Market Overview

The

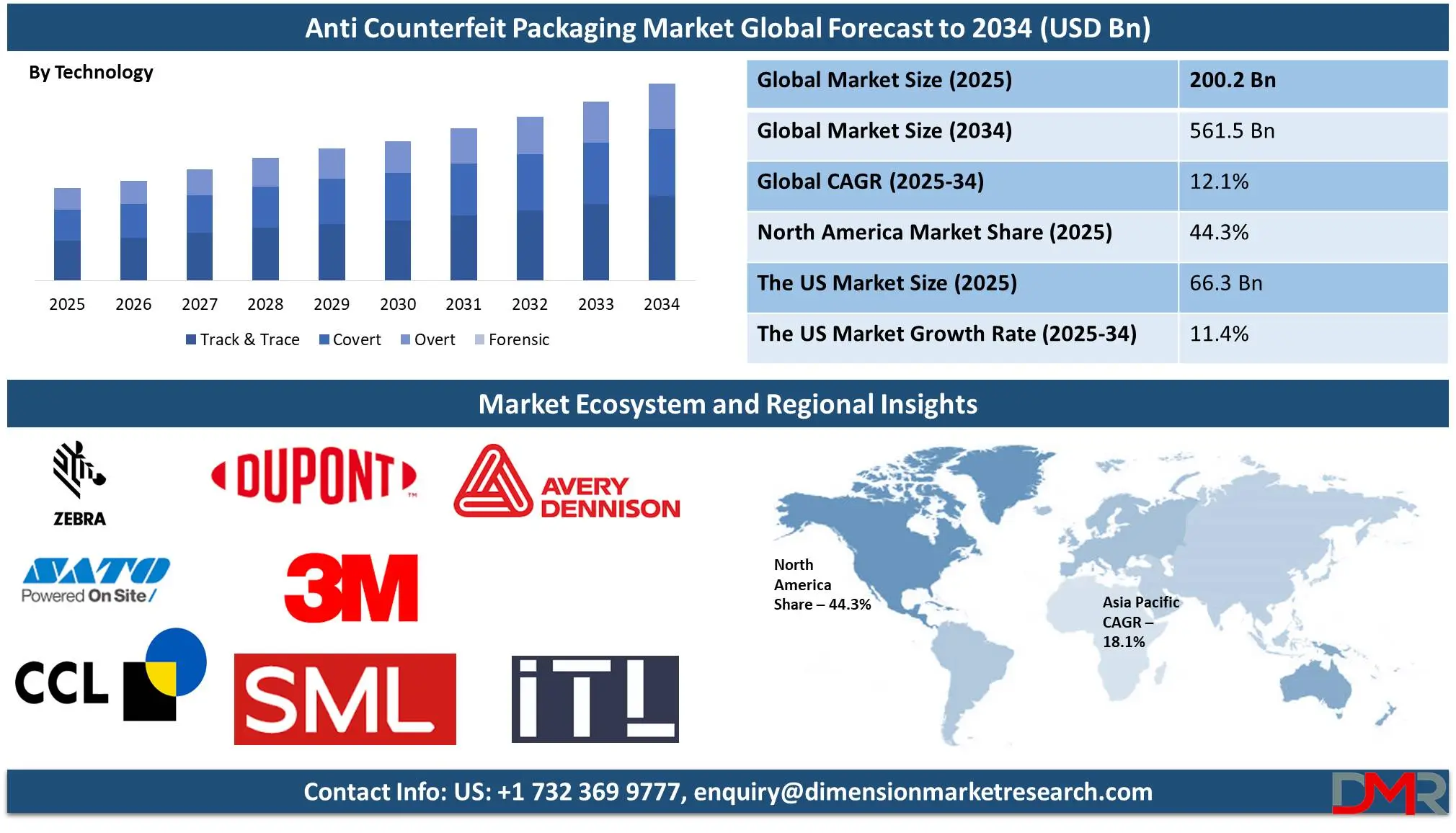

global anti-counterfeit packaging market is predicted to be

valued at USD 200.2 billion in 2025 and is expected to

grow to USD 561.5 billion by 2034, registering a compound annual

growth rate (CAGR) of 12.1% from 2025 to 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Anti-counterfeit packaging is a specific packaging technology for fraud and reproduction avoidance of real goods. It incorporates high-tech security methods such as holograms, watermarks, RFID chips, and specific inks for inhibition of counterfeiting and tampering. All such techniques authenticate and verify legitimacy, safeguarding integrity and allowing buyers to verify genuineness. Pharmaceuticals, electronic, and high-value goods sectors apply such techniques for earnings protection and property safeguarding, and such packaging enables traceability in supply chains and compliance with legislation, and in a larger scenario, instills trust in buyers and keeps counterfeit goods out of circulation, securing the entire world.

Industries such as cosmetics, high-value goods, and electronic goods are most at risk, and therefore, brands have started using sophisticated packaging techniques. With a quick spurt in e-commerce and web stores, the issue is compounded, allowing counterfeiters to disperse counterfeit goods with ease. With increased demand for assurance of genuineness, companies increasingly use new-age authentication technology such as QR codes and NFC tags in an attempt to lock down the supply channel and gain trust with buyers all over the world.

The anti-counterfeit packaging sector stands to receive a significant boost with technological advancement and investment fueling anti-counterfeit system innovation. Business entities in many industries are strengthening tracking capabilities for goods, and in the bargain, developing safer and smarter supply chains. Increased use of new scan technology and electronic checking processes aids in instilling confidence in buyers and generating loyal customer groups.

The adoption of smart packaging technology not only curtails counterfeiting but also generates useful information intelligence. Investment in development and research is powering innovation in digital verification, augmented reality, and integration with blockchain, for increased transparency and traceability. Cross-sector collaboration between producers and technology providers enables custom, high-performance packaging for a range of use cases.

Emerging trends motivate new entrants in the marketplace to build new business models, both in mature sectors and new, unexploited ones. On top of that, supportive government policies and increased awareness amongst consumers drive demand, generating continuous improvement and competitive advantage in anti-counterfeit packaging solutions.

The US Anti-Counterfeit Packaging Market

The US Anti Counterfeit Packaging market is projected to be valued at USD 66.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 174.5 billion in 2034 at a CAGR of 11.4%.

The U.S. anti-counterfeit packaging market is experiencing rapid innovation driven by advancements in technology. Smart packaging solutions such as QR codes, RFID tags, and holographic labels are gaining popularity, enabling real-time tracking and authentication. Consumers and brands increasingly demand secure and transparent packaging, particularly for high-end consumer goods, pharmaceuticals, and luxury items. As counterfeiting tactics become more sophisticated, the market is also witnessing a shift toward multi-layered protection features.

The growth of the U.S. anti-counterfeit packaging market is primarily fueled by the increasing threat of counterfeit products across industries. Companies like Nike and Apple are investing heavily in advanced packaging solutions to protect their brands. The growing need to secure high-value consumer goods, pharmaceuticals, and food products against counterfeiting is also driving demand for innovative anti-counterfeit technologies.

Anti-Counterfeit Packaging Market: Key Takeaways

- Market Growth: The global Anti Counterfeit Packaging market is anticipated to expand by USD 339.5 billion, achieving a CAGR of 12.1% from 2026 to 2034.

- Technology Analysis: Track and trace is predicted to dominate the global market with a revenue share of 50.1% based on product by the end of 2025.

- Application Analysis: Pharmaceuticals are predicted to lead the global market with the highest market share of 30.1% in 2025.

- Regional Analysis: North America is projected to dominate the global market, holding a market share of 37.2% by 2025.

- Prominent Players: Some of the major key players in the Global Anti Counterfeit Packaging Market are Avery Dennison Corporation, 3M Company, and CCL Industries Inc.

Anti-Counterfeit Packaging Market: Use Cases

- Pharmaceutical Industry: Counterfeit packaging is often used to disguise fake medications as genuine products, which can lead to serious health risks for patients and undermine public trust in the healthcare system.

- Luxury Goods Market: In the luxury sector, counterfeit packaging mimics the design and quality of high-end brands, deceiving consumers into purchasing imitations that damage the reputation of established designers.

- Electronics Sector: Counterfeit packaging in the electronics industry is employed to replicate the appearance of original devices, potentially resulting in the distribution of substandard or unsafe products.

- Food and Beverage Industry: Counterfeit packaging in this sector is used to imitate trusted brand designs, misleading consumers and increasing the risk of exposure to inferior or hazardous ingredients.

Anti-Counterfeit Packaging Market: Stats & Facts

- According to Compare Soft, RFID technology has significantly evolved since its inception during World War II, with key milestones such as the first RFID tag patent in 1973 and IBM’s introduction of the first Ultra-High Frequency (UHF) reader in the 1990s.

- UK retailer River Island improved inventory accuracy from 70% to 98% by implementing RFID tags in its stores. Air Canada leverages RFID technology to track food carts, achieving substantial annual cost savings.

- In manufacturing, Club Car reduced vehicle assembly time from 88 minutes to just 46 minutes using RFID tracking. Additionally, skincare company Canus employs RFID temperature sensors to monitor product conditions during transit, showcasing the technology’s versatility in asset tracking and supply chain optimization.

- According to Django Stars and River Logic, data-driven decision-making is transforming supply chain management through predictive analytics and data analysis. Approximately 39% of companies use these tools for demand forecasting, leading to a 20-30% reduction in inventory levels. Additionally, 35% of companies apply analytics in maintenance, asset management, and customer transparency.

Anti-Counterfeit Packaging Market: Market Dynamic

Driving Factors in the Anti-Counterfeit Packaging Market

Rising Concerns Over Product AuthenticityIndustries such as pharmaceuticals and electronics have increased their emphasis on secure packaging due to rising concerns regarding product authenticity. Counterfeit goods pose risks to consumer safety, brand image, and regulatory compliance which must be avoided at any cost. Manufacturers have increasingly invested in advanced packaging solutions that prevent product tampering and ensure product integrity from production through delivery, due to consumer awareness and regulatory pressures that demand verifiable, top-quality goods. Secure packaging not only prevents fraud but also supports traceability and quality assurance throughout their supply chains which builds consumer trust while shielding companies against financial and reputational loss.

Technological Advancements in Tracking and Verification Systems

Emerging technologies are revolutionizing product tracking and verification practices, fundamentally altering secure packaging practices. Examples include RFID tags, blockchain platforms, and AI-powered analytics which offer real-time monitoring as well as enhanced data accuracy across supply chains. These tools facilitate seamless authentication, reduce human error, and thwart fraudulent activities. Companies can now track products from manufacturing through delivery with confidence knowing there are secure records and transparent transactions taking place at every point along their journey.

As technology develops, more of these innovations are integrated into packaging solutions to increase consumer trust and regulatory compliance. Combining digital tracking with secure packaging not only maximizes operational efficiency but also significantly decreases counterfeiting risks as well as product diversion globally.

Restraints in the Anti-Counterfeit Packaging Market

Implementation Costs for New Technologies

Anti-counterfeit packaging market presents significant obstacles due to the high costs associated with adopting advanced technologies. Companies must spend heavily on research and development, equipment acquisition, and skilled labor if they wish to deploy state-of-the-art security features for packaging security features that offer advanced protections against counterfeit goods. Financial considerations often prevent smaller manufacturers from adopting innovative solutions and thus limit market expansion.

Lack of Standardization and Harmonization in Regulation

Uneven regional regulations create confusion for manufacturers when adopting uniform security measures, hindering effective adoption. Compliance efforts become further compromised due to this diversity, forcing companies to customize solutions by various national and international requirements. Lacking universal guidelines limits scalability and discourages innovation, ultimately undermining market trust in anti-counterfeit technologies. Uneven enforcement of regulations can wreak havoc with product security features and leave products vulnerable to counterfeiting risks, necessitating action to address this challenge and advance market expansion. Addressing such matters is vital in streamlining processes and driving market expansion.

Opportunities in the Anti-Counterfeit Packaging Market

Sustainable Packaging Solutions

Sustainable Packaging Solutions in the anti-counterfeit packaging market provide a promising opportunity by aligning environmental stewardship with advanced security features. With increasing global awareness and regulatory pressure on reducing waste, companies are developing eco-friendly materials that maintain high-performance anti-counterfeiting measures. Innovations such as biodegradable substrates, recycled components, and renewable energy-powered manufacturing processes offer an appealing balance between sustainability and brand protection.

This approach not only minimizes environmental impact but also enhances corporate reputation, appealing to eco-conscious consumers. Additionally, investment in sustainable technologies fosters long-term cost savings and regulatory compliance, driving competitive differentiation in the increasingly interconnected global market for success.

Customization to Meet Industry-Specific Needs

Customization to Meet Industry-Specific Needs in anti-counterfeit packaging unlocks tailored security and functionality for diverse sectors. Manufacturers are designing packaging solutions that align with unique challenges in pharmaceuticals, electronics, luxury goods, and food products. These bespoke solutions integrate advanced technologies like holograms, QR codes, and digital markers to deter counterfeiting while meeting logistical, branding, and regulatory requirements.

Customization enhances consumer trust by ensuring authenticity and preserving brand integrity. Furthermore, specialized packaging offers scalability and flexibility, enabling businesses to adapt swiftly to market changes while optimizing cost efficiency and innovation for competitive advantage, driving significantly increased market share and customer loyalty.

Trends in the Anti-Counterfeit Packaging Market

Integration of Advanced Technologies

RFID, blockchain, and IoT technologies have rapidly evolved the anti-counterfeit packaging market by revolutionizing product tracking and authentication processes. RFID tags offer efficient identification and tracking, while blockchain ensures secure data records across supply chains. IoT connectivity enhances real-time monitoring through instantaneous communications between all stakeholders involved. Technological convergence improves tracking accuracy, reduces counterfeiting risks, and strengthens consumer trust. Digital transformation drives efficiency by speeding responses to security breaches quickly and offering innovative methods of maintaining product authenticity within ever-evolving market environments.

Smart Packaging

Smart packaging solutions featuring QR codes and NFC tags are revolutionizing consumer engagement and product verification processes, giving access to detailed product info, verifying authenticity, and creating interactive experiences on mobile devices. QR codes offer an efficient method to quickly retrieve product origin, manufacturing details, and usage instructions while NFC tags facilitate tap-to-verify interactions not only does this trend bolster consumer confidence but it also assists manufacturers with monitoring supply chain integrity. Smart packaging fosters higher consumer engagement while protecting against counterfeiting by linking physical products with digital platforms - two benefits not often considered in traditional retail packaging solutions.

Anti-Counterfeit Packaging Market: Research Scope and Analysis

By Technology

Track and trace is predicted to dominate with a 50.1% revenue share in the anti-counterfeit packaging market based on technology in 2025, with growing demand for transparency and tracking in a supply chain, particularly in industries with high concern for the security of a product and compliance with laws and legislation. Real-time tracking of a product in a supply chain via serialization, use of a barcode, RFID tag, or QR tag assigning a specific ID to a single unit is supported through such technology. Scalability, cost-effectiveness, and ease of integration with digital infrastructure make them effective in terms of operations in a range of industries.

Meanwhile, overt technology boasts conspicuous security markings through which a product's legitimacy can be checked and assured both by governments and consumers with no tools involved. Examples include items such as security labels, changing inks, security labels, and tamper-evident seals. On the other hand, covert anti-false technology, including security labels and invisible printing, is the second most prevalent section with its discreet but effective security feature offering. With its hidden security feature, included in packaging structures, counterfeiters are kept at bay through its detectability with no tools involved. In addition, covert alternatives save cost and can integrate with existing production lines with ease, thus, making them a go-to alternative for producers in quest for additional security layers.

By Application

Pharmaceuticals are anticipated to dominate the Anti-Counterfeit Packaging Market with the highest revenue share of 30.1 % due to the critical need for ensuring drug safety and patient well-being. Counterfeit drugs pose severe risks by reducing therapeutic efficacy and potentially causing harmful side effects. As a result, pharmaceutical companies are increasingly investing in sophisticated packaging solutions such as tamper-evident seals, holographic labels, and QR codes to secure their supply chains.

Stringent regulatory mandates and heightened consumer awareness further drive the adoption of these advanced technologies. With the pharmaceutical sector already commanding a significant revenue share and exhibiting robust growth, the necessity to safeguard the authenticity of medicines is paramount. This trend, coupled with expanding global distribution channels, firmly positions pharmaceuticals as the leading application segment in the anti-counterfeit packaging market globally across sectors.

Food and Beverage is predicted to dominate the Anti-Counterfeit Packaging Market due to rising consumer safety concerns and stringent quality standards. As global trade and online food purchases surge, ensuring product authenticity becomes essential to protect public health and uphold brand trust. Advanced packaging solutions—such as tamper-evident seals, QR codes, and holographic labels which are widely implemented to thwart counterfeit products. Additionally, strict regulatory oversight compels manufacturers to adopt secure packaging methods, ensuring that food and beverage products consistently meet safety and quality requirements.

The Anti-Counterfeit Packaging Market Report is segmented based on the following

By Technology

- Track & Trace

- Machine Readable Data

- RFID

- Others

- Covert

- Security Labels

- Invisible Printing

- Others

- Overt

- Holograms

- Color Shifting Inks

- Others

- Forensic

By Application

- Pharmaceutical

- Food & Beverage

- Apparel & Footwear

- Automotive

- Personal Care

- Others

Regional Analysis

Region with the largest Share

North America is predicted to dominate the global Anti-Counterfeit Packaging Market

with a 51.9% revenue share in 2025 due to several converging factors. The region boasts advanced technological infrastructure, robust research and development initiatives, and stringent regulatory frameworks that mandate compliance and support innovative packaging solutions. Leading markets in the U.S. and Canada invest significantly in cutting-edge technologies—such as holograms, RFID tags, and blockchain-based tracking systems, to secure product authenticity and deter counterfeiting.

High consumer awareness and a strong emphasis on brand protection further stimulate demand for sophisticated packaging methods. Additionally, proactive government initiatives and strategic industry collaborations enhance market resilience and foster continuous innovation. Such dynamic leadership secures consumer trust and further stimulates technological advancement across various sectors. These combined strengths not only position North America as the frontrunner in anti-counterfeit packaging but also ensure a dominant market presence well into the future.

Region with Highest CAGR

Asia Pacific is experiencing robust growth in the Anti-Counterfeit Packaging Market, characterized by the highest compound annual growth rate (CAGR) due to dynamic market forces. Rapid industrialization, expanding e-commerce, and increasing consumer awareness are driving the adoption of advanced packaging solutions to combat counterfeiting. Governments in key economies like China, India, and Southeast Asia are implementing strict regulations and providing incentives for technology upgrades, which further fuel market expansion.

A rising middle class demands authentic products and innovative packaging that ensures product integrity, prompting local manufacturers to invest heavily in research and development. They are integrating technologies such as QR codes, holographic seals, and RFID systems into packaging designs. The competitive market environment fosters continuous innovation and collaboration among industry players. Additionally, increased global trade and digitalization enhance market dynamics, making the region a hotspot for investments and advancements in anti-counterfeit packaging solutions. Overall, this surge reshapes industry landscapes.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global anti-counterfeit packaging market is characterized by a fragmented landscape where numerous prominent players invest heavily in research and development to stay ahead of evolving counterfeiting techniques. These industry leaders continuously innovate, incorporating smart technologies into their packaging solutions to effectively deter fraudulent activities while meeting the dynamic needs of consumers. They drive market growth through a variety of strategic initiatives, including new product launches, acquisitions, collaborations, mergers, and partnerships, all designed to expand their global footprint and enhance market share.

Leading companies are leveraging advanced technologies such as QR codes, holographic seals, RFID tags, and blockchain integration, to create secure, traceable, and tamper-evident packaging solutions. Additionally, these players emphasize eco-friendly, high-quality, and cost-effective materials, aligning with increasing consumer demand for sustainable products. By continuously refining their product offerings and investing in technological innovation, they not only safeguard brand reputation but also drive consumer trust and loyalty. This dynamic competitive landscape compels companies to adopt agile marketing strategies and pursue global expansion to maintain a competitive edge and capitalize on emerging market opportunities.

Some of the prominent players in the global Anti Counterfeit Packaging are

- 3M

- AVERY DENNISON CORPORATION

- CCL Industries

- DuPont

- Zebra Technologies Corp.

- ITL Group

- SML Group

- SATO Holdings Corporation

- SICPA HOLDING SA

- Systech International

- Applied DNA Sciences

- AlpVision SA

- Authentix

- Atlantic Zeiser GmbH

- Other Key Players

Recent Developments

- In July 2023, Holostik India introduced Optashield, a new anti-counterfeiting technology that can be applied to both labels and holographic stickers, enhancing brand authentication for existing packaging and product lines.

- In April 2023, Asahi Kasei and TIS collaborated to launch the Akliteia digital anti-counterfeiting platform, aimed at tackling the issue of food product mislabeling.

- In November 2022, At the Label India Expo 2022, Holostik India debuted its advanced security product, Optashield. This innovation uses custom holographic techniques to display two distinct colors when viewed from different angles, making it one of the most secure and user-friendly authentication devices available.

- In September 2022, UbiQD, Inc., a New Mexico-based nanotechnology company, and Switzerland’s SICPA HOLDING SA expanded their partnership to develop anti-counterfeit security inks. They are leveraging UbiQD's advanced quantum dot technology, which is known for its efficient photoluminescence across a wide spectrum of colors, to enhance security applications.

- In June 2022, Exxon Mobil Corporation launched a new range of lubricants under its "Mobil Super" brand, featuring packaging enhanced with a QR-code-based anti-counterfeit system. This initiative is designed to give consumers a reliable way to verify product authenticity and combat counterfeiting in the lubricant market.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 200.2 Bn |

| Forecast Value (2033) |

USD 561.2 Bn |

| CAGR (2024-2033) |

12.1% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 66.3 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Technology (Track & Trace, Covert, Overt, and Forensic), By Application (Pharmaceutical, Food & Beverage, Apparel & Footwear, Automotive, Personal Care, and Electrical & Electronics, and Luxury Goods, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

3M, AVERY DENNISON CORPORATION, CCL Industries, DuPont, Zebra Technologies Corp., ITL Group, SML Group, SATO Holdings Corporation, SICPA HOLDING SA, Systech International, Applied DNA Sciences, AlpVision SA, Authentix, Atlantic Zeiser GmbH, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Anti Counterfeit Packaging Market?

▾ The Global Anti Counterfeit Packaging Market size is estimated to have a value of USD 200.2 billion in 2024 and is expected to reach USD 561.5 billion by the end of 2033.

Which region accounted for the largest Global Anti Counterfeit Packaging Market?

▾ North America is expected to be the largest market share for the Global Anti Counterfeit Packaging Market with a share of about 44.3% in 2024.

Who are the key players in the Global Anti Counterfeit Packaging Market?

▾ Some of the major key players in the Global Anti Counterfeit Packaging Market are Avery Dennison Corporation, 3M Company, and CCL Industries Inc. and many others.

What is the growth rate in the Global Anti Counterfeit Packaging Market?

▾ The market is growing at a CAGR of 11.7 percent over the forecasted period.

How big is the US Anti Counterfeit Packaging Market?

▾ The US Anti Counterfeit Packaging Market size is estimated to have a value of USD 66.3 billion in 2024 and is expected to reach USD 174.5 billion by the end of 2033.