Animal Therapeutics and Diagnostics Market is poised for robust expansion due to several key drivers. With rising global food demand requiring animal-derived ingredients for consumption, improved animal health management becomes crucial to ensure food safety and supply chain stability.

With pets becoming more like family members than ever before, demand for advanced veterinary treatment and wellness products increases exponentially. Technological advances such as molecular diagnostics and point-of-care testing allow more precise intervention, while innovations like new medications or biologic therapies provide options that address an array of animal health concerns more efficiently than before.

Even with costly R&D costs, stringent regulatory standards and an increasing need for experienced veterinarians as hurdles, market growth remains strong. This growth can be attributed to advances in veterinary science and technology as well as increasing emphasis on preventive animal healthcare services. Furthermore, Animal Therapeutics and Diagnostics Market is integral part of larger healthcare ecosystems required to protect both animal health as well as public wellbeing.

Animal Therapeutics and Diagnostics Market continues its rapid expansion due to rising demand for advanced veterinary care and diagnostics. Technological innovations like molecular diagnostics, point-of-care testing and biologic therapies are revolutionizing animal healthcare with more accurate and efficient solutions than ever before, driving greater focus on both preventative and therapeutic care for animal wellbeing.

Pet adoption and humanization has created significant growth in the pet health care market, as pet owners look for effective health management tools for their animals. Furthermore, increased demand for safe animal-derived foodstuffs is driving investments into livestock health solutions, opening up new opportunities for market players in both veterinary care and diagnostic sectors to expand their offerings and expand services offered in both sectors.

Emerging opportunities include advances in

digital technologies and home care diagnostics. This allows pet owners and veterinarians to monitor animal health remotely from anywhere, resulting in earlier disease detection and better outcomes. As awareness of zoonotic diseases grows globally, this market should experience steady expansion. Furthermore, investments in research and development are expected to accelerate over the coming years.

Key Takeaways

- The animal Therapeutics and Diagnostics market is projected to reach USD 79.4 billion by 2033 at an anticipated compound annual growth rate (CAGR) of 6%.

- Point-of-care testing has seen increased adoption across 2023, providing convenient diagnostic access across various settings.

- Immunodiagnostics was recognized for leading market share within the Technology segment of the Animal Therapeutics and Diagnostics Market in 2023.

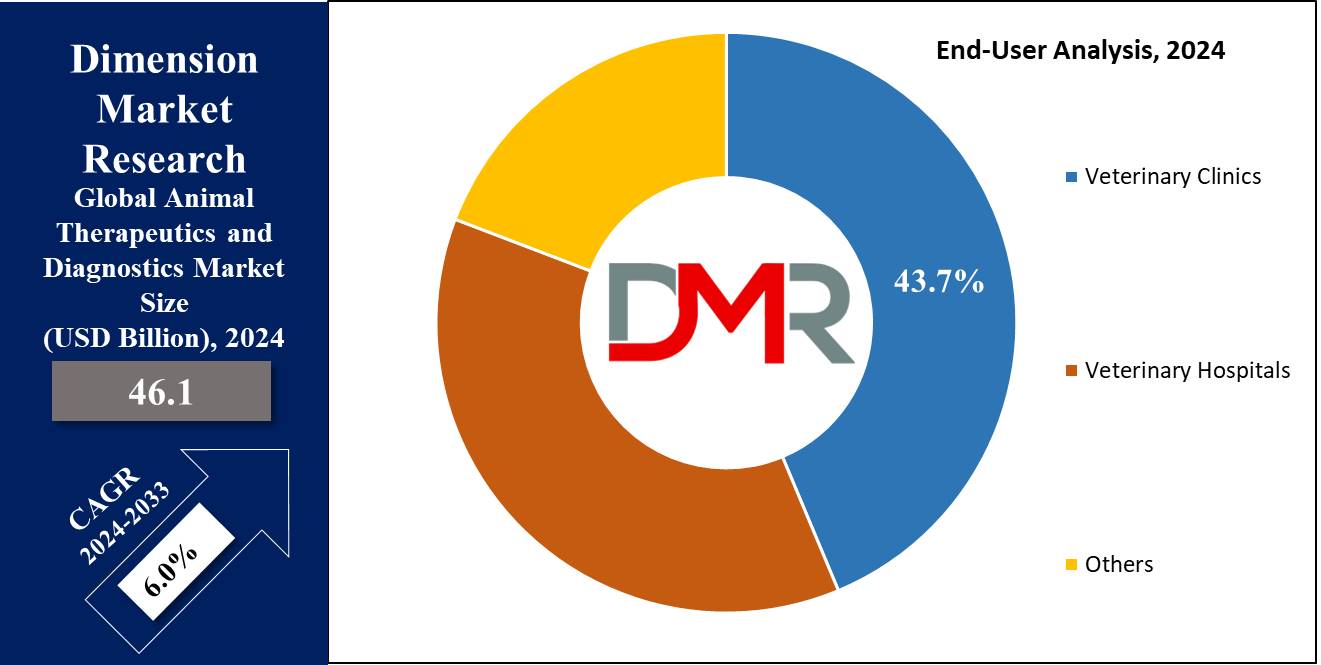

- End Users, in particular Veterinary Clinics, were the market leaders within this segment.

- North America holds an incomparable advantage in pet healthcare due to advanced infrastructure, high pet ownership rates and substantial investments in research.

Use Cases

- Diagnostics and therapeutics are widely employed within veterinary hospitals and clinics to diagnose and treat various animal ailments, ensuring optimal care for pets, livestock, and exotic disease patients.

- Diagnostic and therapeutic products used routinely by livestock managers help prevent disease outbreaks while increasing productivity, leading to superior animal-derived products and increased quality and quantity outputs.

- Pharmaceutical corporations and research facilities use animal therapeutics and diagnostics research in creating novel medications and diagnostic tools, to advance veterinary medicine and treatment efficacy.

- Pet owners rely on diagnostics and therapeutics as an integral component of preventative healthcare to monitor and protect their companion animal's well-being, with early disease identification contributing to improved quality of life for companion animal companions.

- Zoos and wildlife conservation centers use diagnostics and therapeutics to support disease control and conservation activities by managing the health of wild and threatened animal populations at their care.

Driving Factors

Rising Pet Adoption Trend Drives Market Expansion

Rising pet adoption worldwide and in particular within the U.S., where 70% of households own at least one pet, is driving growth within the Animal Therapeutics and Diagnostics Market. Pet ownership increases demand for veterinary services such as health check-ups, vaccinations and treatments for chronic or acute conditions requiring caregiving; as pet owners strive to provide complete care for their animals the market for both therapeutic products and diagnostic services grows as owners strive to provide complete coverage - this further emphasizes the necessity of continuous innovation to supply product solutions meeting growing pet-centric societies' growing demands.

Rising Demand for Pet Health Services and Diagnostic Testing

Pet health services and animal diagnostic testing is one of the key drivers of market expansion. As more pet owners invest in their animal's well-being, more advanced diagnostic tools and treatments ranging from routine blood tests and imaging scans to sophisticated molecular diagnostics are being adopted by veterinarian clinics and hospitals, further propelling market expansion. Furthermore, with increased attention paid to preventative health measures and early disease diagnosis increasing overall well-being for pets creates lasting demand for therapeutics and diagnostics services from veterinarian clinics and hospitals.

Growing Prevalence of Zoonotic Diseases Drive Market Demand

As livestock populations worldwide face rising rates of infectious disease that cause around one billion cases each year of death or sickness, Animal Therapeutics and Diagnostics Market becomes even more critical than ever before. Zoonotic diseases that can spread from animals to humans illustrate the interdependency between animal health and public health, leading to greater recognition that there must be effective diagnostic tools and therapeutic treatments in place to monitor livestock diseases effectively and manage them responsibly.

This has resulted in increasing demand for comprehensive diagnostic tools as well as therapeutics that address their spread efficiently. Investment in advanced diagnostics and cutting-edge treatments is vital to controlling zoonotic diseases and protecting public health, safeguarding food supply chains and safeguarding supply. When combined with regulatory support and global health initiatives, such investments significantly boost market growth.

Growth Opportunities

Rising Demand for Animal-Derived Food Products Drives Market Growth

Rising demand for animal-derived foods such as meat and milk in developing nations presents an invaluable opportunity for the global Animal Therapeutics and Diagnostics Market in 2023. As these regions experience economic development and urbanization, diet patterns shift towards greater consumption of animal proteins which requires improved animal healthcare to ensure product quality and productivity - further fuelling demand for advanced veterinary diagnostics and therapeutics solutions that ensure safe food chains - opening a robust market opportunity for innovative animal healthcare management products and solutions.

Increased Incidence of Chronic and Zoonotic Diseases Fuel Innovation

Bovine Spongiform Encephalopathy (BSE), and other chronic animal diseases that threaten both animal and human health will remain an important market driver in 2023. A greater awareness of potential negative repercussions from such illnesses on animal and human health has increased demand for advanced diagnostics and therapeutics that could mitigate its impacts. Innovations like molecular diagnostics, vaccines and novel therapeutics will become essential tools in managing and mitigating health threats such as these; increasing investments into research & development could result in breakthroughs within veterinary medicine that meet market demands more effectively.

Expanding Pet Health Insurance Coverage Spurs Higher Spending on Animal Wellness

Rising pet insurance coverage in developed nations is one of the main trends driving market opportunities by 2023. More pet owners opting for insurance are now more likely to seek comprehensive veterinary care without financial restrictions that had limited their access. As more pet owners purchase policies, spending increases for preventive, diagnostics and therapeutic health solutions for animals - not to mention regular visits for regular veterinary appointments and early diagnosis of any health problems which drives sustained demand for advanced products and services for optimizing animal well-being. This trend highlights an emerging market segment dedicated to optimizing animal well-being!

Key Trends

Integrating Digital Technology Enhances Precision Care

As 2023 unfolds, digital technology integration into the Animal Therapeutics and Diagnostics Market stands out as a noteworthy trend driving advances in precision care and disease management. Predictive software and wearable devices are becoming more widely adopted for both livestock and companion animals to provide real-time health monitoring as well as data analytics. These technologies enable early diagnosis, tailored treatment plans and ongoing health tracking - ultimately increasing animal welfare and productivity. Digitized tools enable better disease prevention and management strategies, making veterinary care more efficient and cost-effective. This trend highlights how technology has increasingly become an enabler of improving animal healthcare quality.

Point-of-Care Testing Revolutionizes Diagnostic Accessibility

Point-of-care testing represents an emerging trend for 2023, providing more convenient diagnostic access in various settings. Portable diagnostic instruments designed specifically to conduct point-of-care testing provide immediate testing at the point-of-care, speeding up outcomes while enabling timely interventions and saving time required to reach diagnostic results. Point-of-care tests may especially benefit remote or underserved regions where access to clinics or laboratories might be limited, helping improve veterinary care efficiency, support better health outcomes and meet rising consumer demands for reliable diagnostic solutions.

Home Care Diagnostics Enhance Pet Healthcare Management

Home care environments for pets is fuelling an uptick in point-of-care diagnostic tools in 2023, which allows pet owners to monitor their animal's health more conveniently at home without incurring unnecessary stress or strain. Home-care diagnostic tools have grown increasingly popular as owners seek convenient ways to keep tabs on their health monitoring efforts at home.

These tools enable regular health checks and early identification of potential issues without frequent veterinary visits. Home care diagnostics is not only improving pet wellbeing by offering proactive health management but is also representing an emerging market segment dedicated to user-friendly at-home solutions. Home-care diagnostics reflect an industry shift towards providing more accessible veterinary services with consumer benefits in mind.

Restraining Factors

Animal Healthcare Market Access Limited by Expensive Healthcare Costs

Animal Therapeutics and Diagnostics Market has been severely constrained by rising costs for animal healthcare. Vet care and diagnostic tests have become more expensive over time, making it challenging for pet and livestock owners to afford necessary treatments and tests on time - leading them to delay or forgo necessary treatments altogether, negatively affecting animal welfare in turn. Economic strain is compounded further in regions with lower disposable incomes where cost prohibitive diagnostics/therapeutics limit market penetration as well as limit the spread of innovative solutions across markets.

Protracted diagnostic processes impede on-time therapy solutions

Long diagnostic processes also represent a serious barrier in the market. Certain veterinary diagnostic tests require lengthy waits before producing results, delaying effective therapy interventions that might otherwise address health concerns and produce lasting benefits for animals. Furthermore, their inefficiency hinders trust from pet and livestock owners when seeking timely diagnostic information, discouraging them from making use of essential services at critical moments when prompt diagnosis could provide effective therapy solutions. This issue becomes even more evident during emergencies where timely diagnoses must occur for effective

medical attention to be provided as quickly as possible.

By Technology

Immunodiagnostics held an impressive market position within the Technology segment of Animal Therapeutics and Diagnostics Market in 2023, due to their superior abilities for diagnosing multiple diseases with precise, reliable outcomes. Immunodiagnostic technologies like ELISAs and lateral flow assays were utilized widely due to their sensitive specificity; making them indispensable tools in both routine and advanced veterinary diagnostic procedures.

Clinical biochemistry will continue to play an integral part of the Animal Therapeutics and Diagnostics Market through 2023, comprising diagnostic tests which examine biochemical markers present in blood or other body fluids to measure organ function and overall health. With increased emphasis placed upon preventive medicine and early disease diagnosis, demand for clinical biochemistry tests that detect metabolic disorders, liver and kidney diseases, as well as electrolyte imbalances, has skyrocketed; technological improvements further enhance diagnostic accuracy.

Hematology remains an essential area in Animal Therapeutics and Diagnostics Market, focused on studying and diagnosing blood-related disorders. Since 2023, automated hematology analyzer adoption has increased significantly allowing for accurate blood cell counts and morphological assessments as quickly as possible. Hematology tests provide critical data regarding anemia, infections and malignancies; providing important insight for managing health conditions of both companion animals as well as livestock animals alike - thus further strengthening comprehensive veterinary care services.

Animal Therapeutics and Diagnostics Market in 2023 was driven forward by advances in molecular diagnostics, an innovative segment distinguished by its ability to detect genetic and molecular markers associated with diseases to provide high precision in pathogen identification and disease classification. Techniques like PCR, next-generation sequencing and DNA microarrays were widely utilized due to their accuracy and rapid turnaround times; molecular diagnostics is an integral component of modern veterinary medicine with its ever increasing prevalence of infectious diseases that require targeted diagnostic approaches that demand precision as well.

Urinalysis holds an invaluable position within the Animal Therapeutics and Diagnostics Market, offering noninvasive diagnostic insights into animal health. By 2023, this non-invasive diagnostic test had become one of the primary diagnostic tools used for screening kidney function, urinary tract infection monitoring, metabolic diseases monitoring as well as routine health assessments and disease tracking. With advances in dipstick tests and automated urine analyzer technologies enhancing diagnostic accuracy and efficiency reaffirming urinalysis' significance within veterinary practices worldwide.

By End-use

In 2023, Veterinary Clinics held the dominant market position within the End-Use segment of Animal Therapeutics and Diagnostics Market. Their success can be attributed to their widespread presence as primary points of care for pets and livestock alike. Equipped with cutting edge diagnostic tools and therapeutic products that support comprehensive animal healthcare management. With pet humanization being on the rise and expenditure increasing on healthcare for our furry friends rising accordingly Veterinary Clinic services remain in high demand, cementing their position within this segment.

Animal Therapeutics and Diagnostics Market in 2023 will feature veterinary hospitals as a critical segment, providing emergency and specialty care services. Equipped with cutting-edge diagnostic and therapeutic technologies, these hospitals cater to complex or critical health conditions which need advanced interventions from medical specialists. Chronic illnesses have fuelled this growth; alongside offering services ranging from surgery, oncology and intensive care - making veterinary hospitals indispensable facilities in any ecosystem of care provision.

The Animal Therapeutics and Diagnostics Market Report is segmented based on the following:

By Technology

- Immunodiagnostics

- ELISA

- Lateral Flow Assays

- Immunoassay Analyzers

- Other

- Clinical Biochemistry

- Glucose Monitoring

- Blood Gas & Electrolyte Analysis

- Other

- Hematology

- Molecular Diagnostics

- Urinalysis

- Others

By Animal

By Product

- Therapeutic

- Drugs

- Vaccines

- Medicated feed additives

- Diagnostic

By Application

- Bacteriology

- Parasitology

- Pathology

- Others

By End-use

- Veterinary Clinics

- Veterinary Hospitals

- Others

Regional Analysis

North America holds an increasingly dominant share in the Animal Therapeutics and Diagnostics Market due to advanced veterinary healthcare infrastructure, high pet ownership rates, substantial investments in research & development for animal health issues and presence of leading market players like Zoetis, Merck & IDEXX Laboratories; this region's market leadership further cemented by spending on pet healthcare spending; widespread adoption of advanced diagnostic technologies; robust veterinary services as well as supportive regulatory frameworks & strong awareness regarding animal health matters are further contributors.

Europe stands out as an influential region within the Animal Therapeutics and Diagnostics Market due to stringent animal welfare regulations and an emphasis on innovative veterinary solutions. Market growth here can be traced to increasing pet adoption, rising awareness of zoonotic diseases and substantial investments made into research for pet medicine; countries like Germany, France and United Kingdom lead contributors with specializations such as advanced diagnostics and therapeutics while the regulatory environment supports high standards in terms of animal health and welfare - further driving market expansion in this region.

Asia Pacific region has experienced impressive animal therapeutics and diagnostics market expansion due to rising consumer interest for animal-derived food products, rising pet ownership rates, and enhanced veterinary infrastructure development. China and India are major contributors, due to expanding livestock populations as well as greater awareness regarding animal health concerns; further driving economic development, urbanization and government initiatives designed to enhance animal services and health issues within this market potential region.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Bayer and Eli Lilly continue to dominate the market through extensive R&D activities that focus on creating novel therapies and diagnostic tools, investing in biotechnology and precision medicine - thus maintaining their competitive advantage and staying at the top.

Boehringer Ingelheim and Merck are capitalizing on strategic expansions and partnerships to strengthen their market positions. By working alongside technology firms and research institutes, these companies are speeding the creation of next-generation veterinary products while simultaneously expanding global presence - especially within emerging markets where demand for animal healthcare solutions continues to surge.

Zoetis and Ceva Sante Animale offer comprehensive product offerings designed for companion animals as well as livestock. Offering vaccines, pharmaceuticals and diagnostic solutions makes these two companies stand out as top suppliers within the veterinary market; Zoetis' dedication to innovation and customer-centric solutions keeps it at the top of this market segment.

Sanofi S.A. and Nutreco N.V. recognize the vital role nutritional health plays in animal care and development by offering advanced feed additives and nutritional supplements designed to support overall animal well-being; their efforts underscoring how interlinked nutrition and therapy play an essential part in providing animal wellness care.

Some of the prominent players in the Global Animal Therapeutics and Diagnostics Market are:

- Bayer

- Eli Lilly

- Boehringer

- Ingelheim

- Merck

- Zoetis

- Ceva Santé Animale

- Sanofi S.A.

- Nutreco N.V.

- Virbac S.A.

- IDEXX Laboratories

Recent developments

- In 2024, Governor Roy Cooper announced that an international pet healthcare company will establish a facility in Wilson County and create 275 jobs as part of their strategic plan to strengthen manufacturing and distribution capabilities.

- In 2023, Zoetis announced the acquisition of Basepaws, an industry leading petcare genetics provider that specializes in feline diagnostics. With this move, it aimed at expanding Zoetis' skills for tailored veterinary care while broadening its diagnostic portfolio.

- In 2023, Merck Animal Health, a division of Merck & Co. Inc, made headlines with their acquisition of IdentiGEN- an international leader in DNA-based animal traceability solutions and their DNA TraceBack(r) system, providing accurate traceability from farm to table of beef products ensuring food safety and quality from farm. Merck's acquisition aligns perfectly with their strategic focus of improving their food safety and traceability solutions to meet consumer and regulatory expectations for transparency throughout food supply chains.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 46.1 Bn |

| Forecast Value (2032) |

USD 79.4 Bn |

| CAGR (2023-2032) |

6% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Technology(Immunodiagnostics, Clinical Biochemistry, Hematology, Molecular Diagnostics, Urinalysis, ), By Animal(Livestock, Companion), By Product(Therapeutic,Diagnostic), By Application(Bacteriology, Parasitology, Pathology, Others), By End-use(Veterinary Clinics, Veterinary Hospitals, Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Bayer, Eli Lilly, Boehringer, Ingelheim, Merck, Zoetis, Ceva Santé Animale, Sanofi S.A., Nutreco N.V., Virbac S.A., IDEXX Laboratories |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |