Market Overview

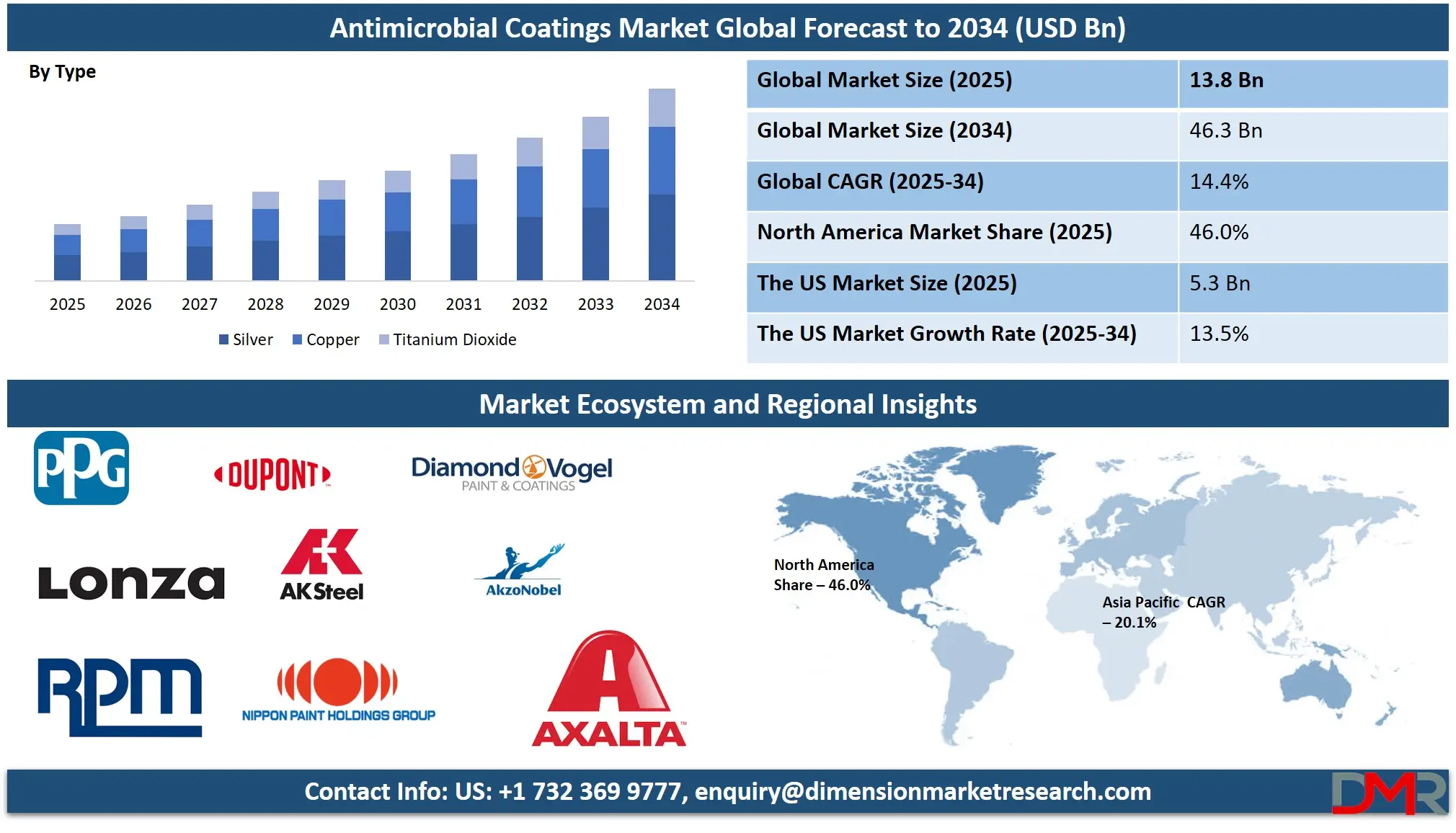

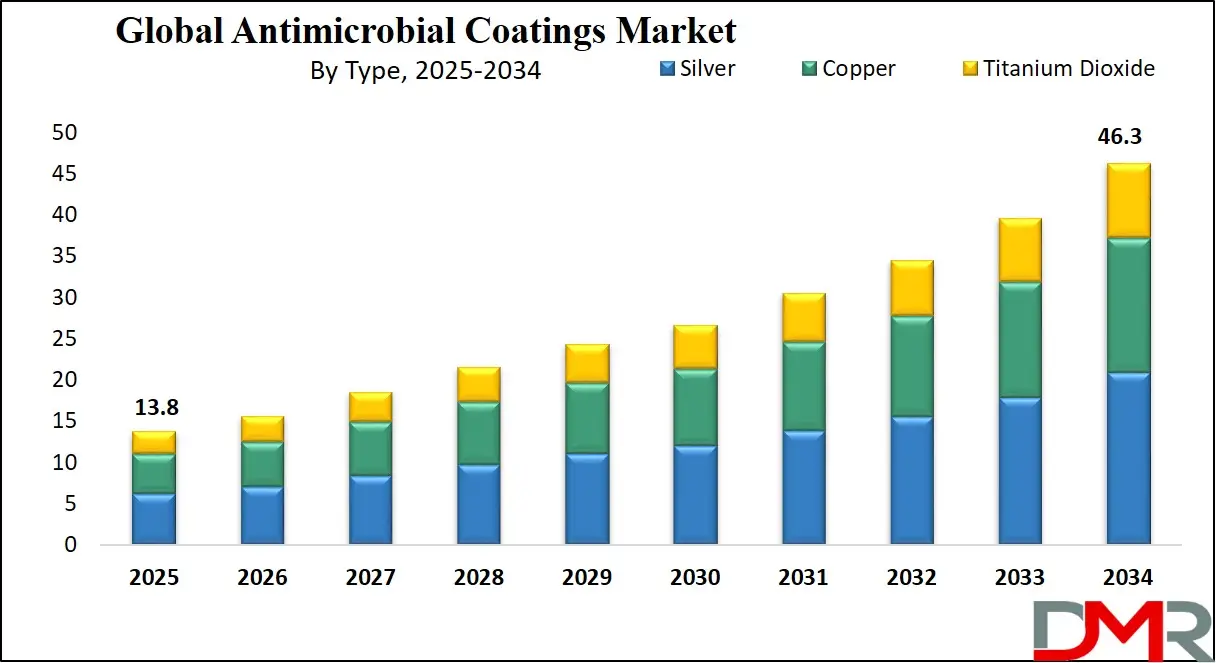

The Global Antimicrobial Coating Market is predicted to be valued at

USD 13.8 billion in 2025 and is expected to grow to

USD 46.3 billion by 2034, registering a compound annual growth rate (

CAGR) of 14.4% from 2025 to 2034.

Antimicrobial coating is a surface treatment infused with agents that inhibit the growth of microorganisms such as bacteria, fungi, and viruses. These coatings are commonly applied to surfaces in healthcare, food processing, public spaces, and high-touch areas to reduce the risk of infection and contamination. The antimicrobial agents like silver ions, copper, or organic compounds which work by disrupting microbial cell walls or interfering with their metabolism. These coatings provide long-lasting protection, helping maintain hygiene and extending the life of products.

They are especially valuable in environments where cleanliness is critical and contribute to improved health and safety standards. The antimicrobial coatings market is witnessing strong demand, primarily driven by the rising need for hygiene and infection control. The COVID-19 pandemic significantly heightened awareness about surface cleanliness, leading to increased adoption of antimicrobial solutions across various industries. Healthcare, in particular, remains the largest consumer due to its critical need to prevent hospital-acquired infections and ensure patient safety.

There is a growing need for antimicrobial coatings in other sectors as well, such as food processing, construction, HVAC, electronics, and consumer goods. These coatings help prevent microbial growth on surfaces, thus improving durability, product life, and safety. With increasing urbanization and improved standards of living, demand for safer, germ-resistant environments is on the rise.

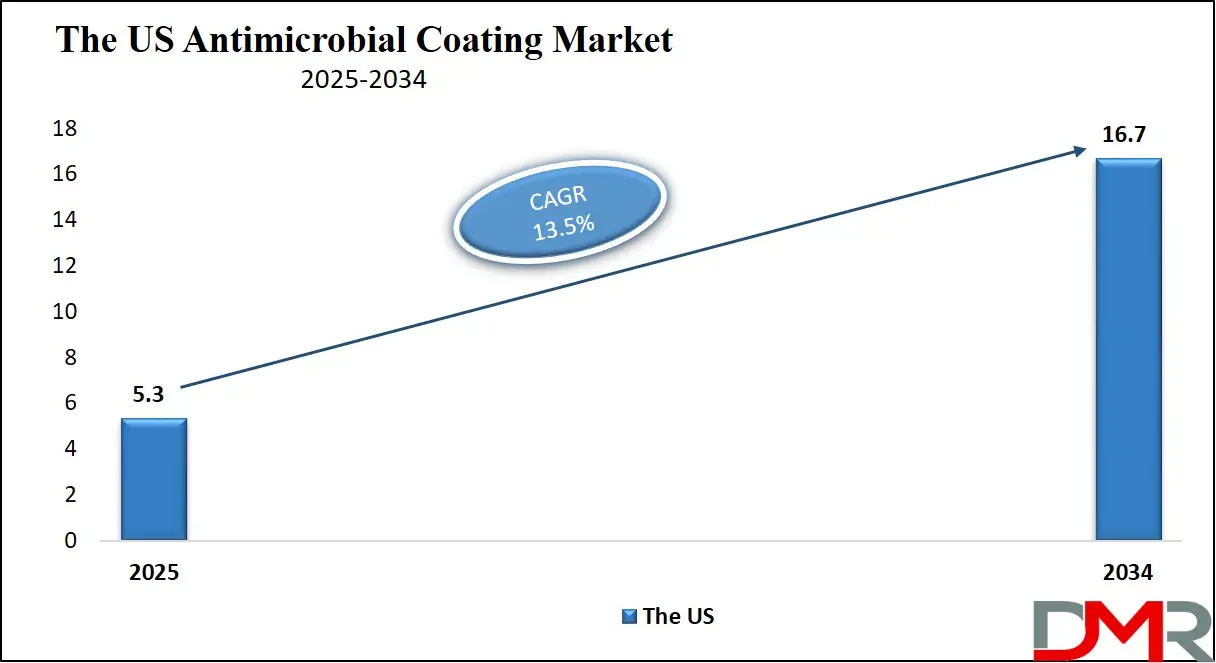

The US Antimicrobial Coating Market

The US Antimicrobial Coating market is projected to be valued at USD 5.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 16.7 billion in 2034 at a CAGR of 13.5%.

The U.S. antimicrobial coating market is primarily driven by increasing concerns about hygiene and infection prevention, particularly in healthcare settings. Hospital-acquired infections (HAIs) remain a serious issue, prompting widespread adoption of antimicrobial coatings on medical devices, surgical tools, and hospital surfaces. Growth in the food processing, packaging, and construction industries also contributes to rising demand, as these sectors seek to maintain cleaner, safer environments. Government support for public health infrastructure and strict regulations on sanitation further push the market forward.

Manufacturers are focusing on water-based and metal-free formulations, addressing both environmental and health concerns. Another growing trend is the incorporation of nanotechnology and smart coatings that offer long-lasting protection and self-cleaning capabilities. Demand is expanding beyond healthcare into sectors like HVAC, food packaging, and consumer electronics, where maintaining cleanliness is increasingly critical. Additionally, the rise of multifunctional coatings that combine antimicrobial properties with durability, corrosion resistance, and aesthetic appeal is creating new opportunities for product innovation and differentiation.

Antimicrobial Coating Market: Key Takeaways

- Global Market Overview: The global antimicrobial coatings market is projected to reach a value of USD 13.8 billion in 2025, with expectations to grow significantly and hit USD 46.3 billion by 2034. This represents a compound annual growth rate (CAGR) of 14.4% over the forecast period from 2025 to 2034.

- U.S. Market Outlook: In the United States, the antimicrobial coatings market is estimated to be worth USD 5.3 billion in 2025. It is forecasted to experience robust growth, reaching approximately USD 16.7 billion by 2034, growing at a CAGR of 13.5%.

- Market Segmentation by Type: Among the various types, silver-based antimicrobial coatings are expected to lead the global market in 2025, securing the highest revenue share.

- Market Segmentation by Product: Surface modifications and coatings are anticipated to hold a dominant position in the market, accounting for 62.6% of the total revenue in 2025.

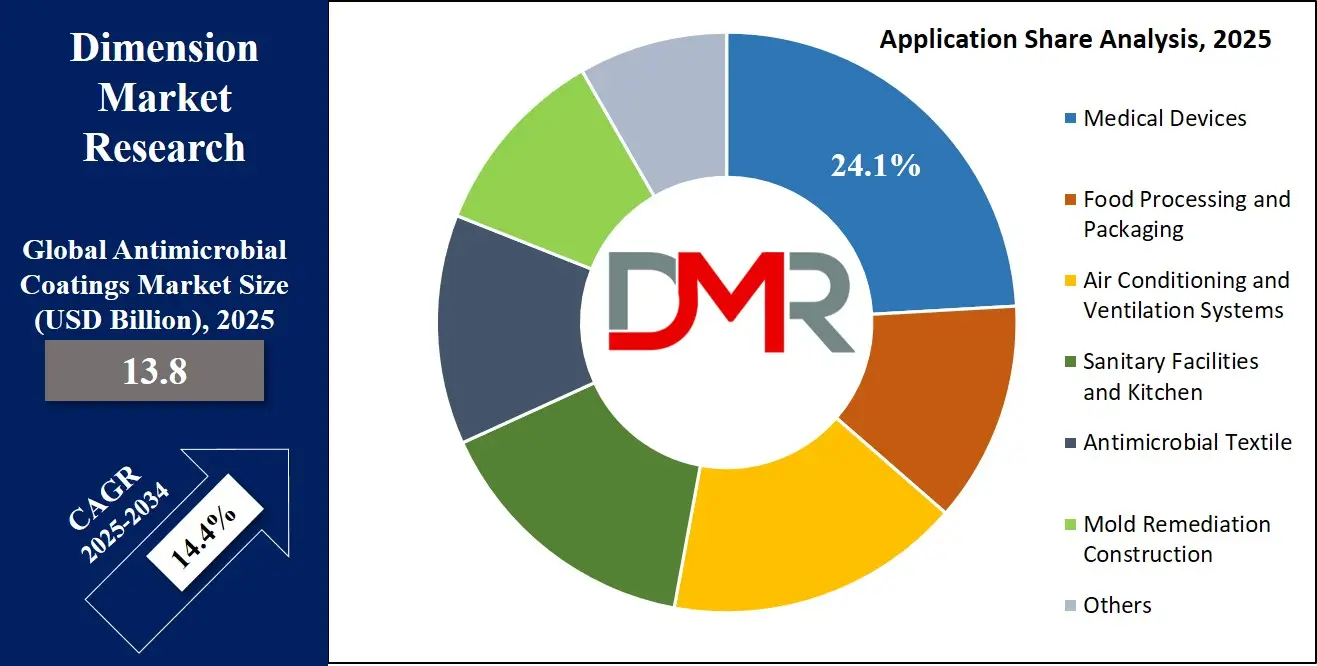

- Market Segmentation by Application: The medical device sector is projected to be the leading application segment for antimicrobial coatings, contributing a 24.1% revenue share by the end of 2025.

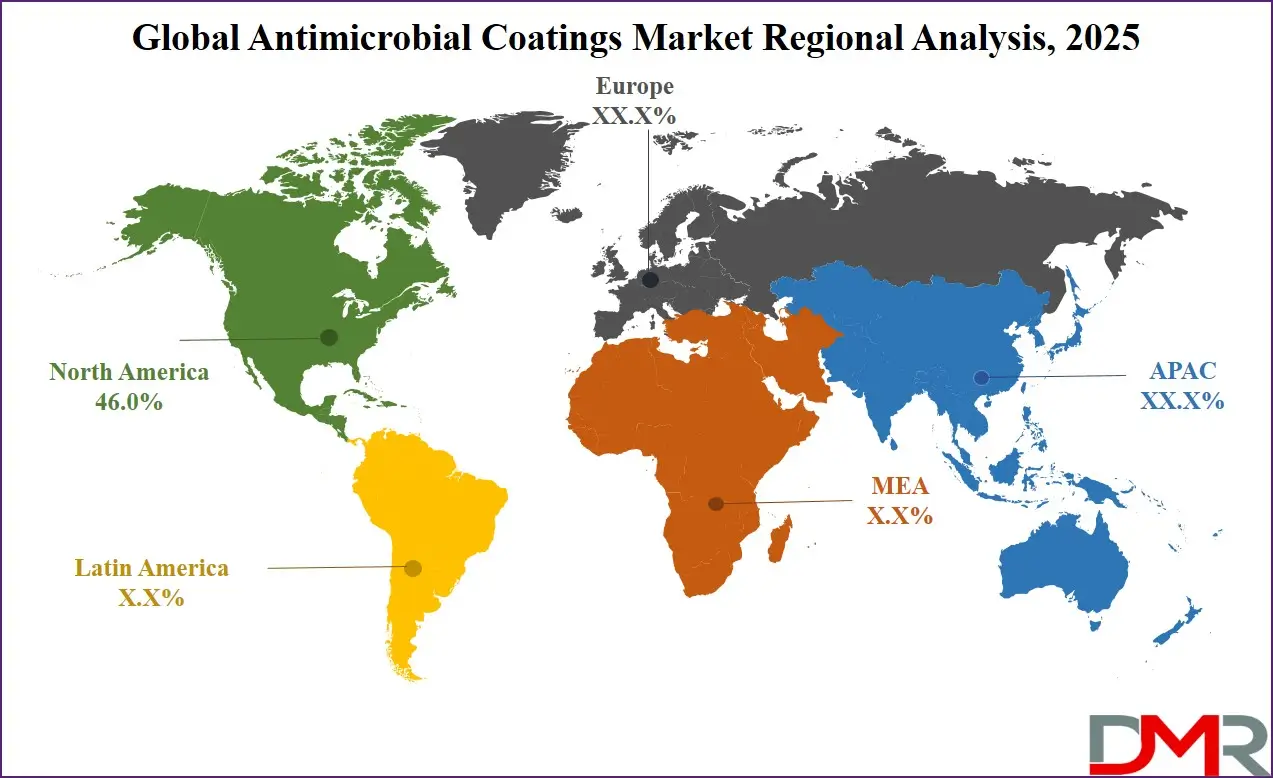

- Regional Market Leaders: North America is expected to remain the largest regional market for antimicrobial coatings, holding a 46.0% revenue share in 2025.

- Region with Fastest Growth: The Asia-Pacific region is set to emerge as the second-largest market, experiencing rapid growth due to accelerated industrialization and urbanization across the region.

Antimicrobial Coating Market: Use Cases

- Healthcare and Medical Devices: Antimicrobial coatings are widely used in healthcare settings on surgical instruments, hospital beds, catheters, and wound dressings to reduce the risk of hospital-acquired infections by inhibiting microbial growth.

- Food Processing and Packaging: In the food industry, these coatings are applied to surfaces such as packaging materials, conveyor belts, and processing equipment to prevent contamination, extend product shelf life, and ensure hygiene during food handling.

- Consumer Electronics and Touch Surfaces: Consumer electronics like smartphones, tablets, ATMs, and public touchscreen kiosks use antimicrobial coatings to reduce the spread of bacteria and viruses on frequently touched surfaces.

- Construction and Building Materials: In the construction sector, antimicrobial coatings are incorporated into building materials such as wall paints, flooring, door handles, and HVAC systems to promote hygiene in high-traffic environments like hospitals, schools, and commercial buildings.

Antimicrobial Coating Market: Stats & Facts

- Broad-Spectrum Antimicrobial Effect: Silver ions are highly effective against a wide range of microorganisms, including bacteria, fungi, and viruses. This makes silver-based coatings versatile for various environments, from healthcare settings to public transportation systems. Their effectiveness even at low concentrations contributes to comprehensive protection against microbial contamination. (Rai et al., Biotechnology Advances )

- Effectiveness against Resistant Microorganism: Silver ions have demonstrated efficacy against antibiotic-resistant pathogens such as MRSA (Methicillin-resistant Staphylococcus aureus) and VRE (Vancomycin-resistant Enterococcus). This makes them particularly valuable in medical and high-risk environments where traditional antibiotics or disinfectants may fail. (Panáček et al., J. Phys. Chem. B)

Antimicrobial Coating Market: Market Dynamics

Driving Factors in the Antimicrobial Coating Market

Rise in Medical Device Usage

Antimicrobial coatings have seen tremendous market expansion as medical devices continue to become an ever-increasing part of diagnostics, treatments, and surgery processes. Due to reusing medical devices across different patients and being exposed to infections due to traditional cleaning methods, and antibiotics being unable to fully disinfect such devices. Due to antimicrobial coatings being embedded during production processes of medical devices, they provide reliable protection from bacteria growth on surfaces as well as provide solutions that prevent hospital-acquired infections; their growing application in this sector helps ensure market growth, which drives the growth of the market further.

Growth in Healthcare Infrastructure in Emerging Economies

Emerging economies are experiencing exponentially greater expansions of healthcare infrastructure due to increasing government investments, an expanding population, and greater awareness of hygiene standards. With such expansion comes an increase in hospital construction as well as clinic and diagnostic center renovation. Antimicrobial coatings have proven indispensable in modernizing facilities like operating rooms, ICUs, and patient wards within such facilities, particularly given their rising focus on modernizing systems such as India, Brazil, and Southeast Asian nations, which further drives demand for antimicrobial coatings.

Restraints in the Antimicrobial Coating Market

Environmental and Health Concerns from Active Ingredient Emissions

Antimicrobial coatings provide significant advantages in infection control, but their gradual release into the environment poses serious issues for human health, livestock welfare, and environmental microbiota. Furthermore, some toxic antimicrobial agents disrupt ecosystems or pose safety concerns when exposed over time. These risks have led regulatory bodies and stakeholders to advocate for comprehensive risk-benefit analyses before widespread adoption. It may impede market expansion, particularly where environmental standards and safety protocols are stringently enforced.

Stringent Regulations and Raw Material Supply Constraints

The antimicrobial coatings market faces significant hurdles due to stringent global regulations and raw material supply issues. Suppliers must comply with rigorous standards such as FIFRA, BPR, ISO, and ASTM, which can slow product approval and increase development costs. Additionally, growing environmental concerns have led to reduced zinc and copper production, especially in key markets like China, the U.S., and India. These metals are essential in many antimicrobial formulations. Regulatory pressures and mine closures are driving up raw material costs, directly impacting the overall production cost and profitability, which restrains market growth.

The growth of the Antimicrobial coatings market is limited by strict global regulations and raw material supply issues, particularly FIFRA, BPR, ISO, and ASTM requirements for suppliers who must abide by them to obtain product approval or incur development costs more rapidly. Environmental concerns have caused zinc and copper production levels to plummet globally which include key markets like China, U.S.A and India where these metals are essential antimicrobial formulation ingredients regulatory pressures due to mine closures is further pushing up raw material costs directly impacting production costs which affect overall costs directly impacting profitability as a direct consequence of market expansion limiting market expansion potential growth potential.

Opportunities in the Antimicrobial Coating Market

Demand in Consumer and Electronic Goods

As public awareness regarding hygiene and surface transmission of viruses increases, so has their application on consumer goods and electronics devices. Manufacturers now increasingly incorporate antimicrobial solutions into everyday items to meet consumers' demand for safer germ-proof items - this development offers market players an attractive chance to diversify their offerings to suit broader industries such as personal electronics, home appliances and public use equipment while increasing market growth outside medical sectors.

Food Processing and Packaging Industry

The food industry is increasingly embracing antimicrobial coatings to enhance safety and shelf life in processing and packaging environments. Cross-contamination and microbial spoilage remain critical concerns in food manufacturing, driving the adoption of antimicrobial surface treatments on equipment, packaging materials, and facility infrastructure. These coatings help minimize microbial growth, reduce the risk of foodborne illnesses, and meet stringent food safety regulations. This growing application in food processing and packaging presents a strong opportunity for antimicrobial coating manufacturers to expand into a high-demand, compliance-driven sector.

Trends in the Antimicrobial Coating Market

Development of Silver-Based Coatings

Silver-based antimicrobial coatings present a significant growth opportunity due to their unique properties such as low toxicity, high durability, and long-lasting antimicrobial effects. As manufacturers seek to enhance the performance of their antimicrobial products, silver has emerged as a preferred material. The market is witnessing increased investment in research and development to create more efficient and eco-friendly silver-based coatings. With consumer preference leaning toward safer and longer-lasting antimicrobial solutions, companies leveraging silver technology stand to capture a larger share of the market, especially in high-touch products like textiles, electronics, and medical tools.

Integration of Antimicrobial Agents in Paints and Surface Finishes

A notable trend in the antimicrobial coatings market is the integration of antimicrobial agents directly into paints and surface finishes used in healthcare environments. Hospitals and clinics are increasingly turning to antimicrobial wall paints and surface treatments that contain active ingredients capable of eliminating microorganisms on contact. These coatings provide continuous protection and are especially valuable in high-touch areas where traditional cleaning methods may fall short. This trend reflects a shift toward more passive, long-term infection control strategies that reduce reliance on frequent disinfection while maintaining sterile and hygienic environments.

Antimicrobial Coating Market: Research Scope and Analysis

By Type Analysis

Silver is predicted to dominate in the global antimicrobial coatings market with the highest revenue share in 2025. Silver leads the antimicrobial coatings market through efficient long-term pathogen protection because of its low toxicity levels and broad-spectrum antibacterial effectiveness against Gram-positive and Gram-negative bacteria, together with fungi and protozoa, along with select viruses. Microbes fail to function when silver ions (Ag⁺) are released from the material. Silver coatings became widespread in healthcare and food processing industries along with consumer goods markets because of their effective antimicrobial concentration range extending from 10 nM to 10 μM.

Ongoing research activities combined with regulatory approvals strengthen silver's standing as the market leader. The antimicrobial coatings market exhibits copper as the anticipated major sub-segment in its metallic grouping. Copper presents valuable antimicrobial properties because it retains strong antimicrobial agent concentrations on its surfaces which enabling bacteria to suffer contact killing effectively.

The way copper coatings persist high antimicrobial substance levels on surfaces prevents microbial resistance formation which makes them highly suitable for hospital conservation and public transit as well as industrial applications. Copper antimicrobial effectiveness surpasses that of silver at a lower cost to manufacturers. Market expansion occurs as health-related institutions increasingly adopt copper due to its infection-preventing capabilities.

By Product Analysis

Surface modifications and coatings are predicted to dominate the antimicrobial coatings market with a revenue share of 62.6% in 2025. The market recognizes surface modifications and coatings as leading antimicrobial solutions because they transform surface characteristics including roughness, together with hydrophilicity and surface charge characteristics, while improving biocompatibility and thus enhancing antimicrobial performance.

Medical orthopedic implants demonstrate enhanced benefits from these modifications because they stop biofilms from growing and combat infections while facilitating integration with human tissue. Surface modifications along with coatings remain essential for health care applications because they offer multiple benefits that establish their market dominance.

Antimicrobial powder coatings show rapid market growth because they gain popularity among different industries. Surface modifications involving these attributes deliver ideal performance for healthcare, together with food processing and public infrastructure applications. Inorganic materials such as silver, alongside copper, enhance antimicrobial effectiveness, and silver-based coatings prove most favorable because of their biocompatible nature. Silver powders have gained increased adoption because they received regulatory authorization from the U.S. EPA. The growing knowledge about infection control and hygiene following the pandemic will increase the substantial demand for these coatings.

By Application Analysis

Medical devices are expected to dominate the antimicrobial coating market with a revenue share of 24.1% by the end of 2025, due to their critical role in infection prevention. The high demand for antimicrobial coatings in catheters, implantable devices, and surgical instruments stems from their biocompatibility, non-toxicity, and biostability. Increasing hospital admissions and the need for advanced, sterile equipment further drive this trend.

Moreover, the presence of major medical device manufacturers such as GE Healthcare, Johnson & Johnson, and Stryker Corp. enhances production capabilities. With rising healthcare expenditure, particularly in North America, the demand for antimicrobial-coated medical devices is expected to remain strong throughout the forecast period. The food processing and packaging segment is predicted to experience the highest CAGR after medical devices.

This growth is driven by the increasing demand for hygiene and safety in food production and packaging environments to prevent microbial contamination. Antimicrobial coatings help extend the shelf life of food products and reduce the risk of foodborne illnesses, making them essential in modern food industries. With growing consumer awareness, stringent food safety regulations, and the expansion of the packaged food sector globally, manufacturers are adopting antimicrobial coatings rapidly. These factors contribute to this segment’s robust growth potential over the forecast period.

The Antimicrobial Coating Market Report is segmented on the basis of the following:

By Type

- Silver

- Copper

- Titanium Dioxide

By Product

- Antimicrobial Powder Coatings

- Surface Modifications & Coatings

By Application

- Medical Devices

- Food Processing and Packaging

- Sanitary Facilities and Kitchen

- Air Conditioning and Ventilation Systems

- Antimicrobial Textile

- Mold Remediation Construction

- Others

Regional Analysis

Region with the largest Share

North America is projected to dominate the antimicrobial coatings market with a revenue share of

46.0% in 2025, due to its advanced healthcare infrastructure, stringent infection control regulations, and heightened hygiene awareness. The region's robust demand stems from diverse sectors, including medical devices, HVAC systems, food processing, and construction. The U.S., in particular, leads with significant investments in healthcare and construction, driving the need for antimicrobial solutions.

Canada and Mexico also contribute through research initiatives and expanding industrial applications. The presence of major manufacturers and continuous innovation further solidifies North America's leading position in the market.

Region with Highest CAGR

The Asia-Pacific region is anticipated to be the second-largest segment in the antimicrobial coatings market, driven by rapid industrialization, urbanization, and increasing healthcare expenditures. Countries like China, India, and Japan are witnessing substantial growth in construction, food processing, and healthcare sectors, leading to higher demand for antimicrobial solutions. Government initiatives promoting hygiene, coupled with a growing middle-class population and awareness of health-related issues, further propel the market. The region's expanding manufacturing base and adoption of advanced technologies position Asia-Pacific as a significant contributor to the global antimicrobial coatings industry.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global antimicrobial coating market is highly competitive and characterized by rapid innovation, strategic partnerships, and a strong focus on research and development. Key players such as AkzoNobel N.V., PPG Industries Inc., Sherwin-Williams Company, BASF SE, and Axalta Coating Systems dominate the market, leveraging their extensive distribution networks and technological expertise. These companies invest heavily in product development to meet the growing demand across healthcare, construction, food processing, and automotive industries.

Smaller and regional players are also emerging, offering niche and cost-effective solutions, intensifying the competitive environment. The market is further influenced by stringent regulations and rising awareness about hygiene and infection control, especially post-COVID-19. Technological advancements such as nanotechnology and bio-based coatings are reshaping product offerings and providing new opportunities for differentiation.

The collaborations with healthcare institutions and research organizations are helping companies enhance their product performance and regulatory compliance. The competitive landscape is also shaped by mergers and acquisitions, aimed at expanding product portfolios and global reach.

Some of the prominent players in the Global Antimicrobial Coating Market are:

- AkzoNobel N.V.

- AK Steel Corp.

- Lonza

- Diamond Vogel

- DuPont

- Axalta Coating Systems

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Koninklijke DSM N.V.

- Burke Industrial Coatings

- The Sherwin-Williams Company

- Troy Corporation

- Akzo Nobel N.V

- BASF SE

- Diamond Voge

- Axalta Coating Systems,

- Nippon Paint Company Ltd.

- PPG Industries

- Royal DSM

- RPM International Inc.

- The DOW Chemical Company

- Other Key Players

Recent Developments

- In February 2024, Nippon Paint Co., Ltd. introduced two new water-based antiviral and antibacterial paint products—PROTECTON® Floor VK Clear and PROTECTON® Interior Wall VK Coat.

- In August 2022, PPG Industries Inc. announced a USD 11 million investment to boost its powder coatings production capacity in Mexico.

- In July 2022, AkzoNobel N.V. revealed plans to invest in expanding and enhancing aerospace coatings production, along with increasing the production flexibility of decorative paints in Europe.

- In July 2022, AkzoNobel N.V. completed the acquisition of the wheel liquid coatings segment from Lankwitzer Lackfabrik GmbH.

- June 2022: AkzoNobel N.V. acquired Kansai Paint’s paints and coatings operations in South Africa.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 13.8 Bn |

| Forecast Value (2034) |

USD 46.3 Bn |

| CAGR (2025–2034) |

14.4% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 5.3 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Silver, Copper, and Titanium Dioxide), By Product (Antimicrobial Powder Coatings, and Surface Modifications & Coatings), By Application (Medical Devices, Food Processing and Packaging, Sanitary Facilities and Kitchen, Air Conditioning and Ventilation Systems, Antimicrobial Textile, Mold Remediation Construction, and Others |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

AkzoNobel N.V., AK Steel Corp., Lonza, Diamond Vogel, DuPont, Axalta Coating Systems, Nippon Paint Holdings Co.Ltd., PPG Industries, Inc., RPM International Inc., Koninklijke DSM N.V., Burke Industrial Coatings, The Sherwin-Williams Company, Troy Corporation, Akzo Nobel N.V, BASF SE, Diamond Voge, Axalta Coating Systems, Nippon Paint Company Ltd., PPG Industries, Royal DSM, RPM International Inc., The DOW Chemical Company,and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|