The market for antibody-drug conjugates (ADCs) is gradually growing on the global level due to the constantly rising number of cancer cases and the improved ADC technology. Antibody drug conjugates are a special type of cancer drug with monoclonal antibodies joined with cytotoxic chemicals and these cancer drugs can deliver the medicine directly to the cancer cells thus affecting the overall means of delivering the drugs to the affected areas without harming the whole body. Market leaders are working on new techniques for ADCs and on optimizing the existing ones to achieve better therapeutic outcomes and minimal side effects.

The continuous influx of new antibody-drug conjugates candidates along with growing demand in research and development is the chief factor likely to propel the market in the coming years. North America leads the market due to the high usage of advanced treatment procedures and many pharmaceutical industries. The ADC market is also benefiting from innovations in the broader field of

drug discovery, where precision targeting, payload optimization, and novel linker strategies are transforming traditional therapeutic development.

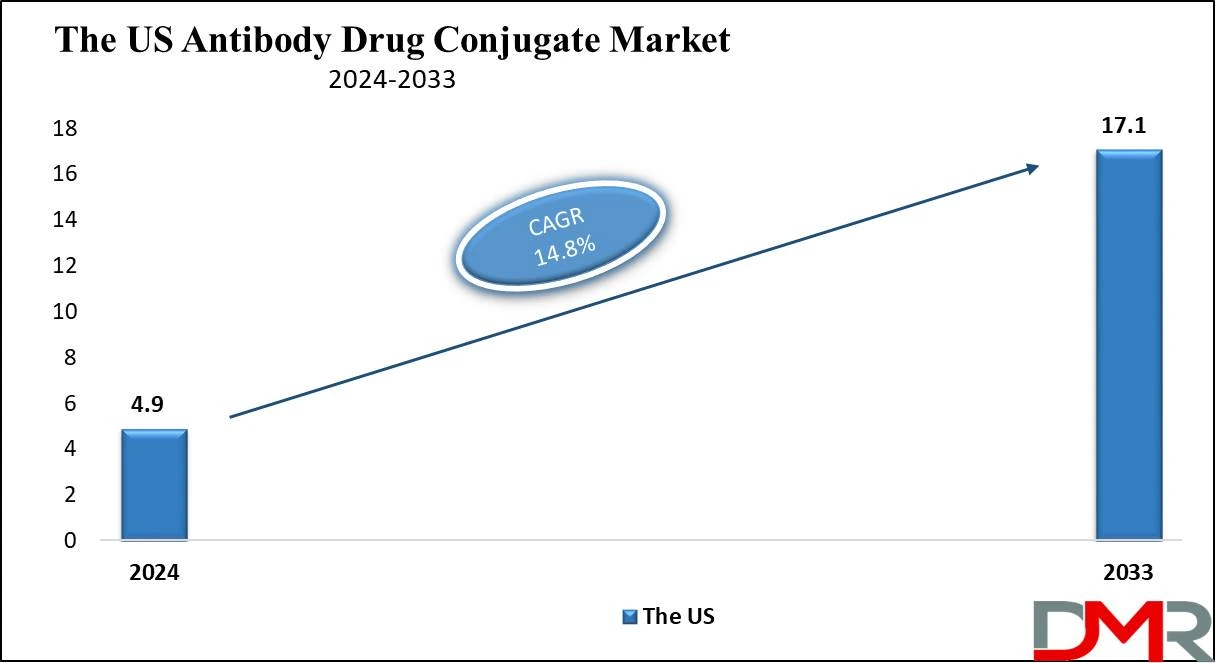

The US Antibody Drug Conjugates Market

The US

Antibody Drug Conjugates market is projected to be

valued at USD 4.9 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it

holds USD 17.1 billion in 2033 at

a CAGR of 14.8%.

The US antibody drug conjugates market occupies a special place in the global landscape and has the highest revenue share which is due to the result of an increased incidence of cancer and the presence of advanced medical facilities in this region.

The US market has the advantage of higher investments in research and development, active clinical trial programs, and responsive regulatory procedures helping in early approval of ADC therapies.

Key ADC developing companies in the USA are involved in improving the accuracy and efficiency of such therapies for cancer treatment. The increasing cases of many types of cancer such as breast cancer, lymphoma, and leukemia that are treated using ADCs also boosts the market.

Moreover, synergistic business relationships are growing strictly between biotechnology companies and academic establishments that are promoting the progress of ADCs which provide the market with more growth prospects.

Additionally, development strategies being leveraged in ADCs are influencing adjacent categories, such as research into Penicillin drug reformulations, to optimize targeted delivery systems for broader applications.

Antibody Drug Conjugates Market Key Takeaways

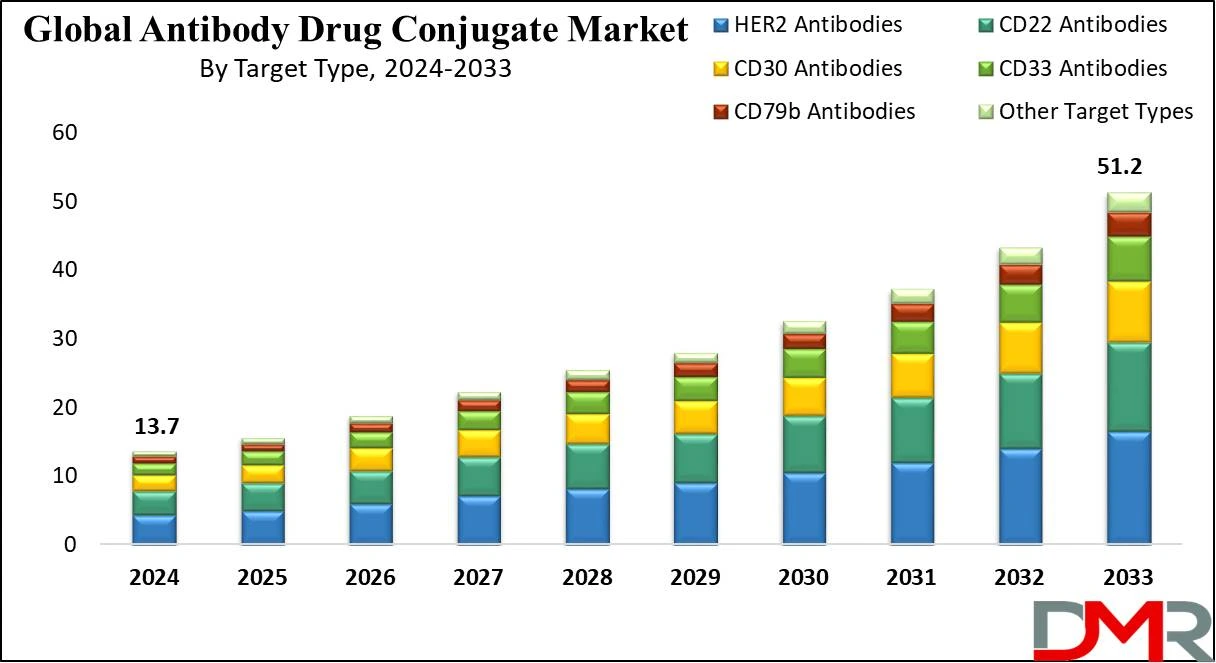

- Market Value: The Global Antibody Drug Conjugates Market size is estimated to have a value of USD 13.7 billion in 2024 and is expected to reach USD 51.2 billion by the end of 2033.

- The US Market Size: The US Antibody Drug Conjugates market is projected to be valued at USD 4.9 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 17.1 billion in 2033 at a CAGR of 14.8%.

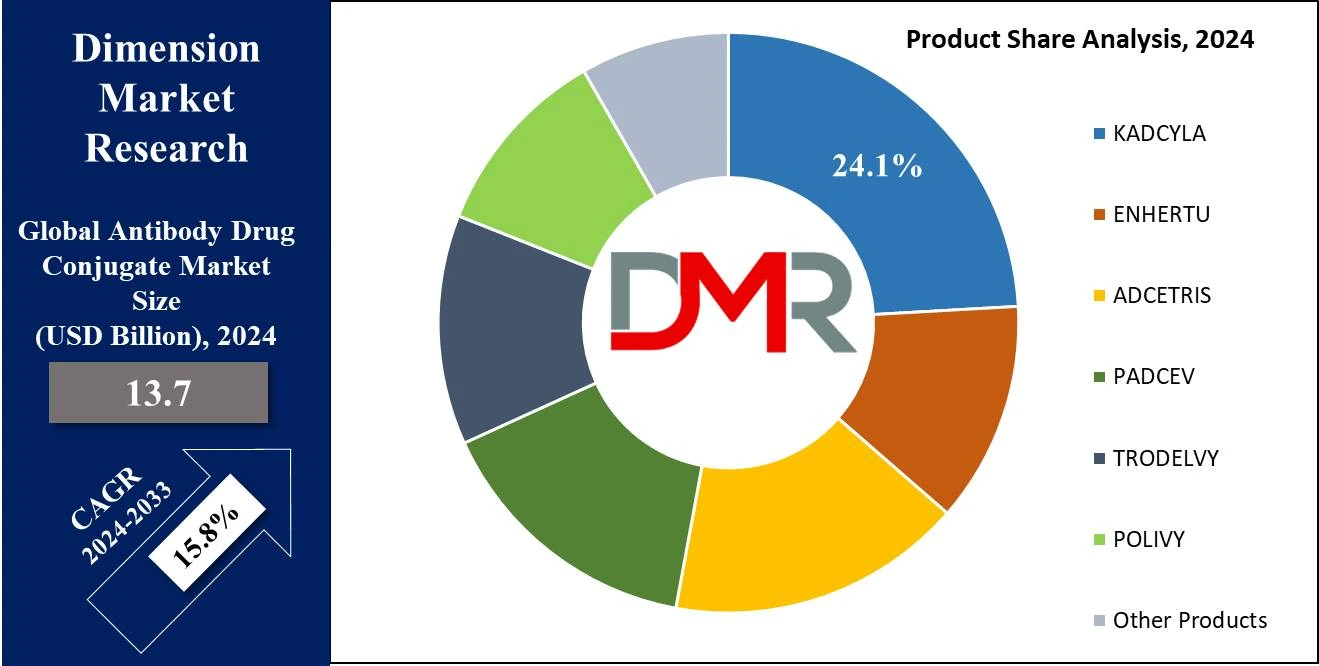

- By Product Segment Analysis: KADCYLA is projected to dominate this segment in this segment as it will hold 24.1% of the market share in 2024.

- By Target Type Segment Analysis: HER2 is projected to dominate the global antibody drug conjugates market in the target type segment as it will hold 32.2% of the market share in 2024.

- By Payload Type Segment Analysis: MMAE (Monomethyl Auristatin E) is projected to dominate this segment as it holds the highest market share in 2024

- By Application Segment Analysis: Blood cancer dominates this segment as it exerts its dominance in the application segment with the highest market share in 2024

- By End User Segment Analysis: Hospitals and specialty cancer centers are projected to dominate the end-user segment as they hold the highest market share in 2024.

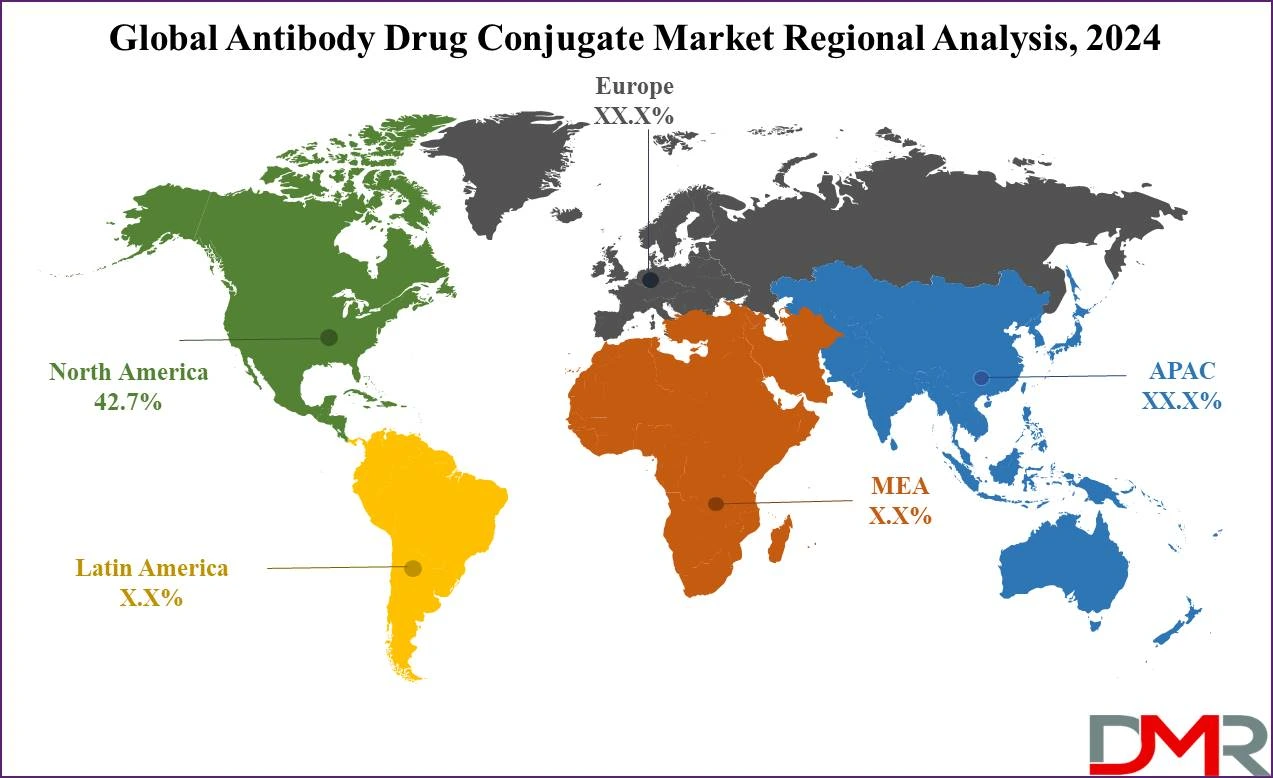

- Regional Analysis: North America is expected to have the largest market share in the global antibody drug conjugates market with a share of about 42.7% in 2024.

- Global Growth Rate: The market is growing at a CAGR of 15.8 percent over the forecasted period.

Antibody Drug Conjugates Market Use Cases

- Breast Cancer Treatment: ADCs like KADCYLA and ENHERTU are used to target HER2-positive breast cancers, imparting improved efficacy and reduced systemic toxicity as compared to traditional chemotherapy.

- Lymphoma Therapy: ADCETRIS targets CD30-high-quality lymphoma cells, supplying a highly specific treatment that reduces side effects and enhances patient outcomes.

- Urothelial Cancer: PADCEV is used for superior urothelial cancers, handing over a cytotoxic payload at once to most cancer cells, resulting in better therapeutic efficacy.

- Leukemia Management: ADCs targeting CD22 and CD33 are used in treating acute leukemias, offering precise targeting and lowering the chance of relapse.

Antibody Drug Conjugates Market Market Dynamic

Trends

Rising Adoption of ADCs in OncologyThe use of ADCs is growing steadily and is most frequently applied in

oncology because of their targeted action, as it unites the function of monoclonal antibodies with the cytotoxic effects of a drug. This is being propelled by marketed ADCs such as KADCYLA, ENHERTU, AND ADCETRIS that has shown positive clinical improvement in the treatment of different types of cancers. More approvals for ADCs and entering into the market will help the growth of this market and make it larger.

Expansion of ADCs Beyond Oncology

As seen, oncology is still the leading indication for ADC development; however, there is a shift in research towards converting ADCs for non-oncological indications, including autoimmune diseases and infections. There is research in progress to find suitable targets and create ADCs for the mentioned indications, suggesting new therapeutic options and increasing the overall size of the market.

Growth Drivers

Technological Advancements in ADC Development

Recent scientific advancements in ADC technology, such as the synthesis of new linkers, potent therapeutic payloads, and effective conjugation strategies, are making ADCs safer and more effective. These advancements are thus providing a positive impetus to the growth of the ADC market due to enhanced conception, preparation as well as the acceptable toxic profile of newer generation ADCs to be incorporated into normal clinical practice.

Increasing Prevalence of Cancer

One of the main factors that spur the ADC market globally is the increasing rates of cancer. In the current increased quest for more efficient treatment of cancers with less detrimental effects to the surrounding healthy tissues, ADCs match the bill perfectly with their singular intention of delivering cytotoxic agents directly to the tumor cells. Most importantly, such a targeted approach has positive impacts on patient outcomes while also addressing the increasing focus on individualized care that is increasingly sought in the contemporary health industry.

Growth Opportunities

Emerging Markets

The availability of healthcare facilities and improved consciousness of cancer in the developing regions provide higher potential for the ADC market. The interest in healthcare and oncology treatments in Asia-Pacific, Latin America, and the Middle East is high; hence, there will be suitable conditions for ADCs in these regions. Also, the rector and legal environments in these areas are gradually trending towards the approval and marketplace availability of new therapies.

Combination TherapiesThe development of combination therapies involving ADCs and other treatment modalities, such as the possibility of combining ADCs with other treatment methods, for instance, immunotherapies or checkpoint inhibitors, improves therapeutic effectiveness. Combination therapies are beneficial because they exhibit synergistic effects that increase response rates and overcome the resistance likely occupying space in patients who rely on ADCs, thus expanding ADC applications and fuelling market growth.

Restraints

High Development CostsADCs are constructed via multiple steps such as the generation of

monoclonal antibodies, formation of cytotoxic drugs, and linking of both the components. These intricacies contribute to the higher costs of development and manufacturing of ADCs, and this makes them expensive to the consumer, and may not be widely used. It is seen that one of the major challenges of the pharma firms is the financial risk that is inherent in the ADC business, especially at the developmental stage.

Regulatory ChallengesThe use of ADCs must go through regulatory procedures to determine the efficacy, safety, and quality of the products. The approval of ADCs is relatively long and intricate since they undergo various

clinical trials with paperwork as well. These issues pose potential threats to the market primarily because they may slow down market access by delaying the release of new ADCs, or by raising the overall costs of ADC development, thereby affecting the growth of this market.

Research Scope and Analysis

By Product

In the context of the product, KADCYLA is projected to dominate this segment in the global antibody drug conjugates market as it will

hold 24.1% of the market share in 2024. This segment is currently being vehemently held by KADCYLA which is an ADC for HER 2 positive breast cancer based on the data available regarding its efficacy and safety. When trastuzumab which is a humanized anti-HER2 monoclonal antibody is conjugated with a cytotoxic agent DM1, its mechanism of action in KADCYLA results in a patient benefit greatly. Directly, for HER2-positive breast cancer, it has been observed to help shrink the size of the tumor and increase the PFS, therefore; making it an ideal option.

The FDA approval of KADCYLA in multiple indications, including adjuvant setting of early-stage breast cancer is a booster to its market share. Furthermore, numerous case-control studies and other clinical trials alone testify in support of this reagent, strengthening the latter’s hegemony. Similarly, KADCYLA has unparalleled marketing and distribution leading to high availability to patients by Roche. Clinical effectiveness in combination with regulatory approval and a properly chosen advertising campaign means that the role of KADCYLA in the market of ADCs is inviolable.

By Target Type

HER2 is projected to dominate the global antibody drug conjugates market in the target type segment as it will hold 32.2% of the market share in 2024. The proliferation of HER2 antibodies is evident in this segment because of their efficiency in regularly forbidding HER2-positive types of cancer, including breast cancer. HER2 is amplified in about 20–25% of breast cancer patients and is thus considered to be important in the development of novel treatment strategies. KADCYLA and ENHERTU are ADCs that apply HER2-targeting to bring cytotoxic payloads to the tumor cells, increasing the therapeutic effect while decreasing systemic side effects. These ADCs have been proven to be successful in clinical trials making HER2 antibodies a reliable treatment method.

In addition, it is widely considered that ADCs targeting HER2 and combination therapies are constantly emerging with continuous improvements, thus enriching the scope of application. These HER2-targeting ADCs are at the forefront of the market because of the high incidence of HER2-positive breast cancer and established therapeutic values. The strong Hercules of HER2-targeting ADCs and constant research confirm their control.

By Technology

To a great extent, the type of technology employed in the preparation of ADCs such as cleavable linker antibodies, non-cleavable linker antibodies, and linker-less antibodies projected to dominate the technology segment of ADCs due to the effectiveness of the linker on the drug’s safety and efficacy. The linkers like VC (Valine-Citrulline) and hydrazone linkers are cleavable linkers that facilitate the drug release at the tumor microenvironment thus increasing the therapeutic efficiency of ADCs.

They resolved the stability issue and the controlled release problem and have the least off-target effects. The application of linker technology impacts the ADC’s performance significantly and thus can be considered as one of the ADC development factors. Pushes for improvements in the linker technology segment consist of the new generations of peptide linkers and the disulfide linkers. ADCs dominate the market because linker technology allows for maximum efficacy with the least amount of side effects due to the ability to fine-tune the delivery of the drug.

By Payload Type

In the context of the payload type segment, MMAE (Monomethyl Auristatin E) is projected to dominate this segment as it holds the highest market share in 2024 which is further expected to show the subsequent growth in the upcoming period as well. This segment is specially constituted by MMAE (Monomethyl Auristatin E) and other auristatins because of their strong cytocidal effect on cancer cells. Being the most frequent payloads in ADCs, MMAE and other related auristatins bind to microtubules causing cell cycle arrest and inducing apoptosis in cancer cells. This characteristic gives them a highly effective action on tumor cells at a low concentration of the drug and, therefore, minimal systemic toxicity.

MMAE-based ADCs such as ADCETRIS and PADCEV are coupled with high clinical benefits relating to the treatment of respective cancers, including lymphomas and urothelial carcinoma. From this, it is clear that MMAE has been effective in producing high levels of therapeutic gains and that research continues to be dedicated to fine-tuning its implementation, which cements MMAE’s position. It is therefore clear that auristatins are central to the ADC market given the achievements of MMAE-based ADCs in clinical trials, as well as their indication approvals.

By Application

In the context of the application, blood cancer dominates this segment as it exert their dominance with the highest market share in 2024 which is further anticipated to show this growth in the upcoming period as well. This segment is currently dominated by blood cancers such as leukemia, lymphoma, and multiple myeloma because ADCs are very effective in the treatment of these cancers. Both ADCs like ADCETRIS and POLIVY are designed to bind to certain antigens, CD30 and CD79b on hematologic cancer cells respectively, while the toxic payload of the latter is directed to the tumor site.

This selective treatment enhances the efficacy of the therapy as well as minimizes the side effects as compared to normal therapies. Blood cancers are prevalent and there are no efficacious therapies for them hence the need for ADCs in this application. ADCs’ dominance is also justified by clinical trials showing that they produce remarkable survival rates for blood cancer patients. The constant increase in new ADCs that target distinct antigens in hematologic malignancy supports this market’s consistent growth and strengthens blood cancer applications’ dominance.

By End User

Hospitals and specialty cancer centers are projected to dominate the end-user segment in the global antibody drug conjugates market as they hold the highest market share in 2024, and it is further anticipated to exert this dominance in the upcoming period as well. This is because most of the providers are focused on the efficient and effective delivery of health services in hospitals and Specialty Cancer Centers. Hospitals and specialty cancer centers represent this segment largely due to their position as the major source of treatment for cancers. These institutions have all that is required to manage complex forms of therapy such as ADCs.

Due to the elevated patient flow through these centers and the availability of superior treatment, the latter is a preferred option for ADC administration. Furthermore, hospitals and cancer centers are frequently engaged in clinical studies based on ADC therapies, so patients can benefit from these platforms. Essentially, these features also contribute to why such institutions offer the best care that incorporates a broad range of treatments, thus explaining their stranglehold on the ADC marketplace.

The Antibody Drug Conjugate Market Report is segmented based on the following

By Product

- KADCYLA

- ENHERTU

- ADCETRIS

- PADCEV

- TRODELVY

- POLIVY

- Other Products

By Target Type

- HER2 Antibodies

- CD22 Antibodies

- CD30 Antibodies

- CD33 Antibodies

- CD79b Antibodies

- Other Target Types

By Technology

- Type

- Cleavable Linker Antibodies

- Non-cleavable Linker Antibodies

- Linkerless Antibodies

- Linker Technology Type

- VC (Valine-Citrulline)

- Sulfo-SPDB (N-Succinimidyl 4-[2-pyridyldithio]-2-sulfobutanoate)

- VA (Valine-Alanine)

- Hydrazone Linkers

- Disulfide Linkers

- Peptide Linkers

- Others

- Payload Technology

- MMAE (Monomethyl Auristatin E)

- MMAF (Monomethyl Auristatin F)

- DM4 (Maytansine Derivative)

- Camptothecin Derivatives

- PBD (Pyrrolobenzodiazepine) Dimers

- SN-38 (Topoisomerase I Inhibitor)

- Others

By Payload Type

- MMAE/Auristatin

- Calicheamicin

- Maytansinoids

- PBD Dimers

- Camptothecin Derivatives

- SN-38

- Other Payload Type

By Application

- Blood Cancer

- Leukemia

- Lymphoma

- Multiple Myeloma

- Breast Cancer

- Urothelial Cancer & Bladder Cancer

- Lung Cancer

- Ovarian Cancer

- Gastric Cancer

- Other Cancers

By End-User

- Hospitals and Specialty Cancer Centers

- Biotechnology and Pharmaceutical Companies

- Academic and Research Institutes

- Contract Research Organizations (CROs)

- Other End Users

Antibody Drug Conjugates Market Regional Analysis

North America is projected to dominate the global antibody drug conjugate market as it

holds 42.7% of market share in 2024 which is further anticipated to show the subsequent growth in the upcoming period of 2024 to 2024.

North America holds the largest share in the global antibody drug conjugate market because of certain factors. Initially, the high incidence of cancer in the area contributes to the need for prominent forms of treatment such as ADCs. Improved systems and the reasonable cost of these enhance the clients’ access to sophisticated therapies owing to the enhanced healthcare systems. North America holds the largest market share in the production and growth of ADCs due to several more notable large-scale pharma players and robust research facilities. The market has an ideal regulatory environment especially the FDA which increases the approval and implementation of new treatments thus boosting the growth of the market.

Also, North America boasts of advanced clinical trial structures that enable a fast rate of clinical trial of new ADCs, and subsequent approval. High utilization of innovative cancer treatments along with the consistent innovation in ADC technology makes it possible for North America to remain ahead of the competition. Furthermore, University-industry relationships in this region for research and development offer additional support to the region in creating the opportunity for further inventions and dominant this market.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

ADCs market is widely competitive and many players are acting in this sphere, trying to gain the biggest possible market share through the constant search for new solutions and strategic collaborations. Global players including Pfizer, Roche, AstraZeneca, Seattle Genetics, and more are contributing a major share, with focused research and development potential for advancing ADCs of better efficacy and safety. These companies are involved in actual clinical trials and regulatory sanctions as they diversify their offerings. Collaborations and partnerships are common, with firms like Daiichi Sankyo partnering with research institutions such as Scripps Research Institute to advance ADC technology.

Additionally, emerging biotech firms like ImmunoGen and ADC Therapeutics are gaining traction by focusing on niche indications and novel targets. The competitive landscape is further intensified by the expansion of manufacturing capabilities and the strategic acquisition of smaller biotech companies with promising ADC pipelines. As a result, the market is witnessing rapid advancements and a surge in new product launches, driving growth and increasing the adoption of ADCs in cancer therapy globally.

Some of the prominent players in the Global Antibody Drug Conjugates Market are

- Hoffmann-La Roche Ltd.

- Pfizer, Inc.

- AstraZeneca

- Gilead Sciences, Inc.

- Astellas Pharma, Inc.

- Seagen, Inc.

- Daiichi Sankyo Company, Limited

- GlaxoSmithKline plc

- Adc Therapeutics Saa

- ImmunoGen Inc.

- Bayer AG

- Novartis AG

- Agensys Inc.

- Concortis Biotherapeutics

- Other Key Players

Recent Developments

2024

- July: Pfizer announced the FDA approval of their new ADC, targeting a specific biomarker in triple-negative breast cancer, offering a novel treatment option for this hard-to-treat cancer subtype.

- June: Roche reported promising phase III trial results for their ADC targeting HER2-positive gastric cancer, showing improved overall survival rates compared to standard chemotherapy.

2023

- December: Seattle Genetics received EMA approval for their ADC aimed at treating relapsed and refractory multiple myeloma, marking its first entry into the European market.

- November: AstraZeneca expanded their ADC manufacturing capabilities with the opening of a new state-of-the-art facility to meet the growing global demand.

- October: Daiichi Sankyo entered into a strategic partnership with Scripps Research Institute to develop next-generation ADCs with novel payloads and linker technologies.

- September: GlaxoSmithKline launched a phase I clinical trial for a new ADC targeting a unique antigen in small-cell lung cancer, highlighting the expanding pipeline of ADCs in various cancer types.

- August: Merck & Co. presented data at the American Society of Clinical Oncology (ASCO) demonstrating the potential of their ADC in combination with an immune checkpoint inhibitor, showing enhanced anti-tumor activity.

- July: Bristol-Myers Squibb announced the initiation of a phase II trial for their ADC designed to treat metastatic colorectal cancer, aiming to address the unmet need in this patient population.

- June: Novartis reported that their lead ADC candidate achieved orphan drug designation for the treatment of a rare form of sarcoma, potentially accelerating its development and approval process.

- May: AbbVie received breakthrough therapy designation from the FDA for their ADC targeting CD123 in acute myeloid leukemia, underscoring its potential to transform treatment for this aggressive cancer.

- April: Sanofi announced positive interim results from a phase II trial of their ADC for HER2-low breast cancer, suggesting a new therapeutic option for patients with limited treatment choices.

- March: Johnson & Johnson formed a collaboration with Genmab to develop ADCs using novel antibody engineering techniques, aiming to enhance specificity and reduce off-target effects.

- February: Takeda received fast-track designation from the FDA for their ADC in development for the treatment of advanced bladder cancer, highlighting its potential for expedited review.

- January: Eli Lilly entered into a licensing agreement with Zymeworks to commercialize their ADC in the Asia-Pacific region, expanding its global reach and market presence.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 13.7 Bn |

| Forecast Value (2033) |

USD 51.2 Bn |

| CAGR (2024-2033) |

15.8% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 4.9 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (KADCYLA, ENHERTU, ADCETRIS, PADCEV. TRODELVY, POLIVY, and Other Products), By Target Type (HER2 Antibodies, CD22 Antibodies, CD30 Antibodies, CD33 Antibodies, CD79b Antibodies, and Other Target Types), By Technology (Type, Linker Technology Type, and Payload Technology), By Payload Type (MMAE/Auristatin, Calicheamicin, Maytansinoids, PBD Dimers, Camptothecin Derivatives, SN-38, and Other Payload Type), By Application (Blood Cancer, Breast Cancer, Urothelial Cancer & Bladder Cancer, Lung Cancer, Ovarian Cancer, Gastric Cancer, and Other Cancers), By End-User (Hospitals and Specialty Cancer Centers, Biotechnology and Pharmaceutical Companies, Academic and Research Institutes, Contract Research Organizations (CROs), and Other End Users) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Hoffmann-La Roche Ltd., Pfizer Inc., AstraZeneca, Gilead Sciences Inc., Astellas Pharma Inc., Seagen Inc., Daiichi Sankyo Company Limited, GlaxoSmithKline plc, Adc Therapeutics Saa, ImmunoGen Inc., Bayer AG, Novartis AG, Agensys Inc., Concortis Biotherapeutics, and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |