Market Overview

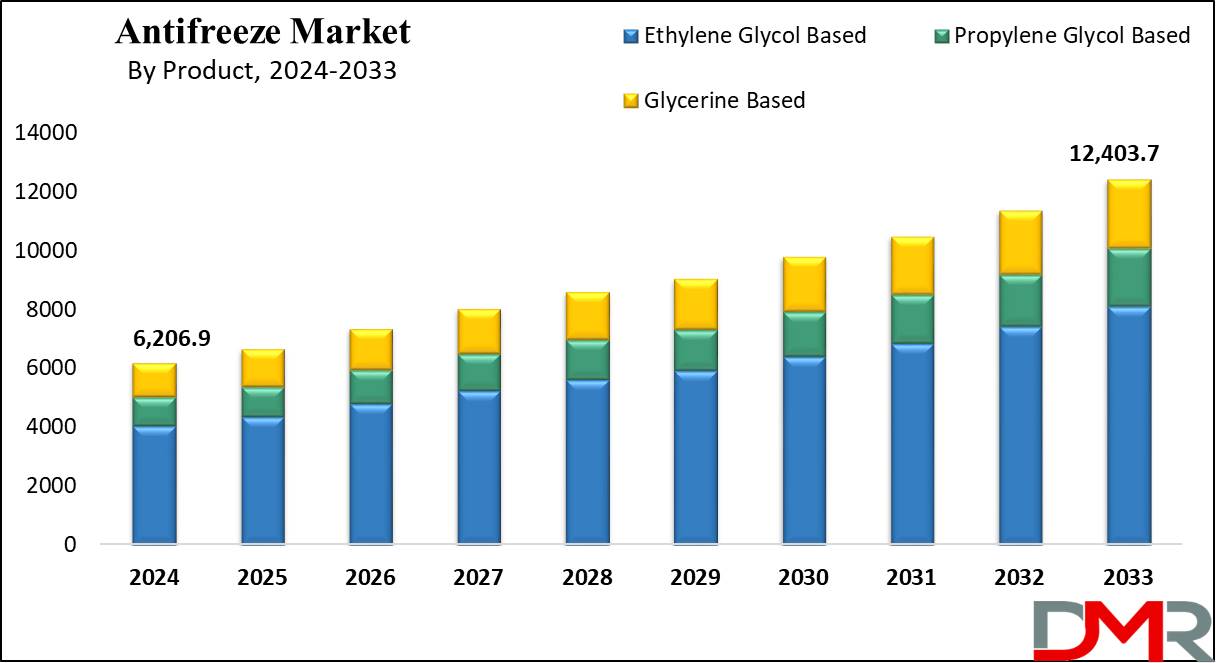

The Global Antifreeze Market is expected to reach a value of USD 6,206.9 million by the end of 2024, and it is further anticipated to reach a market value of USD 12,403.7 million by 2033 at a CAGR of 8.0%.

Antifreeze is a chemical additive used in the cooling system of vehicles to lower the freezing point of the coolant. It raises the boiling point of the coolant, which helps to prevent overheating in hot weather or under heavy engine loads. Most of the antifreeze used in vehicles is either ethylene glycol-based or propylene glycol-based antifreeze products.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

It is mixed with water to create a coolant solution that circulates through the engine to regulate its temperature. It also contains corrosion inhibitors to protect the cooling system's metal components from rust and corrosion.

The antifreeze market is fueling due to the expanding automotive industry in countries like India, Mexico, China, Indonesia, & South Korea. This market is growing due to the increasing use of antifreeze for heat transfer applications & engine protection from freezing in cold climates. Major companies are investing heavily in research & development to create environmentally friendly, cost-effective, & long-lasting products, further boosting market potential.

Antifreeze aftermarket sales have grown as more vehicle owners prioritize regular vehicle maintenance. According to a U.S. Department of Transportation report, average vehicle age in 2023 hit 12.2 years; an increase from 12.0 years just four years earlier; consumers increasingly aim to extend the lifespan of their car and consequently require constant upkeep - fuelling demand for aftermarket coolant replacements such as antifreeze.

A European Commission inquiry also indicates this phenomenon: over 70% of cars within its borders are at least 10 years old which contributes to rising antifreeze sales as well as other essential maintenance products within this region.

Key Takeaways

- Market Size: The Global Antifreeze Market is market is projected to grow by 5,751.9 million, at a CAGR of 8.0% during the forecasted period.

- Market Definition: Antifreeze is a liquid used in internal combustion engines and other heat transfer systems to prevent freezing.

- Product Analysis: By Product, the ethylene glycol-based products segment is expected to lead with the largest market share of 65.3% in 2024 & is anticipated to dominate throughout the forecasted period.

- Technology Analysis: By Technology, OAT (Organic Acid Technology) is expected to come out as a dominant force with the largest revenue share of 68.3% during the forecasted period.

- Application Analysis: By Application, the automotive sector is expected to have led throughout the forecasted period with a revenue share of 83.2% in 2024.

- Regional Analysis: Asia Pacific is expected to hold a 29.3% revenue share in the Global Antifreeze Market in 2024.

Use Cases

- Winter Protection: In cold climates, antifreeze protects the coolant in the engine from freezing as it contains chemicals that lower the freezing point of the coolant, allowing it to remain in a liquid state even in extremely low temperatures, which is vital to prevent engine damage during winter.

- Overheating Prevention: Antifreeze plays a major role in preventing the engine from overheating during high-temperature conditions, as it absorbs & dissipates heat generated by the engine, as the cooling system, with the help of antifreeze, regulates the engine temperature within an optimal range, which prevents the engine from reaching temperatures that could lead to damage, like warping of the cylinder head or engine block.

- Corrosion Inhibition: Antifreeze contains corrosion inhibitors that protect many metal components of the engine & radiator from corrosion & rust, as over time, exposure to water & oxygen can lead to corrosion in the engine's cooling system, as antifreeze with corrosion inhibitors creates a protective layer on metal surfaces, protecting the formation of rust & ensuring the longevity of the engine components.

- Temperature Stability: It helps maintain stable operating temperatures in the engine by absorbing & transferring heat away from critical components, as consistent operating temperatures are important for the efficiency & performance of the engine, as they assist in stabilizing these temperatures, contributing to the overall reliability & longevity of the vehicle.

Market Dynamic

Drivers

Prevent Engine freezing

The demand for antifreeze is increasing due to its use in heat transfer functions & its important role in preventing engine freezing during low temperatures. Further, strict environmental regulations are pushing the adoption of high-performance lubrication to minimize vehicle emissions & improve fuel efficiency, with antifreeze agents preventing freezing in these lubricants.

Vehicle owners are giving priority to engine maintenance which increases the demand for premium antifreeze. Also, glycerin's widespread use, mainly as a safer alternative to ethylene glycol, is a significant driver for the antifreeze market.

Data Centre

Data centers are becoming central core to industries of all kinds in the digital era. They are powerful sources of computing that produce significant heat which require advanced cooling systems to avoid hardware malfunctions and maintain continuous operations.

Antifreeze safeguards data integrity by ensuring sensitive electronics stay within their optimal operating temperature range. Their ability to avoid overheating and compatibility with complex cooling infrastructures make it extremely valuable in data center environments.

Restrains

Disruption in supply chain management

Supply chain disruptions, fluctuating raw material prices, & economic uncertainties pose challenges to the global antifreeze market, as these factors can hinder the smooth production & distribution of antifreeze products, impacting market growth and stability. The price of raw materials like glycols and additives, fluctuates due to geopolitical issues, which restrain the growth of the antifreeze market.

Toxic Ingredients

Antifreeze products contain ethylene glycol, which could be toxic after ingestion and require strict handling, storage, & labeling regulations. Compliance with these regulations adds to the costs & complexities for the market.

Opportunities

Growing demand in the automotive sector

The rising adoption of advanced automotive technology like turbocharged engines & higher-performing cooling systems, is increasing the demand for antifreeze & engine coolant products. Manufacturers are focused on innovation to improve vehicle performance, fuel efficiency, & durability, which require more efficient & effective cooling solutions.

Use of eco-friendly formulation in coolant

Strict government regulations about emissions and fuel efficiency are motivating automaker manufacturers to use more environment-friendly cooling technologies. They use long-lasting coolant formulations that meet regulatory standards while ensuring optimal engine performance and reliability.

Trend

Consumer Education

Consumer Awareness and education initiatives play an important role in expanding the antifreeze market. Companies are investing in informing consumers about proper application methods, the benefits of eco-friendly formulations, and compatibility requirements.

Technological Advancements

There is a growing need for cooling systems due to technological advancement across various sectors which impact the antifreeze market. Latest engines, aerospace systems, and data centers now require antifreeze coolant formulas that can prevent corrosion and cavitation.

Research Scope and Analysis

By Product

The Antifreeze Market is expected to be largely led by Ethylene Glycol-Based Products, by commanding a maximum share of 65.3% in revenue in 2024, which is marked due by the broad usage of ethylene glycol in many key applications like preventing radiator overheating, deicing, hydraulic brakes, freeze protection, & as a heat conductor in cooling & heating systems.

These diverse applications contribute significantly to the growing market demand. However, the growth rate of these products is anticipated to gradually decrease in the projected period because of the strict regulations regarding disposal, quick degradation rates, concerns over toxicity, corrosive properties, & the high costs of storage & handling.

Further, propylene glycol is anticipated to show high growth throughout the forecasted period, as it is majorly due to its enhanced compatibility, non-toxic & economical nature in comparison to conventional ethylene glycol. Also, development in processing technologies & the push towards substituting toxic compounds through regulations are set to drive the demand for propylene glycol, making it a key driver of growth in the coming future.

By Technology

In terms of technology, OAT (Organic Acid Technology) is expected to come out as a dominant revenue generator, holding a significant share of 68.3 % in 2024, which can be accredited to the segment's usage of environmentally friendly neutralized inorganic salts & acids that decompose easily. Further, the extended drain interval provided by OAT leads to its broad acceptance and market expansion.

Furthermore, the market for HOAT (Hybrid Organic Acid Technology) is also expected to experience substantial demand throughout the projected period, as it arises from its long operational lifespan & efficient characteristics of corrosion inhibition. In addition, Hybrid Organic Acid Technology shows better compatibility with many coolants.

Also, the rising usage of Hybrid Organic Acid Technology by key automotive OEMs such as BMW, Mercedes, Mini Cooper, & Volvo as factory fill, along with growing demand within the general aftermarket coolant domain, is expected to boost market growth significantly.

By Application

The automotive is set to dominate the antifreeze market, capturing a significant revenue share of 83.2% in 2024, due to the rising use of antifreeze in HVAC (heating, ventilation, & cooling) systems for both industrial & automotive applications, thereby driving industrial growth.

Other factors that are contributing to this momentum, are supportive initiatives by the government, changing lifestyles, growth in disposable incomes, & changing urbanization trends, which collectively support market expansion in the coming years.

Furthermore, the aerospace & defense sector is expected to have substantial revenue growth during the forecast period, which is supported by enhanced spending & investments in aerospace Research & development, majorly in nations like France, Germany, Sweden, the UK, & Poland, where key industry players reside.

Further, the rise of the commercial aerospace subsector, driven by growing equipment replacement cycles & enhanced demands for passenger travel, is considered to be one of the reasons for industry growth.

The Antifreeze Market Report is segmented based on the following

By Product

- Ethylene Glycol Based

- Propylene Glycol Based

- Glycerin Based

By Technology

- Organic Acid Technology Antifreeze (OAT)

- Inorganic Acid Technology Antifreeze (IAT)

- Hybrid Organic Acid Technology (HOAT)

By Application

- Automotive

- Aerospace & Defense

- Industrial Heat Transfer and Cooling Systems

Regional Analysis

Asia Pacific region is expected to be a dominant force in the antifreeze market, capturing a

revenue share of 29.3% in 2024, due to the rising desire for passenger cars & light

commercial vehicles, mainly in major developing countries like India & China.

Further, expanding growth in the automotive sector in the region is being driven by the increase in consumer awareness, a better standard of living, & an increase in disposable income, which fuels the growth of the overall market. These factors are responsible for driving the growth throughout the coming future. The rising adoption of

electric vehicles & steady investments in R&D for hybrid vehicles is expected to open up new opportunities in this region.

North America is the second largest region for the global market after Asia Pacific, due to increasing automotive manufacturing activities in countries like Mexico, Canada, & the United States. Moreover, the increasing production of light & heavy-duty commercial vehicles in this region is expanding the growth of this market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Key market players in the antifreeze market are quite competitive, with companies looking for innovative & eco-friendly solutions. Major players in the market expand through strategic partnerships, especially in emerging sectors. In addition, brands invest in unique identities & customized solutions for various vehicle and industrial needs.

Further, sustainability is a key focus, while affordability remains crucial. In essence, the market thrives on innovation, strategic decisions, &sustainability, as companies aim to enhance products, enter new markets, & navigate regulations in this dynamic industry.

Some of the prominent players in the Global Antifreeze Market are

Recent Developments

- In January 2024, Prestone introduced Improved Antifreeze/Coolant, Offering Advanced Corrosion Protection, which uses patented Cor-Guard inhibitors to better secure areas in the cooling system most vulnerable to corrosion, as it can protect the water pump, heater core, radiator, and gaskets from corrosion and degradation, minimizing the risk of engine failure &leading to longer engine life.

- In January 2024, PEAK launched a New High-Performance Extended Life Antifreeze + Coolant, which comes out as the first major launch in the extended life antifreeze/coolant segment in more than a decade & is the result of extensive research to understand DIYers' needs and purchase-decision process.

- In December 2023, INEOS introduced an agreement with LyondellBasell to buy its Ethylene Oxide and Derivatives business including the Bayport Underwood site, Texas, which includes the 420 kt Ethylene Oxide plant, the 375 kt Ethylene Glycols plant and the 165kt Glycol Ethers plant together with all associated third-party business on the site, for USD 700 million.

- In April 2023, Arteco launched Freecor EV Multi 10, a new electric vehicle coolant particularly designed as a multifunctional coolant for the cooling of e-motors, power electronics, batteries, and all the other components in both full electric along with hybrid vehicles. These EVs, regular combustion engine coolants are used for the thermal management of the vehicle, which is primarily developed for internal combustion engines (ICE) & could be further optimized for electric vehicles.

- In February 2023, UPM Biochemicals &HAERTOL Chemie GmbH announced a partnership to accelerate the introduction of renewable, sustainable forest-sourced materials into the automotive market & reduce fossil resource consumption, by producing a new range of carbon-neutral engine and battery coolants that will help automotive manufacturers reduce their CO2 footprint.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 6,206.9 Mn |

| Forecast Value (2033) |

USD 12,403.7 Mn |

| CAGR (2024-2033) |

8.0% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Ethylene Glycol Based, Propylene Glycol Based, Glycerin Based), By Technology (Organic Acid Technology Antifreeze (OAT), Inorganic Acid Technology Antifreeze (IAT), and Hybrid Organic Acid Technology (HOAT)), By Application (Automotive, Aerospace & Defense, and Industrial Heat Transfer and Cooling Systems) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Royal Dutch Shell, Total, Amsoil, Sinopec, BP PLC, Dow Chemicals, BASF SE, LUKOIL, Chevron, Old World Industries, PENTOSIN, MITAN, and Other Key Players |

| Purchase Options |

Physio-Control Inc., Schiller, Medtronic, Abbott, Boston Scientific Corporation, Koninklijke Philips N.V., Zoll Medical Corporation, BIOTRONIK, Progetti Srl, LivaNova Plc, and Other Key Players |

Frequently Asked Questions

The market is growing at a CAGR of 4.7 percent over the forecasted period.

▾ The Global Antifreeze Market size is estimated to have a value of USD 6,206.9 million in 2024 and is expected to reach USD 12,403.7 million by the end of 2033.

Which region accounted for the largest Global Antifreeze Market?

▾ Asia Pacific is expected to have the largest market share in the Global Antifreeze Market with a share of about 29.3% in 2024.

Who are the key players in the Global Antifreeze Market?

▾ Some of the major key players in the Global Antifreeze Market are APL, Clariant, Croda International Plc, and many others.

What is the growth rate in the Global Antifreeze Market?

▾ The market is growing at a CAGR of 8.0 percent over the forecasted period.