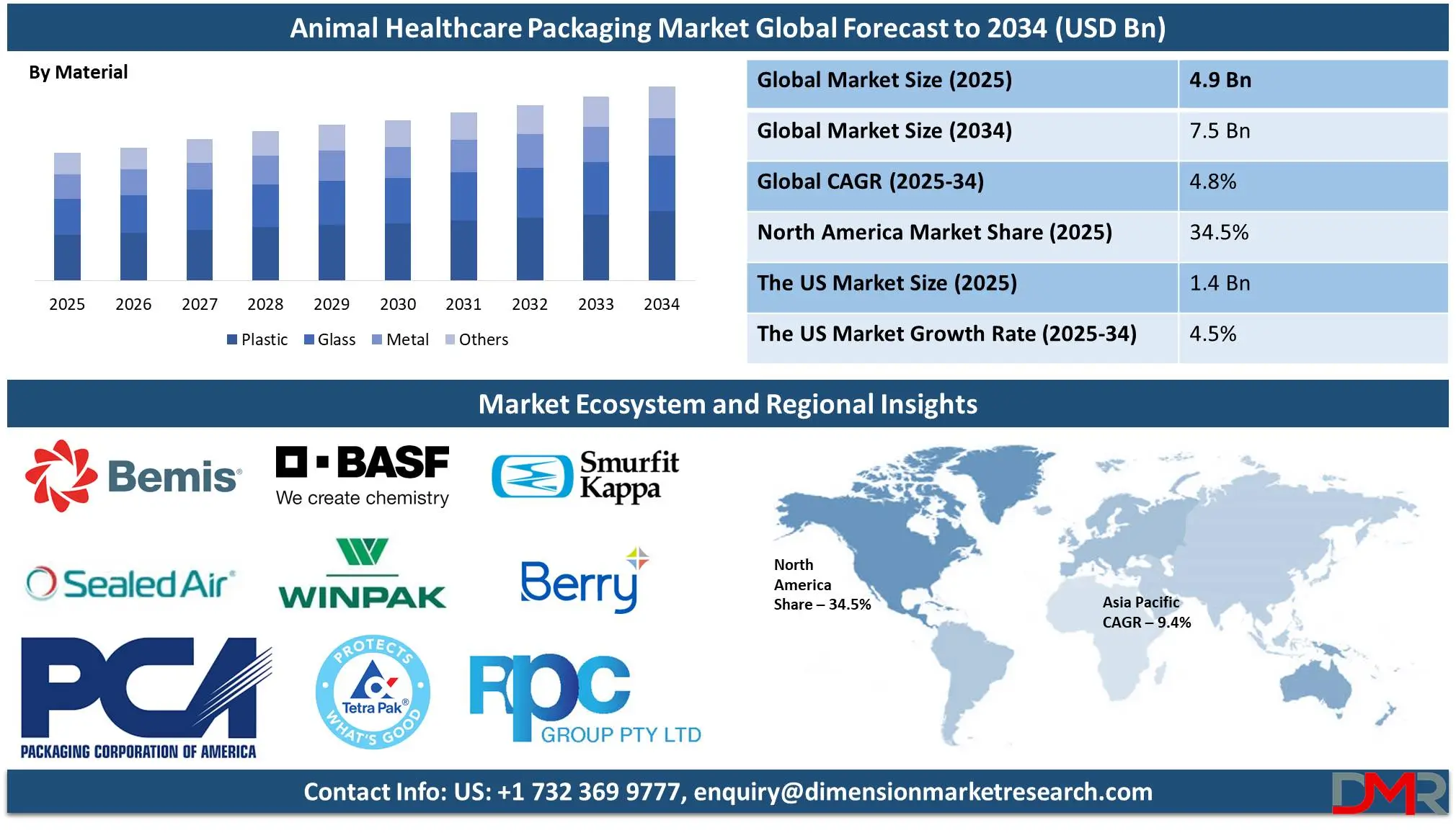

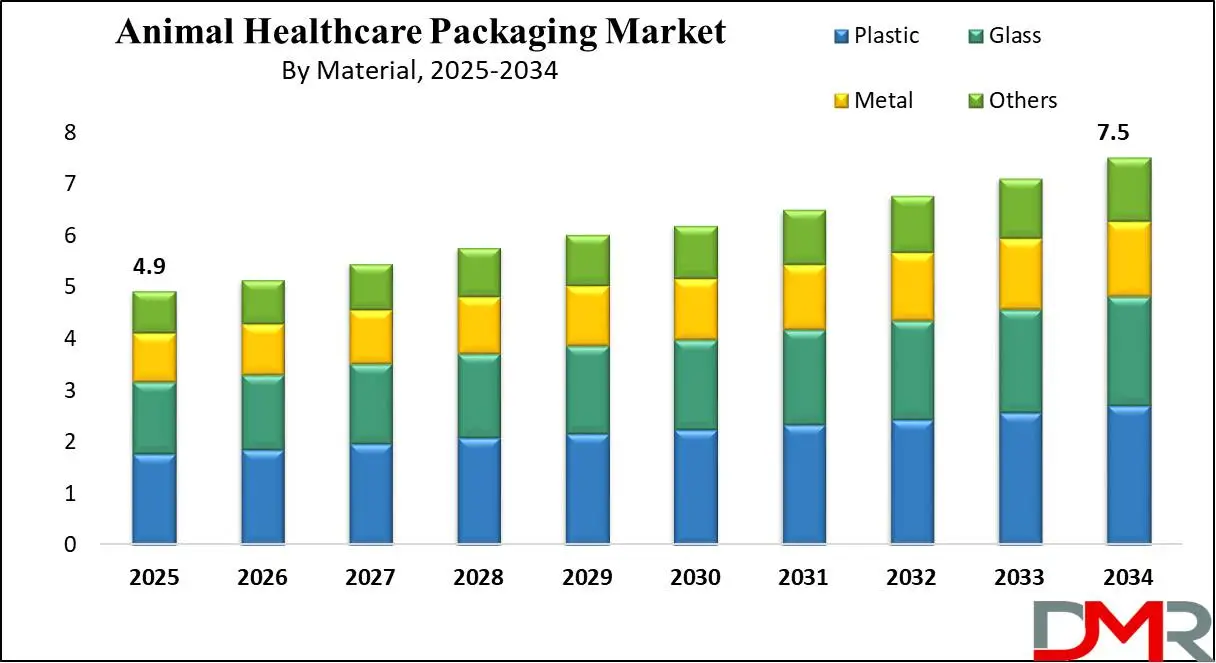

The Global Animal Healthcare Packaging Market is predicted to be valued at USD 4.9 billion in 2025 and is expected to grow to USD 7.5 billion by 2034, registering a CAGR of 4.8% from 2025 to 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global animal healthcare packaging market is experiencing significant growth due to the increasing demand for veterinary medicines, vaccines, and nutritional supplements. With rising pet adoption rates and the expansion of the livestock industry, the need for secure and efficient packaging solutions has become crucial. Proper packaging ensures the safety, efficacy, and longevity of animal healthcare products by protecting them from contamination, moisture, and light exposure. Additionally, as sustainability gains importance, manufacturers are focusing on eco-friendly and recyclable packaging solutions.

The demand for animal healthcare packaging is driven by several key factors. The growing trend of pet humanization and rising disposable incomes have led to an increased demand for pet healthcare products, boosting packaging needs. Similarly, the expanding livestock industry requires effective disease prevention and healthcare solutions, increasing the consumption of veterinary medicines and related packaging. Stringent government regulations also play a crucial role in shaping the market, as regulatory authorities impose strict guidelines on packaging and labeling to ensure product safety, proper dosage, and traceability.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

This market presents numerous opportunities for innovation and growth. The shift towards sustainable packaging has created a demand for biodegradable and recyclable materials, while smart packaging technologies, such as RFID tags and tamper-proof designs, are improving product safety and tracking. Furthermore, customization and user-friendly designs, including portion-controlled and easy-to-use packaging, are becoming more popular among consumers. With ongoing advancements and increasing investments in animal healthcare, the packaging sector is poised for substantial expansion, meeting both regulatory requirements and evolving consumer expectations.

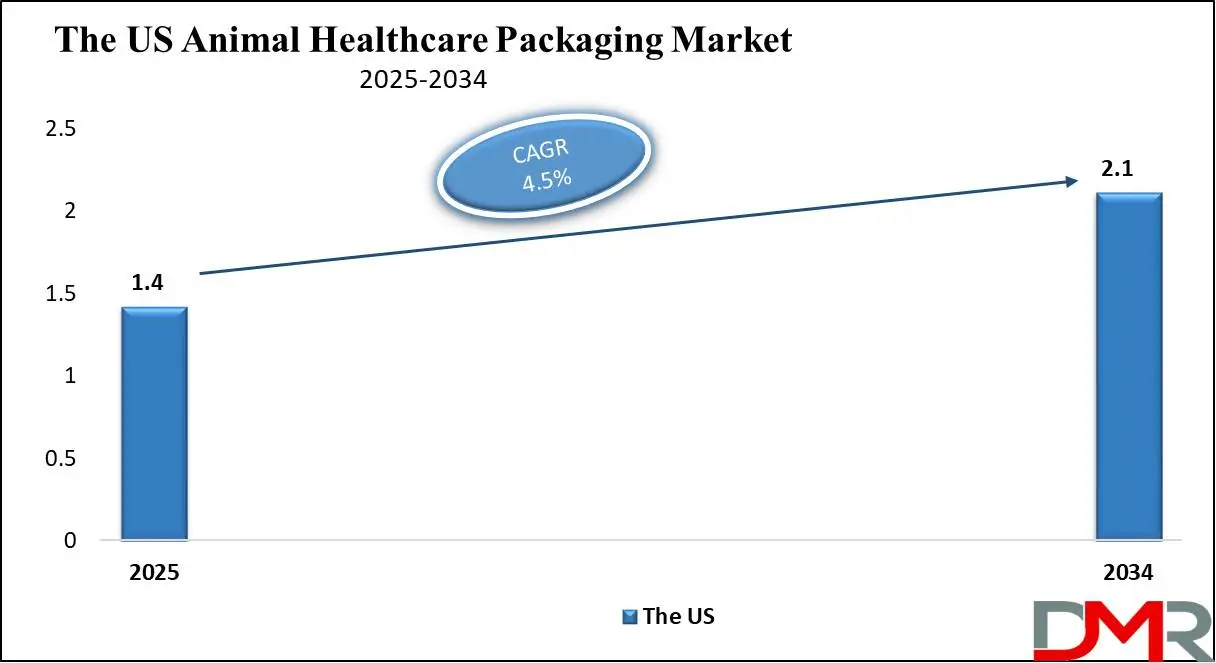

The US Animal Healthcare Packaging Market

The US Animal Healthcare Packaging market is projected to be valued at USD 1.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2.1 billion in 2034 at a CAGR of 4.5%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The U.S. animal healthcare packaging market is driven by increasing pet ownership, rising veterinary care expenditures, and growing awareness of pet health. The expansion of the livestock industry and demand for high-quality animal-derived products further fuel the need for effective healthcare packaging. Stringent regulations regarding veterinary pharmaceuticals and vaccines necessitate advanced, tamper-proof, and sustainable packaging solutions.

Technological advancements, including smart packaging with tracking and monitoring capabilities, enhance product safety and shelf life. Additionally, increasing concerns about zoonotic diseases drive the demand for secure and sterile packaging, ensuring the efficacy of medications, vaccines, and nutritional supplements for both companion and farm animals.

The rise of smart packaging, incorporating QR codes and RFID technology, enhances traceability and product authentication. Single-dose and pre-filled syringes are gaining popularity for convenience and reduced contamination risk.

Additionally, growing e-commerce sales of veterinary medicines are driving demand for durable, tamper-evident packaging. Customization and branding efforts, including user-friendly packaging designs, are improving consumer engagement. Advances in nanotechnology and antimicrobial packaging further enhance product safety and shelf life, aligning with evolving regulatory standards and consumer preferences.

Animal Healthcare Packaging Market: Key Takeaways

- Steady Market Growth: The global animal healthcare packaging market is expected to grow from USD 4.9 billion in 2025 to USD 7.5 billion by 2034, with a CAGR of 4.8%.

- US Market Expansion: The US market is projected to reach USD 2.1 billion by 2034, with a CAGR of 4.5%.

- Animal Type Segment Analysis: Pets are predicted to dominate due to rising ownership, personalized care, and regulations, and livestock follows growing farming needs and disease prevention measures.

- By Packaging Type Segment Analysis: Bottles are expected to lead for durability and safety, meanwhile, syringes grow fastest for precision dosing and infection control.

- By Material Segment Analysis: Plastic is anticipated to dominate for cost and flexibility, meanwhile glass excels in purity and sustainability.

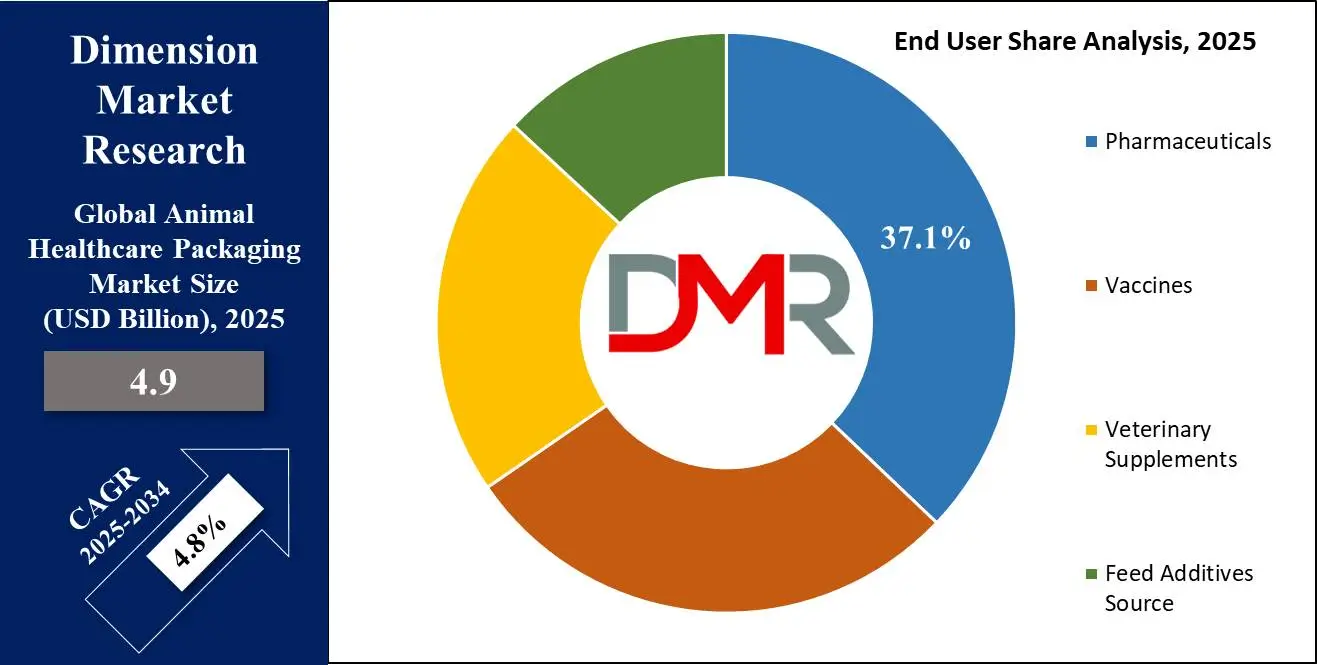

- By End User Segment Analysis: Pharmaceuticals lead with rising veterinary drug demand, meanwhile vaccines grow fastest with increasing disease prevention efforts.

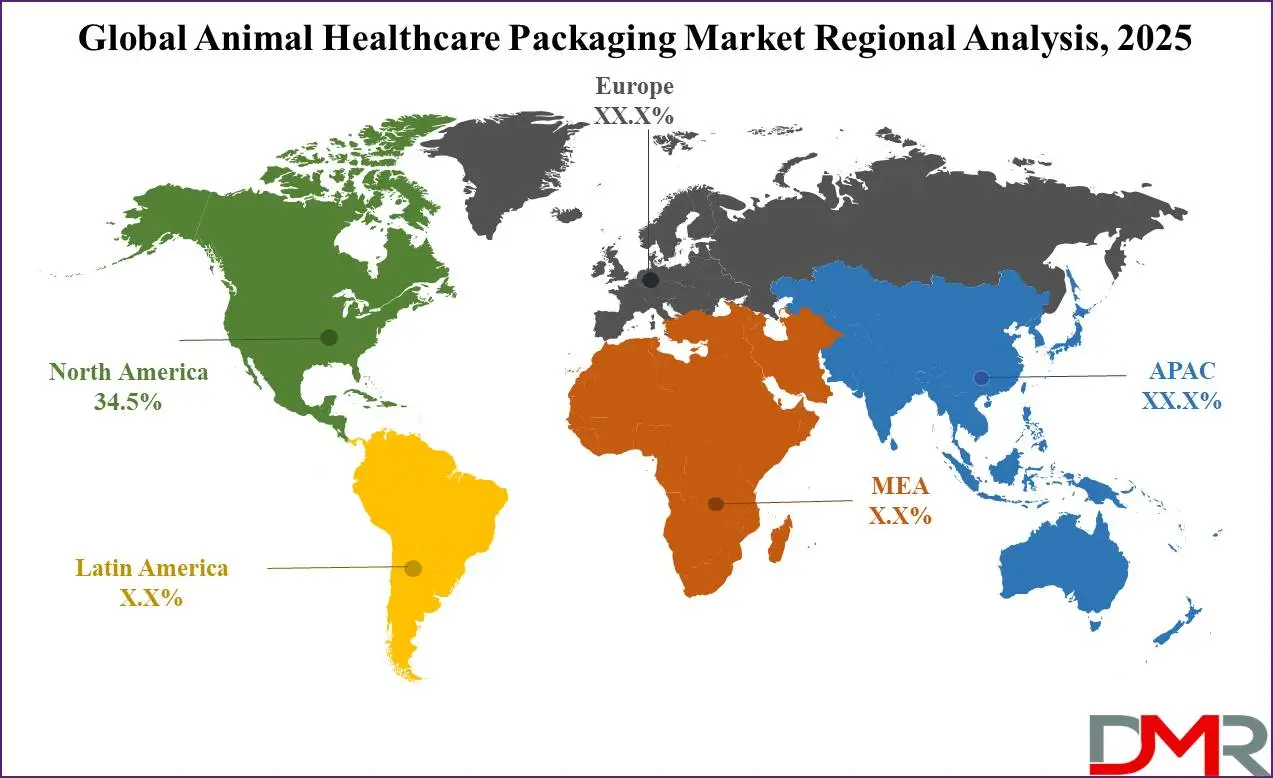

- Regional Market Insights: North America is expected to lead the market with a 34.5% revenue share by 2025, while the Asia-Pacific region is projected to have the highest CAGR.

Animal Healthcare Packaging Market: Use Cases

- Medication Storage and Safety: Animal healthcare packaging ensures the safe storage of veterinary medicines, protecting them from contamination, moisture, and light exposure, which can degrade their effectiveness.

- Ease of Administration: Packaging solutions such as pre-filled syringes, single-dose vials, and blister packs make it convenient for veterinarians and pet owners to administer medications accurately and hygienically.

- Prevention of Cross-Contamination: Specialized packaging for animal healthcare products, such as sealed containers and tamper-proof designs, helps prevent cross-contamination between different medications and ensures proper hygiene in veterinary clinics and farms.

- Extended Shelf Life and Compliance: Proper packaging materials and technologies, such as vacuum-sealed pouches and temperature-controlled containers, help extend the shelf life of vaccines, supplements, and other animal healthcare products while complying with regulatory standards.

Animal Healthcare Packaging Market: Market Dynamic

Driving Factors in the Animal Healthcare Packaging Market

Rising Awareness of Animal Health and Welfare

An increasing global awareness of animal health and welfare has greatly driven demand for veterinary medicines, supplements, and vaccines. Pet owners and livestock farmers have become more attentive to the wellbeing of their animals than ever before resulting in greater adoption of healthcare products by both animal owners and farmers alike.

With strict regulatory standards mandating product integrity, safety, and ease of use packaging solutions that adhere to them require innovation by manufacturers; consequently, the animal healthcare packaging market has seen steady expansion with companies constantly working toward offering durable yet tamper-proof and eco-friendly packaging solutions

Stringent Regulatory Guidelines and Compliance

Regulators around the globe have set stringent packaging regulations for animal healthcare products to ensure safety, efficacy, and proper labeling. Under this legislation, manufacturers are mandated to adopt high-grade materials that prevent contamination while upholding product stability. Compliance with industry safety standards gives businesses a competitive edge, as adopting safety measures builds consumer trust.

Childproof packaging solutions and child resistance measures have also become the industry standard to guarantee the secure distribution of veterinary medicines. Due to regulatory pressures, this trend pushes industry players towards adopting innovative and eco-friendly packaging systems and contributing to market expansion.

Restraints in the Animal Healthcare Packaging Market

High Cost of Advanced Packaging Solutions

Innovative packaging technologies, such as smart packaging, eco-friendly materials, and tamper-evident designs come at high production and material costs. Manufacturers face challenges in meeting regulatory standards and consumer expectations. Small and medium-sized enterprises (SMEs) in animal healthcare may find these expenses prohibitive, hampering their ability to invest in premium solutions like sustainable packaging alternatives. Additionally, sustainable packaging alternatives, though beneficial in the long run, often require higher initial investments, which can be a barrier to widespread adoption, particularly in price-sensitive markets.

Stringent Regulatory Compliance and Approval Processes

Regulations in the Animal healthcare packaging industry are extremely stringent, and controlled by authorities like FDA, EMA, and other global agencies such as OSHA or ISO. Manufacturers must use specific materials, labeling standards, and safety features that meet these agency guidelines to maintain product integrity and consumer safety. Prolonged approval processes often delay product launches resulting in a longer time to market for packaging innovations that fail regulatory inspection. Failure to abide by such requirements could result in product recalls, legal liability lawsuits, or reputational harm for companies.

Opportunities in the Animal Healthcare Packaging Market

Adoption of Smart Packaging Technologies

The integration of smart packaging technologies presents a major opportunity for the animal healthcare packaging industry. Features such as temperature-sensitive indicators, real-time tracking, and QR-code-enabled information sharing enhance product safety and traceability. These innovations help ensure the proper storage and handling of temperature-sensitive vaccines and medicines, reducing the risk of product degradation. Smart packaging solutions also provide consumers with essential product details, fostering transparency and trust. With the rising demand for precision veterinary care, the adoption of such intelligent packaging technologies offers companies an opportunity to differentiate their products and gain a competitive edge in the market.

Expansion of Sustainable Packaging Solutions

As the demand for eco-friendly products continues to rise, the adoption of sustainable packaging solutions is a key opportunity for growth in the animal healthcare packaging market. Manufacturers are increasingly shifting toward biodegradable, recyclable, and compostable packaging materials to align with environmental concerns and regulatory expectations. This transition not only helps companies reduce their carbon footprint but also appeals to environmentally conscious consumers. By investing in green packaging innovations, companies can enhance their brand reputation, meet evolving sustainability requirements, and cater to a growing market of pet owners and livestock farmers seeking eco-friendly solutions.

Trends in the Animal Healthcare Packaging Market

Increasing Demand for Customizable and User-Friendly Packaging

Customizable and user-friendly packaging designs have quickly become an emerging trend in animal healthcare packaging markets, where both pet owners and veterinarians seek solutions that enable easy administration, accurate dosage measurement, and enhanced usability for both pets and humans alike. Features such as pre-measured dosage dispensers, resealable packaging, and easy open mechanisms have become increasingly prevalent over the past several years.

This trend toward convenience-driven packaging solutions enhances the user experience while simultaneously decreasing product wastage. Visually appealing packaging that clearly labels products is helping brands stand out in an increasingly competitive market. Manufacturers have taken notice of rising consumer demands for premium and customized solutions and are developing unique designs that enhance accessibility while increasing satisfaction among their consumers.

Growth in E-commerce and Direct-to-Consumer Distribution

E-commerce and direct sales channels have had a dramatic effect on animal healthcare packaging. More pet owners are purchasing medications, supplements, and pet care items online which has increased demand for secure yet durable packaging that protects from theft or tampering. Due to increased demands for protective and transit-friendly packaging solutions, innovations like shock-resistant materials, leak proof containers, and anti-counterfeit packaging technologies have emerged to meet those demands.

Companies are becoming more efficient with packaging solutions that facilitate cost-efficient shipping while protecting product integrity, which has increased with online retail's growth. Packaging that facilitates safe and hassle-free e-commerce distribution solutions has become an increasing focus, changing the face of the industry in its entirety.

Animal Healthcare Packaging Market: Research Scope and Analysis

By Animal Type Analysis

Pets are expected to dominate the animal healthcare packaging market based on animal type with the highest revenue share by the end of 2025. The rising global pet population numbers, increasing adoption rates, and humanization trends for companion pets drive demand for advanced healthcare solutions. Pet owners spend more on medications, vaccines, and supplements which creates the need for specialty packaging requirements. Furthermore, strict regulations regarding pharmaceuticals for companion pets along with rising personalized pet care trends contribute to the dominance of the pet segment. It also growing due to the demand for sustainable yet convenient packaging solutions like single-dose containers or resealable pouches.

The livestock segment is expected to become the second largest in the animal healthcare packaging market. Growing demand for meat, dairy, and other animal-derived products has necessitated effective veterinary medicines, vaccines, and nutritional supplements for livestock health management. Disease prevention in livestock is crucial to ensure food safety and maintain high productivity levels, increasing the demand for reliable and secure packaging solutions. Government regulations surrounding livestock healthcare as well as increased commercial animal farming have further contributed to its rise. Innovated solutions like large dose vials and multidose containers have also helped meet growing demands within the animal healthcare packaging market for livestock health management needs.

By Packaging Type Analysis

Bottles are predicted to dominate the animal healthcare packaging market based on packaging type with revenue share by the end of 2025. These bottles are used for holding liquid medications, vaccines, and supplements for both companion and livestock animals. They offer exceptional protection from contamination ensuring the safe efficacy of medications while their durability, reusability, and ease of dosage measurement contribute to their demand. Likewise, advancements in material innovation such as biodegradable lightweight plastic bottles contribute significantly towards their market expansion while increased pet ownership and livestock healthcare investments cement bottles' ongoing prominence within this field.

Syringes are expected to experience the highest CAGR due to an increasing need for precise and direct drug administration, especially with injectable vaccines and medications such as those administered via an auto-disable syringe. Their importance arises from an increasing reliance on precision dosage delivery for injectable vaccines and medications and to reduce under or overdosing risks which is something vitally important for animal health. With infectious diseases on the rise among livestock and pets comes greater demand for prefilled syringes. It ensures accurate dosage delivery with increased convenience while advancements in disposable and auto-disable syringes reinforce adoption which makes them an essential element in modern veterinary healthcare packaging solutions.

By Material Analysis

Plastic packaging is projected to lead the animal healthcare packaging market with the highest revenue share by the end of 2025, due to its versatility, affordability, and longevity. The lightweight properties of plastic make transport simpler and cheaper which drives the growth of the market. Flexible packaging offers excellent protection from contamination, helping ensure the safety of medicines for animals as well as vaccines and healthcare products. Furthermore, it increases the demand for blister packs, bottles, or pouches which reaffirms its dominance even more strongly. Innovations in biodegradable and recyclable plastics have addressed environmental concerns, making plastic packaging even more appealing for animal healthcare companies seeking sustainable packaging solutions.

Glass packaging is projected to be the second dominating segment in animal healthcare packaging due to its superior barrier properties and chemical resistance, with strong applications including liquid medications, vaccines, and injectables that require high purity levels as well as protection from external contamination, such as injection. Glass does not react with its contents like plastic does thereby maintaining efficacy and shelf life of products stored. Although heavier and more fragile than plastic alternatives it remains a popular choice among premium veterinarian drug and biologic makers because its recyclability and sustainability make for greater sustainability while increased demand for high-quality packaging supports its strong market position in animal healthcare packaging markets globally.

By End User Analysis

Pharmaceutical companies are projected to lead the animal healthcare packaging market with the highest revenue share in 2025, driven by increasing demand for antibiotics, anti-inflammatory drugs, and parasiticides veterinary medicines - such as antibiotics, anti-inflammatory drugs, and parasiticides. Increasing adoption of pet, livestock farming, and government initiatives for animal health initiatives driving it further.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In addition, regulatory requirements regarding drug safety and packaging integrity increase the need for customized packaging such as blister packs vials prefilled syringes sustainable and tamper-proof packaging which also contributes to growth. Furthermore, the rising prevalence of zoonotic diseases as well as an awareness of animal healthcare globally reinforce pharmaceutical's position within this market sector.

Vaccines are projected to experience the highest compound annual growth rate within animal healthcare packaging due to increasing emphasis on disease prevention in pets and livestock, including rising incidences of infectious animal diseases coupled with stringent regulations encouraging vaccination programs are driving demand. Furthermore, advancements such as mRNA vaccines provide enhanced efficacy. Government support, awareness campaigns, and livestock immunization initiatives further fuel growth while the need for single-dose vials or prefilled syringes contributes to their high CAGR by providing safe storage, transport, and administration worldwide.

The Animal Healthcare Packaging Market Report is segmented based on the following

By Animal Type

- Pets

- Livestock

- Aquaculture

- Horses

By Packaging Type

- Bottles

- Syringes

- Pouches

- Blisters

By Material

- Plastic

- Glass

- Metal

- Paper

By End User

- Pharmaceuticals

- Vaccines

- Veterinary Supplements

- Feed Additives Source

Regional Analysis

Region with the largest Share

North America is predicted to dominate the animal healthcare packaging market with a revenue share of 34.5% by the end of 2025, due to its well-established veterinary industry, high pet ownership rates, and advanced livestock farming practices. The region's strong regulatory framework ensures stringent packaging standards, boosting demand for innovative and safe packaging solutions. Additionally, major pharmaceutical companies and packaging manufacturers are headquartered in North America, fostering continuous research and development. Rising pet care spending, coupled with increasing awareness about animal health, further drives market growth. The presence of a robust distribution network and technological advancements in packaging materials also contribute to North America's leading position in the market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with Highest CAGR

Asia-Pacific is expected to experience high growth in the global market due to increasing livestock production, rising pet ownership, and growing awareness of animal health. Rapid urbanization and economic development in countries like China and India are leading to higher disposable incomes, encouraging greater spending on pet care and veterinary services. The expansion of the pharmaceutical sector and government initiatives supporting livestock healthcare also fuel demand. Additionally, improvements in cold chain logistics and e-commerce penetration are enhancing the distribution of animal healthcare products. The region's cost-effective manufacturing capabilities further contribute to its rapid market expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Animal Healthcare Packaging Market is a dynamic and competitive industry, driven by the growing demand for secure and efficient packaging solutions in the veterinary sector. With increasing global emphasis on animal health, the market has adapted to meet various requirements, including sustainability, safety, and regulatory compliance. Leading companies are leveraging innovative technologies and strategies to enhance their product portfolios, offering solutions that encompass primary and secondary packaging and specialized labeling for animal healthcare products.

Strict regulations on packaging materials and their environmental impact have prompted businesses to adopt eco-friendly practices while ensuring product safety and usability for veterinarians and consumers. BASF has established a strong foothold in this market by prioritizing innovation and sustainability in its packaging solutions.

Some of the prominent players in the global Animal Healthcare Packaging are

- BASF

- Smurfit Kappa

- Berry Global

- Winpak

- Sealed Air

- Bemis Company

- RPC Group

- Tetra Pak

- Packaging Corporation of America

- Mondi

- Constantia Flexibles

- Avery Dennison

- Amcor

- ProAmpac

- WestRock

- CCL Healthcare

- Gerresheimer AG

- Constantia Flexibles

- SCHOTT AG

- Sealed Air

- SGD Pharma

- Hoffman Neopac

- Safepack Industries Ltd

- Silgan Unicep

- Other Key Players

Recent Developments

- In March 2023, SCHOTT started amber pharma glass production in India to meet escalating demand for pharma packaging in Asia.

- In April 2023, Berry Global opened its new state-of-the-art healthcare manufacturing facility in Bangalore, India.

- In June 2023, CCL INDUSTRIES Inc. signed an agreement to acquire Pouch Partners s.r.l., Italy.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 4.9 Bn |

| Forecast Value (2034) |

USD 7.5 Bn |

| CAGR (2025-2034) |

4.8% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.4 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Animal Type (Pets, Livestock, Aquaculture, and Horses), By Packaging Type (Bottles, Syringes, Pouches, and Blisters), By Material (Plastic, Glass, Metal, and Paper), By End User (Pharmaceuticals Vaccines, Veterinary Supplements, and Feed Additives Source) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

BASF, Smurfit Kappa, Berry Global, Winpak, Sealed Air, Bemis Company, RPC Group, Tetra Pak, Packaging Corporation of America, Mondi, Constantia Flexibles, Avery Dennison, Amcor, ProAmpac, WestRock, CCL Healthcare, Gerresheimer AG, Constantia Flexibles, SCHOTT AG, Sealed Air, SGD Pharma, Hoffman Neopac, Safepack Industries Ltd, Silgan Unicep, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Animal Healthcare Packaging Market?

▾ The Global Animal Healthcare Packaging Market size is estimated to have a value of USD 4.9 billion in 2024 and is expected to reach USD 7.5 billion by the end of 2033.

Which region accounted for the largest Global Animal Healthcare Packaging Market?

▾ North America is expected to be the largest market share for the Global Animal Healthcare Packaging Market with a share of about 34.5% in 2024.

Who are the key players in the Global Animal Healthcare Packaging Market?

▾ Some of the major key players in the Global Animal Healthcare Packaging Market are Berry Global, Inc., Amcor, Sealed Air, and many others.

What is the growth rate in the Global Animal Healthcare Packaging Market?

▾ The market is growing at a CAGR of 4.8 percent over the forecasted period.

How big is the US Animal Healthcare Packaging Market?

▾ The US Animal Healthcare Packaging Market size is estimated to have a value of USD 1.4 billion in 2024 and is expected to reach USD 2.1 billion by the end of 2033.